1) Lease Calculations

Click here to download the Excel workbook containing the spreadsheets you will need for this exercise.

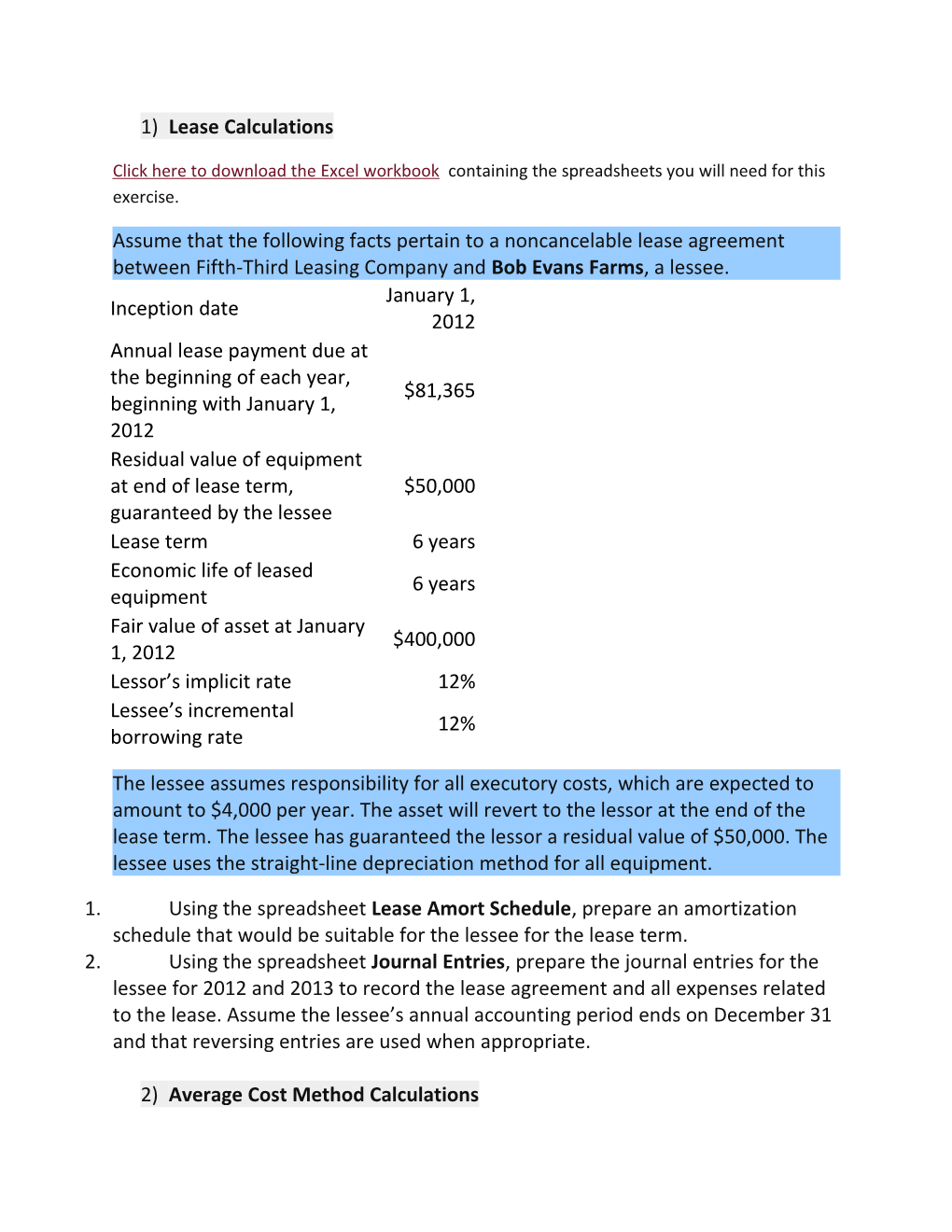

Assume that the following facts pertain to a noncancelable lease agreement between Fifth-Third Leasing Company and Bob Evans Farms, a lessee. January 1, Inception date 2012 Annual lease payment due at the beginning of each year, $81,365 beginning with January 1, 2012 Residual value of equipment at end of lease term, $50,000 guaranteed by the lessee Lease term 6 years Economic life of leased 6 years equipment Fair value of asset at January $400,000 1, 2012 Lessor’s implicit rate 12% Lessee’s incremental 12% borrowing rate

The lessee assumes responsibility for all executory costs, which are expected to amount to $4,000 per year. The asset will revert to the lessor at the end of the lease term. The lessee has guaranteed the lessor a residual value of $50,000. The lessee uses the straight-line depreciation method for all equipment.

1. Using the spreadsheet Lease Amort Schedule, prepare an amortization schedule that would be suitable for the lessee for the lease term. 2. Using the spreadsheet Journal Entries, prepare the journal entries for the lessee for 2012 and 2013 to record the lease agreement and all expenses related to the lease. Assume the lessee’s annual accounting period ends on December 31 and that reversing entries are used when appropriate.

2) Average Cost Method Calculations Garner Company began operations on January 1, 2010, and uses the average cost method of pricing inventory. Management is contemplating a change in inventory methods for 2013. The following information is available for the years 2010–2012.

Net Income Computed Using Average Cost FIFO LIFO

Method Method Method 2010 $15,000 $20,000 $12,000 2011 18,000 24,000 14,000 2012 20,000 27,000 17,000

On January 1, 2012, Garner issued 10-year, $200,000 face value, 6% bonds, at par. Each $1,000 bond is convertible into 30 shares of Garner common stock. The company has had 10,000 common shares outstanding throughout its life. None of the bonds have been exercised as of the end of 2013. (Ignore tax effects.)

Click here to download the Excel workbook containing the spreadsheet you will need for this exercise. 1. Using the spreadsheet Journal Entries, prepare the journal entry necessary to record a change from the average cost method to the FIFO method in 2013. 2. Assume Garner Company used the LIFO method instead of the average cost method during the years 2010–2012. In 2013, Garner changed to the FIFO method. Using the spreadsheet Journal Entries, prepare the journal entry necessary to record the change in accounting principle. 3. Assuming Garner had the accounting change described in (2), Garner’s income in 2013 was $30,000. Compute basic and diluted earnings per share for Garner Company for 2013. Show how income and EPS will be reported for 2013 and 2012.

3) Statement of Cash Flows

Ellwood House, Inc. had the following condensed balance sheet at the end of 2012.

ELLWOOD HOUSE, INC. Balance Sheet December 31, 2012 Current Cash $ 10,000 $ 14,500 liabilities Long- Current term assets (non- 34,000 30,000 notes cash) payable Bonds Investments 40,000 32,000 payable Common Plant assets 57,500 80,000 stock Retained Land 38,500 23,500 earnings $180,000 $180,000

During 2013, the following occurred.

1. Ellwood House, Inc., sold part of its investment portfolio, which was classified as available-for-sale, for $15,500, resulting in a gain of $500 for the firm. 2. Dividends totaling $19,000 were paid to stockholders. 3. A parcel of land was purchased for $5,500. 4. $20,000 of common stock were issued at par. 5. $10,000 of bonds payable were retired at par. 6. Heavy equipment was purchased through the issuance of $32,000 of bonds. 7. Net income for 2013 was $42,000 after deducting depreciation of $13,550. 8. Both current assets (other than cash) and current liabilities remained at the same amount. 1. Prepare a statement of cash flows for 2013, using the indirect method. Assume that current assets (excluding cash) and current liabilities have remained the same on December 31, 2013. The cash balance on December 31, 2013 is $66,050. 2. Draft a one-page letter to Gerald Brauer, president of Ellwood House, Inc., briefly explaining the changes within each major cash flow category. Refer to your cash flow statement whenever necessary. Provide reference(if any) in APA-format