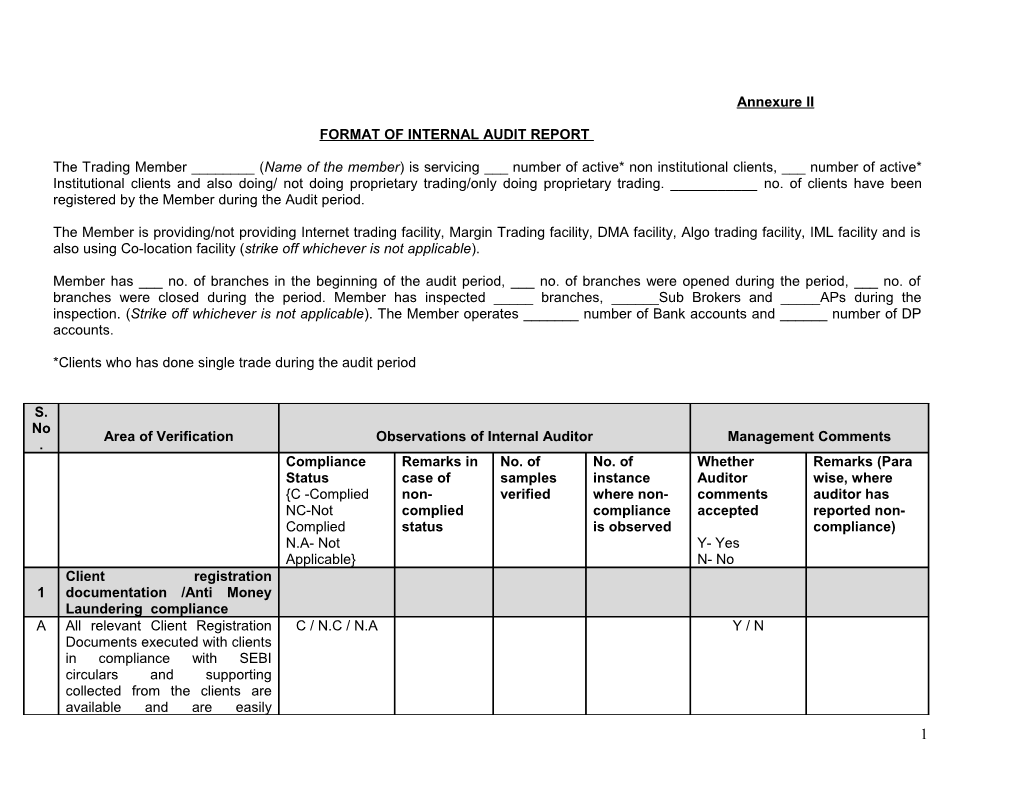

Annexure II

FORMAT OF INTERNAL AUDIT REPORT

The Trading Member ______(Name of the member) is servicing ___ number of active* non institutional clients, ___ number of active* Institutional clients and also doing/ not doing proprietary trading/only doing proprietary trading. ______no. of clients have been registered by the Member during the Audit period.

The Member is providing/not providing Internet trading facility, Margin Trading facility, DMA facility, Algo trading facility, IML facility and is also using Co-location facility (strike off whichever is not applicable).

Member has ___ no. of branches in the beginning of the audit period, ___ no. of branches were opened during the period, ___ no. of branches were closed during the period. Member has inspected _____ branches, ______Sub Brokers and _____APs during the inspection. (Strike off whichever is not applicable). The Member operates ______number of Bank accounts and ______number of DP accounts.

*Clients who has done single trade during the audit period

S. No Area of Verification Observations of Internal Auditor Management Comments . Compliance Remarks in No. of No. of Whether Remarks (Para Status case of samples instance Auditor wise, where {C -Complied non- verified where non- comments auditor has NC-Not complied compliance accepted reported non- Complied status is observed compliance) N.A- Not Y- Yes Applicable} N- No Client registration 1 documentation /Anti Money Laundering compliance A All relevant Client Registration C / N.C / N.A Y / N Documents executed with clients in compliance with SEBI circulars and supporting collected from the clients are available and are easily 1 retrievable.

UCC is allotted to all the clients registered during the audit B C / N.C / N.A Y / N period & the same is timely uploaded to the Exchange. No clauses are included in any of the documents executed with the clients- a) which dilutes responsibility of member or b) which is in conflict with any of C the clauses in mandatory C / N.C / N.A Y / N documents, Rules, Bye-laws, Regulations, Notices, Guidelines & Circulars issued by SEBI & Exchanges or c) Which is not in the interest of the Investor? All the mandatory clauses/documents and Annexures such as KYC, details relating to trading account , rights and Obligation, Dos and D Don’ts , RDD and Tariff sheet as C / N.C / N.A Y / N stipulated by SEBI/Exchanges have been included in the mandatory section of the Account opening kit executed with the clients. E In-person verification is done by C / N.C / N.A Y / N Employee, Sub broker or Authorised person only and the date of verification, name, designation and signature of the official who has done in-person 2 verification and the Rubber Stamp is incorporated in the client registration form

In case, in-person verification of non-resident clients is not done, attestation of KYC documents is done by Notary Public, Court, Magistrate, Judge, Local Banker, Indian Embassy/ Consulate General in the country where the client resides. Any changes in address, bank account or demat account is F carried out on receipt of written C / N.C / N.A Y / N request along with documentary proof from the respective client Trading member has taken documentary evidence in G support of financial information C / N.C / N.A Y / N provided by the client for equity derivatives segment. Client details including financial details are reviewed periodically H and updated for clients in C / N.C / N.A Y / N compliance with Exchange circulars. Trading code and the unique client code allotted to a client and the e-mail id furnished by the client for the purpose of I receiving ECN and other details, C / N.C / N.A Y / N are communicated by the trading member through the client account opening form or otherwise in writing to the client.

3 Member has identified the beneficial owners of the client ( non-individuals) and has taken reasonable measures to verify J C / N.C / N.A Y / N the identity of such person as per SEBI Circular CIR/MIRSD/2/2013 dated January 24, 2013 Member has a process to identify the authority of the K C / N.C / N.A Y / N person who is placing orders on behalf of the client. Risk profiling of the clients has been done as per the written L down policy of the trading C / N.C / N.A Y / N member as per the PMLA master circular. Member has adopted sufficient due diligence process for clients M C / N.C / N.A Y / N according to their risk profile as per the PMLA master circular. Member is having a clearly defined policy for acceptance of clients and has ensured that an N account is not opened where the C / N.C / N.A Y / N member is unable to apply appropriate client due diligence measures/KYC Policies. Member has identified clients of O special category (CSC) as per C / N.C / N.A Y / N the PMLA master circular. The Client has opted and signed against stock exchange as well P as market segment where he C / N.C / N.A Y / N intends to trade/traded during the year.

4 Copies of complete set of client registration documents including POA executed by the client was Q C / N.C / N.A Y / N delivered to the client free of charge and within 7 days of upload of UCC. Authorizations from the client sought in non-mandatory R C / N.C / N.A Y / N document are separate & do have client’s specific consent. Trading members had displayed 1st October the set of standard 2016 to 31st S C / N.C / N.A Y / N documents/policies on their own March, 2017 website for information. The member has uploaded the E mail ID and the Mobile number of the client in the UCI database T C / N.C / N.A Y / N as per the details given by the client in the client registration documents. Member having websites have prominently displayed a message on their websites Member’s U C / N.C / N.A Y / N informing their clients to update website their E mail IDs & Mobile numbers with the member. Member has complied with the requirement of uploading the KYC information with the SEBI registered KRAs for all the clients on a continuous basis within the prescribed time limit V C / N.C / N.A Y / N as per SEBI circular MIRSD/Cir- 26/2011 dated December 23, 2011 and MIRSD/Cir-5/2012 dated April 13, 2012 and complied with the provisions of the Circular. 5 Member has downloaded KYC information from KRA system for W C / N.C / N.A Y / N new clients who are already registered with KRA Member has uploaded the KYC data with CKYCR, in respect of X all individual accounts opened C / N.C / N.A Y / N on or after August 1, 2016 by October 31, 2016. Member has uploaded the KYC data of individual clients Y registered prior to August 01, C / N.C / N.A Y / N 2016 with CKYC by December 31, 2016 Trading Member has prominently displayed on account opening kits, Website Advertisement, publication, notice board and display board, portal website (if any) the 1st October following details- 2016 to 31st Z C / N.C / N.A Y / N i) name of the member as March, 2017 registered with SEBI, ii) its own logo, if any, iii) its registration number, iv) its complete address with telephone numbers.

6 Member has made available the documents relating to rights & obligations, uniform risk disclosure document, do’s & don’t to the clients (registered A after August 01, 2016) either in C / N.C / N.A Y / N A electronic or physical mode as per the preference of the client.

Member has maintained appropriate logs in case the documents relating to rights & obligations, uniform risk disclosure document, do’s & A don’t are sent electronically to C / N.C / N.A Y / N B the clients, registered after August 01, 2016.

Members have displayed the documents relating to rights & obligations, uniform risk disclosure document, do’s & don’t in vernacular languages on 1st October A their own website. C / N.C / N.A 2016 to 31st Y / N C March, 2017

7 Member has undertaken appropriate due diligence w.r.t fit & proper requirement of clients dealing with listed Stock Exchanges and sent A text of Regulation 19 & 20 of C / N.C / N.A Y / N D SECC Regulations, 2012 to such clients along with the contract notes

Order management and risk 2. management systems Trading member has well documented risk management 1st October A policy including policy on Margin C / N.C / N.A 2016 to 31st Y / N collection from clients/Trading March, 2017 members. Member has a sound system for collecting and reporting client margin collection to the Exchange as per the B Exchange/Clearing Corporation C / N.C / N.A Y / N requirement. In case of any irregularity observed, mention the instances where false reporting is observed Member has not funded its clients in contravention to Exchange/SEBI requirement. C (Exchange notice no. 20150515- C / N.C / N.A Y / N 1 dated May 15, 2015 and 20151029-34 dated October 29, 2015) Member has correctly reported 1st October D details of client funding, if any, to C / N.C / N.A 2016 to 31st Y / N the exchange March, 2017

8 Trading member has not 1st October undertaken or was not party to 2016 to 31st or has not facilitated any fund March, 2017 E C / N.C / N.A Y / N based activity through financier including any associate, related or third party entities. Checks are in place to ensure 1st October that no unauthorized orders are 2016 to 31st F C / N.C / N.A Y / N executed from any of the March, 2017 terminals. In case of dormant accounts, if 1st October the account is reactivated then 2016 to 31st G there are checks in place to C / N.C / N.A March, 2017 Y / N ensure that account is operated by the relevant client only. Initial and other margins are collected from respective clients in the prescribed form of funds, H fixed deposit receipts, bank C / N.C / N.A Y / N guarantees and approved/liquid securities with appropriate haircut. Proper systems are in place to 1st October ensure timely collection for pay- 2016 to 31st I C / N.C / N.A Y / N in from the respective client as March, 2017 per settlement schedule. Proper monitoring mechanism is in place to review long outstanding debit balances in clients’ account and recovery of J C / N.C / N.A Y / N the same. Give age wise analysis of debts outstanding for more than 30 days and the recovery pattern for the same

9 Trading member has implemented proper internal code of conduct and adequate internal controls to ensure that proper checks and balances are in place with respect to SEBI Circular Cir/ ISD/1/2011, dated 1st October 2016 to 31st K March 23, 2011 and C / N.C / N.A Y / N Cir/ISD/2/2011 dated March 24, March, 2017 2011 on the subject ‘Unauthenticated news circulated by SEBI registered market intermediaries through various modes of communication.

Trading member has not 1st October outsourced their core business 2016 to 31st activities and compliance March, 2017 L functions and adhered to the C / N.C / N.A Y / N provisions of SEBI circular CIR/MIRSD/24/2011 dated 15th Dec 2011.

The member has not recovered 1st October from the clients, excess amount 2016 to 31st towards short margin penalty March, 2017 M C / N.C / N.A Y / N levied by the Exchange/ Clearing Corporation in the derivative segment. In case the member has passed 1st October on the short margin penalty to 2016 to 31st N the clients, the member has C / N.C / N.A March, 2017 Y / N provided the relevant supporting documents to the clients.

10 Member has drafted and 1st October implemented Surveillance policy 2016 to 31st O as per the Exchange notice no. C / N.C / N.A March, 2017 Y / N 20130307-21 dated March 07, 2013. Member has implemented 1st October appropriate checks for value and 2016 to 31st / or quantity based on the March, 2017 respective risk profile of their P clients as per the provisions of C / N.C / N.A Y / N SEBI Circular CIR/MRD/DP/34/2012 dated December 13, 2012.

Member has put in place 1st October systems to ensure that 2016 to 31st cumulative value of all March, 2017 unexecuted orders placed from Q their terminals are below a C / N.C / N.A Y / N threshold limit as per the provisions of SEBI Circular CIR/MRD/DP/34/2012 dated December 13, 2012. In case the Member or its group 1st October entities holds more than 1% of 2016 to 31st share capital of a listed March, 2017 company, the same has been R C / N.C / N.A Y / N disclosed to the Exchange as per Exchange notice no. 20131129-20 dated November 29, 2013. S Member has taken adequate C / N.C / N.A Y / N documentary evidences as specified in SEBI circular CIR/MRD/DP/20/2014 dated June 20, 2014 in case of participants taking positions in CD segment in excess of the 11 applicable position limits based on underlying exposure specified in the said circular. Contract notes, Client margin 3 details and Statement of accounts Contract notes are sent in the A prescribed format and within C / N.C / N.A Y / N specified time limit. Trading member has issued contract notes only for trades B done under the rules, byelaws & C / N.C / N.A Y / N regulations of the Exchange and not otherwise. All prescribed details including running serial number, name 1st October and signature of authorized 2016 to 31st C C / N.C / N.A Y / N signatory, dealing office details March, 2017 and brokerage are contained in contract note. Daily Margin statement is issued D to the respective clients with the C / N.C / N.A Y / N details as specified. Proof of delivery / dispatch/ log for dispatch of Contract Notes/ E C / N.C / N.A Y / N Statement of Accounts/ daily margin is maintained. Member has complied with 1st October regulatory requirements related 2016 to 31st F to Electronic contract notes C / N.C / N.A March, 2017 Y / N (ECN) if contract notes are sent electronically. Trail of bounced mails is 1st October maintained and physical delivery 2016 to 31st G C / N.C / N.A Y / N is ensured in case of bounce March, 2017 mails for ECNs

12 Complete statement of accounts for funds and securities are H issued on a quarterly basis to C / N.C / N.A Y / N clients (wherever applicable), with error reporting clause. Details regarding appointment of 1st October Compliance Officer and changes 2016 to 31st I there in, if any, have been C / N.C / N.A March, 2017 Y / N informed to the exchange. Trading Member has prominently displayed on contract notes, statement of funds and securities, correspondences with the clients the following details- 1st October i) name of the member as 2016 to 31st J registered with SEBI, C / N.C / N.A Y / N March, 2017 ii) its own logo, if any, iii) its registration number, iv) its complete address with telephone numbers, v) the name of the compliance officer, his telephone number and e-mail address. Trading member has not K created/provided e-mail ids for C / N.C / N.A Y / N clients. 1st October Member has collected physical 2016 to 31st letters from the clients who have March, 2017 L C / N.C / N.A Y / N requested for change in e-mail id.

M In case facsimile signatures are C / N.C / N.A 1st October Y / N used on physical contract notes, 2016 to 31st Member has maintained well- March, 2017 documented & approved policy

13 regarding its use.

Dealing with clients’ funds 4 and securities Client’s funds and securities are used only for the purpose of the A respective client’s transactions. C / N.C / N.A Y / N If not instances to be provided in remarks column. Funds raised by pledging client securities were utilised for respective client only. List of B instances to be provided in C / N.C / N.A Y / N remarks column in case of non- utilisation of proceeds for respective client. Constituent beneficiary account 1st October or client bank accounts are used 2016 to 31st for authorized purposes only. In March, 2017 C C / N.C / N.A Y / N case of any irregularity observed, mention the instances in detail separately. No cash dealings with clients 1st October D are done in violation of the C / N.C / N.A 2016 to 31st Y / N prescribed norms. March, 2017 E In case where aggregate value C / N.C / N.A 1st October Y / N of banker’s cheque / demand 2016 to 31st draft / pay order is of Rs 50,000 March, 2017 or more per client per day, then the same are accompanied with name of bank account holder and number of bank account debited, duly certified by issuing bank as per the provisions of SEBI Circular

14 CIR/MIRSD/03/2011, dated June 9, 2011.

Member maintains audit trail of 1st October the funds received and systems 2016 to 31st March, 2017 F are in place to ensure that the C / N.C / N.A Y / N funds are received from their respective clients only.

Receipts/payment of funds and 1st October receipt/delivery of securities are 2016 to 31st G C / N.C / N.A Y / N received/transferred from/to March, 2017 respective clients only Payments to clients are not 1st October H made from proprietary bank C / N.C / N.A 2016 to 31st Y / N accounts. March, 2017 Client’s funds / securities are transferred to respective clients I within one working day of payout C / N.C / N.A Y / N from Exchange in case of no running account authorization. Constituent securities received as margin is not utilized for execution of proprietary trades J C / N.C / N.A Y / N or trades in the name of Directors/ Key Promoters/ shareholders The Delivery of securities to K constituent is not made from C / N.C / N.A Y / N Proprietary account. 15 Excess Brokerage was not L charged on trades executed on C / N.C / N.A Y / N the Exchange. Member’s Bank books and bank 1st October statements for each bank 2016 to 31st account are reconciled and March, 2017 M reconciliation statement for the C / N.C / N.A Y / N same is prepared periodically and there are no long pending outstanding reconcilable items. Register of Securities and 1st October Holding statement from 2016 to 31st depositories for each DP March, 2017 N C / N.C / N.A Y / N account are reconciled and reconciliation statement for the same is prepared periodically. Dividend and other corporate 1st October benefits received on behalf of 2016 to 31st O clients is paid/credited/passed C / N.C / N.A Y / N March, 2017 on to the respective clients account without any delay. Trading member has taken consent from the client P regarding monthly /quarterly C / N.C / N.A Y / N settlement in the running account authorisation. Trading member has done actual settlement of funds & Q securities as consented by the C / N.C / N.A Y / N client (monthly/quarterly) in the running account authorisation. R Trading member has sent C / N.C / N.A Y / N statement of accounts for funds/securities containing an extract from the client ledger for funds & securities displaying all receipts/deliveries of funds/securities while settling 16 the account explaining retention of funds/securities.

Trading member has not done any inter-client adjustment for S C / N.C / N.A Y / N the purpose of client level quarterly/monthly settlement. The following statutory levies/ fee/ charges are not collected from clients in excess of actuals levied on the members. Such 1st October as- 2016 to 31st T i) Securities Transaction Tax, C / N.C / N.A Y / N March, 2017 ii) SEBI turnover fees, iii) Exchange Transaction Charges If Excess is collected, please give complete details. The running account authorization taken by trading member from client(s) is dated and contains a clause which U explicitly allows a client to C / N.C / N.A Y / N revoke the said running account authorization at any time and would continue until such revocation. Member has put in place 1st October systems for dealing with conflict 2016 to 31st V of interest as per SEBI circular C / N.C / N.A March, 2017 Y / N CIR/MIRSD/5/2013 dated August 27, 2013.

17 Member has not transferred 1st October funds from client bank account 2016 to 31st W C / N.C / N.A Y / N to any third party or any other March, 2017 non-client account Member has not transferred 1st October funds to its Group companies/ 2016 to 31st X C / N.C / N.A Y / N Associates from client bank March, 2017 accounts. Payment for own trades (PRO) 1st October are not made from client bank 2016 to 31st Y C / N.C / N.A Y / N accounts. March, 2017

Member is not operating any 1st October assured returns schemes and 2016 to 31st Z mobilizing deposits from C / N.C / N.A March, 2017 Y / N investors. If yes, please provide details. Member has not taken securities 1st October from any client for purposes 2016 to 31st AA C / N.C / N.A Y / N other than margin or meeting the March, 2017 client’s obligation. Member has ensured that the funds & securities available in the client bank/s and client 1st October beneficiary account/s together 2016 to 31st AB with balances available with C / N.C / N.A Y / N March, 2017 clearing Member and funds with clearing corporation are not less than the funds and securities payable to the client at all times. Banking and Demat account 5 operations A Member maintains separate C / N.C / N.A 1st October Y / N bank account for client funds 2016 to 31st and own funds. March, 2017 Also separate beneficiary account for clients securities and own securities are maintained by 18 the member.

Clients funds and securities are 1st October B segregated from own funds and C / N.C / N.A 2016 to 31st Y / N securities. March, 2017 Member has reported all their 1st October Bank & DP account details to 2016 to 31st the Exchange as required by March, SEBI circular dated 2017 September 26, 2016 & BSE C C / N.C / N.A Y / N notice no. 20161027-1 dated October 27, 2016 and Notice No 20161017-17 dated October 17, 2016 and 20161122-24 dated November 22, 2016. Terminal operations and 6 systems Trading terminals are located in the head office, branch office of A C / N.C / N.A Y / N the Member or the office of sub broker only. Trading terminals are operated by approved persons/approved B C / N.C / N.A Y / N users with valid NCFM/BCSM/NISM certification. Correct Terminal details are C reported to the Exchange. C / N.C / N.A Y / N D Member has ensured that C / N.C / N.A Y / N associated persons functioning as compliance officer employed has obtained NISM series III A certification : - Within one year from the date of his/her employment after 19 March 11, 2013.

- By March 10, 2015 for compliance officers employed as on the date of SEBI notification (i.e. March 11, 2013)

Member has ensured that all associated person as defined in SEBI Notification LAD- NRO/GN/2010-11/21/29390 dated December 10, 2010 have E C / N.C / N.A Y / N valid NISM series VII certification – (Securities Operations and Risk Management Certification Examination). Management of branches / 7 sub brokers and internal control In case of closure of branch (if A any), advance notice of the C / N.C / N.A Y / N same is sent to clients. There is a monitoring 1st October mechanism to identify sudden 2016 to 31st B increase / decrease in client C / N.C / N.A March, 2017 Y / N level turnover from any specific branch. Periodic inspection of branch / 1st October sub broker/Authorised person is 2016 to 31st C C / N.C / N.A Y / N conducted and reports are March, 2017 maintained. Member has adequate follow up 1st October mechanism in case of adverse 2016 to 31st D C / N.C / N.A Y / N observations during branch/sub March, 2017 broker/AP inspections.

20 Trading member has not dealt 1st October with unregistered intermediaries 2016 to 31st E C / N.C / N.A Y / N for transactions on the March, 2017 Exchange. 1st October The member has not shared 2016 to 31st commission/ brokerage with March, 2017 entities with whom trading members are forbidden to do F C / N.C / N.A Y / N business / another trading member / employee in the employment of another trading member.

8 Investor grievance handling Member is maintaining a register 1st October A of investor complaints. C / N.C / N.A 2016 to 31st Y / N March, 2017 Member has a sound system of 1st October B resolution of investor complaints C / N.C / N.A 2016 to 31st Y / N in a time bound manner. March, 2017 A designated email id for 1st October investor grievance is created 2016 to 31st C C / N.C / N.A Y / N and informed to the investors March, 2017 and Exchange. Complaints received on the 1st October D designated email ID are being C / N.C / N.A 2016 to 31st Y / N looked into to address the same. March, 2017 The member has informed the 1st October Stock Exchange/ Investor about 2016 to 31st E the actions taken for the C / N.C / N.A March, 2017 Y / N redressal of grievances of the investor. F The member has taken C / N.C / N.A 1st October Y / N adequate steps to resolve the 2016 to 31st complaints within 30 days from March, 2017 the date of receipt of the

21 complaint.

Information about the grievance redressal mechanism as specified by SEBI circular 1st October G CIR/MIRSD/3/2014 dated C / N.C / N.A 2016 to 31st Y / N August 28, 2014 is displayed at March, 2017 all the offices of the Member for information of the investors Maintenance of Books of 9 Accounts Prescribed books of accounts, 1st October registers, records and client 2016 to 31st master are maintained with the March, 2017 A C / N.C / N.A Y / N required details and for the stipulated period as per regulatory requirements. Register of securities is 1st October B maintained client wise-scrip C / N.C / N.A 2016 to 31st Y / N wise. March, 2017 All Entries for receipt and 1st October payment/transfer of securities 2016 to 31st C C / N.C / N.A Y / N are duly recorded in the register March, 2017 of securities. Exchange wise separate books 1st October of accounts are maintained. C / N.C / N.A 2016 to 31st Y / N D March, 2017 Prior approval has been 1st October obtained by member for change 2016 to 31st E C / N.C / N.A Y / N in shareholding/ March, 2017 directors/constitution. Prior approval has been 1st October obtained in case the member 2016 to 31st F C / N.C / N.A Y / N has traded with another member March, 2017 of the Exchange.

22 Member has intimated the 1st October Exchange in case they have 2016 to 31st G C / N.C / N.A Y / N traded with member of another March, 2017 stock exchange. All advertisements are issued 1st October after prior permission of the 2016 to 31st Exchange. Further, the March, 2017 advertisements specifically H C / N.C / N.A Y / N comply with the requirements of Exchange notice no. 20151217- 17 dated December 17, 2015.

Stock Broker/ Group companies/ 1st October third party/associate of stock 2016 to 31st broker has not offered any March, 2017 schemes/leagues/competitions which involves distribution of price monies and has not issued advertisement for the same. I C / N.C / N.A Y / N Further, the stock broker has not carry out advertisements in which celebrities form part of the advertisement. Refer to Exchange Notice No. 20160812- 22 dated August 12, 2016.

Notice board & SEBI registration 1st October certificate of the Trading 2016 to 31st J C / N.C / N.A Y / N Member was displayed at the March, 2017 location of audit. Trading member has not dealt 1st October with 2016 to 31st K suspended/defaulter/expelled C / N.C / N.A March, 2017 Y / N members and entities prohibited from accessing market. 10 Systems & Procedures pertaining to Prevention of Money Laundering Act, PMLA, 23 2002

Details of appointment of 1st October Principal Officer & Designated 2016 to 31st A Director and any changes C / N.C / N.A March, 2017 Y / N therein are intimated to FIU- India. The member has adopted and 1st October st B implemented written guidelines C / N.C / N.A 2016 to 31 Y / N prescribed under PMLA, 2002. March, 2017 The Member has adequate 1st October system in place that allows 2016 to 31st continuous monitoring of March, 2017 C C / N.C / N.A Y / N transactions and generates alerts based on set parameters for suspicious transactions. Adequate systems & procedures 1st October are in place for scrutinizing the 2016 to 31st D alerts to arrive at suspicious C / N.C / N.A March, 2017 Y / N transactions and to report the same to FIU Member has adequate systems 1st October & procedures in place to ensure 2016 to 31st E C / N.C / N.A Y / N screening of employees while March, 2017 hiring. As per the provision of 1st October Prevention of Money laundering 2016 to 31st Act, 2002 record of transactions, March, 2017 F its nature and its value are C / N.C / N.A Y / N maintained and reserved by the member as prescribed under Rule 3,7 & 8 of PMLA. Member has ongoing training 1st October program for employees so that 2016 to 31st G C / N.C / N.A Y / N staff are adequately trained in March, 2017 AML & CFT procedure. 24 Member has taken adequate 1st October measures to carry out & 2016 to 31st document risk assessment to March, 2017 H C / N.C / N.A Y / N identify, assess and mitigate its money laundering and terrorist financing risk. Member has complied with the requirements of the various I FATF public statements and C / N.C / N.A Y / N updated UNSC lists which are circulated by the exchanges Member has done the online 1st October registration with FIU-India and 2016 to 31st j C / N.C / N.A Y / N has got the FIU Registration no. March, 2017 (FIU-REID) 11 Transfer of trades Trades were executed in respective clients account and are not transferred from one client code to another client code or from client code to pro A or vice-versa in the back office C / N.C / N.A Y / N of the member. In case of such transfers, if any specific pattern is observed instances to be provided in remarks column. All client code modifications 1st October were done to rectify a genuine 2016 to 31st error in entry of client code and March, 2017 B no patterns were observed. C / N.C / N.A Y / N If any pattern is observed, please give instances in remarks column.

25 Systems are put in place to 1st October monitor/ prevent the use of client 2016 to 31st code modification facility for March, 2017 C purposes other than correcting C / N.C / N.A Y / N mistakes arising out of client code order entry.

The trades modified by the 1st October member to the “ERROR” code 2016 to 31st have been settled in ERROR March, 2017 D account and not shifted to some C / N.C / N.A Y / N other client code. If not complied, please provide the details. Trading Member has a well- 1st October documented error policy to 2016 to 31st E handle client code modifications, C / N.C / N.A March, 2017 Y / N approved by their board/management. 12 Margin Trading Member has obtained specific 1st October approval from the exchange, in 2016 to 31st A C / N.C / N.A Y / N case he is providing margin March, 2017 trading facility to his clients. Member has complied with 1st October B regulatory requirements related C / N.C / N.A 2016 to 31st Y / N to margin trading. March, 2017 13 Proprietary Trading If member is doing pro trading, A then member has disclosed this C / N.C / N.A Y / N information to his clients. If member is doing pro trading 1st October from multiple locations, the 2016 to 31st B member has obtained prior C / N.C / N.A March, 2017 Y / N approval from the Exchange in this regard. 14 Internet Trading 26 1st October Member has obtained specific 2016 to 31st A approval from the exchange, in C / N.C / N.A March, 2017 Y / N case he is providing internet trading facility to his clients. 1st October Member has complied with 2016 to 31st B regulatory requirements related C / N.C / N.A March, 2017 Y / N to internet trading.

Execution of Power of 15 Attorney (POA) The POA executed with the client (if any) is in the favor of A C / N.C / N.A Y / N the member and it is not in favor of any other person. The Power of Attorney executed in favour of trading member is only limited to the purposes as B allowed and adheres to the C / N.C / N.A Y / N Provisions of SEBI Circular CIR/MRD/DMS/13/2010 and CIR/MRD/DMS/28/2010. The PoA executed does not C prohibit operation of trading C / N.C / N.A Y / N account by client(s). The Member has adopted sufficient internal controls to D C / N.C / N.A Y / N ensure that POA is not misutilised. Flagging of POA has been undertaken in the UCC with E C / N.C / N.A Y / N respect of all clients registered after February 13th, 2015 Operations of Professional Clearing member/ Members 16 clearing trades of other trading members 27 All the mandatory clauses have 1st October been included in CM - TM 2016 to 31st A C / N.C / N.A Y / N agreement (wherever March, 2017 applicable). The Clearing member custodial 1st October participant agreements are 2016 to 31st B C / N.C / N.A Y / N executed in prescribed formats March, 2017 (wherever applicable). Statement of accounts has been 1st October sent to trading member/custodial 2016 to 31st C C / N.C / N.A Y / N participants. March, 2017

The clearing member had collected appropriate and D adequate margins in prescribed C / N.C / N.A Y / N forms from respective trading members. Margin collection reported to Exchange is in accordance with E C / N.C / N.A Y / N margins actually collected from trading member. Exposure allowed to trading members was based on F C / N.C / N.A Y / N requisite margins available with the clearing member. Securities Lending & 17 Borrowing Scheme Member has obtained specific 1st October A approval from the exchange for C / N.C / N.A 2016 to 31st Y / N offering SLBS. March, 2017 Member has complied with 1st October B regulatory requirements related C / N.C / N.A 2016 to 31st Y / N to SLBS. March, 2017 Compliance status of last inspection carried out by 18 SEBI/ Exchanges/ Internal Auditor

28 Member has complied with the qualifications/violations made in A last SEBI inspection report. If C / N.C / N.A Y / N not complied (NC) then give status of compliance. Member has complied with the qualifications/violations made in B last Exchange inspection report. C / N.C / N.A Y / N If not complied (NC) then give status of compliance. Member has complied with the qualifications/violations made in C latest half yearly Internal Audit C / N.C / N.A Y / N report. If not complied (NC) then give status of compliance.

Comments of the auditor on 19 any other area

The last half years Internal Audit Report was placed/ 20 approved by the Board/ C / N.C / N.A Y / N Proprietor/ partners.

We certify that we have conducted the audit by adhering to the samples size as prescribed by the Exchange. We do not validate the management comments provided by the member in the above report.

We have taken management explanations wherever the information available on the underlying documents were not sufficient to arrive at a decision on the level of compliance.

In addition to the above we would like to draw attention of the concerned persons to following issues which in our considered view is a high risk item:

S.No. Observation Remarks

29 For ______(Name of the Audit Firm)

Signature of the Auditor : ______

Name of the Auditor : ______

Membership No. : ______

Stamp of the Audit Firm : ______

30