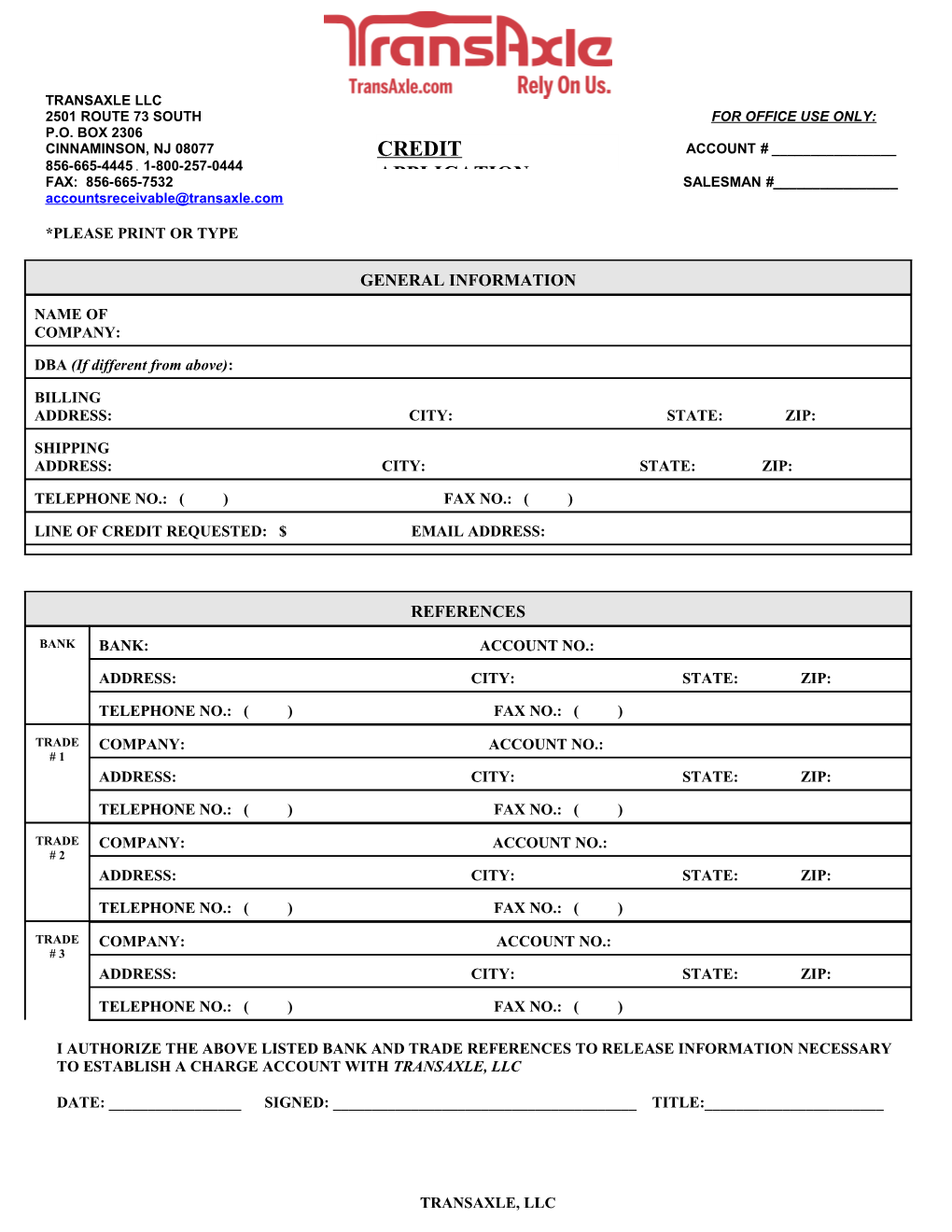

TRANSAXLE LLC 2501 ROUTE 73 SOUTH FOR OFFICE USE ONLY: P.O. BOX 2306 CINNAMINSON, NJ 08077 CREDIT ACCOUNT # ______856-665-44451-800-257-0444 FAX: 856-665-7532 APPLICATION SALESMAN #[email protected]

*PLEASE PRINT OR TYPE

GENERAL INFORMATION

NAME OF COMPANY:

DBA (If different from above):

BILLING ADDRESS: CITY: STATE: ZIP:

SHIPPING ADDRESS: CITY: STATE: ZIP:

TELEPHONE NO.: ( ) FAX NO.: ( )

LINE OF CREDIT REQUESTED: $ EMAIL ADDRESS:

REFERENCES

BANK BANK: ACCOUNT NO.:

ADDRESS: CITY: STATE: ZIP:

TELEPHONE NO.: ( ) FAX NO.: ( )

TRADE COMPANY: ACCOUNT NO.: # 1 ADDRESS: CITY: STATE: ZIP:

TELEPHONE NO.: ( ) FAX NO.: ( )

TRADE COMPANY: ACCOUNT NO.: # 2 ADDRESS: CITY: STATE: ZIP:

TELEPHONE NO.: ( ) FAX NO.: ( )

TRADE COMPANY: ACCOUNT NO.: # 3 ADDRESS: CITY: STATE: ZIP:

TELEPHONE NO.: ( ) FAX NO.: ( )

I AUTHORIZE THE ABOVE LISTED BANK AND TRADE REFERENCES TO RELEASE INFORMATION NECESSARY TO ESTABLISH A CHARGE ACCOUNT WITH TRANSAXLE, LLC

DATE: ______SIGNED: ______TITLE:______

TRANSAXLE, LLC COMPANY BACKGROUND

TYPE OF BUSINESS: SS OR EIN #:

NO. OF YEARS IN BUSINESS: YEARS UNDER PRESENT MGMT.: ARE P.O.'S REQUIRED? (Y/N):

TYPE OF COMPANY: PROPRIETORSHIP PARTNERSHIP CORPORATION

TAX STATUS: TAXABLE EXEMPT NOTE: If exempt a state tax form must accompany this application. Tax will otherwise be charged until completed form is received.

OWNERS, NAME: PARTNERS OR CORPORATE OFFICERS ADDRESS: CITY/STATE/ZIP: NAME:

ADDRESS: CITY/STATE/ZIP:

NAME:

ADDRESS: CITY/STATE/ZIP:

A/P CONTACT NAME: PHONE NO.: ( ) FAX NO.: ( )

SHOP CONTACT NAME: PHONE NO.: ( ) FAX NO.: ( )

PURCH. AGENT NAME: PHONE NO.: ( ) FAX NO.: ( )

The undersigned acknowledges that each credit purchase will be subject to the following terms and conditions: (a) payment is due as indicated on invoice (terms); (b) orders are subject to a minimum delivery charge where applicable; and (c) all claims for shortages must be noted at time of delivery and acknowledged by a TransAxle, LLC employee.

In addition, should TransAxle, LLC incur any collection costs or attorney fees in connection with the collection or attempts to collect any account incurred by the undersigned, with or without the institution of Court proceedings, the undersigned agrees to pay all collection fees in connection with any such proceedings. In consideration of the extension of credit to the above applicant, I/we hereby agree to be unconditionally and personally/jointly and severally responsible for payment of all invoices charged to the above applicant. Collection costs and attorney fees shall be in an amount as actually incurred by TransAxle, LLC and shall not be limited to any published court schedule of fees or collection costs.

The undersigned also acknowledges that (a) checks returned for any reason will be subject to a $30.00 minimum charge; (b) there will be a 15% restocking charge for all returns that are due to the customer's error; and (c) a finance charge of 1.5% will be added per month, 18% per annum, on unpaid past due balances.

DATE: ______SIGNED:______TITLE:______

TRANSAXLE, LLC