ECONOMICS 161 FALL 2003 E. McDEVITT

STUDY QUESTIONS ON LOANABLE FUNDS MARKET AND INTEREST RATES

1. Use the following information to answer the question below: YEAR NOMINAL RATE PRICE LEVEL 1990 113.3 1991 5.42% 117.7 1992 3.45% 121.1 1993 3.02% 124.2

Find the realized real rate of interest (rr) for 1991, 1992, and 1993. 2. What is the Fisher equation? If we take the expected real rate of interest as a given, then what does this equation imply about the impact of an increase in the expected inflation rate (e) on the nominal rate of interest (i)? 3. Assume that the actual inflation rate () is below the expected inflation rate (e). How does this affect borrowers and lenders? Your answer should discuss the realized real rate of interest and the expected real rate of interest. Give a numerical example to justify your answer. 4. What are the two general channels in which savers (lenders) are matched to borrowers? What is a financial intermediary? 5. What is the definition of private saving? ...public saving? ...national saving? 5. Explain why Sg < 0 means the government is running a budget deficit. 6. Explain why Sg < 0 means the government is running a budget deficit. 7. Why is investment inversely related to the expected real rate of interest? What does this relationship imply about the slope of the investment curve? What factor shifts the investment curve (i.e., the demand for loanable funds curve)? 8. What factors shift the S curve and how do they shift this curve? 9. Explain how an increase in T, holding G constant, affects the S curve. 10. Using a graph of the loanable funds market AND a brief written explanation, analyze the impact on r, S and I of each of the following: a. A decrease in G, holding T constant. b. The government adopts a new tax system that no longer taxes saving. c. Firms become more pessimistic about the expected future profitability of investment (that is, EFPI decreases). d. The government allows firms to take a tax credit on the purchase of any new capital goods. e. Both (a) and (d) occur at the same time. 11. Suppose there is an increase the equilibrium expected real rate of interest and a decrease in the equilibrium level of S & I. Which of the following changes can explain this outcome (choose one): a. New government policies that encourage more saving. b. New government policies that encourage more investment. c. An increase in EFPI. d. An increase in G, holding T constant. ANSWERS 1. To answer this question, you must first calculate the inflation rate using the price index numbers. Inflation rates are 3.88%,2.89%, and 2.56%, respectively. Having done this, subtract the inflation rate from the nominal rate of interest (given). Answers: 1.54% in '91, 0.56% in '92, and 0.46% in '93. e e 2. Fisher equation: i = re + where i = nominal rate of interest, re = the expected real rate of interest, and = expected inflation rate. It implies that an increase in e will cause an equal percentage point increase in the i (this is known as the Fisher effect). e 3. If < , then it follows that rr > re, and therefore lenders will gain at the expense of borrowers. e For example, suppose that i = 8%, =3% and = 6%. Then rr = i - = 8%-3%=5% and e re. = i - = 8%-6%= 2%. So at the time the loan was made lenders expected to receive and borrowers expected to pay a 2% real rate of interest. However, as it actually turns out lenders receive 5% and borrowers pay 5%. Lenders end up receiving more than expected and borrowers end up paying more than expected. 4. Lenders are matched to borrowers either through direct lending (bond markets, stock market) or through indirect lending via financial intermediaries. Financial intermediaries are financial middlemen and include banks, savings and loans, credit unions, mutual funds and others.

5. Private saving (Sp) = Y-T-C, Public saving (Sg) = T-G, and national saving (S) equals Sp+Sg = Y-C-G. 6. A budget deficit exists when G-T > 0. Since Sg<0 means T-G < 0, it obviously follows that G-T>0. 7. A higher interest rate means that is costlier for firms to borrow to finance their investment spending. Therefore, as you raise the cost of borrowing you will get a drop in the quantity of borrowing (i.e., a drop in investment spending). NOTE: Remember the economic definition of investment! It does not refer to purchasing financial assets. It implies a negatively-slopped investment curve. Shift factors-the expected future profitability of investment and government policies designed to affect the incentive to invest. For example, if firms expect a high rate of return by investing in, say, a new factory building or a new machine, then at any given interest rate they will desire to borrow more to finance this additional investment. 8. Shift variables for S curve: government policies designed to affect the incentive to save and changes in the budget deficit/surplus.

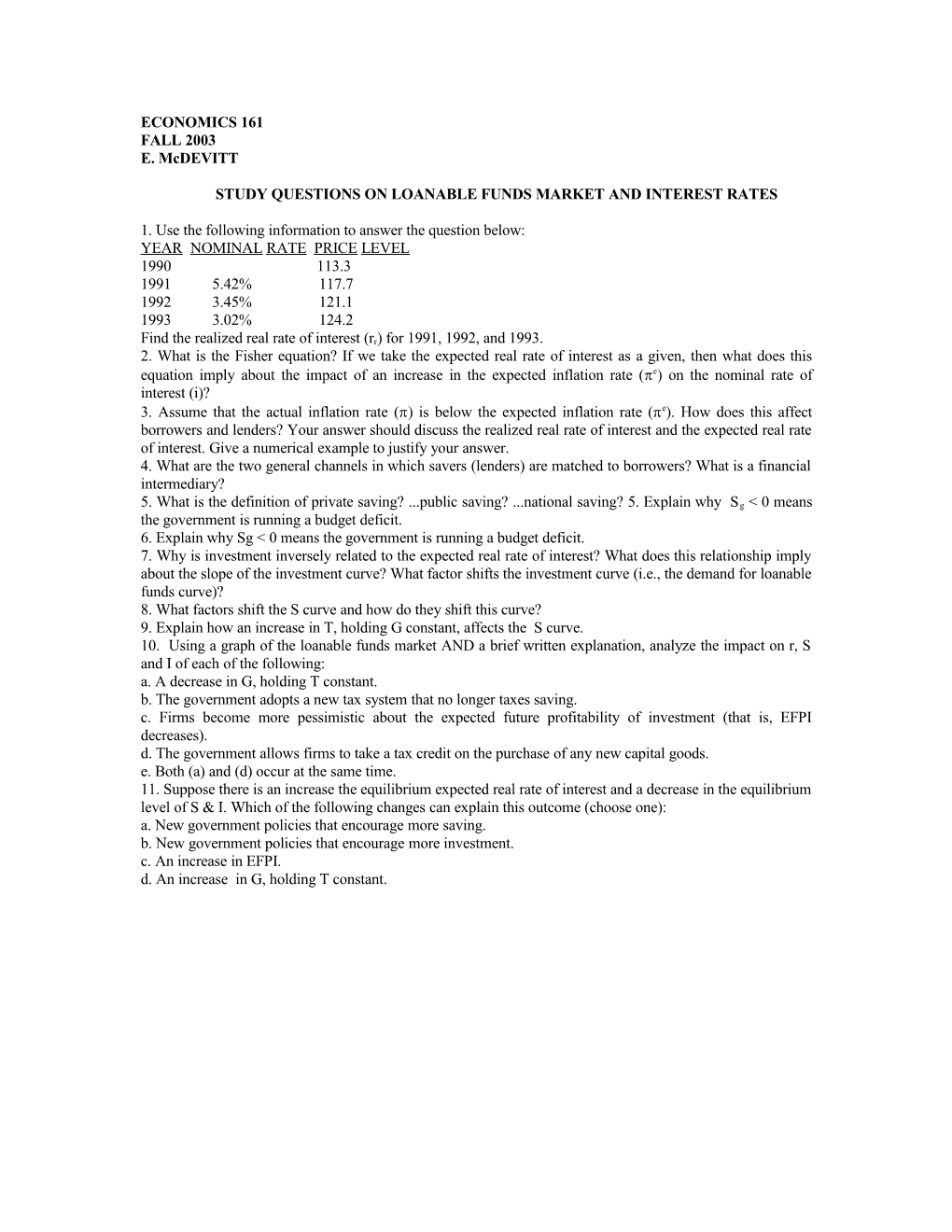

9. An increase in T, holding G constant, causes public saving (Sg) to rise. Since S= Sg + Sp, then it follows that if Sg is rising, S must be rising—that is, S shifts to the right. 10. a. A decrease in G, holding T constant, will cause public saving to rise (recall that, Sg = T-G and so a decrease in G cause T-G to rise). As public saving rises, national saving (S) increases—that is we get a rightward shift in the S curve. This causes r to fall. With the lower r, it is cheaper to borrow and so I rises. 10b. This encourages more saving (so S shifts to the right). This causes r to fall. With the lower r, it is cheaper to borrow and so I rises. 10c. The drop in EFPI causes I to fall (I curve shifts to the left). This shift results in a lower r. The lower r causes the quantity of saving to fall. 10d. This increases I (I curve shifts to the right). This causes r to rise. The higher r causes the quantity of saving to rise. 10. e. Since both curves shift—with S shifting to the right and I shifting to the right—we are uncertain about what happens to r but the equilibrium level of S&I increases. 11. Only a leftward shift in the S curve could explain this outcome. Therefore the answer is (d). QUESTION 10a, 10b . QUESTION 10e.

r S1 r S1 S2 S2 r1 r2 I r1

I1 I2

S1=I1 S2=I2 S,I S1=I1 S2=I2 r QUESTION 10c.

S r1 r2 I2 I1

S2=I2 S1=I1 S,I

r QUESTION 10d.

S r2 r1 I1 I2

S1=I1 S2=I2 S,I