2000 Fourth Quarter Results Cemex Francisco Suárez (525) 325 2898

Sales improved strongly thanks mainly to the consolidation of two months of Southdown (a new operation in the US acquired in 4Q00), as well as the Mexican peso strength and a good performance in Spain. Margins were affected mainly as a result of strong maintenance costs in Mexico (as demand in Mexico was atypically low, the company did extraordinary maintenance works), a different sales mix due to inclusion of Southdown, and to a lesser extent to higher energy prices compared to 4Q99. North America accounted for 64% of total EBITDA in the quarter, South America 20%, Spain and Egypt 12% and 3%, respectively, and the Philippines (Cemex’ weakest market), with just 1%. The ICF improved mainly as a result of the relative strength of the Mexican peso, and higher monetary gains. Cemex’ leverage did not increased when acquiring Southdown: US$ 1.5 billion in preferred equity (minority interest), coupled with an 18 month US$ 1.4 billion facility held its capital structure virtually unchanged. The increase in sales, albeit lower operating margins, and the ICF improvement led to an increase of 47.7% in net earnings Vs 4Q99, while Net Cash Earnings surged 32.4%.

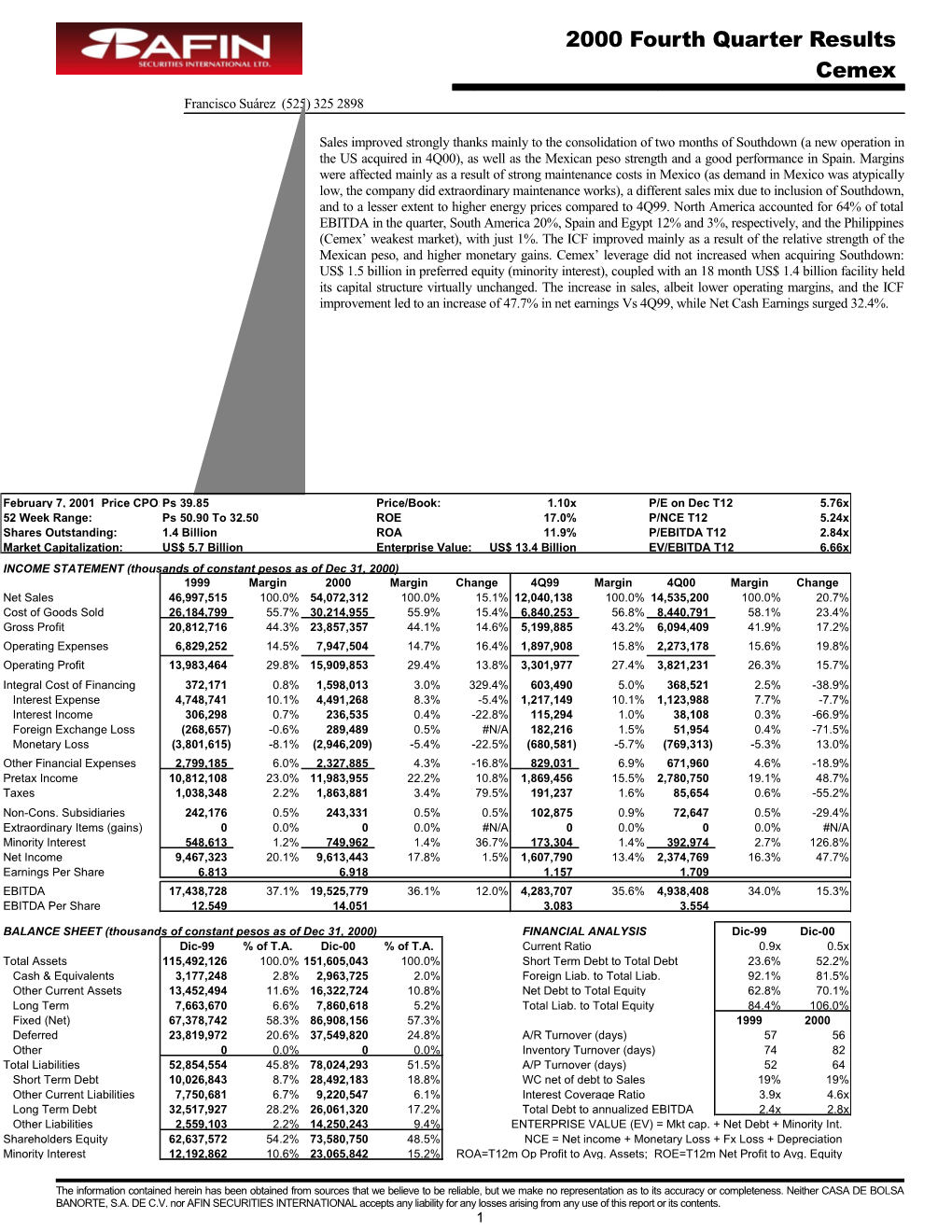

February 7, 2001 Price CPO:Ps 39.85 Price/Book: 1.10x P/E on Dec T12 5.76x 52 Week Range: Ps 50.90 To 32.50 ROE 17.0% P/NCE T12 5.24x Shares Outstanding: 1.4 Billion ROA 11.9% P/EBITDA T12 2.84x Market Capitalization: US$ 5.7 Billion Enterprise Value: US$ 13.4 Billion EV/EBITDA T12 6.66x INCOME STATEMENT (thousands of constant pesos as of Dec 31, 2000) 1999 Margin 2000 Margin Change 4Q99 Margin 4Q00 Margin Change Net Sales 46,997,515 100.0% 54,072,312 100.0% 15.1% 12,040,138 100.0% 14,535,200 100.0% 20.7% Cost of Goods Sold 26,184,799 55.7% 30,214,955 55.9% 15.4% 6,840,253 56.8% 8,440,791 58.1% 23.4% Gross Profit 20,812,716 44.3% 23,857,357 44.1% 14.6% 5,199,885 43.2% 6,094,409 41.9% 17.2% Operating Expenses 6,829,252 14.5% 7,947,504 14.7% 16.4% 1,897,908 15.8% 2,273,178 15.6% 19.8% Operating Profit 13,983,464 29.8% 15,909,853 29.4% 13.8% 3,301,977 27.4% 3,821,231 26.3% 15.7% Integral Cost of Financing 372,171 0.8% 1,598,013 3.0% 329.4% 603,490 5.0% 368,521 2.5% -38.9% Interest Expense 4,748,741 10.1% 4,491,268 8.3% -5.4% 1,217,149 10.1% 1,123,988 7.7% -7.7% Interest Income 306,298 0.7% 236,535 0.4% -22.8% 115,294 1.0% 38,108 0.3% -66.9% Foreign Exchange Loss (268,657) -0.6% 289,489 0.5% #N/A 182,216 1.5% 51,954 0.4% -71.5% Monetary Loss (3,801,615) -8.1% (2,946,209) -5.4% -22.5% (680,581) -5.7% (769,313) -5.3% 13.0% Other Financial Expenses 2,799,185 6.0% 2,327,885 4.3% -16.8% 829,031 6.9% 671,960 4.6% -18.9% Pretax Income 10,812,108 23.0% 11,983,955 22.2% 10.8% 1,869,456 15.5% 2,780,750 19.1% 48.7% Taxes 1,038,348 2.2% 1,863,881 3.4% 79.5% 191,237 1.6% 85,654 0.6% -55.2% Non-Cons. Subsidiaries 242,176 0.5% 243,331 0.5% 0.5% 102,875 0.9% 72,647 0.5% -29.4% Extraordinary Items (gains) 0 0.0% 0 0.0% #N/A 0 0.0% 0 0.0% #N/A Minority Interest 548,613 1.2% 749,962 1.4% 36.7% 173,304 1.4% 392,974 2.7% 126.8% Net Income 9,467,323 20.1% 9,613,443 17.8% 1.5% 1,607,790 13.4% 2,374,769 16.3% 47.7% Earnings Per Share 6.813 6.918 1.157 1.709 EBITDA 17,438,728 37.1% 19,525,779 36.1% 12.0% 4,283,707 35.6% 4,938,408 34.0% 15.3% EBITDA Per Share 12.549 14.051 3.083 3.554

BALANCE SHEET (thousands of constant pesos as of Dec 31, 2000) FINANCIAL ANALYSIS Dic-99 Dic-00 Dic-99 % of T.A. Dic-00 % of T.A. Current Ratio 0.9x 0.5x Total Assets 115,492,126 100.0% 151,605,043 100.0% Short Term Debt to Total Debt 23.6% 52.2% Cash & Equivalents 3,177,248 2.8% 2,963,725 2.0% Foreign Liab. to Total Liab. 92.1% 81.5% Other Current Assets 13,452,494 11.6% 16,322,724 10.8% Net Debt to Total Equity 62.8% 70.1% Long Term 7,663,670 6.6% 7,860,618 5.2% Total Liab. to Total Equity 84.4% 106.0% Fixed (Net) 67,378,742 58.3% 86,908,156 57.3% 1999 2000 Deferred 23,819,972 20.6% 37,549,820 24.8% A/R Turnover (days) 57 56 Other 0 0.0% 0 0.0% Inventory Turnover (days) 74 82 Total Liabilities 52,854,554 45.8% 78,024,293 51.5% A/P Turnover (days) 52 64 Short Term Debt 10,026,843 8.7% 28,492,183 18.8% WC net of debt to Sales 19% 19% Other Current Liabilities 7,750,681 6.7% 9,220,547 6.1% Interest Coverage Ratio 3.9x 4.6x Long Term Debt 32,517,927 28.2% 26,061,320 17.2% Total Debt to annualized EBITDA 2.4x 2.8x Other Liabilities 2,559,103 2.2% 14,250,243 9.4% ENTERPRISE VALUE (EV) = Mkt cap. + Net Debt + Minority Int. Shareholders Equity 62,637,572 54.2% 73,580,750 48.5% NCE = Net income + Monetary Loss + Fx Loss + Depreciation Minority Interest 12,192,862 10.6% 23,065,842 15.2% ROA=T12m Op Profit to Avg. Assets; ROE=T12m Net Profit to Avg. Equity

The information contained herein has been obtained from sources that we believe to be reliable, but we make no representation as to its accuracy or completeness. Neither CASA DE BOLSA BANORTE, S.A. DE C.V. nor AFIN SECURITIES INTERNATIONAL accepts any liability for any losses arising from any use of this report or its contents. 1 2000 Fourth Quarter Results Cemex

BUY

Sales Incr. in Prices * Volume growth * Gross margin Oper. margin EBITDA US$ % Incr. Cement Ready-Mix Cement Ready-Mix 4Q00 Incr. 4Q00 Incr. US$ % Incr. Margen Incr. Mexico $655.0 43% 6% 9% 12% (2%) (1%) 51% (1.7pp) 40% (5.9pp) 290.9 51% (0%) 44% (4.8pp) US $321.7 21% 135% (1%) (2%) 148% 81% 24% (0.7pp) 15% (8.5pp) 73.5 13% 150% 23% 3.8pp Venezuela $158.6 10% 2% 10% 1% 12% (10%) 42% 10.0pp 32% 8.2pp 67.2 12% 29% 42% 10.9pp Colombia $59.2 4% 33% 11% 5% 12% 43% 52% 1.0pp 39% 12.5pp 31.4 6% 41% 53% (3.7pp) Cent. America $50.3 3% 16% N.A. N.A. N.A. N.A. 26% 2.6pp 12% (10.5pp) 11.9 2% 18% 24% 0.5pp Spain $208.0 14% 12% (12%) (7%) 8% 11% 37% (6.7pp) 27% (5.3pp) 67.0 12% (12%) 32% (4.9pp) Phillipines $38.7 3% 17% (8%) N.A. (12%) N.A. 19% (6.2pp) 0% (8.5pp) 6.6 1% (12%) 17% (9.8pp) Egypt $38.1 2% N.A. N.A. N.A. N.A. N.A. 50% N.A. 33% N.A. 17.4 3% N.A. 46% N.A. * Ammounts in millions of US dollars. Price and volume comparison for domestic markets only, in nominal US dollars. Operating Results The change of government in Mexico affected domestic volumes, as private and public projects alike were previously finalized or in some cases deferred. Sales in dollars increased 6% YoY, as the strength of the Mexican peso compensated the fall in volumes -dollar prices in cement and ready mix increased by 9% and 12%, respectively. As demand in 4Q00 was atypically low, the firm did extraordinary maintenance works at its plants in Mexico. Therefore, domestic margins were affected mainly by the strong growth in fixed costs derived from these maintenance expenses, and to a lesser extent due to the increase in energy prices. In the US, weather (and not demand) affected YoY volumes for Southdown’s operations in certain regions, but the inclusion of this new operation increased sales strongly at the consolidated level. Venezuela continued experiencing a lack of important infrastructure projects affecting ready-mix volumes, but demand for cement remained strong. Profitability has increased due to low raw material and maintenance costs as well as a better pricing environment that should be sustainable. Colombia continued its strong rebound as infrastructure activities have increased, and production is concentrated at Ibague’s very efficient plant. It is expected that the Colombian and Venezuelan markets should maintain its profitability in 2001. In Spain, the strong volume growth is explained by infrastructure projects, along with the inclusion of trading operations in the Mediterranean -which were not included in 1999. The Euro’s weakness compared to 4Q99 led to lower prices in dollars. The relatively new trading operations (which carry a very low EBITDA margin), and higher distribution costs due to energy prices, led to the 4.9pp contraction in EBITDA margin and explained the 12% decline in EBITDA vs. 4Q99. Excluding trading operations, EBITDA margin for Spain would have dropped by almost 2pp compared to 4Q99 figures. Operations in the Philippines, by far the weakest market in Cemex’ portfolio, continues to disappoint as the country’s political instability continues. Strong imports from Taiwan, Japan, and China have continued for the quarter, leading to a difficult pricing environment. Sales increased strongly in that market, as a strong export activity to Taiwan began. Finally, in Egypt improvements implemented by Cemex in Assiut did not exceed the negative effect in margins of high transportation costs due to stronger penetration in Northern Egypt. Nevertheless, Egyptian margins (as well as those in Colombia), remain above Cemex’ averages and should continue to help the company’s consolidated results. Financing Activities Cemex’ minority interest increased substantially due to the US$ 1.5 billion injection of preferred equity in Valenciana that helped finance the acquisition of Southdown. In addition, Cemex relied on an 18 month, US$ 1.4 billion facility to acquire Southdown. Before Southdown’s acquisition, Cemex reduced its total debt strongly. Among other facilities, it erased US$ 500 million in equity swaps, enabling the firm to reach a 2.2x debt to EBITDA ratio, well below its 2.7x target. The relative strength in the Mexican peso reduced FX losses in the quarter, while the increased in debt increased monetary gains. These non-cash items reduced the IFC YoY. The strong increase in minority interest expense is attributable to the increase in preferred equity in Valenciana. Net earnings increased 47.7% in peso terms, mainly as a result of the increase in net sales and a low IFC compared to 4Q99 levels, while Net Cash Earnings surged 32.4% vs. 4Q99. Free Cash Flow was used mainly to eliminate debt. Outlook Industry consolidation gained momentum since Cemex’ acquisition of Southdown. Recently, Blue Circle agreed to Lafarge’s improved bid, Heidelberger set a deal with Indocement, and Holderbank is willing to increase its share in Semen Cibinong. The next target on the horizon is Portugal’s Cimpor, due to the likelihood of lifting voting limits in the firm’s stockholders meeting in February 22. It is expected that Holderbank should make the next big move. All of the above should be seen as positives for Cemex’ shares, as visibility for the sector should increase, and Cemex’ valuation is very attractive. In our view, comparability between Cemex and its major peers has increased strongly now that majors have more exposure (or at least are willing to increasing it), in emerging markets. In fact, Lafarge resembles more to Cemex now that the former has a capacity exposure to emerging markets of around 60%, while Cemex’ reaches 68%. Cemex’ EBITDA to assets, and EBITDA margin is higher than that of these companies. Also, Cemex’ current leverage (Debt to T12 EBITDA) is somewhat low compared to these companies. The only major advantage that the Europeans have over Cemex is their flexibility to raise capital, thus financing growth more efficiently. Presumably, Cemex’ planed IPO of its Valenciana subsidiary in Spain is not the only option for the company to pay back the preferred capital that helped finance Southdown’s acquisition. According to our conservative estimates, net cash earnings for the year should reach US$ 1.1 billion, and Cemex’ balance sheet can absorb around US$ 800 million in more debt while still meeting its 2.7x debt to EBITDA target. The refinancing scenario looks more probable if S&P gives Mexico an investment grade status this year. The benefits from conversion to petroleum coke at Cemex’ Mexican plants will be felt mainly in 2002, when the long-term contract with Pemex is fully in place, along with a low price as compared to international quotations. Mexico’s EBITDA margin should return to the 48% level this year. With our conservative projections (EBITDA growth of just 21%), the EV/EBITDA multiple should drop from its current level to 4.5x, once 2001 results are incorporated in full. In other words, there is a strong upside potential for the price of the stock because we think that it should reach an EV/EBITDA level of 6.7x -20% discount to its major peers, well below its five-year average of 8.6x. Even if the stock returns just to the 5.5x 3Q00 level, we might see the stock’s price at Ps 63.00 –a 68% yield. In our view, the main short-term risks are the uncertainty surrounding the extent of the worldwide economic slowdown, and a non-favorable outcome for Cemex concerning its investment in Indonesia. Our price target is Ps 82.00 per CPO for February of 2002 –US$ 38.50 per ADR.

Francisco Suárez [email protected] The information contained herein has been obtained from sources that we believe to be reliable, but we make no representation as to its accuracy or completeness. Neither CASA DE BOLSA BANORTE, S.A. DE C.V. nor AFIN SECURITIES INTERNATIONAL accepts any liability for any losses arising from any use of this report or its contents. 2