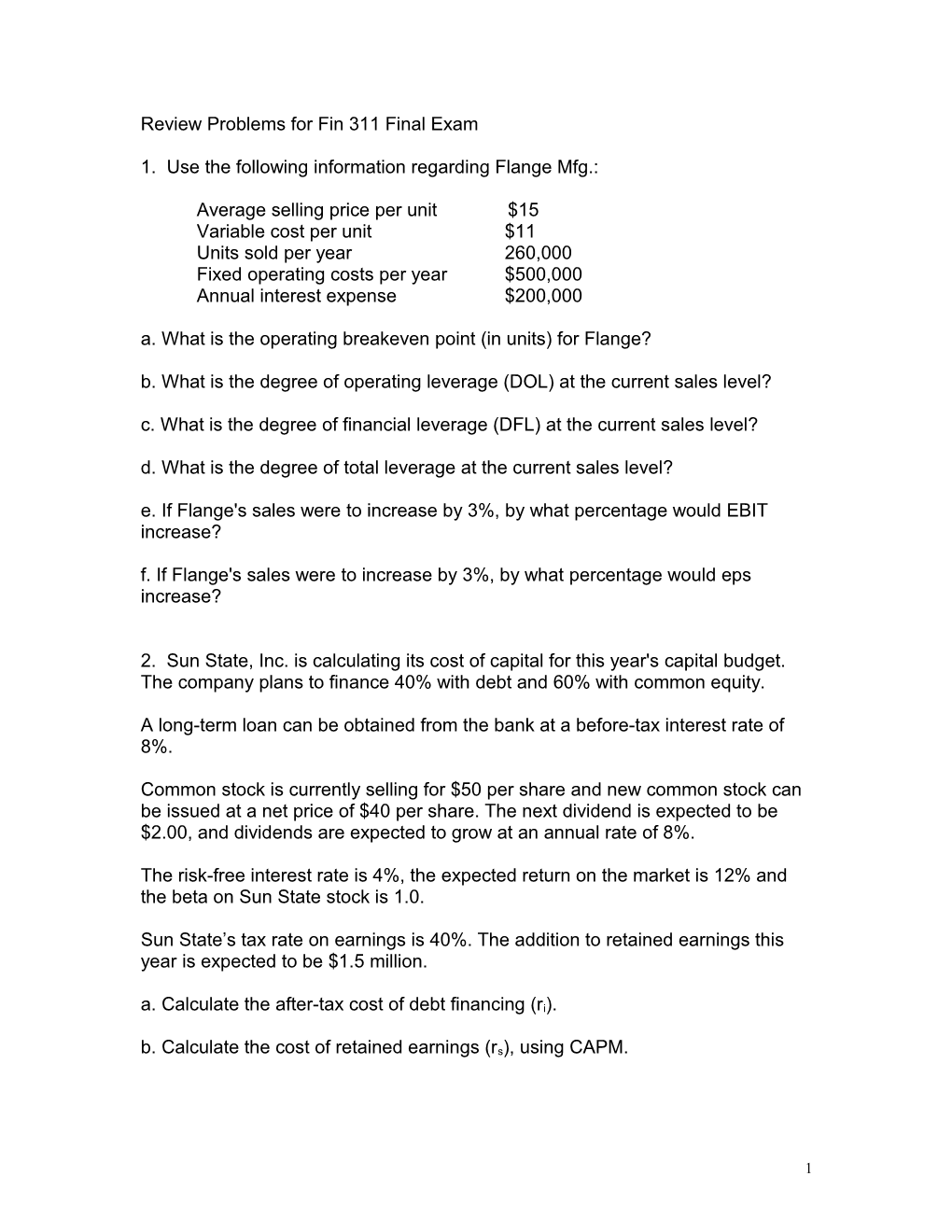

Review Problems for Fin 311 Final Exam

1. Use the following information regarding Flange Mfg.:

Average selling price per unit $15 Variable cost per unit $11 Units sold per year 260,000 Fixed operating costs per year $500,000 Annual interest expense $200,000 a. What is the operating breakeven point (in units) for Flange? b. What is the degree of operating leverage (DOL) at the current sales level? c. What is the degree of financial leverage (DFL) at the current sales level? d. What is the degree of total leverage at the current sales level? e. If Flange's sales were to increase by 3%, by what percentage would EBIT increase? f. If Flange's sales were to increase by 3%, by what percentage would eps increase?

2. Sun State, Inc. is calculating its cost of capital for this year's capital budget. The company plans to finance 40% with debt and 60% with common equity.

A long-term loan can be obtained from the bank at a before-tax interest rate of 8%.

Common stock is currently selling for $50 per share and new common stock can be issued at a net price of $40 per share. The next dividend is expected to be $2.00, and dividends are expected to grow at an annual rate of 8%.

The risk-free interest rate is 4%, the expected return on the market is 12% and the beta on Sun State stock is 1.0.

Sun State’s tax rate on earnings is 40%. The addition to retained earnings this year is expected to be $1.5 million. a. Calculate the after-tax cost of debt financing (ri). b. Calculate the cost of retained earnings (rs), using CAPM.

1 c. Calculate the cost of retained earnings (rs) using the constant growth valuation model. d. Calculate the cost of new common stock financing (rn) using the constant growth valuation model. e. Calculate the retained earnings break-point in Sun State's cost of capital. f. Calculate Sun State’s cost of capital for a capital budget of $2 million. g. Calculate Sun State’s cost of capital for a capital budget of $5 million.

Sun State has several investment opportunities it is considering including in the capital budget.

Project IRR $ Cost A 14% $1 Mil B 12% $1 Mil C 10% $1 Mil D 8% $1 Mil E 6% $1 Mil h. Which projects should be included in the capital budget?

3. Your company has just entered a contract to deliver your product to a German firm for 100,000 Euros. The exchange rate is $1.20/€. How many dollars will the firm receive?

4. You can purchase steel from a Japanese firm for 6,200 Yen per ton, or from a British firm for 29 U.K. Pounds per ton. Both prices include all shipping costs and taxes. The exchange rates are $2.05/£ and $.011/¥. Which costs less in dollars?

5. The spot rate is $2.05/£ and the six month forward rate is $2.10/£. Calculate the annualized forward premium or discount.

6. You have just signed a contract to purchase machinery from a British firm for 1 million U.K. Pounds, to be paid in 6 months. The six month forward rate is $2.10/£. Six months later, the spot rate is $2.20/£. How many dollars did you lose by not hedging?

2 7. JimCo is trying to decide how to finance a new firm that requires a $20 million investment. Under Plan I, the project would be financed entirely with common stock to be sold for $20 per share. Under Plan II, the firm will be financed by borrowing $8 million long-term at an interest rate of 10 percent, and financing the rest by selling stock at a price of $20 per share. The tax rate is 40 percent. JimCo expects EBIT to be approximately $2.5 million annually. a. Calculate earnings per share (eps) for both plans if EBIT equals $2.5 million.

Plan I Plan II

EBIT 2,500 2,500

Int Exp ______

EBT ______

Tax ______

NPAT ______

#Sh St ______eps ______b. Under Plan I, the required return on JimCo stock (kS) is 12%. Under Plan II, kS will be 14%. Calculate the stock price for each plan, assuming zero growth rate for earnings.

c. Which financing plan should JimCo adopt? What is your answer based on?

3