SECTION B PART I PRICE - HEALTH INSURANCE

B.1. HEALTH INSURANCE SERVICES

The Contractor shall provide Health Insurance services to employees of the Government of the United States of America in Ecuador. The groups of employees who shall be provided this insurance are listed in C.1.2. This insurance shall be provided in accordance with Section C and the Exhibits in Section J.

B.2. PRICES

This is a fixed price with economic price adjustment requirements type contract under which will be issued firm, fixed-price task orders. The fixed prices/premium rates for the health insurance services as specified in Section C are as follows:

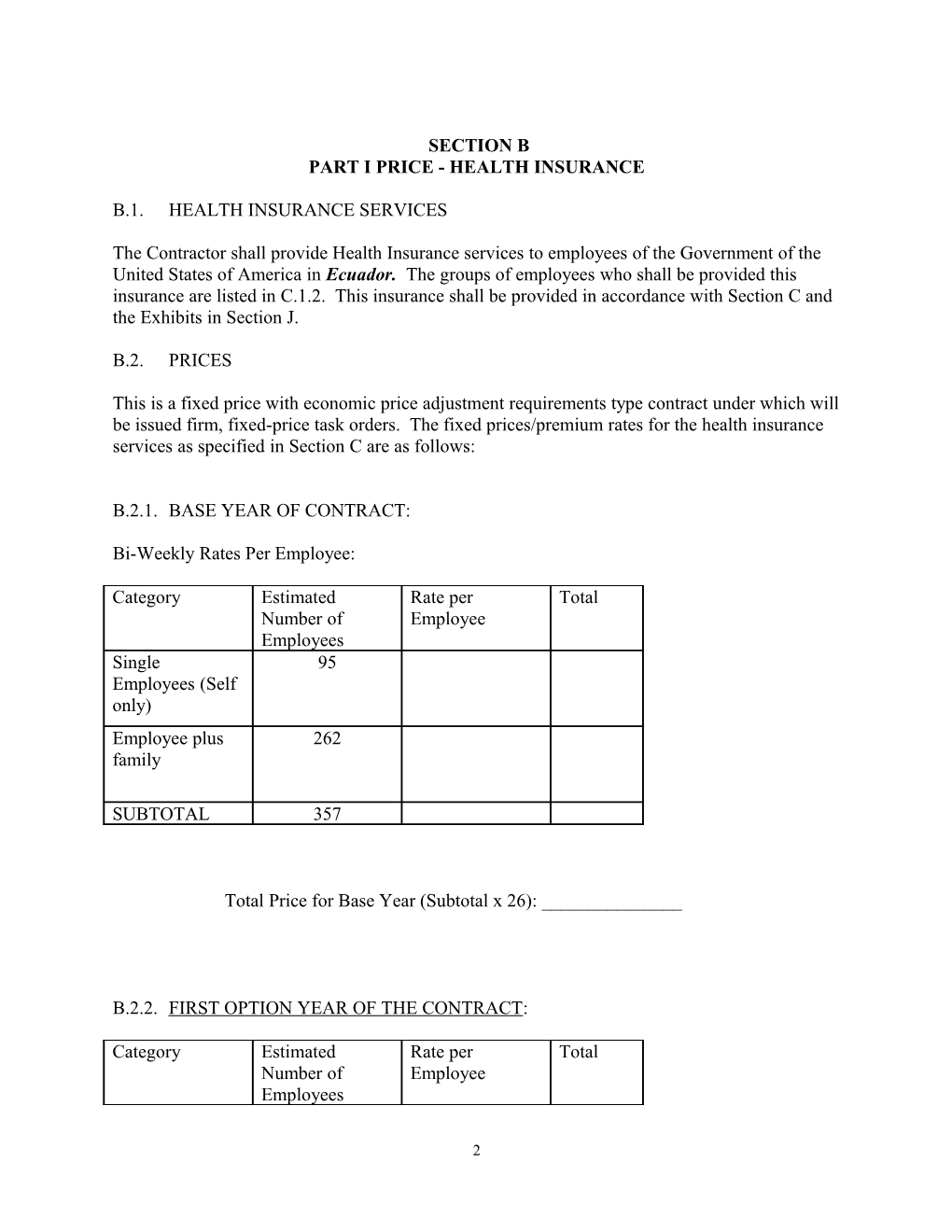

B.2.1. BASE YEAR OF CONTRACT:

Bi-Weekly Rates Per Employee:

Category Estimated Rate per Total Number of Employee Employees Single 95 Employees (Self only) Employee plus 262 family

SUBTOTAL 357

Total Price for Base Year (Subtotal x 26): ______

B.2.2. FIRST OPTION YEAR OF THE CONTRACT:

Category Estimated Rate per Total Number of Employee Employees

2 Single 95 Employees (Self only) Employee plus 262 family

SUBTOTAL 357

Total Price for Option Year 1 (Subtotal x 26): ______

B.2.3. SECOND OPTION YEAR OF THE CONTRACT:

Category Estimated Rate per Total Number of Employee Employees Single 95 Employees (Self only) Employee plus 262 family

SUBTOTAL 357

Bi-Weekly Rates Per Employee:

Total Price for Option Year 2 (Subtotal x 26): ______

B.2.4. THIRD OPTION YEAR OF THE CONTRACT:

Bi-Weekly Rates Per Employee:

Category Estimated Rate per Total Number of Employee Employees Single 95 Employees (Self only) Employee plus 262 family

SUBTOTAL 357

Total Price for Option Year 3 (Subtotal x 26): ______

3

B.2.5. FOURTH OPTION YEAR OF THE CONTRACT:

Bi-Weekly Rates Per Employee:

Category Estimated Rate per Total Number of Employee Employees Single 95 Employees (Self only) Employee plus 262 family

SUBTOTAL 357

Total Price for Option Year 4 (Subtotal x 26): ______

GRAND TOTAL BASE PERIOD PLUS OPTION YEARS: ______

B.3 ADMINISTRATIVE RETENTION AMOUNTS

B.3.1 If the Contractor requests a price adjustment under B.4 below, the Contractor must present cost experience data that includes the retention amount. For purposes of any economic price adjustment, this retention amount is a fixed amount that is a part of the premium amounts in B.2. This retention amount will not be adjusted for any reason.

The retention amount is part of the premium and may include, but not be limited to, such costs as overhead and general and administrative costs. It will also include any profit. Essentially, it includes all costs except the actual portion of the premium intended to fund claims paid to the health care provider/claimant. B.3.2 sets forth the retention amounts per premium paid for each category of premium and for each period of performance.

NOTE TO OFFEROR - Fill in the fixed retention amounts for each period of performance and for each category of premium. This fixed amount must be expressed in the currency in which the premium amount is proposed. The fixed retention amount shall NOT be expressed in terms of a percentage of the premium.

B.3.2.1Retention Amounts per separate premium paid per single employee and per family plan.

Period of Single Employees (Self Employee + Family Performance Only) Members Base Period Option Year 1 Option Year 2

4 Option Year 3 Option Year 4

B.4. ECONOMIC PRICE ADJUSTMENT-HEALTH INSURANCE PREMIUMS

B.4.1. Premium Adjustment based on Experience - For health insurance, prices may be adjusted upward or downward based on the experience rating of the Mission(s) covered by this contract. No adjustment will be allowed during the first twelve months. After such time, the contractor or the Government may request an adjustment in premiums on an annual basis. Before any such adjustment is made, the contractor agrees to provide the Government a balance sheet showing two main components for the time period: (1) receipts (premiums received) minus the retention amount and (2) claims paid. The retention amount is not subject to adjustment. The Government reserves the right to have an independent third party review the balance sheet and make recommendations regarding the appropriateness of the requested adjustment. Any adjustment shall be subject to mutual agreement of the parties and shall result in a written modification to the contract. Any failure to reach agreement under this clause shall be subject to the procedures in the Disputes clause.

B.4.2. Premium Adjustment Based on Laws - The rates may also be adjusted during the performance period of the contract as a result of laws enacted by the host Government, if such change in the laws has a direct impact on the cost to the contractor to perform this contract at the contracted rate. In that event, the Contracting Officer may enter into negotiations with the Contractor to modify the contract to adjust the premium rate. The contractor agrees to provide all documentation necessary to support any requested adjustment.

B.4.2.1Employee Pool – This clause is only in effect if the contractor included details in its offer regarding a pooling arrangement, of which this contract is a part.

Before any adjustment is made under this price adjustment clause, the Contractor must include in its proposal for adjustment, details setting forth how the pool impacts the request for equitable adjustment.

PART II PRICE - GROUP LIFE INSURANCE AND DISABILITY BENEFITS

B.5. GROUP LIFE INSURANCE SERVICES

The Contractor shall provide the Group Life Insurance services described herein to employees of the Government of the United States of America in Ecuador. The groups of employees who shall be provided this insurance are listed in C.2.2. This insurance shall be provided in accordance with Section C and the Exhibits in Section J.

B.6. GROUP LIFE INSURANCE RATES

This is a fixed-price with economic-price- adjustment-requirements type contract under which the Government will issue firm-fixed price task orders. The fixed prices/premium rates in U.S.

5 Dollars per one thousand of salary to provide life insurance, accidental death and dismemberment and partial and total disability coverage are as follows:

B.6.1. BASE YEAR OF CONTRACT

Bi-Weekly Rates per Employee:

Type of Premium (per Estimated Total Insurance 1,000) of salary Payroll (biweekly, in thousands) Basic Life $165,000 Accidental Death $165,000 and Dismemberment Partial and Total $165,000 Disability Coverage

Total Price for Base Year: ______x 26 = ______

6 B.6.2. FIRST OPTION YEAR OF CONTRACT:

Bi-Weekly Rates per Employee:

Type of Premium (per Estimated Total Insurance 1,000) of salary Payroll (biweekly, in thousands) Basic Life $168,300 Accidental Death $168,300 and Dismemberment Partial and Total $168,300 Disability Coverage

Total Price for Option Year 1: ______x 26 = ______

B.6.3. SECOND OPTION YEAR OF CONTRACT:

Bi-Weekly Rates per Employee:

Type of Premium (per Estimated Total Insurance 1,000) of salary Payroll (biweekly, in thousands) Basic Life $171,666 Accidental Death $171,666 and Dismemberment Partial and Total $171,666 Disability Coverage

Total Price for Option Year 2: ______x 26 = ______

B.6.4. THIRD OPTION YEAR OF CONTRACT:

Bi-Weekly Rates per Employee:

Type of Premium (per Estimated Total Insurance 1,000) of salary Payroll (biweekly, in thousands)

7 Basic Life $175,099 Accidental Death $175,099 and Dismemberment Partial and Total $175,099 Disability Coverage

Total Price for Option Year 3: ______x 26 = ______

B.6.5. FOURTH OPTION YEAR OF CONTRACT:

Bi-Weekly Rates per Employee:

Type of Premium (per Estimated Total Insurance 1,000) of salary Payroll (biweekly, in thousands) Basic Life $178,601 Accidental Death $178,601 and Dismemberment Partial and Total $178,601 Disability Coverage

Total Price for Option Year 4: ______x 26 = ______

GRAND TOTAL PRICE FOR ALL YEARS: ______

B.7 ADMINISTRATIVE RETENTION AMOUNTS

B.7.1 If the Contractor requests a price adjustment under B.8 below, the Contractor must present cost experience data that includes the retention amount. For purposes of any economic price adjustment, this retention amount is a fixed amount that is a part of the premium amounts in B.6. This retention amount will not be adjusted for any reason.

The retention amount is part of the premium and may include, but not be limited to, such costs as overhead and general and administrative costs. It will also include any profit. Essentially, it includes all costs except the actual portion of the premium intended to fund claims paid to the claimant.

B.7.2 sets forth the retention amounts per premium paid for each category of premium and for each period of performance.

8 NOTE TO OFFEROR - Fill in the fixed retention amounts for each period of performance and for each category of premium. This fixed amount must be expressed in the currency in which the premium amount is proposed. The fixed retention amount shall NOT be expressed in terms of a percentage of the premium.

B.7.2 Retention Amounts per separate premium paid per employee

Period of Basic Life Accidental Death Partial and Total Performance and Disability Dismemberment Coverage Base Period Option Year 1 Option Year 2 Option Year 3 Option Year 4

B.8 ECONOMIC PRICE ADJUSTMENT-LIFE INSURANCE PREMIUMS

B.8.1. Premium Adjustment Based on Experience - For life insurance, prices may be adjusted upward or downward based on the experience rating of the Mission(s) covered by this contract. No adjustment will be allowed during the first twelve months. After such time, the contractor or the Government may request an adjustment in premiums on an annual basis. Before any such adjustment is made, the contractor agrees to provide the Government a balance sheet showing two main components for the time period: (1) receipts (premiums received) minus the retention amount and (2) claims paid. The retention amount is not subject to adjustment. The Government reserves the right to select an independent third party to review the balance sheet and make recommendations regarding the appropriateness of the requested adjustment. Any adjustment shall be subject to mutual agreement of the parties and shall result in a written modification to the contract. Any failure to reach agreement under this clause shall be subject to the procedures in the Disputes clause.

B.8.2. Premium Adjustment Based on Law - The rates may also be adjusted during the performance period of the contract as a result of laws enacted by the host Government, if such change in the laws has a direct impact on the cost to the contractor to perform this contract at the rate contracted for herein. In that event, the Contracting Officer may enter into negotiations with the Contractor to modify the contract to adjust the premium rate. The contractor agrees to provide all documentation necessary to support any requested adjustment.

9 SECTION C DESCRIPTION/SPECIFICATION/WORK STATEMENT

PART I - HEALTH INSURANCE

C.1. HEALTH INSURANCE SERVICES

The Government of the United States of America requires Health Insurance coverage for its employees as further described in C.1.2 in Ecuador. The Government has determined that the prevailing practice by employers in Ecuador is to provide for their employees’ health insurance protection and that the cost of such insurance protection is usually borne by both the employee (10%) and the employer (90%) on a shared basis. Health insurance protection will be representative of locally prevailing compensation practice as further described in C.1.2. The specific health benefit coverage under this contract is set forth in Section C and the Exhibits in Section J.

The Contractor shall insure that health care under this contract does not exclude HIV/AIDS care, unless exclusion has been authorized by HR/OE/CMD.

C.1.1 Employee and Dependent Health Services Benefits

The health benefits under this contract are as follows. Reimbursement of covered expenses is limited to the stated percentages of reasonable and customary costs. Proposals that contain more benefits (even if there is no increase in cost) or fewer benefits than stated in the solicitation may be deemed technically unacceptable.

Reimbursements or payments shall be made for the following covered benefits, subject to reasonable and customary costs in the locality where treatment was provided.

C.1.1.1. Hospitalization - 100% reimbursement for room and board for a ward room or semi-private room. The cost of a private room will be reimbursed up to 100% of the cost of a semi-private room. 100 %reimbursement of hospital medical expenses including laboratory tests and X-rays, nursing care, operating room costs, and prescription medicines. 100% reimbursement of ambulance service.

C.1.1.2. Professional services and treatment – 100% of doctors’ and surgeons’ fees incurred while hospitalized (in-patient), on an out-patient basis at a hospital, clinic, or doctor’s office, or at home, and for doctor’s visits. Reimbursement for medical treatment and services when not hospitalized, such as laboratory tests, X-Rays, and routine annual physical examinations shall be reimbursed at 100%.

C.1.1.3. Doctor Visits – as mentioned above in C.1.1.2.

C.1.1.4. Prescription Drugs - 100% reimbursement for the cost of medicines and drugs, including immunizations for which a prescription is legally required, when hospitalized and when not. This includes immunizations

10 as well as medicines and drugs that suppress opportunistic infections, such as tuberculosis and toxoplasmosis. Brief courses of anti-retroviral drugs during childbirth to prevent transmission of HIV to the employee’s child are also included; duration of treatment is to be determined by the employee’s personal physician, following WHO and CDC guidelines. Expenses incurred for medicines, vitamins, cold remedies, etc, that are available over the counter without a prescription will not be reimbursed even if prescribed even if prescribed by a physician.

C.1.1.5. Maternity – 100% reimbursement of in-patient obstetrical medical expenses, including normal and caesarean delivery. 100% reimbursement for out-patient obstetrical care, including pre-natal and post-natal care to include provisions for brief courses of anti- retroviral drugs during childbirth to prevent the transmission of HIV to the employee’s child. Duration of treatment is to be determined by the employee’s personal physician, following WHO and CDC guidelines.

C.1.1.6. Optical Service – 100% reimbursement for eye examination and treatment up to U.S. $200.00 every two (2) years. 90% reimbursement up to U.S. $180.00 for prescription eyeglasses or contact lenses, limited to one set of lenses per patient every two(2) years. 80% reimbursement for frames costing up to U.S. $150.00 every two (2) years. There will be no reimbursements for non-prescription lenses or lens tinting.

C.1.1.7. Dental Service – 100% of expenses up to U.S. $2,000.00 per contract year for dental services including dentists’ fees, X-Rays, dental examinations and treatment, including fillings, extractions, false teeth, crowns, and bridges. Orthodontia treatment is covered only if treatment begins before age 15, unless required as the result of an accident. A maximum of four years of orthodontia treatment will be covered per patient.

C.1.1.8. Physical Therapy – 100% reimbursement.

C.1.1.9. Psychiatric Treatment – 100% reimbursement.

C.1.1.10. Ambulance Service – 100% reimbursement over land and 100% reimbursement for air transport, not to exceed U.S. $9,125.00.

11 C.1.1.11. Hearing Aids – 100% reimbursement for hearing aid examinations. 65% reimbursement for the cost of a hearing aid apparatus costing up to U.S. $825.00. This is limited to one apparatus per ear per covered individual in a three-year period.

C.1.1.12. Expenses Incurred Out-of-Country – 80% reimbursement of the cost of medical treatment for both employees and dependents when (a) an illness or injury occurs when the individual is out of the country and treatment is medically necessary before the individual returns home or (b) the individual’s physician and Embassy Management Officer certify in advance through discussion with a regional medical officer that such treatment is medically necessary and unavailable locally. Transportation for such out-of- country medical treatment is a covered expense for employees and dependents. 80% of the patient’s transportation expenses by the least expensive, appropriate means to the nearest city with adequate medical facilities will be reimbursed. Reimbursement for both out-of-country treatment and transportation is subject to the same annual maximum limit as for expenses incurred in-country.

C.1.1.13. Family Planning – 80% reimbursement of prescribed contraceptive devices and drugs, voluntary sterilization, and diagnosis and treatment of infertility. The reversal of voluntary sterilization, infertility treatment after voluntary sterilization, to include genetic counseling, fertility drugs, and assisted reproductive technology, are not covered.

C.1.1.14 Annual Maximum Limits – The insurance company will reimburse covered expenses up to a limit of U.S. $57,600.00 per covered individual, per contract year.

A separate maximum limit of U.S. $10,000.00 applicable to the employee only will be included for HIV/AIDS medications coverage. This separate limit is also applicable to the employee’s covered spouse for anti-retroviral drugs to prevent transmission of HIV to the employee’s child.

C.1.1.15. Deductible – None.

C.1.1.16. Premium Costs – a) For eligible employees who are regularly scheduled to work 30 or more hours per week, the U.S.G will pay 90% and the employee will pay 10% of the premium cost for employee and dependent coverage. b) For eligible employees who are regularly scheduled to work less than 30 hours per week, the U.S.G. will pay a prorated share of the premium cost for employee and dependent coverage, based on the number of hours the employee is regularly scheduled to work. c) During a period of leave without pay or unpaid leave beyond one pay period, the employee is responsible for the full cost of premiums. The U.S.G will pay the premium directly to the contractor, and will collect the full cost from the employee. Alternatively, the employee may elect to have coverage cease if he/she prefers not to pay the premium.

12 d) For retired employees the U.S.G will pay 100% of the premium cost for both the retiree and dependent coverage.

C.1.2 Health Benefits Conditions and Limitations.

Conditions and limitations on the entitlement to health care under this contract are as follow:

There is no reimbursement for elective cosmetic surgery; spa cures; rejuvenation cures; massage; exercise therapy; long term rehabilitative therapy; eyeglass frames; non-medical hospital charges such as telephones or television; home help, family help, or similar household assistance; fees of persons who are not licensed physicians or nurses; or services or supplies which have not been prescribed or approved by a physician or nurse.

There is no reimbursement for expenses that will be reimbursed or paid directly under a host country medical program or workers' compensation program; the U.S. workers’ compensation program; or post’s LES workers’ compensation program.

There is no reimbursement for expenses related to an illness or injury that is a result of an unlawful action on the part of the patient; the practice of a dangerous sport; excessive or illegal use of alcohol or drugs; a self-inflicted wound; or service in the armed forces of any country.

C.1.3 Eligible Participants

C.1.3.1 Eligible Employees - The employees eligible for the health insurance services include the following:

C.1.3.1.1 All current active employees of the United States Government, employed within the geographic boundaries of Ecuador and under Chief of Mission authority paid under the Local Compensation Plan, and certified by the Contracting Officer. Covered employees include Locally Employed Staff (LES) who are (1) working on a full-time or part-time basis under non-temporary direct hire appointments or under personal services agreements/contracts (PSA/PSC) that are not time-limited to less than one year, and (2) paid under the terms of the Local Compensation Plan.

C.1.3.1.2. Among the LES are included Foreign Service Nationals (FSNs) employed under direct hire appointments, Personal Services Agreements (PSAs) and Personal Services Contracts (PSCs); and

C.1.3.1.3. Locally hired U.S. citizens employed under direct hire appointments, PSAs, and PSCs.

C.1.3.2 Location of Employment

13 The individuals covered by C.1.3.1 must be employed within the geographic boundaries of Ecuador by:

U.S. Department of State U.S. Agency for International Development (USAID) Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS) Foreign Agricultural Service Department of Defense, Defense Attache Office Drug Enforcement Administration (DEA) Immigrations and Customs Enforcement (ICE) Department of Defense, Military Assistance Group (MILGROUP) U.S. Army Corps of Engineers (USACE) Marine Security Guard (MSG) Detachment Department of Defense’s Force Protection Detachment (FPD) Peace Corps (PD)

C.1.4 Individuals Not Eligible for Coverage

Not eligible are those working under temporary direct hire appointments; those working on When Actually Employed (WAE) schedules; those working under a PSC or PSA that is limited to less than one year; non-personal services contract personnel and their employees supplied by an independent contractor licensed to do business in Ecuador who provides services to other local organizations as well as to the U.S. Mission; employees of USAID institutional contractors; and Peace Corps personal services contractors, as indicated.

C.1.5. Other Eligible Participants

The following additional categories of persons are covered by this insurance:

C.1.5.1. Dependent Coverage – Eligible employees may elect to enroll their eligible dependents (family members). For the purpose of this plan, an employee’s dependents are defined as the employee’s legal spouse (limit one) and economically dependent children who primarily reside with the employee, unless away at school. A child is defined as the employee’s natural child, adopted child, stepchild, or foster child. An eligible child will be covered until the end of the contract year in which he/she reaches age 18, or 25, if a full-time student. There is no age limit for an eligible child who is physically or mentally handicapped so as to be unable to live independently. There is no limit on the number of children covered per employee. Parents, grandparents, siblings, and other relatives are not eligible dependents.

C.1.5.2. Retired employees – Employees who retire from the service of the U.S. Mission who were covered under the medical insurance plan at the time of retirement remain eligible for coverage for themselves and their dependents after retirement.

14 Employees who separate from employment due to total disability are considered to be medically retired and are eligible for medical benefits regardless of age at the time of separation. An employee is considered disabled when an illness or physical or mental impairment results in the employee’s ability to perform work. In the event that the medically retired employee recovers and starts employment with another entity, his/her eligibility for coverage under this plan ceases as soon as he/she becomes eligible for medical benefits from his/her new employer and/or the LESS.

The maximum benefit levels outlined above apply to retirees unless post opts to use less than the maximum benefit levels for retired employees.

C.1.6. Eligibility

C.1.6.1. Term of Eligibility and Effective Date

Each current active eligible employee is enrolled for health benefits under this contract upon award and thereafter during the performance period of this contract. Each new eligible employee will be enrolled upon entering on duty with the United States Government. An employee is considered active ("on the rolls") whenever such employee is on approved leave, whether paid or unpaid.

During a period of Leave Without Pay or unpaid leave that is one pay period or less, coverage under the insurance contract will continue. The USG will pay the total premium cost to the contractor. The employee’s share of the premium will be collected through payroll deduction in that or the subsequent pay period.

C.1.6.2. Period of Ineligibility.

Employees and their dependents are not entitled to health benefits during any period of employment for which premiums are not paid.

Additionally, employee's dependents are not entitled to health benefits during any period of employment during which the employee was not eligible to participate.

During a period of extended (beyond one pay period) of Leave Without Pay or unpaid leave, the employee is responsible for the full cost of the insurance premiums for self and dependents. The Mission will pay the premiums directly to the contractor, and will collect the full cost from the employee on a quarterly basis. Alternatively, the employee may elect to have coverage cease if that employee prefers not to pay the premium.

C.1.7. BROCHURE REQUIREMENT.

C.1.7.1. The contractor shall provide a document (brochure/pamphlet/other written document) in English and Spanish that sets forth a complete listing of the health insurance benefits to be provided under this contract. This brochure shall be provided in sufficient

15 quantities so that each covered employee receives a copy. The contractor shall furnish all copies of the brochures to the COR, who will ensure that appropriate distribution is made.

C.1.7.2. The contractor shall provide the document described in C.1.7.1 to the COR not later than 15 days after date of contract award. The Contractor shall provide additional brochures for new employees within ten (10) days of the COR’s request.

C.1.7.3. The contractor assumes full responsibility for ensuring that the document described in C.1.7.1 accurately reflects the requirements of the contract, as implemented by the contractor’s technical proposal. In all cases, the contract shall take precedence. Should the COR discover that the brochure contains inaccuracies, the contractor will be notified in writing; however, failure on the part of the Government to notice any inaccuracies shall in no way limit, revise or otherwise affect the requirement under this contract for the contractor to fully comply with all contract terms.

16

PART II GROUP LIFE INSURANCE and DISABILITY BENEFITS

C.2.0 GROUP LIFE INSURANCE

The Government of the United States of America requires group life insurance coverage for its employees, as further described in C.2.2, in Ecuador. The Government has determined that the prevailing practice by employers in Ecuador is that group life insurance coverage shall be paid by the employer, therefore the Government shall pay 100% of the premium for covered employees, which is representative of locally prevailing compensation practice. Therefore, the Government desires to adopt such locally prevailing practice as part of its compensation plan for its employees as further described in C.2.2. The specific group insurance coverage under this contract is set forth in this part of Section C and the Attachments in Section J.

C.2.1. Group Life Insurance Coverage.

The amount of group life insurance coverage is as follows:

C.2.1.1 Amount of Employee Life Insurance.

The amount of life insurance coverage for each employee (as described in C.2.3.1) is based upon the following:

Each employee is eligible for a face amount of coverage that is equal to 27 times his or her monthly basic salary, not to exceed $132,250, in the event that the employee dies of natural causes(while at work or while not on duty).

C.2.1.2 Amount of Accidental Death and Dismemberment Coverage.

Each employee, as defined in paragraph C.2.3.1.1, is eligible for a face amount of coverage that is equal to 41 times his/her monthly basic salary, not to exceed $137,500 in the event that the employee is killed in a non-work related accident and 47 times his/her monthly basic salary, not to exceed $138,000 in the event the employee is killed in a work related accident.

The estates of retirees who participate by paying their own premiums will receive an amount equal to 41 (forty-one) times the amount of the monthly basic salary at the time of their retirement in the event that the employee is killed in a non-work-related accident. The maximum amount payable is $137,500.00 (U.S. dollars).

C.2.1.3 Partial and Total Disability Coverage

Coverage for partial or total incapacity or for dismemberment In case of loss of The benefit will be Total disability amount:

17 Eligible employees: 25 times the amount of the basic monthly pay not to exceed USD 144,000 Partial incapacity from loss of : Percent of coverage for total loss: Both hands 100% Both feet 100% Vision in both eyes 95% One hand and one foot 100% One hand and the sight of one eye 100% One foot and the sight of one eye 100% One hand 50% One foot 50% The sight of one eye 50% The thumb of one hand 30% Thumb/index finger of one hand 30% Total loss of hearing 80% Total loss of one ear No coverage Any other finger of the hand 20% Any other toe of the foot No coverage One leg 50% Both legs 100% Incurable mental desease No coverage Total loss of speech No coverage One arm and one leg 100% One arm or one hand 45% Two arms or two feet 100%

C.2.2 Life Insurance and Disability Benefits Conditions and Limitations.

Conditions and limitations on the entitlement to life insurance benefits under this contract are as follow:

There are no exclusions for life insurance in cases of death as a result of natural causes. Coverage will be 100% without an age limitation.

In cases of accidental death, coverage will be 100%, with the following exceptions: Death occurring as a result of suicide. Transport in airplanes not authorized to carry passengers. Participation in strikes that have violent consequences resulting in death. Military service. Participation in illegal activity that leads to death. Fights, unless in self defense. Engaging in dangerous sports. Death caused by overdose of drugs or excessive use of alcohol.

18 C.2.3. Eligible Participants.

C.2.3.1 Eligible Employees. The employees eligible for the group life insurance coverage include the following:

C.2.3.1.1 All current active employees of the United States Government, employed within the geographic boundaries of Ecuador, paid under the Local Compensation Plan, and certified by the Contracting Officer. Covered employees include:

C.2.3.1.2. Eligible employees are Locally Employed Staff (LES), who are (1) working on a full-time or part-time basis under non-temporary direct hire appointments or under Personal Services Agreements (PSAs)/Personal Services Contracts that are not limited to less than one year, and (2) paid under the terms of the local compensation plan;

C.2.3.1.3. Retired employees may be covered; however, they will bear the full cost of the life insurance premiums. These premiums will be made directly to the insurance company, not through the U.S. Government during the specific time agreed with the contractor.

C.2.3.2 Location of Employment

C.2.3.2 The individuals covered by C.2.3.1 must be employed within the geographic boundaries of Ecuador by:

U.S. Department of State U.S. Agency for International Development (USAID) Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS) Foreign Agricultural Service Department of Defense, Defense Attache Office Drug Enforcement Administration (DEA) Immigrations and Customs Enforcement (ICE) Department of Defense, Military Assistance Group (MILGROUP) U.S. Army Corps of Engineers (USACE) Marine Security Guard (MSG) Detachment Department of Defense’s Force Protection Detachment (FPD) Peace Corps (PD)

C.2.4 Individuals Not Eligible for Coverage

C.2.4.1 Individuals not eligible for coverage under this contract are non-personal services contract personnel; employees working on a temporary basis; employees with an

19 intermittent, seasonal, or WAE (when actually employed) schedule; and any other individual not falling within one of the categories of employees described in this clause.

C.2.5. Other Eligible Participants

The following additional categories of persons are covered by this insurance: RESERVED.

C.2.6 Eligibility and Effective Date

C.2.6.1. Term of Eligibility and Effective Date

Each current active eligible employee is enrolled for life insurance and disability benefits under this contract upon award and thereafter during the performance period of this contract. Each new eligible employee will be enrolled upon entering on duty with the United States Government. An employee is considered active ("on the rolls") whenever such employee is on approved leave, whether paid or unpaid.

During a period of Leave Without Pay or unpaid leave that is one pay period or less, coverage under the insurance contract will continue. The USG will pay the total premium cost to the contractor. The employee’s share of the premium will be collected through payroll deduction in that or the subsequent pay period.

C.2.6.2. Period of Ineligibility

Employees are not entitled to life insurance and disability benefits hereunder during any period of employment for which premiums are not paid.

During a period of extended (beyond one pay period) of Leave Without Pay or unpaid leave, the employee is responsible for the full cost of the insurance premiums. The Mission will pay the premiums directly to the contractor, and will collect the full cost from the employee on a quarterly basis. Alternatively, the employee may elect to have coverage cease if that employee prefers not to pay the premium.

C.2.7. Brochure Requirement

C.2.7.1. The contractor shall provide a document (brochure/pamphlet/other written document) in English and Spanish that sets forth a complete listing of the life insurance and disability benefits to be provided under this contract. This brochure shall be provided in sufficient quantities so that each covered employee receives a copy. The contractor shall furnish all copies of the brochures to the COR, who will ensure that appropriate distribution is made.

C.2.7.2. The document described in C.2.7.1 shall be provided to the COR not later than 15 days after date of contract award. The contractor shall provide additional brochures for new employees within ten days of the COR’s request.

20

C.2.7.3. The contractor assumes full responsibility for ensuring that the document described in C.2.7.1 accurately reflects the requirements of the contract, as implemented by the contractor’s technical proposal. In all cases, the contract shall take precedence. Should the COR discover that the brochure contains inaccuracies, the contractor will be notified in writing; however, failure on the part of the Government to notice any inaccuracies shall in no way limit, revise or otherwise affect the requirement under this contract for the contractor to fully comply with all contract terms.

C.3.0 DEFINITIONS

FMO The Financial Management Officer or the paying office for all U.S. Government Agencies except AID.

COR Contracting Officer's Representative (Human Resources Officer at post).

Contracting Officer Only person at the Embassy authorized to make changes to solicitations and contracts.

Contributory Insurance for which the employee contributes toward the premium.

Dependent For purposes of health insurance, a legal dependent is a spouse or child. For the purpose of this plan, an employee’s dependents are defined as the employee’s legal spouse (limit one) and economically dependent children who primarily reside with the employee, unless away at school. A child is defined as the employee’s natural child, adopted child, stepchild, or foster child. An eligible child will be covered until the end of the contract year in which he/she reaches age 18, or 25, if a full-time student. There is no age limit for an eligible child who is physically or mentally handicapped so as to be unable to live independently. There is no limit on the number of children covered per employee. Parents, grandparents, siblings, and other relatives are not eligible dependents. Dependents are not covered under the life and disability insurance portion of this contract.

Disability, Total and Permanent A physical or mental impairment which precludes the individual from performing ordinary motor or bodily functions and which requires separation from employment. If the impairment is the result of a previous impairment, it shall be considered a continuation of the prior impairment.

Employee An individual employed by the U.S. Government, under a direct-hire appointment, personal services contract, or personal services agreement, as further defined in Section C.1.3 for health insurance and C.2.3 for life and disability insurance.

Employer The United States Government.

21 GSO General Services Officer in charge of the General Services Office at post. This officer is usually the Contracting Officer for this contract.

Hospital An institution established and operated for the care and treatment of sick and injured persons. It provides 24-hour nursing care and has diagnostic, laboratory, treatment, and surgical facilities. Any institution which does not meet this definition is not considered a hospital.

Hospital Patient An individual who has been admitted to a hospital, is assigned a bed, and is given diagnostic tests or receives treatment for a disease or an injury.

Maximum Benefit The total amount that will be paid to any one covered individual for covered medical expenses or life insurance/disability benefit.

Customary and Reasonable Treatment A diagnostic test or medical treatment which is usually performed in the community where the individual is being treated.

Physician An individual who has graduated from an accredited medical school and is licensed to practice medicine in the jurisdiction in which the contract is to be performed. If the individual is a medical specialist, then he or she is Board Certified in that specialty.

Surgical procedure Any invasive medical procedure by manual or instrument operation undertaken for diagnosis or treatment of a diseased patient.

22 SECTION D PACKAGING AND MARKING

(RESERVED)

23 SECTION E INSPECTION AND ACCEPTANCE

E.1. 52.252-2 CLAUSES INCORPORATED BY REFERENCE (FEB 1998)

This contract incorporates the following clauses by reference, with the same force and effect as if they were given in full text. Upon request, the Contracting Officer will make their full text available. Also, the full text of a clause may be accessed electronically at this address:

http://acqusition.gov/far/index.html or, http://farsite.hill.af.mil/search.htm

These addresses are subject to change. If the Federal Acquisition Regulation (FAR) is not available at the locations indicated above, use the Dept. of State Acquisition Website at http://www.statebuy.state.gov to see the links to the FAR. You may also use a network “search engine” (e.g., Yahoo, Excite, Alta Vista, etc.) to obtain the latest location of the most current FAR.

FEDERAL ACQUISITION REGULATION (48 CFR CH. 1)

52.246-4 Inspection of Services - Fixed Price (AUG 1996)

E.2. QUALITY ASSURANCE AND SURVEILLANCE PLAN (QASP)

This plan is designed to provide an effective surveillance method to promote effective contractor performance. The QASP provides a method for the Contracting Officer's Representative (COR) to monitor contractor performance, advise the contractor of unsatisfactory performance, and notify the Contracting Officer of continued unsatisfactory performance. The contractor, not the Government, is responsible for management and quality control to meet the terms of the contract. The role of the Government is to conduct quality assurance to ensure that contract standards are achieved.

Performance Objective PWS Para Performance Threshold Services. Performs all the insurance services set forth C.1.0 thru All required services are in the performance work statement (PWS) C.3.0 performed and no more than three (3) customer complaints are received per month

E.2.1 Surveillance. The COR will receive and document all complaints from Government personnel regarding the services provided. If appropriate, the COR will send the complaints to the Contractor for corrective action.

24 E.2.2 Standard. The performance standard is that the Government receives no more than three (3) customer complaints per month. The COR shall notify the Contracting Officer of the complaints so that the Contracting Officer may take appropriate action to enforce the inspection clause (FAR 52.246-4, Inspection of Services – Fixed Price (AUG 1996) or the appropriate Inspection of Services clause), if any of the services exceed the standard.

E.2.3 Procedures

(a) If any Government personnel observe unacceptable services, either incomplete work or required services not being performed, they should immediately contact the COR.

(b) The COR will complete appropriate documentation to record the complaint.

(c) If the COR determines the complaint is invalid, the COR will advise the complainant. The COR will retain the annotated copy of the written complaint for his/her files.

(d) If the COR determines the complaint is valid, the COR will inform the Contractor and give the Contractor additional time to correct the defect, if additional time is available. The COR shall determine how much time is reasonable.

(e) The COR shall, as a minimum, orally notify the Contractor of any valid complaints.

(f) If the Contractor disagrees with the complaint and challenges the validity of the complaint, the Contractor will notify the COR. The COR will review the matter to determine the validity of the complaint.

(g) The COR will consider complaints as resolved unless notified otherwise by the complaint.

(h) Repeat customer complaints are not permitted for any services. If a repeat customer complaint is received for the same deficiency during the service period, the COR will contact the Contracting Officer for appropriate action under the Inspection clause.

25 SECTION F DELIVERIES OR PERFORMANCE

F.1. 52.252-2 CLAUSES INCORPORATED BY REFERENCE (FEB 1998)

This contract incorporates the following clauses by reference, with the same force and effect as if they were given in full text. Upon request, the Contracting Officer will make their full text available. Also, the full text of a clause may be accessed electronically at this address: http://acqusition.gov/far/index.html or, http://farsite.hill.af.mil/search.htm

These addresses are subject to change. If the Federal Acquisition Regulation (FAR) is not available at the locations indicated above, use the Dept. of State Acquisition Website at http://www.statebuy.state.gov to see the links to the FAR. You may also use a network “search engine” (e.g., Yahoo, Excite, Alta Vista, etc.) to obtain the latest location of the most current FAR.

FEDERAL ACQUISITION REGULATION (48 CFR CH. 1)

52.242-15 Stop Work Order (AUG 1989) 52.242-17 Government Delay of Work (APR 1984)

F.2 PERIOD OF PERFORMANCE. The performance period of this contract is one year beginning on 30 days after contract award with four one-year options to renew.

F.3 OPTIONS

(a) The Government may extend this contract in accordance with the option clause at Section I, clause I.2, FAR Clauses Incorporated by Full Text (FAR 52.217-9, Option to Extend the Term of the Contract), which also specifies the total potential duration of the contract.

(b) The Government may exercise the option set forth at Section I, "FAR 52.217-8, Option to Extend Services".

F.4 REPORTS AND OTHER DELIVERABLES

All reports and other deliverables required under this contract shall be delivered to the following address:

Embajada de los Estados Unidos, Attention: Human Resources Office Avigiras E12-170 y Eloy Alfaro Quito, Ecuador

26 SECTION G CONTRACT ADMINISTRATION DATA

G.1. 652.242-70 CONTRACTING OFFICER’S REPRESENTATIVE (COR) (AUG 1999)

(a) The Contracting Officer may designate in writing one Government employee, by name or position title, to take action for the Contracting Officer under this contract. This designee shall be identified as a Contracting Officer’s Representative (COR). Such designation shall specify the scope and limitations of the authority so delegated; provided, that the designee shall not change the terms or conditions of the contract, unless the COR is a warranted Contracting Officer and this authority is delegated in the designation.

(b) The COR for this contract is the Human Resources Officer.

G.2 COR DUTIES

G.2.1 The COR is responsible for inspection and acceptance of services. These duties include review of Contractor invoices, including the supporting documentation required by the contract. The COR may provide technical advice, substantive guidance, inspections, invoice approval, and other purposes as deemed necessary under the contract.

G.2.2 In addition, the COR shall maintain updated list of employees and dependents insured, which will supersede the initial list provided under this contract and as reported to the insurer or broker, without prejudice to the ineligibility clause.

G.2.3. The COR has the additional responsibility of maintaining the eligible listing of employees and dependents for insurance coverage.

G.2.4 The COR may not change the terms and conditions of the contract. While the COR is authorized to provide the Contractor with updated listings of eligible employees and dependents, only the Contracting Officer may modify existing task orders or issue new task orders, reflecting these changes, since only the Contracting Officer can obligate funding and commit the Government.

G.3. Payment shall be made in U.S. Dollars.

G.4 SUBMISSION OF INVOICES AND PAYMENT

G.4.1. Invoices for U.S. Government employees shall be submitted in an original and three (3) copies to the following address (designated billing office only for the purpose of submitting invoices):

Embajada de los Estados Unidos, Attention: Financial Management Office Avigiras E12-170 y Eloy Alfaro Quito, Ecuador

27

G.4.2. Frequency of Payments. All funds under this contract will be obligated by issuance of task orders, as described in H.3. Each task order will fund a specific period of time and number of employees, and the task orders will be issued at the frequency described in H.3. All payments under this contract will be made at the conclusion of the period covered. Invoices may be submitted bi-weekly, in accordance with Embassy pay periods, and shall be paid with payments being made bi-weekly by the Government.

G.4.3. U.S. Government Employees. The Government shall make payments directly to the contractor for all Government employees, whether or not the employee is contributing to the premium amount.

G.5 REFUNDS TO THE GOVERNMENT - RESERVED

28 SECTION H SPECIAL CONTRACT REQUIREMENTS

H.1 SECURITY. On occasion, a Contractor employee may require entry into U.S. Government-owned or -operated facilities. If so, the Contractor should be prepared to provide the necessary identification to permit escorted access within that facility.

H.2 STANDARDS OF CONDUCT. The Contractor shall maintain satisfactory standards of employee competency, conduct, cleanliness, appearance, and integrity and shall be responsible for taking such disciplinary action with respect to employees as may be necessary. Each Contractor employee is to adhere to standards that reflect credit on themselves, their employer, and the United States Government.

H.3 ORDERING PROCEDURES. The Government will issue a task order as soon as possible after contract award to identify all employees to be covered by the insurance described in this contract and the coverage selected by each employee, including dependents to be covered. The COR will make subsequent additions or deletions to this list in writing and provide the revised list to the Contractor. All such revisions shall be consolidated, and a new or modified task order will be issued by the Contracting Officer. If any changes have been made to the coverage listing, the Government anticipates issuance of a new task order on a [x ] monthly, [ ] quarterly basis. This new task order will include all changes made since the previous task order was issued and will include any increase or decrease in necessary funding. The changes to the list of eligible individuals will supersede the initial list provided under prior task orders without prejudice to the ineligibility clause. Task orders will indicate the effective date of employment, for purposes of calculating the premium due.

H.4. CONTRACTOR RESPONSIBILITY IN CLAIMS AND REIMBURSEMENT TO CLAIMANTS

General. The Contractor shall be responsible for all planning, estimating, programming, project management, scheduling, dispatching, supervision, and inspection of work. The Contractor shall maintain his own reference library of technical reference works and local laws and regulations, including current tariffs and registries. The Contractor shall treat the information provided by the Embassy concerning employee' personal data, medical information, and salaries as highly sensitive and not divulge any employee information to unauthorized persons. The Contractor shall establish procedures for handling medical insurance claims as follows:

(a) Administrative Records.

(1) The Contractor shall maintain medical insurance files for each covered employee and each covered dependent including receipts and proof of paid claims, requests for claim reimbursements, and accounting of paid benefits with balances of amounts remaining in the annual per person reimbursement ceiling.

29 (2) The Contractor shall provide the COR with the necessary claim forms for each type of benefit that can be claimed under the contract. These forms shall specify a list of documents required to be appended to each claim and otherwise provide instructions for claim filing.

(3) The Contractor shall use the English spelling of the employees' names in all transactions, including reimbursement checks.

(4) The Contractor shall send employee claim reimbursement checks to employees not later than two weeks after a claim is submitted.

(b) Medical Insurance Claims. Settlement of medical insurance shall be completed as follows:

(1) All medical claims shall be submitted directly to the Contractor by employees, through a drop box in the COR's office. The claims shall be picked up from the COR each Tuesday.

(2) The Contractor shall date stamp and screen all claims submitted on the day of receipt. If there are any missing documents or information thereby disallowing said claim to be payable, the Contractor shall notify the employee within two days, with a copy to the COR (if notification is written).

(3) The contractor shall settle the claims no later than two weeks from the date the claim is submitted to the Contractor.

(4) Settlement shall be by issuance of checks in the name of the employee for each claim submitted. Each check shall be accompanied by a form providing details of the amount reimbursed with an explanation of deductions, if any.

(5) The Contractor shall accept the employee's or dependent's choice to go for surgery to hospitals designated by the Contractor in order that the Contractor will pay the expenses directly to the hospitals.

(c) Payment of Life Insurance Benefits to Beneficiaries. The Contractor shall settle life insurance claims as follows:

(1) The Contractor shall provide forms for the designation of beneficiaries for the life insurance benefits to the COR. The COR shall have all enrolled eligible employees complete designation of beneficiary forms and keep them in their personnel folders, ORE staff folders, or EAE folders. Upon the death of an enrolled employee, the COR shall provide this form to the Contractor.

(2) The Contractor shall pay the employee's named beneficiary, legal heir, or estate the total amount of the claim within 60 days from the date the Contractor receives

30 a completed dismemberment or death claim. Payment shall be computed on the basis of the coverage as defined in Section C.2.0 and its subparagraphs.

H.5. REPORT REQUIREMENTS. The Contractor shall provide the following reports monthly. All reports must be received by the COR no later than the 10th day of each month. These reports shall report on the previous month's activities.

(a) Employee Claims Report. The report will list all claims paid by the Contractor to a claimant, including the name of the claimant, date claim is received by the Contractor, and the amount claimed. This report shall also include all outstanding claims and a brief description of why claim has not been paid.

(b) The contractor will prepare and submit a report for the incidents of casualties (“siniestralidad”) twice annually, six months after the first half year of the performance period and upon conclusion of the performance period for the year. This report shall include a list of employees’ claims for health, life and disability benefits insurance and corresponding actuarial statistics.

H.6. MISCELLANEOUS CONTRACTOR REQUIREMENTS

H.6.1. General. The Contractor shall take all such steps as are necessary, and obtain and pay for all permits, taxes and fees as are required by the Ecuadorian government to establish and/or operate a commercial venture locally. A contract with the U.S. Government conveys no special privileges or immunities to the Contractor. The Contractor is an independent commercial concern and not a part of the U.S. mission. The Contractor's employees are not U.S. Government employees. Registration of this contract with the Ecuadorian government, if required by law, will be the sole responsibility of the Contractor, and any fees, taxes, or other duties shall be payable by the Contractor without recourse to the Government of the amounts thereof.

H.6.2. Licenses and Local Laws. The Contractor shall possess all permits, licenses, and any other appointments required for the prosecution of work under this contract, all at no additional cost to the Government. The Contractor shall perform this contract in accordance with local laws.

H.7 Erroneous Payments. If the Government becomes eligible for a refund of payment because of erroneous overpayment or other cause, the Contractor shall refund the amounts or use them to offset future payments owed by the Government, whichever the Government prefers. The Contractor shall refund any refunds not complete or discovered after the completion date of this contract.

H.8 Requiring Activity. The requiring activity under this contract is the U.S. Embassy/Consulate.

31 SECTION I CONTRACT CLAUSES

I.1. 52.252-2 CLAUSES INCORPORATED BY REFERENCE (FEB 1998)

This contract incorporates the following clauses by reference, with the same force and effect as if they were given in full text. Upon request, the Contracting Officer will make their full text available. Also, the full text of a clause may be accessed electronically at this address: http://acqusition.gov/far/index.html or, http://farsite.hill.af.mil/search.htm

These addresses are subject to change. If the Federal Acquisition Regulation (FAR) is not available at the locations indicated above, use the Dept. of State Acquisition Website at http://www.statebuy.gov/home.htm to see the links to the FAR. You may also use a network “search engine” (e.g., Yahoo, Excite, Alta Vista, etc.) to obtain the latest location of the most current FAR.

FEDERAL ACQUISITION REGULATION (48 CFR CH. 1)

52.202-1 DEFINITIONS (JUL 2004) 52.203-3 GRATUITIES (APR 1984) 52.203-5 COVENANT AGAINST CONTINGENT FEES (APR 1984) 52.203-6 RESTRICTIONS ON SUBCONTRACTOR SALES TO THE GOVERNMENT (SEP 2006) 52.203-7 ANTI-KICKBACK PROCEDURES (OCT 2010) 52.203-8 CANCELLATION, RESCISSION, AND RECOVERY OF FUNDS FOR ILLEGAL OR IMPROPER ACTIVITY (JAN 1997) 52.203-10 PRICE OR FEE ADJUSTMENT FOR ILLEGAL OR IMPROPER ACTIVITY (JAN 1997) 52.203-12 LIMITATION ON PAYMENTS TO INFLUENCE CERTAIN FEDERAL TRANSACTIONS (OCT 2010) 52.204-4 PRINTING/COPYING DOUBLE-SIDED ON RECYCLED PAPER (AUG 2000) 52.204-9 PERSONAL VERIFICATION OF CONTRACTOR PERSONNEL (JAN 2011) 52.204-10 REPORTING EXECUTIVE COMPENSATION AND FIRST-TIER SUBCONTRACT AWARDS (FEB 2012) 52.209-6 PROTECTING THE GOVERNMENT’S INTEREST WHEN SUBCONTRACTING WITH CONTRACTOR’S DEBARRED, SUSPENDED, OR PROPOSED FOR DEBARMENT (DEC 2010) 52.209-7 INFORMATION REGARDING RESPONSIBILITY MATTERS (FEB 2012) 52.209-9 UPDATES OF INFORMATION REGARDING RESPONSIBILITY MATTERS ALT 1 (FEB 2012) 52.215-2 AUDIT AND RECORDS - NEGOTIATION (OCT 2010) 52.215-8 ORDER OF PRECEDENCE--UNIFORM CONTRACT FORMAT (OCT 1997)

32 52.215-11 PRICE REDUCTION FOR DEFECTIVE CERTIFIED COST OR PRICING DATA – MODIFICATIONS (AUG 2011) 52.215-13 SUBCONTRACTOR CERTIFIED COST OR PRICING DATA - MODIFICATIONS (OCT 2010) 52.215-21 REQUIREMENTS FOR COST OR PRICING DATA OR INFORMATION OTHER THAN COST OR PRICING DATA-- MODIFICATIONS (OCT 2010) 52.222-19 CHILD LABOR – COOPERATION WITH AUTHORITIES AND REMEDIES (JUL 2010) 52.222-50 COMBATTING TRAFFICKING IN PERSONS (FEB 2009) 52.223-18 CONTRACTOR POLICY TO BAN TEXT MESSAGING WHILE DRIVING (AUG 2011) 52.224-1 PRIVACY ACT NOTIFICATION (APR 1984) 52.224-2 PRIVACY ACT (APR 1984) 52.225-13 RESTRICTIONS ON CERTAIN FOREIGN PURCHASES (JUN 2008) 52.225-14 INCONSISTENCY BETWEEN ENGLISH VERSION AND TRANSLATION OF CONTRACT (FEB 2000) 52.228-4 WORKERS’ COMPENSATION AND WAR-HAZARD INSURANCE OVERSEAS (APR 1984) 52.228-5 INSURANCE-WORK ON A GOVERNMENT INSTALLATION (JAN 1997) 52.229-6 TAXES - FOREIGN FIXED PRICE CONTRACTS (JUN 2003) 52.232-1 PAYMENTS (APR 1984) 52.232-8 DISCOUNTS FOR PROMPT PAYMENT (FEB 2002) 52.232-11 EXTRAS (APR 1984) 52.232-17 INTEREST (OCT 2010) 52.232-18 AVAILABILITY OF FUNDS (APR 1984) 52.232-24 PROHIBITION OF ASSIGNMENT OF CLAIMS (JAN 1986) 52.232-25 PROMPT PAYMENT (OCT 2008) 52.232-34 PAYMENT BY ELECTRONIC FUNDS TRANSFER – OTHER THAN CENTRAL CONTRACTOR REGISTRATION (MAY 1999) 52.233-1 DISPUTES (JUL 2002) ALTERNATE I (DEC 1991) 52.233-3 PROTEST AFTER AWARD (AUG 1996) 52.233-4 APPLICABLE LAW FOR BREACH OF CONTRACT CLAIM (OCT 2004) 52.237-2 PROTECTION OF GOVERNMENT BUILDINGS, EQUIPMENT, AND VEGETATION (APR 1984) 52.242-13 BANKRUPTCY (JUL 1995) 52.243-1 CHANGES (AUG 1997) - ALTERNATE I (APR 1984) 52.246-25 LIMITATION OF LIABILITY - SERVICES (FEB 1997) 52.248-1 VALUE ENGINEERING (OCT 2010) 52.249-2 TERMINATION FOR CONVENIENCE OF THE GOVERNMENT (FIXED PRICE) (MAY 2004) 52.249-8 DEFAULT - FIXED PRICE SUPPLY AND SERVICE (APR 1984)

33 I.2. FAR CLAUSES INCORPORATED IN FULL TEXT

52.216-18 ORDERING (OCT 1995)

(a) Any supplies and services to be furnished under this contract shall be ordered by issuance of delivery orders or task orders by the individuals or activities designated in the Schedule. Such orders may be issued from the first day of the ongoing performance period through the last day of that performance period. See F.2.

(b) All delivery orders or task orders are subject to the terms and conditions of this contract. In the event of conflict between a delivery order or task order and this contract, the contract shall control.

(c) If mailed, a delivery order or task order is considered "issued" when the Government deposits the order in the mail. Orders may be issued orally, by facsimile, or by electronic commerce methods only if authorized in the Schedule.

52.216-19 ORDER LIMITATIONS. (OCT 1995)

(a) Minimum order. When the Government requires supplies or services covered by this contract in an amount of less than $25,000, the Government is not obligated to purchase, nor is the Contractor obligated to furnish, those supplies or services under the contract.

(b) Maximum order. The Contractor is not obligated to honor--

(1) Any order for a single item in excess of $550,000. (2) Any order for a combination of items in excess of $550,000; or (3) A series of orders from the same ordering office within 30 days that together call for quantities exceeding the limitation in subparagraph (1) or (2) above.

(c) If this is a requirements contract (such as, includes the Requirement clause at subsection 52.216-21 of the Federal Acquisition Regulation (FAR)), the Government is not required to order a part of any one requirement from the Contractor if that requirement exceeds the maximum-order limitations in paragraph (b) above.

(d) Notwithstanding paragraphs (b) and (c) above, the Contractor shall honor any order exceeding the maximum order limitations in paragraph (b), unless that order (or orders) is returned to the ordering office within 30 days after issuance, with written notice stating the Contractor's intent not to ship the item (or items) called for and the reasons. Upon receiving this notice, the Government may acquire the supplies or services from another source.

52.216-21 REQUIREMENTS (OCT 1995)

34

(a) This is a requirements contract for the supplies or services specified and effective for the period stated in the Schedule. The quantities of supplies or services specified in the Schedule are estimates only and are not purchased by this contract. Except as this contract may otherwise provide, if the Government's requirements do not result in orders in the quantities described as "estimated" or "maximum" in the Schedule, that fact shall not constitute the basis for an equitable price adjustment.

(b) Delivery or performance shall be made only as authorized by orders issued in accordance with the Ordering clause. Subject to any limitations in the Order Limitations clause or elsewhere in this contract, the Contractor shall furnish to the Government all supplies or services specified in the Schedule and called for by orders issued in accordance with the Ordering clause. The Government may issue orders requiring delivery to multiple destinations or performance at multiple locations.

(c) Except as this contract otherwise provides, the Government shall order from the Contractor all the supplies or services specified in the Schedule that are required to be purchased by the Government activity or activities specified in the Schedule.

(d) The Government is not required to purchase from the Contractor requirements in excess of any limit on total orders under this contract.

(e) If the Government urgently requires delivery of any quantity of an item before the earliest date that delivery may be specified under this contract, and if the Contractor will not accept an order providing for the accelerated delivery, the Government may acquire the urgently required goods or services from another source.

(f) Any order issued during the effective period of this contract and not completed within that period shall be completed by the Contractor within the time specified in the order. The contract shall govern the Contractor's and Government's rights and obligations with respect to that order to the same extent as if the order were completed during the contract's effective period; provided, that the Contractor shall not be required to make any deliveries under this contract after 30 calendar days.

52.217-8 OPTION TO EXTEND SERVICES (NOV 1999)

The Government may require continued performance of any services within the limits and at the rates specified in the contract. The option provision may be exercised more than once, but the total extension of performance hereunder shall not exceed 6 months. The Contracting Officer may exercise the option by written notice to the Contractor within the performance period of the contract.

52.217-9 OPTION TO EXTEND THE TERM OF THE CONTRACT (MAR 2000)

35 (a) The Government may extend the term of this contract by written notice to the Contractor within the performance period of the contract or within 30 days after funds for the option year become available, whichever is later.

(b) If the Government exercises this option, the extended contract shall be considered to include this option clause.

(c) The total duration of this contract, including the exercise of any options under this clause, shall not exceed five (5) years.

52.232-19 AVAILABILITY OF FUNDS FOR THE NEXT FISCAL YEAR (APR 1984)

Funds are not presently available for performance under this contract beyond 30 September of each Government Fiscal Year. The Government's obligation for performance of this contract beyond that date is contingent upon the availability of appropriated funds from which payment for contract purposes can be made. No legal liability on the part of the Government for any payment may arise for performance under this contract beyond 30 September of each Government Fiscal Year, until funds are made available to the Contracting Officer for performance and until the Contractor receives notice of availability, to be confirmed in writing by the Contracting Officer.

52.237-3 CONTINUITY OF SERVICES (JAN 1991)

(a) The Contractor recognizes that the services under this contract are vital to the government and must be continued without interruption and that, upon contract expiration, a successor, either the government or another contractor, may continue them. The Contractor agrees to (1) furnish phase-in training and (2) exercise its best efforts and cooperation to effect an orderly and efficient transition to a successor.

(b) The Contractor shall, upon the contracting officer’s written notice, (1) furnish phase-in, phase-out services for up to 90 days after this contract expires and (2) negotiate in good faith a plan with a successor to determine the nature and extent of phase-in , phase-out services required. The plan shall specify a training program and a date for transferring responsibilities for each division of work described in the plan, and shall be subject to the contracting officer’s approval. The Contractor shall provide sufficient experienced personnel during the phase-in, phase-out period to ensure that the services called for by this contract are maintained at the required level of proficiency.

(c) The Contractor shall allow as many personnel as practicable to remain on the job to help the successor maintain the continuity and consistency of the services required by this contract. The Contractor also shall disclose necessary personnel records and allow the successor to conduct on site interviews with these employees. If selected employees are agreeable to the change, the contractor shall release them at a mutually agreeable date and negotiate transfer of their earned fringe benefits to the successor.

36 (d) The Contractor shall be reimbursed for all reasonable phase-in, phase-out costs (i.e., costs incurred within the agreed period after contract expiration that result from phase-in, phase-out operations) and a fee (profit) not to exceed a pro rata portion of the fee (profit) under this contract.

I.3 DEPARTMENT OF STATE ACQUISITION REGULATION (DOSAR) CLAUSES, 48 CFR CH. 6 Included in Full Text:

652.204-70 DEPARTMENT OF STATE PERSONAL IDENTIFICATION CARD ISSUANCE PROCEDURES (MAY 2011)

(a) The Contractor shall comply with the Department of State (DOS) Personal Identification Card Issuance Procedures for all employees performing under this contract who require frequent and continuing access to DOS facilities, or information systems. The Contractor shall insert this clause in all subcontracts when the subcontractor’s employees will require frequent and continuing access to DOS facilities, or information systems. (b) The DOS Personal Identification Card Issuance Procedures may be accessed at http://www.state.gov/m/ds/rls/rpt/c21664.htm . (End of clause)

CONTRACTOR IDENTIFICATION (JULY 2008)

Contract performance may require contractor personnel to attend meetings with government personnel and the public, work within government offices, and/or utilize government email.

Contractor personnel must take the following actions to identify themselves as non-federal employees:

1) Use an email signature block that shows name, the office being supported and company affiliation (e.g. “John Smith, Office of Human Resources, ACME Corporation Support Contractor”);

2) Clearly identify themselves and their contractor affiliation in meetings;

3) Identify their contractor affiliation in Departmental e-mail and phone listings whenever contractor personnel are included in those listings; and

4) Contractor personnel may not utilize Department of State logos or indicia on business cards.

652.216-70 ORDERING - INDEFINITE-DELIVERY CONTRACT (APR 2004)

The Government shall use one of the following forms to issue orders under this contract:

37 (a) The Optional Form 347, Order for Supplies or Services, and Optional Form 348, Order for Supplies or Services Schedule - Continuation; or,

(b) The DS-2076, Purchase Order, Receiving Report and Voucher, and DS-2077, Continuation Sheet.

652.225-71 SECTION 8(A) OF THE EXPORT ADMINISTRATION ACT OF 1979, AS AMENDED (AUG 1999)

(a) Section 8(a) of the U.S. Export Administration Act of 1979, as amended (50 U.S.C. 2407(a)), prohibits compliance by U.S. persons with any boycott fostered by a foreign country against a country which is friendly to the United States and which is not itself the object of any form of boycott pursuant to United States law or regulation. The Boycott of Israel by Arab League countries is such a boycott, and therefore, the following actions, if taken with intent to comply with, further, or support the Arab League Boycott of Israel, are prohibited activities under the Export Administration Act:

(1) Refusing, or requiring any U.S. person to refuse to do business with or in Israel, with any Israeli business concern, or with any national or resident of Israel, or with any other person, pursuant to an agreement of, or a request from or on behalf of a boycotting country;

(2) Refusing, or requiring any U.S. person to refuse to employ or otherwise discriminating against any person on the basis of race, religion, sex, or national origin of that person or of any owner, officer, director, or employee of such person;

(3) Furnishing information with respect to the race, religion, or national origin of any U.S. person or of any owner, officer, director, or employee of such U.S. person;

(4) Furnishing information about whether any person has, has had, or proposes to have any business relationship (including a relationship by way of sale, purchase, legal or commercial representation, shipping or other transport, insurance, investment, or supply) with or in the State of Israel, with any business concern organized under the laws of the State of Israel, with any Israeli national or resident, or with any person which is known or believed to be restricted from having any business relationship with or in Israel;

(5) Furnishing information about whether any person is a member of, has made contributions to, or is otherwise associated with or involved in the activities of any charitable or fraternal organization which supports the State of Israel; and,

(6) Paying, honoring, confirming, or otherwise implementing a letter of credit which contains any condition or requirement against doing business with the State of Israel.

38 (b) Under Section 8(a), the following types of activities are not forbidden ``compliance with the boycott,'' and are therefore exempted from Section 8(a)'s prohibitions listed in paragraphs (a)(1)-(6) above:

(1) Complying or agreeing to comply with requirements:

(i) Prohibiting the import of goods or services from Israel or goods produced or services provided by any business concern organized under the laws of Israel or by nationals or residents of Israel; or,

(ii) Prohibiting the shipment of goods to Israel on a carrier of Israel, or by a route other than that prescribed by the boycotting country or the recipient of the shipment;

(2) Complying or agreeing to comply with import and shipping document requirements with respect to the country of origin, the name of the carrier and route of shipment, the name of the supplier of the shipment or the name of the provider of other services, except that no information knowingly furnished or conveyed in response to such requirements may be stated in negative, blacklisting, or similar exclusionary terms, other than with respect to carriers or route of shipments as may be permitted by such regulations in order to comply with precautionary requirements protecting against war risks and confiscation;

(3) Complying or agreeing to comply in the normal course of business with the unilateral and specific selection by a boycotting country, or national or resident thereof, of carriers, insurance, suppliers of services to be performed within the boycotting country or specific goods which, in the normal course of business, are identifiable by source when imported into the boycotting country;

(4) Complying or agreeing to comply with the export requirements of the boycotting country relating to shipments or transshipments of exports to Israel, to any business concern of or organized under the laws of Israel, or to any national or resident of Israel;

(5) Compliance by an individual or agreement by an individual to comply with the immigration or passport requirements of any country with respect to such individual or any member of such individual's family or with requests for information regarding requirements of employment of such individual within the boycotting country; and,

(6) Compliance by a U.S. person resident in a foreign country or agreement by such person to comply with the laws of that country with respect to his or her activities exclusively therein, and such regulations may contain exceptions for such resident complying with the laws or regulations of that foreign country governing imports into such country of trademarked, trade named, or similarly specifically identifiable products, or components of products for his or her own

39 use, including the performance of contractual services within that country, as may be defined by such regulations.

652.229-71 PERSONAL PROPERTY DISPOSITION AT POSTS ABROAD (AUG 1999)

Regulations at 22 CFR Part 136 require that U.S. Government employees and their families do not profit personally from sales or other transactions with persons who are not themselves entitled to exemption from import restrictions, duties, or taxes. Should the contractor experience importation or tax privileges in a foreign country because of its contractual relationship to the United States Government, the contractor shall observe the requirements of 22 CFR Part 136 and all policies, rules, and procedures issued by the chief of mission in that foreign country.

652.237-72 OBSERVANCE OF LEGAL HOLIDAYS AND ADMINISTRATIVE LEAVE (APR 2004)

All work shall be performed during Monday through Friday, from 0800-1700 hrs. except for the holidays identified below. Other hours may be approved by the Contracting Officer's Representative. Notice must be given 24 hours in advance to COR who will consider any deviation from the hours identified above.

(a) The Department of State observes the following days as holidays:

HOLIDAY U.S./ECUADORIAN DAY OF OBSERVATION

New Year US January 2 (Monday) Martin Luther King’s Birthday U.S. January 16 (Monday) Washington’s Birthday U.S. February 20 (Monday) Carnival Ecuadorian February 21 (Tuesday) Holy Thursday Ecuadorian April 5 (Thursday) Good Friday Ecuadorian April 6 (Friday) Labor Day Ecuadorian May 1 (Tuesday) Batalla de Pichincha Ecuadorian May 25 (Friday) Memorial Day U.S. May 28 (Monday) Independence Day (U.S) U.S. July 4 (Wednesday) Founding of Guayaquil (*) Ecuadorian July 25 (Wednesday) Independence Day (Ecuador) Ecuadorian August 10 (Friday) Labor Day U.S. September 3 (Monday) Columbus Day U.S. October 8 (Monday) Guayaquil Independence Day Ecuadorian October 12 (Friday) All Souls’ Day Ecuadorian November 2 (Friday) Veterans’ Day U.S. November 12 (Monday) Thanksgiving Day U.S. November 22 (Thursday) Founding of Quito(**) Ecuadorian December 6 (Thursday) Christmas Day U.S. December 25 (Tuesday)

40 (*) Guayaquil only – day of observation could change (**)Quito only – day of observation could change

Any other day designated by Federal law, Executive Order or Presidential Proclamation.

(b) When any such day falls on a Saturday or Sunday, the following Monday is observed. Observance of such days by Government personnel shall not be cause for additional period of performance or entitlement to compensation except as set forth in the contract.

652.242-73 AUTHORIZATION AND PERFORMANCE (AUG 1999)

(a) The contractor warrants the following:

(1) That it has obtained authorization to operate and do business in the country or countries in which this contract will be performed;

(2) That it has obtained all necessary licenses and permits required to perform this contract; and,

(3) That it shall comply fully with all laws, decrees, labor standards, and regulations of said country or countries during the performance of this contract.

(b) If the party actually performing the work will be a subcontractor or joint venture partner, then such subcontractor or joint venture partner agrees to the requirements of paragraph (a) of this clause.

652.243-70 NOTICES (AUG 1999)

Any notice or request relating to this contract given by either party to the other shall be in writing. Said notice or request shall be mailed or delivered by hand to the other party at the address provided in the schedule of the contract. All modifications to the contract must be made in writing by the contracting officer.

652.229-70 EXCISE TAX EXEMPTION STATEMENT FOR CONTRACTORS WITHIN THE UNITED STATES (JUL 1988)

This is to certify that the item(s) covered by this contract is/are for export solely for the use of the U.S. Foreign Service Post identified in the contract schedule.