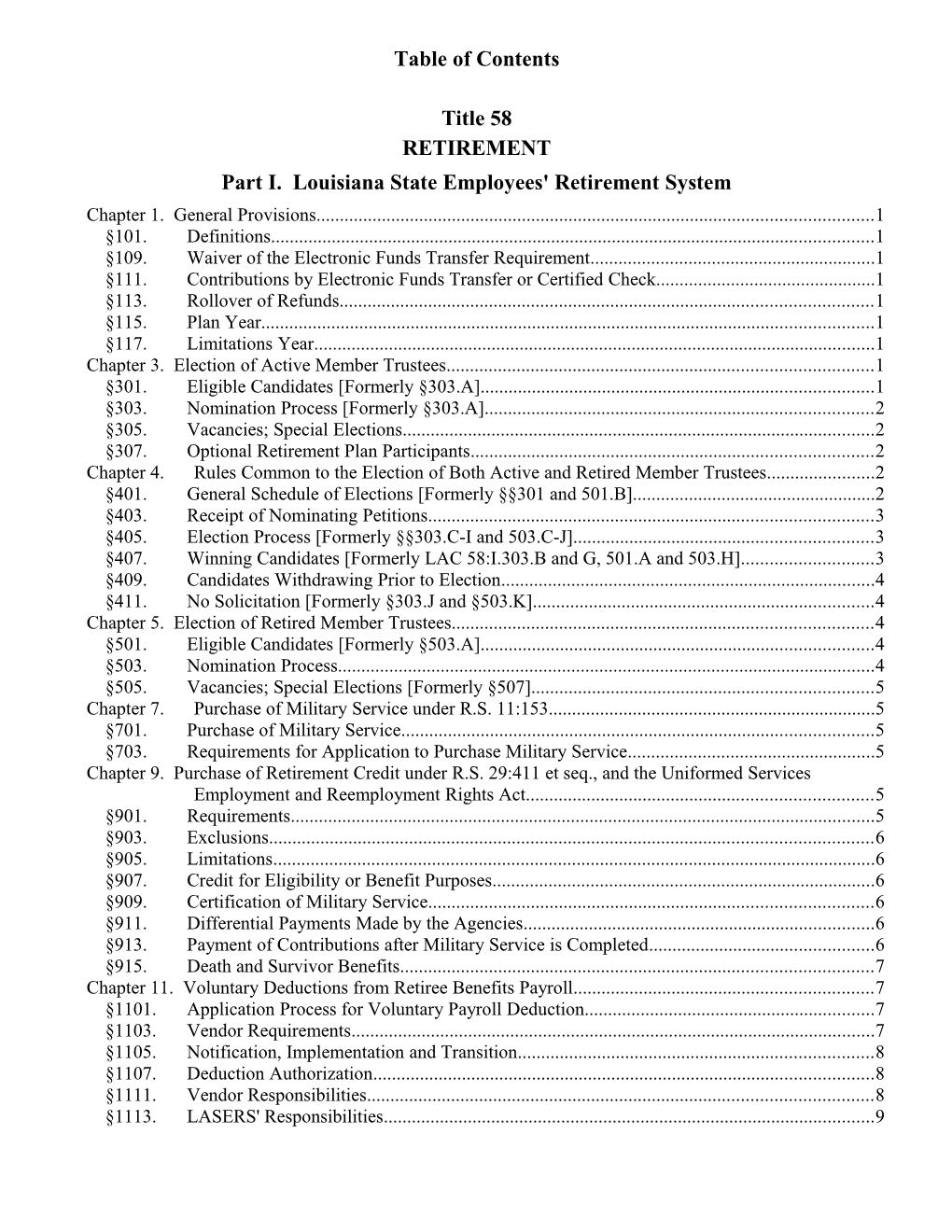

Table of Contents

Title 58 RETIREMENT Part I. Louisiana State Employees' Retirement System Chapter 1. General Provisions...... 1 §101. Definitions...... 1 §109. Waiver of the Electronic Funds Transfer Requirement...... 1 §111. Contributions by Electronic Funds Transfer or Certified Check...... 1 §113. Rollover of Refunds...... 1 §115. Plan Year...... 1 §117. Limitations Year...... 1 Chapter 3. Election of Active Member Trustees...... 1 §301. Eligible Candidates [Formerly §303.A]...... 1 §303. Nomination Process [Formerly §303.A]...... 2 §305. Vacancies; Special Elections...... 2 §307. Optional Retirement Plan Participants...... 2 Chapter 4. Rules Common to the Election of Both Active and Retired Member Trustees...... 2 §401. General Schedule of Elections [Formerly §§301 and 501.B]...... 2 §403. Receipt of Nominating Petitions...... 3 §405. Election Process [Formerly §§303.C-I and 503.C-J]...... 3 §407. Winning Candidates [Formerly LAC 58:I.303.B and G, 501.A and 503.H]...... 3 §409. Candidates Withdrawing Prior to Election...... 4 §411. No Solicitation [Formerly §303.J and §503.K]...... 4 Chapter 5. Election of Retired Member Trustees...... 4 §501. Eligible Candidates [Formerly §503.A]...... 4 §503. Nomination Process...... 4 §505. Vacancies; Special Elections [Formerly §507]...... 5 Chapter 7. Purchase of Military Service under R.S. 11:153...... 5 §701. Purchase of Military Service...... 5 §703. Requirements for Application to Purchase Military Service...... 5 Chapter 9. Purchase of Retirement Credit under R.S. 29:411 et seq., and the Uniformed Services Employment and Reemployment Rights Act...... 5 §901. Requirements...... 5 §903. Exclusions...... 6 §905. Limitations...... 6 §907. Credit for Eligibility or Benefit Purposes...... 6 §909. Certification of Military Service...... 6 §911. Differential Payments Made by the Agencies...... 6 §913. Payment of Contributions after Military Service is Completed...... 6 §915. Death and Survivor Benefits...... 7 Chapter 11. Voluntary Deductions from Retiree Benefits Payroll...... 7 §1101. Application Process for Voluntary Payroll Deduction...... 7 §1103. Vendor Requirements...... 7 §1105. Notification, Implementation and Transition...... 8 §1107. Deduction Authorization...... 8 §1111. Vendor Responsibilities...... 8 §1113. LASERS' Responsibilities...... 9 Table of Contents

§1115. Reporting...... 9 §1119. Termination of Payroll Deduction...... 9 §1121. General Provisions...... 9 Chapter 13. Emergency Refunds...... 9 §1301. Conditions Giving Rise to an Emergency Refund...... 9 §1303. Procedure for an Emergency Refund...... 9 §1305. Responsibility for Overpayment of a Refund...... 9 Chapter 15. Purchases and Transfers of Service...... 10 §1501. Purchases and Transfers of Service; Calculations; Costs...... 10 §1503. Transfers of Service; Other Requirements...... 10 Chapter 17. Purchases of Service by Reinstated Employees...... 10 §1701. Purchases of Service by Reinstated Employees...... 10 §1703. Effect of Reinstatement...... 10 §1705. Service Credit for Dual Employment...... 11 §1707. Repayment of Refund of Contributions...... 11 §1709. Partial Repayment of Refund of Contributions...... 11 Chapter 19. Survivors' Benefits...... 11 §1901. Application for Benefits...... 11 §1903. Qualified Survivors...... 11 §1905. Proof of Entitlement to a Survivors' Benefit...... 12 §1907. Qualification for Benefit to Handicapped Children...... 12 §1909. Children of Previous Marriage...... 12 Chapter 21. Credit for Part-Time Service and Service in Multiple Positions...... 12 §2101. Credit for Part-Time Service and Service in Multiple Positions...... 12 Chapter 23. Renunciation of Benefit...... 12 §2301. Terms and Conditions of Renunciation of Benefit...... 12 Chapter 25. Procedures for Processing Disability Applications...... 13 §2501. Application for Disability Retirement...... 13 §2503. Disability Board Physician's Recommendation...... 13 §2505. Final Determination...... 14 §2507. Contesting Board Physician's Determination...... 14 §2509. Judicial Appeal...... 14 §2511. Certification of Continuing Eligibility...... 15 §2515. Report to the Board of Trustees...... 15 §2517. Appointment of Physicians to the State Medical Disability Board...... 15 §2519. Termination of Benefits...... 15 Chapter 27. DROP Program...... 15 Subchapter A. Participation...... 15 §2701. Eligibility...... 15 Subchapter B. "Old" DROP...... 16 §2703. Participation in Three-Year Program...... 16 §2705. Effects of Participation...... 16 Subchapter C. Withdrawal...... 16 §2711. Methods of Withdrawal...... 16 §2713. Time for Disbursement...... 16 §2715. Interest...... 17 §2717. Changes in Withdrawal...... 17 Subchapter D. "New" DROP...... 17 §2719. Eligibility...... 17 §2721. Participation in New DROP...... 17 Table of Contents

§2723. Initial Benefit Option...... 18 Chapter 29. Spousal Consent...... 18 §2901. Spousal Consent to Retirement Option...... 18 §2903. Instances Where Spousal Consent Is Not Required...... 18 Chapter 31. Excess Benefit Arrangement...... 19 §3101. Participation...... 19 §3103. Benefit...... 19 §3105. Contributions...... 19 §3107. Excess Plan Fund...... 19 §3109. Funding Assets...... 19 §3111. Non-Assignability of Benefits...... 19 §3113. Plan Administration...... 19 §3115. Retirement Benefit...... 20 §3117. DROP Benefits...... 20 Chapter 35. Optional Retirement Plan...... 20 §3501. Plan Year...... 20 §3503. Participation...... 20 §3507. Employee Contributions...... 21 §3509. Employer Contributions...... 21 §3511. ORP Provider...... 21 §3513. Investment Options...... 21 §3515. Benefit Obligations...... 21 §3517. Distribution...... 21 Chapter 37. Leave Conversion to Retirement Credit or Cash Payment...... 21 §3701. Conversion of Leave to Retirement Credit...... 21 §3703. Lump Sum Payment of Leave...... 21 §3705. Tax Liability...... 22 Chapter 41. Self-Directed Plan...... 22 §4101. SDP Provider...... 22 §4103. Persons Vesting for DROP Prior to January 1, 2004...... 22 §4105. Eligibility for Transfer of Funds into SDP...... 22 §4107. Rollovers Out of SDP to Other Providers...... 22 §4109. Right to Recover Overpayments...... 22 §4111. Time to Transfer Funds...... 22 §4113. Spousal Consent...... 22 §4115. Completion of Notification Form...... 22 §4117. Distributions...... 23 §4119. No In-Service Distribution...... 23 §4121. Civil Service Reinstatement...... 23 §4123. Beneficiary...... 23 §4125. Investment Options...... 23 §4127. Participant Investment Direction...... 23 §4129. Distributions from the Plan...... 24 §4131. Domestic Relations Orders...... 24 §4133. Disclaimer...... 24 §4135. No DROP Interest...... 24 Chapter 43. Actuarial Calculations...... 24 §4301. Charges for Actuarial Calculations...... 24 Chapter 45. Effects of Act 75 of the 2005 Regular Session...... 24 §4501. Members Affected...... 24 Table of Contents

§4503. Vesting Because of Prior State Employment...... 24 Part III. Teachers' Retirement System of Louisiana Chapter 1. General Provisions...... 27 §101. Mandatory Submission of Monthly Salaries and Contributions Reports, Contributions Correction Reports (Form 4B), and Prior Years Certification/Correction of Member Data...27 Chapter 2. Earnable Compensation Accounts...... 27 §201. Earnable Compensation Accounts...... 27 Chapter 3. Re-Employment of Retirees...... 28 §301. Retirees Returning to Work at Charter Schools...... 28 Chapter 4. Purchase of Service Credit...... 28 §401. Purchase of Service Credit for Involuntary Furlough or Leave without Pay (LWOP) Due to Gubernatorially Declared Disaster/Emergency...... 28 Chapter 5. Deferred Retirement Option Plan (DROP)...... 28 §501. Service Requirements...... 28 §503. Management of DROP Accounts...... 29 §505. Duration of DROP Participation...... 29 §507. Retirement Benefits...... 30 §509. Withdrawal of Funds from a DROP Account...... 30 §510. Distributions Provided for by Gulf Opportunity Zone Act of 2005...... 31 §511. Change of DROP Withdrawal Method...... 31 §513. Termination of DROP Participation...... 31 §515. Death of Beneficiary...... 32 §517. Affidavit of Plan Election...... 32 §519. Application for DROP...... 32 §521. Teaching Experience...... 32 Chapter 7. Renunciation of Benefits...... 32 §701. General...... 32 Chapter 9. Computation of Final Average Compensation...... 33 §901. Time Frames for Computation...... 33 Chapter 11. Voluntary Deductions from Retiree Benefits Payroll...... 33 §1101. General...... 33 §1103. Application Process...... 33 §1105. Requirements...... 33 §1107. Disclaimer...... 34 §1109. Transmittal of Withheld Amounts...... 34 §1111. Termination of Payroll Deduction...... 34 Chapter 13. Cost-of-Living...... 34 §1301. Cost-of-Living Adjustment―July 2, 1995...... 34 §1303. Cost-of-Living Adjustment―July 1, 1998...... 35 Chapter 15. Optional Retirement Plan (ORP)...... 35 §1501. Definitions...... 35 §1503. Plan Year...... 37 §1505. Establishment of Plan...... 37 §1507. Eligibility and Election to Participate...... 38 §1509. Employee Contributions...... 38 §1511. Employer Contributions...... 39 §1513. Distributions...... 39 §1515. Rollover Distribution...... 41 §1517. Benefit Limitation...... 42 Table of Contents

§1519. Annual Compensation Limitation...... 43 §1521. Fiduciary Responsibility...... 43 §1523. Plan Assets...... 43 §1525. Vesting...... 43 §1527. Governing Law...... 43 §1529. USERRA...... 44 §1531. ORP Providers...... 45 Chapter 17. Defined Benefit Plan Internal Revenue Code Provisions...... 45 §1701. Use of Plan Assets...... 45 §1703. Heroes Earnings Assistance and Relief Tax Act of 2008...... 45 §1705. Domestic Relations Orders...... 45 §1707. Limitations on Contributions and Benefits...... 45 §1709. Group Trust Participation...... 49 Part V. Firefighters' Pension and Relief Fund for the City of New Orleans and Vicinity Chapter 1. Qualified Domestic Relations Orders...... 51 §101. Determining Qualified Status of Domestic Relations Orders...... 51 §103. Definitions...... 51 §105. QDRO Language...... 52 §107. Notice...... 52 §109. Determination...... 52 §111. Payments Pending Determination...... 53 §113. Representative of Alternate Payee...... 53 Chapter 3. Procedural Rules and Regulations of the Board of Trustees...... 53 §301. Definitions...... 53 §303. Organization, Rules, and Procedures of the Board...... 53 §305. Application Procedure, Initial Determination, and Notice...... 54 §307. Hearing Procedures, Appeal, Oath, Testimony, Production of Records and Depositions...... 54 §309. Judicial Review...... 55 Chapter 5. Direct Rollovers...... 55 §501. Requirements...... 55 Chapter 7. Partial Buy Back and Partial Restoration of Forfeited Credits of Service...... 56 §701. Partial Buy Back and Partial Restoration of Forfeited Credits of Service...... 56 Chapter 9. Death Benefits...... 56 §901. Definitions...... 56 §903. Beneficiary Designations and Election of Retirement and Death Benefits...... 57 §905. Calculation of Death Benefits...... 57 §907. Preretirement Death Benefits...... 57 §909. General...... 58 Chapter 11. Calculation of Benefits...... 59 §1101. Definitions...... 59 §1103. General...... 59 §1105. Calculation of Benefit Amount...... 59 Chapter 13. Service Credit...... 60 §1301. Reciprocal Recognition of Credited Service―Reciprocal Benefit...... 60 §1303. Transfer of Service Credits...... 62 §1305. Sick and Annual Leave...... 64 Chapter 15. Deferred Retirement Option Plan...... 65 §1501. Definitions...... 65 Table of Contents

§1503. Eligibility...... 65 §1505. Participation in and Withdrawal from the DROP...... 66 §1507. Post-DROP Accruals and Retirement Benefits...... 68 §1509. Trustees' Procedures Applicable to Payments to DROP Accounts...... 69 §1511. General...... 71 Chapter 17. Election Rules...... 71 §1701. Nominations...... 71 §1703. Election Committee...... 71 §1705. Ballot Procedure...... 71 §1707. Installation of Elected Members...... 72 §1709. Election Inquiries...... 72 §1711. Special Elections...... 72 Chapter 19. Partial Lump-Sum Option Payment...... 72 §1901. General Rules for Participation...... 72 §1903. Distributions from Partial Lump-Sum Option Payment...... 73 Chapter 20. Tax Qualification Provisions...... 73 §2001. General Provisions...... 73 §2003. Actuarial Equivalence...... 73 §2005. Military Service...... 74 Part VII. School Employees' Retirement System Chapter 1. Administration of Act 416 of 1976...... 75 §101. Rules for the Administration of Act 416 of 1976...... 75 Chapter 3. Interest Rates...... 75 §301. Interest Rates Charged on Purchases of Service Credit...... 75 Chapter 4. Internal Revenue Code Provisions...... 75 §401. Limitation on Benefits...... 75 §403. Required Minimum Distributions...... 82 §405. Direct Rollovers...... 82 §407. Annual Compensation Limitation...... 83 Part IX. State Police Retirement System Chapter 1. Service Credit...... 85 §101. Military Service Credit...... 85 Chapter 2. Internal Revenue Code Provisions...... 85 §201. Limitation on Benefits...... 85 §202. Required Minimum Distributions...... 91 §203. Direct Rollovers...... 92 §204. Annual Compensation Limitation...... 92 §205. General...... 93 Chapter 3. Procedures for Election of Louisiana State Police Retirement System Trustees...... 93 §301. General Election Procedures...... 93 §303. Ballots, Count, Tabulation, Posing, Oath of Office...... 93 §305. Vacancy...... 94 Part XI. Parochial Employees' Retirement System Chapter 1. General Provisions...... 95 §103. Definitions...... 95 Chapter 3. Eligibility...... 95 §301. Persons Not Eligible for Membership; Leased Employees...... 95 Table of Contents

§303. Creditable Service; Uniformed Services Employment and Reemployment Rights Act...... 95 Chapter 5. Scope of Benefits...... 96 §501. Limitation on Payment of Benefits...... 96 §503. Early Payment of Benefits...... 96 §505. Compensation Limited...... 97 §507. Transfer of Benefits...... 97 §509. Computation of Retirement Benefits...... 98 Chapter 7. Terminations...... 99 §701. Procedures for Determination of the Unfunded Accrued Liability...... 99 Part XIII. Firefighters' Retirement System Chapter 1. General Provisions...... 101 §101. Survivor Benefits; Procedures to Use When Determining Whether Member's Death Occurred in the Line of Duty...... 101 Part XV. Sheriffs' Pension and Relief Fund Chapter 1. General Provisions...... 103 §101. Court Order or Judgment...... 103 §103. Eligible Rollover Distribution...... 103 Part XVII. Registrars of Voters Employees' Retirement System...... 105 Chapter 1. Procedures for Election of Registrars of Voters Employees’ Retirement System Trustees 105 §101. General Election Procedures...... 105 §103. Ballots, Count, Tabulation, Posting, Oath of Office...... 105 §105. Vacancy...... 105 Chapter 2. Internal Revenue Code Provisions...... 105 §201. Limitation on Benefits...... 105 §202. Required Minimum Distributions...... 112 §203. Direct Rollovers...... 112 §204. Annual Compensation Limitation...... 113 §205. General...... 113 Chapter 3. Final Average Compensation...... 114 §301. Calculation of Post-Drop Final Average Compensation...... 114 Part XVIII. Municipal Police Employees' Retirement System Chapter 1. Internal Revenue Code Provisions...... 115 §101. Limitation on Benefits...... 115 §102. Required Minimum Distributions...... 121 §103. Direct Rollovers...... 122 §104. Annual Compensation Limitation...... 122 §105. Vesting of Benefits at Plan Termination...... 123 Part XIX. Assessors' Retirement Fund Chapter 1. General Provisions...... 125 §101. Compensation...... 125 §103. Actuarial Equivalent...... 126 §105. Accumulated Contributions, Rollovers...... 127 §107. Definitions...... 128 Chapter 3. Creditable Service...... 128 §301. Death Benefits for Qualified Military Service...... 128 Table of Contents

Chapter 5. Limitation on Payment of Benefits...... 128 §501. Suspension of Benefits...... 128 §503. Required Beginning Date...... 128 §505. Benefit Limitations...... 128 Chapter 7. Accumulated Contributions...... 129 §701. Benefit Limitations...... 129 §703. Rollover of Returned Contributions...... 130 §705. Repayment of Withdrawn Accumulated Contributions...... 130 Part XXI. District Attorneys' Retirement System Chapter 1. General Provisions...... 131 §101. Compensation...... 131 §103. Actuarial Equivalent...... 132 §105. Accumulated Contributions, Rollovers...... 133 §107. Repayment of Withdrawn Accumulated Contributions...... 134 Chapter 3. Creditable Service...... 135 §301. Benefits for Qualified Military Service...... 135 Chapter 5. Limitation on Payment of Benefits...... 135 §501. Suspension of Benefits...... 135 §503. Definitions...... 135 §505. Benefit Limitations...... 136 Chapter 7. Required Minimum Distributions...... 137 §701. Required Beginning Date...... 137 Chapter 9. Funding of Retirement System...... 139 §901. Employer Contributions...... 139 Part XXIII. Survivor Benefit Board Chapter 1. Law Enforcement Officers and Firemen’s Survivor Benefit Board (Formerly LAC 37:I.Chapter 11)...... 141 §101. Survivors Benefits (Formerly LAC 37:I.1101.A-B)...... 141 §103. Definitions (Formerly LAC 37:I.1101.C)...... 141 §105. Board Membership and Domicile (Formerly LAC 37:I.1101.D)...... 141 §107. Claims Requests (Formerly LAC 37:I.1101.E)...... 142 §109. Procedures for Hearings (Formerly LAC 37:I.1101.F)...... 142 §111. Appeals (Formerly LAC 37:I.1101.G)...... 143 Title 58 RETIREMENT Part I. Louisiana State Employees' Retirement System

Chapter 1. General Provisions A. Under circumstances as determined by the executive director, LASERS may require agencies to submit employee §101. Definitions and employer contributions by electronic funds transfer ("EF T") or certified check. A. Wherever in these regulations the masculine is used, i t includes the feminine and vice versa. Wherever the singular AUTHORITY NOTE: Promulgated in accordance with is used, it includes the plural and vice versa. The following d R.S. 11:515. efinitions shall apply to all regulations promulgated under Pa HISTORICAL NOTE: Promulgated by the Department of Trea rt I, unless the usage clearly indicates another meaning. sury, Board of Trustees of the State Employees' Retirement System, LR 33:2468 (November 2007). Active Member―a member of the Louisiana State Empl §113. Rollover of Refunds oyees' Retirement System who is in state service. A. Qualified rollovers of accumulated employee contribu Active Member Trustees―those members of the board o tions to be refunded may be made to two different accounts f trustees of the Louisiana State Employees' Retirement Syst with a minimum of $500 to each account. Refunds of funds t em who are active employees, or participating in DROP. otaling less than $500 shall be limited to a single account. Board of Trustees or Board―the board of trustees of the AUTHORITY NOTE: Promulgated in accordance with R.S. 11 Louisiana State Employees' Retirement System. 515. HISTORICAL NOTE: Promulgated by the Department of Trea Director―the executive director of the Louisiana State sury, Board of Trustees of the State Employees' Retirement System, Employees' Retirement System. LR 34:97 (January 2008). DROP―Deferred Retirement Option Plan. §115. Plan Year Inactive Member―a member who is out of state service A. The plan year for LASERS shall be July 1-June 30. but is not retired and has left his contributions in the system. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 LASERS―the Louisiana State Employees' Retirement S 515. ystem. HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, Retired Member Trustees—those members of the board LR 39:120 (January 2013). of trustees of the Louisiana State Employees' Retirement Sys §117. Limitations Year tem who are retired, but not those members who are particip ating in DROP. A. The limitations year for LASERS shall be January 1-December 31. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 515. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 HISTORICAL NOTE: Promulgated by the Department of Trea 515. sury, Board of Trustees of the State Employees' Retirement System, HISTORICAL NOTE: Promulgated by the Department of Trea LR 22:373 (May 1996), amended LR 24:120 (January 1998), amen sury, Board of Trustees of the State Employees' Retirement System, ded LR 43:89 (January 2017). LR 39:120 (January 2013). §109. Waiver of the Electronic Funds Transfer Requir Chapter 3. Election of Active Member ement Trustees A. LASERS may, at its option, issue paper checks in lieu of an Electronic Funds Transfer (EFT) to surviving minor ch §301. Eligible Candidates ildren under R.S. 11:471 et seq., in order to avoid overpayme [Formerly §303.A] nts or other administrative issues associated with the paymen A. An active member candidate for a position on the boa t of such benefits. rd of trustees must be an active member of the system with a AUTHORITY NOTE: Promulgated in accordance with R.S. 11 t least 10 years of credited service (excluding any military se 515 and 11:479. rvice credit) as of the date on which nominations close. Opti HISTORICAL NOTE: Promulgated by the Board of Trustees o onal retirement plan participants do not acquire service credi f the State Employees' Retirement System, LR 31:1611 (July 2005). t and are prohibited from running for trustee positions by §3 §111. Contributions by Electronic Funds Transfer or 07 of this Chapter. Certified Check B. A participant in the Deferred Retirement Option Plan who has not yet terminated state service and who is still emp

1 Louisiana Administrative Code October 2017 loyed by the state is eligible to run as an active member cand are willing to serve and the appointment does not violate law idate for election to the board of trustees, so long as he qualif or these regulations. ies under Subsection A of this Section. B. The appointment shall be valid only until January 1 of C. A rehired retiree who has selected Option 2 of R.S. 11 the year following the next election. 416 or Option 2 of R.S. 11:416.1 is eligible to run as an activ C. When the unexpired term for the vacancy is greater th e member candidate for election to the board of trustees, so l an two years, a special election shall be held to fill the vacan ong as he qualifies under Subsection A of this Section. cy simultaneous with the election ordinarily held in odd num D. A disability retiree who has returned to work under eit ber years. The ballot for the special election may be the same her R.S. 11:224 or R.S. 11:225 is eligible to run as an active as that used in the regular election. Candidates for four year t member candidate for election to the board of trustees, so lo erms may not also be candidates to complete unexpired term ng as he qualifies under subsection A of this Section. s. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 D. The deadlines and procedures for special elections sha 511 and R.S. 11:515. ll be identical to those for elections normally held in years en HISTORICAL NOTE: Promulgated by the Department of Trea ding with odd numbers. sury, Board of Trustees of the State Employees' Retirement System, LR 22:373 (May 1996), amended LR 23:996 (August 1997), LR 25 AUTHORITY NOTE: Promulgated in accordance with R.S. 11 1278 (July 1999), LR 26:2633 (November 2000), LR 31:946 (April 511, R.S. 11:512 and R.S. 11:515. 2005), LR 34:446 (March 2008), LR 37:1614 (June 2011). HISTORICAL NOTE: Promulgated by the Department of the T §303. Nomination Process reasury, Board of Trustees of the State Employees' Retirement Syst em, LR 22:373 (May 1996), amended LR 23:997 (August 1997), L [Formerly §303.A] R 35:271 (February 2009), LR 37:1615 (June 2011). A. The board of trustees shall accept the name and final f §307. Optional Retirement Plan Participants our digits of the Social Security number of every candidate n ominated by petition of 25 or more active members of the sy A. Because optional retirement plan participants do not a stem and shall place the name of such candidates on the ball cquire service credit for purposes of determining eligibility u ot, provided each such candidate meets the requirements for nder R.S. 11:511(4), these participants are not eligible to vot trustee. Those active members signing the petition shall also e in the trustee elections or run for a position on the board of supply the final four digits of their Social Security number. trustees. When returning the nominating petition, the candidate shoul AUTHORITY NOTE: Promulgated in accordance with R.S. 11 d include his qualifications, platform and photograph for incl 511 and R.S. 11:515. usion in the election brochure circulated by LASERS. In yea HISTORICAL NOTE: Promulgated by the Department of Trea rs where a special election is held, a candidate shall clearly s sury, Board of Trustees of the State Employees' Retirement System, tate in his petition whether he is running for a four-year term LR 26:2633 (November 2000), amended LR 37:1615 (June 2011). or for the unexpired portion of the term that is the subject of Chapter 4.Rules Common to the Elect the special election. ion of Both Active and Retired Membe B. The printed name of those persons signing the nomina r Trustees ting petition must be legible for purposes of verification. Un verifiable signatories shall not count toward the required tota §401. General Schedule of Elections l of 25 and may disqualify the petition. [Formerly §§301 and 501.B] C. In years where a special election is held, a candidate s A. Elections shall be held in years ending with an odd nu hall clearly state in his petition whether he is running for a fo mber. ur-year term or for the unexpired portion of the term that is t he subject of the special election. 1. Three active member trustees shall be chosen in eac h election and shall serve a four-year term. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 511 and R.S. 11:515. 2. Beginning in 1995 and continuing thereafter every f HISTORICAL NOTE: Promulgated by the Department of Trea our years, two retired member trustees shall be chosen in an sury, Board of Trustees of the State Employees' Retirement System, election and shall serve a four year term. Beginning in 1997 LR 22:373 (May 1996), amended LR 23:996 (August 1997), LR 25 and continuing thereafter every four years, a single retired tr 1278 (July 1999), LR 26:2633 (November 2000), LR 31:946 (April ustee shall be chosen in an election and shall serve a four ye 2005), LR 34:446 (March 2008), LR 37:1615 (June 2011). ar term. §305. Vacancies; Special Elections B. The schedule for elections shall be as follows: A. The board shall appoint a member to fill any active m ember vacancy created on the board. The appointee shall pos 1. first day in March: nominations shall be opened; sess the necessary qualifications under R.S. 11:511 for the ac 2. second Tuesday in July: nominations shall be close tive member position. The board may give due consideration d. All nominating petitions must be received by the close of to the runners-up in the previous election, if those members business (4:30 p.m. Central time);

Louisiana Administrative Code August 2013 2 3. Monday following second Tuesday in July: a drawi ed before July 1 of the year in which the election is to take pl ng shall be held to determine candidate positions on a ballot; ace shall be considered a retired member for the purposes of this Section. 4. fourth Friday in September: the final day that infor mation on candidates and ballots may be mailed; C. There shall be a drawing as set forth in LAC 58:I.401 in the retirement systems building, 8401 United Plaza Boule 5. fourth Friday in October: all ballots or electronic vo vard, Baton Rouge, LA, to determine the position each candi tes must be received by the close of business (4:30 p.m. Cent date shall have on the ballot or election brochure. ral time). No faxed ballots shall be accepted; D. Each active member may vote for three candidates. 6. Wednesday following fourth Friday in October: all ballots and electronic votes shall be tallied and verified by th E. Each retiree may vote for two candidates during the el is date; ection when two retiree members are up for election, but ma y only vote for one candidate during the election where only 7. regular November meeting: the board shall be prese one retiree member is up for election. If electronic voting me nted with the certified ballot count, and if it is accepted, shall thods are utilized, members shall follow the instructions on t authorize publication of results; he election brochure for registering their votes. 8. January following election: newly elected members F. If electronic voting methods are utilized, members sha receive orientation; oaths shall be taken prior to the regular J ll follow the instructions on the election brochure for register anuary meeting. ing their votes. Votes shall be confidential. Ballots or electro C. In order to facilitate the election process, in the event nic votes received after the close of business on the fourth Fr of a disaster or emergency declared by executive order or pr iday in October (4:30 p.m. central time) shall be rejected. Ba oclamation of the governor, the executive director may chan llots must be returned to the address set forth in the instructi ge the election schedule. Such a schedule change shall be in ons on the election brochure. effect for a single election cycle only, after which the schedu G. Votes shall be tallied in accordance with the general s le shall return to that set forth in Subsection B of this Section chedule of elections.

H. The executive director shall submit a written report of AUTHORITY NOTE: Promulgated in accordance with R.S. 11 511 and R.S. 11:515. the election results to the board of trustees no later than the r HISTORICAL NOTE: Promulgated by the Department of Trea egular November meeting of the board of trustees. sury, Board of Trustees of the State Employees' Retirement System, I. Upon receipt of the results of the election, the board o LR 22:373 (May 1996), amended LR 23:996, 997 (August 1997), L R 25:1278 (July 1999), LR 26:2633 (November 2000), LR 33:1151 f trustees shall timely promulgate the election and notify the (June 2007), LR 34:446, 447 (March 2008), LR 37:1615 (June 201 successful candidates of their election and the secretary of st 1), LR 39:119 (January 2013). ate, so as to allow the candidates sufficient time to take and f ile the oath of office with the Secretary of State within the ti §403. Receipt of Nominating Petitions me specified by law. A. Signed nominating petitions will be accepted if receiv AUTHORITY NOTE: Promulgated in accordance with R.S. 11 ed by facsimile or emailed by the date nominations are close 511 and R.S. 11:515. d so long as original nominating petitions are received by 4: HISTORICAL NOTE: Promulgated by the Department of Trea 30 p.m. central time on the first Friday following the close of sury, Board of Trustees of the State Employees' Retirement System, nominations. If originals are not received by that deadline, th LR 22:373 (May 1996), amended LR 23:996, 997 (August 1997), L e person in whose name they are submitted shall not be quali R 25:1278 (July 1999), LR 26:1490 (July 2000), LR 26:2633 (Nov fied as a candidate. ember 2000), LR 31:946, 947 (April 2005), LR 34:446, 447 (March 2008), LR 37:1616 (June 2011), LR 39:119 (January 2013), LR 41: AUTHORITY NOTE: Promulgated in accordance with R.S. 11 1772 (September 2015). 511 and R.S. 11:515. HISTORICAL NOTE: Promulgated by the Department of Trea §407. Winning Candidates sury, Board of Trustees of the State Employees' Retirement System, [Formerly LAC 58:I.303.B and G, 501.A and 503. LR 37:1616 (June 2011). H] §405. Election Process A.1. Active Members. The three candidates who receive [Formerly §§303.C-I and 503.C-J] the most votes shall be declared successful candidates and pr A. Active Members. Ballots or election brochures shall b esented to the board. e distributed to each active member by the fourth Friday in S 2. Retired Members. Beginning in 1995 and continuin eptember. This includes active members who are not deemed g thereafter every four years, the two retired member candid by LASERS to be retired before July 1 of the year in which t ates who receive the most votes shall be declared successful he election is to take place and participants in the DROP pro candidates and presented to the board. Beginning in 1997 an gram who have not terminated service. d continuing thereafter every four years, the retired member B. Retired Members. Ballots or election brochures shall candidate who receives the most votes shall be declared the s be distributed to each retired member by the fourth Friday in uccessful candidate and presented to the board. September. A member who is deemed by LASERS to be retir

3 Louisiana Administrative Code October 2017 B. Ties affecting elected positions shall be decided by a c HISTORICAL NOTE: Promulgated by the Department of Trea oin toss held by the executive director in the presence of the sury, Board of Trustees of the State Employees' Retirement System, candidates affected or the representative they designate. LR 22:373 (May 1996), amended LR 23:996, 997 (August 1997), L R 25:1278 (July 1999), LR 26:1490 (July 2000), LR 26:2633 (Nov C. No department in the executive branch of state govern ember 2000), LR 31:946, 947 (April 2005), LR 34:446, 447 (March ment may have more than two active trustees serving on the 2008), LR 37:1616 (June 2011). board at the same time. Ex officio trustees and their designee Chapter 5. Election of Retired Memb s do not count toward this limit. er Trustees D. If, after the conclusion of the nomination process, the number of candidates does not exceed or is fewer than the nu §501. Eligible Candidates mber of open positions for which election is being held, no e [Formerly §503.A] lection shall be held for those positions, and those candidates A. A candidate for a position of retired member trustee o that are nominated and are qualified shall be deemed success n the board of trustees must be a retired member of the syste ful candidates and presented to the board. m who has been on retired status (not including retired status 1. Active Member Trustees' Elections. Any remaining under the Deferred Retirement Option Plan) by the date on open positions shall be filled in accordance with Title 58, Par which nominations close. t I, Chapter 3, §305 of the Louisiana Administrative Code. B. A rehired retiree who selected either Option 1 or Opti 2. Retired Member Trustees’ Elections. Any remaining on 3 of R.S. 11:416 or Option 1, Option 3 or Option 4 of R.S. open positions shall be filled in accordance with Title 58, Par 11:416.1 is eligible to run as a candidate for a position of ret t I, Chapter 5, §505 of the Louisiana Administrative Code. ired member trustee on the board of trustees. E. Subsection D shall apply to both active member truste C. A participant in the Deferred Retirement Option Plan e elections and retired member trustee elections. who has not yet terminated state service and who is still emp loyed by the state is not eligible to run for board election as a F. For all relevant purposes, those candidates elected un retired member candidate. der Subsection D shall be considered to have received the m aximum number of votes possible. D. A disability retiree who has returned to work under eit her R.S. 11:224 or R.S. 11:225 is not eligible to run as a retir AUTHORITY NOTE: Promulgated in accordance with R.S. 11 511 and R.S. 11:515. ed member candidate for election to the board of trustees. HISTORICAL NOTE: Promulgated by the Department of Trea AUTHORITY NOTE: Promulgated in accordance with R.S. 11 sury, Board of Trustees of the State Employees' Retirement System, 511 and R.S. 11:515. LR 22:373 (May 1996), amended LR 23:996, 997 (August 1997), L HISTORICAL NOTE: Promulgated by the Department of Trea R 25:1278 (July 1999), LR 26:1490 (July 2000), LR 26:2633 (Nov sury, Board of Trustees of the State Employees' Retirement System, ember 2000), LR 31:946, 947 (April 2005), LR 34:446, 447 (March LR 22:373 (May 1996), amended LR 23:997 (August 1997), LR 25 2008), LR 37:1616 (June 2011), LR 39:119 (January 2013), LR 41: 1278 (July 1999), LR 26:1490 (July 2000), LR 26:2633 (November 1773 (September 2015). 2000), LR 31:947 (April 2005), LR 34:447 (March 2008), LR 37:1 §409. Candidates Withdrawing Prior to Election 617 (June 2011). §503. Nomination Process A. A candidate may withdraw his candidacy at any time. If he withdraws prior to the deadline for voting, all votes cas A. The board of trustees shall accept the name and final f t for him shall not be counted. our digits of the Social Security number of every candidate n AUTHORITY NOTE: Promulgated in accordance with R.S. 11 ominated by petition of 25 or more retired members of the sy 511 and R.S. 11:515. stem and shall place the name of such candidates on the ball HISTORICAL NOTE: Promulgated by the Department of Trea ot, provided each such candidate meets the requirements for sury, Board of Trustees of the State Employees' Retirement System, trustee. Those retired members signing the petition shall also LR 37:1616 (June 2011). supply the final four digits of their Social Security number. §411. No Solicitation When returning the nominating petition, the candidate shoul [Formerly §303.J and §503.K] d include his qualifications, platform and photograph for incl usion in the election brochure circulated by LASERS. A. Candidates for election to the LASERS board of trust ees shall not solicit employees of LASERS to participate in t B. The printed name of those persons signing the nomina heir campaigns, and LASERS' employees cannot participate, ting petition must be legible for purposes of verification. Un or give assistance to any member who is running for election verifiable signatories shall not count toward the required tota or re-election to the board. Candidates shall not solicit or hav l of 25 and may disqualify the petition. e contact with any vendor or employee of a vendor who is pr C. In years where a special election is held, a candidate s oviding LASERS with products or services related to electio hall clearly state in his petition whether he is running for a fo ns of the LASERS board of trustees. LASERS employees ar ur-year term or for the unexpired portion of the term that is t e free to sign nominating petitions. he subject of the special election. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 AUTHORITY NOTE: Promulgated in accordance with R.S. 11 511 and R.S. 11:515. 511 and R.S. 11:515.

Louisiana Administrative Code August 2013 4 HISTORICAL NOTE: Promulgated by the Department of Trea 5. pay for the calculation of the actuarial calculation t sury, Board of Trustees of the State Employees' Retirement System, o determine the cost to purchase the service. LR 37:1617 (June 2011). B. The active member shall pay the actuarial cost to rece §505. Vacancies; Special Elections ive the service credit. Upon receipt of the items listed above, [Formerly §507] LASERS shall issue an invoice to the active member. The in A. The Executive Board of the Retired State Employees voice is void if not paid within 90 days after the date issued. Association shall appoint a member to fill any retired memb Payment shall be made in a lump sum. er vacancy created on the board. The appointee shall possess C. The payment of the cost shall be credited to the memb the necessary qualifications under R.S. 11:511 for the retired er's account. If the member later separates from state employ member position. ment and requests a refund of contributions, the amount paid B. The appointment shall be valid only until January 1 of shall be refunded along with other employee contributions. the year following the next election. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 C. When the unexpired term for the vacancy is greater th 515 and R.S. 11:153. an two years, a special election shall be held to fill the vacan HISTORICAL NOTE: Promulgated by the Department of Trea cy simultaneously with the election ordinarily held in odd nu sury, Board of Trustees of the State Employees' Retirement System, LR 22:373 (May 1996), amended by the Department of Treasury, B mber years. The ballot for the special election may be the sa oard of Trustees of the Louisiana State Employees' Retirement Syst me as that used in the regular election. em, LR 32:265 (February 2006), LR 43:1987 (October 2017). D. The deadlines and procedures for special elections sha Chapter 9. Purchase of Retirement C ll be identical to those for elections normally held in years en ding with odd numbers. redit under R.S. 29:411 et seq., and th AUTHORITY NOTE: Promulgated in accordance with R.S. 11 e Uniformed Services Employment an 511, R.S. 11:512 and R.S. 11:515. d Reemployment Rights Act HISTORICAL NOTE: Promulgated by the Department of the T reasury, Board of Trustees of the State Employees' Retirement Syst §901. Requirements em, LR 23:998 (August 1997), amended LR 37:1617 (June 2011). A. In order to qualify for retirement credit for military se Chapter 7.Purchase of Military Servic rvice, at the time the individual was called to active military e under R.S. 11:153 service, he or she shall have been: §701. Purchase of Military Service 1. a state employee in a position that is other than tem porary including, but not limited to, probational and perman A. A maximum of four years of credit for military servic ent Civil Service positions; e may be purchased by members who rendered military servi 2. an active member of the Louisiana State Employee ce in accordance with R.S. 11:153, provided the member rec s' Retirement System; eived a discharge other than dishonorable. 3. a member of the Army National Guard of the Unite AUTHORITY NOTE: Promulgated in accordance with R.S. 11 d States, the Army Reserve, the Naval Reserve, the Marine C 515 and R.S. 11:153. HISTORICAL NOTE: Promulgated by the Department of Trea orps Reserve, the Air National Guard of the United States, A sury, Board of Trustees of the State Employees' Retirement System, ir Force Reserve, or the Coast Guard Reserve (hereinafter ca LR 22:373 (May 1996), amended LR 26:1490 (July 2000), amende lled reservist) called to active duty; and d by the Department of Treasury, Board of Trustees of the Louisian 4. shall have been released from active duty after satis a State Employees' Retirement System, LR 43:1987 (October 2017). factory completion of military duty, in accordance with the p §703. Requirements for Application to Purchase Milita rovisions of 50 U.S.C. §459. Release shall have been other t ry Service han dishonorable. A. In order to apply for purchase of the service, an active B. The member, at his option, shall pay the required emp member shall: loyee contributions to the retirement system during his perio 1. make application to LASERS; d of service in the uniformed service, or if he chooses not to make such payment during his military duty, he is entitled to 2. provide a copy of military form DD 214; purchase such credit in accordance with §901 herein. 3. certify that he is not drawing a regular retirement be AUTHORITY NOTE: Promulgated in accordance with R.S. 29 nefit based on the military service calculated on the basis of 411 and R.S. 11:515. age and service (This restriction does not apply to disability HISTORICAL NOTE: Promulgated by the Department of Trea benefits based on 25 percent or less disability received as a r sury, Board of Trustees of the State Employees' Retirement System, esult of military service); and LR 22:373 (May 1996). 4. certify that he has not received credit for the service §903. Exclusions in any other public retirement system; A. Employees who were in temporary positions such as, but not limited to, restricted appointments, job appointments,

5 Louisiana Administrative Code October 2017 provisional appointments, and student workers are not eligib service or discharge from hospitalization incidental to the mi le for retirement credit. Elected officials and appointed offici litary service. als in positions established by the constitution or laws of the AUTHORITY NOTE: Promulgated in accordance with R.S. 29 state are eligible for retirement credit. Reservists who were p 411 and R.S. 11:515. articipating in the Deferred Retirement Option Plan at the ti HISTORICAL NOTE: Promulgated by the Department of Trea me of military service are not eligible to receive service cred sury, Board of Trustees of the State Employees' Retirement System, it. LR 22:373 (May 1996). AUTHORITY NOTE: Promulgated in accordance with R.S. 29 §911. Differential Payments Made by the Agencies 411, R.S. 29:415.1 and R.S. 11:515. A. Many reservists active duty base pay may be less than HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, their state base pay. The reservist may elect to pay contributi LR 22:373 (May 1996). ons on the entire amount of state earnings that would have b een received in order to receive retirement credit for benefit §905. Limitations purposes. A. Members may receive no more than a total of five yea AUTHORITY NOTE: Promulgated in accordance with R.S. 29 rs of military service credit in the retirement system for milit 411 and R.S. 11:515. ary service rendered in accordance with R.S. 29:411 et seq., HISTORICAL NOTE: Promulgated by the Department of Trea and the Uniformed Services Employment and Reemploymen sury, Board of Trustees of the State Employees' Retirement System, t Rights Act (USERRA). LR 22:373 (May 1996). AUTHORITY NOTE: Promulgated in accordance with R.S. 29 §913. Payment of Contributions after Military Service 411 and R.S. 11:515. is Completed HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, A. The employer shall pay the employer contribution. LR 22:373 (May 1996), amended by the Department of Treasury, B B. The amount of contributions is based upon the amoun oard of Trustees of the Louisiana State Employees' Retirement Syst t of earnings the employee would have received if still empl em, LR 43:1987 (October 2017). oyed. This includes any increases in compensation the emplo §907. Credit for Eligibility or Benefit Purposes yee would have received if he or she had remained in emplo A. In accordance with provisions of USERRA, a member yment during the period of military service. If the employe shall receive credit for purposes of determining eligibility fo e's compensation varies, such as for legislators, the average r retirement at no cost to the individual or agency. In order to monthly earnings for the 12 months preceding the active mili receive credit for purposes of calculating the retirement bene tary service shall be used to determine the amount of contrib fit, contributions shall be paid to the retirement system in acc utions. ordance with section 414(u) of the Internal Revenue Code. If C. The employer shall determine the amount of earnings the employee was on paid leave during the period of active that would have been earned and compute the employee and military service, the employee has received retirement credit employer’s contributions that are due. for that service and no additional information need be furnis hed to the retirement system. D. The employee shall pay the employee contributions to the agency. The agency shall remit the employee and employ AUTHORITY NOTE: Promulgated in accordance with R.S. 29 er contributions to LASERS within 30 days after the employ 411 and R.S. 11:515. ee has paid his or her portion. The agency shall provide a mo HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, nthly breakdown of the earnings and contributions for each LR 22:373 (May 1996), amended by the Department of Treasury, B member and the certification documents to LASERS. oard of Trustees of the Louisiana State Employees' Retirement Syst E. Payment for military service shall be made in accorda em, LR 43:1987 (October 2017). nce with section 414(u) of the Internal Revenue Code. §909. Certification of Military Service AUTHORITY NOTE: Promulgated in accordance with R.S. 29 A. In order to receive retirement credit for eligibility or b 414 and R.S. 11:515. enefits purposes, the employee shall provide: HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, 1. discharge or release notice (Form DD214) and any LR 22:373 (May 1996), amended by the Department of Treasury, B other pertinent documentation from the appropriate military oard of Trustees of the Louisiana State Employees' Retirement Syst entity which provides the inclusive dates of active service or em, LR 43:1987 (October 2017). discharge from hospitalization incidental to the military servi §915. Death and Survivor Benefits ce; A. The period of military service received under the prov 2. documentation from the agency certifying that the r isions of Chapter 9 shall be counted as creditable service for eservist was employed in a position other than temporary on determining eligibility for death and survivor benefits. The a the date the active duty began; and mount of survivor benefits payable shall be calculated as pro 3. certification from the agency that the reservist appli vided for in R.S. 11:471 et seq. ed for reemployment within 90 days of release from military

Louisiana Administrative Code August 2013 6 B. The final average compensation used for the calculati AUTHORITY NOTE: Promulgated in accordance with R.S. 11 on shall be based on the actual earnings of the member. In or 515. der for the estimated earnings during the period of military s HISTORICAL NOTE: Promulgated by the Department of Trea ervice to be used in the determination of the final average co sury, Board of Trustees of the State Employees' Retirement System, LR 18:1417 (December 1992), amended LR 22:373 (May 1996), L mpensation, the employee and employer's contributions shall R 33:676 (April 2007), LR 34:1639 (August 2008). be paid for the period of military service. §1103. Vendor Requirements C. If a member dies before completing payment for milit ary service under this Chapter, a beneficiary or survivor has t A. Authority for payroll deductions shall be governed by he right to pay the required contributions as set forth in R.S. this Chapter. General insurance deduction vendors shall mee 29:415, except that the applicable time limit within which pa t the following requirements. yment must be made is that set forth in section 414(u) of the 1. Foreign companies shall: Internal Revenue Code. If the beneficiary or survivor choose s not to pay the member's contribution, the computation of d a. have a current rating in A.M. Best of B+ or better eath and survivor benefits shall be based on the actual servic unless: e credit of the member, excluding his or her military service. i. notwithstanding any other law, rule, or regulati AUTHORITY NOTE: Promulgated in accordance with R.S. 29 on to the contrary, and if they are in good standing with the 414, R.S. 29:415 and R.S. 11:515. Department of Insurance, and subject to the other applicable HISTORICAL NOTE: Promulgated by the Department of Trea provisions of this Section, a foreign company which has part sury, Board of Trustees of the State Employees' Retirement System, icipated in the Office of State Uniform Payroll deduction sys LR 22:373 (May 1996), amended by the Department of Treasury, B tem for a period of at least ten years and has a rating in A.M. oard of Trustees of the Louisiana State Employees' Retirement Syst Best of B, may continue to market and sell insurance policie em, LR 43:1987 (October 2017). s through payroll deduction until the beginning of the next o Chapter 11. Voluntary Deductions fro pen enrollment period following the four-year anniversary d ate from the date of the issuance of the B rating by A.M. Bes m Retiree Benefits Payroll t, provided they have maintained a rating of B or better for th §1101. Application Process for Voluntary Payroll Deduc e entire four-year period. Thereafter, in the event that the for tion eign insurer has maintained a rating of B by A.M. Best and t hat rating is increased from B to a B+ or better and they mee A. Application shall be made by the company, corporatio t the other applicable requirements of this Section and other n, or organization which is the provider of coverage, product, applicable rules and regulations, they may resume marketing service, or recipient of monies and shall be signed by two of and selling insurance through the payroll deduction system; ficers of the applicant company, corporation, or organization. or The completed application shall be submitted to LASERS. ii. notwithstanding any other law, rule, or regulati B. The following type providers of services shall be cons on to the contrary, if a foreign company has been participatin idered for approval: g in the Office of State Uniform Payroll deduction system fo 1. the State Group Benefits program; r a period of at least ten years, and they have a rating in A.M. Best of B, they may maintain and administer indefinitely tho 2. the group insurance plan administered by the Depar se policies purchased through payroll deduction as long as th tment of Employment and Training; ey maintain a rating by A.M. Best of no less than a B, are in 3. the Retired State Employees' Association; good standing with the Department of Insurance, and compl 4. general insurance companies and other providers th y with other applicable rules, and regulations, and laws and t at are included on the annual listing maintained by the Office he provisions of this Section; of State Uniform Payroll; b. have been doing business under the same name f 5. credit unions formed for the primary purpose of ser or not less than three years; ving state employees that have a payroll deduction for emplo c. offer like product, service, or coverage to citizens yees of the members' agencies; of Louisiana; 6. other member or retiree associations approved by th e board of trustees; d. be in compliance with all procedural, accounting, and reporting requirements governing employee deductions. 7. vendors receiving payment through voluntary dedu ctions on the effective date of these rules; and 2. Domestic companies shall: 8. other insurance companies approved by the executi a. have a current rating in A.M. Best of B or better, ve director. or if the company is of insufficient size to obtain a rating by C. Applicant shall designate a coordinator to act as prima A.M. Best, has posted a bond with the division of administra ry contact with LASERS for resolution of invoicing, refund, tion in the amount of: and reconciliation problems and resolving claims problems f or retirees.

7 Louisiana Administrative Code October 2017 i. $100,000, if the company is a member insurer month preceding the deduction using the electronic format a of the Louisiana Life and Health Insurance Guaranty Associ nd specifications established by LASERS. All deductions for ation; or a single vendor shall be submitted on one monthly file. ii. $250,000, if the company is not a member insu E. A retiree may discontinue any voluntary payroll dedu rer of the Louisiana Life and Health Insurance Guaranty Ass ction amount by providing written notification of that intent t ociation, or if the product for which the deductions are propo o the vendor. Vendors shall remove these persons from the fi sed is not covered under the Louisiana Life and Health Guar le. anty Association Act; F. A retiree cannot authorize total deductions which exce b. have been doing business under the same name f ed the amount of the benefit. or not less than three years; AUTHORITY NOTE: Promulgated in accordance with R.S. 11 c. provide like product, service, or coverage to citiz 515. ens of Louisiana; HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, d. be in compliance with all procedural, accounting, LR 18:1417 (December 1992), amended LR 22:373 (May 1996), L and reporting requirements of all rules and requirements gov R 35:2478 (November 2009). erning employee deductions. §1111. Vendor Responsibilities 3. Vendors offered through other state agencies or poli A. Vendors shall not be authorized to submit any deducti tical subdivisions, if approved by the executive director. on which was obtained from a retiree for the purpose of trans AUTHORITY NOTE: Promulgated in accordance with R.S. 11 mitting any part of that deduction to a third party. 515. B. The vendor is responsible for refunding any amounts HISTORICAL NOTE: Promulgated by the Department of Trea deducted in error to the individual retiree. sury, Board of Trustees of the State Employees' Retirement System, LR 18:1417 (December 1992), amended LR 22:373 (May 1996), L C. Any information received from LASERS shall be han R 33:676 (April 2007), LR 34:1639 (August 2008), LR 35:2477 (N dled in accordance with the Louisiana Public Records law. ovember 2009). §1105. Notification, Implementation and Transition AUTHORITY NOTE: Promulgated in accordance with R.S. 11 515. A. LASERS shall notify applicant whether applicant is a HISTORICAL NOTE: Promulgated by the Department of Trea pproved as a vendor. sury, Board of Trustees of the State Employees' Retirement System, LR 18:1417 (December 1992), amended LR 22:373 (May 1996), L B. Vendors shall enroll retirees for a monthly deduction a R 35:2478 (November 2009). mount. §1113. LASERS' Responsibilities C. Participation shall be at least 30 or more retirees, if ap A. LASERS shall be responsible for making the monthly proved by the executive director. deductions in the amount that are timely submitted by the ve D. If a vendor falls below the participation level approve ndor. d by the executive director, LASERS has the right to discont B. LASERS shall remit the amount deducted to the vend inue the payroll deduction immediately. or and shall provide a listing of all exceptions. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 AUTHORITY NOTE: Promulgated in accordance with R.S. 11 515. 515. HISTORICAL NOTE: Promulgated by the Department of Trea HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, sury, Board of Trustees of the State Employees' Retirement System, LR 18:1417 (December 1992), amended LR 22:373 (May 1996), L LR 18:1417 (December 1992), amended LR 22:373 (May 1996), L R 35:2478 (November 2009). R 35:2478 (November 2009). §1107. Deduction Authorization §1115. Reporting A. Vendors shall be responsible for obtaining and mainta A. Vendors shall report within 10 days of final approval ining appropriate deduction authorizations from individual r any change in the name, address, company status, principal o etirees. Copies shall be made available to LASERS upon req fficers, or designated coordinator to LASERS. uest. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 B. Any disclaimer, contract, or term of participation agre 515. ement between the retiree and the vendor or provider shall n HISTORICAL NOTE: Promulgated by the Department of Trea ot be binding on LASERS. sury, Board of Trustees of the State Employees' Retirement System, C. A retiree shall have only one monthly deduction (whic LR 18:1417 (December 1992), amended LR 22:373 (May 1996), L R 35:2478 (November 2009). h may cover more than one benefit) for a single vendor effec tive at any one time. §1119. Termination of Payroll Deduction D. Vendor is responsible for submitting a computer file o A. Unethical conduct or practices of the vendor shall res f monthly deductions to LASERS by the twelfth day of the ult in the termination of deduction authority for that vendor.

Louisiana Administrative Code August 2013 8 B. Payroll deduction authority may be revoked for any v ertinent documentation to qualify for the emergency refund. endor that is removed from the annual listing maintained by Outstanding bills must be payable prior to the date the indivi the Office of State Uniform Payroll. dual would otherwise receive the refund, or other like econo mic hardship must be shown to be considered sufficient reas C. Payroll deduction authority may be revoked for any v on for declaring an emergency situation. endor that fails to comply with requirements of this rule. B. Upon receipt of the documentation and approval by th AUTHORITY NOTE: Promulgated in accordance with R.S. 11 515. e executive director, the retirement system shall issue the ref HISTORICAL NOTE: Promulgated by the Department of Trea und at the next scheduled date for issuing refund checks. The sury, Board of Trustees of the State Employees' Retirement System, refund amount shall include all employee contributions recei LR 18:1417 (December 1992), amended LR 22:373 (May 1996), 3 ved from the employing agency and posted to the individua 5:2478 (November 2009). l's account. Any additional contributions received at a later d §1121. General Provisions ate from the agency shall be refunded to the individual after t hey are received and posted to the account. A. Payroll deduction authorization shall not be transferre d. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 515 and 537(B). B. Approval of an applicant in no way constitutes endors HISTORICAL NOTE: Promulgated by the Department of Trea ement or certification of the applicant or vendor or its produ sury, Board of Trustees of the State Employees' Retirement System, cts or services. LR 22:373 (May 1996). AUTHORITY NOTE: Promulgated in accordance with R.S. 11 §1305. Responsibility for Overpayment of a Refund 515. HISTORICAL NOTE: Promulgated by the Department of Trea A. If the amount that is refunded is greater than the amou sury, Board of Trustees of the State Employees' Retirement System, nt actually due the individual, the agency paying the contrib LR 18:1417 (December 1992), amended LR 22:373 (May 1996). utions shall be responsible for recouping any overpayment fr Chapter 13. Emergency Refunds om the individual who was overpaid. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 §1301. Conditions Giving Rise to an Emergency Refund 515 and 11:537(B). A. A refund of accumulated employee contributions may HISTORICAL NOTE: Promulgated by the Department of the T be made in less than 30 calendar days after the date of separa reasury, Board of Trustees of the State Employees' Retirement Syst tion from state service in the following situations: em, LR 22:373 (May 1996), amended LR 23:1711 (December 199 7). 1. the refund results from the death of the member; or Chapter 15. Purchases and Transfers 2. the member has significant expenses for medical ca re for himself, spouse, or child; or of Service 3. an emergency situation of the member, which shall §1501. Purchases and Transfers of Service; Calculations; consist of the foreclosure on a member's domicile, repossessi Costs on of the member's vehicle, or eviction of the member from A. The purchase of service on an actuarial basis and the t his or her apartment. A document filed in the official legal pr ransfer of service from other public retirement systems into oceeding for foreclosure or repossession or a notice of evicti LASERS requires an actuarial calculation by the system actu on shall be required as proof to qualify under this provision. ary. B. The member shall provide a written request detailing t B. The cost of this calculation shall be paid by the memb he emergency situation and the executive director shall appr er requesting the calculation. Payment must be made before t ove or disapprove the request based on this written request. he request for the calculation will be forwarded to the actuar C. Emergency refunds are available on a one-time basis y. only. Once a member has taken advantage of this single opp AUTHORITY NOTE: Promulgated in accordance with R.S. 11 ortunity and has received a refund under the terms of this Ch 424, 11:446 and 11:515. apter, that member shall no longer be eligible for an emergen HISTORICAL NOTE: Promulgated by the Department of Trea cy refund. sury, Board of Trustees of the State Employees' Retirement System, LR 22:373 (May 1996), amended LR 32:265 (February 2006). AUTHORITY NOTE: Promulgated in accordance with R.S. 11 515 and R.S. 11:537(B). §1503. Transfers of Service; Other Requirements HISTORICAL NOTE: Promulgated by the Department of Trea A. In order to transfer service credit from other public ret sury, Board of Trustees of the State Employees' Retirement System, LR 22:373 (May 1996), amended LR 23:1710 (December 1997), L irement systems into LASERS, the person seeking such a tra R 31:107 (January 2005), LR 32:1466 (August 2006). nsfer must be: §1303. Procedure for an Emergency Refund 1. an active member contributing to the LASERS at th e time they apply for the transfer; or A. The member or beneficiary shall provide a copy of th e death certificate, a doctor's statement of total and permane 2. an active member of a public retirement system mai nt disability, a copy of medical invoices, or copies of other p ntained primarily for officers and employees of the state of L

9 Louisiana Administrative Code October 2017 ouisiana, or any political subdivision thereof, or of any distri and the employee shall be treated as if he was a member duri ct, board, commission, or other agency of either, or any other ng this period of purchased service credit, except that the rei such public entity who has been a member of such system fo nstated employee will not be entitled to partial repurchase pr r at least six months and who has membership credit in such ovisions for the service credit that is reinstated through legal system shall have the option of transferring all of his credit f action. rom such system he is currently contributing to or to the syst B. The reinstated employee's date of hire prior to the wro em in which he last contributed. However, membership in a ngful termination shall be used for retirement purposes, if an public retirement system cannot be changed to another publi y contribution refund that the member received is repaid not c retirement system, and any person participating in DROP c later than the sixtieth day following the first day the member annot transfer any service credit into or out of that retirement returns to work after reinstatement is ordered. If the member system. repays all or any portion of such contribution refund after th AUTHORITY NOTE: Promulgated in accordance with R.S. 11 e sixtieth day following the first day the member returns to 143 and R.S. 11:515. work after reinstatement is ordered, the repayment shall be tr HISTORICAL NOTE: Promulgated by the Department of Trea eated in the same manner as a payment for any other refund sury, Board of Trustees of the State Employees' Retirement System, and the date of hire for retirement purposes shall be the first LR 22:373 (May 1996). day the member returns to work after reinstatement is ordere Chapter 17. Purchases of Service by d. Reinstated Employees AUTHORITY NOTE: Promulgated in accordance with R.S. 11 515. §1701. Purchases of Service by Reinstated Employees HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, A. When an employee is reinstated to a position in state LR 22:373 (May 1996), amended LR 25:2466 (December 1999). government by the Department of Civil Service or a court of law, the employee is entitled to receive retirement service cr §1705. Service Credit for Dual Employment edit for the period of time that is reinstated provided paymen A. Any active member who qualifies to purchase service t of employee and employer contributions, plus interest, is m credit under the provisions of R.S. 11:191.B may purchase th ade to the retirement system within 60 days of the reinstatem e service credit to which he would have been entitled in the s ent. ystem had he been an active contributing member of the retir B. If reinstated, the employee shall pay an amount equal ement system during the full term of his employment by pay to the current employee's contributions based on the earned c ing to the system an amount that totally offsets the actuarial ompensation for the period of time that was reinstated. The e cost of the receipt of the service credit. mploying agency shall pay the employer contributions that B. The employer for that employee may pay one-half of t would have been due plus compound interest at the actuarial he actuarial cost of the receipt of the service credit, thereby r valuation rate for all contributions payable from the date the educing the member's cost to one-half of the actuarial cost of contribution was due until paid. the service credit. If the employer pays one-half of the actuar C. When a reinstated employee is entitled to back pay fr ial cost for one employee, it shall be obligated to pay one-hal om the employing agency, the agency shall remit the employ f of the actuarial cost of all employees who qualify to purcha er and employee's contributions that would have been due if se this service credit. the employee had been employed during that time, plus inter C. The full amount must be received by the system, whet est. The agency shall also provide LASERS with a report of her the member is paying the full cost, or the employer is pa earnings on a monthly basis for the period for which the indi ying one-half and the member one-half, prior to any service vidual was reinstated. credit being attributed to a member's account. The amount m D. If a member has received a refund of contributions aft ust be paid in a lump sum. er a wrongful termination, he must repay the refund not later D. A fee of at least $75 (to be set by the system's actuar than the sixtieth day following the first day the member retur y) must be paid to the system's actuary by the individual req ns to work after reinstatement is ordered for the member's ret uesting the calculation. Payment must be made before the re irement status and service credit to be fully restored. quest for calculation will be forwarded to the actuary. E. Any costs to the retirement system associated with the AUTHORITY NOTE: Promulgated in accordance with R.S. 11 se procedures shall be paid by the employing agency. 515. HISTORICAL NOTE: Promulgated by the Department of Trea AUTHORITY NOTE: Promulgated in accordance with R.S. 11 sury, Board of Trustees of the State Employees' Retirement System, 515. LR 22:373 (May 1996). HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, §1707. Repayment of Refund of Contributions LR 22:373 (May 1996), amended LR 25:2466 (December 1999). A. A member who received a refund or employee contrib §1703. Effect of Reinstatement utions may repay the refund after the member has returned t A. Employees reinstated into state government shall be e o state service and contributed to the system for a minimum ntitled to purchase service credit as provided in this Chapter, of 18 months, by paying to the system the employee contribu

Louisiana Administrative Code August 2013 10 tion refund plus interest compounded annually at the actuari Chapter 19. Survivors' Benefits al valuation rate for all contributions payable from the date t he refund was issued until paid in one lump sum, or by partia §1901. Application for Benefits l repayment in accordance with the following Section. A. Survivors' benefits are payable only upon application B. Repayment of refunds must be completed prior to reti therefor, but the benefit becomes effective as of the day follo rement or beginning participation in DROP. wing the death of the member. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 AUTHORITY NOTE: Promulgated in accordance with R.S. 11 515. 471 and R.S. 11:515. HISTORICAL NOTE: Promulgated by the Department of Trea HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, sury, Board of Trustees of the State Employees' Retirement System, LR 25:2467 (December 1999). LR 22:373 (May 1996). §1709. Partial Repayment of Refund of Contributions §1903. Qualified Survivors A. If a member elects to repay part of a refund, he must r A. The following individuals qualify for survivors' benef epay the contributions for the most recent service credit first. its: For example, if a member received a refund for service from 1. surviving spouse with minor children; January 1, 1991 through December 31, 1993, and elects to re pay one year of service, he/she must repay the contributions 2. handicapped or mentally retarded children; for 1993 first. 3. surviving minor child not in custody of surviving sp B. Partial payments must be made in increments based o ouse; and n service within a calendar year with the most recent year(s) 4. surviving spouse without minor child. repaid first. Example: A member worked from June 1, 1990 t hrough April 30, 1993 then received a refund. The refund ma B. The survivors' benefit is a single benefit payable to m y be repaid in the following order: ultiple qualifying groups. If more than one individual qualifi es for the benefit, the benefit shall be prorated between or a 1. January 1, 1993 through April 30, 1993; mong the qualified individuals in accordance with law. 2. January 1 through December 31, 1992; AUTHORITY NOTE: Promulgated in accordance with R.S. 11 3. January 1 through December 31, 1991; then 472, R.S. 11:473, R.S. 11:474, R.S. 11:475, R.S. 11:480 and R.S. 1 1:515. 4. June 1 through December 31, 1990. HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, C. If a member has both full time and part time service c LR 22:373 (May 1996). redit that was refunded, the years of full time service must b e repaid first. When there is both full time and part time serv §1905. Proof of Entitlement to a Survivors' Benefit ice within the calendar year(s), LASERS shall have the auth A. Each survivor benefit recipient shall present proof to ority to determine the calendar year of service credit that mu LASERS upon application, and annually or at such other tim st be repaid first. As a general rule, the year(s) with the most es LASERS feels necessary, that he is legally entitled to the full time service must be repaid before the year(s) with more survivor's benefit. If the applicant for the benefit fails to pres part time service. ent such proof to LASERS, LASERS shall deny such benefit D. Upon receipt of the partial payment, the service credit to the applicant or discontinue the benefit if the recipient fail for the calendar year repaid will be restored to the member. s to provide such proof upon reasonable request. AUTHORITY NOTE: Promulgated in accordance with R.S. 11 E. A member may receive three invoices in a 12-month p 477 and R.S. 11:515. eriod at no cost. Each additional invoice within the HISTORICAL NOTE: Promulgated by the Department of Trea 12-month period will cost $75 each. sury, Board of Trustees of the Louisiana State Employees' Retireme F. Interest at the actuarial rate will be calculated from th nt System, LR 22:373 (May 1996). e date of the refund was issued to the date of the repayment. §1907. Qualification for Benefit to Handicapped Childr Interest will be compounded on an annual basis. en G. The partial repayment must be made in a single paym A. Totally physically disabled or mentally handicapped c ent. hildren of deceased members who are not dependent upon th e surviving spouse of the member or some other legal guardi AUTHORITY NOTE: Promulgated in accordance with R.S. 11 an and who do not also receive state assistance are eligible u 515. nder the provisions of Chapter 19. HISTORICAL NOTE: Promulgated by the Department of Trea sury, Board of Trustees of the State Employees' Retirement System, B. In order to cover this area not addressed by the statute LR 25:2467 (December 1999), amended LR 29:2859 (December 20 it will be the policy of the Louisiana State Employees' Retir 03). ement System to pay survivor's benefits to otherwise qualifie d physically disabled or handicapped children of deceased m embers who have neither a surviving parent or legal guardia