Solo 401(k) Plans

Higher Tax Deductions for One-Person Business Owners

Do Your Clients Have the Best Retirement Plans for Their Needs? For clients who want to deduct $46,000 or less, the Solo 401(k) Plan can be a good choice. Due to changes created by pension law changes, your clients can now deduct more substantial contributions to one-person profit sharing/401(k) plans than ever before. In fact, these deductions can be higher than allowed in most other retirement plans.

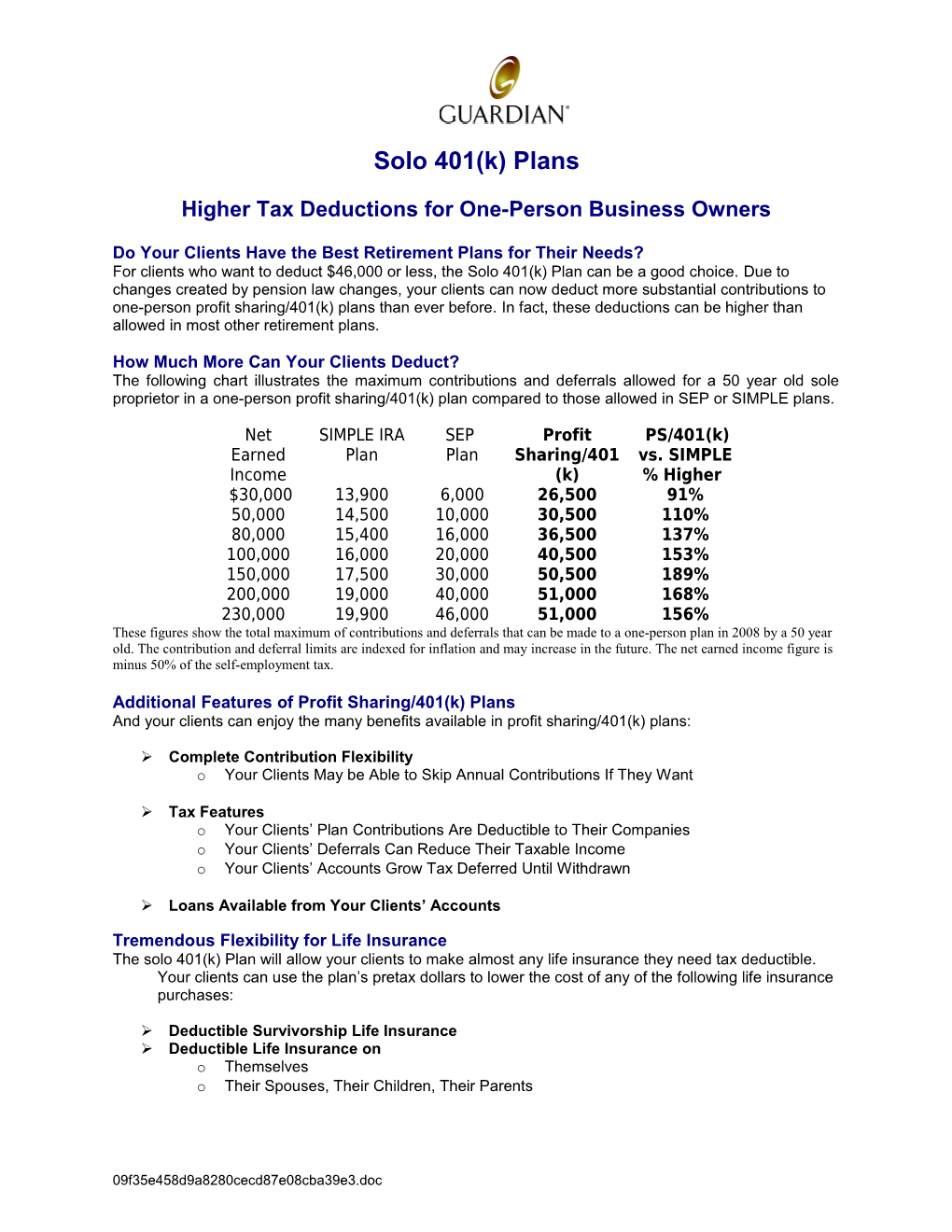

How Much More Can Your Clients Deduct? The following chart illustrates the maximum contributions and deferrals allowed for a 50 year old sole proprietor in a one-person profit sharing/401(k) plan compared to those allowed in SEP or SIMPLE plans.

Net SIMPLE IRA SEP Profit PS/401(k) Earned Plan Plan Sharing/401 vs. SIMPLE Income (k) % Higher $30,000 13,900 6,000 26,500 91% 50,000 14,500 10,000 30,500 110% 80,000 15,400 16,000 36,500 137% 100,000 16,000 20,000 40,500 153% 150,000 17,500 30,000 50,500 189% 200,000 19,000 40,000 51,000 168% 230,000 19,900 46,000 51,000 156% These figures show the total maximum of contributions and deferrals that can be made to a one-person plan in 2008 by a 50 year old. The contribution and deferral limits are indexed for inflation and may increase in the future. The net earned income figure is minus 50% of the self-employment tax.

Additional Features of Profit Sharing/401(k) Plans And your clients can enjoy the many benefits available in profit sharing/401(k) plans:

Complete Contribution Flexibility o Your Clients May be Able to Skip Annual Contributions If They Want

Tax Features o Your Clients’ Plan Contributions Are Deductible to Their Companies o Your Clients’ Deferrals Can Reduce Their Taxable Income o Your Clients’ Accounts Grow Tax Deferred Until Withdrawn

Loans Available from Your Clients’ Accounts

Tremendous Flexibility for Life Insurance The solo 401(k) Plan will allow your clients to make almost any life insurance they need tax deductible. Your clients can use the plan’s pretax dollars to lower the cost of any of the following life insurance purchases:

Deductible Survivorship Life Insurance Deductible Life Insurance on o Themselves o Their Spouses, Their Children, Their Parents

09f35e458d9a8280cecd87e08cba39e3.doc