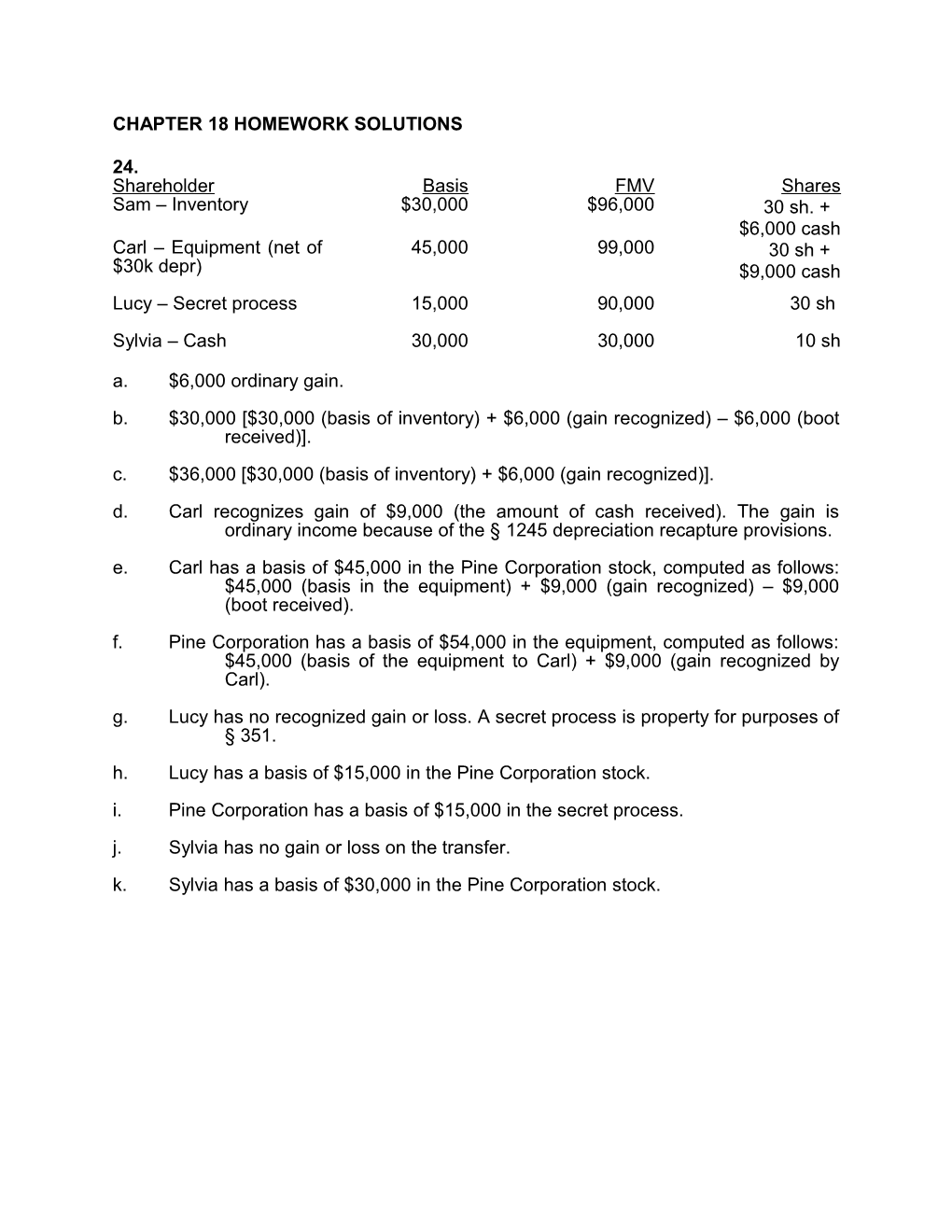

CHAPTER 18 HOMEWORK SOLUTIONS

24. Shareholder Basis FMV Shares Sam – Inventory $30,000 $96,000 30 sh. + $6,000 cash Carl – Equipment (net of 45,000 99,000 30 sh + $30k depr) $9,000 cash Lucy – Secret process 15,000 90,000 30 sh Sylvia – Cash 30,000 30,000 10 sh a. $6,000 ordinary gain. b. $30,000 [$30,000 (basis of inventory) + $6,000 (gain recognized) – $6,000 (boot received)]. c. $36,000 [$30,000 (basis of inventory) + $6,000 (gain recognized)]. d. Carl recognizes gain of $9,000 (the amount of cash received). The gain is ordinary income because of the § 1245 depreciation recapture provisions. e. Carl has a basis of $45,000 in the Pine Corporation stock, computed as follows: $45,000 (basis in the equipment) + $9,000 (gain recognized) – $9,000 (boot received). f. Pine Corporation has a basis of $54,000 in the equipment, computed as follows: $45,000 (basis of the equipment to Carl) + $9,000 (gain recognized by Carl). g. Lucy has no recognized gain or loss. A secret process is property for purposes of § 351. h. Lucy has a basis of $15,000 in the Pine Corporation stock. i. Pine Corporation has a basis of $15,000 in the secret process. j. Sylvia has no gain or loss on the transfer. k. Sylvia has a basis of $30,000 in the Pine Corporation stock. 29. Dan transfers property (basis=60k, FMV=200k) for 50%; Vera transfers property (basis=30k, FMV=150k) & renders services (FMV=50k) for 50%.

a. The transfers qualify under § 351. Vera’s stock is counted in determining control for purposes of § 351; thus, the transferors own 100% of the stock in Oriole. All of Vera’s stock, not just the shares received for the machinery, is considered in determining control because property she transferred has more than a nominal value in comparison to the value of the services rendered. b. Dan: No gain on the transfer: basis in the Oriole stock is $60,000. Vera: Recognizes ordinary income of $50,000; basis in her Oriole stock of $80,000 [$30,000 (basis of the machinery) + $50,000 (income for services)]. c. Oriole: Basis of $60,000 in the land and a basis of $30,000 in the machinery; deduction of $50,000 for the services provided by Vera, or it will capitalize the $50,000 as an organizational expenditure. 30. Monica’s (50% owner) additional contribution of property (basis = $45k; FMV = $300k). Her ownership after the contribution is 75%. a. Fully taxable because Monica, the sole transferor of property, does not have control immediately after the transaction. Amount realized—stock $300,000 Less: Adjusted basis of property transferred (45,000) Realized gain $255,000 Recognized gain $255,000 b. With the change, Monica is trying to avoid recognizing the $255,000 gain. The plan involves Rachel becoming a transferor of property along with Monica so that together they would meet the 80% control test. If Monica is part of a group that meets the control test, she would avoid recognizing the gain. However, this plan will not be successful. Rachel’s interest cannot be counted since the value of the stock she would receive is relatively small compared to the value of the stock she already owns. In addition, Rachel’s contribution would be made primarily to qualify Monica for § 351 treatment. c. Monica can transfer property that has not appreciated in value (e.g, cash).

Rachel could contribute property of an amount that is not small relative to the value of the stock already owned. By doing so, she would be considered a transferor of property along with Monica, and together, they would have control. As a result, Monica would avoid gain recognition. For example, if the value of Rachel’s stock is worth approximately $300,000 prior to the contribution, a transfer of at least $30,000 would likely be sufficient to avoid the relative-small-in- value test. 33. Frank’s Built-in Gain/ Assets Adjusted Basis FMV (Loss) Inventory $ 60,000 $100,000 $40,000 Delivery vehicles 150,000 105,000 (45,000) Shelving 80,000 65,000 (15,000) $290,000 $270,000 ($20,000)

a. The $20,000 realized loss is not recognized, as he owns 100%. b. Basis in the Peach stock is $290,000. c. Because the aggregate basis of the assets transferred to Peach exceeds their FMV, the basis of the loss assets must be stepped down.

Unadjusted Adjusted Assets Tax Basis Adjustment Tax Basis Inventory $ 60,000 $ 0 $ 60,000 Delivery 150,000 (15,000)* 135,000 vehicles Shelving 80,000 (5,000)** 75,000 $290,000 ($20,000) $270,000 *$45,000 $20,000 = $15,000 $60,000

**$15,000 $20,000 = $5,000 $60,000

d. If Frank plans to hold his stock for a substantial period of time, he and Peach should elect to allow Peach to take a carryover basis in the assets. This provides larger depreciation deductions. If they so elect, Frank will reduce his stock basis to $270,000 39. §1244 stock a. Sam has an ordinary loss of $50,000 and a long-term capital loss of $40,000. b. Kara has a long-term capital loss of $40,000. Only the original holder of § 1244 stock qualifies for ordinary loss treatment.

41. MORE §1244 Stock. Susan transfers property (basis = $50k; FMV - $25k) for §1244 stock in a §351 transfer. Sells her stock for $20k two years later. a. The basis of the stock to Susan is $50,000. b. The basis of the stock for purposes of § 1244 is only $25,000. c. Susan would have a $30,000 loss ($20,000 – $50,000), only $5,000 of which would be ordinary under § 1244. The remaining $25,000 loss would be a capital loss.

25. Shareholder Basis FMV Shares Mark – Cash $50,000 $50,000 30 - Install. Note 140,000 250,000 Gail – Cash 150,000 150,000 - Equipment 125,000 250,000 70 - Patent 10,000 300,000 a. $0. b. $190,000. c. $140,000. d. $0. e. $285,000. f. $125,000 (basis in the equipment) and $10,000 (basis in the patent). g. The answers would not change. There is no requirement that the transferors receive the same type of stock. Further, both common stock and most preferred stock qualify as “stock.” However, if Gail received “nonqualified preferred stock,” her realized gain would be recognized because this type of preferred stock is treated as boot. h. The answers would not change. There is no requirement that the transferors be individuals.