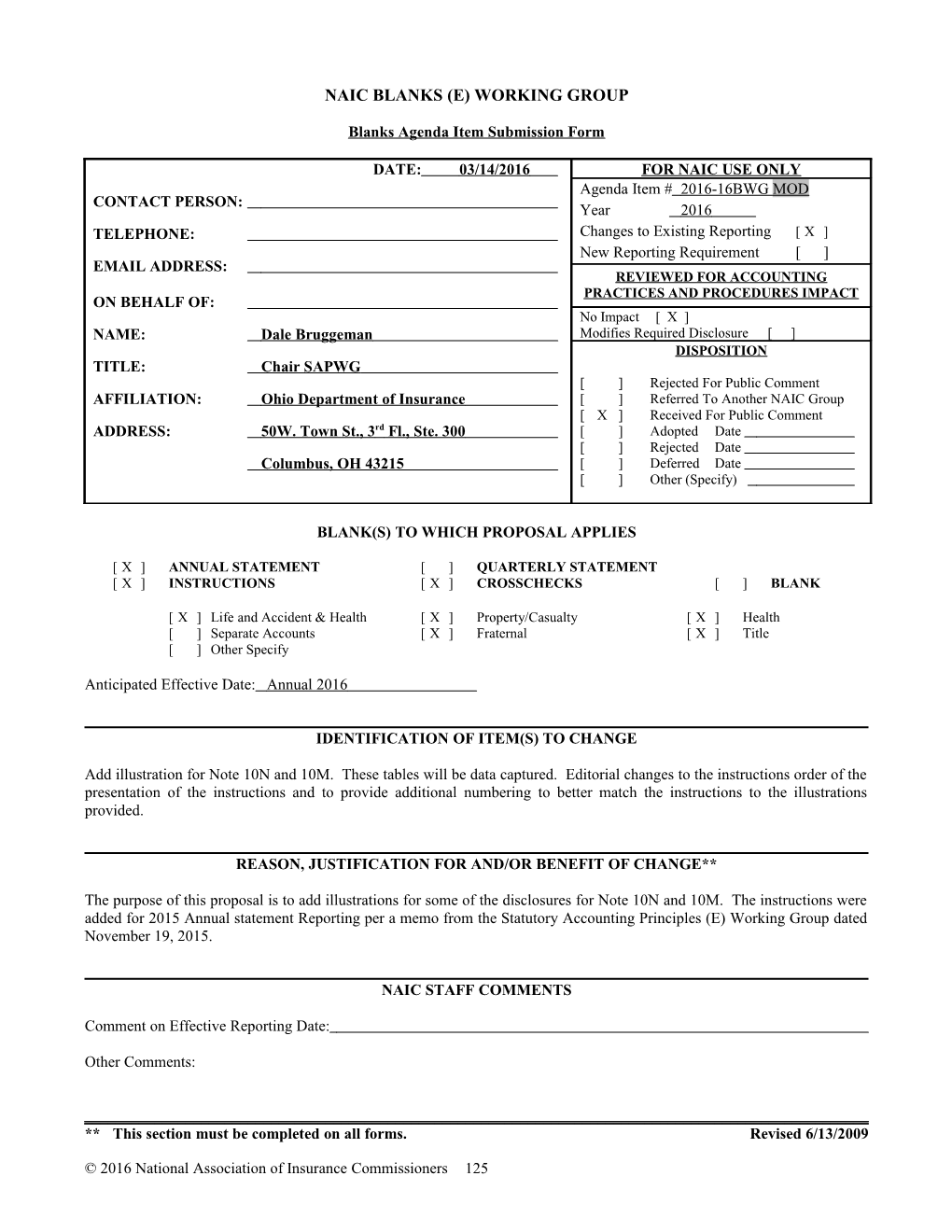

NAIC BLANKS (E) WORKING GROUP

Blanks Agenda Item Submission Form

DATE: 03/14/2016 FOR NAIC USE ONLY Agenda Item # 2016-16BWG MOD CONTACT PERSON: Year 2016 TELEPHONE: Changes to Existing Reporting [ X ] New Reporting Requirement [ ] EMAIL ADDRESS: REVIEWED FOR ACCOUNTING PRACTICES AND PROCEDURES IMPACT ON BEHALF OF: No Impact [ X ] NAME: Dale Bruggeman Modifies Required Disclosure [ ] DISPOSITION TITLE: Chair SAPWG [ ] Rejected For Public Comment AFFILIATION: Ohio Department of Insurance [ ] Referred To Another NAIC Group [ X ] Received For Public Comment ADDRESS: 50W. Town St., 3 rd Fl., Ste. 300 [ ] Adopted Date [ ] Rejected Date Columbus, OH 43215 [ ] Deferred Date [ ] Other (Specify)

BLANK(S) TO WHICH PROPOSAL APPLIES

[ X ] ANNUAL STATEMENT [ ] QUARTERLY STATEMENT [ X ] INSTRUCTIONS [ X ] CROSSCHECKS [ ] BLANK

[ X ] Life and Accident & Health [ X ] Property/Casualty [ X ] Health [ ] Separate Accounts [ X ] Fraternal [ X ] Title [ ] Other Specify

Anticipated Effective Date: Annual 2016

IDENTIFICATION OF ITEM(S) TO CHANGE

Add illustration for Note 10N and 10M. These tables will be data captured. Editorial changes to the instructions order of the presentation of the instructions and to provide additional numbering to better match the instructions to the illustrations provided.

REASON, JUSTIFICATION FOR AND/OR BENEFIT OF CHANGE**

The purpose of this proposal is to add illustrations for some of the disclosures for Note 10N and 10M. The instructions were added for 2015 Annual statement Reporting per a memo from the Statutory Accounting Principles (E) Working Group dated November 19, 2015.

NAIC STAFF COMMENTS

Comment on Effective Reporting Date:

Other Comments:

______** This section must be completed on all forms. Revised 6/13/2009

© 2016 National Association of Insurance Commissioners 125 ANNUAL STATEMENT INSTRUCTIONS – LIFE, HEALTH, PROPERTY, FRATERNAL AND TITLE

NOTES TO FINANCIAL STATEMENTS

Detail Eliminated To Conserve Space

10. Information Concerning Parent, Subsidiaries, Affiliates and Other Related Parties

Instruction:

Detail Eliminated To Conserve Space

M. All SCA investments

Reporting Enities shall disclose for all SCA investments.

(1) Balance Sheet Value (Admitted and Nonadmitted) All SCAs

Disclose the percentage of ownership and aggregate total of all SCA entities with detail of the aggregate gross value under SSAP No. 97 with the admitted and nonadmitted amounts reflected on the balance sheet. See SSAP No. 97 for additional guidance.

(2) NAIC Filing Response Information

Provide the following information regarding the NAIC response to the SCA filing.

The type of NAIC filing The date of the NAIC filing The NAIC valuation for the SCA entity If a response was received from the NAIC If the NAIC disallowed the reporting entities valuation method. If changes in the reported SCA amount were immaterial (I) or material (M)

All SCA investments (except investments in insurance SCA entities) shall include disclosure of the SCA balance sheet value (admitted and nonadmitted) as well as information received from the NAIC in response to the SCA filing (e.g., date and type of filing, NAIC valuation amount, whether resubmission of filing is required). This disclosure shall include an aggregate total of all SCAs (except investments in insurance SCA entities) with detail of the aggregate gross value under SSAP No. 97, with the admitted and nonadmitted amounts reflected on the balance sheet. See SSAP No. 97 for additional guidance.

N. Investment in Insurance SCAs

A reporting entity that reports an investment in an insurance SCA (per SSAP No. 97) for which the audited statutory equity reflects a departure from the NAIC statutory accounting practices and procedures (e.g., permitted or prescribed practices) shall disclose the following:

(1) A description of the accounting practice, with a statement that the practice differs from the NAIC statutory accounting practices and procedures.

© 2016 National Association of Insurance Commissioners 126 (2) The monetary effect on net income and surplus reflected by the insurance SCA as a result of using an accounting practice that differed from NAIC statutory accounting practices and procedures.

The reported entity’s investment in the insurance SCA per the audited statutory equity and the investment in the insurance SCA the reporting entity would have reported if the insurance SCA had completed statutory financial statements in accordance with the NAIC statutory accounting practices and procedures.

(3) Whether the RBC of the insurance SCA would have triggered a regulatory event had it not used a prescribed or permitted practice.

The reported entity’s investment in the insurance SCA per the audited statutory equity, and the investment in the insurance SCA the reporting entity would have reported if the insurance SCA had completed statutory financial statements in accordance with the NAIC statutory accounting practices and procedures.

Illustration:

Detail Eliminated To Conserve Space

THIS EXACT FORMAT MUST BE USED IN THE PREPARATION OF THIS NOTE FOR THE TABLES BELOW. REPORTING ENTITIES ARE NOT PRECLUDED FROM PROVIDING CLARIFYING DISCLOSURE BEFORE OR AFTER THESE ILLUSTRATIONS.

M. All SCA Investments

(1) Balance Sheet Value (Admitted and Nonadmitted) All SCAs

Percentage of SCA SCA Entity Ownership Gross Amount Admitted Amount Nonadmitted Amount a. SSAP No. 97 8a Entities ...... $ ...... $ ...... $ ......

Total SSAP No. 97 8a Entities XXX $ ...... $ ...... $ ...... b. SSAP No. 97 8b(i) Entities ...... $ ...... $ ...... $ ......

Total SSAP No. 97 8b(i) Entities XXX $ $ $ c. SSAP No. 97 8b(ii) Entities ...... $ ...... $ ...... $ ......

Total SSAP No. 97 8b(ii) Entities XXX $ $ $ d. SSAP No. 97 8b(iii) Entities ...... $ ...... $ ...... $ ......

Total SSAP No. 97 8b(iii) Entities XXX $ $ $ e. SSAP No. 97 8b(iv) Entities ...... $ ...... $ ...... $ ......

Total SSAP No. 97 8b(iv) Entities XXX $ $ $ f. Total SSAP No. 97 8b Entities (b+c+d+e) XXX $ $ $ g Aggregate Total (a+f) XXX $ $ $

© 2016 National Association of Insurance Commissioners 127 (2) NAIC Filing Response Information

NAIC Disallowed Entities Valuation Type NAIC Method,, of Response Resubmission SCA Entity NAIC Date of Filing to NAIC Valuation Received Required (Should be same entities as shown in M(1) above.) Filing* the NAIC Amount Y/N Y/N Code** a. SSAP No. 97 8a Entities ...... $ ......

Total SSAP No. 97 8a Entities XXX XXX $ XXX XXX XXX b. SSAP No. 97 8b(ii) Entities ...... $ ......

Total SSAP No. 97 8b(ii) Entities XXX XXX $ XXX XXX XXX c. SSAP No. 97 8b(iii) Entitiesi ...... $ ......

Total SSAP No. 97 8b(iii) Entities XXX XXX $ XXX XXX XXX d. SSAP No. 97 8b(iv) Entities ...... $ ......

Total SSAP No. 97 8b(iv) Entities XXX XXX $ XXX XXX XXX e. Total SSAP No. 97 8b Entities (b+c+d) XXX XXX $ XXX XXX XXX f Aggregate Total (a+e) XXX XXX $ XXX XXX XXX

* S1 – Sub-1, S2 – Sub-2 or RDF – Resubmission of Disallowed Filing

** I – Immaterial or M – Material

© 2016 National Association of Insurance Commissioners 128 THIS EXACT FORMAT MUST BE USED IN THE PREPARATION OF THIS NOTE FOR THE TABLES (LINES 2) BELOW. REPORTING ENTITIES ARE NOT PRECLUDED FROM PROVIDING CLARIFYING DISCLOSURE BEFORE OR AFTER THESE ILLUSTRATIONS.

N. Investment in Insurance SCAs

(2) The monetary effect on net income and surplus as a result of using an accounting practice that differed from NAIC Statutory Accounting Practices and Procedures (NAIC SAP), the amount of the investment in the insurance SCA per audited statutory equity and amount of the investment if the insurance SCA had completed statutory financial statements in accordance with the AP&P Manual.

SCA Entity Monetary Effect on NAIC SAP Amount of Investment (Investments in Insurance SCA Entities) Net Income Surplus Per Audited If the Insurance Increase Increase Statutory SCA Had (Decrease) (Decrease) Equity Completed Statutory Financial Statements * ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ...... $ ......

* Per AP&P Manual (without permitted or prescribed practices)

Detail Eliminated To Conserve Space

D:\Docs\2018-04-04\00cd00bfb47135b369a89fdc9c95b3de.doc

© 2016 National Association of Insurance Commissioners 129 This page intentionally left blank.

© 2016 National Association of Insurance Commissioners 130