ChangeWave Research: Wireless Service Provider Trends

Wireless Service Provider Trends Major Shift Continues To Shared Data Plans

Andy Golub and Paul Carton Overview: Last summer’s rollout of shared data plans has had a transformative effect on the wireless industry. And according to the latest ChangeWave survey, consumers are accelerating the shift to shared data subscriptions.

During December, ChangeWave took a close-up look at consumer data plan preferences. The survey of 4,061 consumers also focused on other wireless service provider trends – including customer satisfaction and loyalty. ChangeWave is a service of 451 Research.

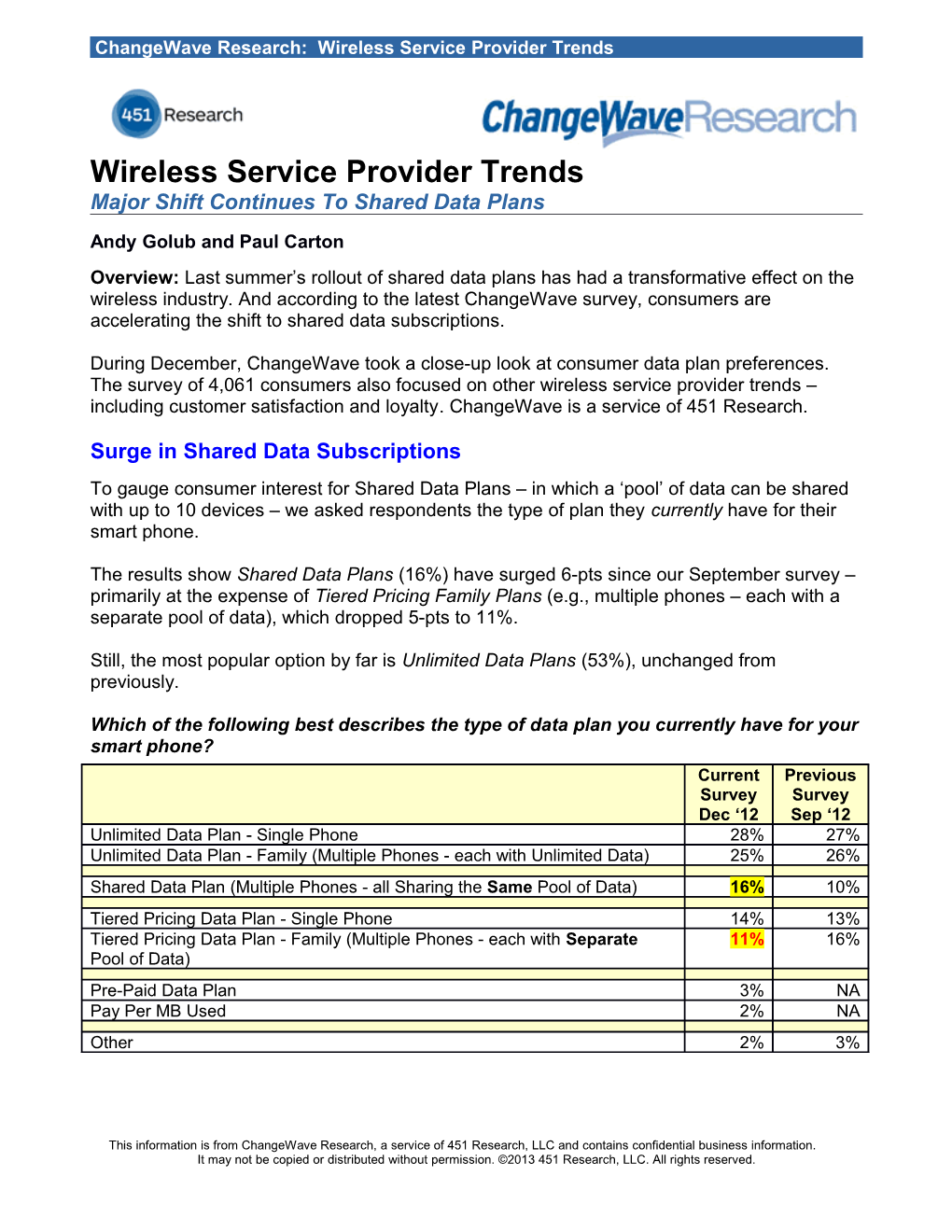

Surge in Shared Data Subscriptions To gauge consumer interest for Shared Data Plans – in which a ‘pool’ of data can be shared with up to 10 devices – we asked respondents the type of plan they currently have for their smart phone.

The results show Shared Data Plans (16%) have surged 6-pts since our September survey – primarily at the expense of Tiered Pricing Family Plans (e.g., multiple phones – each with a separate pool of data), which dropped 5-pts to 11%.

Still, the most popular option by far is Unlimited Data Plans (53%), unchanged from previously.

Which of the following best describes the type of data plan you currently have for your smart phone?

Current Previous Survey Survey Dec ‘12 Sep ‘12 Unlimited Data Plan - Single Phone 28% 27% Unlimited Data Plan - Family (Multiple Phones - each with Unlimited Data) 25% 26% Shared Data Plan (Multiple Phones - all Sharing the Same Pool of Data) 16% 10% Tiered Pricing Data Plan - Single Phone 14% 13% Tiered Pricing Data Plan - Family (Multiple Phones - each with Separate 11% 16% Pool of Data) Pre-Paid Data Plan 3% NA Pay Per MB Used 2% NA Other 2% 3%

This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. ChangeWave Research: Wireless Service Provider Trends Among respondents who plan on changing their data plan in the next 90 days, one-in-four say they'll sign up for a Shared Data Plan (24%) – putting it in a dead heat for first place with Unlimited Family Data Plans (24%; e.g., multiple phones – each with unlimited data).

Not surprisingly, 55% of Unlimited Plan users said they are Very Satisfied with their current plan compared to 32% of Shared Data Plan users. But regardless, most unlimited plans are in the process of being phased out. At the other end of the spectrum, only 17% of Tiered Data Plan users say they are Very Satisfied.

Bottom Line. Shortly after Verizon announced the first 'Share Everything' plan, a June 2012 ChangeWave Wireless survey found shared data plans were causing a "transformational shift for the wireless industry." The current results continue to support this finding. Moreover, the appeal of sharing pools of data is fueling an explosion in overall data consumption. When respondents who plan to switch to a Shared Data Plan were asked if they'll use more or less data in the next 90 days, an astonishing 39% say they’ll use More data compared to only 6% Less.

2 ChangeWave Research: Wireless Service Provider Trends Over the next 90 days, do you think you'll use more data on your smart phone, less data, or about the same amount of data compared to the previous 90 days?

Verizon and AT&T are the only two major U.S. providers currently offering a shared data subscription.

Sprint remains the last major U.S. provider still offering truly unlimited data options, which continue to be popular among consumers. We note that T-Mobile has recently begun offering an unlimited 4G data plan. Consumer Satisfaction The ChangeWave survey also took an up-close look at consumer satisfaction and loyalty towards their wireless service providers.

Verizon Wireless remains the industry leader in customer satisfaction among the top U.S. providers, with 48% of its subscribers saying they’re Very Satisfied. Sprint (32%) has a firm hold on second place, followed by T-Mobile (26%) and AT&T (24%).

This is the third quarter in a row that Verizon has maintained its industry leading 48% Very Satisfied rating. At the same time, AT&T has improved its rating 3-pts since September – its biggest increase in more than three years. This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 3 ChangeWave Research: Wireless Service Provider Trends

Dropped Calls. Verizon also leads the competition in terms of having the lowest dropped call rate – only 1.8% of calls were reported dropped by Verizon customers over the past 90 days. T-Mobile (2.7%) and Sprint (3.2%) are next, followed by AT&T (4.0%).

Customer Loyalty A total of 8% of respondents say they’re likely to switch providers in the next 90 days – 2-pts less than previously. Not surprisingly, Verizon enjoys the lowest (i.e., best) churn rate with just 5% of their customers saying they’re likely to switch in the next 90 days. AT&T (10%) comes in second, followed by Sprint (12%) and T-Mobile (13%).

4 ChangeWave Research: Wireless Service Provider Trends We note that both AT&T and T-Mobile have improved on this measure since September, while Sprint has worsened by 3-pts.

Cost (29%) remains the top reason Sprint subscribers plan on switching, with Moving to a Better 4G Network (24%) having jumped as a key reason in the past two surveys – now ranked second.

Other Findings

Consumer Interest in Samsung Galaxy S IV. As stated in last week's Consumer Smart Phone Demand report, the next generation Samsung “Galaxy S IV” is expected during first half 2013 – and an extraordinary 17% of respondents say they’re likely to buy it (3% Very Likely; 14% Somewhat Likely). A further breakdown of the results shows T-Mobile subscribers are most interested in buying the "S IV" (5% Very Likely; 25% Somewhat Likely).

Current Survey T-Mobile Sprint Verizon AT&T Dec ‘12 Very Likely 3% 5% 5% 2% 2% Somewhat Likely 14% 25% 20% 13% 12%

The survey also looked at iPhone 5 owners in terms of customer satisfaction and dropped calls: iPhone 5 Customer Satisfaction – By Provider. AT&T iPhone 5 owners say they’re the most satisfied with the device (85% Very Satisfied), closely followed by Verizon iPhone 5 owners (77%). In comparison, 57% of Sprint iPhone 5 subscribers say they're Very Satisfied.

This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 5 ChangeWave Research: Wireless Service Provider Trends

iPhone 5 Dropped Call Rates. Verizon iPhone 5 subscribers reported the lowest dropped call rates (1.8% of calls dropped over past 90 days) compared to 2.5% for Sprint and 3.9% for AT&T.

Summary of Key Findings

6 ChangeWave Research: Wireless Service Provider Trends

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 7 ChangeWave Research: Wireless Service Provider Trends Table of Contents

Summary of Key Findings...... 7

Surge in Shared Data Plans 9

Consumer Satisfaction 13

Customer Loyalty 16

Other Findings 19

ChangeWave Research Methodology...... 22

About ChangeWave Research...... 22

About 451 Research...... 22

8 ChangeWave Research: Wireless Service Provider Trends The Findings

Introduction: Last summer’s rollout of shared data plans has had a transformative effect on the wireless industry. And according to the latest ChangeWave survey, consumers are accelerating the shift to shared data subscriptions.

During December, ChangeWave took a close-up look at consumer data plan preferences. The survey of 4,061 consumers also focused on other wireless service provider trends – including customer satisfaction and loyalty. ChangeWave is a service of 451 Research.

Surge in Shared Data Plans To gauge consumer interest for Shared Data Plans – in which a ‘pool’ of data can be shared with up to 10 devices – we asked respondents the type of plan they currently have for their smart phone.

The results show Shared Data Plans (16%) have surged 6-pts since our September survey – primarily at the expense of Tiered Pricing Family Plans (e.g., multiple phones – each with a separate pool of data), which dropped 5-pts to 11%.

Still, the most popular option by far is Unlimited Data Plans (53%), unchanged from previously.

Which of the following best describes the type of data plan you currently have for your smart phone?

Current Previous Survey Survey Dec ‘12 Sep ‘12 Unlimited Data Plan - Single Phone 28% 27% Unlimited Data Plan - Family (Multiple Phones - each with Unlimited Data) 25% 26% Shared Data Plan (Multiple Phones - all Sharing the Same Pool of Data) 16% 10% Tiered Pricing Data Plan - Single Phone 14% 13% Tiered Pricing Data Plan - Family (Multiple Phones - each with Separate 11% 16% Pool of Data) Pre-Paid Data Plan 3% NA Pay Per MB Used 2% NA Other 2% 3%

This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 9 ChangeWave Research: Wireless Service Provider Trends In terms of changes respondents plan on making to their data plans in the next 90 days – the survey shows 12% saying they'll make a change (3% Very Likely; 9% Somewhat Likely).

How likely are you to change the type of data plan you have over the next 90 days?

Current Survey Dec ‘12 Very Likely 3% Somewhat Likely 9% Unlikely 83% Don’t Know 4% Not Applicable 1%

AT&T subscribers are slightly more likely to change their data plans (13%), while Sprint subscribers are least likely (7%).

Current Survey (Dec 2012) AT&T T- Mobile Verizon Sprint Very Likely 3% 3% 3% 2% Somewhat Likely 10% 9% 9% 5% Unlikely 82% 81% 83% 89% Don’t Know 4% 2% 4% 2% Not Applicable 1% 1% 2% 1%

Among respondents who plan on changing their data plan in the next 90 days, one-in-four say they'll sign up for a Shared Data Plan (24%) – putting it in a dead heat for first place with Unlimited Family Data Plans (24%; e.g., multiple phones – each with unlimited data).

Which type of data plan will you most likely switch to?

10 ChangeWave Research: Wireless Service Provider Trends

Current Survey Dec ‘12 Shared Data Plan (Multiple Phones - all Sharing the Same Pool of Data) 24%

Unlimited Data Plan - Single Phone 16% Unlimited Data Plan - Family (Multiple Phones - each with Unlimited Data) 24%

Tiered Pricing Data Plan - Single Phone 7% Tiered Pricing Data Plan - Family (Multiple Phones - each with Separate Pool of Data) 8%

Pre-Paid Data Plan 5% Pay Per MB Used 2%

Don’t Know 13% Other 2%

Not surprisingly, 55% of Unlimited Plan users said they are Very Satisfied with their current plan compared to 32% of Shared Data Plan users. But regardless, most unlimited plans are in the process of being phased out. At the other end of the spectrum, only 17% of Tiered Data Plan users say they are Very Satisfied.

How satisfied are you with your current data plan?

Current Unlimited Shared Tiered Survey Data Plan Data Plan Data Plan Dec ‘12 Very Satisfied 39% 55% 32% 17% Somewhat Satisfied 44% 38% 53% 56% Somewhat Unsatisfied 10% 5% 11% 19% Very Unsatisfied 2% 1% 2% 6% Don't Know /NA 4% 1% 3% 1%

This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 11 ChangeWave Research: Wireless Service Provider Trends Bottom Line. Shortly after Verizon announced the first 'Share Everything' plan, a June 2012 ChangeWave Wireless survey found shared data plans were causing a "transformational shift for the wireless industry." The current results continue to support this finding. Moreover, the appeal of sharing pools of data is fueling an explosion in overall data consumption. When respondents who plan to switch to a Shared Data Plan were asked if they'll use more or less data in the next 90 days, an astonishing 39% say they’ll use More data compared to only 6% Less. Over the next 90 days, do you think you'll use more data on your smart phone, less data, or about the same amount of data compared to the previous 90 days?

Respondents Who Plan on Switching to a Shared Data Plan – Next 90 Days

Current Survey Dec ‘12 More Data Over Next 90 Days 39% Less Data Over Next 90 Days 6% About the Same Amount 52% Don’t Know 3%

Among this group, 27% are planning to use more data because they Bought a New Smart Phone and 26% are Less Concerned about Exceeding their Data Plan Limits.

(FOR THOSE WHO THINK THEY'LL USE MORE DATA) What's the biggest reason why?

Current Survey Dec ‘12 Have a New Smart Phone that Uses More Data 27% Less Concerned About Exceeding My Data Plan Limits 26% Using a Streaming Video Service More Often 13% Don’t Know / NA 12% Other 22%

Consumer Satisfaction

12 ChangeWave Research: Wireless Service Provider Trends

The ChangeWave survey also took an up-close look at consumer satisfaction and loyalty towards their wireless service providers.

Verizon Wireless remains the industry leader in customer satisfaction among the top U.S. providers, with 48% of its subscribers saying they’re Very Satisfied. Sprint (32%) has a firm hold on second place, followed by T-Mobile (26%) and AT&T (24%).

How satisfied are you with your current wireless service provider?

Total Verizon Sprint T-Mobile AT&T

Very Satisfied 34% 48% 32% 26% 24% Somewhat Satisfied 52% 45% 53% 57% 59% Somewhat Unsatisfied 10% 5% 11% 13% 13% Very Unsatisfied 3% 2% 4% 2% 3% This is the third quarter in a row that Verizon has maintained its industry leading 48% Very Satisfied rating. At the same time, AT&T has improved its rating 3-pts since September – its biggest increase in more than three years.

Here’s a look at the satisfaction ratings for Sprint and T-Mobile over the same time period. This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 13 ChangeWave Research: Wireless Service Provider Trends

Dropped Calls. Verizon also leads the competition in terms of having the lowest dropped call rate – only 1.8% of calls were reported dropped by Verizon customers over the past 90 days. T-Mobile (2.7%) and Sprint (3.2%) are next, followed by AT&T (4.0%).

Here's a look at the dropped call ratings for Verizon vs. AT&T over the past four years:

And here's the data for T-Mobile vs. Sprint:

14 ChangeWave Research: Wireless Service Provider Trends

Over the past 90 days, how frequently have you experienced a "dropped call" on your cell phone?

Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Dec ‘12 Sep ‘12 Jun ‘12 Mar ‘12 Dec ‘11 Total 2.4% 2.5% 2.5% 2.7% 2.5%

Verizon 1.8% 1.6% 1.8% 1.5% 1.5% T-Mobile 2.7% 3.4% 2.8% 2.5% 2.8% Sprint 3.2% 3.2% 2.8% 3.2% 2.7% AT&T 4.0% 4.1% 3.7% 4.6% 4.6%

This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 15 ChangeWave Research: Wireless Service Provider Trends Customer Loyalty A total of 8% of respondents say they’re likely to switch providers in the next 90 days – 2-pts less than previously. How likely is it that you will change wireless service providers within the next 90 days?

Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Dec ‘12 Sep ‘12 Jun ‘12 Mar ‘12 Dec ‘11 Very Likely 2% 3% 2% 2% 3% Somewhat Likely 6% 7% 7% 6% 6% Unlikely 88% 85% 87% 88% 87% Don't Know 3% 3% 3% 3% 2% Not Applicable 1% 1% 1% 1% 1% Not surprisingly, Verizon enjoys the lowest (i.e., best) churn rate with just 5% of their customers saying they’re likely to switch in the next 90 days. AT&T (10%) comes in second, followed by Sprint (12%) and T-Mobile (13%).

We note that both AT&T and T-Mobile have improved on this measure since September, while Sprint has worsened by 3-pts.

16 ChangeWave Research: Wireless Service Provider Trends

Current Survey (December 2012) - Breakdown of Respondents by Provider

Total Verizon AT&T Sprint T-Mobile

Very/Somewhat Likely 8% 5% 10% 12% 13% Unlikely 88% 91% 87% 85% 82%

Reasons for Switching. Cost (29%) remains the top reason Sprint subscribers plan on switching, with Moving to a Better 4G Network (24%) having jumped as a key reason in the past two surveys – now ranked second.

Among T-Mobile customers likely to switch providers, nearly a third (31%) say it’s because of Poor Reception/Coverage and 25% due to Cost.

This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 17 ChangeWave Research: Wireless Service Provider Trends What's the most important reason why you're likely to change wireless service providers? Sprint T-Mobile

For AT&T, Poor Reception/Coverage (37%) tops the list and Verizon switchers cite Cost (46%) as the key issue.

AT&T Verizon

Verizo Total AT&T Sprint T-Mobile n Cost 33% 32% 46% 29% 25% Poor Reception/Coverage 26% 37% 15% 15% 31% To Get a Better Data Plan 12% 11% 19% 9% 3% Moving to a Better 4G Network 8% 5% 3% 24% 12% Dropped Calls 6% 10% 4% 6% 3% To Buy a Phone Not Available on My 4% 1% 3% 0% 16% Current Wireless Provider Other 8% 3% 6% 15% 9% No Answer 2% 0% 4% 3% 0%

18 ChangeWave Research: Wireless Service Provider Trends Other Findings

Consumer Interest in Samsung Galaxy S IV. As stated in last week's Consumer Smart Phone Demand report, the next generation Samsung “Galaxy S IV” is expected during first half 2013 – and an extraordinary 17% of respondents say they’re likely to buy it (3% Very Likely; 14% Somewhat Likely).

Some analysts think Samsung may release its next generation “Galaxy S IV” during the first half of 2013. In addition to the new “Premium Suite” software upgrade, one anticipated new feature is an “unbreakable” screen.

How likely is it that you will buy a new Samsung "Galaxy S IV" for yourself or someone else (e.g., a family member) if-and-when it becomes available?

A further breakdown of the results shows T-Mobile subscribers are most interested in buying the "S IV" (5% Very Likely; 25% Somewhat Likely).

Current Survey T-Mobile Sprint Verizon AT&T Dec ‘12 Very Likely 3% 5% 5% 2% 2% Somewhat Likely 14% 25% 20% 13% 12% Unlikely 64% 55% 52% 65% 67% Don't Know 14% 14% 18% 14% 13% No Answer 5% 2% 5% 5% 5%

This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 19 ChangeWave Research: Wireless Service Provider Trends The survey also looked at iPhone 5 owners in terms of customer satisfaction and dropped calls: iPhone 5 Customer Satisfaction – By Provider. AT&T iPhone 5 owners say they’re the most satisfied with the device (85% Very Satisfied), closely followed by Verizon iPhone 5 owners (77%). In comparison, 57% of Sprint iPhone 5 subscribers say they're Very Satisfied.

AT&T Verizon Sprint iPhone 5 iPhone 5 iPhone 5 Owners Owners Owners Very Satisfied 85% 77% 57% Somewhat Satisfied 15% 22% 29% Somewhat Unsatisfied 0% 1% 11% Very Unsatisfied 0% 0% 0% iPhone 5 Dropped Call Rates. Verizon iPhone 5 subscribers reported the lowest dropped call rates (1.8% of calls dropped over past 90 days) compared to 2.5% for Sprint and 3.9% for AT&T.

20 ChangeWave Research: Wireless Service Provider Trends Impact of T-Mobile Announcement Regarding Apple. T-Mobile recently announced they will begin selling Apple products in 2013. To measure the impact of this, we asked respondents if this development makes them more or less likely to use T-Mobile in the future.

Does this announcement make you more likely to use T-Mobile in the future, less likely, or does it have no effect?

Current Survey Dec ‘12 More Likely to Use T-Mobile in the Future 8% Less Likely to Use T-Mobile in the Future 1% No Effect 83% Don’t Know 6% No Answer 2%

By an 8-to-1 margin, respondents say the T-Mobile/Apple relationship makes them More Likely to use T-Mobile.

Among current T-Mobile subscribers, better than one-in-five (21%) reacted positively to the announcement.

Current T-Mobile Customers More Likely to Use T-Mobile in the Future 21% Less Likely to Use T-Mobile in the Future 0% No Effect 72% Don’t Know 4% No Answer 2%

Satisfaction with Prepaid Phones. The survey also looked at satisfaction levels with Prepaid or 'Pay-as-you-go' phones – which allow consumers to buy voice and data service on an as-needed basis, without a long-term wireless contract.

T-Mobile (40% Very Satisfied) prepaid subscribers are most satisfied, followed by Verizon Wireless (38%).

How satisfied are you with your prepaid phone?

Verizon Virgin T-Mobile AT&T Wireless Tracfone Mobile Very Satisfied 40% 38% 34% 33% 29% Somewhat Satisfied 52% 44% 55% 48% 61% Somewhat Unsatisfied 3% 10% 9% 15% 5% Very Unsatisfied 5% 4% 1% 1% 5% Don't Know 0% 1% 1% 3% 0% Not Applicable 0% 3% 0% 0% 0% ChangeWave Research Methodology

This information is from ChangeWave Research, a service of 451 Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 21 ChangeWave Research: Wireless Service Provider Trends This report presents the findings of a recent ChangeWave Research survey on Wireless Service Providers. The survey was conducted December 11-27, 2012, and a total of 4,061 respondents participated.

ChangeWave's proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members of its research network.

The business and investment intelligence provided by ChangeWave provides a real-time view of companies, technologies, and consumer and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

About ChangeWave Research

ChangeWave Research, a service of 451 Research, is a survey research firm that identifies and quantifies change in corporate buying & business trends, telecom trends, and consumer spending & electronics trends.

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com.

ChangeWave Research does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report.

About 451 Research

451 Research, a division of leading global analyst and data company The 451 Group, is focused on the business of enterprise IT innovation. Clients of 451 Research – at end-user, service-provider, vendor, and investor organizations – rely on 451 Research’s insight through a range of syndicated research and advisory services to support both strategic and tactical decision-making. For additional information on 451 Research, go to: 451research.com. For More Information: ChangeWave Research Telephone: 301-250-2363 7101 Wisconsin Ave. Fax: 240-200-3988 Suite 1301 www.ChangeWaveResearch.com Bethesda, MD 20814 [email protected]

22