AST Analysis of Arsenal Holdings PLC Full Year Accounts for the financial year 1 June 2013 to 31 May 2014

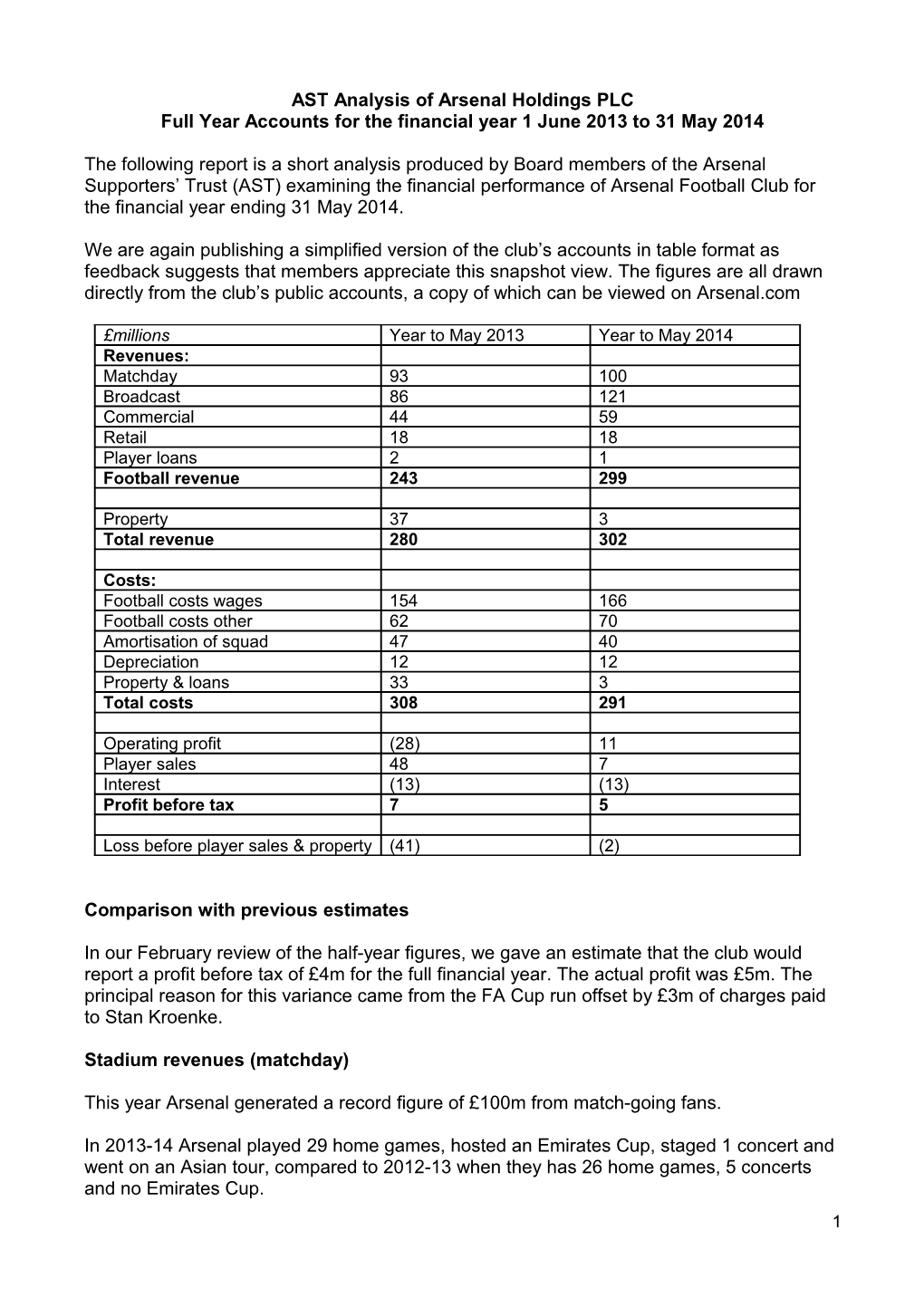

The following report is a short analysis produced by Board members of the Arsenal Supporters’ Trust (AST) examining the financial performance of Arsenal Football Club for the financial year ending 31 May 2014.

We are again publishing a simplified version of the club’s accounts in table format as feedback suggests that members appreciate this snapshot view. The figures are all drawn directly from the club’s public accounts, a copy of which can be viewed on Arsenal.com

£millions Year to May 2013 Year to May 2014 Revenues: Matchday 93 100 Broadcast 86 121 Commercial 44 59 Retail 18 18 Player loans 2 1 Football revenue 243 299

Property 37 3 Total revenue 280 302

Costs: Football costs wages 154 166 Football costs other 62 70 Amortisation of squad 47 40 Depreciation 12 12 Property & loans 33 3 Total costs 308 291

Operating profit (28) 11 Player sales 48 7 Interest (13) (13) Profit before tax 7 5

Loss before player sales & property (41) (2)

Comparison with previous estimates

In our February review of the half-year figures, we gave an estimate that the club would report a profit before tax of £4m for the full financial year. The actual profit was £5m. The principal reason for this variance came from the FA Cup run offset by £3m of charges paid to Stan Kroenke.

Stadium revenues (matchday)

This year Arsenal generated a record figure of £100m from match-going fans.

In 2013-14 Arsenal played 29 home games, hosted an Emirates Cup, staged 1 concert and went on an Asian tour, compared to 2012-13 when they has 26 home games, 5 concerts and no Emirates Cup. 1 The FA Cup run meant an extra A and two extra B games and together with the return of the Emirates Cup this led to a 10% growth in matchday income. Approximately £5m of this increase is in effect a windfall as the club will set their budgets based on the 26 home games included in the season ticket.

The AST have repeatedly argued that with revenues from TV and commercial contracts expanding by close to £90m over the three years ending May 31, 2015, the need to impose further ticket price increases has diminished, and that the club has scope to reduce the cost of some tickets – especially to benefit younger fans and Arsenal’s away fans.

Sadly, the Arsenal Board have instead raised prices by 3% – not because they need the money but because they can. We would not be surprised to see further ‘inflationary’ increases announced for next season.

The vast bulk of Arsenal’s costs are related to player wages and transfer fees and the amount spent by the manager on them is discretionary. His spending on players to date has not even required the full use of the Club’s annual income and cash reserves (which the Club insist are at his disposal) so increases in ticket prices are in our opinion unnecessary, difficult to justify and inevitably further strain the club/supporter relationship.

Broadcast revenues

These increased dramatically as Arsenal’s share of Premier League broadcast revenues (for domestic and overseas rights) grew by approximately 60% (£34m) in 2013-14.

New Premier League wage spending cap rules attempt to keep most of this increase in the game to reduce “unsustainable losses” but inevitably a fair amount seems to have leaked into higher transfer fee spending in summer 2014. The next new Premier League three-year deal, due to start in season 2016-17, will be negotiated in January 2015 and a further set of substantial increases is expected with BT and Sky going head to head (for Arsenal this could be another 50% increase or £40m plus pa).

Champions League income dipped by €4m Euros to approximately €27m. This was due to a smaller TV pool share from a lower League finishing position the previous season, but the FA Cup run helped to compensate.

Finishing in the top four for season 2014-15 has added significance as the new BT Sport Champions League broadcast deal starts in 2015-16 adding probably 50% to the English clubs’ expected takes.

Commercial revenues

As highlighted in our review of the half-year figures, Arsenal reported a significant jump in commercial income in the first half of the financial year due to the new Emirates sponsorship agreement. This was carried into the full year and contributed to the overall increase of £15m to £59m.

A new five-year shirt manufacturing arrangement is now also in place with Puma and an uplift of £19m pa is anticipated for 2014-15 when Arsenal can expect to report commercial income of approximately £80m.

2 Despite this increase, Arsenal’s commercial income is still only 40% of the figures reported by Manchester United, giving them almost a £100m pa spending advantage. Arsenal also lags behind the commercial revenue reported by Chelsea, Liverpool and Manchester City.

Following the Puma deal, securing further growth in commercial income from secondary sponsorships is now the most vital component of future revenue growth. This will allow the wage bill to increase and remain competitive with Europe’s leading clubs. Winning trophies and signing global star names can only help with this aim as illustrated in the Virtuous Circle outlined within the club’s Strategy statement.

Property and player loans

These are no longer significant sources of revenue for the club although the Holloway Road and Hornsey Road sites held in the balance sheet at £9m remain to be sold. Substantial cash was generated in 2013-14 from debtors related to the Queensland Road site sale (£20m) and, in all, we estimate in excess of £60m to have been generated from the property assets, including from Highbury Square since the stadium move commenced. We believe all this cash is available to the football side of the business although it is held within one of the club’s numerous property companies. We cannot identify if any of it has been spent as overall retained cash reserves are still over £100m.

Wages

The wage bill increased in line with our expectations to £166m, an underlying increase allowing for the absence of exceptional items of some £16m or 10%. Only a small part of this increase went on non-playing staff (for example the training team was expanded by 25% to 80 people) so we assume that most of the increase went on player wages (67 players compared to 73 in 2012-13).

In summer 2013 there were considerable changes to the playing squad with large numbers of players sold, released at the end of their contracts, or paid to terminate their contract early. Relatively few players were signed but one, Ozil, joined on very big money (£10m pa+) and many contracts have been renegotiated over the past two seasons (such as Aaron Ramsey moving to £6m pa).

The club has again invested in improving its squad in summer 2014, signing another big wage earner in Sanchez and replacing Sagna and Fabianski with established internationals, whilst retaining a relatively small first team squad. Overall a similar sized increase of approximately 10% is expected in the overall wage bill this season.

It has been reported that for the current season Arsenal will run a higher wage bill than Chelsea. While we think this is unlikely (not least due to bonuses) the gap will have narrowed to a very small amount and shows that the manager can no longer point to lack of resources as a reason for not competing for the top trophies.

In previous commentaries we expressed concern at the club’s policy of paying players in a narrower egalitarian spread (the ‘socialist model’) rather than the pyramid style most leading football clubs adopt, and the difficulty this causes when players deemed surplus to requirements have no desire to leave. These problems now seem to be behind Arsenal and that can only be a good thing. It probably helps with the improved camaraderie and spirit reported within the squad by many sources.

3 Most top teams now apply a fairly harsh line on trimming unwanted players and pay to move on their mistakes as has been seen at Liverpool, City and now United.

Non-wage football costs (other costs)

These costs cover running the team (travel, medical costs, etc) stadium running costs, insurances and retail costs of sale (stock and running costs of the Armoury, etc). They had been remarkably constant in recent years (between £50-55m for the last five years), changing only marginally to reflect the number of games and events staged at the stadium.

This year they suddenly jumped unexpectedly by £8m to £62m and despite the explanation in the accounts about staging more games and the costs of looking after sponsors, the biggest factor was a payment of £3m to a Stan Kroenke-controlled company for “strategic and advisory services”. Sadly the reason for this charge was not explained at all in the accounts, which perhaps reflects an embarrassment at the club at the charge being imposed.

Did Arsenal really need £3m of consultancy services? They never have before in the normal course of business. If so, in what areas and why is the Highbury House team so light? Was a tender issued for the work to ensure value for money was received? We expect these issues aren’t addressed as the charge appears to be an arbitrary way of Stan Kroenke taking money out of Arsenal.

Little reduction is expected in the Other Costs figure in future years as more effort is put into securing extra commercial and event-hosting incomes. If the “management fee” to KSE is repeated, possibly at an increased level and on an on-going basis, this will also bump up the figure.

Amortisation

Amortisation is the accounting cost of buying the team spread over the length of the relevant players’ contracts and includes items like agents’ fees, Premier League levies and contract extension fees as well as the actual transfer fee paid for a player.

As a minimum, we would expect the club to spend the amount of the annual amortisation charge on new players every season with extra sums spent to replace players who left at significant gain over their ‘book’ value in the accounts. Over the past four transfer windows Arsenal have spent more than £250m on new players who are still with the squad and the amortisation charge has more than doubled as a consequence to over £40m pa as players sold at a substantial profit (over £100m) have been in part replaced. We expect this charge to rise to well over £50m in 2014-15 and that will be the new net expenditure required to maintain the playing squad at its current strength.

Profit on player sales

Arsenal booked a profit of £48m in 2012 from selling Van Persie and Song but in 2013 only Gervinho and Mannone left for noticeable fees. In 2014 the trend of letting selected players leave has continued with sizable gains (probably close to £30m) being made from selling Vermaelen, the option to buy back Vela and Djourou.

4 Times have changed and Arsenal are now a buyer of mature talent as well as a buyer of developing talent, as one would expect from a top club. The manager still has his own views on value, but the new trend seems clearly established.

Cash

Arsenal’s end of year (May 31) headline cash figure (£208m) is always bloated by upfront season ticket payments that are used to pay the wages and bills for the rest of the summer (“working capital”).

The amount of available cash increased markedly in 2014 as a result of the realisation of property debtors, the new commercial deals including Puma and the surplus generated over the financial year.

There is also an allocation of cash on the balance sheet (£34.6m) that the club can’t spend because it’s held to the order of its stadium bond holders (“debt reserve protections”). At the May 31 year-end this ‘unavailable’ cash (working capital and debt reserve protections) ) is estimated to account for close to £55m leaving some £150m “spare”, of which approximately £70m net was invested in the squad during the summer leaving £80m “spare” on 1 September 2014.

There is a net amount left in the balance sheet reflecting money to be spent and received on players spread between debtors, creditors and provisions. A big chunk of this is on a long-term basis as it relates to the agents cut on player transfers and wages and renegotiated contracts and to deferred instalments on players and performance related fees the club thinks will become payable in the future (in all approx. £30m). In the next year we estimate that some £15m net is due to go out, so that would leave us £65m of free and unspent cash

In our 1st September Q&A on the transfer window we made an allowance of £40m as the amount the Club could sensibly hold as a contingency to cover a rainy day or more specifically a season of not qualifying for the Champions League. . However, given the linkage in wages to UCL participation we think that £40m is too cautious and £25m is a fairer reserve so that would leave £40m still free to spend in January.

The Club however are now briefing that there is only £20m to spend this Winter. They have been unable to clarify why this is the case telling us they cannot explain exactly why without letting all shareholders know.

This subject was raised at the recent AGM, and Chief Executive Ivan Gazidis referred generally to “superficial analysis” but then failed to provide any explanations. He did raise an issue of the Club having £30m of longer term payables on player purchases as a reason for keeping more cash back now. Our reaction to this is one of surprise. If the Club feel the need to withhold cash for amounts due in two or three years time when they have future operating surpluses and rising revenue streams to help pay for them, then why not also reserve now against more of the Stadium debt or next year’s wages?

To us, based on our own years of commercial experience running our own company’s, that seems excessively prudent.

5 Whilst we appreciate the commercial sensitivity surrounding spare cash for transfers, its inevitable fans want to understand what funds are available and we try and do this in an informed a way as possible, based on the actual report and accounts.

If over optimistic estimates really are an issue for Arsenal’s board, we encourage Arsenal to help all fans and shareholders alike understand exactly why so much money needs to be held in reserve by explaining more fully in the company’s annual report and accounts what working capital will be required in the coming financial year. However, in reality, that is something they just will not do as transfer budgets are so sensitive due to Arsene Wenger’s handling of the squad depth.

For simplification we set out in this table our view of Arsenal’s current cash position:

Cash £208m Debt Service £35m Working capital £20m

Net player payments £16m due 2014/15 CL Contingency £25m Spare Cash £112m Net spent – summer 14 £70m Residual Cash £42m

We believe our analysis is correct and it is interesting that another widely read and valued independent report on Arsenal’s finances by the blogger Swiss Ramble comes to the same conclusions as us.

Accordingly, the AST estimates that the spare cash available for investment in the squad in January is approximately £42m. Further additional investment will be possible in the summer of 2015 as long as Arsenal qualify for the Champions League for the 2015-16 season.

The AST remains very frustrated that with such resources available further additions weren’t made to the squad in key positions. It now remains to be seen whether running such a small squad in these positions will prove costly to Arsenal’s title ambitions this season.

Overall financial performance: what does it mean for Arsenal?

Arsenal have pointedly drawn comparisons to Bayern Munich, and now also to Chelsea, and the accounts demonstrate that Arsenal have even more resources available to compete – even if they aren’t all utilised. The accounts emphasise that now it is about maximising the efficiency of spend and by inference not blowing wages and fees on injudicious buys, so the manager’s ability is now firmly and unequivocally in the spotlight.

As regard the wider issue of finances at the club, it is now clear that the majority owner, whilst backing the self-sufficiency model (which means he hasn’t and will not put a penny into Arsenal), is not averse to withdrawing surplus funds for his own benefit.

This breaks the principle of Custodianship and the much trumpeted self-sustainability values and we therefore hope, but do not expect, that it will only be a one-off occurrence.

6