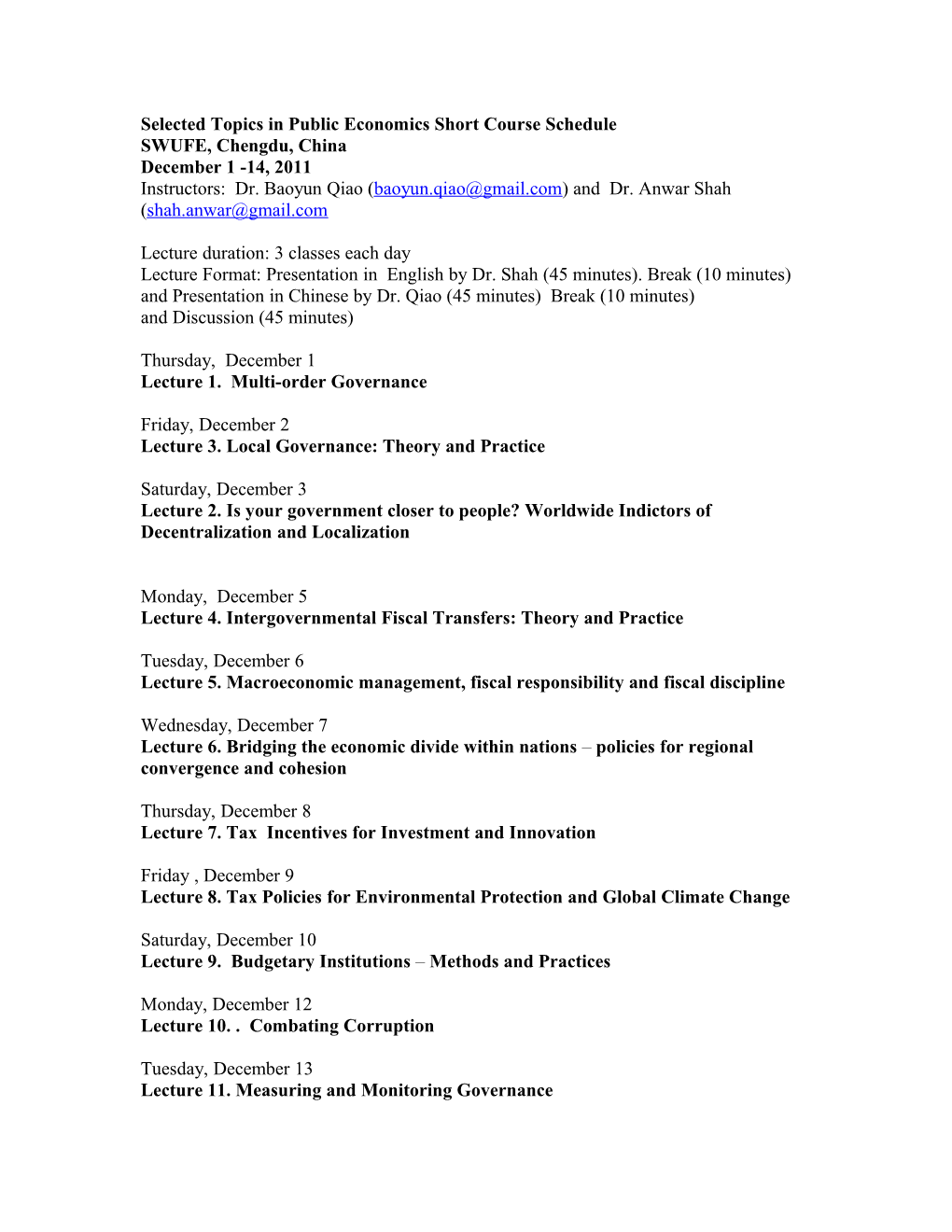

Selected Topics in Public Economics Short Course Schedule SWUFE, Chengdu, China December 1 -14, 2011 Instructors: Dr. Baoyun Qiao ([email protected]) and Dr. Anwar Shah ([email protected]

Lecture duration: 3 classes each day Lecture Format: Presentation in English by Dr. Shah (45 minutes). Break (10 minutes) and Presentation in Chinese by Dr. Qiao (45 minutes) Break (10 minutes) and Discussion (45 minutes)

Thursday, December 1 Lecture 1. Multi-order Governance

Friday, December 2 Lecture 3. Local Governance: Theory and Practice

Saturday, December 3 Lecture 2. Is your government closer to people? Worldwide Indictors of Decentralization and Localization

Monday, December 5 Lecture 4. Intergovernmental Fiscal Transfers: Theory and Practice

Tuesday, December 6 Lecture 5. Macroeconomic management, fiscal responsibility and fiscal discipline

Wednesday, December 7 Lecture 6. Bridging the economic divide within nations – policies for regional convergence and cohesion

Thursday, December 8 Lecture 7. Tax Incentives for Investment and Innovation

Friday , December 9 Lecture 8. Tax Policies for Environmental Protection and Global Climate Change

Saturday, December 10 Lecture 9. Budgetary Institutions – Methods and Practices

Monday, December 12 Lecture 10. . Combating Corruption

Tuesday, December 13 Lecture 11. Measuring and Monitoring Governance Wednesday, December 14 Course Examination

Thursday, December 15 Course Results posted

Reading List:

This course is intended to introduce participants with selected topics in public economics with special emphasis on public finances for multi-order governance.

Required readings are marked by an astrix (*) . All others are optional.

1. Multi-order governance: Principles and Practices . This session will also examine conceptual underpinnings and practices for the assignment of taxing, spending and regulatory responsibilities among various orders of government and beyond government regimes and entities.

Boadway, Robin and Anwar Shah (2009). Fiscal Federalism: The Principles and Practice of Multi-order Governance. New York and London: Cambridge University Press.

Feruglio, Nicolletta and Dallas Anderson (2008). Overview of Fiscal Decentralization. In Fiscal Decentralization Handbook edited by Nicolletta Feruglio and Dallas Anderson, Chapter 1. United Nations Development Program, Bratislava Regional Center.

Shah, Anwar (2004). Fiscal Decentralization in Developing and Transition Economies: Problems, Progress and the Potential. World Bank Working Paper Series.

*Shah, Anwar (2007). “Introduction: Principles of Fiscal Federalism.”in The Practice of Fiscal Federalism: Comparative Perspectives, edited by A. Shah, 3-42, Montreal and Kingston: McGill-Queen’s Press.

Shah, Anwar (2008). “Globalization, the Information Revolution, and Emerging Imperatives for Rethinking Fiscal Federalism”. In Macro Federalism and Local Finance, edited by Anwar Shah, chapter 2: 75-103. Washington, DC: World Bank.

Bird, R. (2008). Tax Assignment Revisited. IIB Working Paper 17. Institute for International Business. University of Toronto. Online: www.rotman.utoronto.ca/userfiles/iib/File/IIBversion Tax %20 Assignment %20 Revisited (1).doc

Brennan, G., Buchanan, J. M. (1980). The Power to Tax: Analytical Foundations of a Fiscal Constitution. Cambridge University Press, New York. Keen, M., Kotsogiannis, C. (2002). Does federalism lead to excessively high taxes? American Economic Review 92 (1), 363–370.

McLure, C. Jr. (1999). The Tax Assignment Problem: Conceptual and Administrative Considerations in Achieving Sub-national Fiscal Autonomy. Paper presented to Seminar on Intergovernmental Fiscal Relations and Local Financial Management organized by National Economic and Social Development Board of the Royal Thai Government and the World Bank, Chiang Mai, Thailand, February 24-March 5, 1999. Online: http://www.bndes.gov.br/clientes/federativo/bf_bancos/e0000744.pdf

OECD (2003). Fiscal Relations Across Levels of Government. OECD Economic Outlook 74. Chapter V. Online: http://www.oecd.org/dataoecd/58/18/23465547.pdf

2. Local Governance. This session will discuss the formulation and execution of collective action at the local level and specific role played by local governments in facilitating outcomes that enrich the quality of life of residents. Both the conceptual underpinnings of the role of local governments as well as the practice of alternative models of local governments and central-local relations will b e reviewed.

*Qiao, Baoyun and Anwar Shah, Local Government Organization and Finance: China: In Shah, Anwar, ed. (2006) Local Governance in Developing Countries . Chapter 4:137-167. Washington, DC: World Bank

Shah, Anwar, ed. (2006) Local Governance in Developing Countries . Washington, DC: World Bank

Shah, Anwar, ed. (2006). Local Governance in Industrial Countries. Washington, DC: World Bank

*Shah, Anwar and Furhawn Shah (2007). "Citizen-centred Local Governance: Strategies to combat democratic deficits," Development, Palgrave Macmillan Journals, 2007, vol. 50(1), pages 72-80, March.

Seabright, P. (1996). Accountability and decentralization in government: an incomplete contracts model. European Economic Review 40 (1), 61–89.

Shah, A. (1998). Balance, Accountability, and Responsiveness: Lessons about Decentralization. The World Bank. Online at: http://web.worldbank.org/WBSITE/EXTERNAL/WBI/EXTWBIGOVANTCOR/0,,contentMDK:2072524 8%7EmenuPK:1976990%7EpagePK:64168445%7EpiPK:64168309%7EtheSitePK:1740530,00.html

Shah, A. (2006). A Comparative Institution Framework for Responsive, Responsible, and Accountable Local Governance. The World Bank. Online at: http://web.worldbank.org/WBSITE/EXTERNAL/WBI/EXTWBIGOVANTCOR/0,,contentMDK:2072524 8%7EmenuPK:1976990%7EpagePK:64168445%7EpiPK:64168309%7EtheSitePK:1740530,00.html

Shah, A., Shah, S. (2006). The New Vision of Local Governance and the Evolving Roles of Local Governments. The World Bank. Online at: http://web.worldbank.org/WBSITE/EXTERNAL/WBI/EXTWBIGOVANTCOR/0,,contentMDK:2072524 8%7EmenuPK:1976990%7EpagePK:64168445%7EpiPK:64168309%7EtheSitePK:1740530,00.html 3. Is your government closer to the people? Worldwide Indicators of Localization and Decentralization. This session will present the conceptual framework for measuring various aspects of decentralization and localization. Countries will be ranked on political, administrative and fiscal decentralization criteria.

Ivanyna, Maksym and Anwar Shah , 2011. Is your Government Closer to the people? Worldwide Indicators of Localization and Decentralization. Unpublished paper

4. Intergovernmental Fiscal Transfers . This session will detail the instruments of intergovernmental finance in theory and practice. It will highlight the incentives, accountability implications, and potential impacts of various instruments and associated designs. Special attention will be given to performance oriented transfers to achieve results-based accountability while preserving autonomy and flexibility of decision making and to equalization transfers to ensure reasonably comparable levels of public services at reasonably comparable levels of taxation across the nation.

*Shah, Anwar (2007). A Practitioner’s Guide to Intergovernmental Fiscal Transfers. In Intergovernmental Fiscal Transfers, edited by Robin Boadway and Anwar Shah, 2007, chapter 1: 1-54. Washington, DC: World Bank

5. Decentralization and Macroeconomic Governance, Fiscal Responsibility, Fiscal Transparency and Fiscal Discipline Fiscal discipline and fiscal sustainability represents major challenges for most especially decentralized countries. This session will examine legal frameworks for ensuring fiscal transparency, fiscal discipline and prudent fiscal management. The incentive compatibility of various approaches in inducing fiscally responsible behavior will be examined. It will also examine as to what extent decentralized fiscal constitutions are incentive-compatible with prudent fiscal management.

*Kopits, George. 2004. Overview of Fiscal Policy Rules in Emerging Markets. in George Kopits, ed., Rule-Based Fiscal Policy in Emerging Markets: Background, Analysis and Prospects. New York: Palgrave Macmillan. Shah, Anwar. 2006. “Fiscal Decentralization and Macroeconomic Management” in International Tax and Public Finance (2006) 13:437-462. Ernesto Crivelli and Anwar Shah, 2009. Promoting Subnational Fiscal Discipline: A Review of Budget Institutions and their Impact on Fiscal Performance. Unpublished paper, World Bank, February 2009. Shah, Anwar, ed. (2008). Macro Federalism and Local Finance , Washington, D.C.: The World Bank Braun, M., Tommasi, M., 2002. Fiscal Rules for Subnational Governments: Some organizing principles and Latin American experiences. Prepared for the IMF/World Bank Conference on Rules- Based Fiscal Policy Fiscal Policy in Emerging Economies. Oaxaca, Mexico, February 14-16.

Corbacho, A., Schwartz, G., 2007. Fiscal Responsibility Laws. In: Kumar, M., Ter-Minassian, T. (eds). Promoting Fiscal Discipline. International Monetary Fund. Hallerberg, M., Strauch, R., von Hagen, J., 2004. The design of fiscal rules and forms of governance in European Union countries. Working Paper Series 419, European Central Bank.

Liu, L., Waibel, M., 2008. Subnational Borrowing, Insolvency, and Regulation. In: Shah, A. (ed). Macro Federalism and Local Finance. The World Bank.

Oliva, C., 2001. Fiscal Responsibility Laws: How Broad Should They Be? Paper presented at the International Seminar on Transparency and Fiscal Responsibility, Rio de Janeiro, November 26-27.

Poterba, J., von Hagen, J. (eds), 1999. Fiscal Institutions and Fiscal Performance. Chicago: University of Chicago Press.

Shah, A., 2008. Federalism and Macroeconomic Performance. In: Shah, A. (ed), Macro Federalism and Local Finance, The World Bank.

Singh, R., Plekhanov, A., 2005. How Should Subnational Borrowing be Regulated? Empirical Evidence from a Cross-Country Study. IMF Working Paper 05/54, International Monetary Fund.

Sutherland, D., Price, R., Joumard, I., 2005. Fiscal Rules for Sub-central Governments: Design and Impact. OECD Economics Department Working Papers 465.

Ter-Minassian, T., 2006. Fiscal Rules for Subnational Governments: Can They Promote Fiscal Discipline? OECD Journal on Budgeting 6(3), 111-121. von Hagen, J., 1991. A note on the Empirical Effectiveness of Formal Fiscal Restraints. Journal of Public Economics 44(2), 199-210. von Hagen, J., Harden, I., 1995. Budget Processes and Commitment to Fiscal Discipline. European Economic Review 39, 771-79.

Webb, S., 2004. Fiscal Responsibility Laws for Subnational Discipline: The Latin American Experience. WB Policy Research Working Paper 3309. The World Bank.

6. Policies for Regional Development and Cohesion . This session will examine alternative approaches to dealing with regional disparities.

*Boadway and Shah (2009), op.cit. Chapter 15, ‘Interregional Competition and Policies for Regional Cohesion and Covegence’, pp.498-516.

Shankar, Raja and Anwar Shah (2009). Lessons from European Union Policies for Regional Development. Unpublished paper, World Bank, Washington, DC.

Shankar, Raja and Anwar Shah (2003). "Bridging the Economic Divide within Nations: A Scorecard on the Performance of Regional Development Policies in Reducing Regional Income Disparities," World Development, 2003, 31(8): 1421-1441.

Rao, Govinda and Anwar Shah, editors (2009). States’ Fiscal Management and Regional Equity in India, New Delhi: Oxford University Press.

7. Tax Incentives for Investment and Innovation. Tax policy instruments to stimulate investment and innovation are widely practiced. Do these work and at what cost in terms of foregone revenues? This session will explore the efficacy of various tax incentives in stimulating investment and innovation per yuan of foregone revenues.

*Shah, Anwar, editor (1995). Fiscal Incentives for Investment and Innovation. New York and London: Oxford University Press. Overview chapter, 1-31.

Boadway, Robin and Anwar Shah (1995). Perspectives on the Role of Incvestment Incentives in Developing Countries. In Shah, Anwar, editor (1995). Fiscal Incentives for Investment and Innovation. New York and London: Oxford University Press. Chapter 1, 31-136

Slemroad, Joel (1995). Tax Policy Towards Foreign Direct Investment. In Shah, Anwar, editor (1995). Fiscal Incentives for Investment and Innovation. New York and London: Oxford University Press. Chapter 6, 289-308

8. Tax Policies for Environmental Protection and Combating Global Climate Change. This session will present a review of economic instruments to combat local pollution and global climate change. The discussion will cover, taxes and charges on congestion, pollution and effluents and tax incentives and tradable permits. Special attention will be given to carbon taxes for combating the greenhouse effect.

Jenkins, Glen and Ranjit Lamech , 1994. Green Taxes and Incentive Policies. San Francisco: ICS Press

Bjorn Larsen and Anwar Shah , 1995. “Global Climate Change, Energy Subsidies and National Carbon Taxes”. In Lans Bovenberg and Sijbren Cnossen, (eds) Public Economics and the Environment in An Imperfect World. 1995. Boston/London/Dordrecht: Kluwer Academic Publishers.

Bjorn Larsen and Anwar Shah, 1994. "Global Tradable Carbon Permits, Participation Incentives, and Transfers," Oxford Economic Papers 1994, 46 (0): 841-56. http://imagebank.worldbank.org/servlet/WDSContentServer/IW3P/IB/1994/06/01/000009265_39 70716141051/Rendered/PDF/multi_page.pdf

Bjorn Larsen and Anwar Shah “Combating the ‘Greenhouse Effect,” Finance and Development 1992, 29(4): 20-23.

Anwar Shah et al, 1995. “An Economic Assessment of Policy Instruments for Combating Climate Change.” In Bruce, James P. , Hoesung Lee and Erik F. Haites Climate Change 1995 - Economic and Social Dimensions of Climate Change. 1996. Contributions of Working Group III to the Second Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge, U.K.: Cambridge University Press.

9. Budgetary Institutions, Methods and Practices Budgetary institutions are observed to play a critical role in fiscal and economic outcomes. This session will discuss budget process and institutions. Further, modern public expenditure management (PEM) has shifted the role of budget systems from the traditional function of financial control to maintaining fiscal discipline and improving efficiency in resource allocation and service delivery. Results-oriented budgeting, allocating resources based on output expectations, has often been advocated as a tool to improve public sector performance. The session aims to introduce the concept of results- oriented (performance) budgeting, compare good practices in a few countries, and discuss its potential for application in developing countries.

Von Hagen, Jurgen (2007). Budgetary Institutions for Better Fiscal Performance. In Anwar Shah, ed., Budgeting and Budgetary Institutions, Chapter 1: 27-52. The World Bank, Washington D.C. Online: http://siteresources.worldbank.org/PSGLP/Resources/BudgetingandBudgetaryInstitutions.pdf

Sciavo-Campo S. (2007). “The Budget and its Coverage”, pp. 53-88, in Anwar Shah, ed., Budgeting and Budgetary Institutions, The World Bank, Washington D.C. Online: http://siteresources.worldbank.org/PSGLP/Resources/BudgetingandBudgetaryInstitutions.pdf

Shah Anwar and Chunli Shen (2007).”A Primer on Performance Budgeting”, pp.137-178, in Anwar Shah, ed., Budgeting and Budgetary Institutions, The World Bank, Washington D.C. Online: http://siteresources.worldbank.org/PSGLP/Resources/BudgetingandBudgetaryInstitutions.pdf Shah Anwar and Chunli Shen (2007).”Citizen-centric Performance Budgeting at the Local Level”, pp.151-178, in Anwar Shah, ed., Local Budgeting , The World Bank, Washington D.C.

Paul Samuel (2007). “India: Civic Participation in Subnational Budgeting”, pp.31-48, in Anwar Shah, ed., Participatory Budgeting, The World Bank, Washington D.C.

Filc, G., Scartascini, C., 2007. Budgetary Institutions. In: Lora, E. (ed), The State of State Reform in Latin America, Inter-American Development Bank, Washington, D.C.

Panzardi, R.O. (2005). Chile: Towards Results-Oriented Budgeting. En Breve 81, The World Bank. Online: http://siteresources.worldbank.org/INTENBREVE/Newsletters/20843624/81NOV05CHBUDGET.pdf

Rose, A. (2003). Results-Orientated Budget Practice in OECD Countries. Working Paper 209, OECD. Online:http://www.unescobkk.org/fileadmin/user_upload/epr/MTEF/04Financial_Planning/01Budgeting_P rocess/040118001Rose,%20Aidan%20(2003).pdf

Shaeffer, M., Yilmaz, S. (2008). Strengthening Local Government Budgeting and Accountability. Policy Research Working Paper 4767. The World Bank.

10.. Combating Corruption and Malfeasance Corruption is a symptom of failed governance. Dysfunctional governance arises because citizens lack the information about government performance in delivering services and are powerless to demand accountability from a government that fails to serve the public interest. This session will critically examine traditional policies to combat corruption and present a neo-institutional economics perspective on alternate approaches to curtail corruption

*Shah Anwar (2007). “Tailoring the Fight against Corruption to Country Circumstances”, pp. 233-254, in Anwar Shah, ed. Performance Accountability and Combating Corruption, The World Bank, Washington D.C. . Online: http://siteresources.worldbank.org/PSGLP/Resources/PerformanceAccountabilityandCombatingC orruption.pdf

*Purohit C. Mahesh (2007). “Corruption in Tax Administration”, pp.285-302, in Anwar Shah, ed. Performance Accountability and Combating Corruption, The World Bank, Washington D.C.

Ivanyna, Maksym and Anwar Shah, 2011. "Decentralization and corruption: new cross- country evidence" . Environment and Planning C: Government and Policy, 2011, 29(2) 344 – 362

Shah, Anwar. 2006. “Corruption and Decentralized Public Governance” in Handbook of Fiscal Federalism edited by Georgio Brosio and Ethisham Ahmad. New York- London: Edward Elgar Press.

Ivanyna, Maksym and Anwar Shah (2010). Decentralization (Localization) and Corruption: New Cross Country Evidence. Submitted to Environment and Planning Dye M. Kenneth (2007). “Corruption and Fraud Detection by Supreme Audit Institutions”, pp.303-321, in Anwar Shah, ed. Performance Accountability and Combating Corruption, The World Bank, Washington D.C.

Bac, A D (2007). “External Auditing and Performance Evaluations, with Special Emphasis on Detecting Corruption”pp.227-254, in Anwar Shah, ed., Local Financial Management. The World Bank, Washington DC.

Bardhan, P., Mookherjee, D. (2005). Decentralization, Corruption and Accountability: An Overview. In: S. Rose-Ackerman, Handbook of Economic Corruption, Edward Elgar. Available Online: http://globetrotter.berkeley.edu/macarthur/inequality/papers/BardhanDecent,Corruption.pdf

Ades, A., Di Tella, R. (1999). Rents, competition and corruption. American Economic Review 89 (4), 982–993.

Alexeev, M., Habodaszova, L. (2007). Decentralization, Corruption, and the Unofficial Economy. Working Paper 2007-008. Center for Applied Economics and Policy Research, Indiana University. Available Online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=990061 Arikan, G. (2004). Fiscal decentralization: a remedy for corruption? International Tax and Public Finance 11 (2), 175–195.

Asthana, A. (2008). Decentralization and Corruption: Evidence from drinking water sector. Public Administration and Development 28, 181-89.

Cai, H., Treisman, D. (2004). State corroding federalism. Journal of Public Economics 88 (3–4), 819– 843.

Fan, S.C., Lin, C., Treisman, D. (2009), Political decentralization and corruption: Evidence from around the world. Journal of Public Economics 93, 14-34.

Fisman, R., Gatti, R. (2002). Decentralization and corruption: evidence across countries. Journal of Public Economics 83 (3), 325–345.

Fjeldstad, O. (2003). Decentralization and Corruption. A review of the literature. Working Paper. Utstein Anti-Corruption Resource Centre. Available Online: http://www.u4.no/pdf/? file=/themes/pfm/decentralisation-and-corruption-fjeldstad-2003.pdf

Kaufmann, D. (2005). Myths and Realities of Governance and Corruption. The World Bank. Online at: http://web.worldbank.org/WBSITE/EXTERNAL/WBI/EXTWBIGOVANTCOR/0,,contentMDK:2072524 8%7EmenuPK:1976990%7EpagePK:64168445%7EpiPK:64168309%7EtheSitePK:1740530,00.html

Olken, B. A. (2007). Monitoring corruption: evidence from a field experiment in Indonesia. Journal of Political Economy 115 (2), 200–249.

Reinikka, R., Svensson, J. (2006). Using micro-surveys to measure and explain corruption. World Development 34, 359–379.

Shleifer, A., Vishny, R. W. (1993). Corruption. Quarterly Journal of Economics 108 (3), 599–618.

Svensson, J. (2003). Who must pay bribes and how much? Evidence from a cross section of firms. Quarterly Journal of Economics 118 (1), 207–230.

Svensson, J. (2005). Eight questions about corruption. Journal of Economic Perspectives 19 (3), 19–42.

Treisman, D. (2000). The causes of corruption: a cross-national study. Journal of Public Economics 76 (3), 399–457.

Veron, R., Williams, G. (2006). Decentralized Corruption or Corrupt Decentralization? Community Monitoring of Poverty-Alleviation Schemes in Eastern India. World Development 34(11), 1922-41.

11. Governance: Basic Concepts and Measurement The session will define various concepts of governance, analytical perspectives on governance and introduce institutions of accountability in governance. It will further discuss governance indicators, their measurement and provide a critical review of available worldwide governance indicators.

Readings – Basic Concepts : Pierre, Jon and Guy Peters, (2000). Different Ways to Think About Governance. In Governance, Politics and the State, by Jon Pierre and B. Guy Peters, Chapter 1: 14-27. London: Macmillan Press Ltd.

Andrews, Matthew and Anwar Shah. (2005). “Citizen-Centered Governance: A New Approach to Public Sector Reform”, in Anwar Shah, ed., Public Sector Governance and Accountability Series: Public Expenditure Analysis. World Bank, Washington DC.

Reading – Governance Measurement:

*Ivanyna, Maksym and Anwar Shah , 2011. Citizen-centric Governance Indicators: Measuring and Monitoring Governance by Listening to the People (with Maksym Ivanyna). CESifo Forum, 1/2011: 59-71

Huther, Jeff and Anwar Shah, 1998. “Applying a Simple Measure of Good Governance to the Debate on Fiscal Decentralization.” Policy Research Working Paper 1894, World Bank, Washington, D.C..

Kaufmann, D., Kraay, A., Mastruzzi, M. (2008). Governance Matters VII: Governance Indicators for 1996-2007. The World Bank. Online at: http://web.worldbank.org/WBSITE/EXTERNAL/WBI/EXTWBIGOVANTCOR/0,,contentMDK:2072524 8%7EmenuPK:1976990%7EpagePK:64168445%7EpiPK:64168309%7EtheSitePK:1740530,00.html

World Bank , 2006. A Decade of Measuring the Quality of Governance. Governance Matters 2006. Washington, DC: World Bank

Arndt, Christiane and Charles Oman, 2006, Uses and Abuses of Governance Indicators, Development Center Studies, OECD.

Iqbal, Kazi and Anwar Shah (2006). Governance Indicators : A Review. Unpublished paper, World Bank, Washington, DC.

Iqbal, Kazi and Anwar Shah (2008). “ How Do Worldwide Governance Indicators Measure Up?”, Unpublished paper, World Bank, Washington D.C.

Thompson, Theresa and Anwar Shah, 2005. Transparency International’s Corruption Perception Index: Whose Perceptions are they anyway? Available at: http;//www.worldbank.org/wbi/publicfinance

United Nations (2005). Good Governance Indicators Project. www.unhabitat.org/campaigns/governance/activities_6.asp\

United Nations Development Programme (2006), Governance Indicators: A User’s Guide, http://www.undp.org/oslocentre/docs04/UserGuide.pdf United Nations (2007), Public Governance Indicators: A Literature Review. http://unpan1.un.org/intradoc/groups/public/documents/un/unpan027075.pdf