February 21, 2005 Ian Madsen, MBA, CFA, Editor E [email protected], Tel: 1-800-767-3771, x417 Marla Harkness, MBA, CFA, Senior Analyst Research Digest Assisted by: Lalit Sikaria

www.zackspro.com 155 North Wacker Drive Chicago, IL 60606

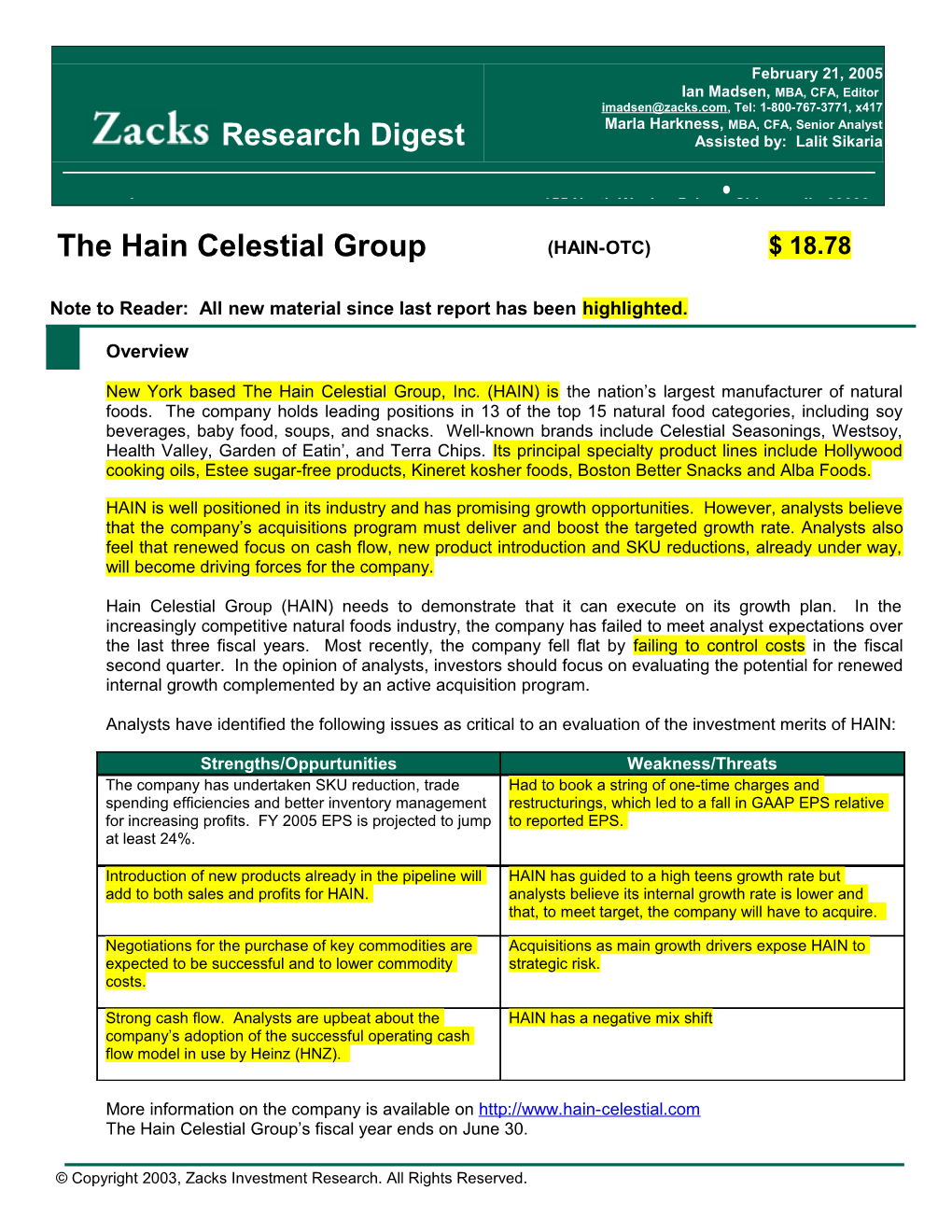

The Hain Celestial Group (HAIN-OTC) $ 18.78

Note to Reader: All new material since last report has been highlighted.

Overview

New York based The Hain Celestial Group, Inc. (HAIN) is the nation’s largest manufacturer of natural foods. The company holds leading positions in 13 of the top 15 natural food categories, including soy beverages, baby food, soups, and snacks. Well-known brands include Celestial Seasonings, Westsoy, Health Valley, Garden of Eatin’, and Terra Chips. Its principal specialty product lines include Hollywood cooking oils, Estee sugar-free products, Kineret kosher foods, Boston Better Snacks and Alba Foods.

HAIN is well positioned in its industry and has promising growth opportunities. However, analysts believe that the company’s acquisitions program must deliver and boost the targeted growth rate. Analysts also feel that renewed focus on cash flow, new product introduction and SKU reductions, already under way, will become driving forces for the company.

Hain Celestial Group (HAIN) needs to demonstrate that it can execute on its growth plan. In the increasingly competitive natural foods industry, the company has failed to meet analyst expectations over the last three fiscal years. Most recently, the company fell flat by failing to control costs in the fiscal second quarter. In the opinion of analysts, investors should focus on evaluating the potential for renewed internal growth complemented by an active acquisition program.

Analysts have identified the following issues as critical to an evaluation of the investment merits of HAIN:

Strengths/Oppurtunities Weakness/Threats The company has undertaken SKU reduction, trade Had to book a string of one-time charges and spending efficiencies and better inventory management restructurings, which led to a fall in GAAP EPS relative for increasing profits. FY 2005 EPS is projected to jump to reported EPS. at least 24%.

Introduction of new products already in the pipeline will HAIN has guided to a high teens growth rate but add to both sales and profits for HAIN. analysts believe its internal growth rate is lower and that, to meet target, the company will have to acquire.

Negotiations for the purchase of key commodities are Acquisitions as main growth drivers expose HAIN to expected to be successful and to lower commodity strategic risk. costs.

Strong cash flow. Analysts are upbeat about the HAIN has a negative mix shift company’s adoption of the successful operating cash flow model in use by Heinz (HNZ).

More information on the company is available on http://www.hain-celestial.com The Hain Celestial Group’s fiscal year ends on June 30.

© Copyright 2003, Zacks Investment Research. All Rights Reserved.

Sales Please refer to the accompanying Consensus Income Statement for a more detailed report on current analysts’ sales, margin and valuation estimates.

Revenue for the second quarter rose 19% to $169.8 million from the $142.8 million posted in the previous year’s second quarter. Arrowhead Mills grew double digits and DeBoles rose 17%. All other brands also witnessed high single digit growth to double digit growth. However, it is important to note that 8.4 percentage points of the 19% growth came from acquisitions.

Table – 1

2003 2004 1Q05 2Q05 3Q05 4Q05 2005 2006 Net Sales $466 $544 $138 $170 $165 $158 $648 $675 Digest High $466 $544 $138 $170 $170 $164 $686 $691 Digest low $466 $544 $138 $170 $162 $152 $621 $648 Digest Average $466 $544 $138 $170 $165 $158 $648 $675

Full year sales are expected to grow 19% to $647.8 from $544.1. Analysts’ revenue estimates range from $621 (RBC Capital Markets) to $685.8 (Pipper Jaffray). Several analysts worry that HAIN will be unable to sustain a high growth rate without acquisitions.

Margins

HAIN’s gross margins fell 162 basis points to 31.36% from 32.98%. Operating margins fell 80 basis points to 11.1%. Net margins also declined 80 basis points to 6.5%, due to higher cost of products, which were in turn mainly pushed up by higher selling and marketing expenses. The Sarbanes-Oxley Act also impacted margins.

Analysts expect HAIN to start to benefit from efforts to improve margins in second half of FY 2005. SKU rationalization and some planned layoffs should begin to benefit earnings by the second half. The recent 4% price hike will help mitigate the impact of higher ingredient and transportation costs.

Table – 2

Margins 2003 2004 1Q05 2Q05 3Q05 4Q05 2005 2006 Gross 30.3% 29.5% 28.3% 31.4% 29.1% 27.9% 31.1% 29.6% Operating 9.9% 8.4% 8.1% 11.1% 8.9% 7.7% 8.8% 10.0% Pre-Tax 9.5% 8.0% 7.6% 10.8% 8.7% 7.5% 8.5% 9.6% Net 5.9% 5.0% 4.7% 6.5% 5.2% 4.5% 5.1% 5.9%

Earnings Per Share

EPS of HAIN increased by $0.02 to $0.31 vis-à-vis prior year quarter, and $0.01 above analysts’ expectations. However, after considering the Sarbanes Oxley Act, the EPS falls to $ 0.29, same as last year. Table – 3

Zacks Investment Research Page 2 www.zacks.com FY ends June 30 2003 2004 1Q05 2Q05 3Q05 4Q05 2005 2006 Zacks Consensus $0.79 $0.74 $0.18 $0.29 $0.24 $0.21 $0.93 $1.11 Digest High $0.79 $0.74 $0.18 $0.29 $0.26 $0.22 $0.95 $1.15 Digest Low $0.79 $0.74 $0.18 $0.29 $0.21 $0.16 $0.85 $0.98 Digest Avg. $0.79 $0.74 $0.18 $0.29 $0.23 $0.20 $0.92 $1.08 Digest YoY growth -6.3% 23.8% 18.3% Mgmt Guidance $0.92-$1.01

Analysts expect EPS to stay above the previous year levels in the next comparable quarters. Full fiscal year EPS is expected to be $0.92, 23.82% higher than last year’s figure of $0.74.

Target Price/Valuation

Of the 8 analysts that cover HAIN, 6 have positive ratings and 2 have neutral ratings.

Target Prices of HAIN are in the range of $19 (RBC Capital Markets, Pipper Jaffray) to $26 (Smith Barney). Both the analyst quoting the highest target price and the analyst with the lowest target price adopted P/E multiple to forward EPS estimates. Most of the analysts have adopted 19x – 22x of P/E multiple to forward EPS Estimate for price target valuation. Table – 4 Rating Distribution Positive 75% Neutral 25% Negative 0% Avg. Target Price $22.13

Long-Term Growth

The long-term growth rates for HAIN fall within the range of 10% (Lehman Brothers) to 20% (Smith Barney), while the digest average is 15%. Several analysts believe that the company is re-establishing itself as a premier growth vehicle with new products, broadened distribution, and an active acquisition program. They believe that SKU rationalization and other initiatives will reinvigorate the company. The natural/organic sector is a bright spot in the food industry, expanding 8%-10% annually. It is difficult to peg HAIN’s exact internal growth rate, but some analysts believe the company is lagging the overall sector. Acquisitions will continue to provide supplemental opportunities as was evident in the most recently-reported quarter. However, HAIN faces many challenges to growing the top-line. Investors will need to assess the risks from new entrants, including some of the food industry’s major players.

Individual Analyst Opinions POSITIVE RATINGS

Adams Harkness – Buy ($23) : Report Date 2/4/05 The analyst has raised price target by $1. Analyst finds the emphasis on SKU rationalization and potential brand divestitures very promising. There is considerable low hanging fruit.

BB & T Cap. – Buy ($24) : Report Date 2/4/05

Zacks Investment Research Page 3 www.zacks.com The analyst retains buy rating. The analyst’s confidence is boosted by strong expected sales in the last half of fiscal 2005.

Bear Stearns – Outperform ($25) : Report Date 2/4/05 The analyst maintains buy rating. The analyst believes that better days are ahead for HAIN. The plan to rationalize SKUs is both prudent and margin enhancing and key brands are showing good growth.

Lehman – Overweight ($20) : Report Date 2/4/05 The analyst believes that SKU rationalization and trade spending efficiencies will create growth.

Smith Barney – Buy ($26) : Report Date 2/3/05 The analyst believes that lower commodity costs and improved pricing will lead to better profits and higher valuation.

Prudential – Overweight($21) : Report Date 2/3/05

NEUTRAL RATINGS

Piper Jaffray – Neutral($19) : Report Date 2/4/05 The stock is rated Market Perform with a price objective of $19. The analyst continues to be concerned about getting market scale across 30 brands. However, strong top-line growth is a silver lining.

RBC Cap. – Neutral($19) : Report Date 2/4/05 The stock is rated Sector Perform with a price target of $19. The analyst is cautious on the stock as falling margins are a major concern. Increasing competition, particularly in the mass market, could impact HAIN’s sales and/or margins and cause performance to fall short of expectations.

NEGATIVE RATINGS

None of the analyst has rated HAIN as negative.

Zacks Investment Research Page 4 www.zacks.com © Copyright 2003, Zacks Investment Research. All Rights Reserved.