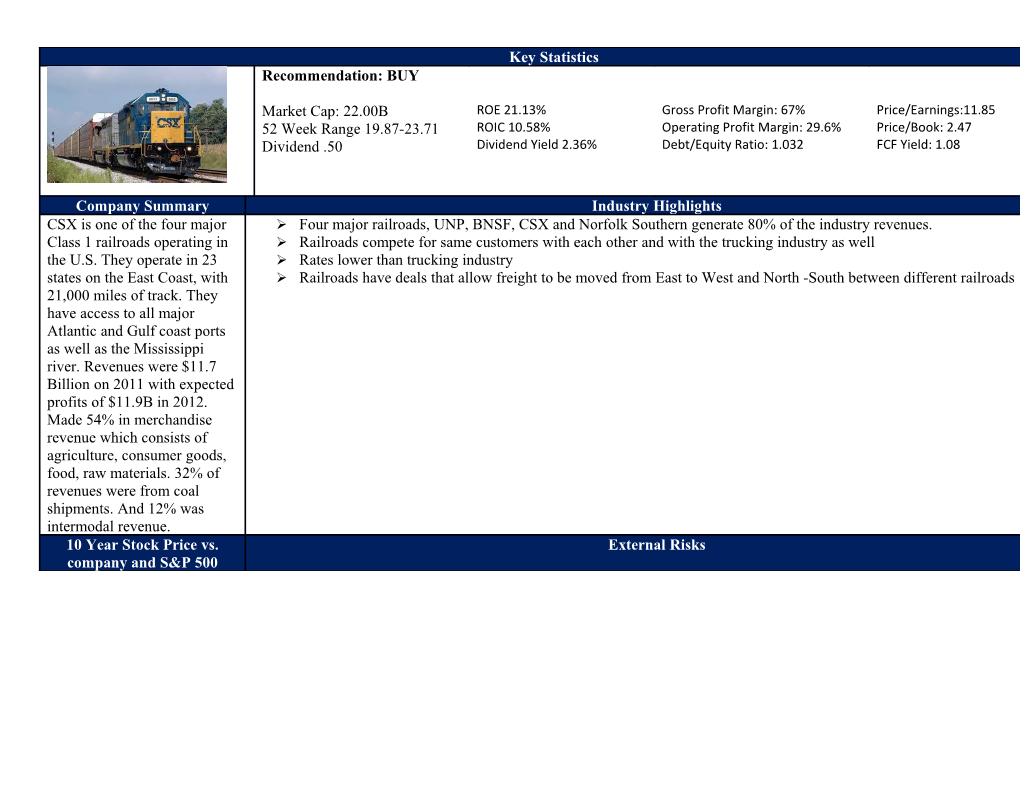

Key Statistics Recommendation: BUY

Market Cap: 22.00B ROE 21.13% Gross Profit Margin: 67% Price/Earnings:11.85 52 Week Range 19.87-23.71 ROIC 10.58% Operating Profit Margin: 29.6% Price/Book: 2.47 Dividend .50 Dividend Yield 2.36% Debt/Equity Ratio: 1.032 FCF Yield: 1.08

Company Summary Industry Highlights CSX is one of the four major Four major railroads, UNP, BNSF, CSX and Norfolk Southern generate 80% of the industry revenues. Class 1 railroads operating in Railroads compete for same customers with each other and with the trucking industry as well the U.S. They operate in 23 Rates lower than trucking industry states on the East Coast, with Railroads have deals that allow freight to be moved from East to West and North -South between different railroads 21,000 miles of track. They have access to all major Atlantic and Gulf coast ports as well as the Mississippi river. Revenues were $11.7 Billion on 2011 with expected profits of $11.9B in 2012. Made 54% in merchandise revenue which consists of agriculture, consumer goods, food, raw materials. 32% of revenues were from coal shipments. And 12% was intermodal revenue. 10 Year Stock Price vs. External Risks company and S&P 500 Fluctuating demand for services could result in congestion and reduced velocity or in restructuring costs stemming from reduced demand. Subject to significant government regulation including health, safety, labor and environmental laws which require CSX to maintain many licenses and permits. Sensitive to general economic conditions Required to transport hazardous materials which in the event of an accident could lead to significant liabilities.

Pros Cons Bought back $1.6B in 32% of revenues comes from the transport of coal which is a volatile industry shares in 2011, with Highly correlated with the general economy another $734m Highly capital intensive industry authorized by end of Less efficient business model than East- West railroads because of less double track or double stack 2012 Rail industry expected to see increased volume and profits in the coming years with rising gas prices. Tracks reach 2/3 of Americans Increasing intermodal capacity Major player in an industry with few dominant players, largest operator on the East Coast. Has agreements to expand track foot print with many state Business Summary: CSX is one of the nation’s oldest Class I railroads, tracing its history back to the Baltimore & Ohio railroad in 1827. CSX has existed in its current capacity since it was incorporated in 1978 in Virginia following the merger of the Chessie system and Seabord Coast Line into the CSX company. CSX later acquired key portions of Conrail allowing CSX to link New England and New York with Chicago and the rest of the Midwest and a rapidly growing South East market.

CSX currently operates approximately 21,000 miles of track in 23 states plus the District of Columbia and the Canadian provinces of Quebec and Ontario. This means that over 2/3rds of Americans live within CSX service territory. CSX also services all major East and Gulf Coast ports as well as those on the Mississippi River and the Great Lakes. CSX owns or operates 4,164 locomotives and 70,368 freight cars as of Q3 2012.

CSX generated $11.7 billion in revenue in FY 2011, with revenues expected to increase to $11.9 billion for FY 2012. In 2011 CSX derived 54% of their revenues from their merchandise business which includes agricultural, automotive, consumer goods, food and raw material shipments. 32% of revenues were from coal shipments with another 12% of revenues coming from the intermodal business. Revenue- ton- miles through 9/28/2012 were 167.3 billion, a slight decrease from 2011 through the same period. EPS for the last twelve months is $1.79 vs. $1.67 for FY 2011, an increase of 7.8%.

Business Analysis: CSX is the largest Class I railroad on the East Coast, with Norfolk Southern a close second. CSX’s service network allows them to reach over 2/3rds of American’s, which puts CSX in a position of strong growth. Over the past 3 years CSX has become the most efficient railroad in the U.S. decreasing their operating ratio from 77.6 in 2007 to 70.9 in 2011, a substantial improvement which will lead to increase profitability in the coming years with the potential to further reduce its ratio.

CSX has entered into several deals with state and local governments to facilitate the construction of infrastructure which will allow CSX to double stack cars. This will lead to substantial increases in efficiency and profitability over the coming years as the projects are completed. CSX is in the process of building the first sections of double stack track in the New England which will allow trains from the Midwest to connect to Massachusetts where CSX has several key hubs. CSX is a principle member of the National Gateway project, which will allow the use of double stack trains from the mid-Atlantic region to the Mississippi river.

With the increase in intermodal business expected to continue, CSX has invested in three new intermodal facilities, one in Ohio, one in Massachusetts and in Louisville Kentucky to handle the additional volumes.

CSX increased profitability has allowed them to repurchase over 298 million shares with plans to buy back an additional $2 billion worth between 2011 and 2012. It has also allowed them to increase capital expenditures to improve infrastructure to meet the requirements of the Positive Train Control act which goes into effect in 2015. These additional capital expenditures will be amortized over a long period, during which time they will be offset by the resulting efficiency improvements. CSX’s ROE, ROIC and ROA have steadily increased over the past 4 years, with 2012 expected to be no different. Free cash flow has varied based on the amount of capital expenditures, but it is expected to increase in the coming years as CSX reduces expenditures. Given reduced expenditures and increasingly favorable operating ratios, CSX should see increased profitability even if revenues slip as a result of the economic environment. At the time of purchase CSX stock was trading at a P/E of around 9.6, well below its historical average of 14 and the S+P average of 15.

Business Risks: The largest risk CSX faces, is economic instability. CSX revenues are highly dependent on the economy as a whole. When manufacturers and suppliers face decreased customer demand, the volume of goods shipped drops. CSX has experienced this with the volume of its coal shipments declining as energy providers switch to cleaner, more efficient and cheaper natural gas to power their plants. A prolonged recession would result in CSX profitability being reduced substantially as it restructures to cope with the decreased demand. On the other hand a significant increase in demand for rail services could also negatively affect CSX as it may result in increased congestion and reduced train velocities.

CSX is subject to substantial government regulation and oversight which has resulted in required increases in capital expenditures. In 2008 Congress passed the Positive Train Control Act, which requires all major Class I railroads to upgrade the safety systems throughout their entire infrastructure including locomotives, track, freight cars, signals and yards to meet more stringent safety regulations. CSX has estimated their spending on PTC to be $1.2 billion by 2015. CSX also faces possible increased environmental, health, safety, labor, or pricing regulation which would affect their profitability.

CSX also is required by law to transport hazardous materials, which in the event of an accident could result in substantial personal injury, property or natural resource damage as well as remediation and environmental penalties.

CSX also is subject to supplier risk as there are few manufacturers of locomotives, rail cars and track. This means CSX could face significant cost increases associated with supply shortages.

Other possible risks include work stoppages and competition from other forms of transportation including truck and ship.

Industry Overview and Outlook: In the U.S. there are four major Class I railroads, Union Pacific, Burlington Northern Santa- Fe, Norfolk Southern and CSX. These four major Class I railroads generating 80% of the $65 billion total industry revenues in 2011. This sort of oligarchy benefits these four railroads as they have exclusive rights to tracks and terminals. Within the rail industry there are two main models, East-West and North-South. East-West is more efficient because of its long haul, double track/ double stack advantage. The two main East-West railroads are UNP and BNSF which operate west of the Mississippi river. NSF and CSX are both North-South railroads, which means shorter duration and fewer places with the ability to double track and stack cars.

Railroads have favorable economics compared to trucking with the average train able to move the equivalent of 280 trucks at any one given time. The four major Class I railroads average close to 500 miles per gallon per ton of freight moved, which is significantly more efficient and environmentally friendly as compared to trucks. With rising fuel prices and more stringent emissions regulations, rail-roads are well positioned to benefit from manufacturers and suppliers looking for alternative ways to ship their goods. As a result of greater operating efficiency, rail roads are often a more cost effective way to ship goods long distance. One drawback to rail is they tend to be slower and more inflexible in schedules as a result of the rail road infrastructure as compared to the road network.

Railroads primary competition comes from the trucking industry which benefits heavily from government funded infrastructure including highways, bridges and tunnels. Railroads are forced to pay for their own infrastructure often with little to no government or municipal assistance. Other advantages trucking has over rail is a vast interconnected network which allows a single truck to travel across country, as compared to trains where the goods going from East to West have to be turned over to another carrier around the Mississippi river.

Valuation:

Change in Change in Working Period Revenues NOP Adj. Taxes NOPAT Invest Deprec. Invest. Capital FCFF Discount factor Discounted FCFF 0 11780 1 13841.5 3352.41 1310.52 2041.89 2375.2 1231.89 1143.31 31.95 866.63 0.93 805.97 2 16263.76 3939.08 1539.87 2399.21 2790.86 1447.47 1343.39 37.55 1018.27 0.87 885.89 3 19109.92 4628.42 1809.34 2819.08 3279.26 1700.78 1578.48 44.12 1196.48 0.81 969.15 4 22454.16 5438.4 2125.98 3312.42 3853.13 1998.42 1854.71 51.84 1405.87 0.75 1054.4 5 26383.63 6390.12 2498.03 3892.09 4527.43 2348.14 2179.29 60.91 1651.89 0.7 1156.32 6 31000.77 7508.39 2935.18 4573.21 5319.73 2759.07 2560.66 71.57 1940.98 0.65 1261.64 7 36425.91 8822.36 3448.84 5373.52 6250.69 3241.91 3008.78 84.09 2280.65 0.61 1391.2 8 42800.44 10366.27 4052.38 6313.89 7344.56 3809.24 3535.32 98.81 2679.76 0.57 1527.46 9 50290.52 12180.36 4761.55 7418.81 8629.85 4475.86 4153.99 116.1 3148.72 0.53 1668.82 10 59091.36 14311.93 5594.82 8717.11 10140.08 5259.13 4880.95 136.41 3699.75 0.49 1812.88 Residual 118202.1 57919.01

Discounted Discounted Less Excess Corporate Short- Total Less Short- Total Value to Intrinsic Return Residual Term Corporate Preferred Term Common Stock Period FCFF Value Assets Value Less Debt Stock Liabilities Equity Value 12533.73 57919.01 2301 72753.74 -8160 0 -3066 61527.74 58.6