TISA Model Language

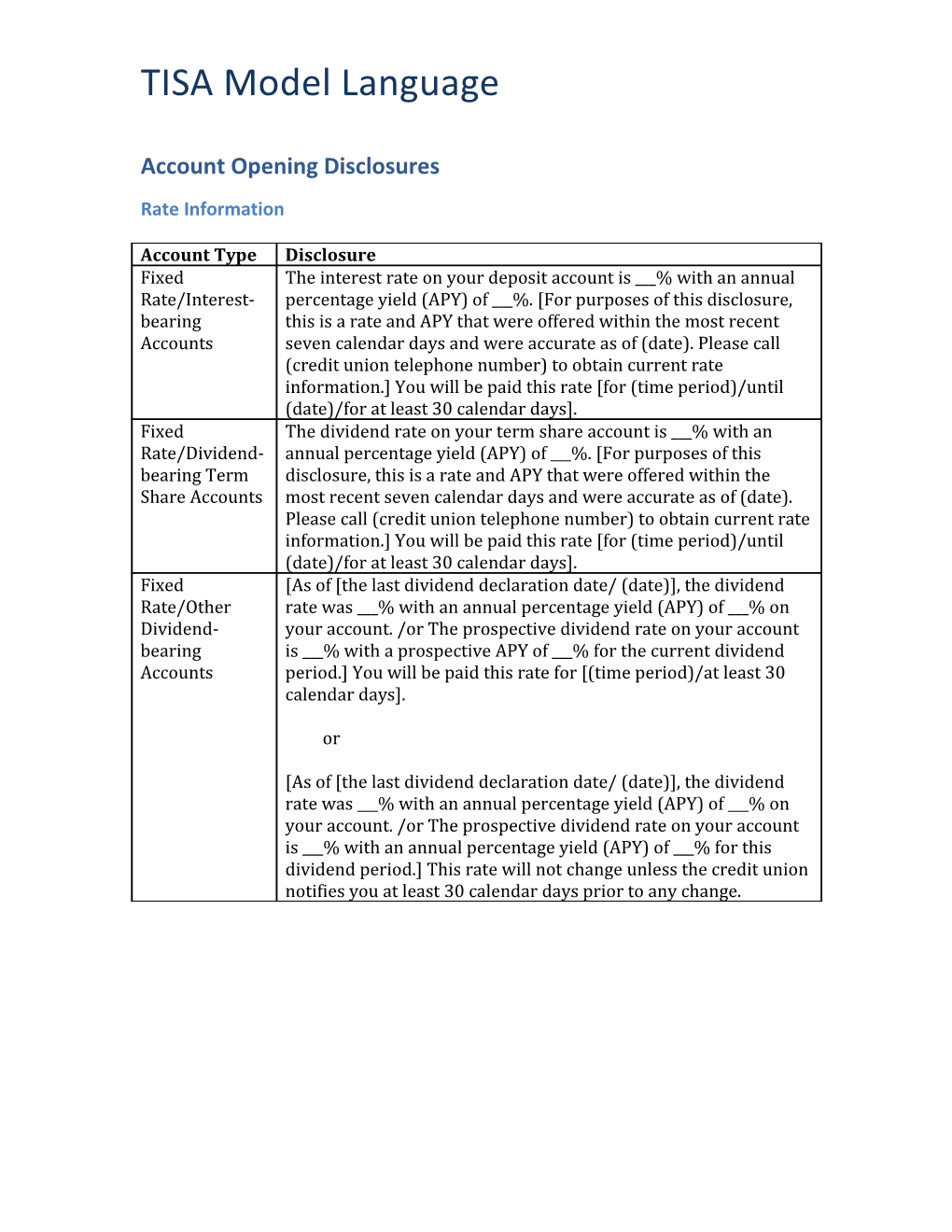

Account Opening Disclosures Rate Information

Account Type Disclosure Fixed The interest rate on your deposit account is ___% with an annual Rate/Interest- percentage yield (APY) of ___%. [For purposes of this disclosure, bearing this is a rate and APY that were offered within the most recent Accounts seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.] You will be paid this rate [for (time period)/until (date)/for at least 30 calendar days]. Fixed The dividend rate on your term share account is ___% with an Rate/Dividend- annual percentage yield (APY) of ___%. [For purposes of this bearing Term disclosure, this is a rate and APY that were offered within the Share Accounts most recent seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.] You will be paid this rate [for (time period)/until (date)/for at least 30 calendar days]. Fixed [As of [the last dividend declaration date/ (date)], the dividend Rate/Other rate was ___% with an annual percentage yield (APY) of ___% on Dividend- your account. /or The prospective dividend rate on your account bearing is ___% with a prospective APY of ___% for the current dividend Accounts period.] You will be paid this rate for [(time period)/at least 30 calendar days].

or

[As of [the last dividend declaration date/ (date)], the dividend rate was ___% with an annual percentage yield (APY) of ___% on your account. /or The prospective dividend rate on your account is ___% with an annual percentage yield (APY) of ___% for this dividend period.] This rate will not change unless the credit union notifies you at least 30 calendar days prior to any change. TISA Model Language Variable- The interest rate on your deposit account is ___%, with an annual Rate/Interest- percentage yield (APY) of ___%. [For purposes of this disclosure, bearing this is a rate and APY that were offered within the most recent seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.] The interest rate and annual percentage yield may change every (time period) based on [(name of index)/the determination of the credit union board of directors]. The interest rate for your account will [never change by more than ___% each (time period)/never be less/more than ___%/never exceed ___% above or fall more than ___% below the initial interest rate]. Variable The dividend rate on your term share account is ___%, with an Rate/Dividend- annual percentage yield (APY) of ___%. [For purposes of this bearing Term disclosure, this is a rate and APY that were offered within the Share most recent seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.] The dividend rate and annual percentage yield may change every (time period) based on [(name of index)/the determination of the credit union board of directors]. The dividend rate for your account will [never change by more than ___% each (time period)/never be less/more than ___% /never exceed ___% above or fall more than ___% below the initial dividend rate]. Variable [As of [the last dividend declaration date/ (date)], the dividend Rate/Other rate was ___% with an annual percentage yield (APY) of ___% on Dividend- your account. /or The prospective dividend rate on your account bearing is ___% with an anticipated annual percentage yield (APY) of ___% for the current dividend period.] The dividend rate and annual percentage yield may change every (dividend period) as determined by the credit union board of directors. Stepped- The initial interest rate on your deposit account is ___%. You will Rate/Interest- be paid that rate [for (time period)/ until (date)]. After that time, bearing the interest rate for your deposit account will be ___% and you will be paid that rate [for (time period)/ until (date)]. The annual percentage yield (APY) for your account is ___%. [For purposes of this disclosure, this is a rate and APY that were offered within the most recent seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.] You will be paid this rate [for (time period)/until (date)/for at least 30 calendar days]. TISA Model Language Stepped The initial dividend rate on your term share account is ___%. You Rate/Dividend- will be paid that rate [for (time period)/ until (date)]. After that bearing Term time, the dividend rate for your term share account will be ___% Share and you will be paid that rate [for (time period)/ until (date)]. The annual percentage yield (APY) for your account is ___%. [For purposes of this disclosure, this is a rate and APY that were offered within the most recent seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.] You will be paid this rate [for (time period)/until (date)/for at least 30 calendar days]. Stepped [As of [the last dividend declaration date/ (date)], the initial Rate/Other dividend rate on your account was ___%. /or The prospective Dividend dividend rate on your account is ___%.] You will be paid that rate bearing [for (time period)/ until (date)]. After that time, the prospective dividend rate for your share account will be ___% and you will be paid such rate [for (time period)/ until (date)]. The annual percentage yield (APY) for your account is ___%. You will be paid this rate for [(time period)/at least 30 calendar days]. Tiered- 1* If your [daily balance/average daily balance] is $___ or more, Rate/Interest- the interest rate paid on the entire balance in your account will be bearing Tiering ___%, with an annual percentage yield (APY) of ___%. Method A 2* If your [daily balance/average daily balance] is more than $___, but less than $___, the interest rate paid on the entire balance in your account will be ___%, with an APY of ___%.

3* If your [daily balance/average daily balance] is $___ or less, the interest rate paid on the entire balance will be ___% with an APY of ___%.

[For purposes of this disclosure, this is a rate and APY that were offered within the most recent seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.]

[ Fixed-rate —You will be paid this rate [for (time period)/until (date)/for at least 30 calendar days]./ Variable-rate —The interest rate and APY may change every (time period) based on [(name of index)/ the determination of the credit union board of directors.] TISA Model Language Tiered Tiering Method B Rate/Interest- bearing Tiering 1* An interest rate of ____% will be paid only on the portion of Method B your [daily balance/average daily balance] that is greater than $____. The annual percentage yield (APY) for this tier will range from ____% to ____%, depending on the balance in the account.

2* An interest rate of ____% will be paid only on the portion of your [daily balance/average daily balance] that is greater than $____, but less than $____. The annual percentage yield (APY) for this tier will range from ____% to ____%, depending on the balance in the account.

3* If your [daily balance/average daily balance] is $____ or less, the interest rate paid on the entire balance will be ____%, with an annual percentage yield (APY) of ____%.

[For purposes of this disclosure, this is a rate and APY that were offered within the most recent seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.]

[ Fixed-rate —You will be paid this rate [for (time period)/until (date)/for at least 30 calendar days]./ Variable-rate —The interest rate and APY may change every (time period) based on [(name of index)/ the determination of the credit union board of directors.] TISA Model Language Tiered Rate/ 1* If your [daily balance/average daily balance] is $____ or more, Dividend- the dividend rate paid on the entire balance in your account will bearing Term be ____%, with an annual percentage yield (APY) of ____%. Share Tiering Method A 2* If your [daily balance/average daily balance] is more than $____, but less than $____, the dividend rate paid on the entire balance in your account will be ____%, with an APY of ____%.

3* If your [daily balance/average daily balance] is $____ or less, the dividend rate paid on the entire balance will be ____% with an APY of ____%.

[For purposes of this disclosure, this is a rate and APY that were offered within the most recent seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.]

[ Fixed-rate —You will be paid this rate [for (time period)/until (date)/for at least 30 calendar days]./ Variable-rate —The interest rate and APY may change every (time period) based on [(name of index)/ the determination of the credit union board of directors.] TISA Model Language Tiered Rate/ Tiering Method B Dividened- bearing Term 1* A dividend rate of ____% will be paid only on the portion of your Share Tiering [daily balance/average daily balance] that is greater than $____. Method B The annual percentage yield (APY) for this tier will range from ____% to ____%, depending on the balance in the account.

2* A dividend rate of ____% will be paid only on the portion of your [daily balance/average daily balance] that is greater than $____, but less than $____. The annual percentage yield (APY) for this tier will range from ____% to ____%, depending on the balance in the account.

3* If your [daily balance/average daily balance] is $____ or less, the dividend rate paid on the entire balance will be ____%, with an annual percentage yield (APY) of ____%.

[For purposes of this disclosure, this is a rate and APY that were offered within the most recent seven calendar days and were accurate as of (date). Please call (credit union telephone number) to obtain current rate information.]

[ Fixed-rate —You will be paid this rate [for (time period)/until (date)/for at least 30 calendar days]./ Variable-rate —The interest rate and APY may change every (time period) based on [(name of index)/ the determination of the credit union board of directors.] TISA Model Language Tiered 1* [As of [the last dividend declaration date/ (date)], if your [daily Rate/Other balance/average daily balance] was $____ or more, the dividend Dividend- rate paid on the entire balance in your account was ____%, with an bearing/Tiering annual percentage yield (APY) of ____%. /or If your [daily Method A balance/average daily balance] is $____ or more, a prospective dividend rate of ____% will be paid on the entire balance in your account with a prospective annual percentage yield (APY) of ____ % for this dividend period.]

2* [As of [the last dividend declaration date/ (date)], if your [daily balance/average daily balance] was more than $____, but was less than $____, the dividend rate paid on the entire balance in your account was ____%, with an annual percentage yield (APY) of ____ %. /or If your [daily balance/average daily balance] is more than $____, but is less than $____, a prospective dividend rate of ____% will be paid on the entire balance in your account with a prospective annual percentage yield (APY) of ____% for this dividend period.]

3* [As of the last dividend declaration date/ (date)], if your [daily balance/average daily balance] was $____ or less, the dividend rate paid on the entire balance in your account will be ____% with an annual percentage yield (APY) of ____%. /or If your [daily balance/average daily balance] is $____ or less, the prospective dividend rate of ____% will be paid on the entire balance in your account with a prospective annual percentage yield (APY) of ____ % for this dividend period.

[ Fixed-rate —You will be paid this rate for [(time period)/at least 30 calendar days]./ Variable-rate —The dividend rate and APY may change every (dividend period) as determined by the credit union board of directors.] TISA Model Language Tiered 1* [As of [the last dividend declaration date/ (date)], a dividend Rate/Other rate of ____% was paid only on the portion of your [daily Dividend- balance/average daily balance] that was greater than $____. The bearing/Tiering annual percentage yield (APY) for this tier ranged from ____% to Method A ____%, depending on the balance in the account. /or A prospective dividend rate of ____% will be paid only on the portion of your [daily balance/average daily balance] that is greater than $____ with a prospective annual percentage yield (APY) ranging from ____% to ____%, depending on the balance in the account, for this dividend period.]

2* [As of [the last dividend declaration date/ (date)], a dividend rate of ____% was paid only on the portion of your [daily balance/average daily balance] that was greater than $____ but less than $____. The annual percentage yield (APY) for this tier ranged from ____% to ____%, depending on the balance in the account. /or A prospective dividend rate of ____% will be paid only on the portion of your [daily balance/average daily balance] that is greater than $____, but less than $____] with a prospective annual percentage yield (APY) ranging from ____% to ____%, depending on the balance in the account, for this dividend period.]

3* [As of [the last dividend declaration date/ (date)], if your [daily balance/average daily balance] was $____ or less, the dividend rate paid on the entire balance was ____%, with an annual percentage yield (APY) of ____%. /or If your [daily balance/average daily balance] was $___ or less, the prospective dividend rate paid on the entire balance in your account will be ___% with a prospective annual percentage yield (APY) of ___% for this dividend period.

Nature of Dividends

Dividends are paid from current income and available earnings, after required transfers to reserves at the end of a dividend period. Compounding and Crediting

[Dividends/Interest] will be compounded (frequency) and will be credited (frequency).

and, if applicable:

If you close your [share/deposit] account before [dividends/interest] [are/is] paid, you will not receive the accrued [dividends/interest].

and, if applicable (for dividend-bearing accounts): TISA Model Language

For this account type, the dividend period is (frequency), for example, the beginning date of the first dividend period of the calendar year is (date) and the ending date of such dividend period is (date). All other dividend periods follow this same pattern of dates. The dividend declaration date follows the ending date of a dividend period, and for the example is (date). Minimum Balance Requirements Condition Disclosure To open the The minimum balance required to open this account is $____. account or, for first share account at a credit union

The minimum required to open this account is the purchase of a (par value of a share) share in the credit union. To avoid You must maintain a minimum daily balance of $____ in your imposition of account to avoid a service fee. If, during any (time period), your fees account balance falls below the required minimum daily balance, your account will be subject to a service fee of $____ for that (time period).

or

You must maintain a minimum average daily balance of $____ in your account to avoid a service fee. If, during any (time period), your average daily balance is below the required minimum, your account will be subject to a service fee of $____ for that (time period). To obtain the You must maintain a minimum daily balance of $____ in your annual account each day to obtain the disclosed annual percentage yield. percentage yield disclosed or

You must maintain a minimum average daily balance of $____ in your account to obtain the disclosed annual percentage yield. Absence of No minimum balance requirements apply to this account. minimum balance requirements Par Value The par value of a share in this credit union is $____.

Balance Computation Method Method Disclosure TISA Model Language Daily Balance [Dividends/Interest] [are/is] calculated by the daily balance method which applies a daily periodic rate to the balance in the account each day.

Average Daily [Dividends/Interest] [are/is] calculated by the average daily Balance balance method which applies a periodic rate to the average daily balance in the account for the period. The average daily balance is calculated by adding the balance in the account for each day of the period and dividing that figure by the number of days in the period.

Accrual of Dividends/Interest on Noncash Deposits

[Dividends/Interest] will begin to accrue on the business day you [place/deposit] noncash items (e.g. checks) to your account.

or

[Dividends/Interest] will begin to accrue no later than the business day we receive provisional credit for the [placement/deposit] of noncash items (e.g. checks) to your account.

Fees and Charges The following fees and charges may be assessed against your account:

(Service/explanation)—$___.

(Service/explanation)—$___.

Transaction Limitations

The minimum amount you may [withdraw/write a draft for] is $____

During any statement period, you may not make more than six withdrawals or transfers to another credit union account of yours or to a third party by means of a preauthorized or automatic transfer or telephonic order or instruction. No more than three of the six transfers may be made by check, draft, debit card, if applicable, or similar order to a third party. If you exceed the transfer limitations set forth above in any statement period, your account will be subject to [closure by the credit union/a fee of $____. Term Share Account Disclosures Condition Disclosure TISA Model Language Time Requirements Your account will mature on (date).

or

Your account will mature after (time period). Early withdrawal We [will/may] impose a penalty if you withdraw [any/all] penalties of the [funds/principal] in your account before the maturity date. The penalty will equal [____ [days'/weeks'/months'] [dividends/interest] on your account.

or

We [will/may] impose a penalty of $_____ if you withdraw [any/all] of the [funds/principal] before the maturity date.

If you withdraw some of your funds before maturity, the [dividend/interest] rate for the remaining funds in your account will be ___%, with an annual percentage yield of ___ %. Withdrawal of The annual percentage yield is based on an assumption Dividends/Interest that [dividends/interest] will remain in the account until Prior to Maturity maturity. A withdrawal will reduce earnings. Renewal Your term share account will automatically renew at Policies/Automatically maturity. You will have a grace period of ____ Renewal [calendar/business] days after the maturity date to withdraw the funds in the account without being charged an early withdrawal penalty.

or

Your term share account will automatically renew at maturity. There is no grace period following the maturity of this account. Renewal This account will not renew automatically at maturity. If Policies/Non-auto you do not renew the account, your account will [continue renewal to earn/no longer earn] [dividends/interest] after the maturity date. Required dividend This account requires the distribution of dividends and distribution does not allow dividends to remain in the account

Bonuses You will [be paid/receive] [$_____/(description of item)] as a bonus [when you open the account/on (date)]. TISA Model Language

You must maintain a minimum [daily balance/average daily balance] of $_____ to obtain the bonus.

To earn the bonus, [$_____/your entire principal] must remain on deposit [for (time period)/until (date)]. Overdrafts Fees for Overdrawing Accounts. Fees may be imposed on each check, draft, item, ATM card withdrawal, debit card point of purchase, preauthorized automatic debit, telephone initiated withdrawal or any other electronic withdrawal or transfer transaction that is drawn on an insufficient available account balance. The entire balance in your account may not be available for withdrawal, transfer or paying a check, draft or item. You may consult the Funds Availability Policy for information regarding the availability of funds in your account. Fees for overdrawing your account may be imposed for each overdraft, regardless of whether we pay or return the draft, item or transaction. If we have approved an overdraft protection limit for your account, such fees may reduce your approved limit. Please refer to the Fee Schedule for current fee information.

Changes in Terms On (date), the (type of fee) will increase to $_____.

On (date), the [dividend/interest] rate on your account will decrease to ___%, with an annual percentage yield (APY) of ___%.

On (date), the [minimum daily balance/average daily balance] required to avoid imposition of a fee will increase to $_____.

Pre-Maturity Notices for Term Share Accounts Condition Disclosure Maturity Date Your term share account will mature on _____. Nonrenewal Unless your term share account is renewed, it will not accrue further [dividends/interest] after the maturity date. Rate The [dividend/interest] rate and annual percentage yield that Information will apply to your term share account if it is renewed have not yet been determined. That information will be available on ____. After that date, you may call the credit union during regular business hours at (telephone number) to find out the [dividend/interest] rate and annual percentage yield (APY) that will apply to your term share account if it is renewed. TISA Model Language Overdraft and Return Items – Periodic Statement

B–12 Aggregate Overdraft and Returned Item Fees Sample Form

Total for this period Total year-to-date Total overdraft fees $60.00 $150.00 Total returned item fees $0.00 $30.00

Overdraft Advertisement Model Language Categories of Transactions Covered Fees may be imposed on each check, draft, item, ATM card withdrawal, debit card point of purchase, preauthorized automatic debit, telephone initiated withdrawal or any other electronic withdrawal or transfer transaction that is drawn on an insufficient available account balance. Time Period for Repayment After overdrawing your account you have [ ] days to bring your account current.

When you overdraw your account we reserve the right to demand that you bring your account current. Circumstances under which an overdraft will not be paid “Whether your overdrafts will be paid is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is not in good standing, or you are not making regular deposits, or you have too many overdrafts.”