Three Simple Steps to High Income With Larry Kendall, author of Ninja Selling

Step #1: Your Mindset and Your “Why”

A. Mindset: a set of beliefs or a way of thinking that determines one’s behavior, outlook, and mental attitude.

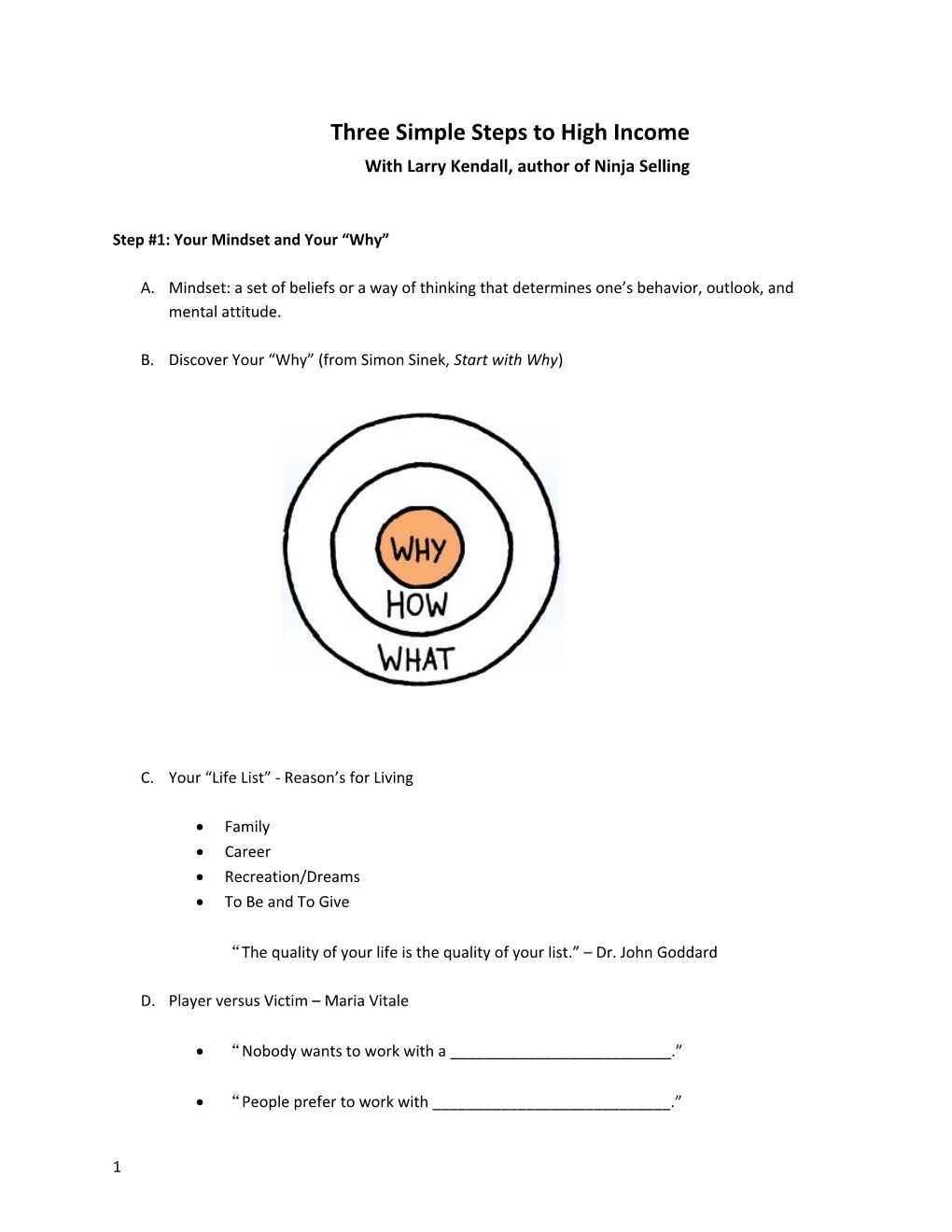

B. Discover Your “Why” (from Simon Sinek, Start with Why)

C. Your “Life List” - Reason’s for Living

Family Career Recreation/Dreams To Be and To Give

“The quality of your life is the quality of your list.” – Dr. John Goddard

D. Player versus Victim – Maria Vitale

“Nobody wants to work with a ______.”

“People prefer to work with ______.”

1 Your “vibe” is generated by what you are ______and ______.

E. Managing your Emotional Energy

F. Fixed and Growth Mindsets

Fixed: My intelligence and talent are fixed.

Growth: I can get better with hard work.

Virtually all great people have a ______.

Step 2: Your Goals and Success Formula

A. Your Financial Goals

B. Your Net Worth Goals

C. Your Success Formula

2 Divide your financial goal by 1,000 and that will show you how many households you need in your CRM to make your financial goal. (Each household is worth $1,000 in Gross Commission Income working the Ninja System.)

Build your CRM (data base) to the right size

Become the Realtor of Choice via FLOW

Develop your skills and systems to handle the business

D. Your CRM (Customer Relationship Manager) needs to be:

Mobile friendly

Have a calendar

Be simple and easy to use

“Your CRM is NOT a project to finish! It IS an organic, living record of your relationships and future income. IT REQUIRES WEEKLY MAINTENANCE!”

E. Organizing Your CRM

Family

o Names – his, hers, kids, dogs, etc.

o Birthdates – not ages!

o Anniversary dates – house, marriage

3 o Contact information – phone, email, Facebook, home address, work address

Occupation

o Where all family members work

o Positions and titles

o Work contact information

o When they started (anniversary)

Recreation

o Favorite hobbies

o Kids sports, arts, activities

o Favorite sports teams

o Favorite vacation spots

o Favorite restaurants

Dreams

o To live “anywhere”

o College for kids/grandkids

o Wake-Up Money of $______

o Bucket List

F. Prioritizing Your CRM

A = Advocate (proactively refers you)

B = Fan (refers you if asked)

C = Know, like, trust (will do business with you)

D = Goal to develop a relationship

4 Step #3: Your Activities and Habits “Success is a choice and a habit.”

A. The Challenge: Each person knows ______Realtors.

B. How do you become the Realtor of Choice? ______

“Flow fixes everything!” – Clara Capano

C. Two Kinds of Flow:

1. Live Flow

Face-to-Face, Voice-to-Voice

50 Live Interviews per week

2. Auto-Flow

Mail, email, social media

3 items of value per month (36 a year)

D. The best flow: ______and ______.

E. Your calendar should drive your calls.

F. Use 8 in 8 for rebranding yourself, building a relationship, or warming a stale data base

G. Focus on productive activities and production will take care of itself.

H. The Ninja Nine: 9 Habits for Generating Business (A Trendbender!)

5 1. ______

2. ______

3. ______

4. ______

5. ______

6. ______

7. ______

8. ______

9. ______

“Stop actually thinking about winning and losing and instead focus on those daily activities that cause success.” – Nick Saban, Head Football Coach, University of Alabama

“Are the habits you have today on a par with the dreams you have for tomorrow?” – Stephan Curry

“People do not decide their futures. They decide their habits and their habits decide their futures.” – F.M. Alexander

Initial Goal Setting Session

1. F.O.R.D.

Family:

o Associate’s Name: ______

6 o Address: ______

o Email:______

o Phone:______

o Birth date:______

o Anniversary______

o Start date: ______

o Spouse/Significant Name______o Email: ______o Phone: ______o Birth date: ______

o Children Name: ______o Birth date: ______o Notes: ______

o Children Name: ______o Birth date: ______o Notes: ______

o Children Name: ______o Birth date: ______o Notes:______

o Children Name: ______o Birth date: ______o Notes:______

o Pets & Names:______ Occupation

o Past Occupations: ______

7 o Spouse/Significant Occupations:______

o Children Occupations: ______

Recreation

o Hobbies:______

o Favorite sports teams______

o Favorite Restaurants______

o Favorite Vacation ______

o Other Fun:______

Dreams/Goals

8 o ______

2. Life List (Bucket List) - Attached

3. Financial Goal Worksheet - Attached

4. Net Worth Worksheet - Attached

5. Success Formula: Financial Goal ÷ 1000 = Size of Data Base

6. Data Base Formatting (Make sure your data base has a calendar & is mobile friendly.)

A = Will proactively refer you

B = Will refer you if asked

C = Will do business with you

E = Would like to get to know

9 Hot List = Wants to buy/sell in next 90 days

Warm List = Wants to buy/sell in the next year

7. Transaction Rate and becoming “Realtor of Choice”

The National Transaction Rate is 15%

The Transaction Rate in ______is ______%

8. FLOW System

8 x 8 (Rebranding)

3/month – Auto-flow – Combination or “Art” and “Science”

50 live interviews per week

9. Ninja Training – Ninja 9 activities

10. Interview/shadow five top producers

My Life List (Reasons for Living)

Family: Occupation/Career:

1. ______1. ______

2. ______2. ______

10 3. ______3. ______

4. ______4. ______

5. ______5. ______

6. ______7. ______

7. ______8. ______

9. ______9. ______

10. ______10. ______

Recreation/Dreams: To Be & To Give:

1. ______1. ______

2. ______2. ______

3. ______3. ______

4. ______4. ______

5. ______5. ______

6. ______6. ______

7. ______7. ______

8. ______8. ______

9. ______9. ______

10. ______10. ______

“Financial Goals”

DECIDE WHAT YOU WANT! (Not What You Think You Can Have!)

MINE TO KEEP = $ ______

11 (Deposit in my “Feel Good” Account)

RECREATION = $ ______

PERSONAL GROWTH = $ ______

FAMILY GROWTH = $ ______

BUSINESS GROWTH = $ ______

DEBT REDUCTION = $ ______

CREATURE COMFORTS = $ ______(Annual Living Expenses)

CREATURE COMFORTS = $ ______(Large Purchases)

BUSINESS COSTS = $ ______

RETIREMENT FUNDS = $ ______

TO GIVE = $ ______

INVESTMENTS = $ ______

TAXES = $______RECEIVING GOAL = $ ______Net Worth Goal Worksheet

Current Net Worth ______(date)

What I Own (A) What I Owe (B)

$______Cash and Savings $______Current Bills $______Automobiles (Value) $______Automobiles (Loans)

12 $______Retirement Plan $______Credit Card Balance $______Insurance (Cash Value) $______Taxes Owed $______Home Value $______Home Loan(s) $______2nd Home/Vacation Home $______2nd Home Loan $______Group Stock $______Line of Credit $______Stocks/Mutual Funds $______Loans $______Properties (Total Value) $______Property Loans $______Other Investments $______Other Debts

$______Total $______Total

$______Net Worth (A total – B total)

Net Worth Goal ______(date)

What I Own (A) What I Owe (B)

$______Cash and Savings $______Current Bills $______Automobiles (Value) $______Automobiles (Loans) $______Retirement Plan $______Credit Card Balances $______Insurance (Cash Balance) $______Taxes Owed $______Home Value $______Home Loan $______2nd Home/Vacation Home $______2nd Home Loan $______Group Stock $______Line of Credit $______Stocks/Mutual Funds $______Loans $______Properties (Total Value) $______Property Loans $______Other Investments $______Other Debts

$______Total $______Total

$______Net Worth (A total)

13