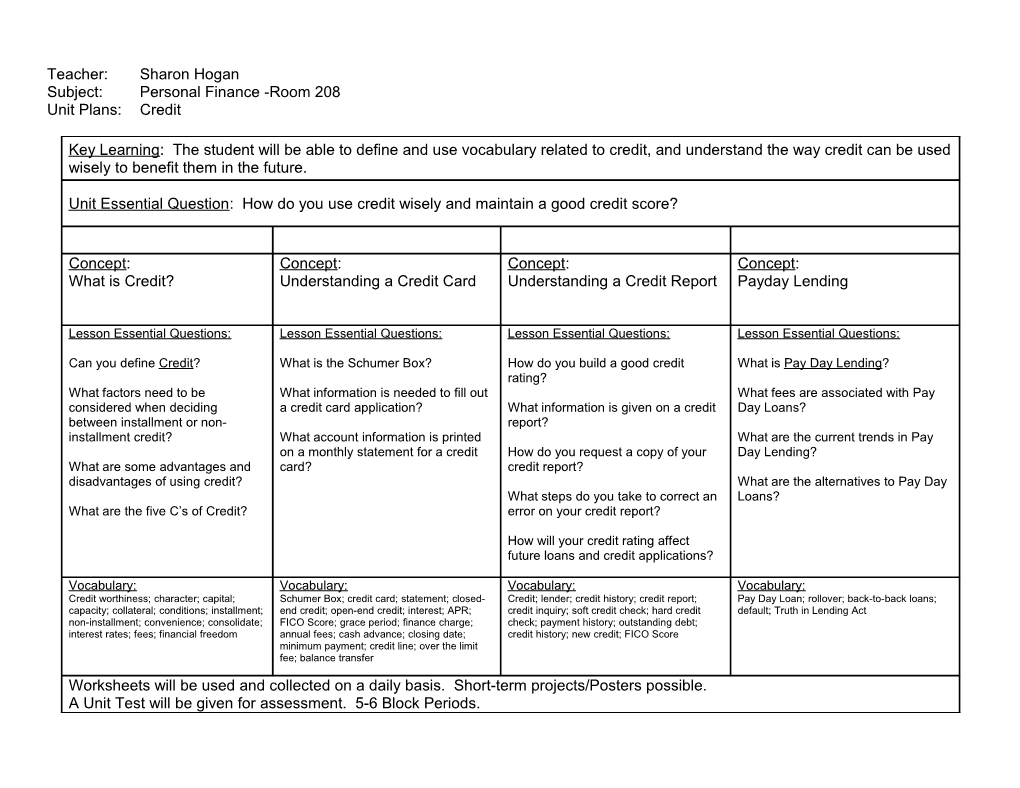

Teacher: Sharon Hogan Subject: Personal Finance -Room 208 Unit Plans: Credit

Key Learning: The student will be able to define and use vocabulary related to credit, and understand the way credit can be used wisely to benefit them in the future.

Unit Essential Question: How do you use credit wisely and maintain a good credit score?

Concept: Concept: Concept: Concept: What is Credit? Understanding a Credit Card Understanding a Credit Report Payday Lending

Lesson Essential Questions: Lesson Essential Questions: Lesson Essential Questions: Lesson Essential Questions:

Can you define Credit? What is the Schumer Box? How do you build a good credit What is Pay Day Lending? rating? What factors need to be What information is needed to fill out What fees are associated with Pay considered when deciding a credit card application? What information is given on a credit Day Loans? between installment or non- report? installment credit? What account information is printed What are the current trends in Pay on a monthly statement for a credit How do you request a copy of your Day Lending? What are some advantages and card? credit report? disadvantages of using credit? What are the alternatives to Pay Day What steps do you take to correct an Loans? What are the five C’s of Credit? error on your credit report?

How will your credit rating affect future loans and credit applications?

Vocabulary: Vocabulary: Vocabulary: Vocabulary: Credit worthiness; character; capital; Schumer Box; credit card; statement; closed- Credit; lender; credit history; credit report; Pay Day Loan; rollover; back-to-back loans; capacity; collateral; conditions; installment; end credit; open-end credit; interest; APR; credit inquiry; soft credit check; hard credit default; Truth in Lending Act non-installment; convenience; consolidate; FICO Score; grace period; finance charge; check; payment history; outstanding debt; interest rates; fees; financial freedom annual fees; cash advance; closing date; credit history; new credit; FICO Score minimum payment; credit line; over the limit fee; balance transfer Worksheets will be used and collected on a daily basis. Short-term projects/Posters possible. A Unit Test will be given for assessment. 5-6 Block Periods. Teacher: Sharon Hogan Subject: Personal Finance -Room 208 Unit Plans: Credit

Date Activity What is Credit? 10/9/13 Advantages and Disadvantages of Credit worksheet.

Understanding a Credit Card 10/10/13 Vocabulary sheets 10/10/13 Credit Card Offer Scavenger Hunt 10/9/13 Packet of Three Credit Card Offers

10/15-16/13 PowerPoint Presentation with Note-taking Guide for students (59 slides) 10/16/13 Information Sheets

10/17/13 Stock Market Project – five spreadsheets with charts completed are due.

10/18/13 Understanding a Credit Card Statement - Worksheet 10/18/13 Comparison Shopping for a Credit Card (students need to reuse packet of three credit card offers)

10/21/13 QUIZ - Understanding a Credit Card (Open Note)

10/22, 10/24, Half-periods in computer lab to finish stock market presenations. 10/25 Teacher: Sharon Hogan Subject: Personal Finance -Room 208 Unit Plans: Credit

Understanding a Credit Report 10/21-22/13 PowerPoint Presentation with Note-taking Guide for students (59 slides) 10/21/13 Isabella Langley’s Story – Used throughout the PPt Presentation 10/22/13 Information Sheets 10/23/13 Credit Report Scenario – Carolina Blue 10/23/13 QUIZ - Credit Reports (Open Note)

Payday Lending 10/23-24/13 PowerPoint Presentation with Note-taking Guide for students 10/24/13 Information Sheets 10/24/13 PayDay Lending Hazard – Activity Sheet

10/25/13 QUIZ - PayDay Lending

10/25/13 Review for Final Exam

10/28-29/13 Stock Market Presentations

10/30/13 Final Exam