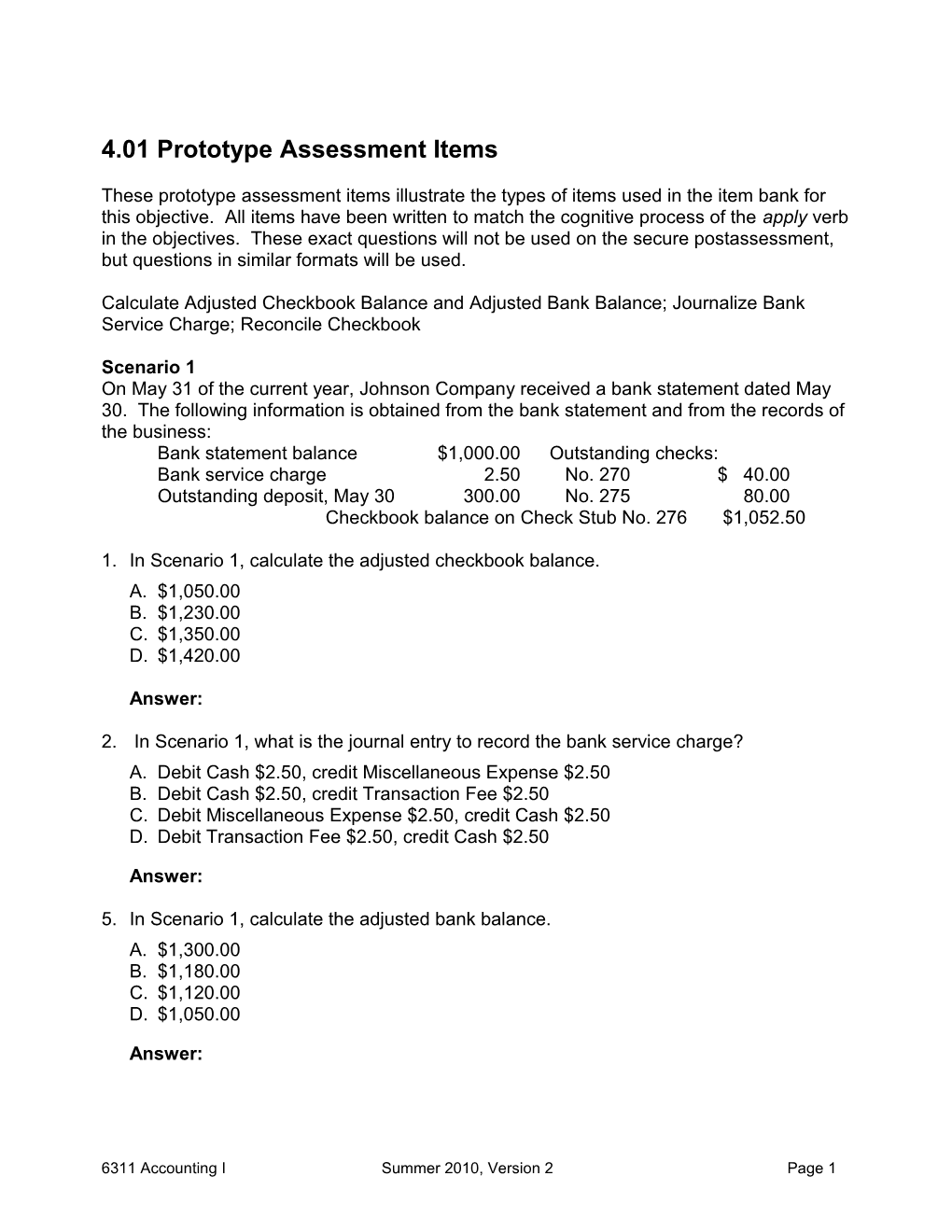

4.01 Prototype Assessment Items

These prototype assessment items illustrate the types of items used in the item bank for this objective. All items have been written to match the cognitive process of the apply verb in the objectives. These exact questions will not be used on the secure postassessment, but questions in similar formats will be used.

Calculate Adjusted Checkbook Balance and Adjusted Bank Balance; Journalize Bank Service Charge; Reconcile Checkbook

Scenario 1 On May 31 of the current year, Johnson Company received a bank statement dated May 30. The following information is obtained from the bank statement and from the records of the business: Bank statement balance $1,000.00 Outstanding checks: Bank service charge 2.50 No. 270 $ 40.00 Outstanding deposit, May 30 300.00 No. 275 80.00 Checkbook balance on Check Stub No. 276 $1,052.50

1. In Scenario 1, calculate the adjusted checkbook balance. A. $1,050.00 B. $1,230.00 C. $1,350.00 D. $1,420.00

Answer:

2. In Scenario 1, what is the journal entry to record the bank service charge? A. Debit Cash $2.50, credit Miscellaneous Expense $2.50 B. Debit Cash $2.50, credit Transaction Fee $2.50 C. Debit Miscellaneous Expense $2.50, credit Cash $2.50 D. Debit Transaction Fee $2.50, credit Cash $2.50

Answer:

5. In Scenario 1, calculate the adjusted bank balance. A. $1,300.00 B. $1,180.00 C. $1,120.00 D. $1,050.00

Answer:

6311 Accounting I Summer 2010, Version 2 Page 1 4.01 Prototype Assessment Items – Page 2

6. In Scenario 1, assuming that the bank balance is correct, does the bank statement reconcile? A. No, the adjusted checkbook balance is $130.00 lower than the adjusted bank balance. B. No, the adjusted checkbook balance is $130.00 higher than the adjusted bank balance. C. Yes, the adjusted checkbook balance and the adjusted bank balance agree. D. Yes, the adjusted bank balance is $52.50 lower than the adjusted checkbook balance. Answer:

Calculate the Cash Account Balance

7. On March 31, Bozeman Company received a bank statement showing the following information. Bank statement balance $2,045.00 Bank service charge $15.00

The records of the business show the following information: Outstanding deposit, Mar. 29 $200.00 Outstanding checks: No. 288 $125.00 No. 289 $50.00 Assuming that the bank statement balance is correct, what is the correct Cash account balance on March 31? A. $1,870.00 B. $2,055.00 C. $2,070.00 D. $2,245.00 Answer: Journalize Dishonored Checks 8. On January 13, Columbia Incorporated received notice from the bank of a dishonored check from Davis Company in the amount of $100.00. The bank charged a service fee of $25.00. What is the correct journal entry to record the dishonored check? A. Debit Accounts Receivable/Davis Company $100.00, Credit Bank Service Charge $25.00, Credit Cash $125.00 B. Debit Accounts Receivable/Davis Company $125.00, Credit Cash $125.00 C. Debit Accounts Receivable/Davis Company $125.00, Debit Bank Service Charge $25.00, Credit Cash $100.00 D. Debit Cash $125.00, Credit Accounts Receivable/Davis Company $125.00

6311 Accounting I Summer 2010, Version 2 Page 2 Answer:

6311 Accounting I Summer 2010, Version 2 Page 3