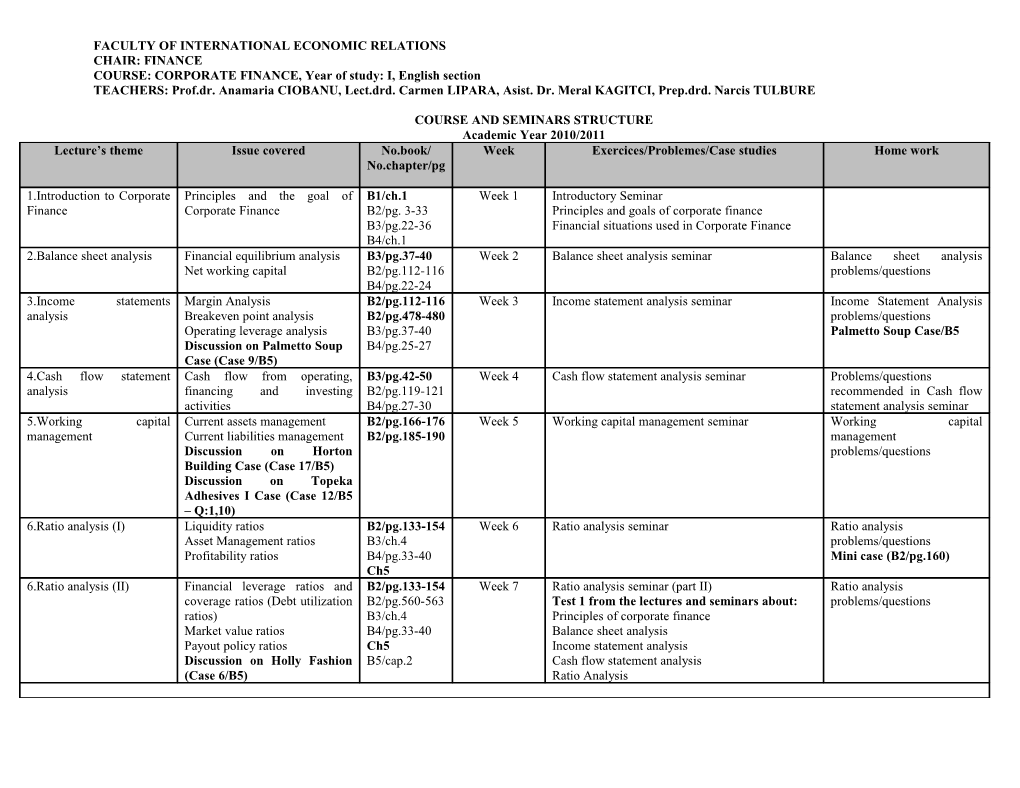

FACULTY OF INTERNATIONAL ECONOMIC RELATIONS CHAIR: FINANCE COURSE: CORPORATE FINANCE, Year of study: I, English section TEACHERS: Prof.dr. Anamaria CIOBANU, Lect.drd. Carmen LIPARA, Asist. Dr. Meral KAGITCI, Prep.drd. Narcis TULBURE

COURSE AND SEMINARS STRUCTURE Academic Year 2010/2011 Lecture’s theme Issue covered No.book/ Week Exercices/Problemes/Case studies Home work No.chapter/pg

1.Introduction to Corporate Principles and the goal of B1/ch.1 Week 1 Introductory Seminar Finance Corporate Finance B2/pg. 3-33 Principles and goals of corporate finance B3/pg.22-36 Financial situations used in Corporate Finance B4/ch.1 2.Balance sheet analysis Financial equilibrium analysis B3/pg.37-40 Week 2 Balance sheet analysis seminar Balance sheet analysis Net working capital B2/pg.112-116 problems/questions B4/pg.22-24 3.Income statements Margin Analysis B2/pg.112-116 Week 3 Income statement analysis seminar Income Statement Analysis analysis Breakeven point analysis B2/pg.478-480 problems/questions Operating leverage analysis B3/pg.37-40 Palmetto Soup Case/B5 Discussion on Palmetto Soup B4/pg.25-27 Case (Case 9/B5) 4.Cash flow statement Cash flow from operating, B3/pg.42-50 Week 4 Cash flow statement analysis seminar Problems/questions analysis financing and investing B2/pg.119-121 recommended in Cash flow activities B4/pg.27-30 statement analysis seminar 5.Working capital Current assets management B2/pg.166-176 Week 5 Working capital management seminar Working capital management Current liabilities management B2/pg.185-190 management Discussion on Horton problems/questions Building Case (Case 17/B5) Discussion on Topeka Adhesives I Case (Case 12/B5 – Q:1,10) 6.Ratio analysis (I) Liquidity ratios B2/pg.133-154 Week 6 Ratio analysis seminar Ratio analysis Asset Management ratios B3/ch.4 problems/questions Profitability ratios B4/pg.33-40 Mini case (B2/pg.160) Ch5 6.Ratio analysis (II) Financial leverage ratios and B2/pg.133-154 Week 7 Ratio analysis seminar (part II) Ratio analysis coverage ratios (Debt utilization B2/pg.560-563 Test 1 from the lectures and seminars about: problems/questions ratios) B3/ch.4 Principles of corporate finance Market value ratios B4/pg.33-40 Balance sheet analysis Payout policy ratios Ch5 Income statement analysis Discussion on Holly Fashion B5/cap.2 Cash flow statement analysis (Case 6/B5) Ratio Analysis 7.Time value of money Oportunity cost of capital, B1/ch.3 Week 8 Time value of money seminar Problem set 1 present value, compund interest, B2/pg.33-68 Questions/Problems: annuities, perpetuities, real B1/pg. 50-57; versus nominal cash flows B2/pg.70-79

8.Investment Valuation (I) Presentation of investment B1/ch.5 Week 9 Investment criteria seminar Investment criteria efficiency criteria (NPV, IRR, B4/ch.6 problems/questions MIRR, DPP, IP) Art.2

8.Investment Valuation (II) Estimation of investment B1/pg.119-131 Week 10 Investment criteria seminar (part II) Investment criteria project elements (capital B2/pg.377-397 problems/questions expenditure, free cash flow, terminal value, forecasting period, discounting rate) 9. Analysis of long term Cost of equity B1/pg.219-227 Week 11 Cost of equity seminar Cost of equity seminar financing decisions (I) Risk premium estimation problems 9. Analysis of long term Cost of debts (loans and bond B1/pg.227-231 Week 12 Cost of debt + WACC Cost of debt + WACC financing decisions (II) issues) B2/pg.435-455 problems Weighted Average Cost of Capital 9. Analysis of long term Case study Week 13 Test 2 from the lectures and seminars about: financing decisions (III) B5/Case 30 – Taylor Brands Time value of money Investment valuation criteria Cost of Equity Cost of debt WACC 10. Recap Lecture Exam preparation B3/Appendix Week 14 Presentation of seminar grades II (pg.433) Exam preparation

Recommended Books and Articles: B1. Brealey R., Myers S. –Principles of corporate finance, The McGraw Hill Companies, 2003 (search on www.esnips.com) B2. Brealey R., Myers S., Marcus A. – Fundamentals of Corporate Finance, The McGraw Hill Companies, 2001 (search on www.esnips.com) B3. Helfert, E. – Financial analysis tools and techniques, a guide for managers, The McGraw Hill Companies, 2001, (search on www.esnips.com) B4. Ross, S., R. Westerfield, J. Jaffe – Corporate Finance, Irwin, 2002 (search on www.esnips.com) B5. Sulock J.M, Dunkelberg J.S. – Cases in Financial Management, 2nd ed., John Wiley & Sons, 1997 (search on www.esnips.com) Ch.5 Analysis of financial statements –Reviewing and assessing financial information Art.1 Graham, J., Harvey, C. – How do CFOs do capital budgeting and capital structure decisions?, Journal of Applied Corporate Finance, Spring 2002 Art.2 Kelleher, J. C., MacCormack J.J. - Internal rate of return: A cautionary tale, McKinsey on Finance, Summer 2004