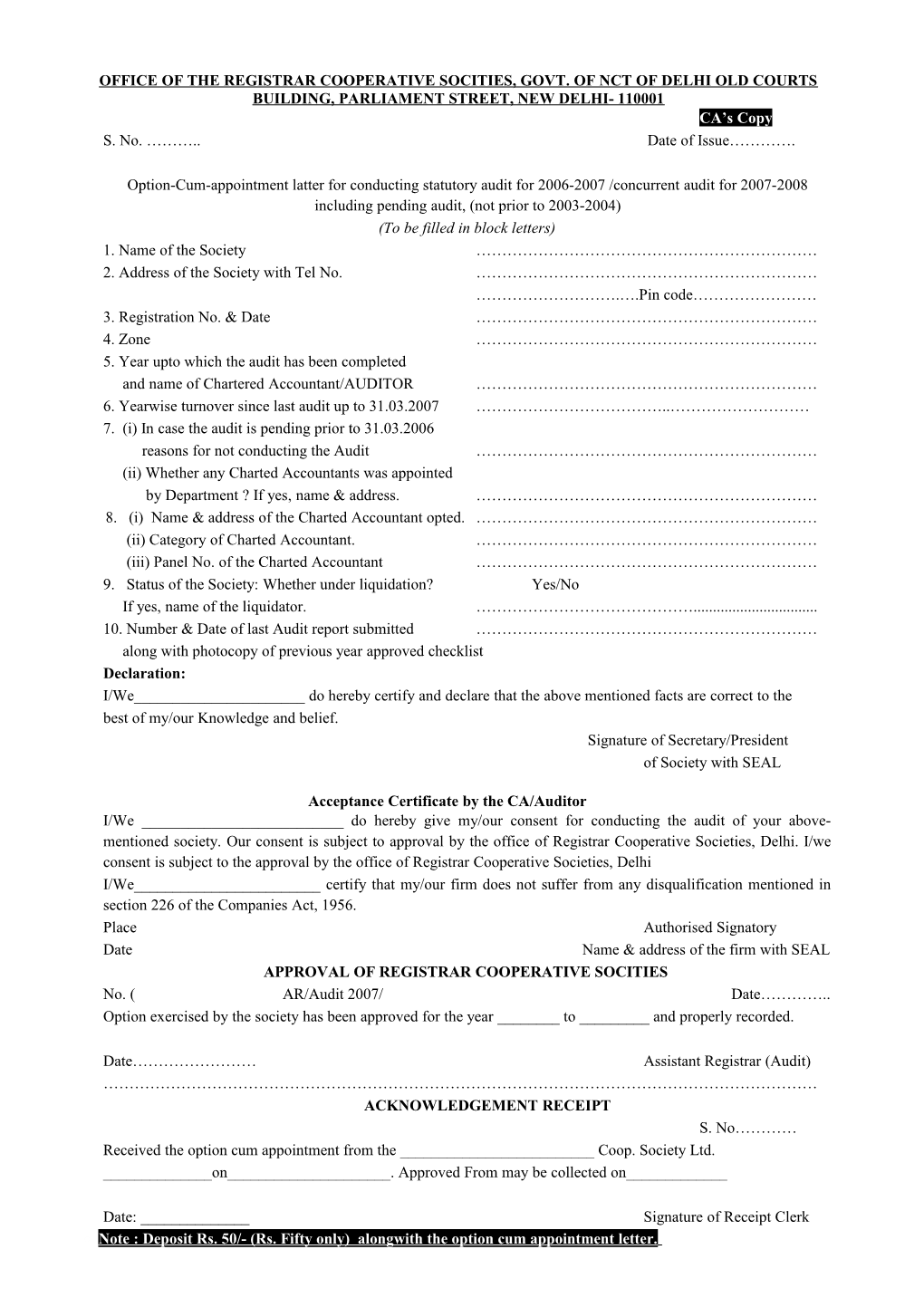

OFFICE OF THE REGISTRAR COOPERATIVE SOCITIES, GOVT. OF NCT OF DELHI OLD COURTS BUILDING, PARLIAMENT STREET, NEW DELHI- 110001 CA’s Copy S. No. ……….. Date of Issue………….

Option-Cum-appointment latter for conducting statutory audit for 2006-2007 /concurrent audit for 2007-2008 including pending audit, (not prior to 2003-2004) (To be filled in block letters) 1. Name of the Society ………………………………………………………… 2. Address of the Society with Tel No. ………………………………………………………… ……………………….….Pin code…………………… 3. Registration No. & Date ………………………………………………………… 4. Zone ………………………………………………………… 5. Year upto which the audit has been completed and name of Chartered Accountant/AUDITOR ………………………………………………………… 6. Yearwise turnover since last audit up to 31.03.2007 ………………………………..……………………… 7. (i) In case the audit is pending prior to 31.03.2006 reasons for not conducting the Audit ………………………………………………………… (ii) Whether any Charted Accountants was appointed by Department ? If yes, name & address. ………………………………………………………… 8. (i) Name & address of the Charted Accountant opted. ………………………………………………………… (ii) Category of Charted Accountant. ………………………………………………………… (iii) Panel No. of the Charted Accountant ………………………………………………………… 9. Status of the Society: Whether under liquidation? Yes/No If yes, name of the liquidator. ……………………………………...... 10. Number & Date of last Audit report submitted ………………………………………………………… along with photocopy of previous year approved checklist Declaration: I/We______do hereby certify and declare that the above mentioned facts are correct to the best of my/our Knowledge and belief. Signature of Secretary/President of Society with SEAL

Acceptance Certificate by the CA/Auditor I/We ______do hereby give my/our consent for conducting the audit of your above- mentioned society. Our consent is subject to approval by the office of Registrar Cooperative Societies, Delhi. I/we consent is subject to the approval by the office of Registrar Cooperative Societies, Delhi I/We______certify that my/our firm does not suffer from any disqualification mentioned in section 226 of the Companies Act, 1956. Place Authorised Signatory Date Name & address of the firm with SEAL APPROVAL OF REGISTRAR COOPERATIVE SOCITIES No. ( AR/Audit 2007/ Date………….. Option exercised by the society has been approved for the year ______to ______and properly recorded.

Date…………………… Assistant Registrar (Audit) ………………………………………………………………………………………………………………………… ACKNOWLEDGEMENT RECEIPT S. No………… Received the option cum appointment from the ______Coop. Society Ltd. ______on______. Approved From may be collected on______

Date: ______Signature of Receipt Clerk Note : Deposit Rs. 50/- (Rs. Fifty only) alongwith the option cum appointment letter. OFFICE OF THE REGISTRAR COOPERATIVE SOCITIES, GOVT. OF NCT OF DELHI OLD COURTS BUILDING, PARLIAMENT STREET, NEW DELHI- 110001 Office Copy S. No. ……….. Date of Issue………….

Option-Cum-appointment latter for conducting statutory audit for 2006-2007 /concurrent audit for 2007-2008 including pending audit, (not prior to 2003-2004) (To be filled in block letters) 1. Name of the Society ………………………………………………………… 2. Address of the Society with Tel No. ………………………………………………………… ……………………….….Pin code…………………… 3. Registration No. & Date ………………………………………………………… 4. Zone ………………………………………………………… 5. Year upto which the audit has been completed and name of Chartered Accountant/AUDITOR ………………………………………………………… 6. Yearwise turnover since last audit up to 31.03.2007 ………………………………..……………………… 7. (i) In case the audit is pending prior to 31.03.2006 reasons for not conducting the Audit ………………………………………………………… (ii) Whether any Charted Accountants was appointed by Department ? If yes, name & address. ………………………………………………………… 8. (i) Name & address of the Charted Accountant opted. ………………………………………………………… (ii) Category of Charted Accountant. ………………………………………………………… (iii) Panel No. of the Charted Accountant ………………………………………………………… 9. Status of the Society: Whether under liquidation? Yes/No If yes, name of the liquidator. ……………………………………...... 10. Number & Date of last Audit report submitted ………………………………………………………… along with photocopy of previous year approved checklist Declaration: I/We______do hereby certify and declare that the above mentioned facts are correct to the best of my/our Knowledge and belief. Signature of Secretary/President of Society with SEAL

Acceptance Certificate by the CA/Auditor I/We ______do hereby give my/our consent for conducting the audit of your above- mentioned society. Our consent is subject to approval by the office of Registrar Cooperative Societies, Delhi. I/we consent is subject to the approval by the office of Registrar Cooperative Societies, Delhi I/We______certify that my/our firm does not suffer from any disqualification mentioned in section 226 of the Companies Act, 1956. Place Authorised Signatory Date Name & address of the firm with SEAL APPROVAL OF REGISTRAR COOPERATIVE SOCITIES No. ( AR/Audit 2007/ Date………….. Option exercised by the society has been approved for the year ______to ______and properly recorded.

Date…………………… Assistant Registrar (Audit) ………………………………………………………………………………………………………………………… ACKNOWLEDGEMENT RECEIPT S. No………… Received the option cum appointment from the ______Coop. Society Ltd. ______on______. Approved From may be collected on______

Date: ______Signature of Receipt Clerk Note : Deposit Rs. 50/- (Rs. Fifty only) alongwith the option cum appointment letter. OFFICE OF THE REGISTRAR COOPERATIVE SOCITIES, GOVT. OF NCT OF DELHI OLD COURTS BUILDING, PARLIAMENT STREET, NEW DELHI- 110001 Society’s Copy S. No. ……….. Date of Issue………….

Option-Cum-appointment latter for conducting statutory audit for 2006-2007 /concurrent audit for 2007-2008 including pending audit, (not prior to 2003-2004) (To be filled in block letters) 1. Name of the Society ………………………………………………………… 2. Address of the Society with Tel No. ………………………………………………………… ……………………….….Pin code…………………… 3. Registration No. & Date ………………………………………………………… 4. Zone ………………………………………………………… 5. Year upto which the audit has been completed and name of Chartered Accountant/AUDITOR ………………………………………………………… 6. Yearwise turnover since last audit up to 31.03.2007 ………………………………..……………………… 7. (i) In case the audit is pending prior to 31.03.2006 reasons for not conducting the Audit ………………………………………………………… (ii) Whether any Charted Accountants was appointed by Department ? If yes, name & address. ………………………………………………………… 8. (i) Name & address of the Charted Accountant opted. ………………………………………………………… (ii) Category of Charted Accountant. ………………………………………………………… (iii) Panel No. of the Charted Accountant ………………………………………………………… 9. Status of the Society: Whether under liquidation? Yes/No If yes, name of the liquidator. ……………………………………...... 10. Number & Date of last Audit report submitted ………………………………………………………… along with photocopy of previous year approved checklist Declaration: I/We______do hereby certify and declare that the above mentioned facts are correct to the best of my/our Knowledge and belief. Signature of Secretary/President of Society with SEAL

Acceptance Certificate by the CA/Auditor I/We ______do hereby give my/our consent for conducting the audit of your above- mentioned society. Our consent is subject to approval by the office of Registrar Cooperative Societies, Delhi. I/we consent is subject to the approval by the office of Registrar Cooperative Societies, Delhi I/We______certify that my/our firm does not suffer from any disqualification mentioned in section 226 of the Companies Act, 1956. Place Authorised Signatory Date Name & address of the firm with SEAL APPROVAL OF REGISTRAR COOPERATIVE SOCITIES No. ( AR/Audit 2007/ Date………….. Option exercised by the society has been approved for the year ______to ______and properly recorded.

Date…………………… Assistant Registrar (Audit) ………………………………………………………………………………………………………………………… ACKNOWLEDGEMENT RECEIPT S. No………… Received the option cum appointment from the ______Coop. Society Ltd. ______on______. Approved From may be collected on______

Date: ______Signature of Receipt Clerk Note : Deposit Rs. 50/- (Rs. Fifty only) alongwith the option cum appointment letter. INSTRUCTIONS TO THE CHARTED ACCOUNTANT FOR AUDIT 1. The auditor should submit the report on the affairs of the society in accordance with the provisions of Section 60 of DCS Act 2003 & DCS Rule 73 within 90 days from the close of cooperative year. In the case of concurrent audit, report will be submitted within 30 days of the end of quarter and final report will be submitted within 60 days of the end of final quarter. If report is not submitted within time limit stipulated above, late fees will be charged in accordance with directive issued u/s 77 on 11/6/1999 (Annexure-D)

2. If the Charted Accountant during the course of audit finds that the accounts of the society have not been written/ completed he shall in accordance with the provisions of the Section 60 (8) cause the account, to be written at the expenses of the society with an intimation to the Asst. Registrar (Audit).

3. If any information in the application for empanelment is found to be incorrect, the firm name shall be removed from the panel.

If any adverse report is received against the Chartered Accountant in conducting the audit of the society or he is not following the instructions of the Department the CA will be black listed under intimation to the institute of Chartered Accountants for appropriate action.

4. The CA/ Auditor shall adhere to the instruction enclosed while submitting the audit report.

Without prejudice to generality of provisions contained in Rule 84 of the Delhi Cooperative Society Rules, 1973, the Audit Report shall contain the following:-

PART-A Whether the society has taken the corrective steps to comply with the objections/suggestions made in the previous audit, if not what is the explanation of the society there of?

PART-B a) Is the society functioning from the Registered Office and the members are being allowed to Inspect documents of the society including audit report as per provision of Delhi Cooperative Societies Rules 1973. In addition, the auditor is required to comment on each item of Profit & Loss Account and the Balance Sheet alongwith all b) the controlling statements duly signed by the office bearers and countersigned by the auditor broadly on the lines indicated under rule 46 (Form No. 11, 12, 13) Delhi Cooperative Societies Rules 1973. Specific responsibility be fixed in case of misutilisation of funds or any lapse on the part of any responsible Committee members. c) Whether the society periodically reconciles its accounts with the accounts of the members, outside parties including Bank at the close of the Cooperative year with General Cash Book? d) Whether the society has raised funds, so as to conform to the provisions of the Rules 69(1) of the Delhi Coop. Societies Rules 1973 and that the society has restricted its borrowings to the borrowing powers approved by the Register from time to time? e) What is the debt equity ratio of the society and how the society proposes to discharge its debt liability? f) What has been the lending policy of the society? Whether the society is extending loans to its members within their borrowing limits? Incase the society is granting loans to other parties, what is the general loaning policy and how far the interest of the society have been secured against proper tangible or intangible securities? When and at what point of time a debt is considered bad debt and ripe enough to initiate legal action to recover demand? g) Whether the management committee has implemented/carried out the decisions of the Ganeral Body in letter and spirit keeping in view the best interest of the members of the society, in accordance with the Cooperative Principles? (CA will give his comments on the appointment of Architect, Building Contractors other contracts etc.) h) Number of unresolved dispute position of society as also, the steps taken to resolve disputes at various forums. CA is also required to give his comments on complaints received against the society by the Department. i) Details of claims if any against the members and .outside parties, not being pursued properly and proceedings not launched within period of limitation. j) In respect of Group Housing Society whether management committee or any sub-committee is exercising the financial; material management and control to keep the project cost as low as possible? What is the allotment policy of the society with particular reference to categorisation of members both for the purpose of getting building plans approved as also handing over the possession of the flats? k) Has the society been holding meeting of various committees including General Body and proper records of proceedings are being maintained in the minutes/proceeding Register? l) List of members with their ledger balances at the close of Cooperative Year. A separate list of changes on account of resignations, expulsions and whether rules/instructions in his behalf have been properly complied with? m) Without prejudice to the generality of the provisions contained in Delhi Cooperative Societies Act, 1972 and the Rules framed thereunder, the auditor shall state if any of the office bearers suffers from the disqualifications contained in Section 35 read with Rule 59 and 60? n) Whether the society is incurring expenditure in accordance with the approved budget if not indicate the lapses? o) Whether the society is periodically reviewing the fixed assets as also, the Cash credit limits visa-a- vis loans extended on the basis of goods hypothecated to the cooperative society? p) Whether the monthly expenditures of society are being approved in the ensuing managing committee meetings, if not reasons for same must be explained in detail? q) In respect of T/C society, Cooperative Banks and Stores whether the respective cooperative society is reviewing he Cash Credit Limit and restricting its future loaning/credit to good parties only. r) A certificate shall be obtained from the custodian of records regarding documents and cash/certifying the possession thereof alongwith certificate of CA regarding details of books of accounts seen and signed by CA. s) The details of various bank A/Cs being maintained by the society as also the securities and investment of the society alongwith the addresses. Account numbers of the Banks and comments on the Bank Reconciliation Statement.

PART-C The report will clearly indicate the acts of omission commission on the part of the Managing Committee with the specific reference to acts involving malfeasancae; misappropriation; acts of omission; mismanagement of funds etc. On the basis of the evidence collected, the Auditor shall record his opinion as to the person who in his opinion was responsible for the lapses noted by him. (Every case of misappropriation of frauds shall be directly reported to the Registrar at the first instance.)

GENERAL INSTRUCTION 5. The auditor shall obtain wherever, required to get utilisation certificate from the society in respect of financial assistance provided by Government to the society. He shall also in accordance with the Rule 68 (ii) schedule 6 classify the society with reasons. 6. The Auditor in addition to various certificates prescribed under Rule 84 shall give additional certificate on the Balance Sheet and in the case of Thrift and Credit Societies including the Cooperative Banks that the Balance Sheet is in accordance with the provisions of the Reserve Bank of India and the society has been following the provisions of Banking Regulation Act, 1949.

AUDIT FEE

The scales of fee admissible to the Certified Auditors is enclosed as Annexure 'B'. In case of Concurrent Audit, the Society will release payment for first three quarters at the rate of 25% anticipated fee bill on Auditors furnishing a proof of having submitted audit report for the concerned quarter to the Registrar's office. Last and final installment will however be settled by the Registrar.

The Auditor shall not be entitled to receive estimated audit fee directly from the society until the audit report is submitted to this office alongwith estimated Audit Fee bill and an order of final settlement of Bill has been received by him. Any action contrary to this para shall be liable for taking disciplinary action which may extend to removal of name from the Panel.

In case of Cooperative Banks where a Chartered Accountant has been engaged by the bank for concurrent audit, the Concurrent Audit may not be insisted upon by the Auditor. The detailed instructions for the Concurrent Audit Report may be collected from the office of the Asstt. Registrar (Audit). SUBMISSION OF AUDIT REPORT

Audit report will be submitted to AR (Audit) in triplicate alongwith a copy of option cum appointment letter and Other documents as per checklist. (Each in separate file cover). The CA/Auditor will certify on the report that the society has deposited the prescribed sum of Cooperative Education Fund for the period under audit. The Societies which have taken loans from Delhi Cooperative Housing Finance Corporation Ltd. or Delhi State Cooperative Bank Ltd., shall have to submit one copy extra to that institution directly.

The Auditor(s) shall also include in their audit report a detailed list of members/society who are at default towards loan from society/loan taken from the Banks of Financing Institutions tike the Delhi State Coop. Bank Ltd. or Delhi Cooperative Housing Finance Corporation Ltd.

ESSENTIAL & IMPORTANT AUDIT PERIOD PROFORMA

DEFAULT IN REPAYMENT OF DCHFC/DSC BANK/OTHER LOANS

NAME OF THE SOCIETY …………………………………………………………………………………………….. S.No. Name of Membership Flat No. Loan Outstanding Default Default Total Remarks member/ No./ Society (Incase raised (Rs.) towards towards (Col. society Regn.No. of (Rs.) Principle interest/ 7& 8) with Group (Rs.) other address Housing charges Society) (Rs.) 1 2 3 4 5 6 7 8 9 10 ANNEXURE -A BRIEF SUMMARY OF THE SOCIETY

Audit Period To Name of the Society ______Address of the Society______Address of the site(G/H)______Regn No.______Date______Category______Deposit ______Paid up Capital______Details of Bank A/C ______Details of Financial Assistance Cliamed/MDA etc.. ______Details of Loan from DCHFC/ D.S. Coop. Bank ______Area of operation ______Date of last election held ______Pending enquiries ______No. of pending Arbitration cases / Suits ______Audit Fee Claimed ______Any irregularity of misappropriation mismanagement /Fraud ______

Names of Managing Committee members during audit period

President Secretary Treasurer AT THE TIME OF PREVIOUS AUDIT PRESENT AUDIT

Audit Period ______No. of members ______No. of resigned/expelled members ______No. of new enrolled members ______Name of the C.A. ______Audit classification ______Sanctioned MCL ______Sanctioned CCL ______Turnover of the society ______Working capital ______Sales ______Net profit ______Education Fund Due ______Education Fund paid on (date) ______Report for previous year ______Collected on ______

Signature

PRESIDENT SECRETRAY TREASURER AUDITOR

______ANNEXURE-B Office of the Registrar of Cooperative Societies (Govt. of Delhi) Old Courts Buildings, Parliament Street New Delhi-110001

Dated: 04-12-2001 No. F-101/35/Misc/Audit/coop./2001/952-956

In pursuance of the powers conferred under Rules 85 of Delhi Cooperative Societies Rules, 1973 and in supersession of previous orders I, N Diwakar Registrar of Cooperatives Societies Delhi, do hereby lay down the following scales of Audit Fee Payable to Chartered Accountants in respect of cooperatives societies Registered under the Delhi Cooperative Societies Act, 1972.

Audit fee norms in respects of Urban Cooperative thrift & Credit Societies and Banks. For first 5 lakhs of working capital Rs. 4.00 per 1000 For next 10 lakhs of working capital Rs. 3.00 per 1000 For next 15 lakhs of working capital Rs. 2.00 per 1000 For next 20 lakhs of working capital Rs. 1.00 per 1000 For next 50 lakhs of working capital & above Rs. 0.50 per 1000 Audit fee norms in respect of Consumer Cooperative Stores. For first 5 lakhs of sales Rs. 4.00 per 1000 For next10 lakhs of sales Rs. 3.00 per 1000 For next 15 lakhs of sales Rs. 2.00 per 1000 For next 20 lakhs of sales Rs. 1.00 per 1000 For next 50 lakhs of sales & above Rs. 0.50 per 1000 Audit fee norms in respect of other societies such as Housing, Industrial, Credit and Non Credit Societies etc. For first 5 lakhs of turnover Rs. 3.00 per 1000 For next10 lakhs of turnover Rs. 2.00 per 1000 For next15 lakhs of turnover Rs. 1.00 per 1000 For next 20 lakhs of turnover & above Rs. 0.50 per 1000

The minimum audit fee shall be Rs. 2,250/- and the maximum Rs. 1 lakh for Coop. Banks, Delhi Coop. Housing finance Corporation ltd. and Delhi Consumer coop. Wholesale Stores ltd. and Rs. 70,000/- on all types of Primary Coop. Societies. Besides this i) No separate fee will be given for branches. ii) 33% of the total audit fee shall also be paid in those cases where concurrent audit is allotted and conducted by the auditors. iii) Further 25% of the total audit Fee will paid in those cases where tax Audit is involved subjects to a minimum of Rs. 3.500/- and maximum Rs. 10,000/-.

EXPLANATION: Turnover : It means the total receipt or total disbursements of the year whichever is higher after excluding the deposits withdrawals from banks and also Opening and Closing Cash in Hand. Working Capital: It includes such portion of the Reserve Fund and other Reserves apportioned out of the profit, paid up share capital, loan and deposits received and Debentures issued by a Cooperative Society as have not been locked up in building and other fixed assets. This supercedes all previous orders on the subject. The above scales of Audit Fee are applicable with immediate effect and will be paid by the concerned society on approval from this office.

Sd/- (N. DIWAKAR) Cooperative Societies, Govt. of Delhi ANNEXURE-C Dy. No. ______Date______Total Pages______

CHECK LIST FOR SUBMISSION OF AUDIT REPORT

1. Name of the CA/Auditor

2. Name of the society

3. Regn. No.

4. Audit period

5. Distt./Zone

6. Net Profit

Amount Receipt No. Date Page No

7. Education Fund deposited ______

8. Appointment Letter S. No. Dated

9. Admission Audit Fee (with fee Bill)

Audit report on form A, B & C alongwith following enclosures:-

a) Balance Sheet ______b) Receipt & Payment A/C ______c) Income & Expenditure A/c ______d) List of members including addition & deletion ______e) Details of loan from DCHFC Ltd./DSCB Ltd. ______f) Certificates of records from custodian ______g) Lost of managing committee members. ______h) Brief summary of the society in Annexure ‘A’ ______i) Bank Certificate/Reconciliation Statement ______j) List of Staff/Employee ______k) Cash in Hand Certificate ______

Examined the audit report and submitted for signatures please. Counter Signed

Asstt. Registrar (Audit)

Copy to :- (1) The Secretary Signature of Dealing Asst. (2) Asstt. Registrar ( ) Dated : ANNEXURE-D

OFFICE OF THE REGISTRAR: COOPERATIVE SOCIETIES: GOVT. OF NCT OF DELHI: OLD COURT'S BUILDING: PARLIAMENT STREET: NEW DELHI-110 001

No: XR(Audit)/99/457-466 Dated : 11.6.1989

Directive U/R 77 of DCS Rules 1973

Sub:- Regarding submission of Audit Reports.

It has been brought to my notice that in many cases CAs/Societes are quite indifferent towards time- limit of 120 days allowed to submit the Audit Reports and Audit Reports are submitted by them much after the period allowed to conduct the audit. Delayed audit is detrimental to the interests of members and society. Therefore, to ensure the smooth conduct and timely submission of audit reports, I Gopal Dikshit Registrar, Cooperative Societies, Govt. of NCT of Delhi by virtue of powers vested in me under Rule 77 of DCS Rules 1973, issue this directive that audit reports submitted late i.e., after expiry of 90 of assignment will be accepted in the manner given below:

i) If the audit report of a particular year is late upto one month : It will be accepted on payment of late fee of is Rs. 100/- ii) If the audit report of a particular year is late upto two months : It will be accepted on payment of late fee of Rs. 200/- iii) If the audit report of a particular year is late upto three months : It will be accepted on payment of

late fee RS. 300/- iv) If the audit report of a particular year is late upto four months : It will be accepted on payment of late fee of Rs. 500/-

Further, Audit reports received after four months will not be accepted. However in exceptional cases, Registrar Cooperative Societies may accept reports submitted after four months after examining the merits of individual cases and on payment of Rs. 1000/- as late fee.

This comes into force with immediate effect.

Sd/- (Gopal Dikshit) Registrar Coop. Societies

OFFICE OF THE REGISTRAR: COOPERATIVE SOCIETIES GOVT. OF NCT OF DELHI:OLD COURT’S BUILDING PARLIAMENT STREET: NEW DELHI-110001

No: F.AR (Audit)/2007/46 Dated: 27/04/2007

CIRCULAR

In order to ensure that statutory audit of the cooperative societies are completed on priority, the following procedure would be adopted with immediate effect:-

1. Option policy as adopted in previous year as well as appointment of C.A by the Deptt. be allowed to continue in this year and societies may also be allowed to opt the C.A. from the panel notified in the year 2007. 2. Each society shall intimate to this office in writing by 16.06.2007 the details of its turnover, along with the name and address of the CA/Auditor selected by them out of the notified panel of the department. Further, the society shall also certify that the CA/ Auditor selected by them is neither a member of the society nor directly or indirectly connected with the affairs of the society. 3. The society shall adhere to the following norms while selecting the CA/ Auditor:- (a) The society shall obtain Option Form cum Appointment letter of the CA/Auditor, panel of Departmental Auditors alongwith instructions from this office on payment of Rs. 50/- only. (b) The society shall submit option form cum appointment letter after obtaining consent and acceptance of CA/Auditor, to this office for approval of the Registrar, Cooperative Societies. (c) Cooperative Society wherever the Audit is pending prior to 2003-04 approval of the RCS shall be obtained. 4. Norms for opting the category of CA/ Auditor according to the turnover of the society are fixed as under:-

A. (Four Fellow of CAs+ more than ten years standing of the firm/) No limit B. (Three Fellow of CAs + more than ten years standing of the firm & left out of A) Below Rs. 5 Crores. C. (Two fellow of CAs + more than ten years standing of the firm & left out of B) Below Rs. 3 Crores. D. ( All remaining fellow of CA Firms) Below Rs. 2 Crores. E ( All Associate CAs) Below Rs. 50 lacs

Note: The accounts of the societies, whose turnover is upto Rs. 5 Lakhs except the societies categorized under “Industrial and Package units” whose turnover is upto Rs. 25 Lakhs will be audited by the Departmental Auditors.

No society shall get its accounts audited from the CA/Auditors of lower category. Such audit reports, if any, will be not be accepted by this Department and no audit fee will paid by the society. However the Department may issue appointment orders to any CA irrespective of his category.

Every CA firm/Auditor may conduct the audit up to five societies in a financial year. Further, no CA/Auditor shall audit a society for more than Three year’s without the permission of the undersigned in writing. This issue with the prior approval of the RCS. However the CAs who will be assign departmental audit will be entitled to conduct a total of six audits per year (this is inclusive of one departmental audit). The CAs who is assigned the departmental audit will be entitled audit fees as per departmental audit rule.

(K.M. Samuel) Dy. REGISTRAR (AUDIT)