1

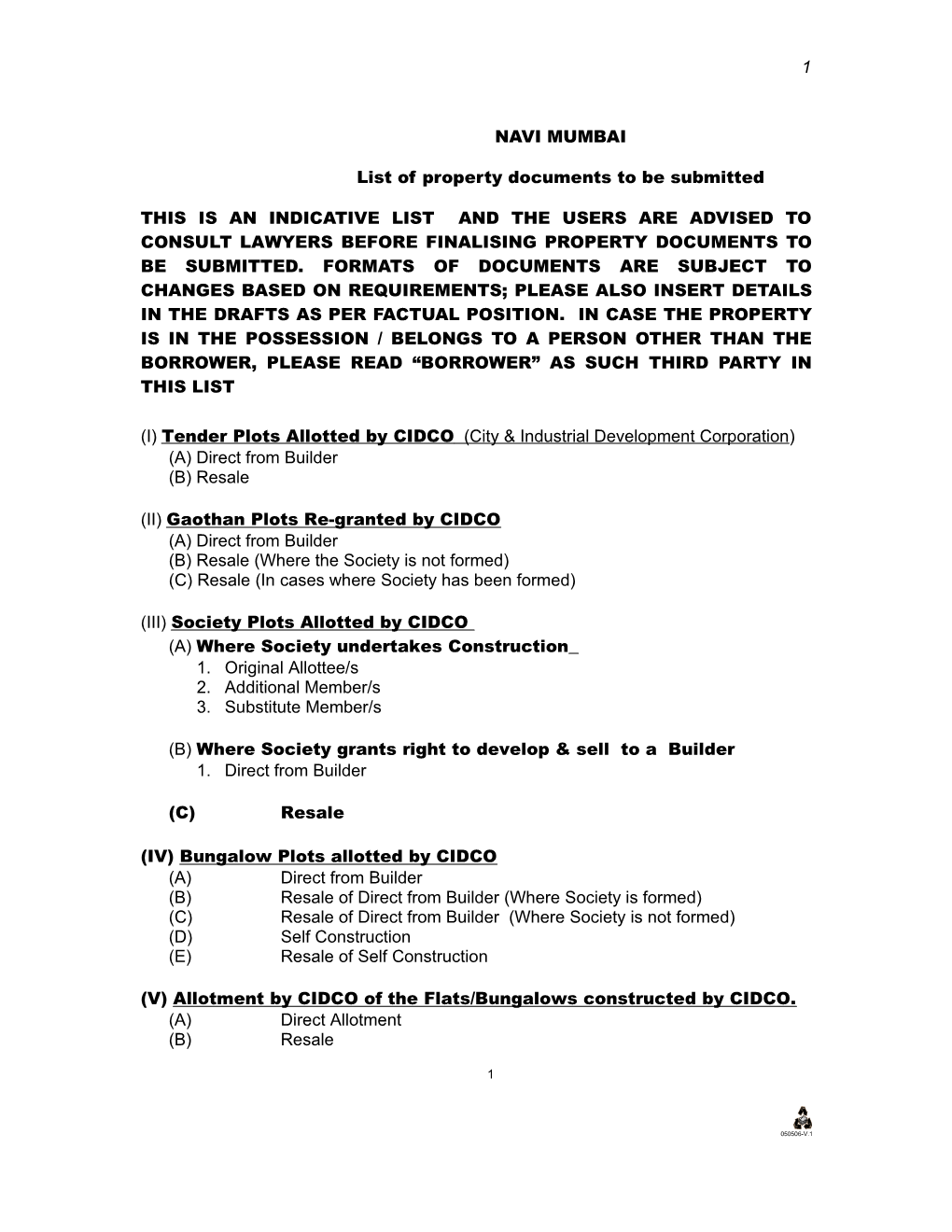

NAVI MUMBAI

List of property documents to be submitted

THIS IS AN INDICATIVE LIST AND THE USERS ARE ADVISED TO CONSULT LAWYERS BEFORE FINALISING PROPERTY DOCUMENTS TO BE SUBMITTED. FORMATS OF DOCUMENTS ARE SUBJECT TO CHANGES BASED ON REQUIREMENTS; PLEASE ALSO INSERT DETAILS IN THE DRAFTS AS PER FACTUAL POSITION. IN CASE THE PROPERTY IS IN THE POSSESSION / BELONGS TO A PERSON OTHER THAN THE BORROWER, PLEASE READ “BORROWER” AS SUCH THIRD PARTY IN THIS LIST

(I) Tender Plots Allotted by CIDCO (City & Industrial Development Corporation) (A) Direct from Builder (B) Resale

(II) Gaothan Plots Re-granted by CIDCO (A) Direct from Builder (B) Resale (Where the Society is not formed) (C) Resale (In cases where Society has been formed)

(III) Society Plots Allotted by CIDCO (A) Where Society undertakes Construction 1. Original Allottee/s 2. Additional Member/s 3. Substitute Member/s

(B) Where Society grants right to develop & sell to a Builder 1. Direct from Builder

(C) Resale

(IV) Bungalow Plots allotted by CIDCO (A) Direct from Builder (B) Resale of Direct from Builder (Where Society is formed) (C) Resale of Direct from Builder (Where Society is not formed) (D) Self Construction (E) Resale of Self Construction

(V) Allotment by CIDCO of the Flats/Bungalows constructed by CIDCO. (A) Direct Allotment (B) Resale

1

050506-V.1 2

(VI) PRESS Plots allotted by CIDCO (A) Direct from Builder (B) Resale (Where Society is not formed) (C) Resale (Where Society is formed)

2

050506-V.1 3

Procedure & Drafts - NAVI MUMBAI

(I) TENDER PLOTS – Allotted by CIDCO

(A) DIRECT FROM BUILDER (Builder applies for the plot & CIDCO allots to the Builder for Development & Sale of the units constructed)

Borrowers Documents

Pre-Disbursal Documents

Original stamped and registered Agreement for Sale executed between the Builder and the Borrower/s & the Original Money Receipts issued by the Sub- Registrar for the Registration fee paid by the Borrower(s) / Applicant(s) (RR) . Original Own Contribution Receipts of the payment made to the Builder on revenue stamps (if not included in the Agreement for Sale). Original NOC for Mortgage from Builder as per ICICI BANK format. (Draft-1) Letter from Builder/Architect indicating the latest progress of Construction for under-construction cases.

Builder Documents

Pre-Disbursal Documents

Copy of Agreement for Lease executed between CIDCO and the Builder (This document should give Builder right to sell without the need of NOC from CIDCO). Copy of Partnership Deed / MOA / AOA of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of the Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO) Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease)

In case of completed projects the following additional documents would be required:

Copy of the Completion Certificate issued by NMMC/CIDCO

3

050506-V.1 4

Copy of the Lease Deed

(I) (B) RESALE

Borrowers Documents

Pre- Disbursal Documents

Copies of all previous title deeds establishing chain of title up to the present seller Original own contribution receipts for the payments made to Seller. (If not included in the Agreement for Sale) Original NOC for mortgage from the Builder (Draft-3) / Society (Draft-4) as per ICICI BANK format. Permission to Transfer (PTT) from CIDCO in favour of Borrower/s (If not available then Undertaking -cum- Indemnity from the Borrower for non-availability of Permission to Transfer in favour of the Borrower/s as per ICICI BANK format. (Draft –5) & Undertaking -cum- Indemnity from the Seller for non-availability of Permission to Transfer in favour of the Seller/s as per ICICI BANK format.(Draft – 7) (PTT is required in cases where Society is formed) Title clearance report for last 13 years in detail & search fee receipt.

Builder Documents:

Pre-Disbursal Documents

Copy of Agreement for Lease executed between CIDCO and the Builder Builder (This document should give Builder right to sell without the need of NOC from CIDCO). Copy of Partnership Deed / MOA / AOA of the builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO) Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease)

In case of completed projects, the following additional documents would be required :

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed

4

050506-V.1 5

Over The Counter Documents

Borrowers Documents

All original previous title deeds (including registration receipts) Original duly stamped and registered Agreement for Sale executed between the Seller and the Borrower/s with original Registration Receipt. Share Certificate duly transferred in the name of Vendor/s (In case the society is formed)

(II) GAOTHAN PLOTS (Re-granted to Original Land- Owners by CIDCO)

(A)DIRECT FROM BUILDER

Borrowers Documents

Pre Disbursal Documents

Original stamped and registered Agreement for Sale executed between the Builder and the Borrower/s & the Original Money Receipts issued by the Sub- Registrar for the Registration fee paid by the Borrower/ Applicant (RR) Original Own Contribution Receipts of the payments made to Builder on revenue stamps (If not included in the Agreement for Sale). Original NOC for Mortgage from Builder as per ICICI BANK format (Draft-1). Letter from Builder/Architect indicating the latest progress of Construction for under-construction cases. Permission to Transfer from CIDCO in favour of Borrower/s (If not available then Undertaking -cum- Indemnity from the Borrower for non- availability of Permission to Transfer in favour of the Borrower/s as per ICICI BANK format. (Draft –5)

Builder Documents

Pre- Disbursal Documents:

Copy of the Agreement for Lease executed between CIDCO and the Original Landowner.

5

050506-V.1 6

Copy of the Development Agreement executed between the Original Landowner and Builder Copy of the Power of Attorney executed by Lessee (Original Landowner to whom the land has been re-granted) in favour of the Builder. Copy of the Partnership Deed / AOA / MOA of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of the Transfer Order in favour of the Builder

In case of completed projects the following additional documents would be required Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed

Post-Disbursal Documents

Borrowers Documents

Share Certificate duly transferred in the name of Borrower/s, (Incase the society is subsequently formed by the Builder)

(II) (B) RESALE OF FLATS (where the land was regranted to the Original Landowner & the development rights were given to the Builder by the Original Landowner & the Society is not formed by the Builder

(Applicable only for the period of 3 years from the date of Development Agree- ment & Power of Attorney in favour of the Builder)

Pre-Disbursal Documents

Borrowers Documents

Original Own Contribution Receipts for the payments made to Seller. (If not included in the Agreement for Sale) Copies of all previous title deeds establishing chain of title up to the present seller. Original NOC for mortgage from the Builder as per ICICI BANK format (Draft-3).

6

050506-V.1 7

Permission to Transfer from CIDCO in favour of Borrower/s (If not available then Undertaking -cum- Indemnity from the Borrower for non-availability of Permission to Transfer in favour of the Borrower/s as per ICICI BANK format. (Draft –5) Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Permission to Transfer from CIDCO in favour of Seller/s (If not available then Undertaking -cum- Indemnity from the Seller for non-availability of Permission to Transfer in favour of the Seller/s as per ICICI BANK format. (Draft –7)

Builder Documents:

Pre-Disbursal documents

Copy of the Agreement for Lease executed between CIDCO and the Original Landowner. Copy of the Development Agreement executed between the Original Landowner and Builder Copy of the Power of Attorney executed by lessee (Original Landowner to whom the land has been re-granted) in favour of the Builder. Copy of the Partnership Deed / AOA / MOA of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of Commencement Certificate & Occupation Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of the Transfer Order in favour of the Builder

In case of completed projects the following additional documents would be required

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed

Over the Counter Documents

Borrowers Documents

All original previous title deeds (including Registration Receipts) Original stamped and registered Agreement for Sale executed between the Seller & the Borrower and the original money receipts issued by the Sub- Registrar for the registration fee paid by the Borrower/s (RR).

7

050506-V.1 8

Post-Disbursal Documents

Borrowers Documents Share Certificate duly transferred in the name of Borrower/s, (In case the society is subsequently formed.)

(II) (C) RESALE OF FLAT (where the land was regranted to the landowner & the development rights were given to the Builder by the Landowner & the Society is formed by the Builder & lease deed is executed by CIDCO in favour of society)

Pre-Disbursal documents

Borrowers documents

Original own contribution receipts for the payments made to Seller. (If not included in the Agreement for Sale) Copies of all previous title deeds establishing chain of title up to the present seller. Original NOC for Mortgage from the Society as per ICICI BANK format. (Draft-4) Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Permission to Transfer from CIDCO in favour of Borrower/s

Society Documents

Pre Disbursal Documents

Copy of Society’s Registration Certificate & Copy of Byelaws with the list of original members Copy of Permission to Transfer from CIDCO in favour of Society Copy of the Award passed by CIDCO in favour of the Original Landowner, as available. Copy of the Agreement for Lease executed between CIDCO and the Original Landowner, as available. Copy of the Development agreement executed between the Original Landowner and Builder, as available. Copy of the Power of Attorney executed by lessee (Original Landowner to whom the land has been re-granted) in favour of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). 8

050506-V.1 9

Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of the Completion Certificate & Occupation Certificate issued by NMMC/CIDCO Copy of the Lease Deed executed between CIDCO & the Society.

Over the Counter Documents

Borrowers Documents

All original previous title deeds (including Registration Receipts) Original stamped and registered Agreement for Sale executed between the Seller & the Borrower and the original money receipts issued by the Sub- Registrar for the registration fee paid by the Borrower/s (RR). Share certificate transferred in the name of the Seller.

(III) SOCIETY PLOTS Allotted by CIDCO

(A)Where consideration is paid to the Society & Society undertakes construction. (Pending Lease Deed execution between CIDCO & the Society)

1. Borrower is an Original Allottee, Borrower’s name appears in the original list of members attached to Agreement for Lease executed between CIDCO and Society

Borrowers Documents

Pre-Disbursal Documents

Original Letter of Allotment from the society mentioning the flat no. allotted and the total cost of the flat in favour of the Borrower/s. Original Own Contribution Receipts for payments made to Society on revenue stamps Original NOC for Mortgage from the Society as per ICICI BANK format. (Draft-2)

Society Documents: 9

050506-V.1 10

Pre-Disbursal Documents

Copy of the Agreement for Lease executed between CIDCO and the Society including the list of members. Copy of Society’s Registration Certificate & Copy of Byelaws Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. .

In case of completed projects the following additional documents would be required

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed executed between the Society & CIDCO.

Post-Disbursal Documents

Borrowers Documents

Share Certificate duly transferred in the name of Borrower/s

(III) (A) (2) Borrower is an Additional Member –who is given membership subsequently

Borrowers documents

Pre disbursal documents:

Original Letter of Allotment from the society mentioning the flat no. allotted and the total cost of the flat in favour of the Borrower/s. Original Own Contribution Receipts for payments made to Society on revenue stamps Original NOC from the Society for Mortgage as per ICICI BANK format (Draft-2).

10

050506-V.1 11

Copy of the Permission to Transfer from CIDCO for admitting the new member as the Additional Member in the society duly certified by the society.

Society Documents

Pre Disbursal Documents

Copy of the Agreement for Lease executed between CIDCO and the Society including the list of members. Copy of Society’s Registration Certificate & Copy of Byelaws Copy of Approved Building plans Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copy of the Location Plan (Attached to Agreement for Lease) Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt.

In case of completed projects the following additional documents would be required

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed executed between the Society & CIDCO.

Post-Disbursal Documents

Borrowers Documents

Share Certificate duly transferred in the name of Borrower/s

(III) (A) (3) Borrower is a Substitute Member, who is being substituted for the Original member whose name was appearing in the list & who has resigned. (Agreement for Lease executed & pending execution of the Lease Deed with Society & CIDCO).

Borrowers documents

11

050506-V.1 12

Pre Disbursal Documents

Original Letter of Allotment in favour of the Society mentioning the flat no. allotted and the total cost of the flat in favour of the Borrower/s. Original Own Contribution Receipts for payments made to Society on revenue stamps Original NOC for Mortgage from the Society as per ICICI BANK format (Draft-2). Copy of the Permission to Transfer from CIDCO for admitting the new member as the Substitute Member in the society duly certified by the society.

Society Documents

Pre Disbursal Documents :

Copy of the Agreement for Lease executed between CIDCO and the Society including the list of members. Copy of Society’s Registration Certificate & Copy of Byelaws Copy of Approved Building plans Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copy of the Location Plan (Attached to Agreement for Lease) Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt.

In case of completed projects the following additional documents would be required

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed executed between the Society & CIDCO.

Post-Disbursal Documents

Borrowers Documents

Share Certificate duly transferred in the name of Borrower/s

(III) (B) Plot allotted to Society by CIDCO, Society grants development rights to the Builder. Construction is undertaken by the Builder & Prospective Purchasers are purchasing flats from Builder (Pending Lease Deed execution between CIDCO & the Society)

(1) Direct from Builder 12

050506-V.1 13

Borrowers documents

Pre disbursal documents

Original Letter of Allotment from the Society mentioning the flat no. allotted and the total cost of the flat in favour of the Borrower/s accompanied by a letter from the society directing & permitting the Borrower/s to make payment of the consid- eration directly to a Builder giving reference to the Development Agreement and POA executed with them. Original Own Contribution Receipts of the payments made to Builder on revenue stamps (If not included in the Agreement for Sale). Original NOC for Mortgage from the Society as per ICICI BANK format (Draft-2) Original NOC for Mortgage from the Builder as per ICICI BANK format (Draft-1) Copy of the Permission to Transfer from CIDCO for admitting the new member as the Additional Member in the society duly certified by the society/ Copy of the Permission to Transfer from CIDCO for admitting the new member as the Substitute Member in the society duly certified by the society.

Society & Builder Documents

Pre Disbursal Documents

Copy of the Agreement for Lease between CIDCO and society including the list of members. Copy of the Partnership Deed / AOA / MOA of the builder. Copy of Society’s Registration Certificate & Copy of Byelaws Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of the Development Agreement executed between the Society and Builder. Copy of the Power of Attorney from the Society to the Builder. Copy of the Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copy of the Approved Building plans. Copy of the Location Plan (Attached to Agreement for Lease)

In case of completed projects the following additional documents would be required

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed executed between the Society & CIDCO.

Post-Disbursal Documents

Borrowers Documents

13

050506-V.1 14

Original Share Certificate in favour of the Borrower/s.

(III) (C) Resale

Resale of

(III) (A) Where Plot is allotted to Society by CIDCO, Society has undertaken Construction & flats have been directly allotted by the Society to Original Allottee, Substitute member & Additional member by the Society

(1) Seller/s is an Original Allottee- Name of the Seller/s appears in the original list of members attached to Agreement for Lease executed between CIDCO and Society) (2) Seller/s is an Additional Member –who is given membership subsequently) (3)- Seller/s is a Substitute Member – Substituted for the Original member whose name was appearing in the list

& Resale also of

(III) (B) Society Plot where Society grants right to develop & sell to a Builder & Borrower/s purchases from the Seller/s who has purchased directly from a Builder

Borrowers Documents

Pre-Disbursal Documents

Draft of Agreement for Sale/Transfer to be executed between the Seller & the Borrower/s Original own contribution receipts for the payments made to Seller. (If not included in the Agreement for Sale) Original NOC for Mortgage from the Builder (Draft 3) / Society (Draft – 4) as per ICICI BANK format Permission to Transfer from CIDCO in favour of the Borrower/s. – Required if an Agreement for lease between CIDCO and Society is executed after 7th Feb, 1990 Copies of all previous title deeds establishing chain of title upto the present seller.

14

050506-V.1 15

Title clearance report for last 13 years in detail & search fee receipt

Society & Builder Documents

Pre-Disbursal Documents

Copy of the Partnership Deed / AOA / MOA of the Builder. Copy of Society’s Registration Certificate & Copy of Byelaws Copy of the Agreement for Lease executed between CIDCO and the Society. Copy of the Development Agreement executed between the Society and the Builder Copy of the Power of Attorney executed by the Society in favour of the Builder. Copy of Title Clearance Report for last 13 years in detail & search fee receipt. Copy of the Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease)

Post Disbursal Documents

Borrowers Documents

If the Construction is complete than the following two additional documents will be required:

Copy of the Completion Certificate & Occupation Certificate issued by NMMC/CIDCO Copy of the Lease Deed executed between CIDCO & the Society.

Over the Counter Documents

Borrowers Documents

All original previous title deeds (including Registration Receipts) Original duly stamped and registered Agreement for Sale executed between the Seller and the Borrower/s with original Registration Receipt. Share certificate transferred in the name of the Seller.

(IV) BUNGALOW PLOTS

(A) DIRECT FROM BUILDER Development Rights granted by the Individual Allottee to a Builder

15

050506-V.1 16

Pre- Disbursal Documents

Borrowers Documents

Original stamped and registered Agreement for Sale executed between the Builder and the Borrower/s & the Original Money Receipts issued by the Sub- Registrar for the Registration fee paid by the Borrower/ Applicant (RR) Original Own Contribution Receipts of the payments made to Builder on revenue stamps (If not included in the Agreement for Sale). Original NOC for Mortgage from Builder as per ICICI BANK format (Draft-1). Letter from Builder/Architect indicating the latest progress of Construction for under-construction cases. Permission to Transfer from CIDCO in favour of Borrower/s ( If not available then Undertaking -cum- Indemnity from the Borrower for non-availability of Permission to Transfer in favour of the Borrower/s as per ICICI BANK format. (Draft –5)

Builder Documents

Pre- Disbursal Documents

Copy of the Agreement for Lease executed between CIDCO and the Original Allottee. Copy of the Development Agreement executed between the Original Allottee and Builder Copy of the Power of Attorney executed by Lessee (Original Allottee to whom the land has been allotted) in favour of the Builder. Copy of the Partnership Deed / AOA / MOA of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of the Transfer Order in favour of the Builder

In case of completed projects the following additional documents would be required

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed

Post-Disbursal Documents

16

050506-V.1 17

Borrowers Documents

Share Certificate duly transferred in the name of Borrower/s, (In case the society is subsequently formed.)

(IV) (B) Resale of Direct from Builder (Where the Development Rights are granted by the individual allottee of plot to a Builder, Immedi- ate Seller has purchased from the Builder-Where lease deed is executed in favour of Society

Pre-Disbursal documents

Borrowers documents

Original own contribution receipts for the payments made to Seller. (If not included in the Agreement for Sale) Copies of all previous title deeds establishing chain of title up to the present seller. Original NOC for Mortgage from the Society as per ICICI BANK format. (Draft-4) Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Permission to Transfer from CIDCO in favour of Borrower/s

Society Documents

Pre Disbursal Documents

Copy of Society’s Registration Certificate & Copy of Byelaws with the list of original members Copy of Permission to Transfer from CIDCO in favour of Society Copy of the Agreement for Lease executed between CIDCO and the Original Allottee. Copy of the Development agreement executed between the Original Allottee and Builder Copy of the Power of Attorney executed by Lessee (Original Allottee to whom the land has been allotted) in favour of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of the Completion Certificate & Occupation Certificate issued by NMMC/CIDCO 17

050506-V.1 18

Copy of the Lease Deed executed between CIDCO & the Society.

Over the Counter Documents

Borrowers Documents

All original previous title deeds (including Registration Receipts) Original stamped and registered Agreement for Sale executed between the Seller & the Borrower and the original money receipts issued by the Sub- Registrar for the registration fee paid by the Borrower/s (RR). Share certificate transferred in the name of the Seller.

(IV) (C) Resale of Direct from Builder (Where the Development Rights are granted by the individual allottee of plot to a Builder, Immedi- ate Seller has purchased from the Builder-Where Society is not formed) (Applicable only for the period of three years from the date of Development Agreement & Power of Attorney in favour of the Builder)

Pre-Disbursal Documents

Borrowers Documents

Original Own Contribution Receipts for the payments made to Seller. (If not included in the Agreement for Sale) Copies of all previous title deeds establishing chain of title up to the present seller. Original NOC for mortgage from the Builder as per ICICI BANK format (Draft-3). Permission to Transfer from CIDCO in favour of Borrower/s (If not available then Undertaking -cum- Indemnity from the Borrower for non-availability of Permission to Transfer in favour of the Borrower/s as per ICICI BANK format.(Draft –5) & Undertaking -cum- Indemnity from the Seller for non-availability of Permission to Transfer in favour of the Seller/s as per ICICI BANK format.(Draft –7) Title Clearance Report by Advocate for last 13 years in detail & search fee receipt.

Builder Documents:

Pre-Disbursal documents

Copy of the Agreement for Lease executed between CIDCO and the Original Allottee.

18

050506-V.1 19

Copy of the Development Agreement executed between the Original Allottee and Builder Copy of the Power of Attorney executed by Lessee (Original Allottee to whom the land has been allotted) in favour of the Builder. Copy of the Partnership Deed / AOA / MOA of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of the Transfer Order in favour of the Builder

In case of completed projects the following additional documents would be required :

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed

Over the Counter Documents

Borrowers Documents

All original previous title deeds (including Registration Receipts) Original stamped and registered Agreement for Sale executed between the Seller & the Borrower and the original money receipts issued by the Sub- Registrar for the registration fee paid by the Borrower/s (RR).

Post-Disbursal Documents

Borrowers Documents

Share Certificate duly transferred in the name of Vendor/s, (In case the society is subsequently formed.)

(IV) (D) SELF-CONSTRUCTION by the Original Allottee (Plot allotted by CIDCO to individual & Self Construction carried by the Original Allottee himself)

Borrowers Documents:

19

050506-V.1 20

Pre-Disbursal documents

Original Letter of Allotment from CIDCO in favour of the Original Allottee / Borrower/s. Original Agreement for Lease between CIDCO and the Plot Owner (Original Allottee/Borrower) (Period of License to enter the property should not have lapsed). Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Copy of the Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO) Copies of the Approved Building Plans. Detailed Architect’s Estimate of the cost of the Project. Copy of the Location Plan (Attached to Agreement for Lease) Undertaking cum Indemnity from the Borrower/s for submission of Original Lease Deed executed between CIDCO and Original Allottee / Borrower as and when executed & also to complete construction as per the period allowed & norms specified by CIDCO & other authorities. As per ICICI BANK format (Draft – 8) NOC to mortgage from CIDCO

Society Documents (in case society is formed and a single lease deed has been executed in favour of society for a cluster of plots):

Pre-Disbursal Documents:

Copy of the Registration Certificate of the Society Copy of the Bye Laws of the Society.

Post disbursal documents (within 60 days of final disbursal)

In case the Society of cluster of plots is not formed:

Original Lease Deed executed between CIDCO and the Original Allottee/Borrower/s OR

In case the Society for cluster of plots is formed and if a single Lease Deed is executed for cluster of plots with Society, Borrower/s will be required to submit:

Original Share Certificate & Certified copy of the Lease Deed executed between CIDCO and the Society.

20

050506-V.1 21

(IV) (E) Resale purchase by the Borrower of the Constructed House by the original allottee (Plot allotted by CIDCO to individual & Self Construction carried by the Original Allottee himself & the Original Allottee reselling the constructed house to the Borrower-Only cases where the Lease Deed is executed by CIDCO in favour of the Original Allottee/Society-Cluster of Plots)

Borrowers Documents

Pre-Disbursal documents

Copies of all previous title deeds establishing chain of title upto the present seller (including copies of registration receipts & letter of allotment issued by CIDCO in favour of the Original Allottee) Copy Share certificate duly transferred in the name of seller (If the Society is formed). Original NOC for mortgage from the Society (Draft – 2) as per ICICI BANK format (If the Society is formed) Copy of Title Clearance Report by Advocate for the property.. Copy of the Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Certified copies of the Approved Plans. Individual NOC for mortgage from CIDCO in the name of our borrower only Not required if the Lease Deed is in favour of society and society NOC is received. Copy of the Location Plan (Attached to Agreement for Lease). Original own contribution receipts for the payments made to Seller. (If not included in the Agreement for Sale) Permission to transfer from CIDCO

Society Documents (Only if society is formed)

Pre Disbursal Documents

Copy of Society registration Certificate & Copy of Bye Laws. Copy of Lease deed in favour of Society

21

050506-V.1 22

Over the Counter documents

Borrowers Documents

Original stamped & Registered Agreement for sale executed between the Seller & the Borrower / s. & the Original Money Receipts issued by the Sub-Registrar for the Registration fee paid by the Borrower/Applicant (RR) All original prior title deeds (including registration receipts) (For first chain, both original agreement to lease AND lease deed are required) Original Share Certificate in favour of the Seller (If the Society is formed for cluster of plots)

(V) Allotment by CIDCO of the Flats/Bungalows con- structed by CIDCO.

(A) Direct Allotment by CIDCO of the Flats/Bungalows construct- ed by CIDCO.

Borrowers Documents

Pre-Disbursal Document

Original Letter of Allotment from CIDCO with demand letter / schedule of payment in favour of the Borrower/s. Original receipts issued by CIDCO for the payments made for the flat. Undertaking cum Indemnity for submission of Original Agreement to Sale executed between CIDCO and Original Allottee/Borrower as and when executed as per ICICI BANK format (Draft – 9) NOC for Mortgage from CIDCO in favour of the Borrower/s (as per CIDCO’s format)

22

050506-V.1 23

Post-Disbursal Documents (2 years from final disbursal):

Original duly stamped & registered Agreement to Sale executed between CIDCO and the borrower. Original Registration receipts

(V) (B) Resale of Flats/Bungalows allotted & constructed by CIDCO (Our Borrower is purchasing the flat from the Seller who is the original allottee of the constructed Flat/Bungalow-Only cases where Lease Deed is executed in favour of the Seller/Original Allottee)

Borrowers documents

Pre-Disbursal Documents

Original own contribution receipts for the payment made to seller (If not included in the Agreement for Sale) Permission to Transfer from CIDCO in favour of the Borrower/s. Copies of all previous title deeds establishing chain of title upto the present Seller. Title Clearance Report for last 13 years in detail & search fee receipt Original NOC for Mortgage from CIDCO in favour of the Borrower/s (as per CIDCO’s format) – in case society is not formed NOC from Society, in case society has been formed (If Society is formed then the Permission to Mortgage from CIDCO is not required)

Over the Counter Documents:

Borrowers Documents

Original all previous title deeds establishing chain of title upto the present Seller including Registration receipts beginning from the Allotment Letter and Agreement for Sale executed between CIDCO & First allottee. Original duly stamped & registered Agreement for Sale executed between seller and Borrower/s with original Registration Receipt. Original Share certificate in the name of Seller (In case the Society is formed).

(VI) PRESS PLOTS

23

050506-V.1 24

(A) DIRECT FROM BUILDER

Pre Disbursal Documents

Borrowers documents

Original stamped and registered Agreement for Sale executed between the Builder and the Borrower/s & the Original Money Receipts issued by the Sub- Registrar for the Registration fee paid by the Borrower/ Applicant (RR) Original Own Contribution Receipts of the payments made to Builder on revenue stamps (If not included in the Agreement for Sale). Original NOC for Mortgage from Builder as per ICICI BANK format (Draft-1). Letter from Builder/Architect indicating the latest progress of Construction for under-construction cases. Permission to Transfer from CIDCO in favour of Borrower/s (If not available then Undertaking -cum- Indemnity from the Borrower for non-availability of Permission to Transfer in favour of the Borrower/s as per ICICI BANK format. (Draft –5)

Builder Documents

Pre- Disbursal Documents

Copy of the Agreement for Lease executed between CIDCO and the Press Owner Copy of the Development Agreement executed between the Press Owner and Builder Copy of the Power of Attorney executed by Lessee (Press Owner to whom the land has been allotted) in favour of the Builder. Copy of the Partnership Deed / AOA / MOA of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. . Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of the Transfer Order in favour of the Builder

In case of completed projects the following additional documents would be required Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed

Post-Disbursal Documents

24

050506-V.1 25

Borrowers Documents Share Certificate duly transferred in the name of Borrower/s, (In case the society is subsequently formed.)

(VI) (B) Resale of Direct from Builder (Where the Development Rights are granted by the individual allottee of plot to a Builder, Seller of the Borrower has purchased from the Builder-Where Society is not formed- Applicable only for the period of three years from the date of Development Agreement & Power of Attorney in favour of the Builder

Pre-Disbursal Documents

Borrowers Documents

Original Own Contribution Receipts for the payments made to Seller. (If not included in the Agreement for Sale) Copies of all previous title deeds establishing chain of title up to the present seller. Original NOC for mortgage from the Builder as per ICICI BANK format (Draft-3). Permission to Transfer from CIDCO in favour of Borrower/s (If not available then Undertaking -cum- Indemnity from the Borrower for non-availability of Permission to Transfer in favour of the Borrower/s as per ICICI BANK format.(Draft –5) & Undertaking -cum- Indemnity from the Seller for non-availability of Permission to Transfer in favour of the Seller/s as per ICICI BANK format.(Draft –7) Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. Permission to Transfer from CIDCO in favour of Seller/s .

Builder Documents:

Pre-Disbursal documents

Copy of the Agreement for Lease executed between CIDCO and the Press Owner Copy of the Development Agreement executed between the Press Owner and Builder Copy of the Power of Attorney executed by Lessee (Press Owner to whom the land has been allotted) in favour of the Builder. Copy of the Partnership Deed / AOA / MOA of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. .

25

050506-V.1 26

Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of the Transfer Order in favour of the Builder

In case of completed projects the following additional documents would be required

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed

Over the Counter Documents

Borrowers Documents

All original previous title deeds (including Registration Receipts) Original stamped and registered Agreement for Sale executed between the Seller & the Borrower and the original money receipts issued by the Sub- Registrar for the registration fee paid by the Borrower/s (RR).

Post-Disbursal Documents

Borrowers Documents Share Certificate duly transferred in the name of Vendor/s, (In case the society is subsequently formed.)

(VI) (C) Resale of Direct from Builder (Where the Development Rights are granted by the individual allottee of plot to a Builder, Seller of the Borrower has purchased from the Builder-Where Society is formed and lease is granted in its favour

Pre-Disbursal documents

Borrowers documents

Original own contribution receipts for the payments made to Seller. (If not included in the Agreement for Sale) Copies of all previous title deeds establishing chain of title up to the present seller.

26

050506-V.1 27

Original NOC for mortgage from the Society as per ICICI BANK format (Draft-4). Permission to Transfer from CIDCO in favour of Borrower/s Title Clearance Report by Advocate for last 13 years in detail & search fee receipt.

Society Documents

Pre Disbursal Documents

Copy of Society’s registration Certificate & Copy of Byelaws with the list of original members Copy of Permission to Transfer from CIDCO in favour of Society Copy of the Agreement for Lease executed between CIDCO and the Press- Owner Copy of the Development agreement executed between the Press-Owner and Builder. Copy of the Power of Attorney executed by Lessee (Press Owner to whom the land has been allotted) in favour of the Builder. Copy of Title Clearance Report by Advocate for last 13 years in detail & search fee receipt. . Copy of Commencement Certificate issued by Navi Mumbai Municipal Corporation (NMMC) /City & Industrial Development Corporation (CIDCO). Copies of the Approved Building Plans. Copy of the Location Plan (Attached to Agreement for Lease) Copy of lease deed between CIDCO and society.

In case of completed projects the following additional documents would be required

Copy of the Completion Certificate issued by NMMC/CIDCO Copy of the Lease Deed

Over the Counter Documents

Borrowers Documents

All original previous title deeds (including Registration Receipts) Original stamped and registered Agreement for Sale executed between the Seller & the Borrower and the original money receipts issued by the Sub- Registrar for the registration fee paid by the Borrower/s (RR). · Share certificate transferred in the name of the Seller.

27

050506-V.1 28

APART FROM THE ABOVE DOCUMENTS ANY OTHER DOCUMENTS REQUIRED BY ICICI BANK AND ITS APPROVED LAWYERS IN ORDER TO CERTIFY A CLEAR AND MARKETABLE TITLE

Draft 1 Draft of NOC to be obtained from the Builder on his letter-head

Date: Place:

To, ICICI Bank Limited ( ICICI Bank) (Address)

Dear Sirs :

Re : Permission to mortgage flat no...... (Hereinafter referred to as the “said Flat”). on the ...... floor of the building proposed to be named as / named as ...... situated at ...... (Hereinafter referred to as the “said Property”).

1. This is to confirm that we have allotted/sold flat no...... admeasuring ...... sq. ft. (carpet/built-up area) on the ...... floor of the building proposed to be named as / known as ...... situated at ...... under construction / constructed by us to Mr./Mrs./Ms...... for a total con- sideration of Rs...... (Rupees ...... only) under an Agree- ment for Sale/Sale Deed dated ...... 28

050506-V.1 29

2. We confirm that we have obtained necessary permissions/approvals/sanctions for construction of the said building from all the concerned competent authorities and the construction of the building as well as of the flat are in accordance with the approved plans. We assure that the said flat as well as the said building and the land appurtenant thereto are not subject to any encumbrance, charge or liability of any kind whatsoever and that the entire property is free and marketable. We have a clear, legal and marketable title to the said property and every part thereof. 3. Mr./Mrs./Ms...... has paid an amount of Rs...... (Rupees ...... only) and a sum of Rs...... (Rupees ...... only) remains to be paid towards the cost of the said flat. OR Mr./Mrs./Ms...... has to pay the total cost of Rs...... (Rupees ...... only) of the said flat. 4. Possession of the said flat will be given to Mr./Mrs./Ms...... on or about ...... on payment of the full consideration of the flat. OR Possession of the said flat has already been given to Mr./Mrs./Ms...... 5. We are aware that the said Mr./Mrs./Ms...... has approached ICICI Bank Limited for a loan for purchasing/acquiring the said flat and that ICICI Bank Limited has agreed to sanction/grant the loan to Mr./Mrs./Ms...... to purchase / acquire the above flat and Mr./Mrs./Ms...... has agreed to mortgage the said flat in your favour / in favour of your security trustee as security for the said loan. We hereby confirm that we have no objection to Mr./Mrs./Ms...... mortgaging the said flat to your Company / in favour of your security trustee by way of security for repayment of the said loan. AND notwithstanding anything to the contrary contained in the said Agreement for Sale, we hereby agree to note the aforesaid charge in our books in respect of the said flat and Mr./Mrs./Ms...... will not be permitted to transfer, assign, sell off / cancel or in any other way / manner deal with the said flat prejudicial to the interest of the aforesaid mortgagee without the prior written consent of the aforesaid mortgagee. 6. We undertake to form a Co-operative Society under the Maharashtra Flat & Apartment Ownership Act of the premises/flat holders in the aforesaid building within the statutory period and also further undertake to get the Lease Deed in respect of the said property executed in favour of the Co-operative Society to be formed. And we agree to inform and give proper notice to the Co-operative Society as and when 29

050506-V.1 30 formed, about and said unit/flat being so mortgaged to your Company / the security trustee nominated by your Company. Yours faithfully, For ...... (Builders) Signatures

Note : This NOC is to be signed on behalf of the Builders by the same persons who have signed the Agreement for sale in favour of the Purchaser/s (Borrower/s) or any person authorised by the Builders to sign on their behalf

30

050506-V.1 31

Draft- 2

Draft of the NOC from Co-operative Housing Society (On Society Letterhead) (Original Member/Additional Member/Substitute Member/ for granting rights to develop and sell)

Date: Place: To, ICICI Bank Limited ( ICICI Bank) (Address)

Dear Sirs,

Re: Flat No...... (Hereinafter referred to as the said “Flat”) of Mr./Mrs...... in the building named as ...... of the ...... Co-op. Housing Society Ltd., situated at ...... (Hereinafter referred to as the said “property”)

This is to confirm that our above named society registered under no...... dated ...... is the owner of the above building pursuant to the lease deed dated ...... registered under no...... dated ...... OR The deed transferring the land and the said building to our society is not yet executed and it will be done in due course. Mr. / Ms...... is a member of our Society and share certificate no...... for shares bearing distinctive nos...... to ...... stand in his / her name and the said flat is possessed by him / her. The said flat is possessed by Mr. / Ms...... (“the said Member”). OR Mr. / Ms...... is a member of our society and the said flat is possessed by Mr./Ms...... (“the said member”). The share certificate has not yet been issued by the society to the said Member. We hereby assure you that the said flat, as well as the said building and the land appurtenant thereto are not subject to any encumbrance, charge or liability of any kind whatsoever and that the entire property is free and marketable. 31

050506-V.1 32

We further confirm that we have a clear, legal and marketable title to the said property and every part thereof, and that all taxes and dues in respect thereof have been paid up to the date. We confirm that there are no restrictive/negative covenants in the Bye laws / Rules of the above mentioned society concerning the transfer of shares / members interest in the society and other related matters. We are informed by the said Member that ICICI BANK has granted / agreed to grant a loan of Rs...... to the said Member upon the term and conditions, one of which stipulates creation of security by way of mortgage by deposit of original documents of title pertaining to the said flat in favour of ICICI BANK The said member has requested us to permit him/her to create the said security over the said flat and the shares (as and when issued) in favour of ICICI BANK. We, hereby confirm and agree we have “No Objection” to the permit the said Member to create the security in favour of ICICI BANK by way of mortgage of the right, title, interest of the said Member in the said shares and the said flat with you / in favour of your security trustee for repayment of the said loan and we hereby agree to note the mortgage charge on the said flat in our books. We also confirm that there are no outstanding dues/charges payable by the said Member in respect of the said flat and he/she has paid all the taxes and due in respect of the same upto date. We undertake not allow the said Member to transfer/further transfer / cancel the said flat or add any name in the share certificate without the prior written permission of ICICI BANK and as soon as the share certificates are issued by the society to the said Member, the same will be forwarded directly to ICICI BANK (if applicable)/security trustee. AND we agree to accept, subject to the byelaws of our society, in future, the application for membership from the person/s, firm, company to whom the said flat and the right, title and interest of the said Member in the said shares will be transferred/sold, on enforcement of the said security. Yours faithfully,

Authorised Signatories (Secretary and / or Chairman / President)

32

050506-V.1 33

Draft – 3

Draft of NOC to be obtained from the Builder on his letter- head (For Resale Cases)

Date: Place:

To, ICICI Bank Limited ( ICICI Bank) (Address)

Dear Sirs : Re : Permission to mortgage flat no...... (Hereinafter referred to as the said ”flat”) on the ...... floor of the building proposed to be named as...... situated at ...... (Hereinafter referred to as the “said property”):

1. This is to confirm that we have allotted/sold flat no...... admeasuring ...... sq. ft. (carpet/built-up area) on the ...... floor of the building proposed to be named as / known as ...... situated at ...... under construction / constructed by us to Mr./Mrs./Ms...... for a total consideration of Rs...... (Rupees ...... only) under an Agreement for Sale/Sale Deed dated ...... 2. We confirm that we have obtained necessary permissions/approvals/sanctions for construction of the said building from all the concerned competent authorities and the construction of the building as well as of the flat are in accordance with the approved plans. We assure that the said flat as well as the said building and the land appurtenant thereto are not subject to any encumbrance, charge or liability of any kind whatsoever and that the entire property is free and marketable. We have a clear, legal and marketable title to the said property and every part thereof. 3. Mr./Mrs./Ms...... had paid an amount of Rs...... (Rupees ...... only) and a sum of Rs...... (Rupees ...... only) remains to be paid towards the cost of the said flat. OR Mr./Mrs./Ms...... has to pay the total cost of Rs...... (Rupees ...... only) of the said flat.

33

050506-V.1 34

4. Possession of the said flat will be given to Mr./Mrs./Ms...... on or about ...... on payment of the full consideration of the flat. OR Possession of the said flat has already been given to Mr./Mrs./Ms...... 5. We are aware that the said Mr./Mrs./Ms...... (“the seller”) has agreed to sell the said flat and all his/her/their right, interest and title therein to Mr./Mrs./Ms...... (“the purchaser”) under an Agreement for Sale dated ...... and that the said Mr./Mrs...... (“the Purchaser”) has approached ICICI BANK (by itself or as or as duly constituted attorneys in this behalf of ICICI Bank Limited) for a loan for purchasing/acquiring the said flat and that ICICI BANK(for itself or as or as duly constituted attorneys in this behalf of ICICI Bank Limited) has agreed to sanction/grant the loan to Mr./Mrs./Ms...... to purchase / acquire the above flat and Mr./Mrs./Ms...... has agreed to mortgage the said flat in your favour as security for the said loan. We hereby confirm that we have no objection to the same and we shall transfer the said flat to the name of the Purchaser, in our books, on completion of the sale formalities between the said Seller and the said Purchaser. AND Notwithstanding anything to the contrary contained in the said Agreement for Sale, we confirm to register the aforesaid charge in our books in respect of the said flat on completion of the sale formalities as aforesaid and the said purchaser will not be permitted to transfer/cancel, assign, sell off or in any other way/manner deal with the said flat prejudicial to the interest of your Company/ your security trustee without the prior written consent of your Company / your security trustee. 6. We undertake to form a Co-operative Society under the Maharashtra Flat & Apartment Ownership Act of the premises/flat holders in the aforesaid building within the statutory period and also further undertake to get the Lease Deed in respect of the said property executed in favour of the Co-operative Society to be formed.. And we agree to inform and give proper notice to the Co-operative Society as and when formed, about the said unit/flat being so mortgaged. Yours faithfully, For ...... (Builders) Signatures

Note : This NOC is to be signed on behalf of the Builders by the same persons who have signed the Agreement for sale in favour of the Purchaser/s (borrower/s) or any person authorised by the Builders to sign on their behalf.

34

050506-V.1 35

Draft – 4

Draft of N.O.C. from the Co-operative Housing Society (To be obtained by the Borrower/s on the Society’s Letter head in case of Resale )

Date : Place :

To , ICICI Bank Limited ( ICICI Bank) (Address)

Dear Sirs, Re : Flat No...... (Hereinafter referred to as the said “Flat”) of Mr./Mrs...... in the building called ...... of the ...... Co-operative Housing Society Ltd., situated at ...... (Hereinafter referred to as the “said Property”).

This is to confirm that our above named society registered under no...... dated ...... is the lessee of the above building pursuant to the conveyance dated ...... registered under No...... dated ...... OR The lease deed transferring the land and the said building to our society is not yet executed and it will be done in due course. Mr. / Ms...... is a member (“the member”) of our Society and share certificate no...... for shares bearing distinctive numbers ...... to ...... stand in his / her name and the said flat is possessed by him / her. OR The share certificate are yet to be issued in the name of / to the Member. The member has informed the Society that he/she has agreed to sell and transfer all his/her right, title, interest in the said shares (in case issued) and the said flat to Mr. /Mrs...... to proposed Transferee (the prospective Borrower/s of ICICI BANK (for itself or as or as duly constituted attorneys in this behalf of ICICI Bank Limited), who has approached ICICI BANK (by itself or as or as duly constituted attorneys in this behalf of ICICI Bank Limited ) for a loan for acquiring the said flat.

35

050506-V.1 36

We confirm that our Society has no objection for transferring the above flat to/in the name of the proposed Transferee, subject to completion of the transfer formalities in respect of the said flat and the shares (if issued).

We hereby assure you that the said flat, as well as the said building and the land appurtenant thereto are not subject to any encumbrance, charge or liability of any kind whatsoever and that the entire property is free and marketable and that we have a clear title to the said property and every part thereof.

We further confirm that all taxes and dues in respect thereof have been paid upto date. We also confirm that there are no outstanding dues/charges payable by the said Member in respect of the said flat and he/she has paid all the taxes / dues in respect of the same upto date.

We confirm that there are no restrictive/negative covenants in the Bye laws/Rules of the above mentioned society concerning the transfer of shares/members interest in the society and other related matters.

We confirm that we have no objection to ICICI BANK (by itself or as or as duly constituted attorneys in this behalf of ICICI Bank Limited ) giving a loan to the said proposed transferee and his/her mortgaging the said flat to you / your security trustee by way of security for repayment of the said loan.

And we undertake to register the aforesaid charge on the said flat and the said shares on completion of the transfer formalities.

We further confirm that as soon as the share certificates are issued, the share certificates pertaining to the proposed transferee will be forwarded directly to ICICI BANK.

Yours faithfully,

Authorised Signatories

(Secretary AND / OR Chairman/President)

Note : Applicable in case the shares certificates are not issued.

36

050506-V.1 37

Draft 5

(TO BE SIGNED BY ALL BORROWER/S) (TO BE TAKEN ON STAMP PAPER OF REQUISITE VALUE)

INDEMNITY CUM DECLARATION

Place:

Date:

To, ICICI Bank Limited ( ICICI Bank)

Dear Sir/Sirs

I/We, ______(hereinafter referred to as "the Borrower/s") refer to the Loan Agreement dated ______entered into between the Borrower/s i.e. myself / ourselves and ICICI Bank Limited Bank (hereinafter referred to as "the said Loan Agreement") in respect of the Loan of Rs.______/- (Rupees ______only) agreed to be lent and advanced to the Borrower/s by ICICI Bank Limited premises bearing No. ______(Hereinafter referred to as the said “Flat”) situated at ______, which property (hereinafter referred to as the 'said property').

I/We ______do hereby solemnly affirm and declare as follows :

1. I/We say that I/We were are entitled to purchase flat being No ______in ______(Name of Building), admeasuring ______sq feet situated at ______(hereinafter for the brevity sake referred to as the said property) and by an Agreement for Sale dated ______

I/We have agreed to purchase the said property from Mr./ Ms.______(hereinafter re- ferred to as the “Sellers”).

2. I/We have disclosed all facts relating to the said Property to the authorised representatives of ICICI BANK.

3. I/We also hereby state that the Agreement for Sale executed between myself/ourselves and ______dated ______is sufficiently stamped and registered (hereinafter referred to as the “said Agreement”). 37

050506-V.1 38

4. I/We hereby declare and confirm that the Borrower/s have clear and marketable title to the said property and the Borrower/s are aware that they have to make out a clear and marketable title to the said property and therefore they will have to comply with various formalities, including but not limited to the submission to ICICI BANK of the original No Objection Certificate (NOC) and transfer order from the City & Industrial Development Corporation (CIDCO) and (ii) payment of transfer fee to CIDCO. We have not obtained No Objection Certificate (NOC) and transfer order from the CIDCO and we have not paid any transfer fee to CIDCO.

5. I/We hereby declare and undertake jointly and severally to indemnify and keep ICICI BANK and /or ICICI Bank Limited fully indemnified, saved and harmless of, from or against any loss, costs, charges, expenses, damages, disputes, litigation or risk that ICICI HFC/ICICI Bank may incur or suffer in respect of the flat (described hereinabove) or any part thereof, on account of (i) non availability of NOC & Transfer order, (ii) payment of transfer fee to CIDCO.

6. I/We have acquired the said Property with my/our self acquired funds (except for the LOAN) and I/We am/are the only sole and absolute owners thereof and no other person has any share, right, title or interest of any kind or nature whatsoever in the said property, beneficial owners thereof.

7. I/We say that the said property is free from all encumbrances, claims and demands and the same is not subject to any charge, liens, lis pendens, attachment or any other processes issued by any court or authority and I/We have not created any lien, gift or trust in respect thereof and no suit, writ, action or other proceeding is pending against me/us in respect of the said property and that no notice for acquisition or requisition is issued in respect of the said property. I/We further declare that the said property is not encumbered in any manner whatsoever and I/We have an absolute, clear and marketable title thereto.

And I/We make the aforesaid declarations and statements and give the aforesaid undertaking solemnly and sincerely believing the same to be true and knowing fully well that on the faith and strength thereof, ICICI Bank through its duly constituted attorney ICICI BANK has agreed to give the said LOAN.

Borrower(s) Signatures

1.

2.

38

050506-V.1 39

39

050506-V.1 40

Draft 6 Letter of Undertaking (On the letter-head of the Builder)

Date:

Place:

To: To, ICICI Bank Limited ( ICICI Bank)

Dear Sir,

This is further to the Development Agreement dated ______executed between the ______& our company/firm and Power of Attorney dated issued to us by Shri/Smt/M/s……………………………………………… (herein referred to as the “landowners”)in respect of plot no……….. situated at village ……………………………. (Hereinafter referred to as the said “Plot”), wherein we have been authorised to complete formalities for transferring the said plot in favour of the flat purchaser’s Society/Association/Company etc.

We confirm that we have obtained necessary permissions / approvals / sanctions for development of the said Plot from all competent authorities and the development of the said Plot is in accordance with the approved plan. We undertake to adhere to comply with the permitted use of the said Plot and further undertake not to violate other norms specified by CIDCO or any other competent authority for the development of the said Plot.

We declare that the building is constructed on a plot allotted to the landowner under ______Scheme. The State Government and CIDCO have now allowed the transfer of the title to the plot in favour of Society/Association/Company etc of the flat purchasers after completion of the building.

We undertake to transfer a clear and marketable title from the said original allottee after complying with the necessary formalities including but not restricted to the payment of fees laid down by CIDCO, in favour of the Society/Association/Company etc or the receipt of the occupation certificate, whichever is earlier. We state that, we have the right, authority and entitled to transfer the title from the said original allottee in favour of the Society/Association/Company etc.

We also undertake to inform you as soon as such transfer is effected.

40

050506-V.1 41

And We make the aforesaid declarations and statements and give the aforesaid undertaking solemnly and sincerely believing the same to be true and knowing fully well that on the faith and strength thereof, ICICI BANK (for itself or as duly Constituted Attorney on this behalf of ICICI Bank Limited) has agreed to give the said LOAN to Mr./Ms.______(nam e of the borrowers)

Yours faithfully,

For ______Builders

41

050506-V.1 42

Draft - 7

INDEMNITY CUM DECLARATION (TO BE SIGNED BY ALL SELLERS) (TO BE TAKEN ON STAMP PAPER OF REQUISITE VALUE)

Place:

Date:

To, ICICI Bank Limited ( ICICI Bank)

Dear Sir/Sirs

I/We ______do hereby solemnly affirm and declare as follows :

1. I/We say that I/We were are absolutely seized and possessed of or otherwise well and entitled to flat being No ______(Hereinafter referred to as the said “Flat”) in ______(Name of Building), admeasuring ______sq feet situ- ated at ______(hereinafter for the brevity sake re- ferred to as the said property) and by an Agreement for Sale dated ______I/We have agreed to sell the said property to Mr./ Ms.______(hereinafter referred to as the “Borrower/s”) who is/are desirous of taking a loan from ICICI BANK for purchase of the said property.

2. I/We have disclosed all facts relating to the said Property to the authorised representatives of ICICI BANK.

3. I/We also hereby state that the Agreement for Sale executed between myself/ourselves and ______dated ______is sufficiently stamped and registered (hereinafter referred to as the “said Agreement”). We have not obtained No Objection Certificate (NOC) to Transfer and Transfer order from the City & Industrial Development Corporation (CIDCO).

4. I/We hereby declare and undertake jointly and severally to indemnify and keep ICICI BANK/ and/or ICICI Bank Limited fully indemnified, saved and harmless of, from or against any loss, damage or risk that might arise to ICICI BANK/ and/or ICICI Bank Limited on account of (I) non availability of NOC to Transfer & 42

050506-V.1 43

Transfer order, order (ii) payment of transfer fee to CIDCO and (ii) to make good all the said loss, damage or claim that may arise on account of the above.

5. I/We have acquired the said Property with my/our self acquired funds and I/We am/are the only sole and absolute owners thereof and no other person has any share, right, title or interest of any kind or nature whatsoever in the said property, we are the beneficial owners thereof and have sole rights to sell the said property. By an Agreement for Sale dated ______I/We have agreed to sell the said property to the Borrower/s for the consideration and terms and conditions mentioned therein.

6. I/We say that the said property is free from all encumbrances, claims and demands and the same is not subject to any charge, liens, lis pendens, attachment or any other processes issued by any court or authority and I/We have not created any lien, gift or trust in respect thereof and no suit, writ, action or other proceeding is pending against me/us in respect of the said property and that no notice for acquisition or requisition is issued in respect of the said property. I/We further declare that the said property is not encumbered in any manner whatsoever and I/We have an absolute, clear and marketable title thereto and by an Agreement dated ______executed between myself/ourselves and the Borrower/s I/We have agreed to transfer my/our absolute right, title, share and interest in the said property to the Borrower/s.

And I/We make the aforesaid declarations and statements and give the aforesaid undertaking solemnly and sincerely believing the same to be true and knowing fully well that on the faith and strength thereof, ICICI BANK has agreed to give the said LOAN to Mr./Ms. ______

Seller(s) Signatures

1.

2.

43

050506-V.1 44

Draft 8

On stamp paper of requisite value (TO BE SIGNED BY ALL BORROWERS)

Undertaking cum Indemnity by Borrower/s

To,

ICICI Bank Limited ( ICICI Bank) Dear Sirs:

We, ______(hereinafter referred to as "the Borrower") refer to the Loan Agreement (hereinafter referred to as "the said Loan Agreement") entered into between the Borrower and ICICI Bank Limited ( ICICI Bank) in respect of the Housing Loan of Rs.______/- agreed to be lent and advanced to the Borrower by ICICI BANK (hereinafter referred to as "the said Loan") on the terms and conditions set out in the said Loan Agreement, for the construction of residential premises (hereinafter referred to as the 'said premises') on the plot situate at ______, (hereinafter referred to as the 'said plot') and allotted to the Borrower by City Industrial Development Corporation (CIDCO) , We are aware that the lease deed is required to be executed between the CIDCO and the Borrower upon completion of the construction of the said residential premises.

The Borrower/s are also aware that they are required to complete the construction of the house on the said premises as per the plan approved by CIDCO or any other competent authority and as per the norms, regulations & conditions specified by CIDCO and / or other authorities and to complete the construction of the house on the said premises within the time sanctioned by CIDCO at the time of sanction of the plan or within such time as may be extended by CIDCO from time to time.

The Borrower/s are aware that, they have to comply with various formalities prior to creation of security for the said Loan in favour of ICICI BANK, including but not limited to the submission to ICICI BANK of the original stamped and registered lease deed to be entered into between CIDCO and the Borrower upon completion of the construction of the said residential premises.

The Borrower/s confirms that ICICI BANK has agreed to make disbursements out of the said Loan to the Borrower subject to the following: i) Borrower/s submitting to ICICI BANK the original stamped and registered lease deed to be entered into by the CIDCO with the Borrower upon completion of the construction of the said premises within a period of six months from the date of final disbursement under the said Loan and to handover the Share certificate issued by the society, if formed.

44

050506-V.1 45 ii) Borrower/s completing the construction of the house on the said premises as per the plan approved by CIDCO or any other competent authority and as per the norms specified by CIDCO and / or other authorities and shall complete the construction of the said premises within the time sanctioned by CIDCO and / or other authorities at the time of sanction of the plan or within such time as may be extended by CIDCO and / or other authorities from time to time and iii) Borrower/s agreeing to indemnify, saved & harmless ICICI BANK from all losses, damages, claims, expenses, costs etc caused to ICICI BANK on account of breach of the above undertaking.

Borrower hereby agrees with and undertakes to Indemnify and save harmless ICICI BANK from all losses, damages, claims, expenses, costs etc that ICICI BANK may be put to/ caused to ICICI BANK on account of breach of the above undertaking.

We are aware that it is on the faith of our aforesaid undertakings that ICICI BANK has agreed to make the aforesaid disbursement to the Borrower out of the said Loan.

Yours faithfully,

(Signature of the Borrower/s)

Dated this ______day of ______20__.

45

050506-V.1 46

Draft 9

On stamp paper of requisite value (TO BE SIGNED BY ALL BORROWERS)

Undertaking cum Indemnity by Borrower/s

To,

ICICI Bank Limited ( ICICI Bank)

Dear Sirs:

We, ______(hereinafter referred to as "the Borrower") refer to the Loan Agreement (hereinafter referred to as "the said Loan Agreement") entered into between the Borrower and ICICI Bank Limited ( ICICI Bank) in respect of the Housing Loan of Rs.______/- agreed to be lent and advanced to the Borrower by ICICI BANK (hereinafter referred to as "the said Loan") on the terms and conditions set out in the said Loan Agreement, for the purchase of residential premises allotted to the Borrower by the CITY & INDUSTRIAL DEVELOPMENT CORPORATION (hereinafter referred to as “CIDCO”)being Flat/House No ______situated at ______, (hereinafter referred to as the 'said premises'.

The Borrower/s confirms that Agreement for Sale is required to be executed between the CIDCO and the Borrower/s upon completion of the construction of the said housing project.

The Borrower/s confirms that, Borrower/s have to comply with various formalities prior to creation of security for the said Loan in favour of ICICI BANK, including but not limited to the submission to ICICI BANK of the original stamped and registered Agreement for Sale to be entered into between CIDCO and the Borrower/s upon completion of the construction of the said housing project in respect of the said premises.

The Borrower/s confirms that ICICI BANK has agreed to make disbursements out of the said Loan to the Borrower/s, which amount has been agreed to be paid to CIDCO by the Borrower/s as the agreed consideration under the Letter of Allotment dated ______subject to the following:

(a) Borrower/s submitting to ICICI BANK of a Original stamped and registered Agreement for Sale to be entered into by the CIDCO with the Borrower upon completion of the construction of the said housing project on the said premises within a period of ______from the date of final disbursement under the said Loan and

(b) Borrower/s agreeing to indemnify, saved & harmless ICICI BANK from all losses, damages, claims, expenses, costs etc caused to ICICI BANK on account of 46

050506-V.1 47

breach of the above undertaking.

We are aware that it is on the faith of our aforesaid undertakings that ICICI BANK has agreed to make the aforesaid disbursement to the Borrower/s out of the said Loan.

Yours faithfully,

(Signature of the Borrower/s)

Dated this ______day of ______20__.

47

050506-V.1