Solutions to practice problems – Chapter 13

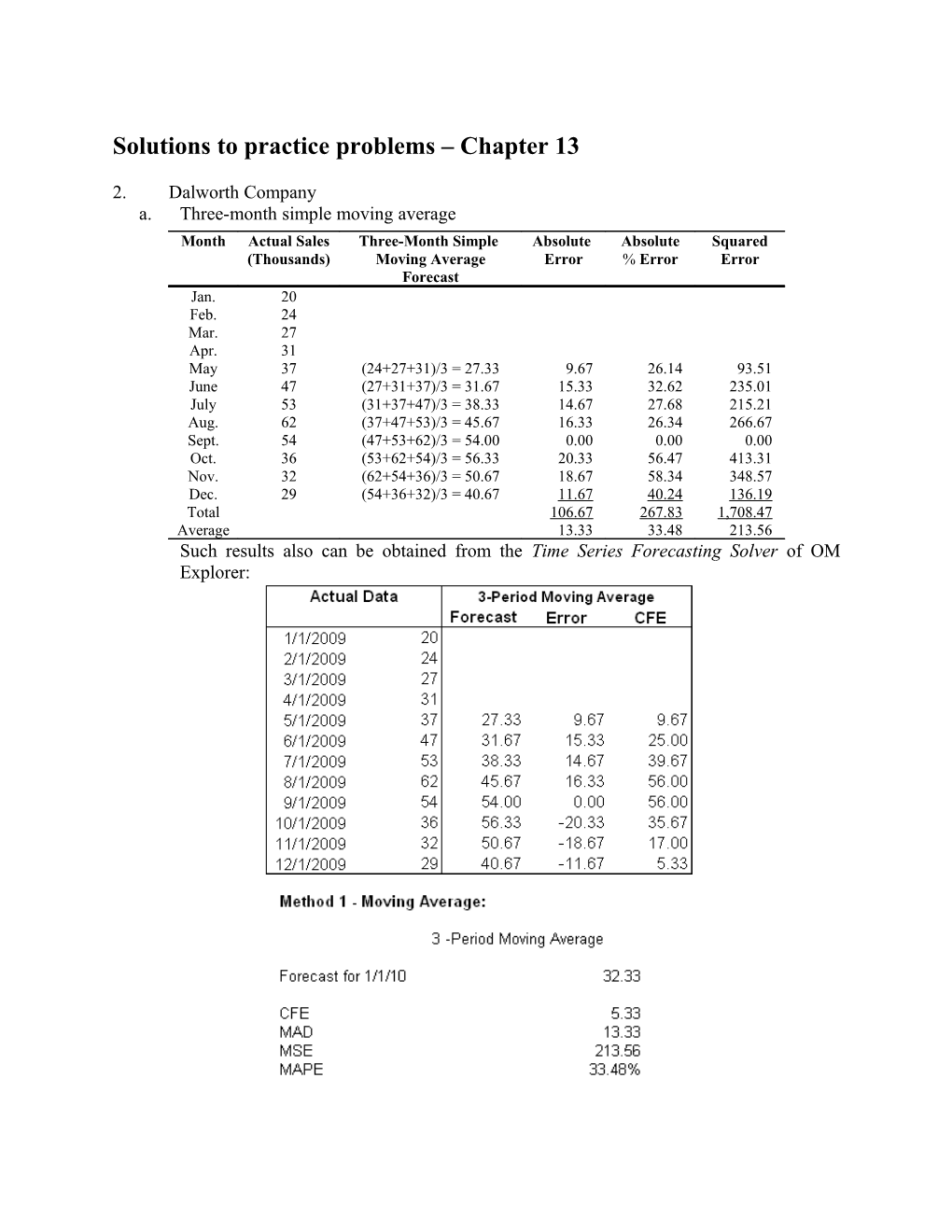

2. Dalworth Company a. Three-month simple moving average Month Actual Sales Three-Month Simple Absolute Absolute Squared (Thousands) Moving Average Error % Error Error Forecast Jan. 20 Feb. 24 Mar. 27 Apr. 31 May 37 (24+27+31)/3 = 27.33 9.67 26.14 93.51 June 47 (27+31+37)/3 = 31.67 15.33 32.62 235.01 July 53 (31+37+47)/3 = 38.33 14.67 27.68 215.21 Aug. 62 (37+47+53)/3 = 45.67 16.33 26.34 266.67 Sept. 54 (47+53+62)/3 = 54.00 0.00 0.00 0.00 Oct. 36 (53+62+54)/3 = 56.33 20.33 56.47 413.31 Nov. 32 (62+54+36)/3 = 50.67 18.67 58.34 348.57 Dec. 29 (54+36+32)/3 = 40.67 11.67 40.24 136.19 Total 106.67 267.83 1,708.47 Average 13.33 33.48 213.56 Such results also can be obtained from the Time Series Forecasting Solver of OM Explorer: b. Four-month simple moving average Month Actual Sales Four-Month Simple Absolute Absolute Squared (Thousands) Moving Average Error % Error Error Forecast Jan. 20 Feb. 24 Mar. 27 Apr. 31 May 37 (20+24+27+31)/4 = 25.5 11.50 31.08 132.25 June 47 (24+27+31+37)/4 = 29.75 17.25 36.70 297.56 July 53 (27+31+37+47)/4 = 35.5 17.50 33.02 306.25 Aug. 62 (31+37+47+53)/4 = 42.00 20.00 32.26 400.00 Sept. 54 (37+47+53+62)/4 = 49.75 4.25 7.87 18.06 Oct. 36 (47+53+62+54)/4 = 54.00 18.00 50.00 324.00 Nov. 32 (53+62+54+36)/4 = 51.25 19.25 60.16 370.56 Dec. 29 (62+54+36+32)/4 = 46.00 17.00 58.62 289.00 Total 124.75 309.71 2,137.68 Average 15.59 38.71 267.21 Similarly, using Time Series Forecasting Solver of OM Explorer, we get:

c.-e. Comparison of performance Question Measure 3-Month 4-Month Recommendation SMA SMA c. MAD 13.33 15.59 3-month SMA d. MAPE 33.48 38.71 3-month SMA e. MSE 213.56 267.21 3-month SMA 4. Dalworth Company (continued) c. Three-month weighted moving average (weights of 3/6, 2/6, and 1/6) Month Actual Sales Three-Month Weighted Absolute Absolute % Squared (000s) Moving Average Forecast Error Error Error Jan. 20 Feb. 24 Mar. 27 Apr. 31 [(3 27)+(2 24)+(l 20)]/6 = 24.83 6.17 19.90 38.07 May 37 [(3 31)+(2 27)+(l 24)]/6 = 28.50 8.50 22.97 72.25 June 47 [(3 37)+(2 31)+(l 27)]/6 = 33.33 13.67 29.09 186.87 July 53 [(3 47)+2 37)+(l 31)]/6 = 41.00 12.00 22.64 144.00 Aug. 62 [(3 53)+(2 47)+(l 37)]/6 = 48.33 13.67 22.05 186.87 Sept. 54 [(3 62)+(2 53)+(l 47)]/6 = 56.50 2.50 4.63 6.25 Oct. 36 [(3 54)+(2 62)+(l 53)]/6 = 56.50 20.50 56.94 420.25 Nov. 32 [(3 36)+(2 54)+(l 62)]/6 = 46.33 14.33 44.78 205.35 Dec. 29 [(3 32)+(2 36)+(l 54)]/6 = 37.00 8.00 27.59 64.00 Total 99.34 250.59 1,323.91 Average 11.04 27.84 147.09 The results from Time Series Forecasting Solver of OM Explorer give the same results: d. Exponential smoothing (a = 0.6)

Month Dt Ft Ft+1 = Ft + a(Dt - Ft) Absolute Absolute Squared (t) (millions) (Forecast for Next Month) Error % Error Error Jan. 20 22.00 20.80 Feb. 24 20.80 22.72 Mar. 27 22.72 25.29 Apr. 31 25.29 28.72 5.71 18.41 32.60 May 37 28.72 33.69 8.28 22.38 68.56 June 47 33.69 41.67 13.31 28.32 177.16 July 53 41.67 48.47 11.33 21.38 128.37 Aug. 62 48.47 56.59 13.53 21.82 183.06 Sept. 54 56.59 55.04 2.59 4.80 6.71 Oct. 36 55.04 43.62 19.04 52.88 362.52 Nov. 32 43.62 36.64 11.61 36.28 134.79 Dec. 29 36.64 32.06 7.65 26.38 58.52 Total 93.05 232.65 1,152.29 Average 10.34 25.85 128.03 c.-e. Comparison of performance Question Measure 3-Month Exponential Recommendation WMA Smoothing c. MAD 11.04 10.34 Exponential smoothing d. MAPE 27.84 25.85 Exponential smoothing e. MSE 147.09 128.03 Exponential smoothing

7. Heartville General Hospital i. Exponential smoothing, 0.6 Year Demand Exponential Smoothing Absolute Absolute % Square Deviation Deviation Error 1 45 45 2 50 45 + .6(45 – 45) = 45 3 52 45 + .6(50 – 45) = 48 4.00 7.69 16.00 4 56 48 + .6(52 – 48) = 50.40 5.60 10.00 31.36 5 58 50.40 + .6(56 – 50.4) = 53.76 4.24 7.31 17.98 Totals 13.84 25.00 65.34 Averages 4.61 8.33 21.78 The same forecast (45) is shown for both years 1 and 2, because the default setting makes the initial forecast for the first period equal to its actual demand. Because there is no forecast error in year 1, the forecast made in year 2 (for year 3) remains at 45. ii. Exponential smoothing, a = 0.9 Year Demand Exponential Smoothing Absolute Absolute % Squared Deviation Deviation Error 1 45 45 2 50 45 + .9(45 – 45) = 45 3 52 45 + .9(50 – 45) = 49.50 2.50 4.81 6.25 4 56 49.50 + .9(52 – 49.5) = 51.75 4.25 7.59 18.06 5 58 51.75 + .9(56 – 51.75) = 55.58 2.43 4.19 5.90 Totals 9.18 16.59 30.21 Averages 3.06 5.53 10.07 iii. Trend-adjusted exponential smoothing ( 0.6, 0.1)

Year Demand At Tt Ft Absolute Absolute % Squared Deviation Deviation Error 1 45 45.00 0.00 45.00 2 50 48.00 0.30 45.00 + 0.00 = 45.00 3 52 50.52 0.52 48.00 + 0.30 = 48.30 3.70 7.12 13.69 4 56 54.02 0.82 50.52 + 0.52 = 51.04 4.96 8.86 24.60 5 58 56.73 1.01 54.02 + 0.82 = 54.84 3.16 5.44 9.99 Totals 11.82 21.42 48.28 Averages 3.94 7.14 16.09 Calculations by year: Year 1 A1: 0.6(45) + 0.4(45 + 0) = 27.0 + 18.0 = 45.00

T1: 0.1(45.00 45.00) + 0.9(0) = 0.0 + 0.0 = 0.00

F2: A1 + T1 = 45.00 (Forecast for Year 2) Year 2 A2: 0.6(50) + 0.4(45 + 0) = 30.0 + 18.0 = 48.00

T2: 0.1(48.00 45.00) + 0.9(0) = 0.3 + 0.0 = 0.30

F3: A2 + T2 = 48.30 (Forecast for Year 3) Year 3 A3: 0.6(52) + 0.4(48.00 + 0.30) = 31.2 + 19.32 = 50.52

T3: 0.1(50.52 48.00) + 0.9(0.30) = 0.25 + 0.27 = 0.52

F4: A3 + T3 = 51.04 (Forecast for Year 4) Year 4 A4: 0.6(56) + 0.4(50.52 + 0.52) = 33.6 + 20.42 = 54.02

T4: 0.1(54.02 50.52) + 0.9(0.52) = 0.35 + 0.47 = 0.82

F5: A4 + T4 = 54.84 (Forecast for Year 5) iv. Two-year moving average

Year Demand 2-Year Moving Absolute Absolute % Square Average Deviation Deviation Error 1 45 2 50 3 52 (45 + 50)/2 = 47.5 4.50 8.65 20.25 4 56 (50 + 52)/2 = 51.0 5.00 8.93 25.00 5 58 (52 + 56)/2 = 54.0 4.00 6.90 16.00 Total 13.50 24.48 61.25 Average 4.50 8.16 20.42 v. Two-year weighted moving average Year Demand 2-Year Weighted Absolute Absolute % Squared Moving Average Deviation Deviation Error 1 45 2 50 3 52 (45(0.4) + 50(0.6)) = 48.0 4.00 7.69 16.00 4 56 (50(0.4) + 52(0.6)) = 51.2 4.80 8.57 23.04 5 58 (52(0.4) + 56(0.6)) = 54.4 3.60 6.21 12.96 Totals 12.40 22.47 52.00 Averages 4.13 7.49 17.33 vi. Regression model Y 42.6 3.2X Year Demand Trend Projection Absolute Absolute % Squared Deviation Deviation Error 1 45 42.6 + 3.2 1 = 45.8 2 50 42.6 + 3.2 2 = 49.0 3 52 42.6 + 3.2 3 = 52.2 0.20 0.38 0.04 4 56 42.6 + 3.2 4 = 55.4 0.60 1.07 0.36 5 58 42.6 + 3.2 5 = 58.6 0.60 1.03 0.36 Totals 1.40 2.48 0.76 Averages 0.47 0.83 0.25

a.-c. Comparison of the forecasting methodologies Forecast MAD MAPE MSE Methodology Exponential smoothing = .6 4.61 8.33 21.78 Exponential smoothing = .9 3.06 5.53 10.07 Trend-adjusted exp. smoothing 3.94 7.14 16.09 Two-year moving average 4.50 8.16 20.42 Two-year weighted moving average 4.13 7.49 17.33 Regression model 0.47 0.83 0.25 Regression model methodology works best in this case under all performance criteria.

12. Utility company Quarter Year 1 Year 2 Year 3 Year 4 1 103.5 94.7 118.6 109.3 2 126.1 116.0 141.2 131.6 3 144.5 137.1 159.0 149.5 4 166.1 152.5 178.2 169.0 Totals 540.2 500.3 597.0 559.4 Averages 135.05 125.075 149.25 139.85 Quarter Year 1 Year 2 Year 3 Year 4 Average Seasonal Index 1 0.7664 0.7571 0.7946 0.7816 0.7749 2 0.9337 0.9274 0.9410 0.9410 0.9371 3 1.0700 1.0961 1.0653 1.0690 1.0751 4 1.2299 1.2193 1.1940 1.2084 1.2129 Totals 4.0 4.0 4.0 4.0 4.0 Forecast for Year 5 Quarter Average Demand Adjusted per Quarter Demand 1 150 116.235 = 116 2 150 140.565 = 141 3 150 161.265 = 161 4 150 181.935 = 182 600 600 Turning to the Seasonal Forecasting Solver of OM Explorer, we get the same results:

13. Garcia’s Garage a. The results, using the Regression Analysis Solver of OM Explorer, are:

The regression equation is Y = 42.464 + 2.452X b. Forecasts Y (Sep) = 42.464 + 2.452 (9) = 64.532 or 65 Y (Oct) = 42.464 + 2.452 (10) = 66.984 or 67 Y (Nov) = 42.464 + 2.452 (11) = 71.888 or 72

14. Hydrocarbon Processing Factory Using the Regression Analysis Solverof OM Explorer, we get: a. Relationship to forecast Y from X Y = 0.888 + 0.622 X b. Strength of relationship between Y and X is moderate as indicated by R2 = 0.450 R = 0.671 Standard Error of Estimate = 0.331