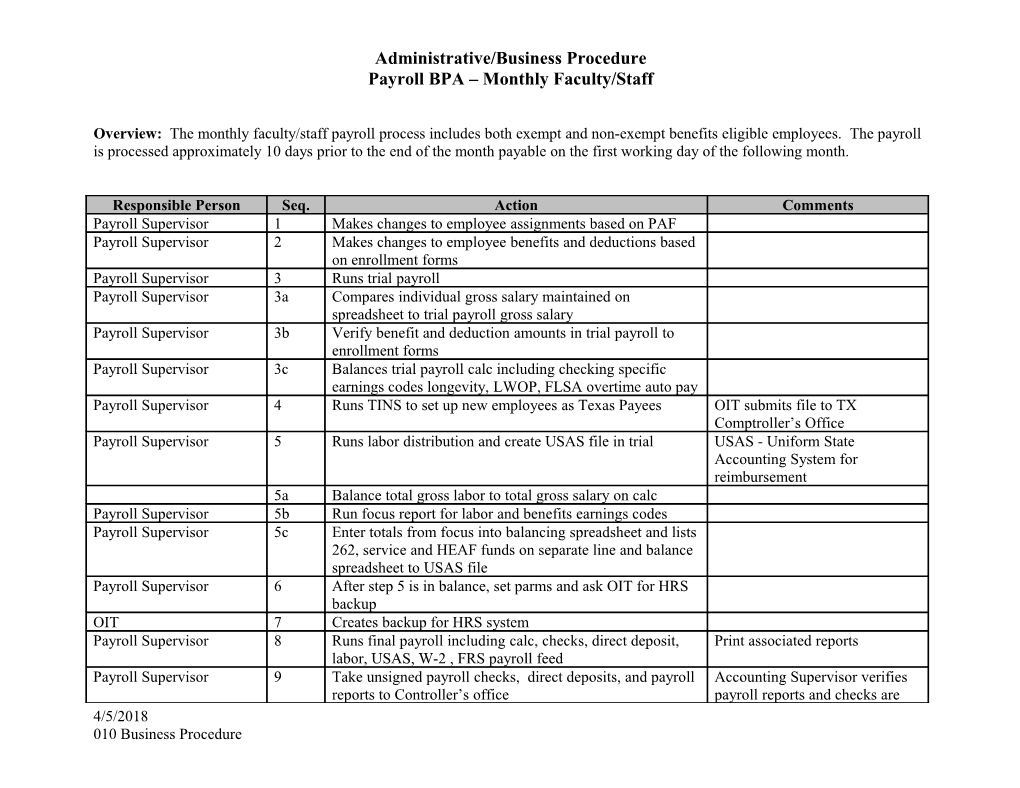

Administrative/Business Procedure Payroll BPA – Monthly Faculty/Staff

Overview: The monthly faculty/staff payroll process includes both exempt and non-exempt benefits eligible employees. The payroll is processed approximately 10 days prior to the end of the month payable on the first working day of the following month.

Responsible Person Seq. Action Comments Payroll Supervisor 1 Makes changes to employee assignments based on PAF Payroll Supervisor 2 Makes changes to employee benefits and deductions based on enrollment forms Payroll Supervisor 3 Runs trial payroll Payroll Supervisor 3a Compares individual gross salary maintained on spreadsheet to trial payroll gross salary Payroll Supervisor 3b Verify benefit and deduction amounts in trial payroll to enrollment forms Payroll Supervisor 3c Balances trial payroll calc including checking specific earnings codes longevity, LWOP, FLSA overtime auto pay Payroll Supervisor 4 Runs TINS to set up new employees as Texas Payees OIT submits file to TX Comptroller’s Office Payroll Supervisor 5 Runs labor distribution and create USAS file in trial USAS - Uniform State Accounting System for reimbursement 5a Balance total gross labor to total gross salary on calc Payroll Supervisor 5b Run focus report for labor and benefits earnings codes Payroll Supervisor 5c Enter totals from focus into balancing spreadsheet and lists 262, service and HEAF funds on separate line and balance spreadsheet to USAS file Payroll Supervisor 6 After step 5 is in balance, set parms and ask OIT for HRS backup OIT 7 Creates backup for HRS system Payroll Supervisor 8 Runs final payroll including calc, checks, direct deposit, Print associated reports labor, USAS, W-2 , FRS payroll feed Payroll Supervisor 9 Take unsigned payroll checks, direct deposits, and payroll Accounting Supervisor verifies reports to Controller’s office payroll reports and checks are 4/5/2018 010 Business Procedure Administrative/Business Procedure Payroll BPA – Monthly Faculty/Staff run through signature machine Payroll Assistant 9a Signed payroll checks and direct deposit stubs are Distribution alpha by packaged for distribution. Checks are forwarded to department. Direct Deposit Cashiers and direct deposit stubs are forwarded to campus mail to employees. employees prior to payday. Cashiers 9b Payroll checks for Alpine are distributed on payday. Payroll Assistant 9c Payroll checks for RGC are packaged for UPS shipment to Inventory sheets prepared for Uvalde, Del Rio and Eagle Pass for distribution on payday. checks and direct deposits going to each RGC campus. Payroll Supervisor 10 Benefit and deduction check requests taken to Controller’s office Accounting Assistant 10a Benefit and deduction checks returned from Controller’s office Payroll Supervisor 10b Benefit and deduction checks sent to appropriate recipient Includes child support, student with supporting documentation loans, TX Tomorrow Fund, and TX Saver, Payroll Assistant 10c Retirement benefit and tax shelter deduction checks sent to TIAA, VALIC, ING, Lincoln appropriate recipient with supporting documentation ORP contributions online OIT 11 OIT submits electronic USAS file to TX Comptroller Printed report submitted to USAS Specialist for verification USAS Specialist 12 Balances USAS batch and notifies Controller or Asst Controller to release batch Controller/Asst 12a Releases USAS batch USAS Specialist 12b Reviews USAS file for error report. If error is for payee, Payroll Supervisor or Senior notifies payroll that employee is not set up in TINS. Buyer in Purchasing need to set up vendor online at TX Comptroller for USAS reimbursement to process USAS Specialist 12c If error is in funding, notifies Controller/Asst of Controller/Asst tells USAS insufficient funds in State appropriations. Specialist what appropriation to use in USAS OIT 13 Uploads payroll feed from HRS to FRS Payroll Supervisor 14 Payroll voucher, deduction, labor, and tax payment to Accountant 4/5/2018 010 Business Procedure Administrative/Business Procedure Payroll BPA – Monthly Faculty/Staff Accountant 15 Reviews and validates data in payroll clearing account and balances. Notifies Payroll Supervisor of any discrepancies in benefits or deductions Accountant 15a Prepares journal entry to clear account and record expenditures in payroll bank account Accountant 15b If problem is encountered researches data and notifies payroll of needed adjustments.

Shadow Systems: Four Excel spreadsheets on individual employee’s gross, labor and benefit distribution, deduction codes, and tax information. Focus report on labor and benefit totals by fund.

Document Decisions: Does trial payroll, labor and benefits balance before continuing to final payroll

Document Business Process Improvements: Paycheck and direct deposit stub distribution. Why carbon copy of check?

4/5/2018 010 Business Procedure