Market Intelligence Report CLA / Smiths Gore Rural Economy Index 3Q | 2013

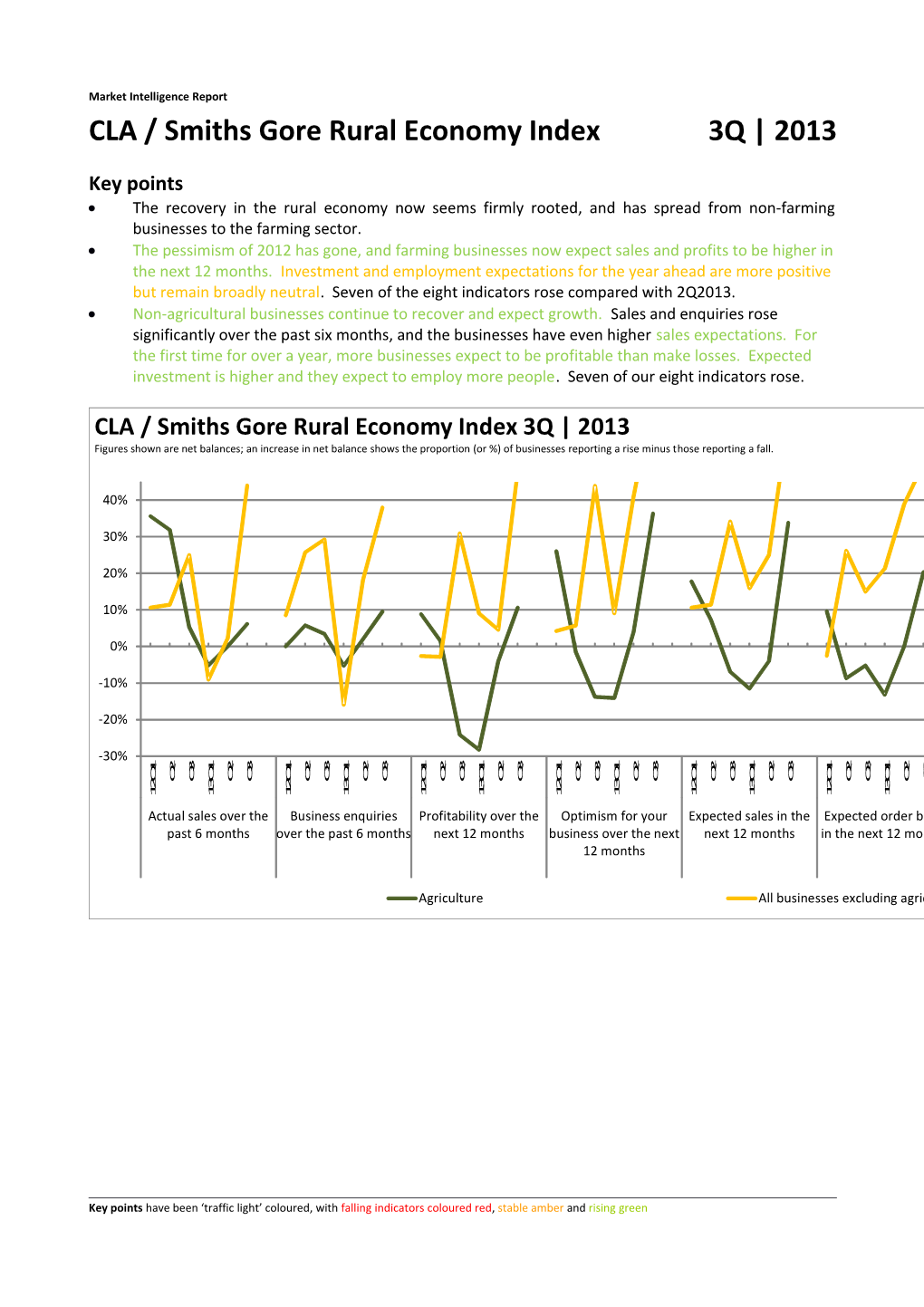

Key points The recovery in the rural economy now seems firmly rooted, and has spread from non-farming businesses to the farming sector. The pessimism of 2012 has gone, and farming businesses now expect sales and profits to be higher in the next 12 months. Investment and employment expectations for the year ahead are more positive but remain broadly neutral. Seven of the eight indicators rose compared with 2Q2013. Non-agricultural businesses continue to recover and expect growth. Sales and enquiries rose significantly over the past six months, and the businesses have even higher sales expectations. For the first time for over a year, more businesses expect to be profitable than make losses. Expected investment is higher and they expect to employ more people. Seven of our eight indicators rose.

CLA / Smiths Gore Rural Economy Index 3Q | 2013 Figures shown are net balances; an increase in net balance shows the proportion (or %) of businesses reporting a rise minus those reporting a fall.

40%

30%

20%

10%

0%

-10%

-20%

-30% 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 1 2 3 Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q 2 2 2 2 3 2 3 2 3 2 3 3 3 3 2 3 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Actual sales over the Business enquiries Profitability over the Optimism for your Expected sales in the Expected order book Expected investment Expected past 6 months over the past 6 months next 12 months business over the next next 12 months in the next 12 months in the business in next employment in the 12 months 12 months business in next 12 months

Agriculture All businesses excluding agriculture

Key points have been ‘traffic light’ coloured, with falling indicators coloured red, stable amber and rising green Market Intelligence Report About the Rural Economy Index Actual business performance over the last 6 months The CLA and Smiths Gore have developed the Rural Economy Index (REI) to provide a quarterly insight into the business environment of the rural More farming businesses reported rising sales than falling for the first time economy. in a year (net balance up to +6% from 0%). Sales greatly increased for non- farming businesses (net balance up to +44% from +2%) compared with the A sample of agricultural and non-businesses from all regions in England and previous quarter. So the recovery we first reported in 1Q13 is continuing. Wales are surveyed. The non-agricultural businesses include: 50% of non-farming businesses are now reporting higher sales, the highest level since the start of our survey. Mining, quarrying, renewable Hotels, accommodation, Public sector administration, energy or waste restaurants or food service education or health Actual sales over the past 6 months management All figures are net balances. Manufacturing Transport, storage or Other services (sports, arts, communications entertainment, recreation) 40% Construction Financial services or property Other 30% 20% Agricultural and non-agricultural businesses are analysed separately as the 10% sectors have different drivers. The businesses were asked questions about… 0% -10% -20% ...your actual sales over the past 6 months -30% ...business enquiries over the past 6 months 12Q1 Q2 Q3 13Q1 Q2 Q3 ...your profitability over the next 12 months ...your optimism for your business over the next 12 months Agriculture All businesses excluding agriculture ...your expected sales in the next 12 months ...your expected order book in the next 12 months ...your expected investment in the business in next 12 months Enquiries continue to rise for both farming businesses (net balance up to ...expected employment in the business in next 12 months +10% from +2%) and non-farming businesses (net balance rising to +38% from +18%). Interpreting net balances Business enquiries over the past 6 months As well as showing percentages of businesses reporting higher or lower sales, All figures are net balances. the REI uses net balances to show the direction and scale of change in indicators. Net balance shows the proportion of businesses reporting a rise 40% 30% in actual sales (or optimism or investment etc) minus those reporting a fall. 20% For example, +26% of agricultural businesses reported higher sales and -21% 10% lower, so the net balance is +5%. This can then be compared with previous 0% quarters. -10% -20% -30% 12Q1 Q2 Q3 13Q1 Q2 Q3

Agriculture All businesses excluding agriculture

Key points have been ‘traffic light’ coloured, with falling indicators coloured red, stable amber and rising green Market Intelligence Report The level of business confidence over the next 12 months Projected business performance over the next 12 months The perception of confidence or optimism is a good indicator of the short- The Index also looks forward at how businesses are expecting to perform. term outlook for businesses. Agricultural businesses now expect sales to be higher, the first time the The farming sector seems to have recovered from 2012 and is now optimistic sector has had positive expectations for a year (+34% from -4%). The rising about the future, with a net balance of +36%, up from +4%. It is now at its optimism of the non-agricultural businesses continues to be reflected in highest since our survey started. expectations of higher sales (+62% from +25% in Q1). So optimism is feeding through into higher sales expectations. The non-farming businesses are becoming even more optimistic and have fully rebounded from the drop in confidence in 1Q2013. The net balance of Expected sales in the next 12 months +68% from +41% in 2Q is the highest level we have recorded. All figures are net balances.

Optimism for your business over the next 12 months 50% All figures are net balances. 30% 80% 10% 60% -10% 40% -30% 20% 12Q1 Q2 Q3 13Q1 Q2 Q3

0% Agriculture All businesses excluding agriculture -20% These trends follow through into expected order books. Farming 12Q1 Q2 Q3 13Q1 Q2 Q3 businesses now expect orders to be higher in the next 12 months (net Agriculture All businesses excluding agriculture balance up to +20% from 0%). And more non-agricultural businesses expect growing order books (net balance up to +50% from +39%). Expected order book in the next 12 months All figures are net balances.

50% 40% 30% 20% 10% 0% -10% -20% -30% 12Q1 Q2 Q3 13Q1 Q2 Q3 Agriculture All businesses excluding agriculture

Key points have been ‘traffic light’ coloured, with falling indicators coloured red, stable amber and rising green Market Intelligence Report

Expected investment in the business in next 12 months Future Trends – Profitability, investment and employment All figures are net balances.

Profitability 40% 30% Agricultural businesses now expect profitability to be higher in the next 20% 12 months, the first time since 12Q2 (net balance rising to +11% from -4%). 10% Profit expectations for non-agricultural businesses rose sharply, to their 0% highest levels since we started this survey in 2012 (+48% from +5%). -10% -20%

Profitability over the next 12 months -30% All figures are net balances. 12Q1 Q2 Q3 13Q1 Q2 Q3

Agriculture All businesses excluding agriculture 40% 30% 20% 10% 0% -10% -20% -30% 12Q1 Q2 Q3 13Q1 Q2 Q3

Agriculture All businesses excluding agriculture

Investment Farming businesses continue to put investment decisions on hold as the net balance remains broadly neutral, at +6% from -4%. The investment expectations of non-agricultural businesses have levelled off but remain at their highest for over a year (net balance is up to +26% from +27%). 40% of non-farming businesses now expect to invest more compared with only 14% which will invest less.

Key points have been ‘traffic light’ coloured, with falling indicators coloured red, stable amber and rising green Market Intelligence Report Employment The signs of optimism in terms of employment we reported in Q2 continue. Farming business expect to employ about the same in the next 12 months (net balance -2% from +2% in Q2) but more non-agricultural businesses now expect to employ more people (+20% from +11%).

Expected employment in the business in next 12 months All figures are net balances.

40% 30% 20% 10% 0% -10% -20% -30% 12Q1 Q2 Q3 13Q1 Q2 Q3

Agriculture All businesses excluding agriculture

Key points have been ‘traffic light’ coloured, with falling indicators coloured red, stable amber and rising green