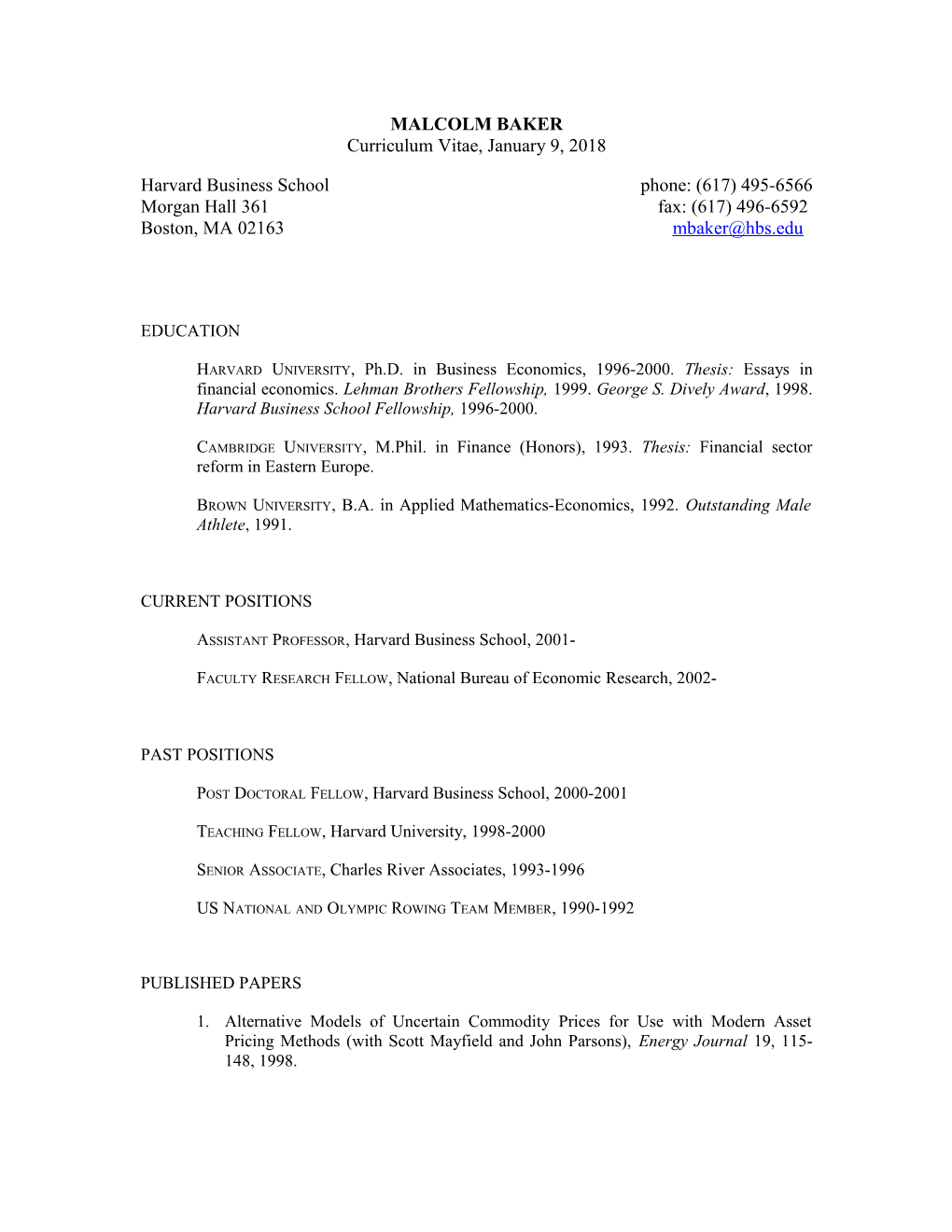

MALCOLM BAKER Curriculum Vitae, January 9, 2018

Harvard Business School phone: (617) 495-6566 Morgan Hall 361 fax: (617) 496-6592 Boston, MA 02163 [email protected]

EDUCATION

HARVARD UNIVERSITY, Ph.D. in Business Economics, 1996-2000. Thesis: Essays in financial economics. Lehman Brothers Fellowship, 1999. George S. Dively Award, 1998. Harvard Business School Fellowship, 1996-2000.

CAMBRIDGE UNIVERSITY, M.Phil. in Finance (Honors), 1993. Thesis: Financial sector reform in Eastern Europe.

BROWN UNIVERSITY, B.A. in Applied Mathematics-Economics, 1992. Outstanding Male Athlete, 1991.

CURRENT POSITIONS

ASSISTANT PROFESSOR, Harvard Business School, 2001-

FACULTY RESEARCH FELLOW, National Bureau of Economic Research, 2002-

PAST POSITIONS

POST DOCTORAL FELLOW, Harvard Business School, 2000-2001

TEACHING FELLOW, Harvard University, 1998-2000

SENIOR ASSOCIATE, Charles River Associates, 1993-1996

US NATIONAL AND OLYMPIC ROWING TEAM MEMBER, 1990-1992

PUBLISHED PAPERS

1. Alternative Models of Uncertain Commodity Prices for Use with Modern Asset Pricing Methods (with Scott Mayfield and John Parsons), Energy Journal 19, 115- 148, 1998. 2. The Equity Share in New Issues and Aggregate Stock Returns (with Jeffrey Wurgler), Journal of Finance 55, 2219-57, 2000. Nominated for the Smith Breeden and Brattle prizes.

3. Market Timing and Capital Structure (with Jeffrey Wurgler), Journal of Finance 57, 1-32, 2002. Abstracted in Economic Intuition, Summer 2001. Winner of the Brattle Prize for the best paper in Corporate Finance published in the Journal of Finance in 2002.

4. Limited Arbitrage in Mergers and Acquisitions (with Serkan Savasoglu), Journal of Financial Economics 64, 91-116, 2002.

5. The Maturity of Debt Issues and Predictable Variation in Bond Returns (with Robin Greenwood and Jeffrey Wurgler), Journal of Financial Economics, forthcoming.

6. The Determinants of Board Structure at the Initial Public Offering (with Paul Gompers), Journal of Law and Economics, forthcoming.

7. When Does the Market Matter? Stock Prices and the Investment of Equity Dependent Firms (with Jeremy Stein and Jeffrey Wurgler), Quarterly Journal of Economics, forthcoming. Formerly NBER Working Paper Series, No. 8750. Abstracted in Economic Intuition, Fall 2001.

8. A Catering Theory of Dividends (with Jeffrey Wurgler), Journal of Finance, forthcoming. Formerly NBER Working Paper Series, No. 9542. Winner of the 2003 NYU-Fitch Ratings Working Paper of the Year Award.

WORKING PAPERS

Why are Dividends Disappearing? An Empirical Analysis (with Jeffrey Wurgler), 2002. First Draft in 2002.

Market Liquidity as a Sentiment Indicator (with Jeremy Stein), NBER Working Paper Series, No. 8816, 2002. Abstracted in Business Week, April 2002. First Draft in 2001.

Career Concerns and Staged Investment: Evidence From the Venture Capital Industry, 2000. First Draft in 2000.

Executive Ownership and Control in Newly Public Firms: The Role of Venture Capitalists (with Paul Gompers), 1999. First Draft in 1998.

Estimating Industry Multiples (with Rick Ruback), 1999. First Draft in 1999.

COURSE DEVELOPMENT

1. Pharmacyclics: Financing Research & Development (with Rick Ruback and Aldo Sesia), Harvard Business School Case. Pharmacyclics: Financing Research & Development TN (with Rick Ruback and Aldo Sesia), Harvard Business School Teaching Note.

2. Giant Cinema (with Rick Ruback and Erik Stafford), Harvard Business School Case.

INVITED PRESENTATIONS

2004: UCLA 2003: University of Alberta, Harvard University, Federal Reserve Bank of New York, Chicago Quantitative Alliance, University of Wisconsin at Madison 2002: University of Rochester, Harvard Business School, University of Michigan, University of Chicago, Atlanta Finance Forum, Harvard University 2001: Duke University, Chicago University, Northwestern University, Stanford University, Cornell University, MIT, Harvard Business School, Wharton, Harvard Business School, London Business School 2000: Harvard University, Yale University, Columbia University, New York University, Harvard Law School, Harvard University, Charles River Associates 1999: Harvard University, Yale University, Lehman Brothers, Harvard Business School

CONFERENCE PRESENTATIONS

2003: American Finance Association Annual Meetings, Eastern Finance Association Annual Meetings 2002: Kellogg/Zell Center Conference on Risk Perceptions and Capital Markets , NBER Behavioral Finance Conference, NBER Corporate Finance Conference, Texas Finance Festival 2001: HBS Financial Decisions and Control Conference, NBER Corporate Finance Conference, Western Finance Association Annual Meetings 2000: American Finance Association Annual Meeting, European Financial Management Association, Tuck/JFE Corporate Governance Conference 1999: NBER Behavioral Finance Conference 1998: London Business School Venture Capital Conference

DISCUSSIONS

2004: American Economic Association Annual Meeting 2003: American Finance Association Annual Meeting, Western Finance Association Annual Meeting 2002: American Finance Association Annual Meeting, NBER Corporate Finance Conference 2001: American Economic Association Annual Meeting 2000: European Financial Management Association

TEACHING AND INVITED LECTURES

CORPORATE FINANCE, Harvard University, 2004. Co-taught graduate course on the theory and empirical evidence of capital structure, dividends, investment policy, managerial incentives, and takeovers.

BEHAVIORAL CORPORATE FINANCE, Harvard Business School, 2003. Provided an overview of my research in behavioral corporate finance at the annual HBS research symposium.

EMPIRICAL CORPORATE FINANCE, Harvard Business School, 2003. Contributed 2-session lectures on dividend policy and behavioral corporate finance to a graduate topics course.

ADVANCED MANAGEMENT DEVELOPMENT PROGRAM IN REAL ESTATE, Graduate School of Design, Harvard University, 2003. Contributed 2 case-based classes on corporate finance to an executive program. (Instructor Rating: 4.7/5.0)

FINANCE 1, Harvard Business School, 2001-2003. Taught first required finance course in the Harvard MBA curriculum on working capital management, capital budgeting, the Capital Asset Pricing Model, and integrated valuation techniques, with applications to acquisitions, initial and seasoned equity offerings, and entrepreneurial finance. (Instructor Rating: 6.8/7.0 in 2001, 7.0/7.0 in 2002)

BEHAVIORAL FINANCE, Harvard University, Invited Lecture, 2002. Market liquidity and investor sentiment.

BEHAVIORAL FINANCE, Harvard University, Invited Lecture, 2001. Empirical evidence of the limits to arbitrage.

CORPORATE FINANCE, Harvard University, Teaching Fellow, 2000. Graduate course taught by Andrei Shleifer on the theory and empirical evidence of capital structure, dividends, investment policy, managerial incentives, and takeovers.

BEHAVIORAL FINANCE, Harvard University, Invited Lecture, 2000. Real consequences of inefficient markets.

CONTRACT THEORY, Harvard University, Teaching Fellow, 1998-1999. Graduate course taught by Oliver Hart on recent developments in contract theory, including hidden action and hidden information models, dynamic agency issues, incomplete contracts, and applications of contract theory to theories of the firm and corporate financial structure.

PROFESSIONAL ACTIVITIES

Referee: Financial Management, Financial Review, Journal of Business, Journal of Economics and Management Strategy, Journal of Finance, Journal of Financial Economics, Journal of Financial Intermediation, Quarterly Journal of Economics, Review of Economics and Statistics, Review of Financial Studies MEDIA CITATIONS

2003: Moneycentral.com 2002: Business Week 2001: Economic Intuition, Hedgeworld Research Institute 2000: Europe Investor Direct.com, Money Magazine, Morningstar.com

ADVISING

Gene D’Avolio Robin Greenwood (Placed at HBS; Thesis, July 2002) Eric Nierenberg (Orals, March 2003) Harini Parthasarathy Pavel Savor (Orals, March 2003) Ryan Taliaferro Eliza Hammel (Orals, July 2003)

ADMINISTRATIVE

Co-Organizer, Outside Seminar Series, 2002-2003 Business Economics Admissions Committee, 2003 Crimson Greetings, 2003 Finance Area Recruiting Committee, 2003-3004 PAPER PRESENTATIONS (DETAIL)

MARKET TIMING AND CAPITAL STRUCTURE Harvard University (October 2000), Yale University (December 2000), Columbia University (December 2000), New York University (December 2000), Duke University (January 2001), Chicago University (January 2001), Northwestern University (January 2001), Stanford University (January 2001), Cornell University (January 2001), MIT (January 2001), Harvard Business School (January 2001), Wharton (February 2001), Western Finance Association Annual Meetings (2001)

THE EQUITY SHARE IN NEW ISSUES AND AGGREGATE STOCK RETURNS Harvard University (March 1999), Yale University (September 1999), Lehman Brothers (November 1999), NBER Behavioral Finance Conference (December 1999)

A CATERING THEORY OF DIVIDENDS University of Rochester (April 2002), Harvard Business School (May 2002), University of Michigan (September 2002), University of Chicago (September 2002), NBER Corporate Finance Conference (November 2002), American Finance Association Annual Meetings (January 2003), Eastern Finance Association Annual Meetings (April 2003)

WHY ARE DIVIDENDS DISAPPEARING? AN EMPIRICAL ANALYSIS University of Alberta (January 2003)

INVESTOR SENTIMENT AND THE CROSS-SECTION OF STOCK RETURNS Harvard University (April 2003), Chicago Quantitative Alliance (September 2003), University of Wisconsin at Madison (September 2003), UCLA (Spring 2004)

MARKET LIQUIDITY AS A SENTIMENT INDICATOR Harvard Business School (September 2001), Atlanta Finance Forum (February 2002), Texas Finance Festival (April 2002), Harvard University (April 2002), NBER Behavioral Finance Conference (November 2002), American Finance Association Annual Meetings (January 2003)

THE MATURITY OF DEBT ISSUES AND PREDICTABLE VARIATION IN BOND RETURNS HBS Financial Decisions and Control Conference (June 2001), NBER Corporate Finance Conference (August 2001), London Business School (October 2001)

WHEN DOES THE MARKET MATTER? STOCK PRICES AND THE INVESTMENT OF EQUITY DEPENDENT FIRMS Kellogg/Zell Center Conference on Risk Perceptions and Capital Markets (January 2002)

CAREER CONCERNS AND STAGED INVESTMENT: EVIDENCE FROM THE VENTURE CAPITAL INDUSTRY Harvard University (December 1999), Harvard Law School (September 2000)

LIMITED ARBITRAGE IN MERGERS AND ACQUISITIONS Harvard Business School (November 1999), Harvard University (February 2000), Charles River Associates (April 2000), European Financial Management Association (June 2000)

THE DETERMINANTS OF BOARD STRUCTURE AT THE INITIAL PUBLIC OFFERING Tuck/JFE Corporate Governance Conference (July 2000)

ESTIMATING INDUSTRY MULTIPLES Harvard University (April 1999), Harvard Business School (May 1999)

EXECUTIVE OWNERSHIP AND CONTROL IN NEWLY PUBLIC FIRMS: THE ROLE OF VENTURE CAPITALISTS London Business School Venture Capital Conference (October 1998), American Finance Association Annual Meeting (January 2000) MEDIA CITATIONS (DETAIL)

Europe Investor Direct.com (June 2000, The equity share in new issues and aggregate stock returns) Money Magazine (October 2000, The equity share in new issues and aggregate stock returns) Morningstar.com (December 2000, The equity share in new issues and aggregate stock returns) Economic Intuition (Summer 2001, Market timing and capital structure) Hedgeworld Research Institute (Fall 2001, Limited arbitrage in mergers and acquisitions) Economic Intuition (Fall 2001, When does the market matter? stock prices and the investment of equity dependent firms) Business Week (April 8, 2002, Market liquidity as a sentiment indicator) Moneycentral.com (April 10, 2003, The equity share in new issues and aggregate stock returns) SYLLABI 1. Yale University (Jeffrey Wurgler)

2. Harvard University Corporate Finance (Jeremy Stein)

3. Harvard University Behavioral Finance (Andrei Shleifer)

4. Harvard Business School Empirical Corporate Finance (Paul Gompers)

5. University of Chicago Behavioral Finance (Nick Barberis)

6. University of Minnesota (Paul Richardson)

7. University of Illinois at Urbana-Champaign (Allen Poteshman)

8. Tel Aviv University (David Frankel)

9. MIT (Espen Eckbo)

10. Dartmouth (Espen Eckbo)

11. College of Business Administration, Korea University (Inmoo Lee)

12. University of Buffalo (Joseph Ogden)

13. Queen’s University Belfast (Charles Hickson)

14. Purdue University (Raghavendra Rau, John McConnell)

15. University of London (Timothy Johnson)

16. Carnegie Mellon University (Richard Green)

17. University of Texas at Dallas (Robert Kieschnick) SOME CITATIONS 1. Shiller, Irrational Exhuberance

2. Campbell, Survey Paper

3. Barberis and Thaler, Survey Paper

4. Mitchell and Pulvino, Characteristics of Risk in Risk Arbitrage

5. Jindra and Walkling, Arbitrage Paper

6. Kaplin and Levy, Debt Paper

7. Reed, Musto, etc., Short Selling Paper

8. Shleifer, Inefficient markets

9. Shleifer and Vishny, Stock market driven acquisitions

10. David L. Ikenberry and Sundaresh Ramnath, Underreaction

11. D’Avolio, Gildor, and Shleifer, Technology, information production, and market efficiency

12. Roberts (Duke), The dynamics of capital structure: an empirical analysis of a partially observable system

13. Jenter, Market timing and managerial portfolio decisions

14. Malmendier, Managerial overconfidence and investment

15. Benninga, Helmantel, and Sarig (Wharton), The timing of IPOs

16. Ritter, Investment banking and securities issuance

17. Alti (CMU), Clustering patterns in IPOs

18. Graham, Taxes and corporate finance: a review

19. Allen and Michaely, Payout policy

20. Greenwood, Large events

21. Welch, Capital Structure Paper

22. Titman, MM and Market Integration paper

23. Winters and Farrell, Small Business Compensation paper