Ms. Cameron BAT4M Unit 2: Assets Chapter 8: Meigs

Receivables

consist of the money owed to a business can be created by simply writing out an invoice and delivering, or mailing it to a customer. As they are usually collected in 30 to 90 days, receivables are: o considered liquid assets o found on the balance sheet under current assets. o key factor in a business’s liquidity --- its ability to pay its bills without additional revenues or selling fixed assets.

Receivables have three general categories . Accounts Receivable . Notes Receivable . Other

Accounts Receivable and Notes Receivable

Accounts Receivable Notes Receivable The money owed by customers on account A written promise to pay a specified amount of money Money owed by customers for goods or services on demand or at a specified time provided on credit Used for large amounts for 30 to 90 days, Usually collected in 30 days Usually requires the debtor to pay interest Very liquid Very liquid Appears after Cash or Cash equivalents on the Appears after Accounts Receivable on the Balance Balance Sheet Sheet Current Asset Current Asset or Long-term Assets based on due date

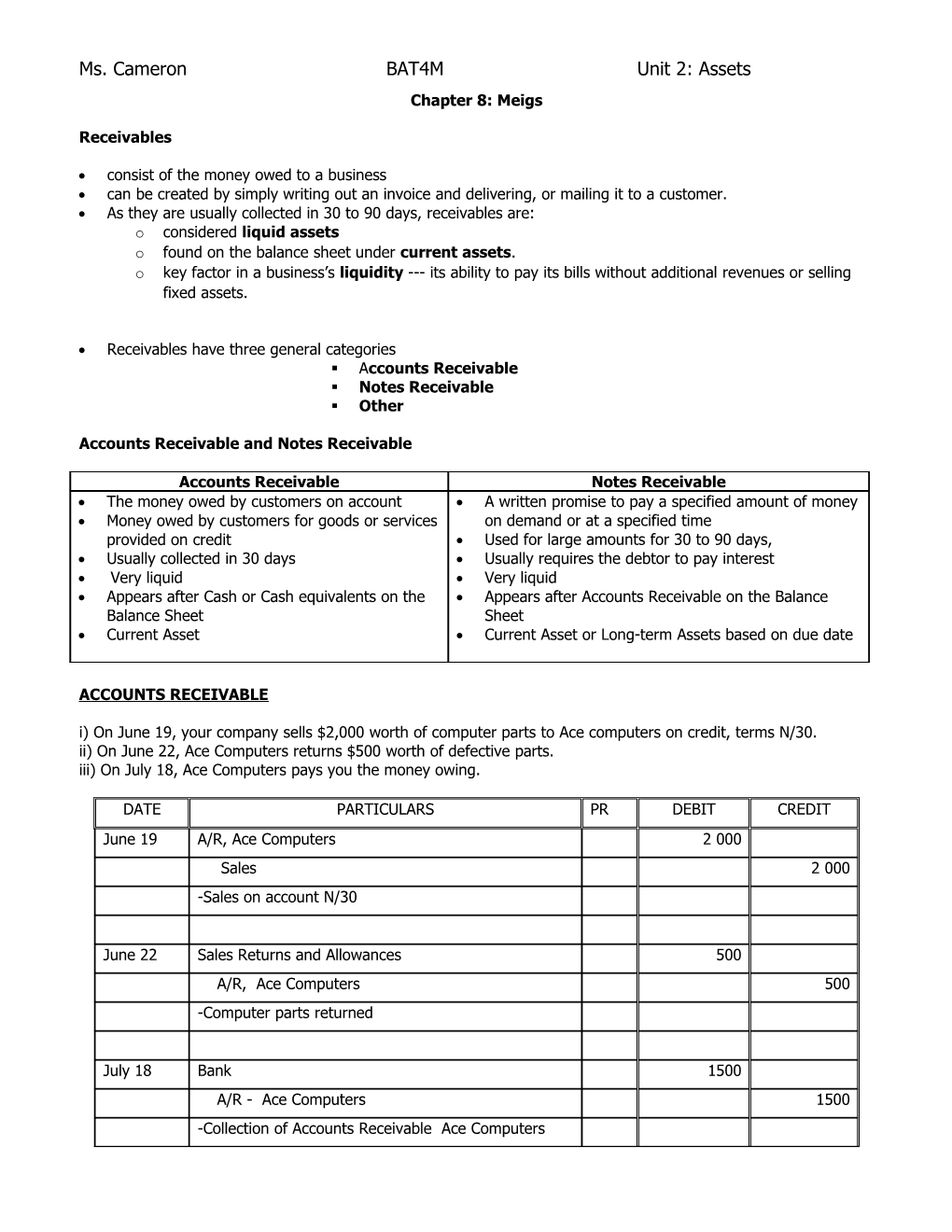

ACCOUNTS RECEIVABLE i) On June 19, your company sells $2,000 worth of computer parts to Ace computers on credit, terms N/30. ii) On June 22, Ace Computers returns $500 worth of defective parts. iii) On July 18, Ace Computers pays you the money owing.

DATE PARTICULARS PR DEBIT CREDIT June 19 A/R, Ace Computers 2 000 Sales 2 000 -Sales on account N/30

June 22 Sales Returns and Allowances 500 A/R, Ace Computers 500 -Computer parts returned

July 18 Bank 1500 A/R - Ace Computers 1500 -Collection of Accounts Receivable Ace Computers Ms. Cameron BAT4M Unit 2: Assets

Other Receivables

Other Receivable are amounts owed to a business that do not result from sales transactions.

Examples are: Interest Receivable Recoverable taxes Amounts owing on account from private persons o A pay advance o Loan to an executive

Interest Receivable

Recording accounts receivable transactions is a simple process. However, customers do not always pay in full in the specified time. What happens then? Let’s work through another scenario with Ace Computers.

Ace Computers is both retail and a wholesale operation, they sell merchandise on account to other small retailers. On May 1, Ace sold $10 000 worth of computers to Cheng Computers, the invoice indicated terms N/30. Like most retailers, Ace adds interest changes to the balance if the customer does not pay in the specified period.

However, rates can vary, Ace charges 18% per year. Cheng computers will be charged $150 per month ($10 000 x .18 ÷ 12).

General Journal, Ace Computers General Journal Date Description PR Dr. Cr. May 1 A/R, Cheng Computers 10,000 Sales. 10,000 Sales on account N/30

June 1 Interest Receivable, Cheng Computers 150 Interest Revenue 150 To record interest on amount due

Transactions related to Accounts Receivable - Bad Debts

Sales on account allow a business to increase their sales. Businesses realize that they will never collect some of the receivables; this is just a cost of doing business. A bad debt is an A/R that the business will never collect.

In an accounting system, the entries for uncollectible receivables must be done in accordance with Generally Accepted Accounting Principles (GAAP).

The accrual basis of accounting requires that you recognize income at the time of the sale.

The Revenue Recognition Principle states revenue must be recognized in the accounting period it is earned.

The Matching Principle requires that expenses be recognized at the same time as the revenue they support. Ms. Cameron BAT4M Unit 2: Assets The Principle of Conservatism requires that when choosing between indefinite amounts in asset valuation we choose the lower range that is least likely to overstate assets and net income.

The Materiality Principle requires accountants to adhere to GAAP except when to do so would be exorbitantly expensive or difficult, and where there is no real difference if the rules are ignored.

The nonpayment of receivables is a normal cost (expense) of doing business on credit. A business must account for uncollectible receivables according to GAAP. Remember, expenses must be accounted for in the same time period as the revenue they support.

How is this going to happen?

A business does not know that a receivable will be uncollectible in the month of the sale. If they did, the business would not sell to that customer on credit. The Revenue Recognition Principle requires that you must recognize your income at the time of the sale. While, the Matching Principle requires that an expense be matched to the revenue it supports.

Even though there is a time lag between when a sale is made on credit and when the business recognizes the account is a bad debt, that expense should be recognized in the same period as the sale. What a business must do is match the bad debts to the sales by estimating the amount of bad debts. Bad debts are estimated and recorded to match revenue and expense in the same time period as the sale.

As you know, the estimate is not a true figure. Ace Computers does not know which actual customer accounts will be uncollectible. Ace Computers cannot reduce specific customer accounts by the amount of the estimated Bad Debt Expense. The solution is to credit a separate account with the amount estimated to be uncollectible.

The accounting entry required creates a contra accounts receivable or valuation account called one of the following:

Allowance for Doubtful Accounts *use this one with Meigs text Allowance for Bad Debts Allowance for Uncollectibles

This contra assets account appears on the balance sheet directly after accounts receivable as a deduction for the accounts receivable account. This process gives a clear picture of the balance sheet value of the accounts receivable at statement date.

Ace Computers Balance Sheet (partial) December 31, 2006 Current Assets Cash $ 39 420.00 Accounts Receivable $285 175.09 Less: Allowance for Doubtful Accounts 5 088.20 280 086.90* Merchandise Inventory 910 000.00

*$280 086.90 is the Net Realizable Value for the Accounts Receivable: NRV = value of an asset that can be realized by a company or entity upon the sale of the asset, less the estimated amount uncollectible. Ms. Cameron BAT4M Unit 2: Assets METHODS OF ESTIMATING BAD DEBTS:

1. Allowance Method

The allowance method gauges receivables not expected to be collected. A business usually does not know which accounts receivable they will not collect. The credit manager looks at the amount of receivable still uncollected at the end of the period and estimates what percentage is uncollectible based upon past experience and current business conditions.

One method of establishing this percentage is to use the actual write-off amount of the pervious year and divide it by the total credit sales in the previous year.

To use this method, the credit manager for Ace Computers looks at his last year’s total figures.

1. He looks at the total figure for the accounts that the business was unable to collect last year, our example below shows $5088.20.

2. Then, he divides this figure by the year’s total sales, $285 175.09.

3. This gives him the percentage of receivables that the business was unable to collect in the previous year of 1.78%

Actual total Write-Off 2006 $ 5 088.20 Total Accounts Receivable Sales 2006 285 175.09 Actual Write-0ff % = (5088.20 ÷ 285 175,09) 1.78%

4. Now the credit manager multiplies the credit sales reported in the June by the actual write-off percentage for last year to estimate the bad debt expense for June.

Accounts Receivable Sales in June 2007 $ 26 619.33 Estimated Allowance % .0178 June 2007’s Bad Debt Expense = (26 619.33 x .0178) 473.82

5. The debt, once it is deemed uncollectible, is written off by the business as an expense. Ace Computers General Journal, June 2007

General Journal Date Description PR Dr. Cr. June 30 Bad Debt Expense 473.82 Allowance for Doubtful Accounts 473.82 To record accounts receivable estimated to be uncollectible

Writing Off an Uncollectible Accounts Receivable

When the specific (customer) accounts receivable account is deemed uncollectible, the account should no longer be considered an asset and is removed from the books by: DR. Allowance for Doubtful Accounts CR. Accounts Receivable – Client Name

When a particular A/R is later determined uncollectible, this does not represent an additional expense, it merely confirms our previous estimate. Writing off an A/R does not change the NRV of A/R on the Balance Sheet. Ms. Cameron BAT4M Unit 2: Assets Example: Ace Computers has decided the J. Grayson account is uncollectible.

Ace Computers

General Journal Date Description PR Dr. Cr. Sept 30 Allowance for Doubtful Accounts 225 Accounts Receivable, J. Grayson 225 To write off accounts receivable from J. Grayson as uncollectible.

Only balance sheet accounts are affected here. Accounts Receivable and Allowance for Doubtful Accounts. The NRV of Accounts Receivable stays the same.

Accounts Receivable Allowance for Doubtful Accounts Sept 30 Balance $150 000 Dr Sept 30 Balance $2 550 Cr before write-off before write-off Sept 30 write-off 225 Cr Sept 30 write-off 225 Dr 149775 Dr 2325 Cr The NRV of the Accounts Receivable stays the same. Before write-off: Acc. Rec. Dr. – Allowance for Doubtful Accounts Cr. 150 000 -2 550 = 147 450 After write-off: Acc. Rec. Dr. – Allowance for Doubtful Accounts Cr. 149 775 – 2325 = 147 450

What to do if a previously written-off A/R pays? J. Grayson calls to say that his financial picture is improving and he is going to pay his debt.

It is a two-step process for Ace Computers to update their accounting records:

Step 1 Reverse entry to write off the account and reinstate customer.

Step 2 Record payment as per usual method.

Ace Computers General Journal Date Description PR Dr. Cr. Nov. 1 Accounts Receivable, J. Grayson 225 Allowance for Doubtful Accounts 225 To reinstate J. Grayson account earlier written off

Nov 1 Bank 225 Accounts Receivable, J. Grayson 225 Payment of account Ms. Cameron BAT4M Unit 2: Assets

Allowance Method and GAAP

By using the Allowance Method for calculating bad debt, the income statement will comply with the Revenue Recognition and Matching Principle --- revenue is recognized when earned and matched with the expenses used to generate that revenue.

The Principle of Conservatism, one of the basic concepts underlying reliable financial records, requires that we value assets at the most conservative figure we can logically support.

Allowance for Doubtful Accounts enables the accountant to value assets at a conservative figure. It is a contra asset account with a credit balance. An adjusting entry at the end of each accounting period offsets the receivables account to give a conservative assessment of the asset that the accountant can logically support.

EXAMPLE: Each (month) uncollectible amounts should again be estimated and there should be an adjusting entry to bring the allowance account to the new estimated amount:

Previous bal: Allowance for Doubtful Accounts= $6000 CR

New Estimate: $11 000 of A/R likely uncollectible

To bring Allowance for D. A to $ 11 000:

DR. Bad Debts Expense (Uncollectible Accounts Expense) $5000 CR. Allowance for Doubtful Accounts $5000

2. Direct Write-off Method

Uncollectible accounts can be recorded through the allowance method or the direct method.

Some businesses do not recognize uncollectible accounts until the specific receivable is believed to be uncollectible. The direct-write off method does not attempt to match revenue and expense. Nor does it reflect the conservatism principle. The accounts receivable will appear on the balance sheet without any reduction for uncollectibles.

In some circumstances, the direct method is an acceptable form of accounting:

1. The business generates most of its revenue through cash sales.

2. The amount of accounts receivable is minor.

3. The expense from uncollected accounts is trivial.

4. The direct write off method does not have a material effect on the net income. The Materiality Principle is in effect here.

EXAMPLE: Let’s look at an example of such a company. Pulscom designs and manufactures plasma screens. They normally sell to a few large distributors on a cash on delivery (COD) basis. Their product is unique so they are in a position to dictate the terms. In the past Pulscom has never had a collection problem. They use the direct write off method. On December 1, Pulscom sells $100 worth of components to another manufacturer on account. By March 1, the debt becomes uncollectible. It is such a small portion of their sales, Pulscom writes off the debt. Ms. Cameron BAT4M Unit 2: Assets General Journal Date Description PR Dr. Cr. 2006 Dec. 1 Accounts Receivable, Moore Parts 100 Sales 100 Item # 50082 on account

2007 March 1 Bad Debt Expense 100 Accounts Receivable, Moore Parts 100 To write off Moore Parts account

ESTIMATING CREDIT LOSSES

i) Balance Sheet Approach

Called such as this method emphasizes proper B/S valuation of A/R

Estimate is determined by Aging the A/R (classifying according to age and assigning % uncollectible)

Estimated Uncollectible Accounts Receivable Age Group Total % Estimated Uncollectible A/R Uncollectible Not yet due $6 400 2% $128.00 1-30 days 10 000 5% $500.00 31-60 days 13 500 6% 810.00 61-90 days 8 200 7% 574.00 Over 90 days 10 600 10% 1060.00 TOTALS $3 072.00

Therefore at the end of the current month, this company needs to have $3 072 CR Bal in Allowance for Doubtful Accounts.

Adjusting Entry: Imagine the balance prior to this estimate in Allowance for D. A. is $2 000. Ms. Cameron BAT4M Unit 2: Assets Required Entry:

DR Bad Debts Expense (Uncollectible Accounts Expense) 1 072 CR Allowance for Doubtful Accounts 1 072 -adjusting entry to increase balance to $3 072.

ii) Income Statement Approach

Based on past experience, the Bad Debts Expense (Uncollectible Accounts Expense) is estimated as a percent of net credit sales.

Example:

Company estimates that 2% of Net Credit Sales will be uncollectible based on past experience. This month’s net credit sales total $150 000.

Adjusting Entry:

*under this method the allowance is CR (and the expense is DR) for the FULL AMOUNT OF THE ESTIMATE—no consideration is given to any prior balance in Allowance for Doubtful Accounts

DR Bad Debts Expense (or Uncollectible Accounts Expense) 3 000 CR Allowance for Doubtful Accounts 3 000 -to record uncollectible accounts expense, 2% of net credit sales