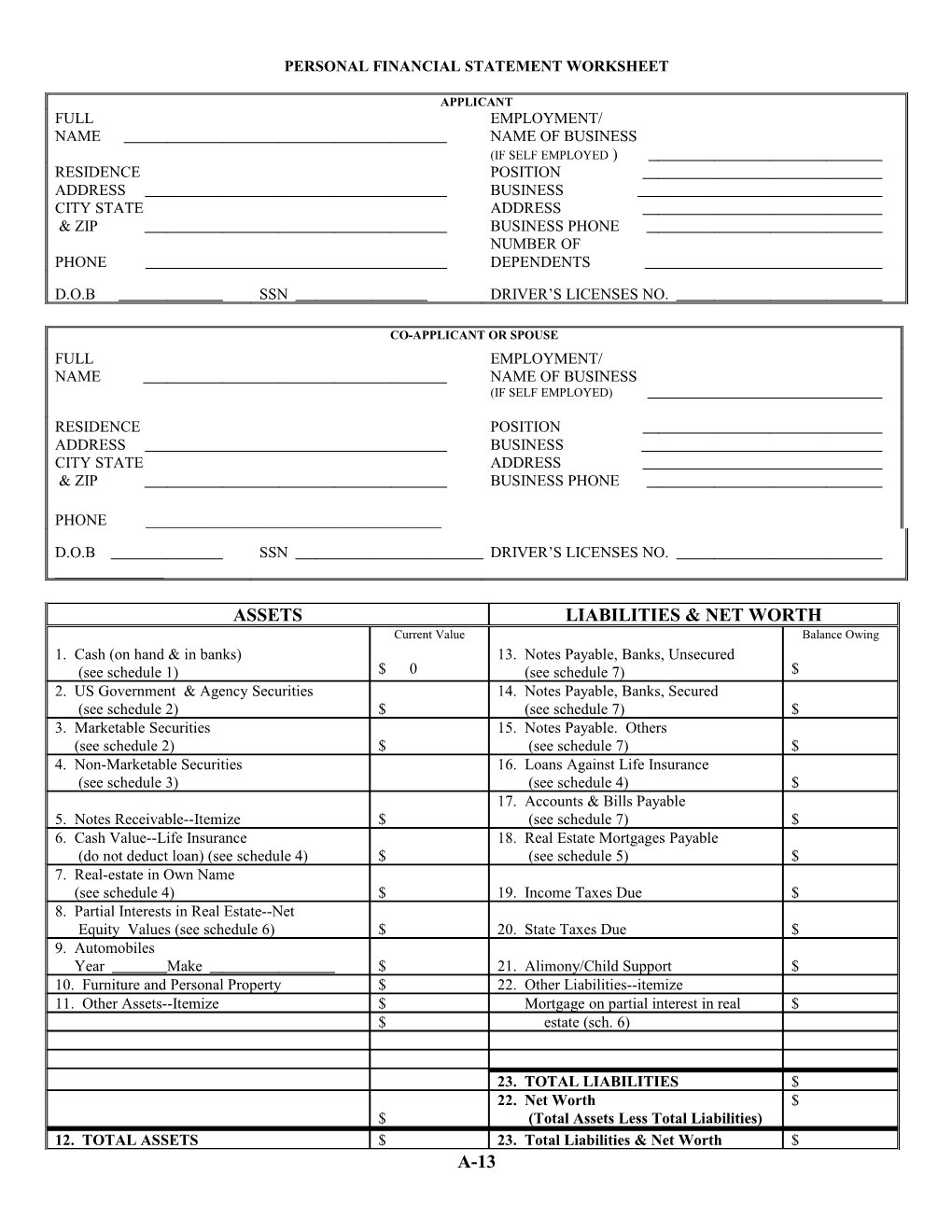

PERSONAL FINANCIAL STATEMENT WORKSHEET

APPLICANT FULL EMPLOYMENT/ NAME NAME OF BUSINESS (IF SELF EMPLOYED ) RESIDENCE POSITION ADDRESS BUSINESS CITY STATE ADDRESS & ZIP BUSINESS PHONE NUMBER OF PHONE DEPENDENTS

D.O.B SSN DRIVER’S LICENSES NO.

CO-APPLICANT OR SPOUSE FULL EMPLOYMENT/ NAME NAME OF BUSINESS (IF SELF EMPLOYED)

RESIDENCE POSITION ADDRESS BUSINESS CITY STATE ADDRESS & ZIP BUSINESS PHONE

PHONE ______

D.O.B SSN DRIVER’S LICENSES NO. ______

ASSETS LIABILITIES & NET WORTH Current Value Balance Owing 1. Cash (on hand & in banks) 13. Notes Payable, Banks, Unsecured (see schedule 1) $ 0 (see schedule 7) $ 2. US Government & Agency Securities 14. Notes Payable, Banks, Secured (see schedule 2) $ (see schedule 7) $ 3. Marketable Securities 15. Notes Payable. Others (see schedule 2) $ (see schedule 7) $ 4. Non-Marketable Securities 16. Loans Against Life Insurance (see schedule 3) (see schedule 4) $ 17. Accounts & Bills Payable 5. Notes Receivable--Itemize $ (see schedule 7) $ 6. Cash Value--Life Insurance 18. Real Estate Mortgages Payable (do not deduct loan) (see schedule 4) $ (see schedule 5) $ 7. Real-estate in Own Name (see schedule 4) $ 19. Income Taxes Due $ 8. Partial Interests in Real Estate--Net Equity Values (see schedule 6) $ 20. State Taxes Due $ 9. Automobiles Year Make $ 21. Alimony/Child Support $ 10. Furniture and Personal Property $ 22. Other Liabilities--itemize 11. Other Assets--Itemize $ Mortgage on partial interest in real $ $ estate (sch. 6)

23. TOTAL LIABILITIES $ 22. Net Worth $ $ (Total Assets Less Total Liabilities) 12. TOTAL ASSETS $ 23. Total Liabilities & Net Worth $ A-13 SOURCES OF ANNUAL INCOME GENERAL INFORMATION Income from alimony, separate maintenance or child support need not be revealed if you do not choose to rely on it in connection with this financial statement. Amount Are you a partner, stockholder, or officer in Salary/wages $ any other business venture? % of Ownership Commissions and Bonuses $ If so, what

Dividends $ Have you entered into a separate or community property agreement with your Real Estate Income $ spouse? If so, attach a copy. Do you have a will? Proprietorship/Partnership $

Other Income--Itemize Name of Executor

Living Trust Income $

$

TOTAL ANNUAL INCOME $

CONTINGENT LIABILITIES CASUALTY INSURANCE COVERAGE

Amount Company Amount

As Endorser, Guarantor or CO-Maker $ Homeowners: $

On Leases or Contracts: Store lease $ Automobile: $

Legal Claims $ Professional Liability: Are you, or have you ever been defendant in Income Tax Claims $ any legal actions, suits, or bankruptcy? Have you ever had any property posted for foreclosure or surrendered to the mortgage Other--Itemize $ holder in lieu of foreclosure?

$ Explain:

$ (Complete Schedules on Next Page) SUPPLEMENTARY SCHEDULES

SCHEDULE 1 - BANKING RELATIONSHIPS Name & Location Account Number Checking Savings Retiremen Collateral High of Institution Balances Balances t Funds Credit

$ $ $ $

$ $ $ $

$ $ $ $

$ $ $ $

SCHEDULE 2 - SECURITIES (GOV’T AND MARKETABLE) No. Shares Source of Registered in Name % Stock or Face Description Cost Market Value Valuation of Pledged? Value

$ $

$ $

$ $

$ $

SCHEDULE 3 - NON-MARKETABLE SECURITIES Description No. Shares No. Shares Book Value Financial Total Value Registered in Name Owned Outstanding Per Share Statement of Date

$ $

$ $

$ $

$ $

SCHEDULE 4 - LIFE INSURANCE COVERAGE Face Insurance Owner of Policy Name of Beneficiary Total Policy Yearly Is Policy Value Company C.S.V.* Loans Premium Assigned?

$ $ $ $

$ $ $ $

$ $ $ $

$ $ $ $ *Cash Surrender Value SCHEDULE 5 - REAL ESTATE IN OWN NAME Description Including Dimensions Improve- Purchase Date Market Mortgage Terms or Mortgage Monthly Location of Address or # Acres ments Price Acquired Value Balance Maturity Holder Payment (Years) Amount

$ $ $ $ $

$ $ $ $

$ $ $ $ $

$ $ $ $ $

SCHEDULE 6 - PARTIAL INTERESTS IN REAL ESTATE - NET EQUITY VALUES Description Including Location Improvements % of Purchase Date Market Mortgage Terms or Mortgage Monthly of Address Ownership Price Acquired Value Balance Maturity Holder Payment (Years)

$ $

$ $ $ $ $

$ $ $ $ $

$ $ $ $ $ *Note: Share ownership with three siblings

SCHEDULE 7 - BANK, FINANCE COMPANIES, SAVINGS & LOAN ASSOCIATIONS, STORES, AND INDIVIDUALS FROM WHOM CREDIT HAS BEEN OBTAINED.** Original Maturity High Current Monthly Collateral Name Address Loan or Terms Credit Balance Payments Balance

$ $ $ $

$ $ $ $

$ $ $ $

$ $ $ $

**Include: Lines of credit, loans against retirement plans, and loans secured by savings/CDs