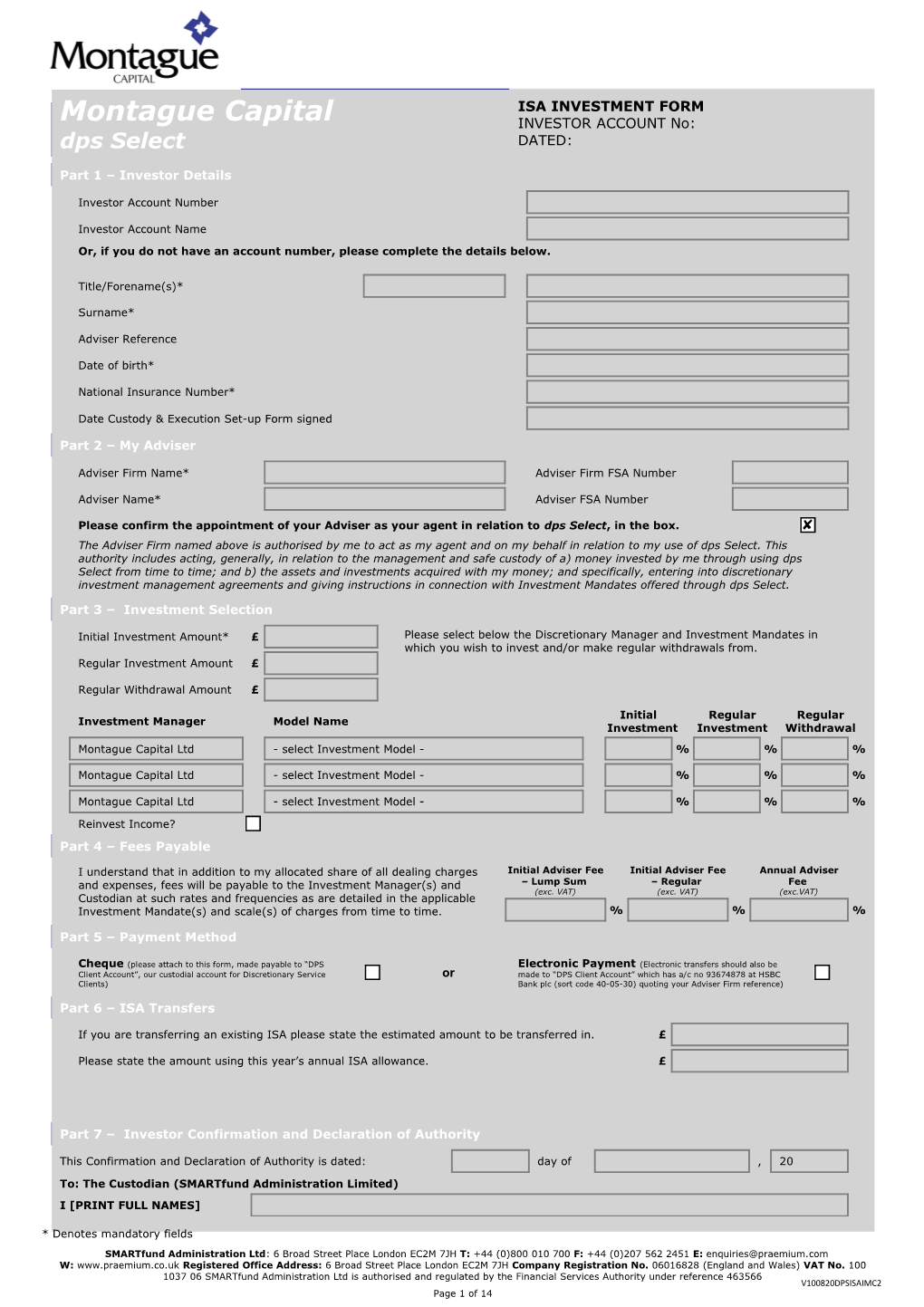

Montague Capital ISA INVESTMENT FORM INVESTOR ACCOUNT No: dps Select DATED:

Part 1 – Investor Details

Investor Account Number

Investor Account Name Or, if you do not have an account number, please complete the details below.

Title/Forename(s)*

Surname*

Adviser Reference

Date of birth*

National Insurance Number*

Date Custody & Execution Set-up Form signed

Part 2 – My Adviser

Adviser Firm Name* Adviser Firm FSA Number

Adviser Name* Adviser FSA Number

Please confirm the appointment of your Adviser as your agent in relation to dps Select, in the box. The Adviser Firm named above is authorised by me to act as my agent and on my behalf in relation to my use of dps Select. This authority includes acting, generally, in relation to the management and safe custody of a) money invested by me through using dps Select from time to time; and b) the assets and investments acquired with my money; and specifically, entering into discretionary investment management agreements and giving instructions in connection with Investment Mandates offered through dps Select.

Part 3 – Investment Selection

Initial Investment Amount* £ Please select below the Discretionary Manager and Investment Mandates in which you wish to invest and/or make regular withdrawals from. Regular Investment Amount £

Regular Withdrawal Amount £

Initial Regular Regular Investment Manager Model Name Investment Investment Withdrawal

Montague Capital Ltd - select Investment Model - % % %

Montague Capital Ltd - select Investment Model - % % %

Montague Capital Ltd - select Investment Model - % % % Reinvest Income? Part 4 – Fees Payable

I understand that in addition to my allocated share of all dealing charges Initial Adviser Fee Initial Adviser Fee Annual Adviser and expenses, fees will be payable to the Investment Manager(s) and – Lump Sum – Regular Fee (exc. VAT) (exc. VAT) (exc.VAT) Custodian at such rates and frequencies as are detailed in the applicable Investment Mandate(s) and scale(s) of charges from time to time. % % %

Part 5 – Payment Method

Cheque (please attach to this form, made payable to “DPS Electronic Payment (Electronic transfers should also be Client Account”, our custodial account for Discretionary Service or made to “DPS Client Account” which has a/c no 93674878 at HSBC Clients) Bank plc (sort code 40-05-30) quoting your Adviser Firm reference)

Part 6 – ISA Transfers

If you are transferring an existing ISA please state the estimated amount to be transferred in. £

Please state the amount using this year’s annual ISA allowance. £

Part 7 – Investor Confirmation and Declaration of Authority

This Confirmation and Declaration of Authority is dated: day of , 20 To: The Custodian (SMARTfund Administration Limited)

I [PRINT FULL NAMES]

* Denotes mandatory fields

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 V100820DPSISAIMC2 Page 1 of 14 declare that the Investment Manager(s) (each an “Investment Manager”) named in Part 3 of this Initial Investment Form (this “Form”) has full authority on my behalf to give instructions and otherwise deal with the investments and assets (including, if applicable, in respect of my dps Select ISA) held under the Investment Mandate(s) to which this Form relates (the “Mandate(s)”) including, without limitation:

a) to debit such accounts with you as the Investment Manger shall in its discretion deem expedient (and, if applicable, transfer to my dps Select ISA) subscription amounts up to the maximum permitted for any Tax Year, selling investments where necessary to ensure that cash is available for this purpose; b) to receive all notices, demands or other communications from or by you in relation to the investments and assets held under the Mandate(s); c) to instruct you to carry out any transactions with or for me in relation to the investments and assets held under the Mandate(s), and to do all other things which may be necessary or desirable to give effect to such transactions; d) to give instructions generally in relation to the investments and assets held in my dps Select ISA under the Mandate(s) and any other Individual Savings Account(s) (ISAs) I may have from time to time; and e) generally to execute and sign in my name and on my behalf all deeds or documents which may be required and to do any other act, matter or thing which the Investment Manager(s) shall consider necessary or expedient in acting under the authority conferred by this declaration of authority or, where applicable, the dps Select Investment Management Terms. PROVIDED THAT the Investment Manager(s) shall have no power (other than as may be necessary in order to act under the authority conferred by this declaration of authority or, where applicable, the dps Select Investment Management Terms):

a) to withdraw or obtain delivery from you of any property whatsoever held by you on my behalf, save for the Investment Manager’s fees as detailed in its scale of charges provided to you from time to time; b) to draw cheques on any account(s) for the time being opened in my name with you nor to give any other orders or instructions for payment out of any such account nor to withdraw any monies standing to the credit of any such account; c) to agree with you for advances to me by way of loan, overdraft, discount or in any other manner with or without any guarantee or other security; to instruct you to give any guarantee, indemnity or counter-indemnity in favour of any person or company for any amount or in respect of any indebtedness or liability; or to mortgage, charge, pledge and deposit any property belonging to me as security in respect of any advance or other indebtedness or liability. I CONFIRM THAT:

I have received advice from the Adviser Firm named in Part 2 of this Form (the “Adviser”) in relation to the Mandate(s) to which this Form relates; I have instructed the Adviser to act as my agent and on my behalf to deal with my dps Select ISA generally and, where applicable, to accept the Investment Manager’s offer of portfolio management services under the Mandate(s) for an investment of the amount(s) stated in Part 3 of this Form; I have irrevocably authorised you to acquire and dispose of investments and assets held in my dps Select ISA in accordance with the instructions of the Investment Manager(s) in the same way as if those investments and assets were managed by them through dps Select but were held outside of an ISA; I am bound by the dps Select Custody & Execution terms and conditions and make the representations and give the warranties contained in those Terms; All reports, statements and valuations relating to my Portfolio may be sent to the Adviser in accordance with those Terms; I have read and understand the Money Laundering requirements set out in those Terms. I understand that SMARTfund Administration Ltd may need to use credit reference/information agencies in order to satisfy their statutory money laundering obligations. These agencies may keep a record of such enquiries; and The information provided on this Form is correct and complete to the best of my knowledge.

I understand that the data, including the personal information, contained in this form will be collected and processed in accordance with the Data Protection statement as set out in the dps Select Custody & Execution Terms. For the purposes of the Data Protection Act 1998, the data controller in relation to any personal data supplied by myself is SMARTfund Administration Ltd. Information I or the Adviser supply may be processed for the purposes of investment administration by any company within the same group as SMARTfund Administration Ltd, by any third parties who provide services to members of that group and by the Investment Manager(s) and companies within their respective groups, and such processing may include the transfer of data out of the European Economic Area.

I undertake to ratify everything that the Adviser or Investment Manager(s) may do or purport to do under or because of this Declaration of Authority or the dps Select Investment Management Terms.

This Declaration of Authority is a deed and has been executed as a deed. This Declaration of Authority is governed by and will be construed in accordance with English law and I submit for your benefit to the jurisdiction of the English Courts. Nothing in this clause limits your right to take any legal action or proceeding in any other court of competent jurisdiction. Executed and delivered as a deed

Signature* Date*

Witness

Signature* Date*

Name*

Address Line 1*

Address Line 2

Town/City*

Country* Post Code* Part 8 – Investor ISA Declarations and Signature

* Denotes mandatory fields

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 V100820DPSISAIMC2 Page 2 of 14

I am resident and ordinarily resident in the United Kingdom for tax purposes, or if not so resident either perform duties which, by virtue of Section 28 of the Income Tax (Earnings and Pensions) Act 2003 (Crown employees serving overseas), are treated as being performed in the United Kingdom, or be married to, or in civil partnership with a person who performs such duties, and will inform SMARTfund Administration Ltd if I cease to be so resident and ordinarily resident, or to perform such duties, or be married to, or in a civil partnership with a person who performs such duties.

All subscriptions made, and to be made, to the dps Select ISA belong to me and I am the beneficial owner of the assets being used for this ISA.

I understand that the transfer of my existing ISA may be delayed if this Transfer Form is not complete in all respects.

I declare that for each new ISA investment:

I have not subscribed and will not subscribe more than the permitted annual subscription in total to a Cash ISA and Stocks and Shares ISA, in the same tax year;

I have not, and will not, subscribe to another Stocks and Shares ISA in the same tax year that I subscribe to this Stocks and Shares ISA.

I apply to subscribe for a dps Select ISA, which is a Stocks & Shares ISA, for the Current Tax Year and each subsequent year until further notice.

I authorise SMARTfund Administration Ltd, as ISA Plan Manager:

To receive and hold my cash subscriptions, ISA investments, interest, dividends and any other rights, or proceeds in respect of those investments and any other cash in my dps Select ISA. On my written request or on the request of my agent or attorney to transfer or pay to me, as the case may be, account investments, dividends, rights or other proceeds in respect of such investments, or any cash, held in my dps Select ISA account. To make on my behalf any claims to relief from tax in respect of account investments. To accept on my behalf the instructions of the Investment Manager(s) named in Part 3 of this Initial Investment Form as if those instructions were given by me and with my authority in relation to my dps Select ISA.

By signing this application form I confirm that:

I agree to each of the statements listed above; I am over 18 years of age; and

the information I have provided is correct and complete to the best of my knowledge.

Investor and ISA Applicant: Name*

Signature* Date*

Part 9 – Direct Debit Form

Name and full postal address of your Bank Originator’s Identification Number:

To the Manager: 249843

Bank Address Ref. Number (office use only)

Instruction to your Bank

Please pay SMARTfund Administration Ltd Direct Debits from the account detailed in this Instruction subject to the safeguards assured

by the Direct Debit Guarantee. I understand that this Instruction may remain with SMARTfund Administration Ltd and, if so, details will be

passed electronically to my Bank.

Name of Account Holder(s)

Sort Code* Account number* Signature:

Date:

The Direct Debit Guarantee - This guarantee should be detached and retained by the Payee.

This Guarantee is offered by all Banks and Building Societies that take part in the Direct Debit Scheme. The efficiency and security of the Scheme is monitored and protected by your own Bank or Building Society. If the amounts to be paid or the payment dates change SMARTfund Administration Ltd will notify you 30 working days in advance of your account being debited or as otherwise agreed. If an error is made by SMARTfund Administration Ltd or your Bank or Building Society, you are guaranteed a full and immediate refund from your branch of the amount paid. You can cancel a Direct Debit at any time by writing to your Bank or Building Society. Please also send a copy of your letter to SMARTfund Administration Ltd. Montague Capital ADVISER DECLARATION AND SUBMISSION FORM INVESTOR ACCOUNT No: dps Select DATED: * Denotes mandatory fields

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 V100820DPSISAIMC2 Page 3 of 14 Adviser Declarations and Signature

The Adviser acknowledges and accepts the Investment Mandate(s) referred to in Part 3 of the dps Select ISA Application Form (the “Mandate(s)”) to which this Adviser Declaration and Submission Form is attached (the “ISA Form”) and the dps Select Investment management Terms.

By signing below the Adviser confirms that:

The information provided on the ISA Investment Form is correct and complete to the best of its knowledge; The Investor named in Part 1 of the ISA Form (the “Investor”) is the Adviser’s client; The investment objective of the Investor for the amount(s) to be invested is as stated for the applicable Mandate(s); The Adviser has made the relevant suitability assessment and given a personal recommendation to the Investor in relation to the Mandate(s); The Adviser has the Investor’s authority for acting as their agent; The Adviser has read the dps Select Investment Management Terms and understands that they become binding on signature of this Form; and As agent for and on behalf of the Investor, the Adviser accepts each Investment Manager’s offer of discretionary portfolio management services in relation to the Investor’s dps Select ISA in accordance with the applicable Mandate(s).

Client Name*

Adviser Firm* Firm’s FSA No.

Adviser Name*

Signature* Date*

Attachments Checklist:

I attach a duly completed Individual Savings Account application form and confirm my client has signed:

the Investor Confirmation and Declaration of Authority

the Investor ISA Declarations and Signature

I attach the client’s signed and correctly completed cheque if applicable. (Incorrect cheques will delay the investment process)

The funds for the investment will be transmitted electronically on quoting your Adviser reference

and are expected to be available for investment on .

I attach the letter(s) signed by the client authorising the transfer of existing funds held within an ISA to SMARTfund Administration Ltd for the dps Select ISA, if applicable

This Adviser Declaration Form must be attached to and submitted with the signed ISA Investment Form (and cheque) and mailed to: SMARTfund Administration Ltd, PO Box 60294, London, EC2P 2DL

* Denotes mandatory fields

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 V100820DPSISAIMC2 Page 4 of 14 Montague Capital ISA TERMS dps Select

Please read this document and the dps Select ISA Application Form carefully.

These terms and conditions (the “dps Select ISA Terms” or “ISA Terms”), together with the ISA Application Form, are important legal documents that form the contractual agreement between you and SMARTfund Administration Limited as Plan Manager for the dps Select ISA.

Background

These Terms are divided into sections, as follows:

Section 1: (General) applies generally to dealings between you and us in relation to your dps Select ISA;

Section 2: (Definitions) applies generally throughout these Terms and ISA Application Form; and

Appendix: (Investment Risks) gives some general information on certain risks associated with investments.

When you sign the ISA Application Form you state that you have read and agree to these Terms and that you understand that they are binding on you.

The dps Select ISA is a “self select” ISA which means that the Investment Manager(s), acting as your agent, selects the Investments that are held through your dps Select ISA. You irrevocably authorise Us to acquire and dispose of investments and assets held in your dps Select ISA in accordance with the instructions of the Investment Manager(s) in the same way as if those investments and assets were managed by them through dps Select but were held outside of an ISA. We will provide execution-only services in relation to your dps Select ISA on the instructions of the Investment Manager(s) (acting on your behalf) in accordance with these Terms. Nothing in these Terms or the ISA Application Form is to be construed as appointing us as or of giving us the responsibility or functions of an investment adviser to you, dps Select or anyone else.

The dps Select ISA is available to those who invest through dps Select, who are 18 or over and are residents of the UK. It may also be available to certain other persons in limited cases (see clause 2.3 for details). By completing an ISA Application Form and accepting these Terms, you warrant that you are resident in the UK and otherwise eligible for a dps Select ISA.

You can subscribe to one dps Select ISA, which is a Stocks & Shares ISA, each Year. You cannot subscribe more than the current applicable HMRC investment limit in total to a Cash ISA and a Stocks & Shares ISA in the same tax year.

These Terms are issued by and, if you invest through a dps Select ISA, you will deal with SMARTfund Administration Limited as the Plan Manager of the dps Select ISA. SMARTfund Administration Limited is a member of the Præmium Limited group of companies.

Our agreement with you takes effect when you sign the ISA Application Form. Your dps Select ISA will begin with us when your first subscription is paid into your dps Select ISA. Any future subscriptions must comply with the ISA Regulations and these Terms.

dps Select ISA Terms Version: January 2010

SMARTfund Administration Limited PO Box 60294 Floor 6, London, EC2P 2DL

Tel: 0844 801 0700 Fax: 020 7562 2451 www.praemium.co.uk

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 Page 5 of 14 3. Payments & Client Money SECTION 1 – GENERAL DEALINGS 3.1 Payment for the full amount of your initial and subsequent subscription(s) must be 1. FSA & Client Classification made by:

1.1 We are authorised and regulated by the Financial Services Authority and are (a) bank transfer direct to our account with the details set out on the entered on the FSA register, registration number 463566. Our address is 6 Broad Street ISA Application Form. All wire transfers that are sent for the credit of your dps Place, London EC2M 7JH. These details can be verified on the FSA register by visiting the Select ISA should include your account number or equivalent reference with your FSA’s website at www.fsa.gov.uk/register/ or by contacting the FSA. The FSA's address is Adviser; 25, The North Colonnade, Canary Warf, London E14 5HS. (b) cheque made payable to “DPS Client Account”, the Custodian’s 1.2 As permitted by the FSA Rules, we will treat you as a “retail client”. client account that is used for dps Select ISAs) with your ISA Application Form. All cheques must be drawn on a personal UK bank/building society account in your own 2. Applying for a dps Select ISA name or one held jointly by you. We do not accept post-dated cheques; or,

2.1 If you are in any doubt as to the tax consequences of the acquisition, holding or (c) in the case of regular contributions, by completing the relevant disposal of Investments (whether held directly or through an ISA), you should consult sections of your ISA Application Form to allow us to submit an appropriate direct your Adviser or other appropriate professional adviser. debit instruction to your bank or building society.

2.2 An application to open a dps Select ISA must be made on the relevant hard copy 3.2 You understand that if you send cheques or other assets or documents by post, you ISA Application Form together with payment for the full amount of your initial do so at your own risk. We reserve the right to refuse to accept cheques that are subscription. An ISA Application Form may be obtained from us or generated from the payable to others, even if they have been endorsed in your favour. Præmium Platform by your Adviser. It is initially completed online but must then be 3.3 You must provide us with your personal account details at your bank, initially by printed for signature by you. completing your ISA Application Form. We will make all payments to you from your ISA

2.3 You are eligible to open a dps Select ISA if you are: directly to this account, rather than issue a cheque (except in exceptional circumstances and only if previously agreed by us). Payments will not be made to third parties. (a) resident in the UK; 3.4 When we make payments to your bank, we will use the most recent account details (b) aged 18 or over; and provided by you. We will not be liable for any delays, losses or costs if you provide incomplete or incorrect details or if you fail to advise us of any changes to your account (c) invest through dps Select. details or your circumstances that may affect payments we make to you. Clause 17.3 2.4 You cannot open an ISA jointly with anyone else. below will apply if such provision of incomplete or incorrect details or your failure to notify us of such changes causes us costs or losses. We may deduct any charges or other 2.5 We reserve the right to ask you to provide proof of your status and eligibility for a amounts due to us or the Investment Manager, any tax liabilities, and any additional dps Select ISA before we accept your Application. You may also be eligible to open a dps expenses incurred for which you are liable. Select ISA if you are a Crown employee working outside of the UK or you are married to, or in a civil partnership with, such a person. 3.5 Your cash contributions and any other cash held in your dps Select ISA will be held by us for you, pending investment, as client money under the FSA Rules. Consistent with 2.6 You must write and tell us if you cease to be eligible to apply for an ISA in the those FSA Rules: future. (a) we will deposit the cash in the UK with an authorised bank; and 2.7 You may invest one or more lump sums in your dps Select ISA during the Year. By (b) the bank will hold the cash on our behalf in a trust account completing the relevant sections of your ISA Application Form you may also make regular separate to any account used to hold money belonging to us in our own right. contributions by direct debit under a monthly savings plan. You will be sent an acknowledgement when you make a lump sum contribution or set up a monthly savings 3.6 We will not, however, be responsible for any acts or omissions of the bank. If the plan. bank becomes insolvent, we will have a claim on behalf of our clients (including you) against the bank. If, however, the bank cannot repay all of its creditors, any shortfall 2.8 When you apply to open a dps Select ISA, your Adviser (acting as your agent) will may have to be shared pro rata between them. select the appropriate Investment Mandate(s) to which your funds will be applied within your dps Select ISA. The Investment Manager(s) (appointed by the Adviser acting as 3.7 Interest will not be paid on cash balances held on your behalf unless otherwise your agent) will then specify the Investments(s) in which your dps Select ISA will be stated in these Terms. invested in accordance with the applicable Investment Mandate(s) in the same way as if those investments and assets were managed by them through dps Select but were held 4. Minimum subscription outside of an ISA. We will continue to acquire and dispose of investments and assets held in your dps Select ISA in accordance with the instructions of the Investment Manager(s) 4.1 The minimum subscription amounts for the dps Select ISA are as specified in the given in this way on your behalf. The regulatory obligation to assess suitability will be applicable Investment Mandate(s). discharged by your Adviser selecting the appropriate Investment Mandate(s) to which your funds will be applied. We and the Investment Manager will rely on the Adviser to 4.2 We may reduce or waive the minimum subscriptions at our discretion. have made a suitability assessment as required under the FSA Rules in relation to investment of your funds into the dps Select ISA and the selected Investment 5. Cancellation Mandate(s). 5.1 You have a right to cancel this Agreement within 14 calendar days of the date on 2.9 If you wish to open a dps Select ISA for the current tax year, your Application must which you sign the ISA Application Form (the “Cancellation Period”). However, under the be received by Us not later than five business days before the end of the tax year. The terms of Clause 24.1, you may also terminate this Agreement (without additional end of the tax year is 5 April of each year. This is due to the time required for the payment or penalty) at any time by giving us notice in writing. instruction to be processed and your subscription to be available in cleared funds for 5.2 Should you wish to cancel this Agreement, you need to send us notification of this investment through your dps Select ISA. in writing to our address as stated in clause 29. Exercising your right to cancel does not 2.10 If you wish to ensure that the first contribution of a monthly savings plan is made necessarily mean that you will receive back the amount that you invested or subscribed. in the current tax year you must ensure the relevant Application is received by us by the If you exercise any such cancellation right, you acknowledge that the value of your ISA end of February in that year. Applications where subscriptions are made in this way that and/or the amount you will get back in respect of any transactions effected or are received after the end of February will be processed as soon as practicable but the commenced in relation to your ISA will be reduced by any fall in value during the first payment may not be collected until after 5 April, in which case your dps Select ISA Cancellation Period as well as any applicable transaction costs. The investment risk would fall into the next tax year. therefore remains with you even if you cancel this Agreement.

2.11 Applications to open a dps Select ISA are irrevocable, once made, unless you have 5.3 If you choose not to exercise your right to cancel, this Agreement will remain in the right to cancel your Application – see clause 5. effect and binding on you until otherwise terminated in accordance with these Terms.

2.12 We may, subject to its obligations under the FSA Rules, reject any Application on 5.4 If you validly exercise your right to cancel, any money paid to us will be repaid reasonable grounds. If we do so, we will return to you any money sent, or the balance of (subject to deduction of the amount, if any, by which the value of the Investment(s) in such monies, at your risk. your dps Select ISA has fallen as well as any applicable transaction costs).

2.13 Subject to the ISA Regulations, your dps Select ISA will be managed as set out in 6. Your Account & the Investment Manager(s) your ISA Application Form and otherwise in accordance with the directions given by you or on your behalf by the Investment Manager(s). 6.1 When you first invest through dps Select the Custodian will open an Account for you. You will be able to access your Account online and view details of investment held 2.14 On acceptance of an Application, each new dps Select ISA will be designated by us through your dps Select ISA and a variety of investment reports. Access to the Præmium as a Stocks and Shares ISA. You may not open more than one Stocks and Shares ISA in Platform is subject to the provisions in Section 2 (Præmium Platform) of these Terms. the same tax year. 6.2 Your Adviser and the Investment Manager(s) selected by them as your agent will also have access to your Account and the information in it.

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 Page 6 of 14 6.3 Your Account is updated to reflect any transactions, charges, additional investments wish to discuss any Investment or risks associated with it you should contact your and withdrawals that affect your dps Select ISA. Adviser or other appropriate professional adviser.

6.4 The Investment Manager(s) acting as your agent (either generally as manager with 8.3 The Investment Manager(s) may also instruct us on your behalf to sell all or part of discretionary authority over your assets managed through dps Select or specifically in the Investment(s) held in your dps Select ISA and either to reinvest the proceeds in relation to your dps Select ISA) may give us instructions to engage in specific other Investments, or to hold the proceeds temporarily in cash pending re-investment. transactions to buy, sell or otherwise deal in securities and other assets held in your dps Any such Investments or cash will still be held within your dps Select ISA. Select ISA on your behalf in the same way as they give us instructions in relation to other investments managed under the relevant Investment Mandate(s). The Investment 8.4 All the Investments held in your ISA must be Qualifying Investments. Manager(s) will give us instructions in relation to your dps Select ISA by using the 8.5 Cash may only be held in your ISA for the purpose of investing it in Qualifying Præmium Platform. Investments. 6.5 We may identify your Account on the Præmium Platform by name, number, code or 8.6 If we are aware that any of your Investments are not Qualifying Investments or any combination. Your Account then provides the Investment Manager(s) with: cease to be Qualifying Investments we may at our sole discretion: (a) access to information about your dps Select ISA; and (a) sell them and pay the proceeds into your dps Select ISA; (b) a means of instructing us on your behalf. (b) transfer them into another account you hold with us to be held 6.6 You understand and acknowledge that you and the Investment Manager(s) retain outside an ISA; or full responsibility for making all investment decisions with respect to such transactions. (c) re-register them into your own name. We do not and will not provide advisory services in respect of your dps Select ISA or any such transactions; neither do we or will we provide any recommendations or assessment 8.7 We may charge you for taking any of these steps. as to suitability or merits of transactions. 8.8 Instructions to deal in Investments within your dps Select ISA may only be given in 6.7 You request and authorise us to accept and execute instructions from the accordance with clause 29.1. Investment Manager(s) in relation to your dps Select ISA which we may receive by any means including through the use of the Præmium Platform and/or email including, by 8.9 We will execute orders for you in accordance with instructions given on your behalf way of example and not by way of limitation, instructions for: by the Investment Manager(s) only in relation to Qualifying Investments that are:

(a) the payment of funds; (a) UK sterling denominated London Stock Exchange FTSE All-share listed equities; (b) the deduction of fees, costs or expenses due to us, the Investment Manager(s) or any third party; (b) UK sterling denominated ETFs and Ishares;

(c) the free delivery of cash or any others assets held in your dps (c) UK authorised OEICs and unit trusts; and Select ISA, to third parties. (d) such other securities as we may agree from time to time. 6.8 You undertake to ratify all such instructions upon which we may act if we ask you 8.10 We will only enter into transactions if instructed to do so. We will not advise you or to. the Investment Manager(s) or anyone else on the merits of any transaction and we are 6.9 We will have no duty to verify or check the information or instructions provided to not obliged to ensure any transaction is suitable for you. us by you, your Adviser or the Investment Manager(s) and we will, in all circumstances, 8.11 We will act on instructions given in relation to your dps Select ISA subject to your be entitled to rely on information provided by you, your Adviser or the Investment Application, the ISA Regulations and these Terms. Manager(s) when acting as Plan Manager or otherwise under this Agreement or our agreement with the Investment Manager(s). 8.12 We may refuse to act on any instruction if we consider it insufficiently clear in any respect or we reasonably believe it was not given by you or on your behalf or that you 6.10 You acknowledge that the use of electronic means (e.g. using internet access or may be unable to promptly settle any relevant transaction. We will take reasonable steps email) to access information or give instructions carries the risk of being intercepted, to notify you and the Investment Manager(s) in these circumstances. altered or otherwise subject to fraud by third parties, and that even acting with reasonable care and skill we may not detect such events. 8.13 When your dps Select ISA is opened, we will normally carry out written dealing instructions within 2 business days of receiving them, however, during periods of high 7. Transferring your existing ISA to Us volumes this may increase up to 5 business days.

7.1 You may transfer to your dps Select ISA an existing ISA from another ISA manager 8.14 If dealing instructions are sent to us by post to invest money held once your ISA in the form of cash. Any residual income arising from that existing ISA will be paid to has been opened, we will carry these out within 2 business days of receiving them. you by your former ISA manager. Alternatively, in certain limited circumstances and subject to the agreement of the existing ISA manager, we can re-register the underlying 8.15 When we execute transactions on your behalf, we will normally be required to investments of your existing ISA into your dps Select ISA. Re-registration may save you provide best execution, and, in doing so, we will comply with our execution policy. We certain costs which might be incurred if cash only were transferred but may result in the will use the brokerage services of our sub-custodian in accordance with our execution loss of (a) very small fraction(s) of share(s) or unit(s) (less than 0.01%). This small loss policy in order to execute orders in relation to your dps Select ISA. We review and will not be returned to you in any circumstances. If, following the re-registration of more update these arrangements as necessary and will tell you if and when we make a than one holding of shares or units, we receive an income payment, dividend, tax credit material change. or other cash amount from the former ISA manager, we may invest such amount in the largest Investment holding by value in your dps Select ISA. A charge may be made by 8.16 When an order to deal is placed, we will execute that order promptly and to your the existing ISA manager if the underlying shares or units are re-registered in this way. best advantage. We may execute deals for you as your agent and/or as principal, including in investments issued by our Associates or by mutual funds managed by us. We 7.2 If you transfer two or more ISAs from previous years to us, we may treat those may also rely on a third party broker to execute the order on our behalf. previous ISAs as relating to a single year (and will do so if the existing ISA manager has already bundled them in this way). 8.17 We may execute deals on your behalf outside of a regulated market or Multilateral Trading Facility (MTF). We will do so when we believe it is in your best interest to 7.3 We accept no liability for any loss caused in the transfer of investments or payment transact in this way. Reasons for doing so may include, but are not limited to, of funds to us. You must ensure that your existing ISA manager complies with improvements to the pricing or liquidity conditions that can be expected from trading in instructions for transfers. this way in the investment concerned.

7.4 Transfers from other ISA managers may take several months to complete; 8.18 In some circumstances and entirely at our sole discretion, we may accept specific however, you may still deal in Investments and cash we already hold in your dps Select execution instructions from the Investment Manager(s) on your behalf. If we agree to ISA during this period. execute in accordance with such instructions, it may not be possible for us to obtain the best result that would otherwise be available to you at the time of dealing using our own 8. Investments & dealing instructions dealing process. In providing a specific execution instruction to us, the dealing terms you receive may be adversely affected. 8.1 Your Investment Adviser(s) (acting on your behalf) must tell us which Investments to acquire and hold in your dps Select ISA. You irrevocably authorise Us to acquire and 8.19 When we execute an order for you, we will generally execute transactions with dispose of investments and assets held in your dps Select ISA in accordance with the reference to the best total consideration identified (net of dealing charges and other instructions of the Investment Manager(s) in the same way as if those investments and transaction costs) and available to us at the point of dealing, unless there is a reason why assets were managed by them through dps Select but were held outside of an ISA. We we believe it is not in your best interests to do so. will return cash subscriptions to you if we do not receive investment instructions within any period prescribed by the ISA Regulations or otherwise permitted by HMRC. 8.20 We may (and generally will) place reliance on third party brokers to execute transactions for your dps Select ISA. When we do so, we will take reasonable steps to 8.2 It is important that you understand the nature and risks involved with each ensure that the dealing arrangements of the parties we use are sufficient to provide Investment selected. Information on some of the general risks of investing and the appropriate execution quality, having regard to our own execution arrangements where nature and risks of particular types of investments is set out in the Appendix to these relevant. When passing orders for execution to a broker outside the EEA, you should note Terms. Please ensure that you take time to read and understand this information. If you that brokerage standards in such markets may not be equivalent to those in the EEA. In markets outside the EEA, we will take reasonable care to identify that the brokers used

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 Page 7 of 14 provide an appropriate quality of execution in the context of the arrangements available 10.7 If an item is returned to us unpaid or there is an operational error, we may reverse in the market in question. entries and correct errors made in any document without prior notice to you.

8.21 Subject to clauses 8.15 to 8.20, when we place or execute orders, we and any 11. Corporate Actions & income third party broker we use may: 11.1 Any Qualifying Investments arising out of a corporate action may be incorporated in (a) deal for you on such markets and exchanges and with or through your dps Select ISA. Where we are able to do so, we will refuse to take up or accept an any counterparties we in our sole discretion think fit; issue or offer relating to ineligible shares. Otherwise, we will ask the Investment (b) take, or omit to take, steps (including refusing to place an order) Manager(s) for your instructions. as we, in our sole discretion, believe are necessary to comply with the rules, 11.2 Subject to the terms of the corporate action, shares will be taken up as requested regulations, constitution and customary market practice of any such market or as long as there are sufficient funds in your dps Select ISA. Otherwise, you may be able exchange, and with all applicable law; to sell part of an entitlement to take up the remainder. (c) negotiate and execute sub-accounts with third parties (including 11.3 If you receive shares as a result of a take-over, merger, reorganisation or other clearing brokers and, where relevant, contracts of life insurance) on your behalf; and corporate action, you can only hold these shares in your dps Select ISA if they are (d) otherwise act as we, in our sole discretion, consider to be Qualifying Investments. If they do not qualify, they must be either sold or transferred to reasonable or appropriate. you. We will ask the Investment Manager(s) or you for instructions as to what action to take, however, if we do not receive your instructions within the required period, we will 8.22 We may aggregate any order or instruction relating to your dps Select ISA with sell your shares where we are able to do so. We may charge you for this. orders and/or instructions of our Associates or other customers. We will only aggregate transactions where it is unlikely that doing so will work overall to the disadvantage of any 11.4 We will pay cash dividends, gilt and bond interest to your dps Select ISA. These of the clients concerned. However, such aggregation may on occasion work to the payments will normally be paid into your dps Select ISA 6 business days after the disadvantage of you and/or your Adviser in relation to a particular order. business day we receive them.

8.23 When we aggregate your order with another, we will allocate the transaction in 11.5 We may pay interest on money held in your dps Select ISA at the rates published accordance with our allocation process. Should a combined order not be filled, we will from time to time in our charges tariff. Details of the currently applicable rates can be generally allocate to all participants on a pro rata basis, unless it may not be in your obtained from our website and are also available from us on request. We are required interest to receive a reduced allocation, or we are otherwise unable to do so because an under the ISA Regulations to give HMRC a flat rate charge on this interest (currently applicable regulation or law. 20%). This deduction is not refundable to you.

9. Title and registration 11.6 We will reinvest all income from your dps Select ISA and all related tax reclaims, net of any tax liability (for example, stamp duty), without further instruction from you or 9.1 Your dps Select ISA includes your Investments and any cash balances held through the Investment Manager, unless you have elected to be paid the income from your dps it, all income and other rights, and the benefit of any tax relief in respect of such Select ISA. Investments. Title to Investments and any other asset held in your dps Select ISA will be registered either in the name of our nominee (which may be a member of our Group) or 11.7 You can elect to receive the income by completing the relevant section of the ISA jointly in the name of such a nominee and in your name. We or the nominee may give Application Form or by notifying us. Payment is by direct credit to your bank or building your name, address and the size of your holding to the issuer or trustee of any of your society. ISA Investments. 11.8 You must notify us if you wish to cancel a previous election to receive income. 9.2 Share certificates (if any) or other documents evidencing title to ISA investments 12. Reports and Voting will be held by us or as we may direct.

9.3 Your dps Select ISA Investments will be, and must remain, beneficially owned by 12.1 Although you will not be the registered holder of Investments held in your dps you and must not be used as security for a loan. Select ISA (see clause 4.1 above), if you so elect, we will arrange for you:

10. Settlement (a) to attend any meetings of holders of and to exercise voting rights attaching to the Investment(s) held in your dps Select ISA; and/or

10.1 We will settle all transactions undertaken and/or as instructed by the Investment (b) to receive copies of the annual reports and accounts and any other Manager(s) on your behalf: information issued to holders of any Investment(s) held in your dps Select ISA.

(a) subject to our holding or receiving all necessary documents or 13. Withdrawals funds; and

(b) on such basis as is good market practice for the type of investment 13.1 You may, by request in writing to us, make cash withdrawals from your dps Select and market concerned and normally on the basis of “cash against delivery”. ISA. You may also by request in writing transfer Investments held out of your dps Select ISA so that they are registered in your name but any Investments transferred in this way 10.2 Delivery or payment by the other party to any such transaction will be at your risk, will cease to benefit from any tax reliefs relating to your dps Select ISA. We may charge and our obligation to account to you for any investment or the proceeds of sale of any you if we agree to a request to transfer Investments to you. investment will be conditional upon receipt by us of the relevant documents or sale proceeds from the other party. 13.2 The amount of requested cash withdrawal will be met by selling all or part of your Investment held in your dps Select ISA or (if applicable) returning cash held in your dps 10.3 You must make sure that there are sufficient funds available in your dps Select ISA Select ISA. Unless you give us instructions with your withdrawal request, we will have to cover all payments when they are due. If you do not, your dps Select ISA may become discretion to choose which Investment(s) to sell. Payment will be made to you in void. We will take the cost of purchases from, and pay sale proceeds to, your dps Select accordance with these Terms – see clause 3.4 in particular. ISA. 13.3 The minimum cash withdrawal from a dps Select ISA is £1,000 and the 10.4 We may operate a settlement system under which you are debited with the Investments remaining in your dps Select ISA after a withdrawal must have a minimum purchase cost or credited with the proceeds of sale on the usual settlement (or value of £3,000 (failing which we may treat your request as an instruction to terminate subscription) days for the market concerned, conditionally upon settlement being your dps Select ISA and withdraw the proceeds in cash). ultimately effected. This may result in either a benefit or a loss to us or you where settlement is effected at other times. We reserve the right to effect the cancellation of 13.4 We may at our sole discretion reduce or waive the minimum withdrawal and any such debit or credit attributed to you if there are unreasonable delays or difficulties holding amounts for any dps Select ISA. in settlement. In this event, we will promptly notify the Investment Manager(s) 14. Tax concerned but, where appropriate, will also continue to seek to effect settlement.

10.5 For administrative purposes (and not in any way so as to be treated as an 14.1 We will make all necessary claims for tax relief relating to your dps Select ISA. You agreement by us to make loans or investments available to you) we may: must provide us with all information which we reasonably request and you must immediately inform us of any change in your tax status or any other material change in (a) credit the receipt of Securities, cash or other assets to your your circumstances. Portfolio before their actual receipt; and if we do so, we may reverse such credit at any time before actual receipt and charge you such amounts by way of interest or 14.2 Your dps Select ISA will be managed in accordance with the ISA Regulations, which otherwise to put us in the position we would have been in had the credit not been take precedence over these Terms. made; and 14.3 We will notify you if, by reason of any failure to satisfy the provisions of the ISA (b) debit your Portfolio with Securities, cash or other assets on or Regulations your dps Select ISA has or will become void and cease to be exempt from tax before the date they are due to be transferred to a third party even though actual by virtue of the ISA Regulations. When a dps Select ISA is voided, we will sell the settlement has not yet occurred; and if we do so, we may reverse such debit at any Investments previously held in it and, after making any deductions (if any) permitted by time before actual settlement. these Terms, pay you the proceeds together with any cash balance previously held in your dps Select ISA. Alternatively, we may transfer any Investments previously held in 10.6 You accept that you may not rely on any such debit or credit until actual your dps Select ISA for you to hold them as an Investment outside an ISA. Where you settlement. have another investment account with us, we may transfer the Investments for you to hold outside and ISA in that account. We may deduct any charges or other amounts due

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 Page 8 of 14 to us as well as any tax liabilities under the dps Select ISA and any additional expenses 17.2 Subject to clause 17.2, in no event shall we be liable for or in respect of or in incurred in terminating the dps Select ISA. connection with:

15. Fees & Charges (a) any adverse tax implications of any transaction whatsoever;

(b) any delay or change in market conditions before or after any 15.1 We may charge a percentage of the value of your dps Select ISA for acting as the particular transaction is effected; Plan Manager of the dps Select ISA in addition to any charges payable for custody and execution services. Where we do charge fees for acting as the Plan Manager of the dps (c) providing your Adviser and/or Investment Manager, you and/or Select ISA and these will not be paid by your Adviser or the Investment Manager(s) on your professional advisers with reports for the purposes of assisting you with your your behalf the applicable rates will be as stated in the applicable Investment Mandate(s) capital gains tax reporting obligations or them in advising you; or as published from time to time in our charges tariff. Details of all currently applicable rates can be obtained from us on request. (d) the use by any person of or inability to access the Præmium Platform and/or the information normally accessible by using it; 15.2 We shall be entitled to deduct and retain all charges payable in respect of your dps (e) any delay, partial or non-performance of our obligations under this Select ISA and may apply any cash or sell any Investments to pay such charges or to pay Agreement by reason of force majeure (being any event or circumstance outside our any tax or other liabilities under your dps Select ISA. reasonable control); 15.3 You should be aware that taking monies from any component of your dps Select (f) any indirect, consequential or special loss and/or damage, loss of ISA may reduce your overall tax-efficient benefits. You may not be able to reinvest business, loss of profit, loss of data, loss of goodwill or reputation or wasted monies to replace any that we have had to take. management time even if we had prior notice of the possibility of the loss and/or 15.4 Individual Investments which you hold in your dps Select ISA may have charges damage arising. associated with them. These charges will continue to apply. For actual charges as they 17.3 We shall not be responsible for any loss resulting from the acts, omissions or apply to individual Investments you should refer to the relevant prospectus or key insolvency of any broker, trader, market maker or dealer, exchange or any depository, features document. agent, sub-custodian (which is not an Associate of ours) selected by us in good faith to 15.5 You will be liable for any costs properly incurred by us in connection with your dps effect any transaction or for the safe custody of any of your investments or other assets. Select ISA, including reasonable commissions, calls, transfer and registration fees, 17.4 You agree to indemnify us against all liabilities, demands, losses, claims, insurance fees, taxes, stamp duties and other fiscal liabilities. proceedings, costs and expenses which may be incurred by or made against us: 15.6 Any charge or fee payable to us, together with any dealing loss, fees, expenses, (a) as a result of any party claiming to be entitled to investments costs or other charges properly incurred by us on your behalf (including, but not limited which form part of your dps Select ISA at the time which we first assume custodial to, all and any applicable taxes and other duties) or other sums due to us in relation to responsibility for your dps Select ISA; your dps Select ISA may be debited by us from your dps Select ISA or from any other account you may hold with us on your behalf at such times as we may decide. (b) in consequence of any breach by you of this Agreement;

15.7 Our fees may be supplemented (but not, unless we agree otherwise, abated) by (c) in connection with the enforcement or preservation (including legal other remuneration receivable by us in connection with transactions we effect for you fees and expenses) of our rights under this Agreement; or under this or any other agreement. (d) arising out of any action properly taken by us in accordance with 15.8 We may in our sole discretion, discount or waive any charges in relation to the dps this Agreement, Select ISA. 17.5 and to pay us on demand all sums suffered or incurred by reason of such liabilities 15.9 All fees, charges and expenses are stated exclusive of value added tax, which will PROVIDED THAT you will not be responsible for or required to indemnify us against also be charged where applicable. The applicable rate of value added tax in the UK may anything that may result from our negligence, wilful default or fraud or that of our sub- change from time to time. custodians, nominees or its or their employees.

16. Statements & Reports 17.6 If any sub-custodian should fail to deliver any necessary documents or to account for any securities: 16.1 Details of the investments held in your dps Select ISA will be sent to you or your (a) we will take all reasonable steps on your behalf to recover such Adviser in accordance with and at the intervals required by the FSA Rules. You will also documents or securities or any sums due, or compensation for their loss; and have access to this information if you have been given access to your Account on the Præmium Platform. (b) you will reimburse us for all reasonable costs we may incur.

16.2 Please note that the FSA Rules and ISA Regulations may require us to provide you 17.7 However, subject to our obligation in sub-clause a) above and to clause 17.1, we with a statement of your dps Select ISA even if you request not to receive any will not be liable for any such failure by a sub-custodian. statements or request a longer period between statements than the rules permit. 17.8 We shall not be required to take any legal action on your behalf unless fully 16.3 We will acknowledge any initial cash and/or provide you with a starting valuation indemnified to our reasonable satisfaction for all costs and liabilities likely to be incurred statement for all assets transferred into your dps Select ISA at the start of this or suffered by us. If you require us to take any action which in our opinion might make Agreement. us liable for payment of money or liable in any other way then you will provide us on demand with such amounts as we may consider necessary to cover any expenses we 16.4 It is your responsibility to review your statement and other advices from us, and consider we may incur before our taking such action. notify us promptly of any discrepancies you believe there may be. We will be entitled to assume that a trade confirmation or contract note is correct and approved by you if you 17.9 Nothing in this Agreement shall operate to exclude or restrict any duty or liability do not object within 2 business days of receipt, and we will assume that each periodic assumed by us under FSMA or the FSA Rules which are not capable of exclusion or statement is correct and approved by you if you do not provide us with a written restriction. objection within 20 business days of receipt. 18. Anti-Money Laundering 16.5 Unless we tell you otherwise, the value of assets held in your dps Select ISA and reported to you in your valuation statements will be calculated by using the latest 18.1 We are required to undertake procedures and controls to combat money available closing price for that asset as quoted by a reputable market data supplier (such laundering. We may need at any time to request additional evidence of identity and/or as Telekurs) as at the date of valuation. Where holdings in your dps Select ISA are not source of funds from you. If asked for evidence, you must provide it. We may also readily marketable assets we will use reasonable endeavours to obtain a market request information from third parties and may use a credit reference agency for this valuation in accordance with our fair value pricing procedures. purpose (who will record that any inquiry has been made).

16.6 We may from time to time provide your Adviser and/or the Investment Managers 18.2 All information obtained for verification of identity and source of funds will be used with reports detailing your chargeable gains on investments held outside an ISA and/or for that purpose and no other. allowances for the purposes of assisting them in advising you in relation to your UK capital gains tax reporting obligations (where applicable). You acknowledge and agree 18.3 Instructions will only be accepted and an Account will only be set up subject to that the accuracy of any such reports is dependent upon, amongst other things, the completion of identification and related procedures to our satisfaction and, where information you and/or your professional advisers (including the Investment Manager) appropriate, receipt of cleared funds. If we are unable to verify your identity a requested provide to us. transaction may be refused, reversed or cancelled.

17. Liability 19. Data Protection

17.1 We accept responsibility for the acts and omissions of our nominees. We also 19.1 For the purposes of the Data Protection Act 1998 (the “DPA”), we are the data accept responsibility for any loss to you which is due to our negligence, wilful default or controller in respect of the personal information which is provided to us in relation to your fraud, or that of any sub-custodian which is an Associate of ours. For the purposes of this Portfolio and/or your Account. Agreement, whether a sub-custodian, which is an Associate, is negligent, in wilful default 19.2 You consent to, and warrant that you have informed all persons you authorise to or fraudulent will be determined by reference to the market standards in the place where instruct us or to have access to your Account and you and they consent to, our holding such entity is providing its services. and processing both electronically and manually the data (which may include “sensitive

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 Page 9 of 14 data” as defined by the DPA) we are provided or collect relating to you, those persons (g) we deal in investments as principal with you and we may, acting as and/or your Portfolio. principal, sell to or purchase from you currency other than the currency in which you have requested your valuations to be expressed; 19.3 The personal information may be used for a number of different purposes including: (h) the transaction is in units or shares of in-house funds or any (a) providing to you, your Adviser and Investment Manager(s) services company of which we or any Associate is the manager, operator, banker, adviser or we have agreed to provide; trustee;

(b) to identify you and those authorised by you when you contact us, (i) we effect transactions involving placings and/or new issues with an your Adviser or the Investment Manager; Associate who may be acting as principal or receiving agent's commission;

(c) to comply with legal and regulatory requirements; (j) the transaction is in securities of an entity for which we or an Associate have underwritten, managed or arranged an issue or offer for sale within (d) our own administration and the management of our business; and the period of 12 months before the date of the transaction; (e) for internal analysis and research. (k) we or an Associate may receive remuneration or other benefits by 19.4 We may use external third parties to process your personal information on our reason of acting in corporate finance or similar transactions involving companies behalf in accordance with the above purposes. We may also provide personal information whose securities are held by you; and to any company to which we may assign our rights and obligations under this Agreement. (l) the transaction is in securities in respect of which we or an 19.5 We may share your personal information with the following third parties: Associate, or an officer or employee of ours, or an Associate, is contemporaneously trading or has traded on its own account or has either a long or short position. (a) Your Adviser and the Investment Manager(s) and their Associates; 21.3 Further details of our Conflicts of Interest policy are available upon request. (b) our Associates for the purposes set out in clause 19.3; and 22. Representations & warranties (c) other organisations for the purposes of:

(i) compliance with any legal or regulatory 22.1 You hereby represent and warrant that: requirements; and (a) you have the power to enter into and perform this Agreement and (ii) protecting us and the Manager and our respective that this Agreement constitutes a legal, valid and binding obligation on you and that customers from theft and fraud. you are not acting as agent or trustee for another person or persons;

19.6 The personal information provided will be processed by us or our Associates, who (b) none of the investments or other assets held by us or to our order may be based outside of the EEA (including, without limitation, Australia). This may for your dps Select ISA are encumbered and you undertake that you will not dispose involve the transfer of data by electronic media including the internet. Where your data is of, encumber or otherwise deal with any of such investments or other assets without transferred outside of the UK, we will ensure that the recipient agrees to keep your our prior agreement; information confidential and hold it securely in accordance with the requirements of the DPA. (c) your Adviser and each Investment Manager has due authority from you as your agent to instruct us in relation to your dps Select ISA; 19.7 Except as outlined in this clause or otherwise required by law, your personal information will not be passed to anyone without your permission. (d) we may rely on any instruction or communication we reasonably believe to be from your Adviser or your Investment Manger(s) in relation to your dps 19.8 With limited exceptions, you may ask for a copy of the personal information which Select ISA; we hold on you. We are allowed by law to make a charge for this. If any of the information which we hold about you or any of the persons referred to in clause 19.2 is (e) you have taken such tax and other professional advice as may be incorrect, you should tell us and we will amend it. necessary in relation to your dps Select ISA and all transactions in relation to it; and

(f) these representations will remain true and accurate on each 20. Foreign Law & Practice occasion a transaction is entered into under this Agreement by or on your behalf.

20.1 We draw to your attention the fact that, in certain overseas jurisdictions, there 23. Complaints and Compensation may be different settlement, legal and regulatory requirements to those applying in the

UK and also different practices for the separate identification and segregation of 23.1 If you have a complaint arising from the services we have provided to you under customer’s investments. this Agreement, you should contact our Client Services Department. A member of this department will investigate your complaint promptly. 20.2 The purpose of investments being separately identified by being “registered in a

nominee name” is that in the event a custodian or sub-custodian default then the 23.2 Since we will not provide you with any personal recommendations, you may not investments should be deemed as “segregated” and your position as ultimate owner benefit from the protection (if any) offered by financial services regulations on the safeguarded. However, there are certain national jurisdictions where the “nominee name” suitability of a transaction or other course of action for you. concept is either unavailable or unrecognised. You should be aware that in those countries which do not recognise the “nominee concept”, your investments may not be as 23.3 We operate a formal complaint handling procedure in accordance with FSA Rules well protected as in those that do. and you may be eligible to subsequently refer your complaint to the Financial Ombudsman Service if you remain dissatisfied with the outcome of our complaint 21. Conflicts of Interest investigation. We are required by FSA Rules to advise you where you are eligible for this service. 21.1 We and any of our agents (including sub-custodians) may affect transactions in relation to which either we or an Associate have, directly or indirectly, a material interest 23.4 Please note that in the event of our being unable to meet any of our potential or a relationship of any description with another party, which may involve a potential financial liabilities to you, you may have certain rights to compensation under the conflict with our duty to you. Neither we nor any Associate shall be liable to make any Financial Services Compensation Scheme. This depends on the type of business and the payment to you on account of any profit, commission or remuneration made or received circumstances of the claim. Payments under the scheme to clients are limited to 100% of by us from or by reason of such transactions or any connected transactions and our fees the first £30,000 and 90% of the next £20,000, so the maximum compensation is shall not, unless otherwise provided, be abated. We will ensure that such transactions £48,000 for any one investor. A statement describing those rights is available from us are effected on terms that are not materially less favourable to you than if the conflict upon request or further details are available upon request from the Financial Services had not existed. Compensation Scheme.

21.2 Examples of where such potential conflicting interests or duties may arise include 24. Termination where: 24.1 You may terminate your dps Select ISA at any time by giving written notice to us. (a) either we or an Associate undertakes business for other customers; Your notice of termination will be effective on receipt but will not affect transactions (b) any of our officers or employees, or those of an Associate, is a already initiated. director of, holds or deals in securities of, or is otherwise interested in any company 24.2 We may terminate your dps Select ISA by giving you one month's written notice to whose securities are held or dealt in on your behalf; you. If it becomes impractical or impossible to comply with the ISA Regulations, or if we (c) the transaction is in securities issued by an Associate or the are required to do so by applicable law, the FSA or any other competent regulatory customer of an Associate; authority we may also terminate your dps Select ISA immediately in which case you will be notified in writing. (d) the transaction is in relation to an investment in respect of which we or an Associate may benefit from a commission, fee or mark-up payable 24.3 When a dps Select ISA is terminated, we will sell the Investments held in your dps otherwise than by you, and/or we or an Associate may also be remunerated by the Select ISA and pay you the proceeds together with any cash balance held in the dps counterparty to any such transaction; Select ISA. Alternatively, at our sole discretion, we may transfer into another account you hold with us or otherwise into your name any Investments previously held in your (e) we deal on your behalf with ourselves and/or an Associate; dps Select ISA for you to hold them as an Investment outside an ISA. We may deduct (f) we act as your agent in relation to transactions in which we are any charges or other amounts due to us, any tax liabilities under the dps Select ISA, and also acting as agent for the account of other customers and Associates; any additional expenses incurred in terminating the dps Select ISA.

SMARTfund Administration Ltd: 6 Broad Street Place London EC2M 7JH T: +44 (0)800 010 700 F: +44 (0)207 562 2451 E: [email protected] W: www.praemium.co.uk Registered Office Address: 6 Broad Street Place London EC2M 7JH Company Registration No. 06016828 (England and Wales) VAT No. 100 1037 06 SMARTfund Administration Ltd is authorised and regulated by the Financial Services Authority under reference 463566 Page 10 of 14 24.4 Your dps Select ISA ceases to be exempt from tax on your death and will (c) take account of any corporate reorganisation inside our group of terminate. We will reinvest any income received after your death and any previous companies and/or a transfer of our rights and obligations under these Terms to election to be paid income will lapse. another company as contemplated by clause 27.1; and