COURSE SYLLABUS International settlement Spring 2013 BEIJING NORMAL UNIVERSITY

Time: Tues 10:00-12:00 am

Location: No.7 building 302

Lecturer: Yang Juan

Contact Info: [email protected]

Prerequisite: The students should have some basic knowledge of economics before learning.

Overview: The course provides a full explanation of the key finance areas of international trade - including risk management, international payments, currency management, bonds and guarantees, and trade finance. Upon completion of this course, students should be able to: understand how the international transactions are settled and financed: identify the most competitive finance alternatives, how to reduce risks and improve cash flow, structure the best payment terms, minimize finance and transaction costs how these activities are governed and the related international customs and practices. The overall objective of this course is to provide those students who would like to work in companies or banks involved in international sales, finance, shipping and administration a good specialty foundation and a prospective professional future.

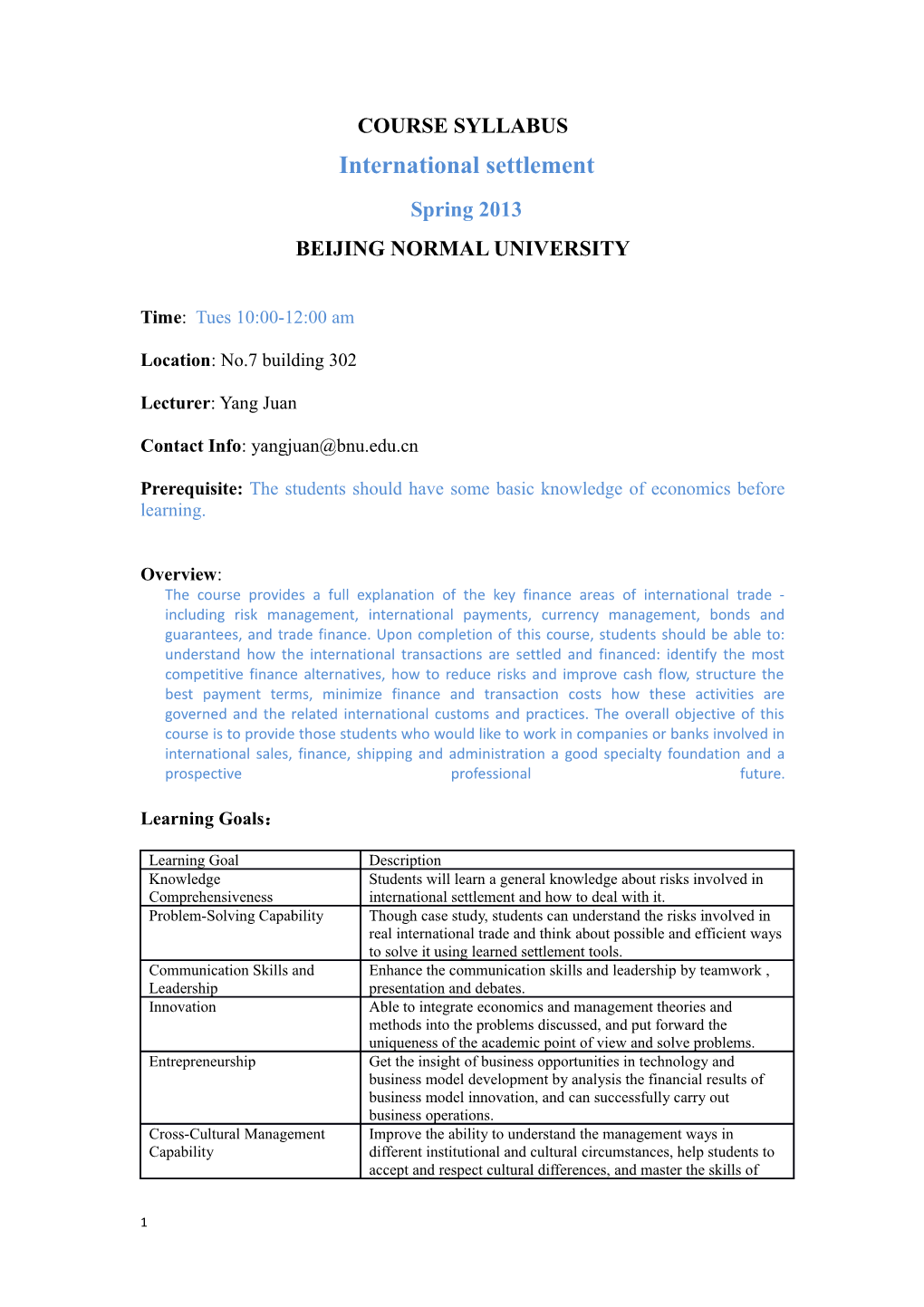

Learning Goals:

Learning Goal Description Knowledge Students will learn a general knowledge about risks involved in Comprehensiveness international settlement and how to deal with it. Problem-Solving Capability Though case study, students can understand the risks involved in real international trade and think about possible and efficient ways to solve it using learned settlement tools. Communication Skills and Enhance the communication skills and leadership by teamwork , Leadership presentation and debates. Innovation Able to integrate economics and management theories and methods into the problems discussed, and put forward the uniqueness of the academic point of view and solve problems. Entrepreneurship Get the insight of business opportunities in technology and business model development by analysis the financial results of business model innovation, and can successfully carry out business operations. Cross-Cultural Management Improve the ability to understand the management ways in Capability different institutional and cultural circumstances, help students to accept and respect cultural differences, and master the skills of

1 cross-cultural communication with international vision. Social Responsibility Enhance understanding of social responsibility of default in letter of credit and collection. After learning the new development of settlement, students should build up credit conscious.

Teaching Approach:

The teaching approach is composed by lectures delivery, case study and classroom discussions

Texts and Materials: 1 Yang, Juan, International settlement, Beijing Normal University Press, 2012 2 David, Hinkelman, A short Course in International Payment, 2nd Edition, World Trade Press, 2003 3 Anders Grath The handbook of international trade and Finance, Kogan Page Limited 2008

Recommended background textbooks

1. A N Yianopoulos, Ocean Bill of Lading,Kluwer Law International,1995 2. Charles Del Busto. ICC Guide to Documentary Credit Operations for UCP 500: A Stage-by- Stage Presentation of the documentary Credit Process. ICC, the World Business Organization, 1994. 3. Christopher Hill, Maritime Law, Lloyds of London Press Ltd., 4th. Edition,1995 4. Clive M Schmitthoff, Export Trade, The Law and Practice of International Trade, London Sweet & Maxwell, 2000 5. Hugh M Kindred, Muti-modal Transport Rules, Kluwer Law International, 1997 6. General Rules for International Factoring, 2000 7. Uniform Customs and Practices for Documentary Credits, ICC Publications 600, 2006. 8. Uniform Rules for Collection, ICC Publication 522, 1995. 9. Uniform Rules on Demand Guarantees, ICC Publications 458, 1992 10. International Standard Banking Practices for the Examination of Documents under Documentary Credits(ISBP), ICC Publication No.681, 2007 11. Uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits, ICC Publication No.725, 2008 12. Official Rules for the Interpretation of Trade Terms (Incoterms 2000), ICC Publication No. 560, 1999 13. International Standby Practice 98 (ISP98), ICC Publication No. 590, 1998 14. Johan Bergamin. Payment Techniques in Trade Finance. ING Barings, 1999 15. John S. Gordon. Export/Import letters of Credit and Payment Methods: Making Payments in International Trade. 2nd edition. Global Training Center, Inc. Dayton, 2002 16. Paul Todd, Cases and Materials on Bills of Lading, BSP Professional Books, 1990 17. R H Brown, Dictionary of Marine Insurance Terms and Clauses, Witherby & Co Ltd, 1989 18. UNCTAD/ICC rules for Mulitmodel Transport Documents 19. Wim Albert Timmermans, Carriage of Goods by Sea in the Practice of the USSR Maritime Arbitration Commission, Martinus Nijhoff Publishers, 1991

Required Readings:

2 No required readings before the class

Grading:

10% attendance + 10% course performance + 40% Assignments (presentation) +40% final exam

The course requires students to analyze a real case of international settlement by collecting related materials and present it to other students

mark 90-100, exceptional, 80-89 good, 70-79 satisfactory, 60-69 unsatisfactory, below 60 failing

Course Schedule:

chapter General Introduction 2 hours 1: The definition of international trade settlement, international non-trade settlement, visible trade, invisible trade. Characteristics of the evolution of international settlement SWIFT, CHIPS, CHAPS, TARGET, CNAPS, FEDWIRE Players and their roles in international trade Factors considered by an exporter in making payment decisions Types of payment techniques Related customs and practice, banking institutions chapter Instruments of international settlement 2 hours 2: Broadly and narrowly defined negotiable instrument; characteristics of negotiable instruments: negotiability, unconditional promise or order to pay, requisite in form, non-causative nature; functions of negotiable instruments; negotiable instrument laws;parties to a negotiable instrument; the relationship of the parties to a negotiable instrument Bills of exchange; essential items required in a bill of exchange; acts relating to a bill of exchange; classification of bills of exchange Promissory notes; essential items of a promissory note; joint notes; joint and several notes; difference between a bill and a note; types of notes Cheques; essential items of a cheque, types of cheques, differences between a bill and a cheque chapter Remittance 2 hours 3: Remittance Basic parties to a remittance: remitter, remitting bank, paying bank and payee or beneficiary Types of remittance: mail transfer, telegraphic transfer and demand draft Reimbursement of remittance cover Application of remittance in international trade: cash in advance, open account and consignment Chapte Collection 2hours r 4 Collection; URC522; Basic Parties to a Collection: Principal/drawer, remitting bank, collecting bank, presenting bank, and drawee;

3 Types of collection: clean collection and documentary collection Terms of Releasing documents: D/P, D/A, D/P after sight Direct collection Procedures of a documentary collection transaction Banks’ liabilities and disclaimers under a collection Financing provided by banks under a collection: negotiation, advance against collection, trust receipt, and release of goods against guarantee. Problems frequently arising from collection Chapte Letters of Credit 12 hours r 5 General Introduction of Letter of Credit Characteristics of a letter of credit: a written undertaking on the part of the issuing bank, independent of the sales contract, exclusively dealing with documents Parties to a letter of credit: applicant, issuing bank, beneficiary, advising/transmitting bank, confirming bank, paying/accepting bank, negotiating bank, claiming bank, reimbursing bank Procedures of a documentary credit operation Contents of a letter of credit: items on the credit itself, items on draft, items on goods, shipping documents and transport, other items Examination of a documentary credit: establishing the authenticity of the authorized signature or the test key; investigating the creditworthiness of the issuing bank; investigating the credit rating of the country where the issuing bank resides; checking the liability clause of the transmitting bank, if any; checking the credit rating of the transferring bank; checking the credit itself Types of credit: revocable credit; irrevocable credit; confirmed irrevocable credit; sight payment credit; acceptance credit; buyer’s acceptance credit; deferred payment credit; negotiation credit; straight credit; anticipatory credit; transferable credit; back-to-back credit; revolving credit; reciprocal credit; standby credit Financing Provided by Banks: negotiation; packing loan; credit line approved to the importer by the issuing; inward bill purchasing; trust receipt; delivery of the goods against bank guarantee Letters of credit and other payment methods Chapte Standby Letters of Credit 2 hours r 6 Meaning of standby credit Differences between a standby L/C and a commercial L/C; UCP 500 vs. ISP98 Characteristics of a standby L/C: clean L/C; financial obligation; non- financial obligation; irrevocable form; duration and amount; payment procedures Types of standby L/C: performance standby; advance payment standby; bid bond/tender bond standby; counter standby; financial standby; direct pay standby; insurance standby; commercial standby Chapte Bonds and Guarantee 2 hours r 7 General introduction of bank guarantee; Uniform Rules for Demand Guarantees; Uniform Rules for Contract Guarantees Basic parties to a letter of guarantee: applicant/principal; beneficiary; guarantor; advising or transmitting bank Direct and Indirect Guarantee Types of guarantees: tender guarantee/bid bond; performance guarantee; repayment guarantee; advance payment guarantee; maintenance guarantee; retention money guarantee; counter guarantee Contents of a bank guarantee: basic contents of a bank guarantee; basic

4 contents of a counter guarantee; additional clauses of a bank guarantee: validity clause, reduction of the value clause, authentication clause, legal clause, automatic extension clause, no change or addition clause, joint and several liability clause, interest clause, return clause, non-negotiable clause, assignment of proceeds clause, unconditional to pay clause, no deduction clause, primary obligor clause. Procedures of a bank guarantee operation Chapte International Factoring 2 hours r 8 Origin and evolution of factoring General introduction of factoring; general rules for international factoring Basic Parties and procedures of international factoring (supplier, debtor, export factor, import factor) Types of factoring: maturity factoring and financed factoring, disclosing factoring and undisclosed factoring, single factoring and co-factoring Services provided to the exporter by a factor: credit investigation; collection of proceeds; maintenance of the sales ledger; risk protection; payment on account Legal Framework for Factoring Transaction The Role of Factoring in International Trade Factoring and its Prospects in China Chapte International Forfaiting 2 hours r 9 The evolution of forfaiting The meaning of forfaiting; parties to a forfeiting finance transaction; characteristics and documentation of forfaiting, including evidence of debts, evidences of the commercial transaction and guarantee; costs of forfaiting finance The Procedures of a Forfaiting Transaction Primary and Secondary Forfaiting Markets Forfaiting vs. Other Trade Financing Methods: forfaiting vs. officially supported export credits; forfaiting vs. factoring; forfaiting vs. invoice discounting Forfaiting in China Chapte Documents 4 hours r 10 Types of documents; roles of documents: representing the title to the ownership of the goods and evidencing the fulfillment of obligation Drafts drawn under a letter of credit: characteristics of drafts( requisite form, compliance with the credit); examination of drafts drawn under a letter of credit; frequently found discrepancies with drafts Commercial Invoices: contents of commercial invoices( heading, body, complementary clause); frequently found discrepancies with invoices; other invoices( proforma invoice, customs invoice, consular invoice) Bills of lading; basic parties to a bill of lading; main contents of a bill of lading; types of bills of lading; frequently found discrepancies with a bill of lading; other transport documents: airway bill, railway bill Insurance documents: types of marine cargo transport insurance; checking of an insurance policy under a letter of credit Certificates of Origin: GSP Certificate of Origin Form A; CCPIT Certificate of Origin; Certificate of Origin issued by the exporter Inspection Certificate Other documents: packing list and weight list, cable copy, beneficiary statement, shipping company’s certificate

5