Promoting Ceylon Tea in Egypt

Promoting Ceylon Tea in Egypt

Tea is the main beverage of Egypt. Sri Lanka was the largest tea exporter to Egypt before 1990s, Sri Lanka annually exported around 30-40 million kg which accounted for more than 90% of the Egyptian market at that time. Sri Lanka’s market share unexpectedly started to decline with heavy custom duty imposed on imported tea from non member countries of the free trade Agreement ‘Common Market for Eastern and Southern Africa (COMESA)1. This duty accounted to 30% making Sri Lanka tea expensive in Egypt.

Being a member, Kenya was able to increase bulk tea exports to Egypt under duty free facility of COMESA while other non member countries including Sri Lanka could not compete in the market and had to reduce tea exports to Egypt because of higher customs duty. Kenya has gradually managed to acquire about 89% of the Egyptian tea market. Sri Lanka’s share reduced to about 3.1%2. This market setback led to Sri Lanka having low expectations about Egyptian tea market. Sri Lanka Tea Centre in Cairo was closed down after COMESA. Promotions for Lion logo were not undertaken in Egypt since then.

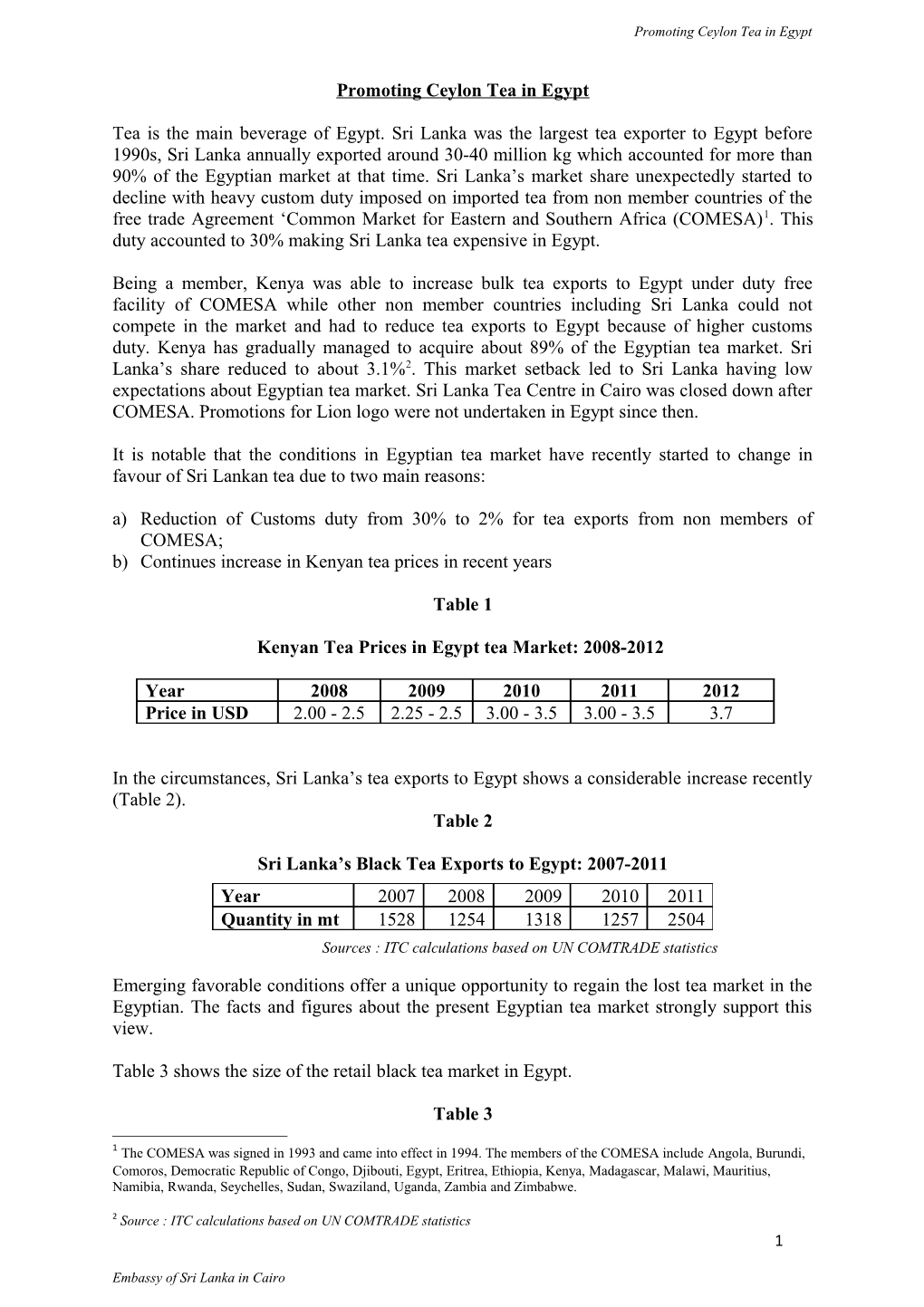

It is notable that the conditions in Egyptian tea market have recently started to change in favour of Sri Lankan tea due to two main reasons: a) Reduction of Customs duty from 30% to 2% for tea exports from non members of COMESA; b) Continues increase in Kenyan tea prices in recent years

Table 1

Kenyan Tea Prices in Egypt tea Market: 2008-2012

Year 2008 2009 2010 2011 2012 Price in USD 2.00 - 2.5 2.25 - 2.5 3.00 - 3.5 3.00 - 3.5 3.7

In the circumstances, Sri Lanka’s tea exports to Egypt shows a considerable increase recently (Table 2). Table 2

Sri Lanka’s Black Tea Exports to Egypt: 2007-2011 Year 2007 2008 2009 2010 2011 Quantity in mt 1528 1254 1318 1257 2504 Sources : ITC calculations based on UN COMTRADE statistics

Emerging favorable conditions offer a unique opportunity to regain the lost tea market in the Egyptian. The facts and figures about the present Egyptian tea market strongly support this view.

Table 3 shows the size of the retail black tea market in Egypt.

Table 3

1 The COMESA was signed in 1993 and came into effect in 1994. The members of the COMESA include Angola, Burundi, Comoros, Democratic Republic of Congo, Djibouti, Egypt, Eritrea, Ethiopia, Kenya, Madagascar, Malawi, Mauritius, Namibia, Rwanda, Seychelles, Sudan, Swaziland, Uganda, Zambia and Zimbabwe.

2 Source : ITC calculations based on UN COMTRADE statistics 1

Embassy of Sri Lanka in Cairo Promoting Ceylon Tea in Egypt

Volume of Retail Sales of Black Tea in Egypt Tea Market: 2006-2011 Year 2006 2007 2008 2009 2010 2011 Quantity in mt 69,974.7 71,253.1 72,535.6 74,018.9 76,208.7 77,997.3 Source: Euromonitor International

Table 4 shows the leading players in the Egyptian tea market along with their brands and respective market shares. Table 4

Tea Company / Brand Shares by Retail Value 2008 - 2011 Company Brand 2008 2009 2010 2011 Badawy & Sons Co El Arosa 59.2 59.2 58.0 57.7 Uniliver Group Lipton 29.2 29.3 29.2 29.4 El Jawhara Co El Jawhara 8.4 8.3 8.1 8.3 Isis Co Isis 1.6 1.6 1.7 1.7 Ottoman Co Royal 0.3 0.3 0.3 0.3 Twining & Co Ltd. R Twinings 0.4 0.3 0.3 0.3 Mansour Manufacturing Keddah Dust 0.2 - - - & Distribution (MMD) Tea El Anany Co El Warda 0.3 0.3 - - Others Others 0.5 0.5 2.2 2.2 Total Total 100 100 100 100 Source: Euromonitor International El Arosa Tea:

El Arosa is the brand name of the tea widely marketed by the company named Badawy & Sons Company, the leading player in the Egyptian tea market. This company sells Kenyan CTC tea, targeting the lower income price conscious consumers. According to a research conducted by the ‘Euromonitor International’, El Arosa Company had a market share3 of 57.7% in 2011. It is found that Sri Lanka tea can not be offered to this market segment as its prices are higher than those of El Arosa.

Badawy Company also offers ‘El Arosa tea bags’ to the middle income group. But the tea bag sale is not significant within market share of Badway.

Lipton Tea:

Lipton tea brand is owned by Uniliver group. Being the second largest market player, Lipton tea has a market share of 29.4%. Its market share continues to grow because Uniliver is now making inroads to the market of El Arosa through effective advertizing campaigns. These promotional campaigns have shown clear signs of being successful.

However, Lipton tea mainly targets upper income and middle income consumers. Lipton tea bags are popular and in good demand. These tea bags consist of Kenyan tea mixed with tea from Malawi, India and Uganda etc. This mixing and packing take place in Egypt. The unique blending methods and sophisticated advertising campaigns have enabled Lipton to retain its identity as a prestigious brand among upper and middle income consumers. The market catered by Lipton tea could be the potential market segment for Sri Lankan tea.

El Jawhara Tea:

3 Euromonitor International: http://www.euromonitor.com/tea-in-egypt/report 2

Embassy of Sri Lanka in Cairo Promoting Ceylon Tea in Egypt

El Jawhara Company sells its tea under ‘El Jawhara’ and has a market share of 8.3%. El Jawhara sells Kenyan tea targeting mainly lower income consumers.

Other Brands:

The rest of Egyptian tea market share is around 5% consisting of many tea varieties used by upper, middle and lower income groups. Pure Sri Lanka tea (Lion Logo) also falls within this market share and cater to upper middle class and super rich consumers. Pure Sri Lanka tea brands Dilmah, Ahmed, Kings, El-salam and Supperfine. Other tea brands such as Cairo, Lord, Rose are basically targeting lower income consumers.

Dilmah Tea:

Dilmah, El Salam, Ahmed, Supperfine are the main brands of packed tea being exported from Sri Lanka to Egypt. Among them, Dilmah is the most prominent and is available in every big super markets. It is now considered to be the most prestigious and popular brand among high spending customers looking for high quality tea. According to the survey of retail tea prices, the Dilmah tea is sold under the highest prices in the Egyptian market. The table 5 at Annex I give a comparative picture about the retail prices of packed tea. Dilmah has achieved a remarkable success in capturing this exclusive market.

El Salam Tea:

It is also noteworthy that El Salam has managed to retain the customer loyalty in Egyptian market for Lion logo tea over a period of 30 years.

Current population4 of Egypt is 83.7million of which nearly 10% is estimated to be the supper rich sharing 26.6% of country’s national income5. The next 10% of the population possess 13.7% of the national income. These two income groups represent about 16.7 million people claiming 40.3% of the national income. Good purchasing power naturally makes them buy quality products including high quality tea.

As tea is an essential beverage and part of the Egyptian culture, the existence of any unstable political and security situation would not be a significant factor negatively influencing tea consumption in Egypt. This is evident from the fact that tea consumption increased from 76,208.7 mt in 2010 to 77,997.3 mt. in 2011 when the revolution and political instability started in Egypt. Sizable number of high income people in Egypt offer an excellent opportunity for Sri Lankan tea exporters to regain the lost tea market in Egypt.

Analysis of Retail Tea Prices:

The Embassy conducted an initial market survey. Collected tea samples were sent to the Sri Lanka tea Board. The table 5 at Annex I shows the retail prices of different tea packs marketed under main brands in Egypt. As per the details in the table, it is clear that Sri Lankan tea cannot compete with leading brand El Arosa because of its low prices. In the circumstances, the market prospects for Sri Lankan tea would remain with upper and middle income groups. These consumers from these two income groups mainly consume varieties of Lipton tea.

4 Estimated figure by World Fact Book - https://www.cia.gov/library/publications/the-world- factbook/geos/eg.html Population in 2011 - 82.53 -World Bank Indicators 5 World Bank Indicators- Egypt - http://data.worldbank.org/indicator/SI.DST.10TH.10/countries 3

Embassy of Sri Lanka in Cairo Promoting Ceylon Tea in Egypt

The market survey of the Embassy revealed that price differentials between Lipton and El Salam (Lion Logo tea) are marginal. Lipton’s market is about 29.4% of the entire Egyptian tea market. This 29.4% represents an average of 23089 mt [(78533.9/100) * 29.4] per annum6. This is the approximate size of the potential market segment on which Sri Lankan tea exporters need to focus for promoting Lion logo tea.

The well-planned, vigorous tea promotion campaign should be launched on a sustainable basis over a period of two to three years for penetrating market segment dominated by Lipton. If Sri Lanka tea exporters can capture 10% - 15% the Lipton’s market share, after 3 years, it would be a huge success.

Specific Actions:

Following suggestions are made to derive a strategic plan for promoting Lion Logo tea in Egypt.

1. To conduct tea promotion Events at; - Five Star Hotels - Prestigious sports clubs - Cultural Centers (American, Spanish, Japanese, etc) - Leading Universities/Colleges - Newspaper publishing houses

2. To identify potential buyers especially leading companies specialized and engaged in distributing food products in Egypt for introducing and promoting Sri Lankan tea to them.

3. To encourage Sri Lankan tea exporters, biscuits manufacturers and Porcelain products to undertake joint promotion campaigns.

4. To display billboards in prominent places, airports, hotels, leading supermarkets, major junctions at highways.

5. To conduct promotional programs through TV, News paper and Trade Magazines etc.

6. To participate at high level International Trade Fairs in Egypt such as Cairo International Fair, this year fair will be held 19th to 29th March 2013.

Prepared by;

Sri Lanka Embassy Cairo, Egypt February, 2013

6 As per statistics of Euromonitor international, total amount of tea sold in Egypt in 2011 was 78533.9 mt. 4

Embassy of Sri Lanka in Cairo Promoting Ceylon Tea in Egypt

Annex I

Table 5

Bag Tea Prices

Price per g in No. of Net Price per Price in USD Brand Tea weight gm Remarks LE LE 1 = USD bags in gm in LE 0.152855 1 El Arosa 25 50 3.80 0.076 0.0116 2 Lipton 25 50 3.95 0.079 0.0121 3 Ahmed 25 50 5.75 0.115 0.0176 4 Alokozay 25 50 4.49 0.090 0.0137 5 Carrefour 25 50 5.95 0.119 0.0182 El 6 Gawhara 25 50 2.95 0.059 0.0090 7 Dilmah 25 50 6.10 0.122 0.0186

1 El Arosa 50 100 7.00 0.070 0.0107 2 Lipton 50 100 7.00 0.070 0.0107 3 Alokozay 50 100 8.50 0.085 0.0130 4 Dilmah 50 100 11.99 0.120 0.0183

1 El Arosa 100 200 13.45 0.067 0.0103 2 Lipton 100 200 15.99 0.080 0.0122 3 El Salam 100 200 14.95 0.075 0.0114 4 Ahmed 100 200 18.75 0.094 0.0143 5 Supperfine 100 200 18.75 0.094 0.0143 6 Dilmah 100 200 20.75 0.104 0.0159

Dust Tea Prices

5

Embassy of Sri Lanka in Cairo Promoting Ceylon Tea in Egypt

Price per g in Quantity Price Price per g USD Brand Remarks in grm LE in LE LE 1 = USD 0.152855 1 El Arosa 40 1.50 0.038 0.0057 2 Lipton 1 40 1.50 0.038 0.0057 3 Lipton 2 40 2.45 0.061 0.0094 4 El Salam 40 1.25 0.031 0.0048 5 Al Asary 40 1.50 0.038 0.0057 6 Orouba 40 3.25 0.081 0.0124 7 Cairo Tea 40 1.20 0.030 0.0046 8 Crown 40 1.20 0.030 0.0046 El 9 Gawhara 40 1.40 0.035 0.0053 10 Lord 40 1.25 0.031 0.0048

1 El Arosa 1 100 3.10 0.031 0.0047 2 El Arosa 2 100 3.75 0.038 0.0057 3 Lipton 1 100 4.70 0.047 0.0072 4 Lipton 2 100 5.25 0.053 0.0080 5 El Salam 100 3.95 0.040 0.0060 6 Orouba 100 3.25 0.033 0.0050 7 Cairo 100 2.75 0.028 0.0042 8 Lord 100 2.80 0.028 0.0043

1 El Arosa 1 250 7.75 0.031 0.0047 2 El Arosa 2 250 8.90 0.036 0.0054 3 Lipton 1 250 9.75 0.039 0.0060 4 Lipton 2 250 10.45 0.042 0.0064 5 El Salam 250 7.95 0.032 0.0049 6 Cairo 250 7.00 0.028 0.0043 7 Jawhara 250 10.49 0.042 0.0064 8 Al Barad 250 5.95 0.024 0.0036 9 Lord 250 7.15 0.029 0.0044

6

Embassy of Sri Lanka in Cairo