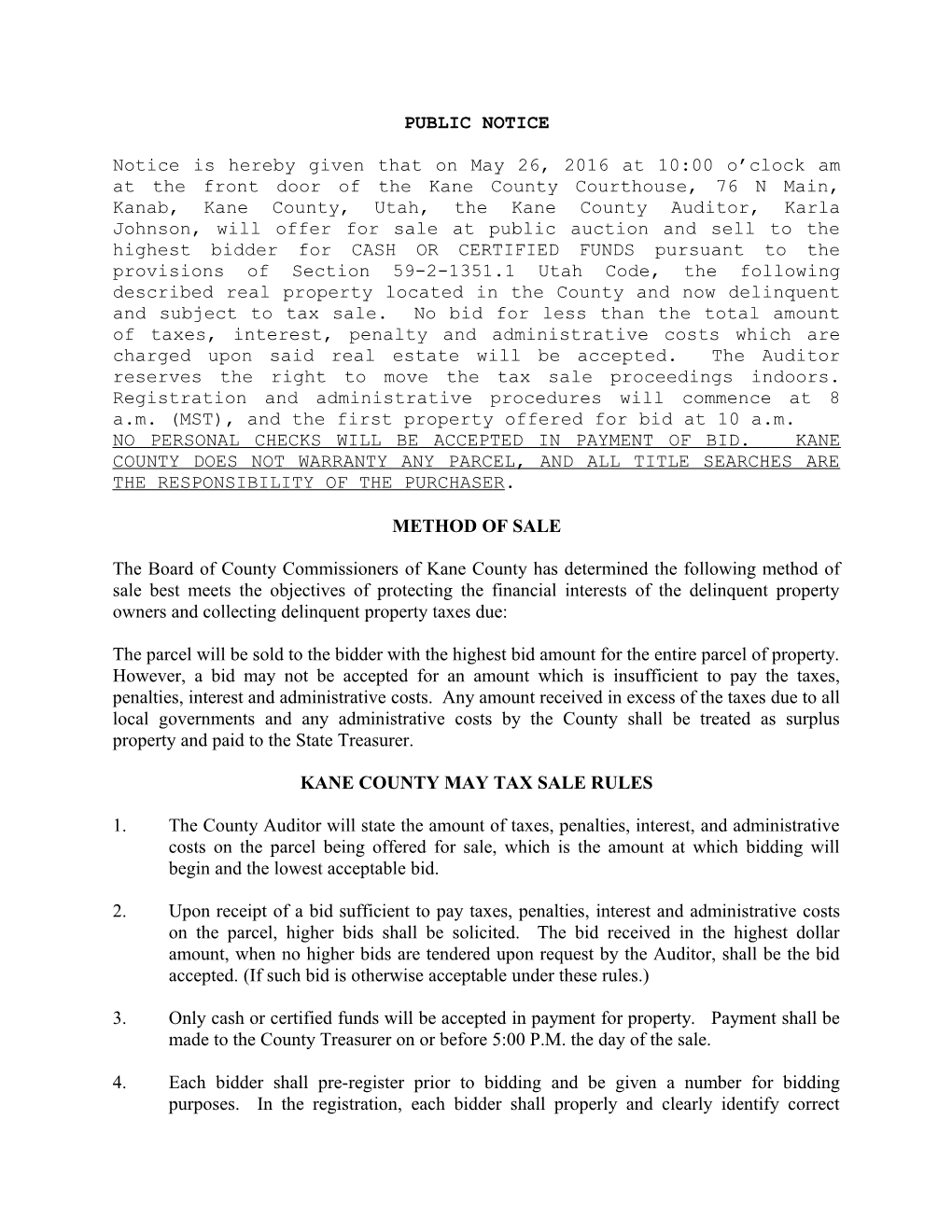

PUBLIC NOTICE

Notice is hereby given that on May 26, 2016 at 10:00 o’clock am at the front door of the Kane County Courthouse, 76 N Main, Kanab, Kane County, Utah, the Kane County Auditor, Karla Johnson, will offer for sale at public auction and sell to the highest bidder for CASH OR CERTIFIED FUNDS pursuant to the provisions of Section 59-2-1351.1 Utah Code, the following described real property located in the County and now delinquent and subject to tax sale. No bid for less than the total amount of taxes, interest, penalty and administrative costs which are charged upon said real estate will be accepted. The Auditor reserves the right to move the tax sale proceedings indoors. Registration and administrative procedures will commence at 8 a.m. (MST), and the first property offered for bid at 10 a.m. NO PERSONAL CHECKS WILL BE ACCEPTED IN PAYMENT OF BID. KANE COUNTY DOES NOT WARRANTY ANY PARCEL, AND ALL TITLE SEARCHES ARE THE RESPONSIBILITY OF THE PURCHASER.

METHOD OF SALE

The Board of County Commissioners of Kane County has determined the following method of sale best meets the objectives of protecting the financial interests of the delinquent property owners and collecting delinquent property taxes due:

The parcel will be sold to the bidder with the highest bid amount for the entire parcel of property. However, a bid may not be accepted for an amount which is insufficient to pay the taxes, penalties, interest and administrative costs. Any amount received in excess of the taxes due to all local governments and any administrative costs by the County shall be treated as surplus property and paid to the State Treasurer.

KANE COUNTY MAY TAX SALE RULES

1. The County Auditor will state the amount of taxes, penalties, interest, and administrative costs on the parcel being offered for sale, which is the amount at which bidding will begin and the lowest acceptable bid.

2. Upon receipt of a bid sufficient to pay taxes, penalties, interest and administrative costs on the parcel, higher bids shall be solicited. The bid received in the highest dollar amount, when no higher bids are tendered upon request by the Auditor, shall be the bid accepted. (If such bid is otherwise acceptable under these rules.)

3. Only cash or certified funds will be accepted in payment for property. Payment shall be made to the County Treasurer on or before 5:00 P.M. the day of the sale.

4. Each bidder shall pre-register prior to bidding and be given a number for bidding purposes. In the registration, each bidder shall properly and clearly identify correct information and address for use in issuance of deeds.

5. Upon ratification by the Board of County Commissioners, one deed, and only one deed, will be issued to the successful bidder on each parcel sold and shall be recorded by the County Recorder, upon submission (the filing fee being part of the administrative costs of the tax sale). The deed issued shall be a tax deed and not a warranty deed.

6. This tax deed will not guarantee a clear title. Kane County offers no warranties, assertions, legal opinions, or advice regarding the property. Kane County makes no representations as to the title conveyed, nor as to the purchaser’s right of possession of the property. Additionally, the County makes no warranties or representations as to whether the property is buildable or developable, nor does the County make any representations regarding whether or not if the parcel complies with applicable zoning or land use regulations. Kane County does not warrant or represent that any property purchased during tax sale is habitable or in any particular condition. The County makes no warranties or representations regarding the accuracy of the assessment of the property or the accuracy of the description of the real estate or improvements thereon.

7. The bidder first recognized by the County Auditor will be the first bid recorded, etc. As in any auction, the bid recognized is the one in effect at the time. All bids must be in increments of $50 or more. After bidding on any given parcel of land has started, parties who are bidding will not be permitted to withdraw their bids.

8. Loud whispering, yelling or talking, other than bids, shall be avoided, so that accurate records may be kept of the proceedings of the sale. The County reserves the right to remove any person(s) from the tax sale for disruptive behavior, at the request of the County Auditor.

9. The final bid number announced by the Auditor is the official sale, and the registered name and address will be the name that will go on the deed.

10. All bids shall be considered conditional, whether or not the bid is contested, until reviewed and accepted by the Board of County Commissioners, acting at a regularly scheduled meeting. The County Commissioners may reject any and all bids on the grounds that none are acceptable. Bids may not be withdrawn unilaterally by the successful bidder(s). The County Commissioners may enforce the terms of the bid by obtaining a legal judgment against the successful bidder in the amount of the bid, plus interest and attorney’s fees.

11. The County Commission reserves the right to reject any and all bids.

12. Upon any final bid being rejected, the next previous acceptable bid may be accepted and the property sold to such bidder.

13. A fee in the amount of $300 will be assessed for "administrative costs" per parcel. 14. Any person wishing to contest any action taken in connection with the Kane County Tax Sale must present such protest to the Kane County Commission, in writing, within ten (10) days of the sale.

15. Property may be redeemed on behalf of the record owner by any person at any time prior to the tax sale, by paying all delinquent taxes, interest, penalties, and administrative costs that have accrued on the property to the Kane County Treasurer. Redemption must be paid by cash or certified funds. The period to redeem property shall end the day preceding the tax sale, prior to the closing of the books at the Treasurer’s Office at 5 p.m. (MST), as the tax sale will commence at 8 a.m. the following day.

State law requires payments on delinquencies be applied first to the interest and administrative costs accrued on the delinquencies for the last year included in the delinquent account at the time of payment, then payment is applied to the penalty charged for the last year included. After, payments are applied in the same manner to the delinquent year prior to the last year included on the tax sale, payment going towards the most recent year of interest, penalties, and delinquent taxes until paid in full. A parcel will not be withdrawn from the tax sale unless the year of delinquent taxes triggering the inclusion of the parcel on the tax sale list, with its corresponding penalties and interest, are paid in full.Any property listed may be subject to a roll-back tax under the provisions of "THE FARMLAND ASSESSMENT ACT" Utah Code Section 59-2-501 through 59-2-515. 16. Parcels subject to bankruptcy shall be withdrawn from the tax sale.

17. Properties not purchased at the tax sale shall be struck off to the County by the Auditor, becoming property of Kane County, subject to approval and acceptance of the Board of County Commissioners. If a successful bidder fails to tender payment as required, the property may, at the discretion of the Board of County Commissioners, be struck off to the County. Properties struck off to the County may only be sold for fair market value, not the amount of the tax arrearages, the excess sale proceeds being treated according to State law and unclaimed property requirements.

18. No absentee or collusive bidding shall be permitted.

19. No person or party who has a conflict of interest shall be permitted to bid. Kane County employee(s) or official(s) may bid on a parcel, subject to these rules.

20. The County Auditor or Board of Commissioners shall withdraw a parcel from the tax sale, due to the discovery of irregular or erroneous assessment, deficient legal description, or may withdraw a parcel if withdrawal is in the best interest of the County. If the County Auditor withdraws a parcel based on it being in the best interest of the County, the Auditor must issue a written finding as to the reason for withdrawal, which then must be approved by the Board of County Commissioners, pursuant to State law.

21. The County Auditor shall disclose the properties withdrawn from the tax sale, for reasons other than redemption, at the regularly convened meeting of the Board of Commissioners, preceding the tax sale and the meeting after the tax sale.

22. The Board of County Commissioners may reject acceptance of property stricken off to the County by the County Auditor.

23. There shall be no preference given to any bidder.

24. Property taxes for the current year are not included in the tax sale, as they are not considered delinquent at the time of the tax sale.

2017 TAX SALE KANE COUNTY COURTHOUSE MAY 25, 2017 10:00 A.M.

Tax Sale # 1

0045180 ADAMS GEORGE Parcel: 14-B-16 ALL OF LOT 16 BLOCK "B" COUGAR CANYON SUBDIVISION. Tax $352.62 Interest $68.31 Penalty $50.00 Other $300.00 Total Due: $770.93

Tax Sale # 2

0141401 ALEXANDER HENRY & VICKI Parcel: T-A-48 ALL OF LOT 48 MAXWELL TOWERY SUBDIVISION AMENDED. Tax $277.99 Interest $94.83 Penalty $80.00 Other $1,200.00 Total Due: $1,652.82

Tax Sale # 3

0141419 ALEXANDER HENRY & VICKI Parcel: T-A-49 ALL OF LOT 49 MAXWELL TOWERY SUBDIVISION AMENDED. Tax $277.99 Interest $94.83 Penalty $80.00 Other $1,200.00 Total Due: $1,652.82

Tax Sale # 4

0173925 ALPINE GEMS & MINERALS Parcel: ZZZ-113 SEE ATTACHED SHEET Tax $2,011.71 Interest $286.52 Penalty $51.36 Other $600.00 Total Due: $2,949.59

Tax Sale # 5

0006406 ASPEN VIEW COTTAGES LLC Parcel: I-64 A PORTION OF LOT 64 MOVIE RANCH SUBDIVISION UNIT "A" AMENDED & EXTENDED: Tax $14,455.29 Interest $2,305.79 Penalty $219.70 Other $300.00 Total Due: $17,280.78

Tax Sale # 6

0141476 BAGOLY ATTILA Parcel: T-A-55 ALL OF LOT 55 MAXWELL TOWERY SUBIVISION AMENDED. Tax $177.90 Interest $38.42 Penalty $50.00 Other $300.00 Total Due: $566.32

Tax Sale # 7

0049232 BAGOLY BELA A Parcel: 2-1E-32-3-25 BEG AT A PT 475.0 FT E & 4,310.0 FT N FROM THE S 1/4 COR OF SEC 32 T42S R1E SLB&M, UTAH & RUN TH E 270.0 FT; TH N 150.0 FT; TH W 270.0 FT; TH S 150.0 FT TO THE PT OF BEG. CONT 0.929 AC, M/L. Tax $177.90 Interest $38.42 Penalty $50.00 Other $300.00 Total Due: $566.32

Tax Sale # 8

0141450 BAGOLY BELA A Parcel: T-A-53 ALL OF LOT 53 MAXWELL TOWERY SUBDIVISION AMENDED. Tax $177.90 Interest $38.42 Penalty $50.00 Other $300.00 Total Due: $566.32

Tax Sale # 9

0005929 BANGERTER GARRET Parcel: I-20 ALL OF LOT 20 MOVIE RANCH SUBDIVISION UNIT "A" AMENDED & EXTENDED. Tax $6,222.62 Interest $1,051.52 Penalty $155.61 Other $300.00 Total Due: $7,729.75

Tax Sale # 10

0141377 BARATH JOHN Parcel: T-A-45 ALL OF LOT 45 MAXWELL TOWERY SUBDIVISION AMENDED. Tax $177.90 Interest $38.42 Penalty $50.00 Other $300.00 Total Due: $566.32

Tax Sale # 11

0141443 BARATH JOHN Parcel: T-A-52 ALL OF LOT 52 MAXWELL TOWERY SUBDIVISION AMENDED. Tax $177.90 Interest $38.42 Penalty $50.00 Other $300.00 Total Due: $566.32

Tax Sale # 12

0111545 BARKER MICHAEL ROBERT -TR- Parcel: 8-8-19-1A1 BEG AT A PT S 89*43' W 897.2 FT FROM THE CENTER OF SEC 19 T38S R8W SLB&M & RUN TH S 1,320.0 FT; TH S 89*43' W 897.2 FT; TH N 1,320.0 FT; TH N 89*43' E 897.2 FT TO THE PT OF BEG. CONT 27.19 AC,M/L Tax $3,109.57 Interest $885.96 Penalty $80.54 Other $1,200.00 Total Due: $5,276.07

Tax Sale # 13

0002074 BOGDANOVICH DONNA -SUC TR- Parcel: B-24-78A THE W'LY 1/2 OF THE N'LY 329.0 FT OF LOT 78 SEC 24 T43S R2E SLB&M. Tax $1,640.95 Interest $353.17 Penalty $60.00 Other $600.00 Total Due: $2,654.12

Tax Sale # 14

0008212 BRODERICK DAVID L Parcel: B-J-H-1 ALL OF LOT 1 BLOCK "H" REVISED PLAT "A" OFFICIAL TOWNSITE GLEN CANYON, UT. Tax $1,335.19 Interest $233.74 Penalty $50.00 Other $300.00 Total Due: $1,918.93

Tax Sale # 15

0008329 BRODERICK DAVID L Parcel: B-J-H-2 ALL OF LOT 2 BLOCK "H" REVISED PLAT "A" OFFICIAL TOWNSITE GLEN CANYON, UT. Tax $1,134.32 Interest $200.39 Penalty $50.00 Other $300.00 Total Due: $1,684.71

Tax Sale # 16

0044969 BUEHNER ROB -TR- Parcel: 14-A-14 ALL OF LOT 14 BLOCK "A" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 17

0045123 BUEHNER ROB -TR- Parcel: 14-B-10 ALL OF LOT 10 BLOCK "B" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79 Tax Sale # 18

0045131 BUEHNER ROB -TR- Parcel: 14-B-11 ALL OF LOT 11 BLOCK "B" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 19

0045198 BUEHNER ROB -TR- Parcel: 14-B-17 ALL OF LOT 17 BLOCK "B" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 20

0045206 BUEHNER ROB -TR- Parcel: 14-B-18 ALL OF LOT 18 BLOCK "B" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 21

0045339 BUEHNER ROB -TR- Parcel: 14-C-11 ALL OF LOT 11 BLOCK "C" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 22

0045396 BUEHNER ROB -TR- Parcel: 14-C-17 ALL OF LOT 17 BLOCK "C" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 23

0045511 BUEHNER ROB -TR- Parcel: 14-D-1 ALL OF LOT 1 BLOCK "D" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 24

0045560 BUEHNER ROB -TR- Parcel: 14-D-14 ALL OF LOT 14 BLOCK "D" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 25

0045636 BUEHNER ROB -TR- Parcel: 14-D-20 ALL OF LOT 20 BLOCK "D" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 26

0045651 BUEHNER ROB -TR- Parcel: 14-D-4 ALL OF LOT4 BLOCK "D" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 27

0045768 BUEHNER ROB -TR- Parcel: 14-E-14 ALL OF LOT 14 BLOCK "E" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 28

0045800 BUEHNER ROB -TR- Parcel: 14-E-18 ALL OF LOT 18 BLOCK "E" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 29

0045974 BUEHNER ROB -TR- Parcel: 14-F-7 ALL OF LOT 7 BLOCK "F" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 30

0040314 C&C HOLDINGS & SERVICES LLC Parcel: O-4-58-ANNEX BEG AT A PT 660.0 FT N & 486.3 FT W OF THE E 1/4 COR OF SEC 7 T41S R7W SLB&M & RUN TH W 162.1 FT; TH N 660.0 FT TO THE N LINE OF THE SE/4NE/4 OF SAID SEC 7; TH E 163.1 FT ALONG THE N LINE OF SAID SE/4NE/4; TH S 660.0 FT TO THE PT OF BEG. CONT 2.46 AC M/L. Tax $842.69 Interest $402.62 Penalty $38.49 Other $1,175.00 Total Due: $2,458.80

Tax Sale # 31

0138936 CANTRELL DOYLE 1/3 INT Parcel: O-25-11 BEG AT A PT 317.5 FT W FROM THE NE COR OF BLOCK 25 REVISED PLAT "A" OF THE OFFICIAL SURVEY OF ORDERVILLE TOWNSITE & RUN TH W 87.0 FT; TH S 90.0 FT; TH E 87.0 FT; TH N 90.0 FT TO THE PT OF BEG. CONT 0.18 AC,M/L Tax $989.62 Interest $170.18 Penalty $13.54 Other $300.00 Total Due: $1,473.34

Tax Sale # 32

0016215 COLEMAN JERRY S & ROSA LIE Parcel: K-45-1 BEG AT A PT 272.5 FT E OF THE SW COR OF LOT 2 BLOCK 45 PLAT "A" OF THE OFFICIAL SURVEY OF KANAB TOWNSITE & RUN TH N 264.0 FT; TH E 190.42 FT TO THE E LINE OF SEC 28; TH S 09*35' W ALONG SAID SEC LINE 172.0 FT; TH W 70.0 FT; TH S 92.0 FT; TH W 118.36 FT TO BEG. Tax $9,782.61 Interest $2,186.21 Penalty $231.99 Other $600.00 Total Due: $12,800.81

Tax Sale # 33

0016272 COLEMAN JERRY S & ROSA LIE Parcel: K-45-4 BEG AT A PT 160.0 FT E OF THE SW COR OF BLOCK 45 PLAT "A" OF THE OFFICIAL SURVEY OF KANAB TOWNSITE & RUN TH N 132.0 FT; TH W 41.0 FT; TH N 132.0 FT; TH E 13.0 FT; TH N 132.0 FT; TH E 331.95 FT, M/L, TO THE E LINE OF SAID SEC 28; TH S 0*09'35" W 132.0 FT ALONG SAID LINE; TH W 190.42 FT; TH S 264.0 FT; TH W 112.5 FT TO BEG. Tax $5,357.13 Interest $1,477.04 Penalty $105.35 Other $600.00 Total Due: $7,539.52

Tax Sale # 34

0058290 CRAIN TIMOTHY & KRISTI Parcel: 29-7-106 ALL OF LOT 106 BLOCK 7 BRYCE WOODLAND ESTATES UNIT #5C. Tax $512.02 Interest $93.31 Penalty $50.00 Other $300.00 Total Due: $955.33

Tax Sale # 35

0108962 CUDDY WILLIAM T & HARRIET F -CO-TR- 1/5 Parcel: 8-5-11-1C THE W/2NE/4NW/4NW/4 OF SEC 11 T38S R5W SLB&M, UTAH CONT 5.0 AC, M/L. Tax $494.74 Interest $113.33 Penalty $60.00 Other $600.00 Total Due: $1,268.07

Tax Sale # 36

0118060 DAVIS KARI K & LYNN R Parcel: 86-246 ALL OF LOT 246 MEADOW VIEW HEIGHTS PLAT "E". Tax $2,571.29 Interest $637.11 Penalty $49.02 Other $300.00 Total Due: $3,557.42

Tax Sale # 37

0139991 DICKSON REUBEN Parcel: B-13-66B A PORTION OF LOT 66 SEC 13 T43S R2E SLB&M: Tax $3,705.96 Interest $689.89 Penalty $100.20 Other $300.00 Total Due: $4,796.05

Tax Sale # 38

0074701 FRAZER DONEL N Parcel: 42-18 ALL OF LOT 18 PONDEROSA VILLA PLAT "F". Tax $7,796.01 Interest $1,277.22 Penalty $194.95 Other $300.00 Total Due: $9,568.18

Tax Sale # 39

0149420 GIBSON SCOTT Parcel: 3-6-16-DC DRY CANYON UTAH STATE LEASE. SEC 16 T43S R6W SLB&M (BUILDINGS ONLY) Tax $74.87 Interest $52.80 Penalty $80.00 Other $900.00 Total Due: $1,107.67

Tax Sale # 40

0117526 JOHNSON LAWRENCE B & MICHELLE A Parcel: 86-192 ALL OF LOT 192 MEADOW VIEW HEIGHTS PLAT "E". Tax $5,644.42 Interest $855.42 Penalty $36.72 Other $300.00 Total Due: $6,836.56

Tax Sale # 41

0055361 LUECK VERNON JR & LANEL Parcel: 25-A-212 ALL OF LOT 212 SWAINS CREEK PINES UNIT #1 AMENDED. Tax $2,632.63 Interest $472.71 Penalty $65.86 Other $300.00 Total Due: $3,471.20

Tax Sale # 42

0115264 MARIS KEITH L & DONNA L Parcel: 81-555 ALL OF LOT 555 SWAINS CREEK PINES UNIT 3. Tax $6,288.10 Interest $1,640.21 Penalty $157.25 Other $900.00 Total Due: $8,985.56

Tax Sale # 43

0045230 POWERS SAM JR Parcel: 14-B-20 ALL OF LOT 20 BLOCK "B" COUGAR CANYON SUBDIVISION. Tax $353.28 Interest $68.51 Penalty $50.00 Other $300.00 Total Due: $771.79

Tax Sale # 44

0102163 SPRING NATALIE CLARKSON Parcel: 72-367 ALL OF LOT 367 KANAB CREEK RANCHOS UNIT #4. Tax $966.91 Interest $233.34 Penalty $11.99 Other $300.00 Total Due: $1,512.24

Tax Sale # 45

0006505 STADTLANDER DOUGLAS & SAMANTHA Parcel: I-76 ALL OF LOT 76 MOVIE RANCH SUBDIVISION UNIT "A" AMENDED & EXTENDED. Tax $29,736.52 Interest $3,919.56 Penalty $707.08 Other $325.00 Total Due: $34,688.16

Tax Sale # 46

0002223 ST GERMAIN BRUCE & PATRICIA Parcel: C-A-29A THE N/2 OF LOT 29 CLARK BENCH ACRES AMENDED. Tax $1,258.44 Interest $173.64 Penalty $20.00 Other $300.00 Total Due: $1,752.08

Tax Sale # 47

0107444 TOWN N COUNTRY SALES INC Parcel: 8A-F-20 ALL OF LOT 20 BLOCK "F" AMENDED PLAT OF LITTLE PONDEROSA RANCH. Tax $1,714.54 Interest $570.99 Penalty $90.00 Other $900.00 Total Due: $3,275.53

Tax Sale # 48

0141468 VOJCIK ANICA Parcel: T-A-54 ALL OF LOT 54 MAXWELL TOWERY SUBDIVISION AMENDED. Tax $177.90 Interest $38.42 Penalty $50.00 Other $300.00 Total Due: $566.32

Tax Sale # 49

0102643 WELCH LANDON Parcel: 72-413 ALL OF LOT 413 KANAB CREEK RANCHOS UNIT 4. Tax $6,249.08 Interest $947.78 Penalty $156.22 Other $300.00 Total Due: $7,653.08

Tax Sale # 50

0104169 JONSSON LAMONT Parcel: 73-78 ALL OF LOT 78 NAVAJO LAKE ESTATES UNIT 4. Tax $1,292.11 Interest $225.84 Penalty $50.00 Other $300.00 Total Due: $1,867.95

Tax Sale # 51

0034473 JONSSON LAMONT Parcel: G-2-49-ANNEX THE SE/4SW/4 OF SEC 13 T40S R7W SLB&M. CONT 40.0 AC M/L. Tax $1,644.85 Interest $274.83 Penalty $50.00 Other $300.00 Total Due: $2,269.68

Tax Sale # 52

0034838 JONSSON LAMONT Parcel: G-2-72-ANNEX THE N/2NE/4NE/4NW/4 OF SEC 24 T40S R7W SLB&M, CONT 5 AC M/L. Tax $790.18 Interest $136.46 Penalty $50.00 Other $300.00 Total Due: $1,276.64

Tax Sale # 53

0088156 KANE COUNTY Parcel: 6-37 ALL OF LOT 37 VERMILION CLIFF ESTATES. Tax $11,350.37 Interest $679.12 Penalty $67.51 Other $300.00 Total Due: $12,397.00

Tax Sale # 54

0088529 KANE COUNTY Parcel: 6-70 ALL OF LOT 70 VERMILION CLIFF ESTATES. Tax $12,766.33 Interest $710.52 Penalty $268.62 Other $300.00 Total Due: $14,045.47