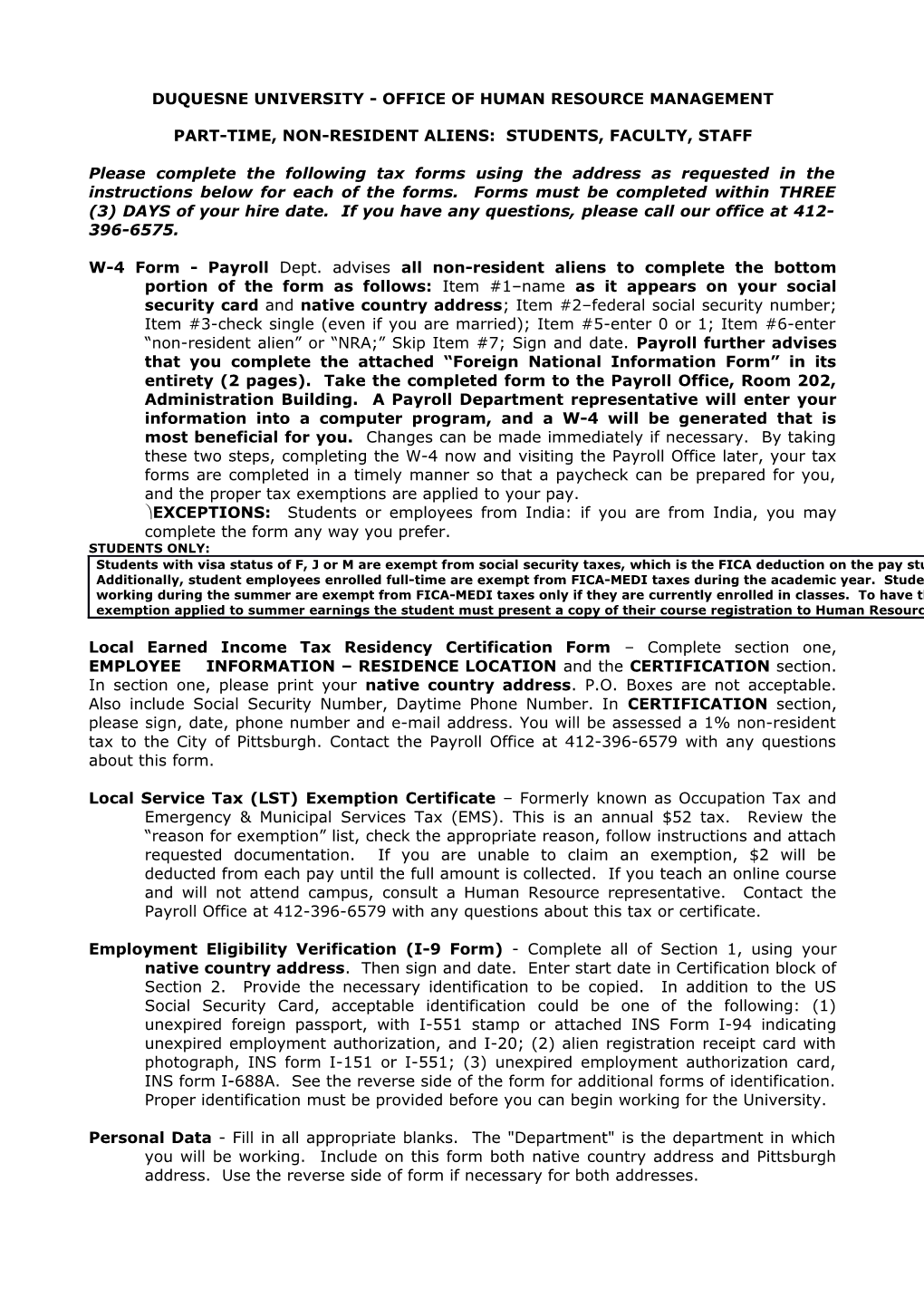

DUQUESNE UNIVERSITY - OFFICE OF HUMAN RESOURCE MANAGEMENT

PART-TIME, NON-RESIDENT ALIENS: STUDENTS, FACULTY, STAFF

Please complete the following tax forms using the address as requested in the instructions below for each of the forms. Forms must be completed within THREE (3) DAYS of your hire date. If you have any questions, please call our office at 412- 396-6575.

W-4 Form - Payroll Dept. advises all non-resident aliens to complete the bottom portion of the form as follows: Item #1–name as it appears on your social security card and native country address; Item #2–federal social security number; Item #3-check single (even if you are married); Item #5-enter 0 or 1; Item #6-enter “non-resident alien” or “NRA;” Skip Item #7; Sign and date. Payroll further advises that you complete the attached “Foreign National Information Form” in its entirety (2 pages). Take the completed form to the Payroll Office, Room 202, Administration Building. A Payroll Department representative will enter your information into a computer program, and a W-4 will be generated that is most beneficial for you. Changes can be made immediately if necessary. By taking these two steps, completing the W-4 now and visiting the Payroll Office later, your tax forms are completed in a timely manner so that a paycheck can be prepared for you, and the proper tax exemptions are applied to your pay. EXCEPTIONS: Students or employees from India: if you are from India, you may complete the form any way you prefer. STUDENTS ONLY: Students with visa status of F, J or M are exempt from social security taxes, which is the FICA deduction on the pay stub. Additionally, student employees enrolled full-time are exempt from FICA-MEDI taxes during the academic year. Students working during the summer are exempt from FICA-MEDI taxes only if they are currently enrolled in classes. To have the exemption applied to summer earnings the student must present a copy of their course registration to Human Resources.

Local Earned Income Tax Residency Certification Form – Complete section one, EMPLOYEE INFORMATION – RESIDENCE LOCATION and the CERTIFICATION section. In section one, please print your native country address. P.O. Boxes are not acceptable. Also include Social Security Number, Daytime Phone Number. In CERTIFICATION section, please sign, date, phone number and e-mail address. You will be assessed a 1% non-resident tax to the City of Pittsburgh. Contact the Payroll Office at 412-396-6579 with any questions about this form.

Local Service Tax (LST) Exemption Certificate – Formerly known as Occupation Tax and Emergency & Municipal Services Tax (EMS). This is an annual $52 tax. Review the “reason for exemption” list, check the appropriate reason, follow instructions and attach requested documentation. If you are unable to claim an exemption, $2 will be deducted from each pay until the full amount is collected. If you teach an online course and will not attend campus, consult a Human Resource representative. Contact the Payroll Office at 412-396-6579 with any questions about this tax or certificate.

Employment Eligibility Verification (I-9 Form) - Complete all of Section 1, using your native country address. Then sign and date. Enter start date in Certification block of Section 2. Provide the necessary identification to be copied. In addition to the US Social Security Card, acceptable identification could be one of the following: (1) unexpired foreign passport, with I-551 stamp or attached INS Form I-94 indicating unexpired employment authorization, and I-20; (2) alien registration receipt card with photograph, INS form I-151 or I-551; (3) unexpired employment authorization card, INS form I-688A. See the reverse side of the form for additional forms of identification. Proper identification must be provided before you can begin working for the University.

Personal Data - Fill in all appropriate blanks. The "Department" is the department in which you will be working. Include on this form both native country address and Pittsburgh address. Use the reverse side of form if necessary for both addresses. Code of Business Ethics and Conduct – Please read. Sign and date at bottom.

Code of Responsibility for Security and Confidentiality – Please read. Sign and date at bottom.

Workers’ Compensation Employee Notification - Please read. Print your name, sign, and date. Keep the second page for your information. Direct Deposit Authorization Agreement (green sheet) – Duquesne’s method of payment. You may choose to have your paycheck directly deposited in either a checking or savings account. Complete the form, follow directions opposite sample check at bottom of form, and return to the PAYROLL DEPT., ROOM 202 ADMINISTRATION BLDG. or attach with your other tax forms. HRM 30 09/11