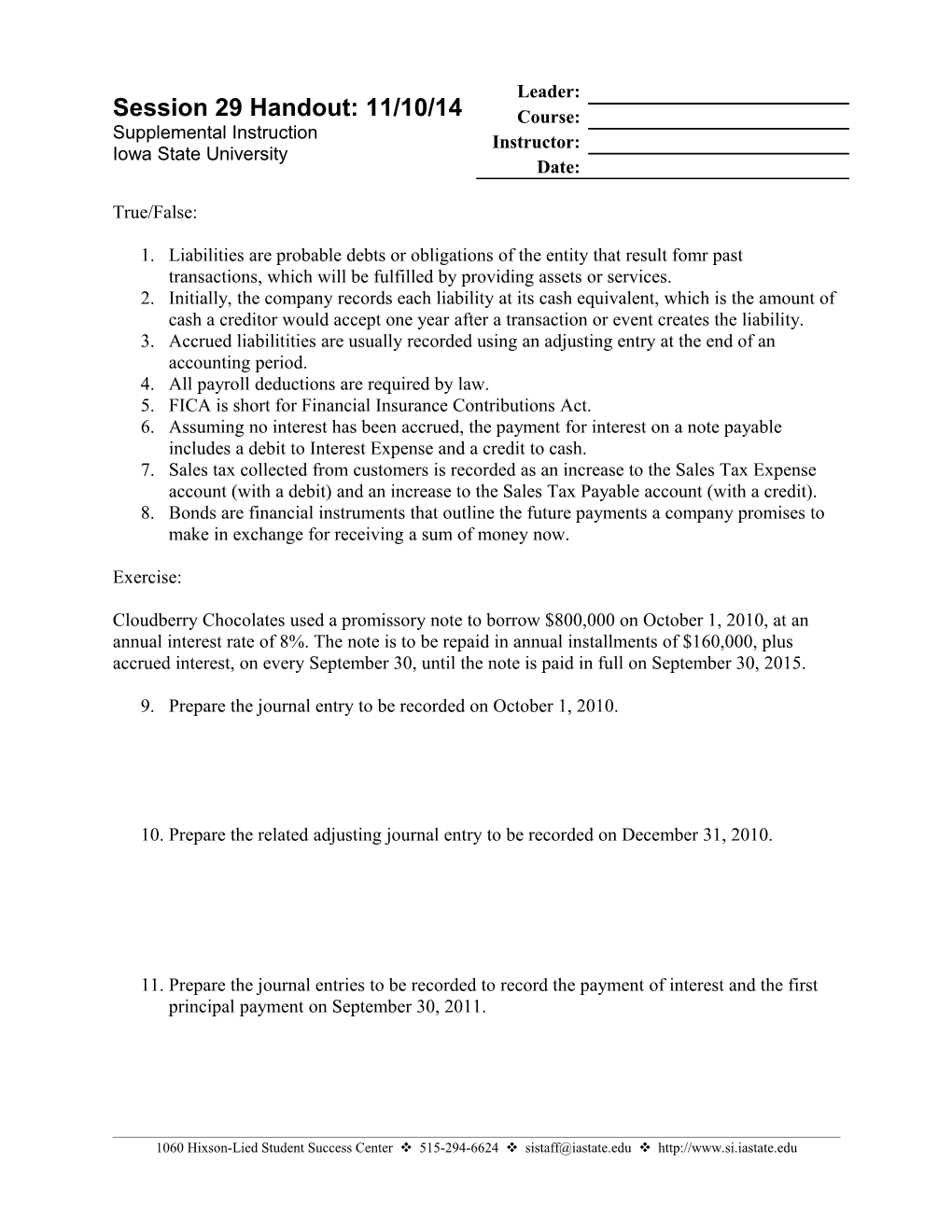

Leader: Session 29 Handout: 11/10/14 Course: Supplemental Instruction Instructor: Iowa State University Date:

True/False:

1. Liabilities are probable debts or obligations of the entity that result fomr past transactions, which will be fulfilled by providing assets or services. 2. Initially, the company records each liability at its cash equivalent, which is the amount of cash a creditor would accept one year after a transaction or event creates the liability. 3. Accrued liabilitities are usually recorded using an adjusting entry at the end of an accounting period. 4. All payroll deductions are required by law. 5. FICA is short for Financial Insurance Contributions Act. 6. Assuming no interest has been accrued, the payment for interest on a note payable includes a debit to Interest Expense and a credit to cash. 7. Sales tax collected from customers is recorded as an increase to the Sales Tax Expense account (with a debit) and an increase to the Sales Tax Payable account (with a credit). 8. Bonds are financial instruments that outline the future payments a company promises to make in exchange for receiving a sum of money now.

Exercise:

Cloudberry Chocolates used a promissory note to borrow $800,000 on October 1, 2010, at an annual interest rate of 8%. The note is to be repaid in annual installments of $160,000, plus accrued interest, on every September 30, until the note is paid in full on September 30, 2015.

9. Prepare the journal entry to be recorded on October 1, 2010.

10. Prepare the related adjusting journal entry to be recorded on December 31, 2010.

11. Prepare the journal entries to be recorded to record the payment of interest and the first principal payment on September 30, 2011.

1060 Hixson-Lied Student Success Center v 515-294-6624 v [email protected] v http://www.si.iastate.edu