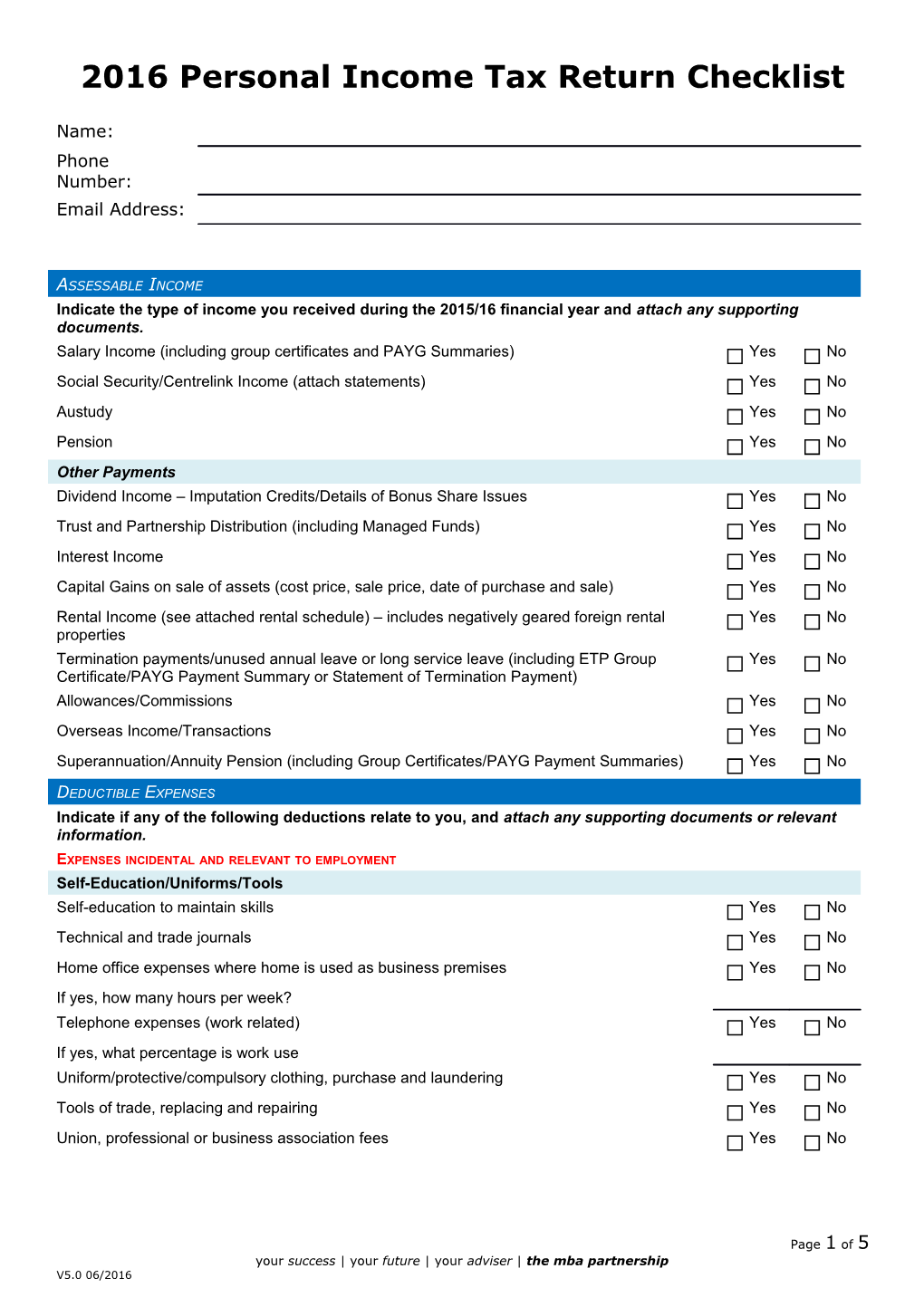

2016 Personal Income Tax Return Checklist

Name: Phone Number: Email Address:

ASSESSABLE INCOME Indicate the type of income you received during the 2015/16 financial year and attach any supporting documents. Salary Income (including group certificates and PAYG Summaries) Yes No Social Security/Centrelink Income (attach statements) Yes No Austudy Yes No Pension Yes No Other Payments Dividend Income – Imputation Credits/Details of Bonus Share Issues Yes No Trust and Partnership Distribution (including Managed Funds) Yes No Interest Income Yes No Capital Gains on sale of assets (cost price, sale price, date of purchase and sale) Yes No Rental Income (see attached rental schedule) – includes negatively geared foreign rental Yes No properties Termination payments/unused annual leave or long service leave (including ETP Group Yes No Certificate/PAYG Payment Summary or Statement of Termination Payment) Allowances/Commissions Yes No Overseas Income/Transactions Yes No Superannuation/Annuity Pension (including Group Certificates/PAYG Payment Summaries) Yes No

DEDUCTIBLE EXPENSES Indicate if any of the following deductions relate to you, and attach any supporting documents or relevant information. EXPENSES INCIDENTAL AND RELEVANT TO EMPLOYMENT Self-Education/Uniforms/Tools Self-education to maintain skills Yes No Technical and trade journals Yes No Home office expenses where home is used as business premises Yes No If yes, how many hours per week? Telephone expenses (work related) Yes No If yes, what percentage is work use Uniform/protective/compulsory clothing, purchase and laundering Yes No Tools of trade, replacing and repairing Yes No Union, professional or business association fees Yes No

Page 1 of 5 your success | your future | your adviser | the mba partnership V5.0 06/2016 Car Expenses Make, model, engine capacity (cc) Yes No

If a logbook is kept, details of running expenses including fuel, repairs, rego, insurance, Yes No maintenance, log book business percentage If no logbook is kept, estimate of work related kilometres travelled klms Travel Expenses – Business Related Meals and accommodation Yes No Airfares, taxi, train, bus, etc (provide your travel diary) Yes No Other Deductible Expenses Tax Agent fees (other than The MBA Partnership) Yes No Donations Yes No Income Protection Insurance Yes No

Tax Projects (Palandri, Sandalwood, Ecompos, Forestry Managed Investment Schemes) Annual tax statements from the project manager Yes No Separate loan statements from finance provider Yes No

REBATE ITEMS Indicate if any of the following items relate to you and attach any supporting documents. Superannuation Contributions Amount of personal superannuation contributions (excluding employer contributions) Yes No Full Name of Fund: Policy Number: Superannuation contributions on behalf of your spouse Yes No Private Health Cover Private health insurance statement from your health fund Yes No Maintenance of Dependents Spouse and dependent’s incomes Yes No Single or widowed parent Yes No Medical expenses of taxpayer and family (includes disability aids, attendant care or aged care) Yes No (net of health fund and Medicare refunds) if in excess of $2,265 (only able to be claimed in 2016 if also claimed in 2015 Financial Year) Maintenance of your parents, spouse’s parents or invalid relative Yes No Dependent children under 18 - provide name and DOB of each dependent Yes No Child’s Name: DOB: _____/_____/_____ Male Female Child’s Name: DOB: _____/_____/_____ Male Female Child’s Name: DOB: _____/_____/_____ Male Female

OTHER Please indicate if any of the following items relate to you and attach any supporting documents. HECS/HELP liability details (if any) Yes No In 2015/16 did you become/cease being a resident of Australia for tax purposes? Yes No

Page 2 of 5 your success | your future | your adviser | the mba partnership V5.0 06/2016 PROPERTY PURCHASES Indicate if any of the following items relate to you and attach any supporting documents. Have you purchased a property during the year inclusive of your main residence? Yes No

If Yes please include:

Date of Purchase of Property

Contracts

Legal Fees

Stamp Duty

Loan Statements

Details of Construction Costs

Approximate age of Property

EFT DETAILS To ensure a quicker refund, please provide your bank account details. BSB: Bank: Account Number: Account Name:

RENTAL PROPERTY SCHEDULE Property 1 Owner Address Dates available for rent (if not entire financial year) Rental income (attach agent’s statement) Agent’s commission Insurance Council rates Strata levies/Body corporate fees Bank fees Postage Interest (provide loan statements) Other

Property 2 Owner Address

Page 3 of 5 your success | your future | your adviser | the mba partnership V5.0 06/2016 Dates available for rent (if not entire financial year) Rental income (attach agent’s statement) Agent’s commission Insurance Council rates Strata levies/Body corporate fees Bank fees Postage Interest (provide loan statements) Other

Property 3 Owner Address Dates available for rent (if not entire financial year) Rental income (attach agent’s statement) Agent’s commission Insurance Council rates Strata levies/Body corporate fees Bank fees Postage Interest (provide loan statements) Other

LINE OF CREDIT (B ACCOUNT BANK STATEMENTS) Please write details of payments and deposits onto your bank statements and attach copies of all statements for 1 July 2015 to 30 June 2016. If this is the first year rented, please provide the following documents (if not already provided) Loan application and borrowing fees (including those of financial agencies such as Falcon Group) Depreciation schedule from builder Purchase contract (land and buildings) Has your property been refinanced in the 2016 financial year? Yes No If yes, provide copies of bank statements for both loans and borrowing costs for the new loan. FINANCIAL PLANNING We encourage all clients to meet with one of our financial planners for a free consultation. This ensures you are receiving comprehensive advice. Would you like our Financial Planning team to contact you regarding - Superannuation Yes No Personal insurances Yes No Lending or loan review Yes No Leasing Yes No Estate planning (Wills, etc) Yes No

Page 4 of 5 your success | your future | your adviser | the mba partnership V5.0 06/2016 Savings plan Yes No Cash flow and budgeting Yes No Retirement planning Yes No DOCUMENT UPLOAD Email your completed form and attachments through the client login on our website at www.mbapartnership.com.au or send to [email protected].

If you do not have a client login for our website, please contact our office to arrange this before uploading documents.

Or, post to PO Box 10839, Southport BC Qld 4215

If you have any questions, call us on (07) 5557 8700.

Page 5 of 5 your success | your future | your adviser | the mba partnership V5.0 06/2016