INDEX

CONTENTS PAGE NO.S

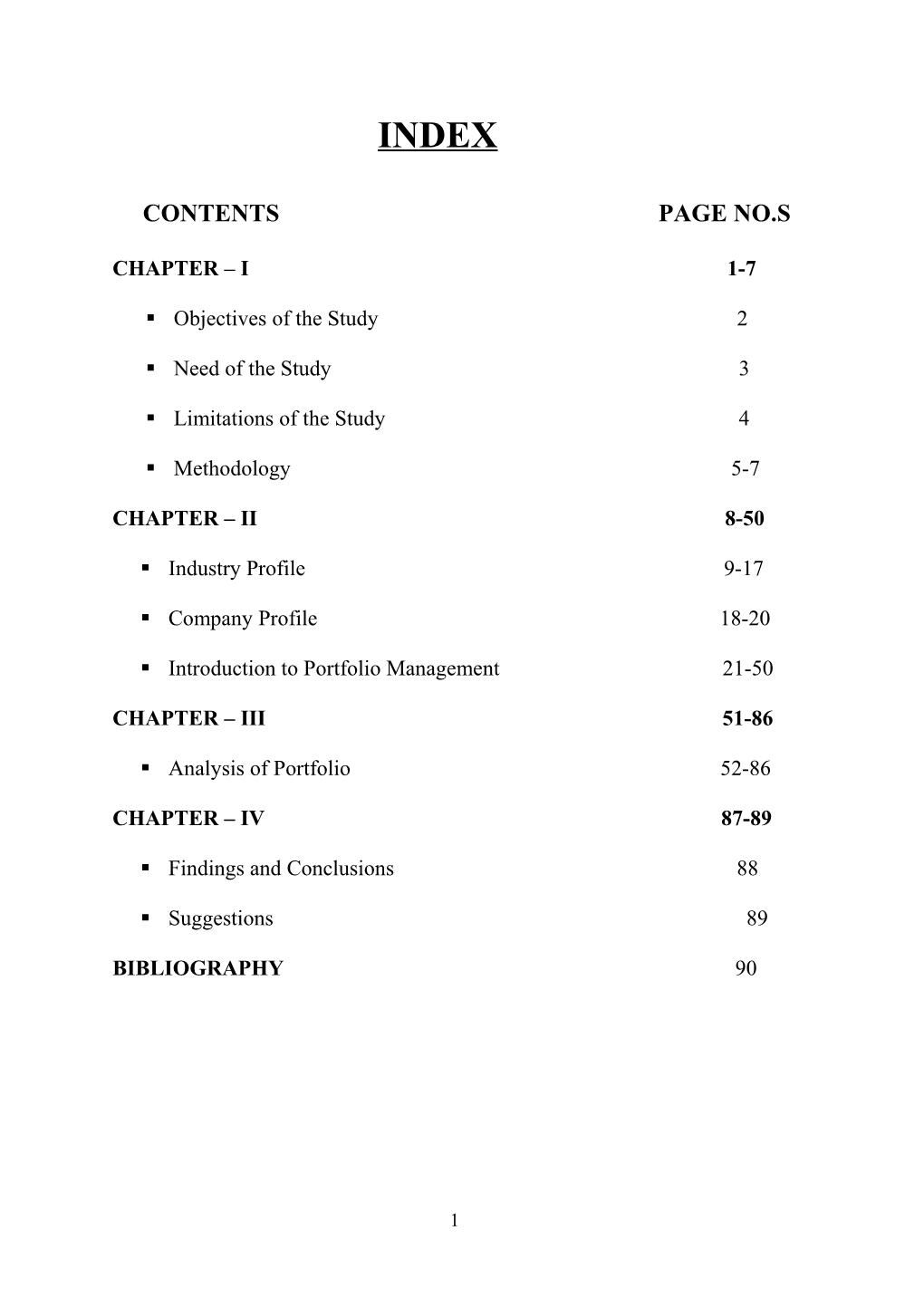

CHAPTER – I 1-7

. Objectives of the Study 2

. Need of the Study 3

. Limitations of the Study 4

. Methodology 5-7

CHAPTER – II 8-50

. Industry Profile 9-17

. Company Profile 18-20

. Introduction to Portfolio Management 21-50

CHAPTER – III 51-86

. Analysis of Portfolio 52-86

CHAPTER – IV 87-89

. Findings and Conclusions 88

. Suggestions 89

BIBLIOGRAPHY 90

1 CHAPTER - I

2 OBJECTIVES OF THE STUDY

The main objective is analyzing the risk return characteristics of individual securities in the portfolio. To identify group of securities from the available securities for better selection of a portfolio for invest. To suggest the best portfolio mix among the selected portfolios. To compare the risk& returns of the each set of portfolio.

(MAJOR HEADING FONT SIZE 14, TEXT & PARAGRAPH 12)

3 LIMITATIONS OF THE STUDY:

The study has certain limitation / constraints, which has led to the obstruction of widening the scope and objectives of the study.

The fulfillment of project limited to 45days. Construction of portfolio restricted to two – assets based in Markowitz model. From B.S.E. listing – a very few and randomly selected scrip’s are analyzed. Limited industries are only covered in the study.

4 SCOPE OF THE STUDY :

This study covers the Markowitz model of portfolio management. Here in, order to find out at what percentage of funds should be invested among the companies in the portfolio. Also the study includes the calculations of individual standard deviations securities involved in the portfolio. These percentages help in allocating the funds available for investment based on risky portfolios.

5 NEED OF THE STUDY:

In the finance field, it is a common knowledge that money or finance is scarce and that investors try to maximize their return. But, the return is higher, if the risk is also higher. Return and risk go together and they have a tradeoff. The art of investment is to see that the return is maximized with the minimum of risk, which is inherent in invest.

In the above discussion, we concentrated on the word ”investment” and for making invest we need to make securities analysis. Combination of securities with different risk return characteristics will constitute the portfolio of the investor. The portfolio is also built up out of the wealth or income of the investor over a period of time, with a view to suit his risk or return preferences to that of the portfolio analysis is thus an analysis of the risk return characteristics of individual securities in the portfolio and changes that Apr take Place in combination with other securities due to interaction among themselves and impact of each one of them on others.

6 METHODOLOGY

For implementing the study, 11 securities or stocks constituting the sensex Market are selected of one-year opening and closing share movement prices data from BSE dated, from March 2010 to March 2011. In order to know the return of each stock or security, the formula, which is used, is given below: Closing price-opening price R=------*100 Opening price To know the average (R) the following formula has been used R Average(R) = ------N The next step is to know the risk of the stock or security; the following formula given below: ______Std.Dev = variance

N Variance =1/n-1 (R-R) 2

T=1

Where

(R-R) 2= squares of difference between sample and mean

N =number of sample observations

After that, the correlation of the securities is calculated by using the following formula:

7 COVAB Correlation coefficient (rAB) = ______

(A)(B) n

Co-variance (COV AB) =1/n(RA- RA)(RB-RB)

T=1

Where,

(RA-RA)(RB-RB)=combined deviations of A&B

(A)(B)=standard deviation of A&B

COVAB=covariance between A&B

N=no of observations

The next would be the construction of the optimal portfolio on the basis of what percentage of investment should be invested when two securities and stocks are combined i.e. calculation of two assets portfolio weights by using minimum variance equation, which is given below

B (B-rABA) WA= ------2 2 A +B -2rABAB

WB=1-WA

Where:

WA=proportion of investment in A

8 WB=proportion of investment in B

The next and final step is to calculate the portfolio risk (combined risk) that shows how much is the risk is reduced by combining two stocks or securities by using this formula.

Formula:

2 2 2 2 P=A WA +B WB +2rABABWAWB

Where

P=PortfolioRisk

A= Standard Deviation of Security A

WA= Portfolio of Investment in security A

B= Standard Deviation of Security B

WB= Proportion of Investment in Security B rAB= Correlation Coefficient between security A&B.

9 CHAPTER – II

10 INDUSTRY PROFILE

11 The following diagram gives the structure of Indian Financial system.

12 FINANCIAL MARKET: Financial Markets are helpful to provide liquidity in the system and for smooth functioning of the system. These Markets are the centers that provide facilities for buying and selling of financial claims and services. The financial Markets match the demands of investment with the supply of capital from various sources.

According to functional basis financial Markets are classified into two types. They are: Money Markets (short-term) Capital Markets (long-term) According to institutional basis again classified in to two types. They are Organized financial Market Non-organized financial Market.

The organized Market comprises of official Market represented by recognized institutions, bank and government (SEBI) registered/controlled activities and intermediaries. The unorganized Market is composed of indigenous bankers, moneylenders, individual professional and non- professionals.

MONEY MARKET: Money Market is a place where we can raise short-term capital. Again the money Market is classified in to Inter bank call money Market Bill Market and Bank loan Market Etc. E.g.; treasury bills, commercial papers, CD's etc

13 CAPITAL MARKET: Capital Market is a place where we can raise long-term capital. Again the capital Market is classified in to two types and they are PriMary Market and Secondary Market. E.g.: Shares, Debentures, and Loans etc.

PRIMARY MARKET:

PriMary Market is generally referred to the Market of new issues or Market for mobilization of resources by the companies and government undertakings, for new projects as also for expansion, modernization, addition, and diversification and up gradation. PriMary Market is also referred to as New Issue Market. PriMary Market operations include new issues of shares by new and existing companies, further and right issues to existing shareholders, public offers, and issue of debt instruments such as debentures, bonds, etc. The priMary Market is regulated by the Securities and Exchange Board of India (SEBI a government regulated authority).

14 Function: The main services of the priMary Market are origination, underwriting, and distribution. Origination deals with the origin of the new issue. Underwriting contract make the shares predictable and remove the element of uncertainty in the subscription. Distribution refers to the sale of securities to the investors. The following are the Market intermediaries associated with the Market: 1. Merchant banker/book building lead manager 2. Registrar and transfer agent 3. Underwriter/broker to the issue 4. Adviser to the issue 5. Banker to the issue 6. Depository 7. Depository participant Investors’ protection in the priMary Market: To ensure healthy growth of priMary Market, the investing public should be protected. The term investor protection has a wider meaning in the priMary Market. The principal ingredients of investors’ protection are: Provision of all the relevant information Provision of accurate information and Transparent allotment procedures without any bias.

15 SECONDARY MARKET

The priMary Market deals with the new issues of securities. Outstanding securities are traded in the secondary Market, which is commonly known as stock Market or stock exchange. “The secondary Market is a Market where scrip’s are traded”. It is a Market place which provides liquidity to the scrip’s issued in the priMary Market. Thus, the growth of secondary Market depends on the priMary Market. More the number of companies entering the priMary Market, the greater are the volume of trade at the secondary Market. Trading activities in the secondary Market are done through the recognized stock exchanges which are 23 in number including Over The Counter Exchange of India (OTCE), National Stock Exchange of India and Interconnected Stock Exchange of India. Secondary Market operations involve buying and selling of securities on the stock exchange through its members. The companies hitting the primary Market are mandatory to list their shares on one or more stock exchanges in India. Listing of scrip’s provides liquidity and offers an opportunity to the investors to buy or sell the scrip’s. The following are the intermediaries in the secondary Market: 1. Broker/member of stock exchange – buyers broker and sellers broker 2. Portfolio Manager 3. Investment advisor 4. Share transfer agent 5. Depository 6. Depository participants.

16 STOCK MARKETS IN INDIA:

Stock exchanges are the perfect type of Market for securities whether of government and semi-govt bodies or other public bodies as also for shares and debentures issued by the joint-stock companies. In the stock Market, purchases and sales of shares are affected in conditions of free competition. Government securities are traded outside the trading ring in the form of over the counter sales or purchase. The bargains that are struck in the trading ring by the members of the stock exchanges are at the fairest prices determined by the basic laws of supply and demand.

Definition of a stock exchange:

“ Stock exchange means any body or individuals whether incorporated or not, constituted for the purpose of assisting, regulating or controlling the business of buying, selling or dealing in securities.” The securities include:

Shares of public company. Government securities. Bonds

History of Stock Exchanges:

The only stock exchanges operating in the 19th century were those of Mumbai setup in 1875 and Ahmedabad set up in 1894. These were organized as voluntary non-profit- Marking associations of brokers to regulate and protect their interests. Before the control on securities under the constitution in 1950, it was a state subject and the Bombay securities contracts (control) act of 1925 used to regulate trading in securities. Under this act, the Mumbai stock exchange was recognized in 1927 and Ahmedabad in 1937. During the war boom, a number of stock exchanges were organized. Soon after it became a central subject, central legislation was proposed and a committee headed by A.D.Gorwala went into the bill for securities regulation. On the basis of the committee’s recommendations and public discussion, the securities contract (regulation) act became law in 1956. 17 Functions of Stock Exchanges:

Stock exchanges provide liquidity to the listed companies. By giving quotations to the listed companies, they help trading and raise funds from the Market. Over the hundred and twenty years during which the stock exchanges have existed in this country and through their medium, the central and state government have raised crores of rupees by floating public loans. Municipal corporations, trust and local bodies have obtained from the public their financial requirements, and industry, trade and commerce- the backbone of the country’s economy-have secured capital of crores or rupees through the issue of stocks, shares and debentures for financing their day-to-day activities, organizing new ventures and completing projects of expansion, diversification and modernization. By obtaining the listing and trading facilities, public investment is increased and companies were able to raise more funds. The quoted companies with wide public interest have enjoyed some benefits and assets valuation has become easier for tax and other purposes.

Various Stock Exchanges in India:

There were 23 stock exchanges recognized under the securities contracts (regulation), Act, 1956 but present only NSE & BSE are active. Those are:

Ahmedabad Stock Exchange Association Ltd.

Bangalore Stock Exchange

Bhubaneshwar Stock Exchange Association

Calcutta Stock Exchange

Cochin Stock Exchange Ltd.

Coimbatore Stock Exchange

Delhi Stock Exchange Association 18 Guwahati Stock Exchange Ltd

Hyderabad Stock Exchange Ltd.

Jaipur Stock Exchange Ltd

Kanara Stock Exchange Ltd

Ludhiana Stock Exchange Association Ltd

Madras Stock Exchange

Madhya Pradesh Stock Exchange Ltd.

Magadh Stock Exchange Limited

Meerut Stock Exchange Ltd.

Mumbai Stock Exchange

National Stock Exchange of India

OTC Exchange of India

Pune Stock Exchange Ltd.

Saurashtra Kutch Stock Exchange Ltd.

Uttar Pradesh Stock Exchange Association

Vadodara Stock Exchange Ltd.

19 NETWORTH STOCK BROKING LTD.

INTRODUCTION:

Ever since its inception in 1993, Networth Stock Broking Limited (NSBL) has sought to provide premium financial services and information, so that the power of investment is vested with the client. We equip those who invest with us to make intelligent investment Novisions, providing them with the flexibility to either tap into our extensive knowledge and expertise, or make their own Novisions.

NSBL made its debut into the financial world by servicing Institutional clients, and proved its high scalability of operations by growing exponentially over a short period of time. Now, powered by a top-notch research team and a network of experts, we provide an array of retail broking services across the globe - spanning India, Middle East, Europe and America. We are a Depository participant at Central Depository Services India (CDSL) and National Securities Depository (NSDL).

Our strong support, technology-driven operations and business units of research, distribution and advisory coalesce to provide you with a one-stop solution to cater to all your broking and investment needs. Our customers have been participating in the booming commodities Markets with our membership at the Multi Commodity Exchange of India (MCX) and National Commodity & Derivatives Exchange (NCDEX) through Networth Stock.Com Ltd.

NSBL is a member of the National Stock Exchange of India Ltd (NSE) and the Bombay Stock Exchange Ltd (BSE) on the Capital Market and Derivatives (Futures & Options) segment. It is also a listed company at the BSE.

Networth Stock Broking Limited (NSBL) has sought to provide premium financial services and information.

20 VISION:

Owing to the vision and expertise of our team of experts, Networth has established itself as one of the premier financial services organization in India. Networth professionals form the backbone of the organization, pooling together their expertise from top financial service and broking houses.

A strong team of professionals experienced and qualified pool of human resources drawn from top financial service & broking houses form the back bone of our sizeable infrastructure. Highly technology oriented, the company's scalability of operations and the highest level of service standards has ensured rapid growth in the number of locations & the clients serviced in a very short span of time.

TEAM OF EXPERTS:

Raj Bhandari Director & Head – Dealing Mr. Raj Bhandari has over 8 years of Capital Market experience at NSBL. His expertise includes dealing and servicing the institutional and retail segments.

Girish Dev Head – Operations & Technology Over the span of 14 years, Mr. Girish Dev has acquired an in-depth knowledge of the Capital Market. His experience covers a wide spectrum, ranging from Arbitrage & Client dealing across several exchanges and client categories to setting up operations, including those of a Foreign Brokerage and one of the first major e-broking ventures in the country. He has led compliance, e-business and book-building IPO activities, and has also contributed in developing a technology-sustained infrastructure that supports broking trading and settlement.

S.P. Jain Chairman & Managing Director The priMary force behind the founding and the listing of Networth Stock Broking Ltd., S.P. Jain has propelled the company forward from its very origins. With over 14 years of 21 experience in the Capital Market and Financial services, he is at the helm of NSBL, working closely with the research division and guiding the organization to the forefront of financial services in India.

Sathyan RaDec Director & Head – Sales With over a Novade in the industry and experience in various capacities, Mr. Sathyan RaDec brings to NSBL insights from the length and breath of the financial sector. He has previously worked with Karvy Stock Broking Ltd., one of the largest retail networks in the country, and was responsible for establishing the company’s overseas network. His transition from research to sales Marked a significant step in his career.

J. Gopalakrishnan Vice President & Southern Region Head Mr. J. Gopal’s 15 years of Capital Market experience is replete with the distinguished leadership roles he has played in the organizations he was involved with. At Anush Shares & Securities Pvt. Ltd., where he served for 12 years, he was the Head of Operations. He has also headed the finance, trading & settlement operations at Karvy Stock Broking Ltd., where he worked for 3 years.

Suhas Bade Director Mr. Suhas Bade heads NSBL’s Investment Banking Division. As a Management Consultant, Mr. Bade has lead organizations through the various stages of their lifecycle to achieve and surpass growth targets. His wide-ranging experience in the field includes funds mobilization, placement of equity and BPR services for SME.

Satish Pasari Country Head – Distribution and Advisory From a career in consumer durables (with four years of experience with in Videocon International) to a comprehensive knowledge and experience in the equity Markets, Mr. Satish Pasari has acquired a gamut of experience across sectors. Over the span of 11 years, 22 Mr. Pasari has handled distribution of financial services in retail, HNI and institutional segments. He has previously worked with Karvy Stock Broking Ltd.

INTRODUCTION TO PORTFOLIO MANAGEMENT

23 INTRODUCTION TO PORTFOLIO MANAGEMENT

The art and science are making Novisions about investment mix and policy, matching investments to objective, asset allocation for individuals and institutions, and balancing risk vs., performance.

Portfolio management is all about strengths, weaknesses, opportunity, threats in the choice of debt., vs., equity, domestic., vs., international vs., growth vs., safety, and numerous other trades-offs encountered in the attempt to maximize return at a given appetite for risk.

A portfolio is a collection of securities. Since it is rarely desirable to invest the entire funds of an individual or an institution in a single security, it is essential that every security be view in portfolio context. Thus it seems logical that the expected return on a portfolio should depend on the expected return of each of the security contained in the portfolio.

24 Portfolio analysis considers the determination of future risk and return in holding various blends of individual securities. Portfolio expected return is a weighted average of the expected return is a weighted average of the expected of individual securities but portfolio variance, in short contrast, can be something less than a weighted average of a security variances. As a result an investor can sometimes reduce portfolio risk by adding security will greater individual risk than any other security in the portfolio. This is because risk depends greatly on the con variance among returns of individual securities. Portfolios, which are combination of securities Apr or Apr not take only aggregate characteristics of their individual parts.

Since portfolios expected return is a weighted average of the expected returns of its securities, the contribution of each security to the portfolios expected returns depends on its expedited returns and its proportionate share of the initial portfolio’s Market value it follows that an investor who simply wants the greatest possible expected return should hold one security, the one which is considered to have a greatest expected return. Very few investors do this, and very few investment advisors would counsel such an extreme policy. Instead, Investors should diversify, meaning that their portfolio should include more than one security.

WHAT DOES PORTFOLIO MANAGEMENT INVOLVE?

Portfolio management involves establishing and integrated process which links programmers and project management with effective portfolio management practices that support the successful delivery of the organizations strategic objectives.

25 The portfolio management process involves the collection in one place of pertinent information about all the programmers and projects in an organization, and relating that information to the business requirement and capabilities of the organization. The outputs of portfolio management will be informed Novisions about choice of programmers and projects, assignment of priorities, reserves allocation, interdependencies, staffing and skill requirements and deployment, risks and benefits, gaps and overlaps in the portfolio.

OBJECTIVES OF PORTFOLIO MANAGEMENT:

The objectives of investment/portfolio management can be classified into two categories as follows

1. Basic Objectives The basic objectives in investment/portfolio management are: A) To maximize yield and B) To minimize the risk ` 2.Secondary Objectives The following are the other ancillary objectives are: A) Regular Return B) Stable Income C) Appreciation of Capital D) More liquidity E) Safety of Investment F) Tax benefits

26 NEED FOR PORTFOLIO MANAGEMENT:

Portfolio management is a process encompassing many activities of investments in assets and securities. It is a dynamic and flexible concept and involves regular and systematic analysis, judgment and actions. The objective of this service is to help the unknown and investors with the expertise of professionals in investment portfolio management. It involves construction of portfolio based upon the investor’s objectives, constraints and preferences for a risk and returns and tax liability. The portfolio reviewed and adjusted from time to time in tune with the Market conditions. The evolution of portfolio is to be done in terms of targets set for risk and return. The changes in the portfolio are to be effected to meet the changing conditions.

Portfolio construction refers to the surplus funds in hand among the verify of financial asset open for investment. Portfolio theory concerns itself with the principal governing such allocation. The modem view of investments is oriented more towards the assembly of proper combinations of individual securities to form investment portfolio. A combination of

27 securities held together will give a beneficial result if they are grouped in a manner to secure a high return after taking into consideration the risk element.

The mode a theory is of the view that by diversification, risk can be reduced. The investor can make diversification either by having a large number of shares of companies in different regions; in different industries are those reducing different types of product lines. Modern theories believe in the perspective of combination of securities and constrains of risk and return.

ELEMENTS OF PORTFOLIO MANGEMENT: Portfolio management is on going process involving the following basic tasks:

1) Identification of investor’s objectives, constraints and preferences. 2) Strategies are to be developed and implemented in turn with investment policy formulated. 3) Review and monitoring of the performance of the portfolio. 4) Finally the evaluation of portfolio.

IMPORTANCE OF PORTFOLIO MANAGEMENT: Most organizations operate in a complex environment with many programmers and projects going on any one time. Portfolio management provides the means to: Establish a structure for selecting the right programmers and projects Assess whether requirements can be accommodated with in existing organization capability and capacity Allocate the right resources to the right programmers and projects.

28 Resolve conflicts and contentions for scarce and costly resources. Identify and manage interdependencies between programmers and projects. Assess the true implications of the aggregate level of programmed and project risks. Monitor progress on programmers and projects against key outcomes. Ensure on going successful delivery of programmers and projects. Optimize organizational investment Achieve value for money savings and efficiency gains form programmed and project rationalization. PHASES OF PORTFOLIO MANAGEMENT:

Each phase is an integral part of the whole process and the success of portfolio management depends upon the efficiency in carrying out each of these phases.

SECURITY ANALYSIS:

The securities available to an investor for investment are numerous and of various types. The shades of over 7000 companies are listed in the stock exchanges of the country. Traditionally the securities were classified into ownership securities such as equity shares and preference shares and creator ship securities such as debentures and bonds. Security analysis is the initial phase of the portfolio management process. This consists of two alternative approaches namely FUNDAMENTAL ANALYSIS AND TEHCNICAL ANALYSIS.

29 FUNDAMENTAL ANALYSIS:

The priMary motive of buying a share is to sell it subsequently at a higher rate. An investor would be interested to know the dividend to be paid on the share in the future as also the further price of the share. These values can only be estimated and not predicted with certainty. These values are primarily determined by the performance of the company, which in turn is influenced by the performance of the industry.

An investor at the time of the investment has to evaluate a lot of information about the past performance and the expected future performance of companies, industries and the economy as a whole before taking the investment Novision such evaluation or analysis is called fundamental analysis.

Fundamental analysis insists that no one should purchase or sell a share on the basis of tops and rumors. The fundamental approach calls upon the investors to make buy or sell Novision on the basis of a detailed analysis of the information about the company, the industry to which the company belongs

30 and the economy. This result in informed investing for the fundamentalist makes use of EIC framework of analysis.

The multitude of factors affecting the performance of a company can be broadly classified as A. Company specific factors such as the age of its plant, the quality of management, brand image of its products, its labor management relation’s etc. And these factors are likely to make a company performance quite different from that of its competitors in the same industry.

B. Industry wide factors such as demand supply gap in the industry, the emergence of substitute products, change in government policy relating to industry etc., and these factors affect only those companies belonging to a specific industry.

C. Economy wide factors such as growth rate of the economy, inflation rate and foreign exchange rates etc., which affects all companies.

31 ECONOMY ANALYSIS:

The performance of a company depends on the performance of the economy. If the economy is booming, income raises and the demand for the goods will increases. On the other hand if the economy is in recession, the performance of the companies will be generally bad.

The following are them some of the key economic variable that an investor must monitor as a part his fundamental analysis.

a. Growth rate of national income. b. Government revenue, expenditure and deficits c. Economic and political stability d. Inflation e. Interest rates f. Exchange rates g. Infrastructure h. Monsoon.

INDUSTRY ANALYSIS:

An investor ultimately invests his money in the securities of one or more specific companies. Each company can be characterized as belonging to an industry. The performance of companies would therefore, be influenced by the fortunes of the industry to which it belongs. For this reason an analyst has to undertake and industry analysis so as to study the fundamental factors affecting the performance of different industries.

32 INDUSTRY LIFE CYCLE:

Marketing experts believes that each product has life cycle. In the same way an industry is also said to have a lifecycle. In the same way, an industry is also said to have a lifecycle. This industry life cycle theory is generally attributed to Julius gowdinsky. According to the theory the life of an industry can be segregated into 1. Pioneering stage 2. The Expansion stage 3. The stagnation stage 4. The Novay stage.

COMPANY ANALYSIS:

Company analysis is the final stage of fundamental analysis. The economy analysis provides the investors a broad outline of the prospects of growth in the economy. The industry analysis helps the investors to select the industry in which investment would be rewarding. Now he has to Novide the company in which he should invest his money.

TECHNICAL ANALYSIS:

The analysis believes that share prices are determined by the demand and supply forces operating in the Market. These demand and supply forces in turn are influenced by a number of factors. These factors cannot be qualified. The combined impact of all these factors is reflected in the share price

33 moment. Technical analysis is the name given to forecasting techniques that utilize historical share price date.

The basic premise of technical analysis is that price move in trends or waves, which Apr be upward or downward. It is believed that due present trends are influenced by the past trends and that due projection of future trends in possible by a past price trends. The technical analysis is really a study of past or historical price and volume movements so as to predict the future stock price behavior.

DOW THEORY:

What ever is generally being accepted today as technical analysis has its roots in due Dow Theory. Charles Dow formulated a hypothesis that the stock Markets does not move on a random basis but it is influenced by three district cyclical trends that guide its direction. According to Dow Theory, the Market has three moments & these moments are simultaneous in nature. These moments are the priMary moments, secondary reactions and minor moments. The priMary moment is the long-range cycle that carries the entire Market up or down. This due long term trend in the Market. The secondary reactions act as a restraining force on due priMary moment. These are in due opposite direction to the priMary moment and last only for a short while. These are also known as corrections. The third moment in the Market is the minor moments, which are the day fluctuations in the Market. These moments are not significant and have a very short duration.

According to Dow Theory, the price moment in the Market can be identified by means of a line chart; the closing prices of shares or the closing

34 values of the Market index Apr be plotted against the corresponding trading days. PORTFOLIO ANALYSIS:

A portfolio is a group of securities held together as investment. Investors invest their funds in a portfolio of securities rather than in a single security because they are risk averse. By constructing a portfolio, investors attempts to spread risk by not putting all their eggs into one basket. Portfolio phase of portfolio management consists of identifying the range of possible [portfolios that can be constituted from a given set of securities and calculating their return & risk for further analysis.

PORTFOLIO SELECTION:

Portfolio analysis provides the input for the next phase in portfolio management, which is portfolio selection. The proper goal of portfolio construction is to get high return at a given level of risk. The inputs from portfolio analysis can be used to identify the set of efficient portfolios. From this set of portfolios, the optimal has to be selected for investment.

PORTFOLIO REVISION:

Having constructed the optimal portfolio, the investor has to constantly monitor the portfolio to ensure that it continues to be optimal. As the economy and financial Markets are dynamic, the changes take place almost daily. The investor now has to revise his portfolio. The revision leads

35 to purchase of new securities and sale of some of the existing securities from the portfolio. PORTFOLIO EVALUTION:

The objective of construction a portfolio and revising it periodically is to earn maximum returns with minimum risk. Portfolio evaluation is the process, which is concerned with assessing the performance of a portfolio over selected period of time in terms of return and risk. Portfolio evaluation useful in yet another way. It provided a mechanism of identifying weakness in the investment process and for improving these deficient areas. RISK: Every investment is characterized by return and risk. A person making an investment expects to get some return from the investment in the future. But as future is uncertain, so is the future expected return. It is this uncertainly associated with the return from an investment that introduces risk into an investment.

Risk distinguished between the expected return and the realize return from an investment. The expected return is the uncertain future return that an investor expects to get from his investment. The realized return is the certain return that an investor has actually obtained from his investments at the end of the holding period. The investor makes the investment Novision based on the expected return from the investment. The actual return realized from the investment Apr not compare to the expected return. This possibility of variation of the actual return from the expected return is termed risk.

36 Risk arises where there is a possibility of variation between expectations and realization with regard to an investment. Risk is directly proportional to return risk can be of different types. MARKET RISK: Market risk arises due to ups and downs in the Market. This risk affects the Shares. Market prices of shares move up or down consistently for some time periods. A general rise in share price is referred to as a Bullish trend. Where as a general fall is share price is referred to as a Bearish trend. The alternating movements can be easily seen in the movement of share price indices such as the BSE sensitive index etc. INTEREST MARKET RISKS: Interest rate risk is a type of that particularly affects debt securities like bonds, debentures. A bonds or debenture normally has a daze coupon rate of interest. The issuing company pays interest to the bondholder at this coupon rate. A bond is normally issued with a coupon rate, which is equal to the interest rate Apr change but the coupon rate remains constant till the maturity if the instrument. PURCHASING POWER RISK: This risk refers to the variation in investor return caused by inflation. Inflation results in lowering of the purchasing power of money. This type of risk is more inflationary in fixed income securities and less in variable returns securities. BUSINESS RISK: Every company operates with in particular operating environment, this operating environment comprise both internal and external environment, the impact of these operating conditions is reflected in the operating cost of the company. Business risk is thus a function of the operating condition faced by

37 a company and is the variability in operating income caused by the operating condition of the company.

FINANCIAL RISK: Financial risk is a function of financial of leverage, which is the use of use of debt in the capital structure, the presence of debt in the capital structure cerates fixed payments in the form of interest, this fixed interest payment creates more variability in the earning per share (EPS) available to equity shareholder, this variability is EPS due to the presence of debt in the capital Structure of a company is referred to as financial risk, this is an avoidable risk. RETURN ON PORTFOLIO: Each security in portfolio contributes returns in the proportion of its investment in a security. Thus the portfolio expected returns is the average of the expected returns from each of the, with weight representing the proportionate share of the security in the total investment. Why an investor does have some many securities in his portfolio, if the security ABC given the maximum returns why not he the security all his funds and thus maximum the return? The answers to this question lie in the investor’s perception of risk attached to investments his objectives of income, safety, appreciation, liquidity and hedge against loss of value of money etc., this pattern of investment in different asset categories, securities categories, types of instrument etc., would all be described under the caption of diversification which aims at the reduction or even elimination of non systematic or company related risk and achieve the specific objectives of investors.

38 PORTFOLIO RISK: Risk on a portfolio from risk on individual securities. The risk is reflected in the variability of the return from zero to infinity. The expected return depends on the probability of return and their weighted contribution the of portfolio. There are two measures of risk in this context, one is the absolute deviation and the other is standard deviation. Most investors invest in a portfolio of assets, as they do not want to put all their eggs in one basket. Hence what really matter to the is not the risk and return of the stock in isolation but the risk and return of the portfolio as whole PORTFOLIO DIVERSIFICATION: Combinations of securities that have risk return feature make up a portfolio. Portfolio Apr not take on the aggregate directive scripts on the individual particulars. Portfolio analysis take the various components of risk and return for each industry consider mixed effect of combined securities

Portfolio selection involves choosing the best portfolio to Suit the Risk return preference of portfolio investor. Management of portfolio is a dynamic of activity of evaluating and revising the Portfolio in term of its objective. It is a widely accepted that Individual scripts carry a certain degree of risk.

Portfolio help in spreading the risk over many securities. This is reduced the basic principle is that if a portfolio hold several assets or securities, which many include cash also if even one goes back the other will provide protection from the loss, the diversification can be either vertical or

39 horizontal. In vertical diversification a portfolio can have scripts of different company’s with in same industry. In horizontal diversification one can have different script’s chosen from different industries…………

PORTFOLIO MANAGEMENT AND DIVERSIFICATION:

Combination of securities that have risk and return features make up a portfolio, portfolio Apr or Apr not rely aggregate characteristics of individual facts Portfolio analysis takes the various factors for each industry and considered the fixed effects of combine’s securities Portfolio selection involves choosing the best portfolio to suit the risk return reference of the portfolio inventory Management of portfolio is a dynamic activity of evaluating and revising the portfolio in terms of its objective

It is widely accepted that individual scripts carry a certain degree of risk. Portfolio helps in spreading the risk in many securities. Thus the risk is reduced. That basic principle is that is a portfolio holds several assets or securities that Apr include cash also even in one goes bad the other will provide protection with the loss.

40 MARKOWITZ MODEL

THE MEAN-VARIANCE CRITERION

Dr. Harry M. Markowitz is credited with developing the first modern portfolio analysis model in order to arrange for the optimum allocation of assets with in portfolio. To reach this objective Markowitz generated portfolios with in a rewards risk context. In essence, Markowitz Model is theoretical framework for the analysis of risk return choices. Novisions are based on the concept efficient portfolio.

A portfolio is efficient when it is expected to yield the highest return for the level of risk accepted or, alternatively, the smallest portfolio risk for a specified level of expected return to build an efficient portfolio an expected return level is chosen, and assets are substituted until the portfolio combination with the smallest variance at the return level is found. At this repeated for other returns, set of efficient portfolio is generated. ASSUMPTIONS:

The Markowitz Model is based on several assumptions regarding investor behavior:

Investors consider each investment alternative as represented by a probability distributed of expected returns over some holding period. Investors maximize one period –expected utility and possess utility curve, which demonstrates diminishing Marginal utility of wealth. Individuals estimate risk on the basic of the variability of expected returns. Investors base Novisions solely on expected return and variance returns only.

41 For a given risk level, investors prefer high returns to lower returns. Similarly for a given level of expected return, investor prefers less risk to more risk. Under these assumptions, a single asset or portfolio assets is considered to be “Efficient” if no other asset or portfolio of assets offers higher expected return with the same risk or lower risk with the same expected return.

THE SPECIFIC MODEL

In developing his model, Markowitz first disposed of the investment behavior rule that the investor should maximize expected return. This rule implies that the non-diversified single security portfolio with the highest expected return is the most desirable portfolio. Only by buying that single security can expected return be maximized. The single security portfolio would obviously be preferable if the investor were perfectly certain that this highest expected return would turn out to be the actual return. However, under real world conditions of uncertainty, most risk adverse investor joins with Markowitz in discarding the role of call for maximizing the expected return. As an alternative, Markowitz offers the “expected returns/ variance of returns” rule.

Markowitz has the shown the effect of diversification by reading the risk of securities. According to him, the security with covariance that is either negative or low amongst them is the best manner to reduce risk. Markowitz has been able to show that securities, which have less than positive correlation, will reduce risk with out, in any way, bringing the return down. According his research study a low correlation level between securities in the portfolio will show less risk. According to him, investing in large number of securities is not the right method of investment. It is a right kid of security, which brings the maximum results.

42 Henry Markowitz has given the following formula for a two-security portfolio.

p=A

SUBJECT TO:

A maximum expected return: n E (Rp)=Wx *E (Rx) X=1

To solve the above set of equations analyst need the data estimates on standard deviation and expected returns for all ’n’ securities along with the correlation coefficient between all possible securities pairs.

A graphical presentation of meanvariance criterion is presented in Markowitz Efficient Frontier.

EFFICIENT FRONTIER OR EFFICIENT PORTFOLIO:

To construct an efficient portfolio, we have to conceptualize various combination of investment in a basket an designate than as portfolio “I” and “n”. The expected returns from the portfolios have to be workout. The risk on these portfolios is to be estimated by measuring the standard deviation of different portfolio return. In order to understand more easily, we will see Markowitz Graphical selection of portfolio.

43 If there are “n” assets available in the capital Market, we can constitute two assets portfolio, three assets portfolio. Four assets portfolio and investments. Together they result in an almost infinite number of portfolios. The risk and return can be seen in following graph:

FINDINGS:

The Markowitz graphic selection of portfolio is said to be not an efficient one because if an investor is ready to take at x he can vote the last portfolio y. From the risk y and Rx point of view it is not an efficient portfolio. “X” is a dominated portfolio. “y” and “z” is a dominant portfolio.

When the outer points of an efficient portfolio are joined shell is formed or a broken egg is formed. The shape depends upon degree of co- relation among securities, therefore the shell is called attainable set, feasible set or opportunity set, it is called because all the available investment opportunities in the Market like either on the border or within the border.

44 CONCEPT OF EFFICIENT PORTFOLIO:

Assume that “X” is selected. It is an efficient portfolio because, 1. If he is prepared to take a risk of x for the same risk “Y” givens tin the higher rate of Ry. Therefore “Y” is dominant portfolio and “X” is dominated portfolio. 2. If an investor is satisfied with the return of Rx, the same return can be earned by choosing portfolio “Z”, which has a smaller risk of z. The dominance principle states that among all the investment opportunities available with a given return, the investment with the least risk is the most desirable one or among the investment in a given risk class, the one with the highest return with the most desirable one. Risk principle is also called Efficient set theorem.

In the light of this segment A, B is the relevant portion of the feasible set it is called the Markowitz Efficient Frontier. It is so called because all efficient portfolio lie on this frontier.

An efficient portfolio is one that gives the highest return for a given return or a minimum risk for a given return; these efficient portfolios are also referee as mean variance efficient portfolios. The shape of the efficient frontier is given by Rp/p.

45 SELECTION OF THE APPROPRIATE PORTFOLIO:

After the generation of the efficient frontier, the investor must select the most appropriate portfolio from among the many portfolios present on the efficient frontier.

The Markowitz model allows a trade off between expected risks and returns, which depend upon each investor’s risk preferences. Anyone can be selected by him depending on his preferences can be described by using indifference curves as given below:

The are AB shows the efficient frontier and the investor’s utility preference functions are assumed to take the shapes of the curve 1,2 &3. The investor would prefer curve 2 or 2 because curve provides more return per unit of return than curve 2 at any point on the curve. The same can be said of 2 relative to 3. But point C, the point of tangency between an indifference curve and the efficient frontier, gives the optimal portfolio because the portfolio at point C maximizes utility. It is the most satisfactory available portfolio.

INVESTMENT NOVISIONS

46 DEFINITION OF INVESTMENT:

According to F.AMLING, “Investment Apr be defined as the purchase by an individual or institutional investor of a financial or real asset that produce a return proportional to the risk assumed over some future investment period”.

According to D.E. FISHER and R.J.JORDAN, “Investment is a commitment of funds made in the expectation of some positive rate of return. If the investment is properly undertaken, the return will be commensurate with the risk investor assumes”.

CONCEPT OF INVESTMENT:

Investment will be generally be used in its financial sense and as such investment is an allocation of monetary resources to assets that are expected to yield some gain or positive return over a given period of time. Investment is a commitment of person’s funds to derive future income in the form of interest, dividends, rent, premiums, pension benefits or the appreciation of the value of his principle capital.

Any investors would like to know the media or range of investment so that he can use his discretion and save in those investments, which will give him both security and stable return. The ultimate objective of the investor is to derive a variety of investments that met his preference for risk and expected return. The investor will select the portfolio, which will maximize his utility. Another important consideration is the temperament and psychology of the investor. It is not only the s\consideration of a

47 portfolio that will promise the highest expected return, but it is the satisfaction of the need of the investor.

Many types of investment media or channels for making investment are available. Securities ranging from risk free instruments to highly speculative shares and debentures are available for alternative investments.

INVESTMENT PROCESS:

The investment process Apr be described in the following stages. 1. INVESTMENT POLICY: The first stage determines and involves personal financial affairs and objectives before making investment. It can also be called the preparation of the investment policy stage. The investor has to se that he should be able to9 created an emergency fund, an element of liquidity and quick convertibility of securities into cash. This stage Apr, therefore, be called the proper time for identifying investment assets and considering the various features of investment.

2. INVESTMENT ANALYSIS: After arranging a logical order of types of investment preferred, the next step is to analyze the securities available for investment. The investor must make a comparative analysis of type of industry; kind of securities etc., the priMary concerns at this stage would be to form beliefs regarding future behavior of prices and stocks, the expected return and associated risks.

3. INVESTMENT VALUATION:

48 Investment value, in general is taken to be the present worth to the owners of future benefits from investments. The investor has to bear in mind the value of these investments. An appropriate set of weights have top be applied with the use of forecasted benefits to estimate the value of investment assets such as stocks, debentures and bonds and other assets. Comparison of the value with the current Market price of the asset allows a determination of the relative attractiveness of the asset. Each asset must be valued on its individual merit. 4. PORTFOLIO CONSTRUCTION AND FEEDBACK: Portfolio construction required a knowledge of the different aspects of securities in relation to safety and growth of principal, liquidity of assets etc., in this stage, we study, determination of diversification level, consideration of investment timing, selection of invest6ment assets, allocation of ingestible wealth to different investment, evaluation of portfolio feedback.

GUIDELINES FOR EQUITY INVESTMENT:

49 Equity shares are characterized by price fluctuations, which can produce substantial gains, inflict severe loses. Given the volatility and dynamism of the stock Market, investor requires greater competence and skill along with a touch of good luck too-to invest the equity shares. Here are some general guidelines to play to equity game, irrespective of whether you are aggressive or conservative. Adopt suitable formula plan Establish value anchors Asses Market psychology Combine fundamental and technical analysis Diversify sensibly Periodical review and revise your portfolio. FACTORS INVLUENCING INVESTORS NOVISION AND TYPES OF INVESTORS:

THERE ARE FOUR TYPES OF INVESTORS IN A MARKET, THEY ARE AS FOLLOWS: Types of investors: Type A investor: No Market timing and no stock picking skills. If the investor does not believe that he has any special skills in picking undervalued stocks or in predicting the movement of the Market, then the portfolio design problem becomes relatively simple. The investor simply chooses a diversified portfolio and then adjusts its beta to the desired level. Of he weighs the chosen security in proportion to the Market capitalization; he can shift the weights towards high or low beta stocks. He can achieve the same effects by increasing or Novreasing the allocation to the equity portfolio in the overall portfolio. Type B investor: Only stock-picking skills

50 An investor who has and wishes to exploit his stock picking skills should start with a base portfolio similar to that of type A investor. He should then adjust the weights of the stocks, which are in his opinion misruled. Specifically, he should overweight of the stocks that are over valued and underweight those which are under value. For example, the base portfolio Apr have 2% n stock X and 1.5% in stock Y. The invest who finds – X under valued and Y over valued Apr change the weights to 3 % to X He Apr have a problem, as he would than have to short sell Y to the extent of 0.5% of the portfolio. This Apr not be legally or practically possible. The investor than has to raise the weight of X to 4% eliminate Y from the portfolio and reduce the weight of some other stocks by 0.5%.

Type C investor: Only Market – timing skills The type C investor holds a well-diversified portfolio but switches actively between defensive and offensive portfolios to take advantage of the Market timing. If the expects the Market to rise, he should push his portfolio beta above his target level by any of the techniques described in the section on Market timing. The converse should be done if the investor is bearish about the Market. In either case, the portfolio would remain diversified all through. The portfolio of this investor diversified, but its beta is managed and not constant.

Type D investor: Both stock picking and Market timing skills This type of investor would use the techniques used by both the type B and type C investor. These investors would have the most active and aggressive portfolio management strategies. Using their skills in identifying undervalued scrip, they should hold highly concentrated

51 portfolios and let the beta fluctuate quiet sharply around the long run target value. A pitfall to be very strenuously avoided is that of assuming that one has a skill, which one in reality does not have. For example, an investor who does not have very good abilities in scrip selection Apr still think that he does not have such skills. He should then end up with an ill-diversified portfolio, which earns mediocre returns he would have been better off with a passive portfolio.

QUALITIES FOR SUCCESFUL INVESTING: Contrary thinking Patience Composure Flexibility and Open ness

52 CHAPTER - III

53 ANALYSIS OF PORTFOLIO

54 ANALYSIS OF EACH SET OF PORTFOLIO AMBUJA cements & INFOSYS Ltd. CALCULATIONS OF STANDARD DEVIATION OF AMBUJA CEMENTS LTD. R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar - 10 46.025878 12.9720108 33.1138712 1092.558401 Apr – 10 -14.88764 12.9720108 -27.8596468 776.1599198 May – 10 23.833333 12.9720108 10.8613262 117.9684108 Jun – 10 9.1743119 12.9720108 -3.7976949 14.422486554 July – 10 12.626263 12.9720108 -0.3457438 0.119538775 Aug – 10 11.641791 12.9720108 -1.3302158 1.769474115 Sep – 10 12.108844 12.9720108 -0.8631628 0.745110019 Oct – 10 3.253012 12.9720108 -9.7189948 94.45885992 Nov – 10 18.192771 12.9720108 5.2211642 27.25637883 Dec – 11 36.683417 12.97201080 23.714102 562.2309737 Jan – 11 -0.8695652 12.9720108 -13.841572 191.5891154 Mar – 11 -2.1183346 12.9720108 -15.0903414 227.7184036 R = 155.6640811 (R-R) 2 3110.997009

R 155.6640811 AVERAGE = ------= ------= 12.9720108 N 12

VARIANCE = (1/n-1) (R-R) 2 T=1 = (1/12-1) (3110.997009) =282.4542 STANDARD DEVIATION = VARIANCE = 282.4542 =16.8110

CALCULATION OF STANDARD DEVIATION OF INFOSYS LTD

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV

55 Mar – 10 3.7691532 5.08111111 -1.31195747 1.721232403 Apr – 10 1.1436893 5.08111111 -3.93742137 15.50328710 May – 10 5.580195 5.08111111 0.49908433 0.249085168 Jun – 10 13.395855 5.08111111 8.31474433 69.13497327 July – 10 0.8911148 5.08111111 -4.19111587 17.56159662 Aug – 10 7.2911392 5.08111111 2.21002853 4.884226103 Sep – 10 12.279875 5.08111111 7.19876433 51.82221188 Oct – 10 12.59696 5.08111111 7.51584933 56.48799115 Nov – 10 -3287037 5.08111111 -8.36814767 70.02589543 Dec – 11 -1.5126251 5.08111111 -6.59373577 43.4773514 Jan – 11 7.8144578 5.08111111 2.73334713 7.47186533 Mar – 11 1.0112108 5.08111111 -4.10989987 16.56408495 R = 60.973328 (R-R) 2 354.90318

R 60.973328 AVERAGE = ------= ------= 5.08111111 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (354.903118) =32.2639 STANDARD DEVIATION = VARIANCE = 32.2636 =5.6801

weights:-

B (B-rabA) Wa= ------A2+B2-2rab AB A B

Wb= 1-Wa

56 5.6801(5.6801-(-0.2111)(16.8110) Wa= ------(16.8110) 2+(5.6081) 2 -2(-0.2111)(16.8110)(5.6801)

5.6801(9.1540) Wa= ------(282.4551)+(32.2635)+(39.4640)

51.9956 Wa= ------354.1826

Wa= 0.1468

Wb= 1-Wa

Wb= 1-01468

Wb= 0.8532

PORTFOLIO RISK:-

AMBUJA &INFOSIS :-

p=A2WA2+B2WB2+2rabBWaWb

A=16.8110 B=5.6801 rab=-0.2111

57 Wa=0.1468 Wb=0.8532

P= (16.8110) 2 (0.1468) 2+(5.6801) 2 +(0.8532) 2+2(0.2111)(16.8103) (5.6801)(0.1468)(0.8532) P= (6.0870)+(23.4862)-(4.9429) P= 24.6303

P= 4.9629%

AMBUJA CEMENTS&INFOSYSLTD:

AS FOR CALCULATIONS AND STUDY, AMBUJA CEMENTS bears a proportion of 0.1468 and INFOSYS LTD bears a proportion of 0.8532. The risk of INFOSYS is less than that of AMBUJA CEMENTSi.e.5.6801<16.8110,which means an investor can invest his/her funds to a greater extant of 85%in INFOSYS LTD. And the remaining funds in AMBUJA CEMENTS. Even the portfolio risk of 4.9629% when compared to the individual risk of both the companies is less.

AMBUJA cements & BAJAJ AUTO Ltd. CALCULATIONS OF STANDARD DEVIATION OF AMBUJA CEMENTS LTD. R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar – 10 46.025878 12.9720108 33.1138712 1092.558401 Apr – 10 -14.88764 12.9720108 -27.8596468 776.1599198 May – 10 23.833333 12.9720108 10.8613262 117.9684108

58 Jun – 10 9.1743119 12.9720108 -3.7976949 14.422486554 July – 10 12.626263 12.9720108 -0.3457438 0.119538775 Aug – 10 11.641791 12.9720108 -1.3302158 1.769474115 Sep – 10 12.108844 12.9720108 -0.8631628 0.745110019 Oct – 10 3.253012 12.9720108 -9.7189948 94.45885992 Nov – 10 18.192771 12.9720108 5.2211642 27.25637883 Dec – 11 36.683417 12.97201080 23.714102 562.2309737 Jan – 11 -0.8695652 12.9720108 -13.841572 191.5891154 Mar – 11 -2.1183346 12.9720108 -15.0903414 227.7184036 R = 155.664081 (R-R) 2 3110.997009

R 155.6640811 AVERAGE = ------= ------= 12.9720108 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (3110.997009) =282.4542 STANDARD DEVIATION = VARIANCE = 282.4542 =16.8110

CALCULATION OF STANDARD DEVATION OF BAJAJ AUTO LTD

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar – 10 -0.4648649 1.3461797 -1.8111046 3.279882543 Apr – 10 -3.6574586 1.3461797 -5.0036383 25.03639624 May – 10 1.4508545 1.3461797 0.1106748 0.010956814 Jun – 10 -8.5483871 1.3461797 -9.8945668 97.90245216 July – 10 13.109103 1.3461797 11.7228633 137.425524 Aug – 10 9.3543223 1.3461797 8.0081426 64.1311439 Sep – 10 -6.8001548 1.3461797 -8.1463345 66.36276579 Oct – 10 4.6891192 1.3461797 3.3429395 11.1752445 Nov – 10 10.601173 1.3461797 9.1149933 85.65490098 Dec – 11 -9.1046976 1.3461797 -10.3908773 111.9703311 Jan – 11 0.3155187 1.3461797 -1.031061 1.102262097 Mar – 11 5.1896887 1.3461797 3.843509 14.77256143

59 R = 16.1541564 (R-R) 2 614.7836255

R 16.1541564 AVERAGE = ------= ------= 1.3461797 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (3110.997009) =55.8894 STANDARD DEVIATION = VARIANCE = 55.8894 =7.4759

WEIGHTS:-

WA=Weight Of Ambuja Cements WB=weight of Bajaj Auto Ltd.

B(B-rabA) Wa= = ------A2+B2-2rABAB

Wb=1-Wa

7.4759[7.4759-(-0.1185)(16.8110)] Wa= ------(16.8110) 2+(7.4759) 2-2(-0.1185)(16.8110)(7.4759)

60 70.7781 Wa= = ------318.1216

Wa= 0.2225

Wb=1-Wa

Wb= 1-0.2225

Wb= 0.7775

PORTPOLIO RISK:-

AMBUJA CEMENTS&BAJAJ AUTO:

p= A2 Wa2+B2 wb2+2rAbAbWaWb

a= 16.8110 B= 7.4759 rAb= -0.1185

Wa=0.2225 Wb= 0.7775

P= (16.8110) 2 (0.2225) 2+(7.4759) 2 (0.7775) 2 +2(0.1185)(16.8110)(7.4759) (0.2225) (0.7775)

P= (13.9833)+(33.7853)-(5.1513)

P= 42.6173

61 P= 6.5282%

AMBUJA CEMENTS &BAJAJ AUTO:

In this combination, the investors can invest their funds in accordance with in this combination; the investment i.e. 0.225 for Ambuja and the remaining 0.7775 in Bajaj. The difference in weights exits because the risk of Ambuja, which is 16.8110%, is higher than that of Bajaj whose risk is 7.4759%. So if an investor has to invest funds in this portfolio it is suggested that the investor should invest a larger portion of funds in Bajaj and divert the remaining funds to Ambuja.

In comparison the portfolio risk, which is 4.2590%, is less the individual risks of both the assets in the portfolio.

INFOSYS LTD & ACC:

CALCULATION OF STANDARD DEVIATION OF INFOSYS LTD.

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar – 10 3.7691532 5.08111111 -1.31195747 1.721232403 Apr – 10 1.1436893 5.08111111 -3.93742137 15.50328710 May – 10 5.580195 5.08111111 0.49908433 0.249085168 Jun – 10 13.395855 5.08111111 8.31474433 69.13497327 July – 10 0.8911148 5.08111111 -4.19111587 17.56159662 Aug – 10 7.2911392 5.08111111 2.21002853 4.884226103 Sep – 10 12.279875 5.08111111 7.19876433 51.82221188 Oct – 10 12.59696 5.08111111 7.51584933 56.48799115 Nov – 10 -3.287037 5.08111111 -8.36814767 70.02589543 Dec – 11 -1.5126251 5.08111111 -6.59373577 43.4773514 Jan – 11 7.8144578 5.08111111 2.73334713 7.47186533 Mar – 11 1.0112108 5.08111111 -4.10989987 16.56408495 R = 60.973328 (R-R) 2 354.90318

R 60.973328 62 AVERAGE = ------= ------= 5.08111111 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (354.903118) =32.2639 STANDARD DEVIATION = VARIANCE = 32.2639 =5.6801

CALCULATION OF STANDARD DEVIATION OF ACC

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar – 10 8.9087726 2.78101602 6.12835658 37.55675437 Apr – 10 -15.357143 2.78101602 -18.13755902 328.9711072 May – 10 1.1038413 2.78101602 -1.73657472 3.015691758 Jun – 10 -1.2772971 2.78101602 -4.11771312 16.46503576 July – 10 12.1875 2.78101602 9.41108398 88.49322901 Aug – 10 -1.1481481 2.78101602 -3.92856412 15.43361610 Sep – 10 -4.2948536 2.78101602 -7.11626962 50.11359173 Oct – 10 11.465216 2.78101602 8.68479998 75.42575109 Nov – 10 17.441114 2.78101602 14.66103798 214.934210 Dec – 11 5.2112469 2.78101602 2.43083088 5.908938767 Jan – 11 2.029469 2.78101602 -0.75094702 0.563921427 Mar – 11 -2.8436658 2.78101602 -5.62408182 31.63029632 R = 33.3649922 (R-R) 2 868.4721791

R 33.3649922 AVERAGE = ------= ------= 2.78101602

N 12

VARIANCE = (1/n-1) (R-R) 2

T=1

63 = (1/12-1) (868.4721791) =78.9520 STANDARD DEVIATION = VARIANCE = 78.9520 =8.8855

WEIGHTS:-

WA=Weight of INFOSYS Ltd. WB=weight of ACC B (B-rabA) Wa= = ------A2+B2-2rabAB

Wb=1-Wa

8.8855[8.8855-(-0.2213)(5.6801)] Wa= ------(5.6801) 2+(8.8855) 2-2(-0.2213)(5.6801)(8.8855)

90.1212 Wa= = ------133.5539

Wa= 0.6748

Wb=1-Wa

Wb= 1-0.6748

Wb= 0.3252

64 PORTPOLIO RISK:-

INFOSYS & ACC LTD:

p= A2 Wa2+B2 wb2+2rAbAbWaWb

a= 5.6801 B= 8.8855 rAb= -0.2213

Wa=0.6748 =0

P= (5.6801) 2 (0.6748) 2+(8.8855) 2 (0.3252) 2 +2(-0.2213)(5.6801)(8.8855) (0.6748) (0.3252)

P= (14.6914)+(8.3496)-(4.9020)

P= 18.1390

P= 4.2590%

INFOSYS LTD & ACC:

The proportion of the investment in this combination is 0.6748 for INFOSYS and 0.3252 for ACC. The investor can invest a larger share of funds in INFOSYS and a lesser part in CC. This is because the risk of INFOSYS which is 5.6801% is less than the risk of ACC, which is 8.8855% and investors generally tend to invest in less riskier securities.

65 Also the portfolio standard deviation, which is less than the individual risks of both the companies.

ZEE TELEFILMS LTD & HDFC BANK LTD:

CALCULATION OF STANDARD DEVIATION OF ZEE TELTFILMS LTD.

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar – 10 -5.1672862 0.15685282 -5.32413902 28.3464563 Apr – 10 1.0248325 0.15685282 0.867979968 0.753388725 May – 10 -2.248102 0.15685282 -2.41091482 5.78615291 Jun – 10 10.852411 0.15685282 10.69555418 114.3948792 July – 10 7.8798587 0.15685282 7.72301188 59.64481982 Aug – 10 -0.5884276 0.15685282 -0.74528102 0.555442910 Sep – 10 -1.7094017 0.15685282 -1.86625452 3.48911933 Oct – 10 2.0134228 0.15685282 1.85656998 3.4468852091 Nov – 10 11.176088 0.15685282 11.01923518 121.423544 Dec – 11 -10.147867 0.15685282 -10.31072182 110.1872918 Jan – 11 -8.3360258 0.15685282 -8.49287862 72.12898725 Mar – 11 -2.8673029 0.15685282 -3.02415572 9.145517819 R = 1.8822338 (R-R) 2 525.2937011

R 1.8822338 AVERAGE = ------= ------= 0.15685282 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (525.2937011) =47.7539 STANDARD DEVIATION = VARIANCE = 47.7539 =6.9110

66 CALCULATION OF STANDARD DEVIATION OF HDFC

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar – 10 -1.0919616 2.81435892 -3.91032112 15.25934 Apr – 10 -8.4107811 2.81435892 -11.21913942 125.8690893 May – 10 4.7308782 2.81435892 1.91651928 3.673106151 Jun – 10 1.2972973 2.81435892 -1.51710162 2.3014755959 July – 10 -1.5145423 2.81435892 -4.32890122 18.73938577 Aug – 10 9.4701087 2.81435892 6.65574978 44.29901113 Sep – 10 1.5812699 2.81435892 -1.23308902 1.521108531 Oct – 10 19.1025 2.81435892 16.24814108 264.0020886 Nov – 10 4.6108548 2.81435892 1.79249588 3.21310148 Dec – 11 8.1226114 2.81435892 5.30824648 28.17748109 Jan – 11 3.5097002 2.81435892 0.69534128 0.483499496 Mar – 11 -7.5976231 2.81435892 -10.41198202 108.4093696 R = 33.772311 (R-R) 2 615.9473311

R 33.772311 AVERAGE = ------= ------= 2.81435892 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (615.9473311) =55.9952 STANDARD DEVIATION = VARIANCE = 55.9952 =7.4830

WEIGHTS:-

WA=Weigh of ZEE TELE FILMS Ltd WB=Weight of HDFC BANK Ltd

67 B (B-rabA) WA= = ------A2+B2-2rabAB

Wb=1-WA

7.4830[7.4830-(-0.1041)(6.9110)] Wa= ------(6.9110) 2+(7.4830) 2-2(-0.1041)(6.9110)(7.4830)

58.2754 Wa= = ------108.3098

Wa= 0.5380

Wb=1-Wa

Wb= 1-0.5380

Wb= 0.4620

PORTPOLIO RISK:-

ZEE TELE FILMS & HDFC:

68 p= A2 Wa2+B2 wB2+2rAbAbWaWb

A= 6.9110 B= 7.4830 rAB= -0.1041

Wa=0.6748 Wb=0.4620

P= (6.9110) 2 (0.5380) 2+(7.4830) 2 (0.4620) 2 +2(-0.1041)(6.9110)(7.4830) (0.5380) (0.4620)

P= (13.8734)+(11.9519)-(1.1336)

P= 24.6917

P= 4.9690%

ZEE & HDFC:

The standard deviation /risk of ZEE TELEFILMS is 6.9014% and the risk of HDFC. Is 7.4830% this means that the risk of ZEE is less when compared to the risk of HDFC? It therefore suggests that investors can invest a greater percentage of their funds in ZEE and the remaining funds in HDFC. The calculated weight also suggests the same. It shows that investors can invest up to 0.5380% in ZEE and a ratio of 0.4620% in HDFC.

If we combine both the securities the portfolio standard deviation stands at 4.9690%, which is the less than the individual risks of both the companies.

WIPRO LTD & BPCL: CALCULATION OF STANDARD DEVIATION OF WIPRO LTD

R R R-R (R-R) 2

69 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar – 10 13.437385 -2.5817508 16.0191358 256.6127118 Apr – 10 -1.7845659 -2.5817508 0.7971849 0.635503765 May – 10 -65.383865 -2.5817508 -62.8021142 3944.111548 Jun – 10 2.3876410 -2.5817508 4.9693912 24.6948489 July – 10 5.1818182 -2.5817508 1.763569 60.27300862 Aug – 10 2.862109 -2.5817508 5.4438198 29.63517401 Sep – 10 9.9683331 -2.5817508 12.5499729 157.5018198 Oct – 10 16.791159 -2.5817508 19.3729098 375.3096841 Nov – 10 -2.3498695 -2.5817508 0.2318813 0.113768937 Dec – 11 -6.4342629 -2.5817508 -3.8525121 14.84184948 Jan – 11 -1.528169 -2.5817508 1.1135818 1.110034609 Mar – 11 -4.1285714 -2.5817508 -1.5468210 2.392653969 R = -30.98101 (R-R) 2 4867.166551

R -30.98101 AVERAGE = ------= ------= -2.5817508 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (4867.166551 =442.4697 STANDARD DEVIATION = VARIANCE = 442.4697 =21.0350

CALCULATION OF STANDARD DEVIATION OF BPCL

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATION Sq. DEV S Mar – 10 -3.4489838 -1.4734917 -1.9754921 3.902569037 Apr – 10 -37.02127177 -1.4734917 -35.5477853 1263.64510 May – 10 20.016892 -1.4734917 21.4903837 461.8365916 Jun – 10 --1.875 -1.4734917 -0.4015083 0.161208915 July – 10 3.2211882 -1.4734917 4.6941199 22.03438611 Aug – 10 -0.7909611 -1.4734917 0.6825312 0.465848839 70 Sep – 10 -2.3809524 -1.4734917 0.69114611 0.82344922 Oct – 10 14.722222 -1.4734917 16.1957137 262.3011423 Nov – 10 15.317919 -1.4734917 16.7914111 281.9514733 Dec – 11 -8.611852 -1.4734917 -7.1323603 50.87116345 Jan – 11 0.884434 -1.4734917 2.3579257 5.559813611 Mar – 11 -17.72093 -1.4734917 -16.2474383 263.9792513 R = -17.6819011 (R-R) 2 2617.531373

R -17.6819011 AVERAGE = ------= ------= -1.4734917 N 12 VARIANCE = (1/n-1) (R-R) 2

T=1

= (1/12-1) (2617.531373) =237.9574 STANDARD DEVIATION = VARIANCE = 237.9574 =15.4259 WEIGHTS:-

WA=Weigh of WIPRO Ltd WB=Weight of BPCL

B (B-rabA) Wa= = ------A2+B2-2rabAB

Wb=1-Wa

15.4259[15.4259-(-0.2830)(21.0350)] Wa= ------(21.0350) 2+(15.4259) 2-2(-0.2830)(21.0350)(15.4259)

71 329.7872 Wa= = ------864.0873

Wa= 0.3817

Wb=1-Wa

Wb= 1-0.3817

Wb= 0.6183

PORTPOLIO RISK:-

WIPRO & BPCL:

p= A2 WA2+B2 WB2+2rAbAbWaWb

a= 21.0350 B= 15.4259 rAb= -0.2830 Wa=0.3817 Wb=0.6183

P= (21.0350) 2 (0.3817) 2+(15.4259) 2 (0.6183) 2 +2(0.2830)(21.0350) (15.4259)(0.3817) (0.6183) P= (64.4658)+(90.9702)-(43.3442) 72 P= 112.0919

P= 10.5873%

WIPRO & BPCL:

In this 5th combination of portfolio, the risk of BPCL is less when compared to the risk of WIPRO i.e15.4259<21.0350.also the calculated proportion of investment is 0.3817 for BPCL. So it is suggest that investor the large share of funds in BPCL, which is less risky, and the remaining funds be diverted to WIPRO. The calculated portfolio risk, which is 10.5873%, is less when compared to the individual standard deviations of the companies in the portfolio.

HERO HONDA MOTORS & SATYAM LTD

CALCULATION OF STANDARD DEVIATION OF HERO HONDA MOTORS

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar – 10 -1.8699187 0.8814812 -2.7513999 7.57020141 Apr – 10 -7.9621062 0.8814812 -8.8435274 78.21197687 May – 10 12.777778 0.8814812 11.8962968 141.5218776 Jun – 10 -15.736739 0.8814812 -16.6182202 276.1652426 July – 10 2.418711 0.8814812 1.5372203 2.363106251 Aug – 10 -0.0223214 0.8814812 -0.9038026 0.81685914 Sep – 10 -6.0266371 0.8814812 -6.9081183 47.72209845 Oct – 10 16.218448 0.8814812 15.3369668 235.2225510 Nov – 10 16.818292 0.8814812 14.9368108 223.1083169 Dec – 11 -6.6521739 0.8814812 -7.5336551 56.75595917 Jan – 11 0.4151292 0.8814812 -0.466352 0.217484188 Mar – 11 1.199262 0.8814812 0.3177808 0.1009846371

73 R = 10.5777744 (R-R) 2 1109.772598

R 10.5777744 AVERAGE = ------= ------= 0.8814812 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (1109.772598) =97.2520 STANDARD DEVIATION = VARIANCE = 97.2520 =9.8616

CALCULATION OF STANDARD DEVIATION OF SATYAM CO, LTD.

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATION Sq. DEV S Mar – 10 7.8850034 2.47425865 5.41114475 29.27615875 Apr-10 -2.000000 2.47425865 -4.47425865 20.01899107 May-10 -4.0973312 2.47425865 -6.57158985 43.18579316 Jul-10 10.784314 2.47425865 8.31011535 69.11701992 July-10 -0.366784 2.47425865 -2.84110265 8.111523339 Aug-10 10.788199 2.47425865 8.313940365 69.12161014 Sep-10 -1.5139547 2.47425865 -3.98821335 15.91184573 Oct-10 14.911162 2.47425865 12.43290335 154.5770857 Nov-10 -5.7701149 2.47425865 -8.2447355 67.969523 Dec-11 0.5582524 2.47425865 -1.91601025 3.67111995 Jan-11 -1.1177885 2.47425865 -3.59210715 12.90280273 Mar-11 -0.3658537 2.47425865 -2.84011235 8.106238161 R= 29.6911038 (R-R)2 501.8238373

R 29.6911038 AVERAGE = ------= ------= 2.47425865

74 N 12 VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (501.8238373) =45.6203 STANDARD DEVIATION = VARIANCE = 45.6203 =6.7543

WEIGHTS:-

WA=Weigh of WIPRO Ltd WB=Weight of BPCL

B (B-rabA) Wa= = ------A2+B2-2rabAB

Wb=1-Wa

6.7543[6.7543-(-0.1272)(9.8616)] Wa= ------(9.8616) 2+(6.7543) 2-2(-0.1272)(9.8616)(6.7543)

54.0932 Wa= = ------159.8169

Wa= 0.3385

Wb=1-Wa

75 Wb= 1-0.3385

Wb= 0.6615

PORTPOLIO RISK:-

HEROHONDA MOTORS&SATYAM LTD:

p= A2 Wa2+B2 wb2+2rAbAbWaWb

a= 9.8616 B= 6.7543 rAb= -0.1272 Wa=0.3385 Wb=0.6615

P= (9.8616) 2 (0.3385) 2+(6.7543) 2 (0.6615) 2 +2(0.1272)(9.8616)(6.7543) (0.3385) (0.6615)

P= (11.1433)+(19.9628)-(3.7943)

P= 27.3118

P= 5.2261%

HEROHONDA MOTORS & SATYAM LTD:

In this combination the investor can invest up to 0.3385% in HEROHONDA MOTORS and 0.6615 in SATYAM. The lesser proportion of investor is because of the higher risk involved in this security when compared

76 to SATYAM i.e. the risk of HEROHONA which is 9.8616% is greater than that of SATYAM which is 6.7543%. Where as the portfolio risk, which is 5.2261%, is less when compared to the individual risk of both the companies in the portfolio.

BAJAJ AUTO LTD&TISCO LTD :-

CALCULATION OF STANDARD DEVIATION OF BAJAJ AUTO LTD.

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar – 10 -0.4648649 1.3461797 -1.8111046 3.279882543 Apr – 10 -3.6574586 1.3461797 -5.0036383 25.03639624 May – 10 1.4508545 1.3461797 0.1106748 0.010956824 Jul – 10 -8.5483871 1.3461797 -9.8945668 97.90245216 July – 10 13.109103 1.3461797 11.7228633 137.425524 Aug – 10 9.3543223 1.3461797 8.0081426 64.1302479 Sep – 10 -6.8001548 1.3461797 -8.1463345 66.36276579 Oct – 10 4.6891192 1.3461797 3.3429395 11.1752445 Nov – 10 10.601173 1.3461797 9.2549933 85.65490098 Dec – 11 -9.1046976 1.3461797 -10.3908773 111.9703311 Jan – 11 0.3155187 1.3461797 -1.031061 1.102262097 Mar – 11 5.1896887 1.3461797 3.843509 14.77256143 R = 16.1541564 (R-R) 2 614.7836255

R 16.1541564 AVERAGE = ------= ------= 1.3461797 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (614.7836255) =55.8894

77 STANDARD DEVIATION = VARIANCE = 55.8894 =7. 4759

CALCULATION OF STANDARD DEVIATION OF TISCO LTD.

R R R-R (R-R) 2 DATE RETURNS AVERAGE DEVIATIONS Sq. DEV Mar-10 -7.016632 0.62337116 -7.64000316 58.36964828 Apr-10 -16.666667 0.62337116 -17.29003816 289.9454196 May-10 -2.9677419 0.62337116 -3.591310 12.89609301 Jul-10 27.355426 0.62337116 26.73211484 714.602756 July-10 -35.575448 0.62337116 -13.19881916 1310.354509 Aug-10 13.136257 0.62337116 12.51288584 156.572312 Sep-10 -2.4915254 0.62337116 -3.11489646 9.702581179 Oct-10 1.134021 0.62337116 10.51110984 110.4737601 Nov-10 18.6 0.62337116 17.97662884 323.1591845 Dec-11 1.2787724 0.62337116 -1.90214356 3.618150123 Jan-11 8.9221248 0.62337116 8.297875364 68.86931198 Mar-11 -5.6711882 0.62337116 -6.29395936 39.6139443 R= 7.4811139 (R-R)2 3111.177649

R 7.4811139 AVERAGE = ------= ------= 0.62337116 N 12

VARIANCE = (1/n-1) (R-R) 2

T=1 = (1/12-1) (3111.177649) =258.9315 STANDARD DEVIATION = VARIANCE = 258.9315 =16.8109

78 WEIGHTS:-

WA=Weigh of BAJAJ AUTO Ltd WB=Weight of TISO

B (B-rabA) Wa= = ------A2+B2-2rabAB

Wb=1-Wa

16.8109[16.8109-(-0.1988)(7.4759] Wa= ------(7.4759) 2+(16.8109) 2-2(-0.1988)(7.4759)(16.8109)

311.4503 Wa= = ------388.3181

Wa= 0.7917

Wb=1-Wa

Wb= 1-0.7917

Wb= 0.2083

79 PORTPOLIO RISK:-

BAJAJ AUTO LTD & TISO LTD:

p= A2 Wa2+B2+WB2+2rAbAbWaWb

a= 7.4759 B= 16.8109 rAb= -0.1988 Wa=0.7917 Wb=0.2083

P= (7.4759) 2 (0.7917) 2+(16.8109) 2 (0.2083) 2 +2(0.1988)(7.4759)(16.8109) (0.7917) (0.2083)

P= (35.0311)+(12.2561)-(8.2385)

P= 39.1083

P= 6.2489%

BAJAJ AUTO LTD & TICO LTD:-

In this portfolio the risk of Bajaj is less when compared to the risk of TISCO (7.459<16.8109). The proportion of investment arrived at is 0.7917 for BAJAJ AND 0.2083 for TISCO. The calculated portfolio risk is 6.2489%, which is much lesser when compared to the individual standard deviations of both the companies involved in the portfolio.

80 CALCULATED AVERAGES & STANDARD DEVIATIONS

COMPANY NAME AVERAGES STD.DEVIATIONS AMBUJA cements 12.9720 16.8110 INFOSYS 5.0811 5.6801 BAJAJ Auto 1.3468 7.4759 ACC cements 2.7840 8.8855 ZEE TELE FILMS 0.1568 6.9110 HDFC 2.8143 7.4830 BPCL -1.4734 15.4259 HERO HONDA 0.8815 9.8618 TISCO 0.6238 16.8109 SATYAM 2.4742 6.7543 WIPRO -2.5818 21.0350

81 AVERAGES(R') 2.4742 0.6238 -2.5818 0.8815 12.972 -1.4734

2.8143 0.1568 1.3468 2.784 5.0811

AMBUJA INFOSYS BAJAJ ACC ZEE HDFC BPCL HEROHONDA TISCO SATYAM WIPRO

82 STD.DEVIATION 16.8064 21.035 5.6801

6.7543 7.4759

8.8855 6.9104 16.8069 7.483 9.8618 15.4259

AMBUJA INFOSYS BAJAJ ACC ZEE HDFC BPCL HEROHONDA TISCO SATYAM WIPRO

83 CALCULATED CORRELATION COEFFICIENT & PORTFOLIO RISK:

Company Name Correlation Portfolio Co-efficient Risk (%)

AMBUJA cements -0.2611 4.9629 &INFOSYS AMBUJA cements -0.1185 6.5282 &BAJAJ Auto INFOSYS & ACC -0.2213 4.259

ZEE TELEFILMS -0.1041 4.969 &HDFC WIPRO & BPCL -0.283 10.5873

HERO HONDA -0.1272 5.2261 &SATYAM BAJAJ Auto & -0.1988 6.2489 TISCO

INFOSYS -0.186 4.885 &HEROHONDA

84 Correlation Co-efficient

13% 18%

14% 8%

9% 15% 20% 3%

AMBUJA cements & INFOSYS AMBUJA cements & BAJAJ Auto INFOSYS & ACC ZEE TELEFILMS & HDFC WIPRO & BPCL HEROHONDA & SATYAM BAJAJ Auto & TISCO INFOSYS & HEROHONDA

85 PORTFOLIO RISK (%)

10% 10% 13% 14%

11% 9%

23% 10%

AMBUJA cement & INFOSYS AMBUJA cement & BAJAJ Auto INFOSYS & ACC ZEE TELEFILMS & HDFC WIPRO & BPCL HEROHONDA & SATYAM BAJAJ Auto & TISCO INFOSYS & HEROHONDA

86 CHAPTER - IV

87 FINDINGS AND CONCLUSIONS: