Fin 480 Corporate Restructuring Steven C. Isberg, Ph.D, Instructor Spring 2003

Gulf Oil Assignment

Factual Overview and Perspective

By 1984, Gulf Oil was on the verge of being “put into play” by leveraged investors in the market. The bidding was initiated by T. Boone Pickens, Chairman and CEO of Mesa Oil, a small Texas oil company. Gulf’s revenues and assets at the end of 1983 were $6.50MMM and $20.96MMM respectively. Mesa, on the other hand, had revenues and assets of $407MM and $1.67MMM. Pickens was able to initiate the bidding as a result of his ability to access high yield debt provided by institutional investors.

Other companies interested in bidding for Gulf were ARCO and Standard Oil of California (Socal, also known as Chevron), and a group of Gulf insiders funded by Kohlberg, Kravis and Roberts (KKR). By 5 March, the companies were getting ready to submit their final bids.

As this process is competitive, with the prize going to the one with the best offer, bidders needed to evaluate the buyout target in the context of other transactions that had taken place. As the price of comparable real estate determines the price of a home, the value of comparable transactions in the oil industry would, in part, determine what would be paid for Gulf.

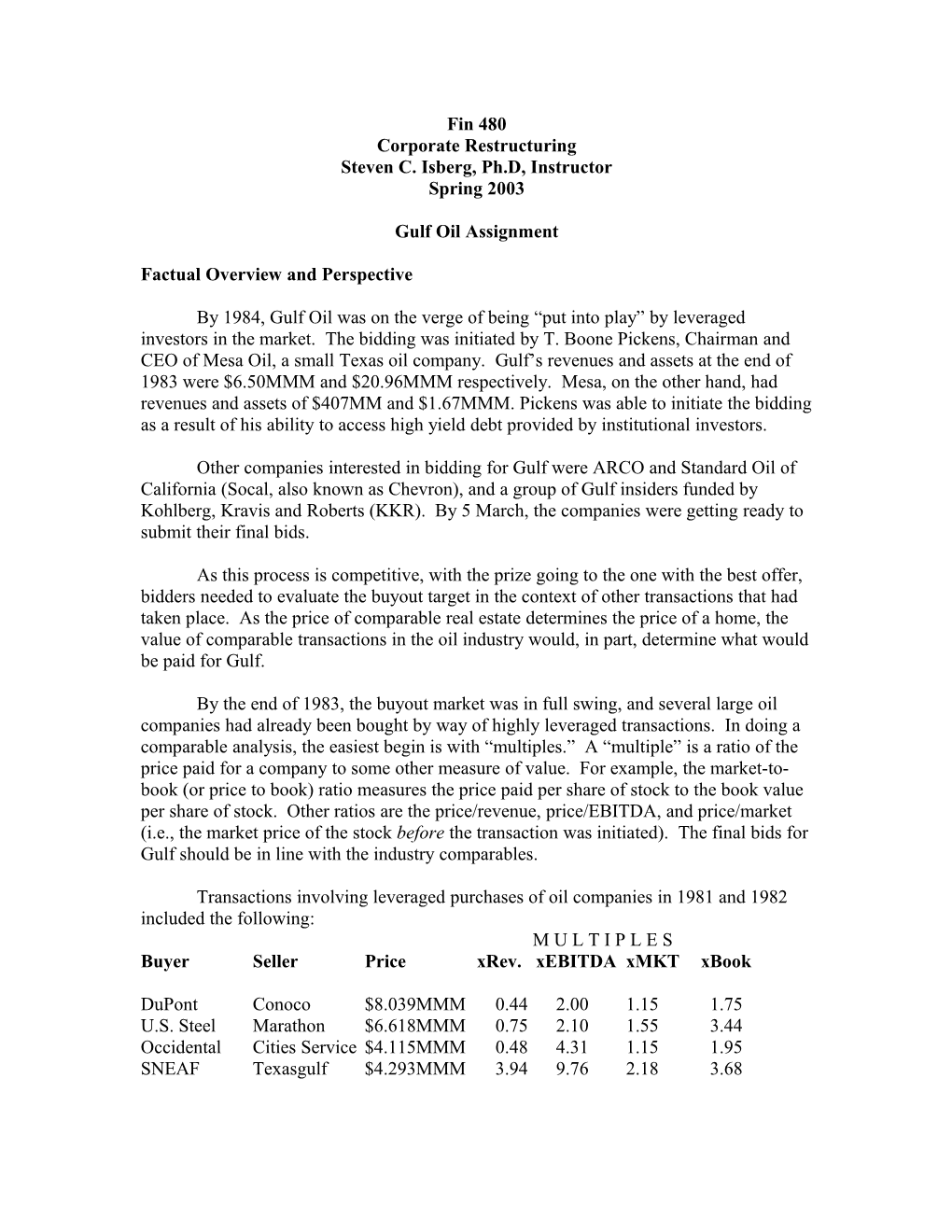

By the end of 1983, the buyout market was in full swing, and several large oil companies had already been bought by way of highly leveraged transactions. In doing a comparable analysis, the easiest begin is with “multiples.” A “multiple” is a ratio of the price paid for a company to some other measure of value. For example, the market-to- book (or price to book) ratio measures the price paid per share of stock to the book value per share of stock. Other ratios are the price/revenue, price/EBITDA, and price/market (i.e., the market price of the stock before the transaction was initiated). The final bids for Gulf should be in line with the industry comparables.

Transactions involving leveraged purchases of oil companies in 1981 and 1982 included the following: M U L T I P L E S Buyer Seller Price xRev. xEBITDA xMKT xBook

DuPont Conoco $8.039MMM 0.44 2.00 1.15 1.75 U.S. Steel Marathon $6.618MMM 0.75 2.10 1.55 3.44 Occidental Cities Service $4.115MMM 0.48 4.31 1.15 1.95 SNEAF Texasgulf $4.293MMM 3.94 9.76 2.18 3.68 Conoco and Marathon were in part purchased for their rich oil reserves. In both cases, there were oil and non-oil companies involved in the bidding. The other two transactions involved the purchase of one oil company by another.

As of the end of 1983, Gulf had 165.3 million shares outstanding. The closing price was $43 per share. Bidding for the company was expected to be in the range of $70 to $90 per share. Most of the bidders would be financing the transaction with high degrees of leverage. For example, if ARCO were to bid $75 per share, its debt ratio would reach 60% (in this case the debt ratio would be measured as long term debt to total assets). A debt ratio of 20% to 25% would be considered as “high normal” in the industry prior to the period of restructuring that was taking place.

Socal was seriously considering its bid on 5 March. At buyout prices of $70, $80, and $90 long term debt levels added to their current balance would be $13.87MMM, $15.52MMM and $17.18MMM respectively (these amounts include debt used to purchase the equity and Gulf debt assumed by Socal).

Consider the following questions:

1. Using the Gulf financial data provided in the spreadsheets, calculate the buyout price and associated multiples for comparison to the four transactions above. 2. Using the Socal financial data provided, calculate the post-transaction long term debt/asset ratio for each buyout price. 3. Examine the statements of operations for both Socal and Gulf. How do the two companies compare? 4. What evidence is there for identifying Gulf’s need to restructure? Is there further evidence in the data you have access to? 5. Examine the exploration and development data for both companies. How do the two compare? How would a purchase of Gulf affect Socal’s reserve position? 6. What opportunities are there for Socal to reduce the costs of operation of Gulf? How might these savings create a synergy and contribute to Socal’s ability to pay down the debt after the buyout? 7. What are the cash flow implications for the restructuring transactions? Specifically, how much capital is exiting the industry? What will happen to capacity as a result of the transaction? 8. Explain with a diagram the flow of financial and physical capital that results from this transaction.

Assignment Question

Socal eventually won in the bidding for Gulf with an offer of $13.2MMM (plus assumed debt) for 100% ownership of the company. Write a two to three page essay that addresses the following general question:

How does this transaction provide an example that illustrates the logical flow of corporate restructuring within an industry? Provide a diagram showing the cash flow effects of the transaction, identifying the exit and reallocation of financial and physical assets. Be sure to include coverage of the following points in your discussion:

An analysis of how the price paid is, in part, determined by comparable market transactions; Evidence of Gulf’s overinvestment in the oil industry as an example of the role of overinvestment in creating the need for restructuring; Evidence of the opportunity to purchase assets at a discount as an incentive to restructure; Evidence of expanded debt capacity in this case as an example of the role of excess debt capacity as a catalyst for restructuring; Evidence of the use of debt in this transaction as an example of how debt disciplines management to operate assets more efficiently.

Feel free to develop, include and refer to exhibits in your paper. You may use as many as you like. Be sure that they are clear, meaningful and accurately referenced in the text of your paper.