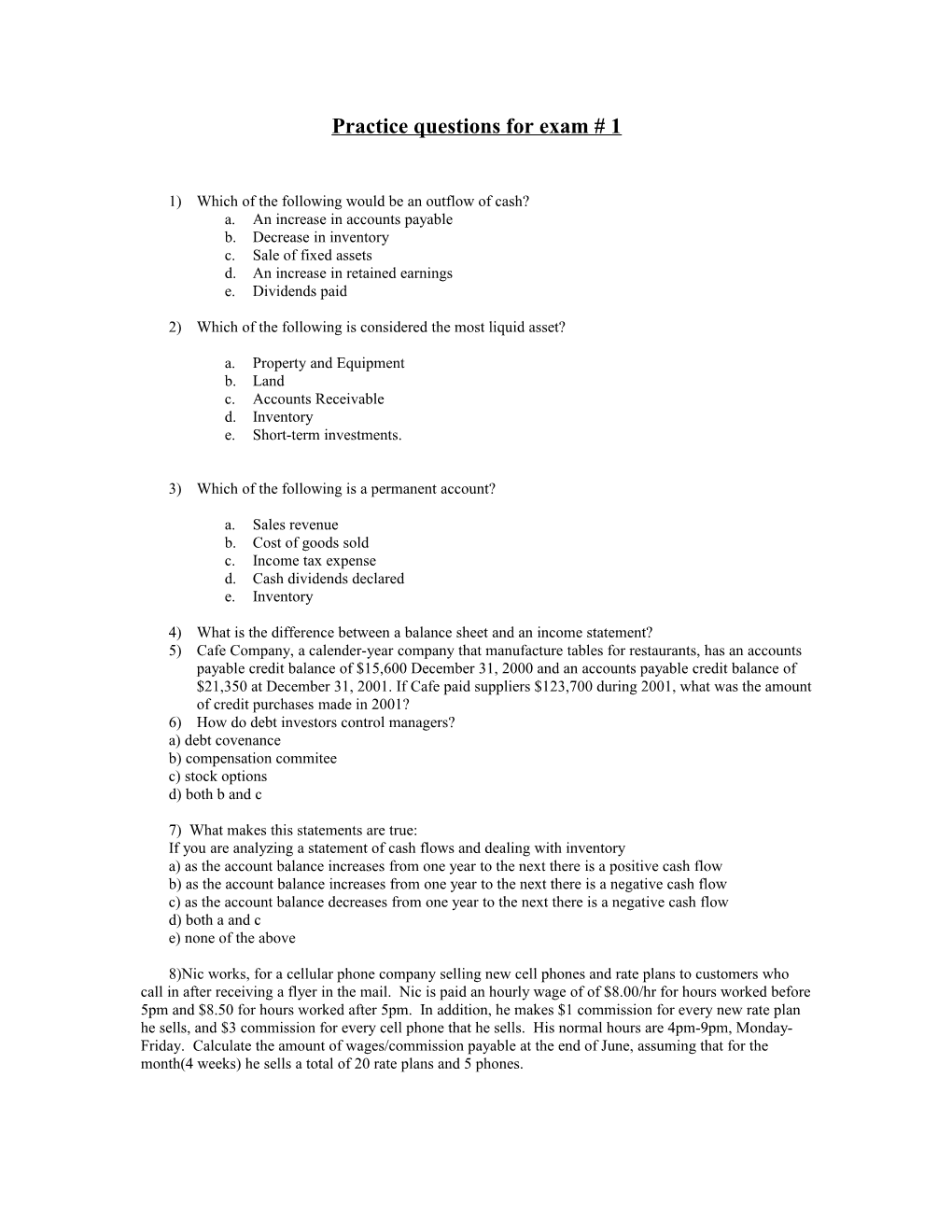

Practice questions for exam # 1

1) Which of the following would be an outflow of cash? a. An increase in accounts payable b. Decrease in inventory c. Sale of fixed assets d. An increase in retained earnings e. Dividends paid

2) Which of the following is considered the most liquid asset?

a. Property and Equipment b. Land c. Accounts Receivable d. Inventory e. Short-term investments.

3) Which of the following is a permanent account?

a. Sales revenue b. Cost of goods sold c. Income tax expense d. Cash dividends declared e. Inventory

4) What is the difference between a balance sheet and an income statement? 5) Cafe Company, a calender-year company that manufacture tables for restaurants, has an accounts payable credit balance of $15,600 December 31, 2000 and an accounts payable credit balance of $21,350 at December 31, 2001. If Cafe paid suppliers $123,700 during 2001, what was the amount of credit purchases made in 2001? 6) How do debt investors control managers? a) debt covenance b) compensation commitee c) stock options d) both b and c

7) What makes this statements are true: If you are analyzing a statement of cash flows and dealing with inventory a) as the account balance increases from one year to the next there is a positive cash flow b) as the account balance increases from one year to the next there is a negative cash flow c) as the account balance decreases from one year to the next there is a negative cash flow d) both a and c e) none of the above

8)Nic works, for a cellular phone company selling new cell phones and rate plans to customers who call in after receiving a flyer in the mail. Nic is paid an hourly wage of of $8.00/hr for hours worked before 5pm and $8.50 for hours worked after 5pm. In addition, he makes $1 commission for every new rate plan he sells, and $3 commission for every cell phone that he sells. His normal hours are 4pm-9pm, Monday- Friday. Calculate the amount of wages/commission payable at the end of June, assuming that for the month(4 weeks) he sells a total of 20 rate plans and 5 phones. 9) 01/01/99 Lauren is a struggling college student working 3 jobs in order to pay for school and living expenses. On her way to work one morning, her car engine blows up, and the mechanic informs her that she’s better off buying a new car than getting this car fixed. So, she goes and borrows an 8 year, $15,000 10% bank loan that requires interest payments once a year on June 1. What would be the amount of interest payable on March 31,1999?

10) Name the 9 steps in the Accounting Cycle. 11)True or False There is no relationship between the Balance sheet, Income statement or the statement of Retained earnings. 12) T or F In the Accrual category of the adjusting entries, the event happens before the cash changes hands

13)All these go under the operating activities in the statement of cash flows except a)Accounts Receivable b)Issuance of stock c)Accounts Payable d)Inventory

14) Every adjusting entry involves atleast one account and one account? a. permanent, cash b. temporary, expense c. permanent, temporary d. all of the above

15) Jim paid $250 for print ads to advertise his business. What account in the journal entry will be debited? a. Cash b. Advertising Payable c. Advertising Expense d. none of the above

16) Calculate Using the straight line depreciation method what is the amount depreciated per month on a new van that costs $19,350 and has a projected useful life of ten years and has a $350 salvage value? A)$162.00 month B) $158.33 per month C) $161.25 per month D)$157.00per month

17) Choose Best Answer 2) Identify the temporary account. A)Accumulative Depreciation-PPE B)Income Summary C)Wages Payable D)Both A and B E)All of the above

18) What is the difference between an asset and an expense?

19) If Ending Accounts receivable = $250,000 and beginning A/R = $110,000. Where would this information be helpful to the preparers of the Statement of cash flows? 20) John C's Liquor had sales last year of $200,000 and expenses of $113,000. The tax rate is 32%. What was the tax expense at year end? 21) ______consists of such things as journals, ledgers, computer hardware, company policies, procedures. a)double-entry syster b)accounting cycle d) accounting information systems e)journalizing and posting adjusting journal entries

22.)Extraordinary items, to be classified as such, must be a)unusual in nature b)infrequent in occurrence c)unusual nature or infrequent occurrence d) unusual nature and infrequent occurrence

23) For financial information to be relevant it must be valuable in predicting future events. It must also be valuable for evaluating past predictions and past performance, as well as being .

24) Which entry is the last to be prepared when making adjusting entries? a) Depreciation expense b) Rent expense c) Income tax expense d) Insurance expense

25) True or false. To find earnings per share, you take the number of shares and divide it by Income.