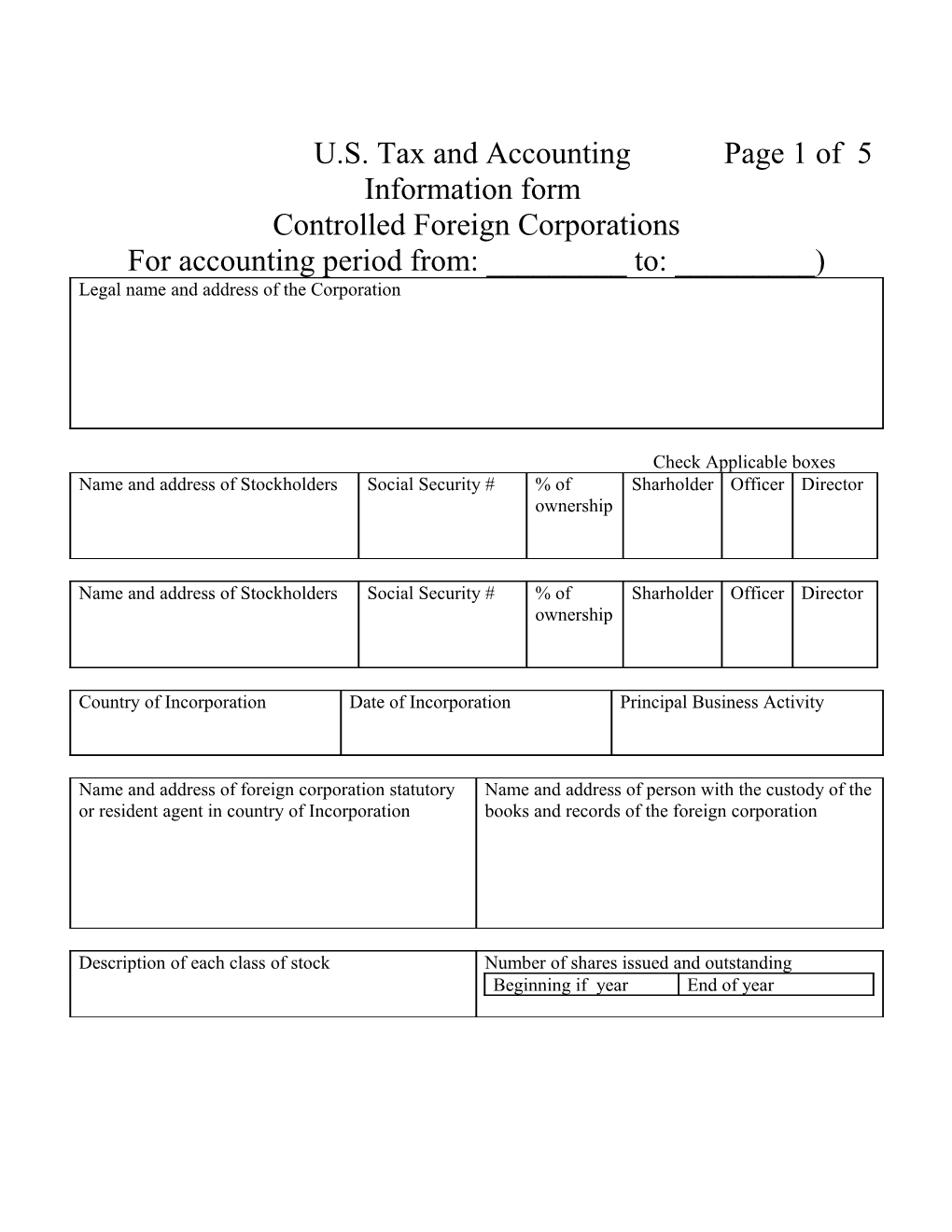

U.S. Tax and Accounting Page 1 of 5 Information form Controlled Foreign Corporations For accounting period from: ______to: ______) Legal name and address of the Corporation

Check Applicable boxes Name and address of Stockholders Social Security # % of Sharholder Officer Director ownership

Name and address of Stockholders Social Security # % of Sharholder Officer Director ownership

Country of Incorporation Date of Incorporation Principal Business Activity

Name and address of foreign corporation statutory Name and address of person with the custody of the or resident agent in country of Incorporation books and records of the foreign corporation

Description of each class of stock Number of shares issued and outstanding Beginning if year End of year Controlled Foreign Corporations page 2 of 5

Income Statement For accounting period From:______To:______.

Income Functional Currency U.S. Dollar

1)a Gross receipts or Sales b Returns and allowances c Subtract a from b 2) Cost of goods sold 3) Gross profit (Subtract line 2 from line 1c) 4) Dividends 5) Interest 6) Gross rents, royalties and license fees 7) Net gain or (loss) on Sale of capital assets 8) Other income (attach Schedule) 9) Total income ( add lines 3 through 8)

Deductions Functional Currency U.S. Dollar

10) Compensation not deducted elsewhere 11) Rents, Royalties and licenses fees 12) Interest Expense 13) Depreciation not deducted elsewhere 14) Depletion 15) Taxes 16) Other Deductions (attach schedule) 17) Total deductions (add lines 10 through 16)

Net income (Subtract line 17 from 9) Controlled Foreign Corporations page 3 of 5

Balance Sheet For period ending ______Assets Functional Currency U.S. Dollar Beginning of End of accounting Accounting period period 1) Cash 2) a Trade notes and accounts receivable b Less allowance for bad debts 3) Inventories 4) Other current assests (attach schedule) 5) Loans from shareholders and other related persons 6) Investment in Subsidiaries (attach schedule) 7) Other investments (attach schedule) 8) a Building and other depreciable assets b Less accumulated depreciable assets 9) a Depletable assets b Less accumulated depletion 10) Land (net of any amortization) 11) Intangable Assets: a Goodwill b Organization Costs c Patents, trademarks and other intangible assets d Less accumulated amortization for lines 11a,b, and c 12) Other assets (Attach schedule) 13) Total assets Liabilities and Shareholders’ Equity 14) Accounts payable 15) Other current liabilities (attach schedule) 16) Loans from shareholders and other related persons 17) Other liabilities (attach schedule) 18) Capital stock: a Preferred stock b Commom stock 19) Paid-in or capital surplus (attach reconciliation_ 20) Retained earnings 21) Less cost of treasury stock ( ) ( ) 22) Total liabilities and shareholder’s equity Controlled Foreign Corporations page 4 of 5

Other Information

Y No es Does the foreign corp. own 10% or more of any foreign partnership? Does the foreign corp. own an interest in any trust? Does the foreign corp. own any property or business in the United States?

During the year, did any U.S. Citizen increase or decrease their stock of the corporation? If yes please explain the details for the Acquisition and or Disposition of the Stock including purchase or sale dates.

If needed attach schedule

During the year did the Corporation sell, give or pay for any of the following items to it’s yes no Stockholders ? Or other Corporation or partnership controlled by the stockholder ? 1) Inventory 2) Property rights (patents, trademarks etc.) 3) Compensation received for technical, managerial or like service? 4) Commissions 5) Rents, royalties and license fees 6) Dividends received 7) Interest 8) Loan money or other property to the stockholder

For any yes responses, please explain details, dates and values on a attached schedule. Controlled Foreign Corporations page 5 of 5

During the year did you or any of your controlled partnerships or corporations sell, give or yes no pay for any of the following items to this Corporation ? Or other Corporation or partnership controlled by the stockholder ? 1) Inventory 2) Property rights (patents, trademarks etc.) 3) Compensation received for technical, managerial or like service? 4) Commissions 5) Rents, royalties and license fees 6) Dividends received 7) Interest 8) Loan money or other property to this corporation?

For any yes responses, please explain details, dates and values on a attached schedule.