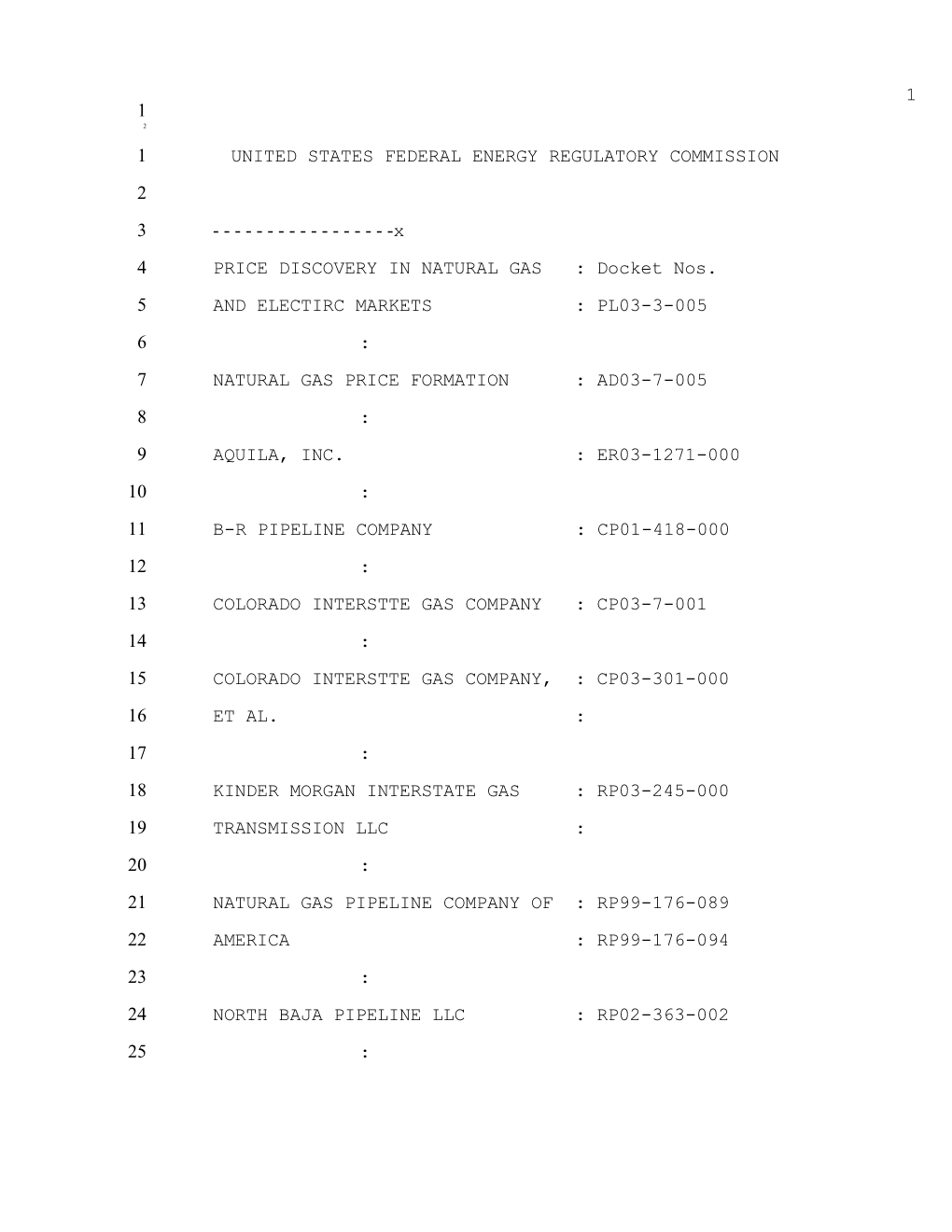

1 1 2 1 UNITED STATES FEDERAL ENERGY REGULATORY COMMISSION 2 3 ------x 4 PRICE DISCOVERY IN NATURAL GAS : Docket Nos. 5 AND ELECTIRC MARKETS : PL03-3-005 6 : 7 NATURAL GAS PRICE FORMATION : AD03-7-005 8 : 9 AQUILA, INC. : ER03-1271-000 10 : 11 B-R PIPELINE COMPANY : CP01-418-000 12 : 13 COLORADO INTERSTTE GAS COMPANY : CP03-7-001 14 : 15 COLORADO INTERSTTE GAS COMPANY, : CP03-301-000 16 ET AL. : 17 : 18 KINDER MORGAN INTERSTATE GAS : RP03-245-000 19 TRANSMISSION LLC :

20 : 21 NATURAL GAS PIPELINE COMPANY OF : RP99-176-089 22 AMERICA : RP99-176-094 23 : 24 NORTH BAJA PIPELINE LLC : RP02-363-002 25 : 2 1 2 1 NORTHERN NATURAL GAS COMPANY : RP03-398-000 2 : 3 NORTHERN NATURAL GAS COMPANY : RP03-533-000 4 : 5 PG&E GAS TRANSMISSION, : RP03-70-002 6 NORTHWEST CORPORATION : RP03-70-003 7 : 8 PORTLAND GENERAL ELECTRIC : CP01-421-000 9 COMPANY : CP01-421-001 10 : 11 TRANSCONTINENTAL GAS PIPE LINE : RP03-540-000 12 CORPORATION : 13 : 14 PACIFICORP : ER04-439-001 15 ------x 16 Commission's Meeting Room, 2C 17 Federal Energy Regulatory Commission 18 888 First Street, N.E. 19 Washington, D.C.

20 21 The above-entitled matter came on for 22 conference, pursuant to notice at 9:00 a.m. 23 24 BEFORE: 25 BILL HEDERMAN, OMOI 3 1 2 1 ATTENDEES: 2 3 Bill Hederman, OMOI 4 Steve Harvey, OMOI 5 Rafael Martinez, OMOI 6 Dave Perlman, OGC 7 Jim Overdahl, CFTC 8 Mike Stzelecki, OMTR 9 Mike Gorham CFTC 10 Ted Gerarden, OMOI 11 Lee-Ken Choo, OMOI 12 Mike McLaughlin, OMTR 13 Dick O'Neill, OMTR 14 15 COMMISSIONERS: 16 17 Sharon Brown Hreska 18 Joseph T. Kelliher 19 Nora Mead Brownell

20 Pat Wood, III, Chairman 21 Suedeen G. Kelly 22 Ric Campbell 23 24 Panelists as listed in the agenda 4 1 2 1 AGENDA 2 3 WELCOME AND OPENING REMARKS 9:00-9:30 a.m. 4 5 William Hederman, Director Office of Market Oversight 6 & Investigations 7 Stephen Harvey, Deputy Director, Market Oversight 8 and Assessment 9 10 Michael Gorham, Director, Division of Market 11 Oversight, Commodity Futures Trading Commission 12 13 Panel 1 -- Reaction to Staff Report and Recommendations for 14 Indices Used in population or Utility Tariffs 15 9:30-10:30 a.m. 16 17 PANELISTS: 18 Bruce Henning, Regulatory and Market Analysis, Energy 19 Environmental Analysis, Inc. (American Gas Association)

20 21 Eugene V. Rozgony, Vice President and Chief Risk Officer, 22 AGL Resources 23 Donald Santa, President, Interstate Natural Gas Association 24 of America 5 1 2 1 APPEARANCES CONTINUED: 2 Alexander Strawn, Proctor & Gamble Company and Chairman of 3 the Process Gas Consumers 4 5 James Allison, Regional Risk Manager, ConocoPhillips 6 7 ISSUES: 8 Should the Commission adopt Staff's recommendation that any 9 index used in a tariff provide volume and number of 10 transactions for each reported price? Should other data be 11 required? 12 13 Are Staff's recommended volumes (25,000 MMBtu/day or 4000 14 MWh/day ) or transactions (five for daily, eight for weekly, 15 ten for monthly indices) sufficient to indicate adequate 16 liquidity? 17 18 Should the Commission require all pipelines and utilities to 19 amend their tariffs by a date certain if indices currently

20 used in tariffs do not meet adopted criteria? 21 22 What conclusions can be drawn for the responses to the 23 Commission's surveys on price reporting? 24 6 1 2 1 ISSUES CONTINUED: 2 How does trading on electronic platforms and price data 3 collected from electronic trading, clearing, and settlement 4 relate to index development and use of indices in 5 jurisdictional tariffs? 6 7 BREAK 10:30 a.m.-10:40 a.m. 8 9 Panel 2 -- Price Reporting, Confidence in Indices and 10 Options for future Commission Action 11 10:40 a.m.-12:15 p.m. 12 13 Scott Nauman, Manager, American Gas Marketing, ExxonMobil 14 Gas &Power Marketing Company (Natural Gas Supply 15 Association) 16 17 Nathan L. Wilson, Vice President, Conectiv Energy (Electric 18 Power Supply Association) 19

20 Michael Novak, Assistant General Manager, Federal Regulatory 21 Affairs, National Fuel Gas Distribution Corporation 22 (American Gas Association) 23 24 Alonzo Weaver, Vice President Operations, Memphis Light Gas 25 & Water (American Public Gas Association) 7 1 2 1 APPEARANCES CONTINUED: 2 3 Jeff Walker, Senior Vice President and Chief Risk Officer, 4 ACES Power Marketing (National Rural Electric Cooperative 5 Association) 6 7 Al Musur, Director, Energy and Utility Programs, Abbott 8 Laboratories and Chairman of the Industrial Energy Consumers 9 of America 10 11 Alexander Strawn, Proctor & Gamble Company and Chairman of 12 the Process Gas Consumers 13 14 ISSUES: 15 What incentives will encourage companies to begin or 16 increase price reporting? 17 18 Are process improvements by reporting companies (public code 19 of conduct, independence source, audit of processes)

20 adequate or are there further improvements that can increase 21 the accuracy of price indices? 22 23 Has industry confidence in prices reported in indices 24 increased to a satisfactory level? 8 1 2 1 ISSUES CONTINUED: 2 3 What steps can be taken to improve transparency of price 4 indices? 5 6 What further information should price indices provide to 7 market participants? 8 9 Has sufficient progress been made under the Policy 10 Statement? 11 12 Should the Commission adopt further requirements for price 13 reporters and/or index developers? If so, what requirements 14 are appropriate? 15 16 Should some form of mandatory report be required? If so, 17 what is the desirable scope of such reporting (Who should be 18 required to report? Should reporting be to existing index 19 developers, to an intermediate or depository, or to the

20 Commission? What data should be required to be reported?)? 21 22 What mandatory report materially improve the qty of price 23 data available to market participants? 24 9 1 2 1 ISSUES CONTINUED: 2 3 Lunch Break 12:15-1:15 p.m. 4 5 Panel 3 -- Index Developers' Response to Industry Views 6 And Staff Report 1:15 -- 2:45 p.m. 7 8 PANELISTS: 9 C. Miles Weigel, Senior Vice President, Argus Media, Inc. 10 Brad Johnson, Global Energy Business Manager, Bloomberg 11 Ernest Onukogo, Manager, Newswire Indexes, DowJones 12 Richard Sansom, Markets Editor, IO Energy LLC 13 Bobette Riner, President, Powerdex 14 Tom Haywood, Editor, Energy Intelligence Group 15 Dexter Steis, Executive Publisher, Intelligence Press 16 Chuck Vice, Chief Operating Officer, 17 Intercontinental Exchange 18 Larry Foster, Global Editorial Director, Power, Platts 19

20 ISSUES: 21 What improvements in data collection and price reporting 22 have index developers seen since issuance of the Policy 23 Statement? 24 10 1 2 1 ISSUES CONTINUED: 2 3 How have index developers responded to the call of greater 4 transparency of indices? 5 6 What plans do price index developers have to provide more 7 information and more transparency to energy market 8 participants? 9 10 Do price index developers meet the standards of the Policy 11 Statement? Did the Staff report accurately depict the 12 extent to which index developers had adopted Policy 13 Statement standards? 14 15 Do price index developers support the criteria propose by 16 Staff for use of indices in jurisdictional tariffs? 17 18 How can price index developers facilitate tariff compliance 19 by pipelines and utilities?

20 21 Will price index developers provide FERC with access to data 22 in the event of an investigation of suspected false 23 reporting on price manipulation? 24 25 Panel 4 -- Market Liquidity 11 1 2 1 APPEARANCES CONTINUED: 2 3 PANELISTS: 4 Martin Marz, Compliance manager, North American Gas and 5 Power, BP America, Inc. 6 7 Christopher Edmonds, Senior Vice President ICAP Energy LLC 8 (Energy Brokers Association) 9 10 Pankaj Sahay, Partner, Energy Risk Management, 11 PriceWaterhouseCoopers 12 13 Tom Jepperson, Division Counsel, Questar Market Resources, 14 Inc. 15 16 Vince Kaminski, Managing Director, Sempra Energy Trading 17 18 ISSUES: 19 Is there adequate trading activity at enough locations to

20 develop reliable price signals for market participants? 21 22 What are the characteristics that make for a good trading 23 hub? 24 12 1 2 1 ISSUES CONTINUED: 2 3 What steps can the Commission take to encourage the 4 development of active trading hubs? 5 6 What role can electronic trading, confirmation/ settlement, 7 and clearing play in improving market liquidity. 8 9 Can improvements in price indices restore confidence in 10 price formation given the present levels of trading? 11 12 Are there standard procedures that can play a role in 13 improving price indices and industry confidence in price 14 formation? 15 16 Audience Questions and Comments 4:15-4:45 p.m. 17 18 Concluding Remarks 4:45-5:00 p.m. 19

20 21 22 23 24 13 1 2 1 P R O C E E D I N G S 2 (9:15 a.m.) 3 MR. HEDERMAN: Okay. Can we take our seats, 4 please. 5 (Pause.) 6 MR. HEDERMAN: Thank you and welcome to the, I 7 guess, fourth chapter in this effort. I want to welcome our 8 colleagues from the CFTC who worked with us from the 9 beginning on this as well. And, also, welcome Chairman 10 Campbell from the Utah Public Service Commission. I hope we 11 can stop meeting like this, at least on this topic. 12 This began as the Commission taking proactive 13 steps to avert a crisis that appeared to be developing on 14 the price formation process for natural gas and to some 15 extent electricity. Thankfully I think we've averted that 16 crisis that we had our eye on initially. 17 Today we meet to seek guidance of affected 18 parties on what the Commission should be doing going 19 forward. Has the crisis merely been postponed, or have we

20 turned an important corner? We're anxious to hear your 21 thoughts on that matter. We are anxious to hear your 22 thoughts on the options that staff has presented to the 23 Commission. And we are also interested in understanding 24 whether the price reporting problems will solve themselves 25 naturally as through improvement of liquidity in the markets 14 1 2 1 and comments on whether that reporting can improve before 2 liquidity improves. So, all of these are matters that we 3 hope to hear your insights on today. 4 We know that all the market participants have put 5 a lot of work into this and to working amongst yourselves, 6 working and communicating with us, and we thank you all for 7 those efforts. 8 We look forward to another fruitful day of 9 exchanging ideas and I'll turn to my key -- 10 MR. HARVEY: Right. 11 (Laughter.) 12 MR. HEDERMAN: Yes, to my key partner here on 13 this, Steve Harvey, to walk us through what we'll be doing 14 here today in more detail. 15 MR. HARVEY: With this being the fourth sort of 16 open meeting that we've had about this issue, it gets to be 17 a little bit of a routine. I usually try to say a couple of 18 things at the beginning, but we really enjoy hearing from 19 you all and we'll try to get to that as quickly as we can as

20 opposed to spending a lot of time doing that. 21 In general I think any statement I would make is 22 pretty fully encompassed in the staff report that we 23 delivered, I guess, at that beginning of May, at this point. 24 There's been plenty of time to look at that. I think it's a 25 good coverage of the issue. I hope so. 15 1 2 1 And I hope that this meeting will be helpful in 2 giving us some good concrete response to this and maybe move 3 the debate forward a little bit as I think some of the 4 previous ones have done. 5 Let me just describe very quickly what the 6 intention is for the four panels today. 7 The first panel was really designed for us to get 8 more direct feedback specifically on the staff reports 9 findings and recommendation. That would encompass the 10 survey results that we have in there, the specific tariff 11 policy recommendations that we have in there about those 12 tariff applications, and then finally the more general 13 public policy options. 14 The second panel really is focused or designed to 15 focus more on those general policy options as laid out in 16 the paper. 17 The third panel, after lunch, will give us the 18 opportunity to hear from the index developers and their view 19 of the status of where things are in this debate.

20 Then the fourth panel is a little bit different, 21 designed to broaden the issue beyond the transparency kind 22 of issues associated with indices and into the area of 23 market liquidity; is there enough activity, in effect, to 24 create prices that are reliable and dependable. 25 Very briefly, what I would like to do is review 16 1 2 1 the four high-level policy options that were laid out in the 2 staff paper. The first was to accept current progress where 3 the Commission would end active involvement with price 4 formation issues and permit the industry to address those 5 issues without any more formal structure or further 6 guidance. 7 The second was to continue to focus attention on 8 the issue where the Commission would actively encourage the 9 industry to implement the policy statement fully and monitor 10 closely the level of trading activity reported by price 11 index developers as well as compliance with the policy 12 statement standards for reporting. 13 The third would be to introduce mandatory 14 reporting where the Commission could move toward some form 15 of mandatory price reporting of energy trade data as a 16 number of parties have urged over the last several months, 17 and, in fact, even in recent comments. 18 And, fourth, encourage greater reliance on 19 platforms for trading, confirmation, settlement and clearing

20 where some parties have observed the most open forum for 21 obtaining accurate price information is trading on electric 22 platforms or some of these other automated efforts where 23 prices can fall out pretty quickly from the information 24 embedded in those. 25 Now, the one thing that has become a bit of a 17 1 2 1 custom for me at the beginning of these meetings is to lay 2 out the rules of the road. And those of you who have been 3 here before will be familiar with many of them, but let me 4 run through them real quickly. 5 We are interested in lively and active dialogue 6 today. So I'm going to ask a few things of the presenters. 7 First of all, panelists will be limited in their initial 8 comments to three minutes in order to cover the principal 9 position or thinking on the issue. I'm going to remind you 10 gently, at first, less so later, if you are running over 11 your time. We need to do that so we can get to the 12 interaction that's proven to be the most interesting part of 13 this. 14 Second, we would remind you that the conference 15 is being broadcast by the Capital Connection, and so it's 16 very important that when you speak you have your microphone 17 on so that people can hear you. 18 Third, material anyone considers germane to the 19 topic of price discovery and electricity or natural gas that

20 we're discussing today should be filed in this docket. And 21 we've tended to keep that open and we're interested in that 22 kind of feedback. Don't know how long that will last, but 23 we continue to be interested. And as always transcripts of 24 today's discussions can be ordered from the court reporter. 25 We're hoping to leave some time at the end of the 18 1 2 1 day in particular for any comments from the audience. But 2 given the number of panelists we've got to go through, it 3 may be a little tough to do much of that during the course 4 of the day. We will do what we can to encourage open 5 dialogue. 6 Now, having said that, I think we should probably 7 move into our first panel. 8 MR. HEDERMAN: Yes. 9 MR. HARVEY: And what we will do is we'll run 10 through the same order as the updated conference agenda and 11 that means we'll start with Mr. Henning. 12 MR. HENNING: Thank you, Steve, appreciate it. 13 My name is Bruce Henning. I'm director of regulatory and 14 market analysis for Energy and Evaluation Analysis, and I'm 15 appearing on behalf of the American Gas Association here 16 today to talk about the Staff Report and recommendations for 17 price indices use in pipeline tariffs. 18 As a backdrop, let me say that AGA believes that 19 the Commission's actions to focus attention on improving the

20 reporting of an indices has been partially responsible for 21 the trend towards improved confidence in the price 22 information. This course of action should continue. That 23 being said, AGA also appreciates the Staff's emphasis that 24 Staff is not evaluating use indices for general contract 25 use. I do not believe that there is a single standard for 19 1 2 1 sufficiency that's applicable for all general business 2 purposes. Each party must evaluate the index in the context 3 of business decisions. 4 Even for an individual LDC, sufficiency will 5 depend upon the circumstances being evaluated. An LDC that 6 is considering a 10, 15, or 20 year contract for the 7 purchase of LNG would have a very different standard than if 8 they're looking at daily, monthly, or balance of the month 9 transactions. 10 In the context of the use of jurisdictional -- of 11 indices in jurisdictional tariffs, I want to make one 12 overarching point. The Commission must not take any action 13 that threatens the viability of an efficient cash-out 14 mechanism, and that mechanism exists today. Cash outs are 15 much more efficient than any other make-up mechanisms and 16 should not be disrupted. 17 That being said, AGA believes that the Commission 18 has correctly identified three key metrics in evaluating the 19 validity of the index and jurisdictional tariffs.

20 Transaction volumes, the number of transactions, and the 21 number of counterparties are all important in evaluating 22 liquidity and in confidence in the index. 23 However, we note the one apparent inconsistency 24 between the language and the executive summary of the report 25 and in the body. The summary refers to a minimum level of 20 1 2 1 activity during an evaluation period, while the body refers 2 to average daily volumes, average number of transactions and 3 average number of counterparties during their respective 4 evaluation period. 5 The language in the body of the report is more 6 appropriate for maintaining the viability of the existing 7 cash out mechanism. 8 Finally, in terms of implementation AGA Is 9 hopeful that the index developers will indicate today in 10 this conference that they'll be able to meet the September 11 1st deadline for compliance with the recommendations. 12 However, even if the index providers meet that deadline, 13 there are significant difficulties with the staff 14 recommendation for the timing and evaluation of all points 15 refer to few in pipeline tariffs. If an index comes into 16 compliance on or near September 1st, the data for the 17 evaluation period may not be available until almost the 18 beginning of December, right in the middle of the winter 19 heating season.

20 Rather than impose an uncertainty in cash out 21 systems at that critical time AGA recommends that the 22 pipelines and their shippers be allowed to propose 23 appropriate solicitations in the context of the Commission's 24 evaluation criteria after the heating season is over. 25 One final comment. After an extremely difficulty 21 1 2 1 period transparency and confidence in price reporting has 2 increased markedly. One factor that contributes to that 3 confidence is multiple independent sources of information 4 that can be corroborated with reported data. My 5 understanding that the Commission staff uses this kind of 6 comparison just to validate the data, just as industry 7 participants do, the existence of these multiple sources 8 adds confidence in transparencies and should not be impeded. 9 Thank you. 10 MR. HARVEY: Thank you, Mr. Henning. 11 Let's go to Mr. Rozgony. 12 MR. ROZGONY: I'm from AGL Resources. I'd like 13 to compliment FERC for their leadership shepherding the 14 industry on these critical issues. 15 In the June issue of Energy Risk Magazine, CFTC 16 Commissioner, Sharon Brown Hreska, was interviewed about the 17 subject of managing manipulation in the energy markets. She 18 was emphatic on one particular point. She said, "It is my 19 view that prescriptive regulation cannot address the

20 problems being experienced by the energy sector, but may 21 exacerbate a liquidity shortage by unnecessarily imposing 22 costs on industry participants and create regulatory and 23 legal uncertainty." 24 Again, she repeated, "let me be clear, I mean to 25 sound an alarm here. These markets are vital to ensuring 22 1 2 1 cheaper, less volatile energy resources. Overly 2 prescriptive requirements for market transparency or 3 mandatory transaction reporting could do harm, raising costs 4 without direct benefit." 5 Let our company, AGL Resources be an example of 6 her contentions. The question we asked ourselves at our 7 company was how do we best serve our shareholders and the 8 best interests of our industry at the same time. 9 We have been very judicious within our company 10 evaluating our approach to price reporting from the 11 frontlines up to the board level. We determined that there 12 are two primary goals for our company regarding the issue of 13 price reporting. First, make the most empirically, logical, 14 economic financial decision in the best interest of our 15 shareholders. 16 Second, support the industry and markets by 17 facilitating a solution that provides both new discipline 18 and vision. 19 With regard to the first goal, our 2004 annual

20 report tells our shareholders that to us no opportunity is 21 too small. We focus on the bottom line, the top line and 22 every line in between. An enormous and burdensome de facto 23 tax has been levied on corporate America with new 24 Sarbanes/Oxley and corporate compliance rules. Every 25 company is suffering through this process and financial 23 1 2 1 expense. Additionally, in the energy sector, the issues at 2 hand also bring with them new burdensome processes and 3 financial expense. 4 We would have to go through a costly and rigorous 5 process to export price data so that another company can 6 financially benefit. These added processes and expenses 7 only serve to provide income to another company, not our 8 shareholders. We don't even get a free subscription in 9 return. 10 We have a fiduciary responsibility to our 11 shareholders, new infrastructure, new process, new 12 governance, new staffing, new compliance all cost money. 13 This is a material, economic fact that we cannot ignore if 14 we are to operate efficiently in the best interest of our 15 shareholders. Although we respect the competitive 16 opportunity of other indices publishers, we do not wish to 17 support the industry by backing in an inferior solution. 18 Especially if that solution creates an economic burden for 19 every company and its shareholders when there is a more

20 efficient alternative. 21 As a company we have decided to contribute to the 22 industry by helping to facilitate a new and better solution. 23 This industry is very fortunate to have these electronic 24 trading platforms in the physical energy markets. No other 25 physical commodity market has the benefits of this solution 24 1 2 1 at this time. 2 With regard to our second goal of supporting the 3 industry, our company executes approximately 85 percent of 4 our next-day transactions on ICE. And we think that is a 5 very significant contribution to price formulation and 6 indices reports that are published by ICE. 7 We also hope in the near future to utilize the 8 value of E-confirm which we also think is a superior product 9 for the industry. I sit on the AGA task force for price 10 reporting reform and have introduced AGA to ICE and helped 11 facilitate dialogue that would better educate the AGA 12 members on electronic platforms as a solution. 13 I have also met several times with ICE executives 14 with regard to these critical issues at hand, and more 15 recently I've met with the new chairman of NYMEX and 16 discussed at a high level the potential solutions that 17 electronic platforms offer to the industry such as ICE, 18 TENEX, E-confirm, and NYMEX Clearport. 19 In sum, we as a company have endeavored in the

20 campaign to bring together the very players of the solution 21 we as a firm believe in. We most effectively assist the 22 industry by supporting the superior solution. We believe 23 options A and D presented in the report are the best 24 solutions going forward. 25 Thank you. 25 1 2 1 MR. HARVEY: Thank you. 2 We would like to move to Mr. Santa. 3 MR. SANTA: Good morning. My name is Donald 4 Santa. I'm the president of Interstate Natural Gas 5 Association of America. I'm here today on behalf of INGA's 6 interstate pipeline members. 7 I'd like to focus my comments on the 8 applicability of the proposals in the Staff policy statement 9 to interstate pipeline cash out mechanisms. 10 It is imperative that the pipeline industry 11 continue to have the ability to reference index prices that 12 bear a close relation to the market conditions at the 13 locations that pipelines and their customers buy and sell 14 gas to resolve imbalances. Why is this important? 15 It's important because a disparity between the 16 location on the system and the index point can create an 17 economic incentive for shippers to go short or long on 18 pipeline imbalances. Let me illustrate this point with an 19 admittedly extreme example.

20 Let's assume that Henry Hub was the index point 21 and that for the New York City region the cash out was the 22 Henry Hub price plus transportation. Clearly, during the 23 winter heating season this price would bear little 24 relationship to the market clearing price for natural gas in 25 New York City. There would be a great incentive for a 26 1 2 1 shipper to short the pipeline. 2 While this example is extreme, it illustrates how 3 a disconnect between the conditions at the index point and 4 the market in which the pipeline and its customers are doing 5 business can affect economic incentives. And given the 6 current high gas prices and levels of volatility, this can 7 add up quickly. 8 What happens if as a result of the disparity 9 between the index and the market the pipeline has an 10 imbalance. Some pipeline tariffs include mechanisms for 11 surcharging shippers for the imbalance, others do not. Some 12 pipeline tariffs allocate the surcharge directly to shippers 13 who cause the imbalance, others use different allocation 14 methods. 15 My guess would be that if the imbalance account 16 levels grow as a result of disconnect between indices and 17 the actual market conditions, this will become a much more 18 contentious issue. 19 Furthermore, as a practical matter, the pipeline

20 is not guaranteed the recovery of the imbalance account. 21 Because of volumes in a subsequent year fall short of the 22 design volumes use for the surcharge. Or if the pipeline 23 moves greater discount volumes than projected, the pipeline 24 could end up short on its collection. 25 Don't get me wrong, pipelines want gas price 27 1 2 1 indices that are accurate. The more accurate the index, the 2 less of an incentive there will be for shippers to go short 3 or long on the pipeline. But pipelines do not want a 4 situation in which the search for the perfect index leaves 5 us in a situation that undermines the workability of the 6 cash out mechanisms in the pipeline tariffs. 7 Second, as highlighted in INGA's written 8 comments, we have got concerns about the workability of the 9 implementation schedule proposed in the staff paper. Staff 10 proposes that effective September 1 from each index location 11 used in a jurisdictional tariff the published index must 12 meet the criteria. It becomes awfully difficult to 13 implement this if we don't know until September 1 whether an 14 index provider qualifies or whether particular index points 15 qualify. 16 I would suggest that the Commission take this one 17 step at a time and allow an adequate interval between for 18 the industry to react to what is established. 19 Finally, INGA suggests that the Commission would

20 need to act under Section 5 of the Natural Gas Act to change 21 existing pipeline tariffs should it wish to proceed. 22 In doing so, the Commission must show that the 23 pipeline's current cash out point is no longer just and 24 reasonable, and also that the substitute that it prescribes 25 is just and reasonable. Should a number of cash out points 28 1 2 1 fall away by application of the Staff's criteria and the 2 pipeline is required to cash out at a distant point from its 3 market, it's not clear that the Commission could justify the 4 substitute point as being just and reasonable. 5 This I think also reinforces a point that there 6 really are not and have not been serious complaints about 7 the use of indices in pipeline cash out mechanisms. 8 Consequently I would suggest that a prudent approach would 9 be for the Commission to apply its criteria in the event 10 that there is a complaint about a particular pipeline's cash 11 out, or if a pipeline comes to the Commission to modify its 12 cash out. There does not appear to be a strong 13 justification for acquiring an across-the-board revision of 14 pipeline cash out mechanisms. 15 MR. HARVEY: Thank you. 16 Mr. Strawn. 17 MR. STRAWN: Good morning. Thank you very much 18 for the opportunity to speak. My name is Alexander Strawn. 19 I oversee all of the physical contracting of gas for Proctor

20 & Gamble in North America. I also happen to be sitting here 21 today representing the Process Gas Consumers Group otherwise 22 known as PGC. We are an active trade association of 23 industrial gas consumers who require natural gas in most of 24 our key operations. And we have a broad cross-section of 25 membership representing just about every single business 29 1 2 1 entity in the United States and we consume over half a TCF 2 of gas annually. 3 We work generally to promote a coordinated and 4 rational and consistent approach to federal and state 5 policies in reaction to natural gas supply and demand. 6 In general I am very pleased to report from our 7 membership and the cross-section of companies that I 8 represent that we have a high level of confidence in the 9 price indices as they are standing today. And as indicated 10 in the May 5th staff report, industrial confidence is at a 11 level of 7.43 on a scale of one to ten. All of our members 12 pretty much reflect that same level of confidence and we are 13 very pleased to report that to FERC today. 14 As shippers on interstate pipelines across the 15 grid, Process Gas Consumers is very familiar with the use of 16 indices and tariffs to calculate such things as penalties 17 and cash out and has been very active in negotiation of 18 pipeline cash outs and penalties in general. 19 In the event that the Commission determines that

20 certain indices or points cannot be used in jurisdictional 21 tariffs, PGC has some concerns about the implementation of 22 the Commission's new policy which I'll detail later in the 23 Q&A. 24 And, finally, we believe that competitive, 25 multiple sources of reporting are vital to a consistent and 30 1 2 1 healthy market, introducing new indices that perhaps bring a 2 note of uncertainty to markets that are already challenged 3 and supply and demand is not a path that we prefer to go 4 down at this point. 5 Thank you very much. 6 MR. HARVEY: Thank you. 7 Mr. Allison. 8 MR. ALLISON: I am Jim Allison with 9 ConocoPhilips, where I am the regional risk manager for gas 10 and power traded activities in North America. 11 Let me begin by congratulating the Staff for the 12 wonderful work they have done getting the survey out, 13 getting the survey analyzed and producing the report. I 14 understand that none of the survey results were in ahead of 15 schedule and a tremendous amount of work got done in the 16 roughly 30 calendar days, which turned into, I guess, 30 17 working days also before the report came out; 300 pages of 18 SAS tables, and 60 some pages of text describing the results 19 is a very impressive accomplishment.

20 Bill, in his opening comments, asked whether the 21 corner has been turned. I would suggest that it has been. 22 There are many causes for that. I would highlight one thing 23 as a triggering event and that would be the guidelines that 24 the Commission issued last summer. I think revolution is an 25 appropriate term to describe what that accomplished in the 31 1 2 1 price reporting practices. 2 Once upon a time price reporting was done by 3 traders very informally. Now price reporting is done out of 4 our system it is done by the risk management or other mid- 5 office people. It is a professional, auditable process that 6 one can fairly hold up the light of day. And I believe that 7 has resulted in a tremendous change. 8 As with most revolutions consolidation of the 9 benefits is taking longer than declaring a revolution. And 10 we see that in the survey and the rate at which volumes are 11 coming back in which people reporting are coming back to 12 business. Even with that, for the October to February time 13 frame the data and the report, I believe, strongly support 14 the notion that people (a) express confidence in the 15 indices, and (b) back that up with their capital by using 16 the indices. 17 I can comment at more length upon my reading of 18 the data but the people out there are in fact using indices, 19 on average, about 62 percent of the volumes transacted are

20 priced off indices. So a very large number of capitalist, 21 profit-driven companies have put capital at risk using the 22 indices. They would not do that if we didn't trust them. 23 This is backed up by the statements from our 24 customers. Our customers who are consumers of gas, like 25 Alex, are not happy with the level of price. If you are a 32 1 2 1 gas consumer, $6 gas is not good news. They are, however, 2 telling us that they are by and large happy with the 3 indices. And, in fact, my traders tell me that with the 4 current level of high prices we see customers choosing to do 5 business on an index basis rather than a fixed-price basis. 6 At the current price level they do not wish to take the 7 fixed-price risk, they choose to use indices instead. 8 Again, if they were not confident in the indices, 9 they would not make that decision. We would be happy to do 10 the business with them on either pricing formula. 11 The other question, I think, is where do we go 12 from here? The Commission articulated four options. I 13 think the staff wisely highlighted the costs and risks 14 associated with mandatory reporting. I believe that would 15 be a grave blunder for the country to move into at this 16 point. I'll not amplify on the comments that the staff had 17 in their report. I think you did a good job covering the 18 implementation difficulties and costs that would bring. 19 Neither do I think we can simply declare victory,

20 close up shop, and move on to everything else. I believe 21 the market is way too important to American consumers not to 22 have some degree of continuing oversight. And I believe 23 that is part of the Commission's role. Other reports, other 24 suggestions were with respect to the use of the electronic 25 platforms. I'm a big fan of electric platforms. From a 33 1 2 1 risk manager's perspective, they make my life much easier, 2 partly because they're standardized, they're transparent, I 3 get good information and because they're electronic, I have 4 a prayer being able to automate data feeds which reduces my 5 costs. All of that is good. However, roughly half of the 6 business done in both the day-ahead and the bid-week market 7 is done directly bilaterally with customers rather than over 8 electronic platforms partly because the customization, the 9 customer's desire, one of the strengths of electronic 10 platforms is the standardization of contracts. But when you 11 are trying to meet the needs of a customer, that is also one 12 of the weaknesses of electronic platforms. 13 I don't believe the Commission needs to do 14 anything beyond what it has already done to encourage us to 15 use platforms where they are suitable for the task. We like 16 the benefits of platforms, they make our lives much easier, 17 but they are not always the right tool for meeting the 18 customer's needs. 19 One other issue I would raise in terms of our

20 path forward, in terms of what changes in the system really 21 would add substantial value. And the one issue I would 22 highlight for the Commission would be something that helps 23 us address the credit problem. We have come to realize, 24 somewhat belatedly, how much economic capital is absorbed 25 through credit exposure. Once upon a time we had grossly 34 1 2 1 under estimated that parameter and some companies that are 2 no long with us are not with us because of that problem. We 3 have had lots of discussions about tools to address the 4 credit issue. I think there are a couple of things the 5 Commission can do to help push this forward and a couple 6 things the Commission should refrain from doing because it 7 would get in the way. 8 Among the things the Commission should refrain 9 from, I think the Commission cannot be in a position of 10 decreeing the solution. I don't think we know what the 11 answer is yet. So I don't think the Commission ought to be 12 imposing a credit solution at this time. In particular I 13 know there have been some groups out there who have been in 14 effect asking for monopoly licenses for particular 15 solutions. I think that would be a mistake; (a) I'm opposed 16 to monopolies; (b) I'm not convinced they got they've got 17 the right answer. 18 On the affirmative side, I think there are a few 19 things the Commission could be doing that would be extremely

20 helpful. First, your influence with the state regulatory 21 groups could be very helpful in having the states recognize 22 that the credit issue really is a broad national issue, not 23 a local state issue. And that the proper solution of the 24 credit issue needs to have all of the participants in the 25 market as part of the solution, not focused on one sector of 35 1 2 1 the industry. 2 Some of the state public utility commissions 3 have, partly because of who they regulate, tended to focus 4 on one segment of the market and have missed other segments 5 of the market. 6 I think the Commission could play a very helpful 7 role helping to guide the public utility commissions and 8 seeing this as part of the national issue and getting all of 9 the players into the credit solution rather than just one 10 side of the market. 11 We have had lots of hopes for mechanisms such as 12 clearing. They have come to pass more slowly than one might 13 have hoped. Although the growth in the NYMEX Clearport 14 contracts has been very encouraging. We have had lots of 15 hope for things like margining and netting agreements. 16 Those two are coming to pass more slowly than many of us 17 might have hoped. 18 I don't know that we know what the right answer 19 is. I think the market is more slowly than I would like,

20 but I think the market is evolving toward a solution. And I 21 said, there are a few things the Commission can do that will 22 help the market evolve toward a good solution. I think this 23 is not the time to decree what that solution would be. 24 I am happy to address the details of the report 25 later on. 36 1 2 1 MR. HEDERMAN: Thank you. I'd like to start with 2 a question for Mr. Rozgony. You were talking about the 3 immense costs that might come with a mandate. Have you done 4 any ballpark estimates of those costs? 5 MR. ROZGONY: (Off mike.) I couldn't give you a 6 number, but I did determine that -- I'm sorry. I don't have 7 any specific numbers. But we did determine that we would 8 have to hire new employees. We did determine that we had to 9 reengineer our systems. We did determine that we would have 10 to involve our legal department to a greater degree through, 11 you know, new compliance requirements around this issue. 12 So when you add all those up, just intuitively it 13 is an expense. I don't have a specific number, but I would 14 say that it's material, it's when we are evaluating some of 15 our smaller subsidiaries. It's a material effect. 16 So, quite simply there is clearly an expense and 17 there's clearly a savings by the fact that we are actually 18 saving money by utilizing the electronic platforms because 19 there's no burden of exporting data. You know, it's

20 directly, we don't even calculate. I mean, we don't do 21 anything. Our consummated transactions which are 22 approximately 85 percent of our transactions get captured in 23 their -- I'll call it a clearing mechanism, it's not exactly 24 a clearing mechanism, but -- and combined with the E-confirm 25 product and produce just very efficient weighted average 37 1 2 1 calculations that, you know, I don't think anybody can argue 2 are the most auditable real-time solution out there. So we 3 see that not only does it benefit us, but it also produces 4 the best result. 5 Did that answer your question? 6 MR. HEDERMAN: Yes, thank you. 7 Steve. 8 MR. HARVEY: I'd like to ask and maybe several of 9 you, but in particular Mr. Henning and Mr. Santa, help me a 10 little bit just kind of lay out the implications in effect 11 of not being able to use the indices for these cash 12 balancing mechanisms. Some of the mechanics of -- you know, 13 on the one hand we've got some timing issues that you've 14 expressed concern about. On the other we do have -- you 15 know, there is potentially a threshold where an index is not 16 sufficiently good to be used in that case. 17 What is in effect the next best solution and what 18 are sort of the consequences of not being able to do it 19 through cash balancing mechanism? Just draw me a sort of

20 mental picture of this thing a little bit. 21 MR. HENNING: Well, I think for the mechanism to 22 work, and for it to be efficient as it is now, it's got to 23 reflect the value of natural gas within that particular 24 market area. In other words, to be a mechanism where it is 25 tied in there. 38 1 2 1 I think that when you look at the issues, you're 2 going to find that with a variety of different data sources, 3 you can find indices that will reflect the value of natural 4 gas in those market areas on those pipeline systems. Now, 5 does that match up with every one according to this 6 efficiency criteria that's proposed in the Staff Report? 7 No, maybe it doesn't. But there will be a mechanism to 8 identify those and the pipeline and the shippers should have 9 the time to be able to go forward and find those particular 10 things. 11 In the absence of that, there is a risk that you 12 will have a gap where you won't have a viable cash out 13 mechanism and that's what I think we're looking to try to 14 avoid. 15 So I think that the issue of timing in terms of 16 how you go about identifying those solves the problem that I 17 think you're referring to which is, you know, what happens 18 in the absence of any viable measure of the value of gas on 19 the pipeline system at that point.

20 MR. SANTA: I would add that if you had a 21 situation where you could not use an index and you were 22 forced for purposes of that you -- then could you do a cash 23 out. Good question. If you couldn't do a cash out, then do 24 you go to resolving imbalances with in-kind payments of gas? 25 Which I think would be much less efficient and potentially 39 1 2 1 could create operational problems for the pipelines. For 2 example, if someone did not resolve their imbalances 3 promptly and increasingly got out of balance, how do you 4 penalize that customer and give them an incentive to get 5 back into balance. 6 Also, to the extent that the imbalances went 7 toward the side of the pipeline being short gas, the 8 pipeline increasingly would have to draw upon its line pack 9 or other sources of gas to operationally meet the delivery 10 requirements. Which then at some point compels the pipeline 11 to have to go the marketplace and become a purchaser of gas 12 to replenish that line pack. 13 And, again, as you have a situation where 14 customers would get increasingly out of balance, the pipe 15 would go back to being more and more involved in the 16 commodity end of things by having to go out there and become 17 a major purchaser of gas or quite frankly if things went the 18 other way possibly a seller of gas. 19 And while the pipes do some of that activity

20 today, it is very, very de minimus. It's like you got a 21 threshold question, do you want to put the pipes back in 22 that role. And I think it's a reason why you would want to 23 try to find a viable means to have, as Bruce said, some 24 indicia of what is the market price of gas in those markets 25 where the pipes are doing business. 40 1 2 1 The other point I would make is I know that the 2 staff paper drew the distinction between the use of the 3 indices and the pipeline tariffs, and the commercial use of 4 the indices. And in the commercial use of the indices it 5 talked primarily about it in bilateral transactions. But, I 6 mean, I think the other thing here, the part that that 7 missed, and what I think was probably one of the real 8 drivers as to why this became such a great issue was the 9 fact that within restructured power markets and if the gas 10 generators were at the margin, and if the price of gas is 11 what is largely driving the incremental price of power, the 12 concerns that if there was a distorted price of gas that was 13 reflected there, it would translate very concretely into the 14 electricity prices. 15 And I think that's a problem of kind of a whole 16 different order of magnitude than the concern about pipeline 17 cash out mechanisms and the accuracy of the indices where 18 the volumes and what is at stake are far less. And also 19 quite frankly it's an area where while pipes and their

20 customers may fight about the cash out mechanism and the 21 context of a tariff proceeding and all the intricacies of 22 it. It was not something over which there was a major human 23 cry that something was out of whack that was adversely 24 affecting the market or consumers. 25 MR. PERLMAN: Can I ask a really quick follow-up 41 1 2 1 question to both of you? 2 When the staff proposed those criteria and tried 3 to be sensitive to the issues you're talking about and try 4 not to cause problems for existing pipelines, thinking that 5 many of the tariff provisions that use cash outs today based 6 upon indices would not be affected. Have you gone back or 7 your members gone back and looked at whether there really is 8 a problem if the staff's criteria where adopted, would there 9 be issues with existing tariffs that would cause the need to 10 make changes? Or would most of them, if not all of them be 11 found to have met that criteria? 12 MR. SANTA: Dave, I'm not sure to say we've done 13 it exhaustively. However, INGA and its members have gone 14 back and looked at it. One of the questions we have has to 15 do with kind of some of the ambiguities about how the 16 criteria would be applied. Because, for example, there are 17 individual days when a particular point on the daily basis 18 may not have either the requisite number of transactions or 19 requisite volumes to qualify.

20 Well, how is the Commission going to treat that 21 for whether or not the point on the whole qualifies? Are 22 you going to look at it over that 90-day period and somehow 23 average it in a way that will recognize that maybe on 24 isolated days it may not comply? Or is this going to be a 25 case of if you don't meet it on one day or you don't meet it 42 1 2 1 on a handful of days it's out. So I think that, you know, 2 some of that in terms of the details as to how those 3 criteria will actually be applied, I think will affect the 4 degree to which a number of points -- significant number of 5 points drop out. 6 MR. PERLMAN: Well, we'll assume that you can 7 make the conclusion that it would be the average rather than 8 the specific day. 9 MR. SANTA: If it is the average, it is -- I 10 think it would be much less problematic. However, I can't 11 say that -- you know, we've gone back and have exhaustively, 12 you know, analyzed it to see how many will drop out if you 13 did it on the average versus the isolated basis. I can say 14 that on the one thing that did come through from our looking 15 at it was that with respect to -- rather than the daily, the 16 monthly, to the extent that there is any reference to the 17 monthly, there are far fewer points that will qualify using 18 the monthly criteria. 19 MR. HENNING: One thing that we did and tried to

20 take a look at the particular issue was we just for the sake 21 of the ease of downloading the data, we actually looked at 22 all of the points reported by ICE and looked at the daily. 23 And applying a rolling 90-day average period, the vast 24 majority of those points, although there are few in the 25 daily market that would meet the proposed criteria. Now, AJ 43 1 2 1 member companies differ as to whether or not that is the 2 exact correct criteria. And I'm not taking a position on 3 that. But just illustratively on the daily most of those go 4 and pass. 5 If you were to apply the minimum threshold 6 interpretation then over half of those points drop out. So 7 there's a significant difference in terms of the 8 interpretation there. 9 Many more of those points are problematic from 10 the perspective of a monthly contract. And so there may 11 well be some points that at the end of the day don't meet 12 that criteria and you're going to have to have the time 13 available for the pipeline and the shippers to evaluate that 14 data and propose what alternatives might be appropriate. 15 MR. STRAWN: If I could make one other comment, 16 too. Just in general I kind of echo the same sentiments 17 here. Any time you're going to bring another level of 18 uncertainty to the cash out provision for these supposedly 19 less liquid points, you're going to cause more complexity to

20 the overall system, more challenge, more potential 21 litigation, more protracted analysis of those points, and 22 more involvement by all parties in an area that largely 23 hasn't been in great dispute. 24 And if you throw it into that level of 25 interaction, then what's likely to happen is you will have 44 1 2 1 more and more individual negotiation that goes on and maybe 2 even less reporting of what actually those points will be. 3 Because most of the discussion will be with the two parties 4 involved. 5 Right now, at least you have the liquidity 6 associated of what's reported even though it may not meet 7 the test of what you consider to be actively liquid. But 8 bottom line it adds more complexity and more challenge of 9 the parties involved. 10 MR. PERLMAN: But just to be clear, I thought I 11 heard Mr. Henning say that it was important that the tariffs 12 have an index, if there is an index used for cash outs, that 13 it have some meaningful relationship to the location. 14 And I think the question that we would have is 15 how do we validate that if the index is usable, and meets 16 the criteria the Commission can use to say it's just and 17 reasonable, and I'm hearing, maybe I'm mischaracterizing, so 18 I'll ask you to explain that. If it didn't meet whatever 19 criteria that we were to establish, it would be the next --

20 Steve was, I think, implying -- the view I'm hearing is that 21 the next step, the uncertainty or the in-kind type of issues 22 are more material than having a problematic index. So we're 23 sort of stuck with trying to do the best we can with the 24 indices that we have because the next best is worse. Is 25 that a fair characterization, or am I overstating the issue? 45 1 2 1 MR. SANTA: I think it goes to the point that I 2 made earlier about if, you know, as Mr. Strawn just said, 3 you know, even if it maybe doesn't precisely meet it, 4 depending upon how you apply it, but nobody is really seeing 5 themselves as being at a disadvantage in the marketplace. 6 And that should be a strong indication that there's not a 7 problem and there really is not a need to say to the 8 pipeline you must come in and amend your tariff and either 9 use a point that meets the criteria or go to some 10 alternative. 11 You know, by the same token, if those who are in 12 the marketplace and dealing with this in the context of the 13 cash out don't have confidence in that point and want to 14 come to the Commission and say, you know, please make the 15 pipeline revise its tariff so as to get in a point that 16 meets the criteria, then as I suggested up front, you know, 17 that would seem to be a prudent approach where it would 18 address a problem to the extent that it was a problem. And 19 yet not create potentially complexity and contention where

20 there isn't one. 21 MR. HENNING: On point, the AGA member companies 22 who have looked at this, as I said, believe that the 23 Commission and staff has correctly identified three 24 important metrics. And so if in fact, we move forward, and 25 I hope we'll hear this afternoon, the index providers can 46 1 2 1 provide information on volumes, numbers of transactions and 2 numbers of counter parties, that information is going to be 3 available and you're going to look at that and you can 4 determine whether or not you're using an appropriate index; 5 and if not, then you talk to your pipeline in terms of how 6 it can go forward. 7 I think that that's going to be a positive step 8 in having that information out there. But it's the issue 9 and uncertainty that would be created by a time schedule 10 that would imply that you wouldn't know that at the time and 11 be able to approach your pipeline and come up with the most 12 appropriate workable solution. I mean, once that 13 information is out there, analysts such as myself and the 14 member companies are all going to be looking at it just as 15 the Commission will. 16 MR. STRAWN: One final point, if I may add it. 17 And that is that particularly if we were to look at this in 18 a more exacting way and not use those points and apply it 19 retroactively where you have some cases that are pending,

20 that would just cause unbelievable confusion and 21 consternation amongst the people and the parties that are 22 involved. And for that reason, if nothing else, we would 23 favor continuing monitoring and just some type of ongoing 24 evaluation as opposed to a definite move toward elimination 25 of those points. 47 1 2 1 Thank you. 2 MR. STRZELECKI: A question for Mr. Henning, a 3 follow-up question. 4 If a pipeline determines that an index point does 5 not comply with our criteria, you said then there is this 6 process that goes to value what your next step is. Transco 7 in their comments, I believe, called it the transition 8 process and they recommended a 60-day timeframe to do this. 9 What timeframe do you need to find another point that 10 qualifies or another solution to the problem? 11 MR. HENNING: I think it's hard to say that 12 there's a particular number that will always be there. And 13 I think that obviously it's going to have to deal with the 14 individual specifics of that pipeline system and identifying 15 an appropriate index that reflects the value of gas at that 16 system. 17 I think a concern is whether or not in the 18 process that's contemplated here, doing all of that for all 19 of the points on all pipelines in a time period that's

20 putting you over the winter heating season. And so the 21 recommendation is let's go forward, get the appropriate 22 metrics out there to the greatest degree possible, the 23 information, and allow that -- the shippers, the LDCs, the 24 pipelines, all other shippers on the pipeline to get 25 together and figure out what that is after the winter 48 1 2 1 heating season. 2 MR. STRZELECKI: Okay. And just one more 3 follow-up. In the Staff Report we recommended or threw out 4 a September 1st implementation date for the criteria. And 5 some pipelines and commenters had problems with that. What 6 would you recommend as a reasonable implementation date? I 7 think National Fuel said June of 2005 after the heating 8 season and such. What would you guys recommend? 9 MR. HENNING: Within the membership there's no 10 particular date that they agreed upon at that. So I can't 11 give you a particular date there. Again, though I'd say 12 what I am hopeful is we'll hear, and frankly the local 13 distribution companies can't know what the index providers 14 are going to say, we'll hear that later, what we're hopeful 15 is that we'll start getting that data and be able to look at 16 it with all of the elements of the metric that are being 17 recommended on or about September 1st. We are already 18 seeing some improvements in terms of the information. We've 19 got more data now to analyze than we did a year ago, and

20 that's a very positive movement. Part of it because the 21 industry did step up in the process making their own 22 recommendations and the Commission is adopting those 23 recommendations as well through the CCRO process and the 24 Commission's actions on it. 25 So I think we're moving in that direction. And 49 1 2 1 hopefully by September 1st we'll be able to get that 2 information from all the index developers. 3 MR. STRZELECKI: Okay. Thanks. 4 MR. ALLISON: Let me add a comment on that, if I 5 may. The view of this panel is that the cash out process is 6 by and large working pretty well right now. As we implement 7 new criteria, we therefore need to be a little bit careful 8 that if the criteria result in rejecting particular points, 9 in contrast with the current view that the market actually 10 is working pretty well, most of those rejections probably 11 should be viewed as highly likely to be false negatives in 12 the sense that the criteria have said an index is not good 13 when in fact the market has said it is good. 14 We haven't seen all the data. Therefore, we 15 don't know what the data will show. There has been some 16 analysis done that is generally encouraging. But I think 17 the fair statement is, anything implemented September 1 18 probably should be viewed as tentative. And we need to 19 evaluate how it actually works in real life.

20 If the criteria, whether it's average or minimum, 21 whether it's 90 calendar days versus 90 trading days, if the 22 criteria result in rejecting lots of points, then the 23 criteria, I think, by definition have been set too strictly 24 and will need to be modified. 25 I don't know that it is possible to know ahead of 50 1 2 1 time what the right criteria are, because there are all 2 these unintended consequences from it. 3 So I would suggest that viewing a September 1 4 date as a tentative, perhaps experimental period, in the 5 market April 1 is traditionally viewed as the beginning of 6 the summer trading season, June 1 is a time when volatility 7 typically is low. I don't know that there's anything 8 magical about either of those as a target date for a more 9 permanent -- and in fact "permanent" probably is way too 10 strong a concept for any of these things, but we do need to 11 be very, very careful to watch out for the false negatives 12 from whatever criteria are established. 13 MR. O'NEILL: Could I ask you to clarify what you 14 mean by -- you said, "a false negative is good" or that the 15 "index is good". What do you mean when you say an index is 16 good? 17 MR. ALLISON: By a "false negative" I mean, the 18 result that applying the criteria means that an index would 19 be rejected as not allowed for the purposes of cash outs.

20 That is a false negative if the market has formed the 21 opinion that that index actually is quite useful for the 22 purposes it's being used for, cash outs, trading, other 23 things. There may be particular markets where the indices 24 are viewed as highly reliable. Even though they fall short 25 of the kinds of criteria that have been set. We simply 51 1 2 1 don't know yet. But the market has had a fair amount of 2 experience dealing with these things and has evolved toward 3 particular patterns of use. 4 As previous speakers have said, there hasn't been 5 a tremendous human cry about the cash out process. So the 6 evidence by and large is that the indices that are currently 7 being used seem to be working pretty well. So I think there 8 is probably a presumption that they are good for the 9 purposes for which they're being used. 10 MR. O'NEILL: I understand that. But I mean, I 11 don't know what it means to say, working well and good. I 12 mean, yes, they work well because they provide people a way 13 to calculate cash out numbers. They really work well 14 because there's a number there and you can cash out on that 15 number. But how good is that number? Is it just and 16 reasonable? 17 MR. ALLISON: It is used without objection by 18 parties that have alternatives both for cash outs and for 19 sundry other commercial transactions.

20 MR. O'NEILL: And you are proposing that as our 21 standard? 22 MR. ALLISON: And I recognize that standard has a 23 lack of objectivity that makes it difficult for the 24 Commission to use only that. And I therefore recognize why 25 you want more numeric standards such as the ones proposed. 52 1 2 1 My cautionary note is that when we observe a conflict 2 between these numerical criteria and the actual market 3 behavior, we need to be very careful before we say that the 4 numerical criteria are right and the market behavior is 5 wrong. 6 And I would suggest that in most cases the market 7 behavior will have been correct and we ought to give strong 8 consideration to the possibility that the numerical result 9 is, in that sense, a false negative. 10 MR. O'NEILL: Yes. I don't want to be 11 oversimplifying, but I guess is the answer, if both parties 12 are happy, we should be happy? 13 MR. STRAWN: I would say that. And I would 14 certainly indicate that -- echoing Jim's sentiments -- that 15 if you throw it into some level of uncertainty, that's the 16 worst thing that can happen to industrials. Because most of 17 the time these types of discussions are held up front or on 18 an ongoing basis. And there's an understanding and 19 acceptance of what's there. Even if there is some question

20 later about the liquidity, most of the -- as mentioned by 21 the Commission, most of the people involved in these 22 transactions and understanding the method of cash out, have 23 already agreed on these points up front, and they understand 24 whatever implied volatility there is there. 25 But if you start to introduce -- again, I have to 53 1 2 1 say, this over and over again, if you start to introduce 2 uncertainty in September or October or whatever time you 3 prefer to introduce these potential indices changes, that is 4 what concerns industrial consumers. Because anything that 5 heightens volatility is what we worry about, overall 6 volatility. And by actually doing this, and in the 7 Commission's view think that you're clarifying, you may 8 actually add potentially to the volatility. And that 9 bothers us. 10 MR. CHOO: I seem to hear the sentiment that 11 maybe things are all right and we don't need to have any 12 criteria. And we want to just use the complaint process, 13 whatever the criteria may be, to settle any disputes. Is 14 that the indication I'm hearing from most of the commenters? 15 MR. ROZGONY: The only thing I would add is just 16 to answer your question, yes, if both business parties are 17 happy in the transaction, that's a pretty good thing. If we 18 can get to that point I think there's a lot of success in 19 the business overall.

20 Two parties happy in a business transaction is an 21 accomplishment. 22 MR. HENNING: Another thing I would add just as 23 well is at the same time the Commission's actions that are 24 moving towards more information being available for all the 25 parties to evaluate that, also then improves the result when 54 1 2 1 you have both parties being happy. And in getting the 2 appropriate metrics, having the volume of transactions and 3 counterparties available is going to help. 4 MR. HEDERMAN: Mike McLaughlin, you had a 5 question. 6 MR. McLAUGHLIN: I can understand the unease 7 about potentially calling into question the existing indices 8 that have been adopted in the Commission's tariffs and the 9 uncertainty that would bring about the review of those to 10 apply them to the staff standard, and, you know, the debate 11 about the timing of when that would be done or should be 12 done. But, what about the idea of applying the staff 13 standard to new filings? Because unlike being already in 14 the tariff, we do not control when companies or pipelines 15 make new -- you know, filings to incorporate new indices 16 into the tariffs. You know, we've experienced that over the 17 last number of months. 18 Does the idea of applying the standards proposed 19 to new filings cause you heartburn?

20 MR. SANTA: As I mentioned in my comments, Mike, 21 I don't think it causes a great problem for the pipeline 22 industry. And I think it's a more prudent approach than 23 effectively ordering all pipelines to come in and file and 24 also, as I said, you know, to the extent that there were a 25 dispute where a shipper or some party felt that the index 55 1 2 1 point along the pipeline was not indicative of the market 2 conditions, it would seem to be a good starting point for 3 evaluating a complaint. 4 MR. STRAWN: I think I would have less concern -- 5 I have overall concern with any change in this area, but I 6 would have less concern on a future basis as opposed to 7 retroactive. But just overall, I think I have to mention 8 Jim's comments again, and the fact that if you want to take 9 a step in this area, maybe a slow evaluation step, or a 10 slower evaluation step, as opposed to a mandate, it will be 11 this way immediately. Even in future markets would probably 12 be more advisable from our point of view. 13 Because, again, every step you take adds to 14 volatility. And as people understand what you are trying to 15 do and understand that you are actually trying to help the 16 overall situation by adding liquidity and understanding of 17 the market, I think there's less concern and less 18 possibility for suing. So I guess I would say, I'd give 19 that a tentative agreement that at least evaluation of that

20 aspect would be preferred to certainly any retroactive or 21 concrete minister. 22 MR. HENNING: Where the pipeline is getting ready 23 to make a new filing, in most instances this happens and in 24 all instances I think it should. There will be a 25 communications between that pipeline and the shippers. When 56 1 2 1 the information that we are talking about is available in 2 terms of volumes, transactions and counterparties, the 3 shippers and the pipeline will be looking at that 4 information and figuring out what particular points should 5 be referenced in that tariff. 6 So I think going forward what you will see is on 7 the basis of having more information out there, you're going 8 to get requests that make more sense in terms of having the 9 gas valued appropriately in the market place. And that 10 should help you. 11 MR. ALLISON: I'm a bit uneasy about any set of 12 criteria until we've had a chance to see how they actually 13 function in the real world. If we have an opportunity to 14 observe how well they function and tune the criteria which 15 might imply making them less rigorous, might imply making 16 them more rigorous. But if we have the chance to tune the 17 criteria, then after they've been tuned, I don't have any 18 inherent objection to using them on new filings. But I do 19 think the opportunity to tune the criteria so that they do

20 what they are designed to do and intended to do is 21 important. 22 MR. PERLMAN: Can I just ask a final question on 23 this to make sure that we're all on the same page. If we're 24 looking, the Commission has to address new filings and make 25 judgment whether the filing is just and reasonable in all 57 1 2 1 respects. And I want to make sure I'm not misunderstanding, 2 is anybody suggesting that if there is a filing and an 3 element of it is not contested, that the Commission should 4 not make an independent review, but just accept it by virtue 5 of the fact that it's not contested and the lack of contest 6 would make it per se just and reasonable? Is that what 7 you're saying? 8 And if you're not saying that and the Commission 9 has to take some sort of independent review to validate the 10 use of it in the tariff, if we don't have standards such as 11 these, or some other way to look at these things to make a 12 judgment, what should we do? Because we need a basis to act 13 from and I at least think, as a legal matter, we probably 14 need to make our own independent judgment and not just rest 15 on the lack of contest to say that the filing is just and 16 reasonable as a matter of law and fact. 17 MR. ALLISON: You need to be careful to count the 18 number of negatives in any of these statements here. 19 (Laughter.)

20 MR. ALLISON: I was not suggesting that the 21 Commission abdicate its responsibility to make an 22 independent review. I was suggesting caution in how we 23 design the criteria, the finite nature of our wisdom about 24 these things, a chance to experiment, I think, will be 25 extremely useful in designing the criteria. 58 1 2 1 MR. STRAWN: I would echo the same sentiments. 2 And certainly any additional scrutiny in this area just 3 helps the overall concern about the market. So I'm pleased 4 to have any independent review. But, at the same time, 5 again, I have to say it over and over again, caution, 6 caution, caution as we approach the heating season and the 7 overall markets. So, yes, I echo the same comments. 8 MR. MARTINEZ: One question I have is, I heard a 9 lot from you about the cost of implementing -- you know, 10 keeping track, if these criteria apply or not, of the 11 uncertainty it could bring, whether a particular point 12 satisfies it or not, but one thing I wanted to ask is if you 13 see at all the public benefit of it. The Commission 14 considers this not on a whimsical basis but because they -- 15 you know, we think that there's a public benefit of it. In 16 this case it was the notion that if more information needs 17 to be made available so that contracting could be more 18 informed and reduce the costs of litigation, and things like 19 that, that one way that the Commission could nudge the

20 system towards having more information and by putting some 21 expressed requirements somewhere in its rules. And if you 22 think that there's -- and so I want to ask, do you think 23 that this is something worth pursuing? And if it is, how 24 could the Commission other than this, through processes like 25 this, how can the Commission put more expressly in its rules 59 1 2 1 the importance of having more information? 2 And the second comment I want to make is that 3 we've gone through some crisis of liquidity of market 4 activity, it might have been caused, you know, lack of 5 confidence also credit problems and all of that. What have 6 we learned for the next time around? How can we set some 7 standards that are clear and spelled out perhaps to reduce 8 uncertainty of what we consider could be some thresholds? 9 And the criteria that we laid out, we really tried to make 10 them not very constraining. We tried to make them actually 11 a minimum, a minimum level. How can we set out some trip 12 wires for the next time around? Well, let's hope it doesn't 13 happen, but the next time around they do have problems with 14 low market activity, you know, what have we learned now to 15 set those alarm bells? And would this be a proper -- if 16 that is a proper public benefit, would this be a good place 17 to set those standards, minimum standards that would set out 18 alarm bells the next time around the market activity 19 decreases?

20 And the last comment I had is that Jim Allison 21 makes a very good point that we should never lose sight of 22 that. If the concern is liquidity, we don't have a good way 23 of measuring it. And it's difficult to define it so that we 24 approximate it with market activities so that there will 25 always be false positives, false negatives, and things like 60 1 2 1 that, where you're trying to measure liquidity market 2 activity. I always think of it as measuring somebody's 3 maturing by their age. It's not that there's really there a 4 connection, a correlation, but there will always be false 5 measurements. But it's just something that can be measured 6 quite easily, readily. 7 But comments about the public good and would 8 these be a good measure to achieve those public benefits? 9 MR. SANTA: I would suggest that that, by virtue 10 of the way you have posed the question in saying, well, we 11 want to be ready for the next time and what happens when 12 this happens, it kind of reinforces the point that I made 13 earlier which is that really this is driven by a reaction to 14 events in the marketplace that really have little to do with 15 pipeline cash out mechanisms and the use of indices in the 16 tariffs. And we concede that the pipeline tariffs are the 17 most readily available jurisdictional hook for the 18 Commission to get at this. There are others that I think 19 would get the Commission further out on the limb legally,

20 but that could be explored. But nonetheless, that's it. 21 In view of that, I think, you know, the message 22 that has come from the panel has been, be very careful that 23 in trying to fix what is another problem you don't upset the 24 workability of the cash out mechanisms which I think across 25 the board there is quite a bit of satisfaction with how 61 1 2 1 those mechanisms are working currently. 2 I think that, you know, as Bruce Henning said, 3 the fact that there will be more information out there as a 4 result of these criteria I think will, in and of itself, 5 will have a benefit. Even if it is not mandated that it be 6 applied in the context of some jurisdictional instrument, or 7 to the extent that you're going to apply it to some 8 jurisdictional instrument like the cash out mechanisms, that 9 it be done prudently and applied where there is a problem 10 but not in an area where quite frankly there may be no 11 problem and there may be one created with some unintended 12 consequences. 13 MR. HENNING: At the risk of jumping ahead and 14 stepping on the toes of Mike Novak who is going to speak for 15 AGA on the next panel, I'll go ahead and take the 16 opportunity because I think the questions that you're 17 talking about really refer to that. It's very clear to the 18 AGA member companies and to an analyst such as myself, that 19 the actions that the Commission has taken and the focus that

20 you put on the issues of liquidity and sufficient data 21 reporting and accurate data reporting are bearing fruit. 22 That the information that we have available today is of much 23 better quality and is really moving to reassure the 24 marketplace. 25 And, in fact, we believe you should continue to 62 1 2 1 do that. We think that you have accurately identified three 2 important metrics and you're going to have that information 3 going. Do those generate public goods? Absolutely. Do 4 they wind up improving the market transparency? Absolutely. 5 Will that in and of itself take -- solve a potential problem 6 that might exist in the future in terms of activity? 7 Unfortunately, no. Because the reality and it was mentioned 8 earlier, for business decisions, you're going to look at 9 different kinds of transactions differently and in, frankly, 10 during periods of high volatility you are more likely to 11 enter into index transactions rather than fixed price 12 transactions. And so you will have ebbs and flows of fixed 13 price transactions. I would note that that would happen 14 whether you had mandatory reporting or whether you had 15 voluntary reporting, that is still going to go up and down. 16 So have we generated improvements? Yes, we have. 17 Are things better than they were? Yes. But in trying to 18 deal with the jurisdictional tariff issues that are facing 19 the Commission here, keep pushing forward. Keep being the

20 bully pulpit for exchange transactions. Don't interfere 21 with the decisions of others, that might determine in some 22 instances you would want to enter into bilateral 23 transactions, but continue to do the work that you're doing. 24 MR. STRAWN: You stole my thunder just a little 25 bit. I had just written down "bully pulpit". I mean, if 63 1 2 1 nothing else, just the threat of some things that could 2 happen alone is encouraging people to have more reporting 3 and just the overall scrutiny of the Commission in general 4 and the recommendations that have been made is moving us in 5 the right direction in our opinion and in the opinion of my 6 member companies. So, just the scrutiny and the 7 encouragement of people to continue to report in the way 8 that they are is really milestone. And that's why we can 9 speak with such confidence about what the Commission has 10 done so far. But, again, if you start introducing things -- 11 if it ain't broke, don't fix it, is what you keep hearing 12 over and over. And we keep saying that for a reason. And 13 it's rare that we have such universal agreement on these 14 types of things. It's not that we all love each other up 15 here -- 16 (Laughter.) 17 MR. STRAWN: -- that's certainly not the case. 18 But it's rare that we have some type of consensus in an 19 area. So we keep pointing back saying, if there is some

20 consensus we are all concerned about what would happen if 21 you started to mitigate that in some way that we don't 22 necessarily agree on at that point. So, again, the bully 23 pulpit that you have has been doing a wonderful job of 24 moving us in the right direction. And we are herded. We 25 are at least moving in the right direction. 64 1 2 1 MR. HARVEY: Before we run out of time with this 2 panel, I would like to switch direction just a little bit. 3 Because one of the issues we would like to talk about, more 4 than half of the physical document that we produced was 5 actually in the form of tables of lots of numbers and that 6 was a deliberate attempt to get a fair amount of information 7 about our questionnaire out and into the hands of everyone 8 to educate. I happen to know that Mr. Allison has looked at 9 this stuff in a fair amount of detail. I don't know about 10 the remainder of you, but I certainly would invite any 11 response. But I would like to spend a few minutes getting 12 your feedback on -- we sort of expressed within our fairly 13 quick period of time, due to the hard work of Mr. Martinez 14 to my right here, among others, but we could learn from 15 that. We would really like to hear what you all have 16 learned from that information to the extent that you could 17 share some of that with us. 18 MR. ALLISON: Cut me off when I've used up too 19 much time because I could go on for a long time on this