Name ______Date ______Period ______

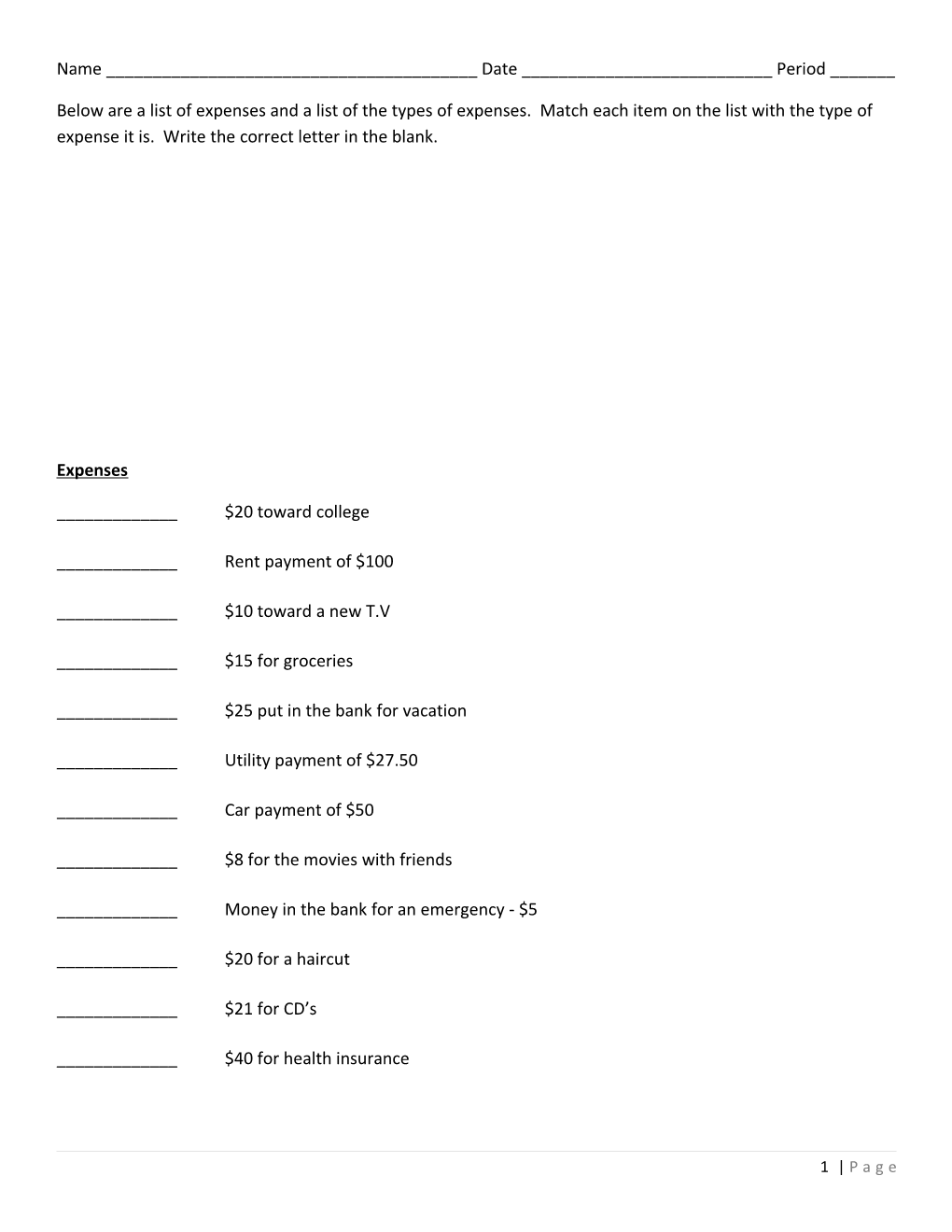

Below are a list of expenses and a list of the types of expenses. Match each item on the list with the type of expense it is. Write the correct letter in the blank.

Expenses

______$20 toward college

______Rent payment of $100

______$10 toward a new T.V

______$15 for groceries

______$25 put in the bank for vacation

______Utility payment of $27.50

______Car payment of $50

______$8 for the movies with friends

______Money in the bank for an emergency - $5

______$20 for a haircut

______$21 for CD’s

______$40 for health insurance

1 | P a g e Personal Budget Project

Introduction

Picture yourself 4 to 5 years in the future. You are about 22 years old, done with college, trade school, or any other options you chose for yourself after high school. You are out of your parents’ house, you have your job, and are now completely on your own! You must figure out how you are going to budget your money based on a take home amount of $28,000 a year.

______

2 | P a g e Your Task

Now that you are ready to jump into the working world, your job is to create a personal budget from scratch. DO NOT assume you have anything! You must buy a car, and if you are planning on going to college, you will have student loans (in other words, don’t assume your parents have given you anything). Based on a take home amount of $28,000 a year (before taxes it would be about $35,000!), create a budget from the bottom up.

The areas you must include are (this list is not the end-all list, but a very good starting place):

Fixed Expenses

o Rent/Mortgage

o Renters Insurance

o Automobile Payment (monthly payment) – or other transportation such as a bike or bus

o Automobile Insurance (monthly or quarterly payment)

o Health Insurance (monthly or quarterly payment)

o Credit Card

o Student Loans (monthly payment – if applicable)

o Savings – Short Term and Long-Term

o Emergency

Flexible/Variable Expenses

o Food – groceries, restaurants, etc…

o Cell phone/landline

o Electricity

o Gas/Heat

o Clothing

o Entertainment (movies, video rentals, sporting events, etc…)

o Haircuts

o Vacation

o Gas – for car

3 | P a g e o Cable T.V and Internet

Make sure you record whatever amount you need and the website that you found your information. Some areas such as allowance for vacation and savings are items that you may ask a parent or teacher for an amount; just make sure to document your resource.

Your last task will be to complete a short questionnaire evaluating where your money is going. You will get the questionnaire sheet from me when you are all finished.

Eating Out

1. Breakfast (Drink & Entrée) Restaurant Name:

List your order below: $______

2. Lunch or Dinner (Drink, Entrée Restaurant Name: & Dessert) List your order below: $______

Total $

Multiply above total by 4: Monthly Cost $

Household Items

Where did you shop? Item Brand of Item Cost 1. Laundry Detergent (at least 18 loads) $ 2. Dishwasher Detergent (at least 42 oz.) $ 3. Bleach $ 4. Stain Remover $ 5. Toilet Paper (at least 4 pack) $ 6. Sandwich Bags (at least 25) $ 7. Paper Towels (at least 2) $ 8. Kleenex (2 boxes) $

4 | P a g e 9. $ 10. $ 11. $ Total: $ 9.5% Sales Tax $ (Total amount from above x 0.095 = Sales Tax amount) Grand Total: $ (Total + Sales Tax = Grand Total)

Personal Care Products *Add anything specific to you*

Where did you shop? Item Brand of Item Cost 1. Body Soap/Wash $ 2. Shampoo $ 3. Conditioner $ 4. Hair Styling Products $ 5. Toothpaste $ 6. Toothbrush $ 7. Deodorant $ 8. Razors and Blades $ 9. Cologne/Perfume/After Shave $ 10. Hair Brush $ 11. $ 12. $ 13. $ 14. $ Total: $ 9.5% Sales Tax $ (Total amount from above x 0.095 = Sales Tax amount) Grand Total: $ (Total + Sales Tax = Grand Total)

5 | P a g e Food (Use www.Safeway.com, then click on “Grocery Delivery”, then click “Start Here”, under “New Customers”, enter your zip code, and click “Browse as Guest”, on the page that pops up, click “Shop by Aisle” at the top of the page) Where did you shop? Item Brand of Item Cost 1. 1 package of spaghetti noodles $ 2. 1 large box of cereal $ 3. 1 jar of spaghetti sauce $ 4. 2 lbs. of potatoes $ 5. 1 dozen eggs $ 6. 1 gallon of milk Percentage: $ 7. 2 loaves of bread $ 8. 1 lb. of margarine/butter $ 9. 1 jug of juice $ 10. 1 jar of jam $ 11. 1 lb. chicken breast Fresh or frozen? $ 12. 1 lb. ground beef Fresh or frozen? $ 13. 1 lb. apples $ 14. 1 lb. of other fruit of your choice What fruit? $ 15. 1 head of lettuce $ 16. 1 package frozen corn $ 17. 1 can of green beans $ 18. 1 package of cookies $ 19. 1 bag of chips $ 20. 1 bottle of salad dressing $ 21. 1 lb. pot roast beef $ 22. 1 can of tuna $ 23. 1 jar of mayonnaise $ 24. 1 lb. of lunch meat $ 25. 1 package of sliced cheese $

6 | P a g e 26. 1 jar of instant coffee $ 27. 1 lb. of sugar $ 28. 1 bottle of ketchup $ 29. 1 jar of peanut butter $ 30. 1 package of hamburger buns $ Total: $ Multiply above total by 4 = Monthly Food Cost $ Housing (Use www.zillow.com) *Only look for apartments or rentals…you are not buying a house*

Experts recommend that your monthly rent should be no more than 30% of your monthly net income. Calculate the appropriate amount you can afford based on your salary.

$28,000 (Yearly Salary) / 12 months = $2,333 (Monthly Net Income)

$2,333 x 0.3 = ______Monthly Rent Allowance

The amount you found above is the amount you can afford on rent each month. DO NOT move into housing that you cannot afford.

What website did you find the rental on? What type of housing is this? (Apartment, house, townhouse, condo)

Address:

Total Monthly Rent: Number of Bedrooms: Number of Bathrooms: How much is the security deposit? (If there is not, assume that it is the same amount as one month’s rent) Are animals allowed? If so, is there an additional fee? Is there a washer and dryer in the unit? Are utilities included? If yes, use the cost and list below. If not, research different costs of utilities and list below. Utility Name of Company Cost 1. Satellite or Cable $ 2. Water/Sewer $ 3. Internet $ 4. Garbage $ 7 | P a g e 5. Electricity $ 6. Oil or Gas Heat $ Total Monthly Utilities NOT included in Rent: $ If the rental is furnished, include a list on a separate sheet telling everything that is included. You have a fully furnished kitchen. Some may be given to you by friends and/or family, some you may already have, and some you will need to purchase. Explain the situation for each piece. For an unfurnished rental, you must have the basic furniture, put the monthly cost on the line if new and full price if used:

Where did you shop? Item Brand of Item Cost 1. Couch $ 2. TV $ 3. Coffee Table $ 4. Lamps $ 5. Bed Frame $ 6. Mattress & Box Spring $ 7. Dresser $ 8. Desk $ 9. Kitchen Table & Chairs $ 10. Nightstand $ 11. $ 12. $ Total: $ 9.5% Sales Tax $ (Total amount from above x 0.095 = Sales Tax amount) Grand Total: $ (Total + Sales Tax = Grand Total)

8 | P a g e Transportation (www.truecar.com, Craigslist, car dealership sites, newspaper ads)

Where did you purchase your car? Make: Model: Year:

1. What is the cost of the vehicle? $ 2. What is 9.5% of the total in Line #1? $ 3. Add Line #1 and Line #2 to get the Grand Total Total with tax included: $ 4. What is 25% of Line #3? This will be the down payment. Down Payment: $ (Line #3 Total x 0.25 = ______) 5. Subtract the total from Line #4 from Line #3 Total Amount of Car Loan: $ 6. Name of Loan Source (Bank) 7. Interest Rate on Car Loan (APR) 8. Number of Years for Financing (New = 4 years, Used = 3 years) 9. Number of Months Financed (Amount of years from Line #8 multiplied by 12) 10. Monthly Payment Monthly Car Payment (Line #7 x Line #5 = ______(Yearly Interest) x Number of Years of Financing = $ ______(Total Interest) + Line #5 = ______(Total Cost of Car) / Line #9 = 11. Gas A. Monthly Miles Driven = 1,000 B. Find average miles per gallon for your Car ______Cost of Gas per C. Gas Station Used ______$______per gallon Month D. Cost of gas per month (Divide Line A by Line B, then multiply the total by Line C $ 12. Total Monthly Transportation Cost $ (Total from Line #10 + Line #10A)

9 | P a g e Cell Phone Provider Research the different cell phone providers below, and choose one provider that fits your needs/lifestyle. Verizon: https://www.verizonwireless.com/ T-Mobile: https://www.t-mobile.com/ AT & T: https://www.att.com/

What provider did you choose? Cost Per Month: $ What does your plan include? Describe below:

In the table below, include the total monthly costs for all of the sections you have researched above: Expenses Total Monthly Cost 1. Eating Out $ 2. Household Items $ 3. Personal Care Products $ 4. Food $ 5. Your portion of rent $ 6. Total cost of utilities $ 7. Total cost of furniture $ 8. Transportation $ 9. Cell Phone $ Grand Total of Expenses: $

Is your grand total less than $2,333? ______

10 | P a g e If it’s not, what could you have done to ensure that it is less than $2,333? Record your answer in the space below. In the table below, you are going to calculate what percentage of your net monthly income is going towards different expenses in your budget. See the example below on how to calculate the percentage. Your net monthly income is: $2,333

Expenses Calculation Total Percentage

1. Eating Out ______/$2,333= %

2. Household Items ______/$2,333= %

3. Personal Care Products ______/$2,333= %

4. Food ______/$2,333= %

5. Your portion of rent ______/$2,333= %

11 | P a g e 6. Total cost of utilities ______/$2,333= %

7. Total cost of furniture ______/$2,333= %

8. Transportation ______/$2,333= %

9. Cell Phone ______/$2,333= %

Reflection Questions (to be completed once you have completed pages 4 – 11, do not complete before you finish those pages)

1. Did the percentage that you are spending of your monthly net income surprise you for any expenses? What expenses surprised you or didn’t surprise you? Explain your answer in 4 – 5 sentences.

2. How would you evaluate your current spending habits? Do they make sense? How could you change your spending habits to better suit your income or your needs? Explain your answer in 4 – 5 sentences.

3. If you could give someone one piece of advice in regards to finances and budgeting, what would it be and why? Explain your answer in 4 – 5 sentences.

12 | P a g e 4. How has your thinking changed about budgeting and spending since completing this project? Explain your answer in 4 – 5 sentences.

13 | P a g e