IRS NEWS FOR BUSINESS June 2016

►UPCOMING WEBINARS

1) IRS Webinar: Identity Theft and Your Business

Date: Wednesday, May 25, 2016

Time: 10:00 a.m. Eastern; 9:00 a.m. Central; 8:00 a.m. Mountain; 7:00 a.m. Pacific.

This webinar is for: Small business owners People who assist small business owners

Highlights of What's Covered: Scams affecting business owners Warning signs that you may be a victim of Identity Theft Steps business owners should take IRS efforts to combat identity theft W-2 Verification Code pilot Plus live Q & A

Continuing Education Credits are not being offered.

Click on the link to register: https://www.webcaster4.com/Webcast/Page/1154/14982

2) The following IRS webinar is now archived and available for viewing in the IRS Video Portal:

Topic: ACA: Employer Shared Responsibility Aired: Wednesday, April 6, 2016

Webinar Description: How to determine if you are considered an applicable large employer What is the definition of a full-time employee?

3) See Webinars for Small Businesses for upcoming National and Local Webinars.

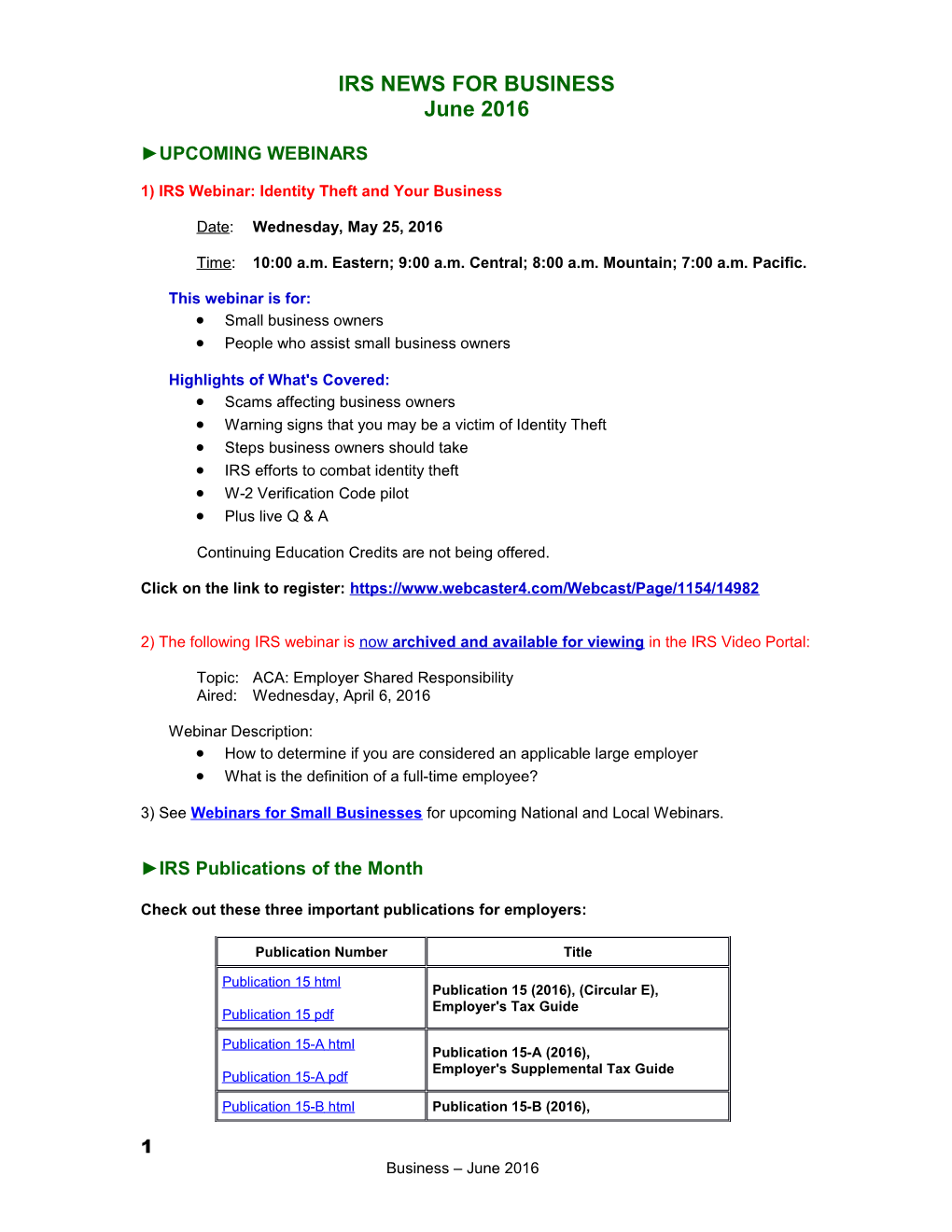

►IRS Publications of the Month

Check out these three important publications for employers:

Publication Number Title

Publication 15 html Publication 15 (2016), (Circular E), Employer's Tax Guide Publication 15 pdf

Publication 15-A html Publication 15-A (2016), Employer's Supplemental Tax Guide Publication 15-A pdf

Publication 15-B html Publication 15-B (2016),

1 Business – June 2016 Employer's Tax Guide to Fringe Benefits Publication 15-B pdf

►NEWS

Now is a Good Time to Plan for Next Year’s Taxes You may be tempted to forget about your taxes once you’ve filed but some tax planning done now may benefit you later. Now is a good time to set up a system so you can keep your tax records safe and easy to find. Here are some IRS tips to give you a leg up on next year’s taxes.

Beauty and Barber Shops Can Get Help at IRS.gov

Landscapers and Gardeners: Tax Help is Just a Click Away

Child Care Providers Learn Tax Rules with IRS Webinar

What You Need to Know if You Get a Letter in the Mail from the IRS

Amending Your Tax Return: Ten Tips

Tips for Those Who Missed the Tax Deadline

Things You Should Know about Filing Late and Paying Penalties

►AFFORDABLE CARE ACT

Tax Season is Over – It’s Time for a Premium Tax Credit Check-up

While you may be tempted to forget all about your taxes and your premium tax credit once you've filed your tax return, don’t give in to that temptation. Doing a PTC check-up now will help you avoid large differences between the advance credit payments made on your behalf and the amount of the premium tax credit you are allowed when you file your tax return next year.

►ACA for Small Employers

No news this month. ►ACA for Applicable Large Employers Why Employers Need to Count Employees It’s important to know how many full-time employees you have because two provisions of the Affordable Care Act – employer shared responsibility and employer information reporting for offers of minimum essential coverage – apply only to applicable large employers.

Healthcare.gov: The SHOP FTE Calculator This tool helps you determine if your mix of full-time and part-time employees equals less than 50 full-time equivalent employees (FTEs).

►TAXES. SECURITY. TOGETHER. (Identity Theft)

Recent Tax Scams and Consumer Alerts

2 ►EMPLOYERS

See articles from the Department of Labor, Wage and Hour Division, below.

►NEWS FROM OTHER AGENCIES

Learn About the New $20, $10, and $5 Notes

Discover Six of the Government's Best Mobile Apps (IRS2Go made the Top Six!)

From the Department of Labor, Wage and Hour Division

Family and Medical Leave Act Employer Guide

Game Changer In 2012, the Department of Labor approached Paul Johnson Drywall Inc. to review our employment practices and compensation structures as part of its worker misclassification initiative. What began as an investigation of employment relationships and pay practices ultimately matured into a cooperative, educational experience that has benefitted my employees and business while raising the bar for the construction industry.

Making Farm Labor Fairer and Safer

►IN EVERY ISSUE

See the latest: Tax Tips Health Care Tax Tips Fact Sheets Headliners News releases Announcements, Notices, Revenue Rulings, Revenue Procedures, Treasury Decisions, and Treasury Regulations are in the Internal Revenue Bulletin (IRB) Tax Statistics Find the latest IRS news via Social Media options.

Outreach Corner. Find it easy to spread the word about key income tax topics! This page offers electronic communication materials to use in reaching out to the people you serve. Get free news you can use each month, targeted by time of year to coincide with what your customers, employees, volunteers, etc. need to know about new tax law legislation, IRS events and other activities that affect them.

Industries/Professions Tax Centers. Tax Centers contain links to topics such as tax tips, financial resources, trends and statistics, forms, and more.

Audit Techniques Guides (ATGs) Audit Techniques Guides (ATGs) help IRS examiners during audits by providing insight into issues and accounting methods unique to specific industries. While ATGs are designed to provide guidance for IRS employees, they’re also useful to small business owners and tax professionals who prepare returns. 3 Business – June 2016