Solutions Guide: Please reword the answers to essay type parts so as to guarantee that your answer is an original. Do not submit as your own

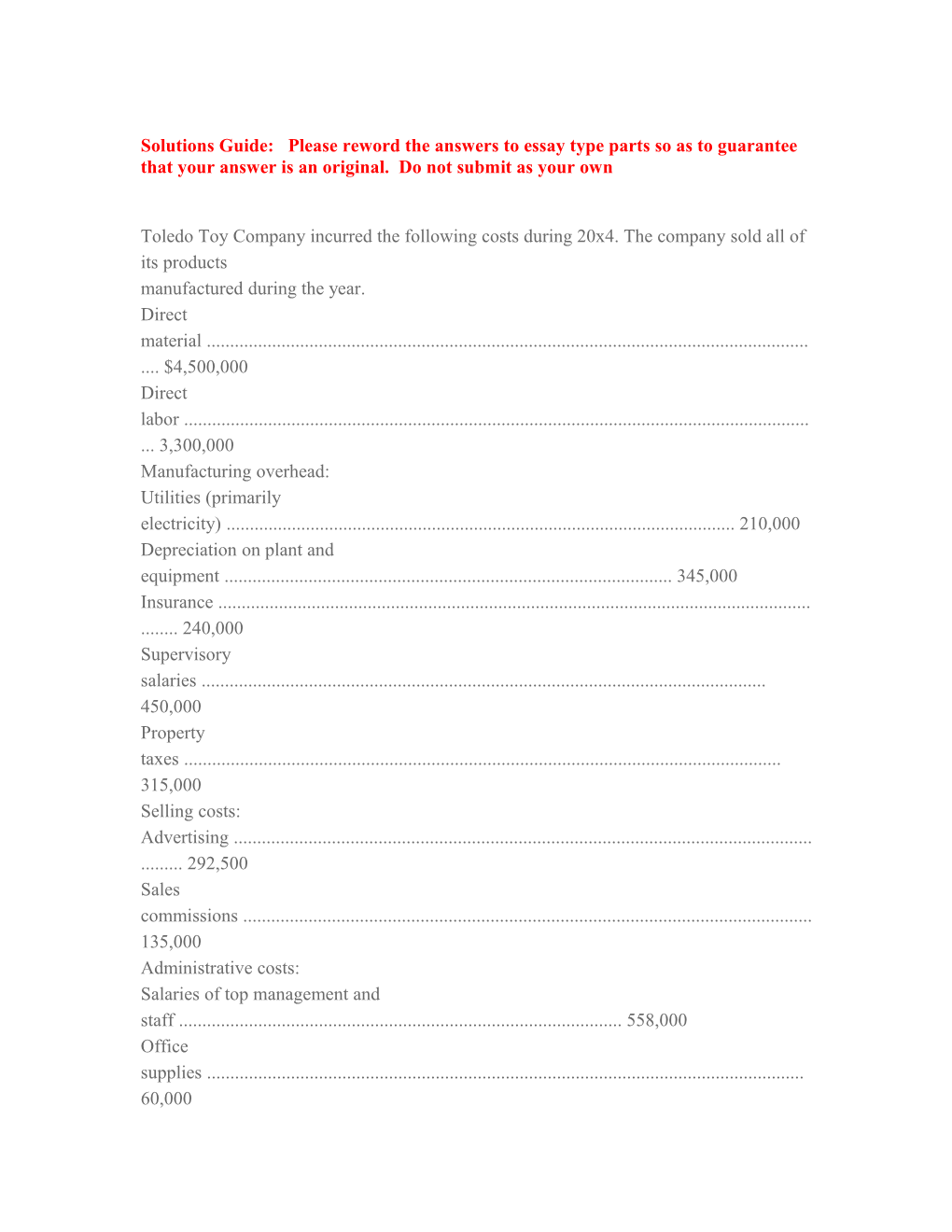

Toledo Toy Company incurred the following costs during 20x4. The company sold all of its products manufactured during the year. Direct material ...... $4,500,000 Direct labor ...... 3,300,000 Manufacturing overhead: Utilities (primarily electricity) ...... 210,000 Depreciation on plant and equipment ...... 345,000 Insurance ...... 240,000 Supervisory salaries ...... 450,000 Property taxes ...... 315,000 Selling costs: Advertising ...... 292,500 Sales commissions ...... 135,000 Administrative costs: Salaries of top management and staff ...... 558,000 Office supplies ...... 60,000 Depreciation on building and equipment ...... 120,000 During 20x4, the company operated at about half of its capacity, due to a slowdown in the economy. Prospects for 20x5 are slightly better. Jared Lowes, the marketing manager, forecasts a 30 percent growth in sales over the 20x4 level. Required: Categorize each of the costs listed above as to whether it is most likely variable or fixed. Forecast the 20x5 cost amount for each of the cost items listed above.

Variable 20x5 or Fixed Forecast Explanation Direct material...... V $5,850,000 $4,500,000 1.30 Direct labor...... V 4,290,000 $3,300,000 1.30 Manufacturing overhead Utilities (primarily electricity)...... V 273,000 $210,000 1.30 Depreciation on plant and equipment.. F 345,000 same Insurance...... F 240,000 same Supervisory salaries...... F 450,000 same Property taxes...... F 315,000 same Selling costs Advertising...... F 292,500 same Sales commissions...... V 175,500 $135,000 1.30 Administrative costs Salaries of top management and staff. . F 558,000 same Office supplies...... F 60,000 same Depreciation on building and equipment...... F 120,000 same

Chapter 2, pp. 75 - Complete problem 2-56 The following terms are used to describe various economic characteristics of costs. a. Opportunity cost b. Out-of-pocket cost c. Sunk cost d. Differential cost e. Marginal cost f. Average cost Required: Choose one of the terms listed above to characterize each of the amounts described below. 1. The management of a high-rise office building uses 3,100 square feet of space in the building for its own management functions. This space could be rented for $335,000. What economic term describes this $335,000 in lost rental revenue? 2. The cost of building an automated assembly line in a factory is $700,000. The cost of building a manually operated assembly line is $475,000. What economic term is used to describe thedifference between these two amounts? 3. Referring to the preceding question, what economic term is used to describe the $700,000 cost of building the automated assembly line? 4. The cost incurred by a mass customizer such as Dell Computer to produce one more unit in its most popular line of laptop computers. 5. The cost of feeding 400 children in a public school cafeteria is $740 per day, or $1.85 per child per day. What economic term describes this $1.85 cost? 6. The cost of including one extra child in a day-care center.

7. The cost of merchandise inventory purchased two years ago, which is now obsolete.

1. a Opportunity cost 5. f Average cost

2. d Differential cost 6. e Marginal cost

3. b Out-of-pocket cost 7. c Sunk cost

4. e Marginal cost

Chapter 2, pp. 76 - Complete problem 2-57 Piedmont Industries currently manufactures 40,000 units of part JR63 each month for use in production of several of its products. The facilities now used to produce part JR63 have a fixed monthly cost of $165,000 and a capacity to produce 74,000 units per month. If the company were to buy part JR63 from an outside supplier, the facilities would be idle, but its fixed costs would continue at $45,000. The variable production costs of part JR63 are $12 per unit.

1. If Piedmont Industries continues to use 40,000 units of part JR63 each month, it would realize net benefit by purchasing part JR63 from an outside supplier only if the supplier's unit price is less than what amount?

2. If Piedmont Industries is able to obtain part JR63 from an outside supplier at a unit purchase price of $14, what is the monthly usage at which it will be indifferent between purchasing and making part JR63?

1. If the company buys 40,000 units of Part JR63, at a price of $X per unit, its total cost will be: (40,000 $X) + $45,000

If the company manufactures the parts, its total cost will be: (40,000 $12) + $165,000

By equating these two expressions for total cost, we can solve for the price, X, at which the total cost is the same under the two alternatives: 40,000 X 45,000 40,000 12 165,000 40,000X 600,000 X 15 Thus the firm will realize a net benefit by purchasing Part JR63 if the outside supplier charges a price less than $15. 2. If the firm buys Y units of Part JR63 at a unit price of $14, the total cost will be: $14 Y $45,000 If the company manufactures Y units of Part JR63, the total cost will be: ($12 Y) $165,000 If we equate these expressions, we can solve for the number of parts, Y, at which the firm will be indifferent between making and buying Part JR63. 14 Y 45,000 12Y 165,000 2Y 120,000 Y 60,000 Thus, the company will be indifferent between the two alternatives if it requires 60,000 units of Part JR63 each month.