FUN Worksheet “Principles of Macroeconomics” NSCC - Summer 2009 Professor: Moonsu Han

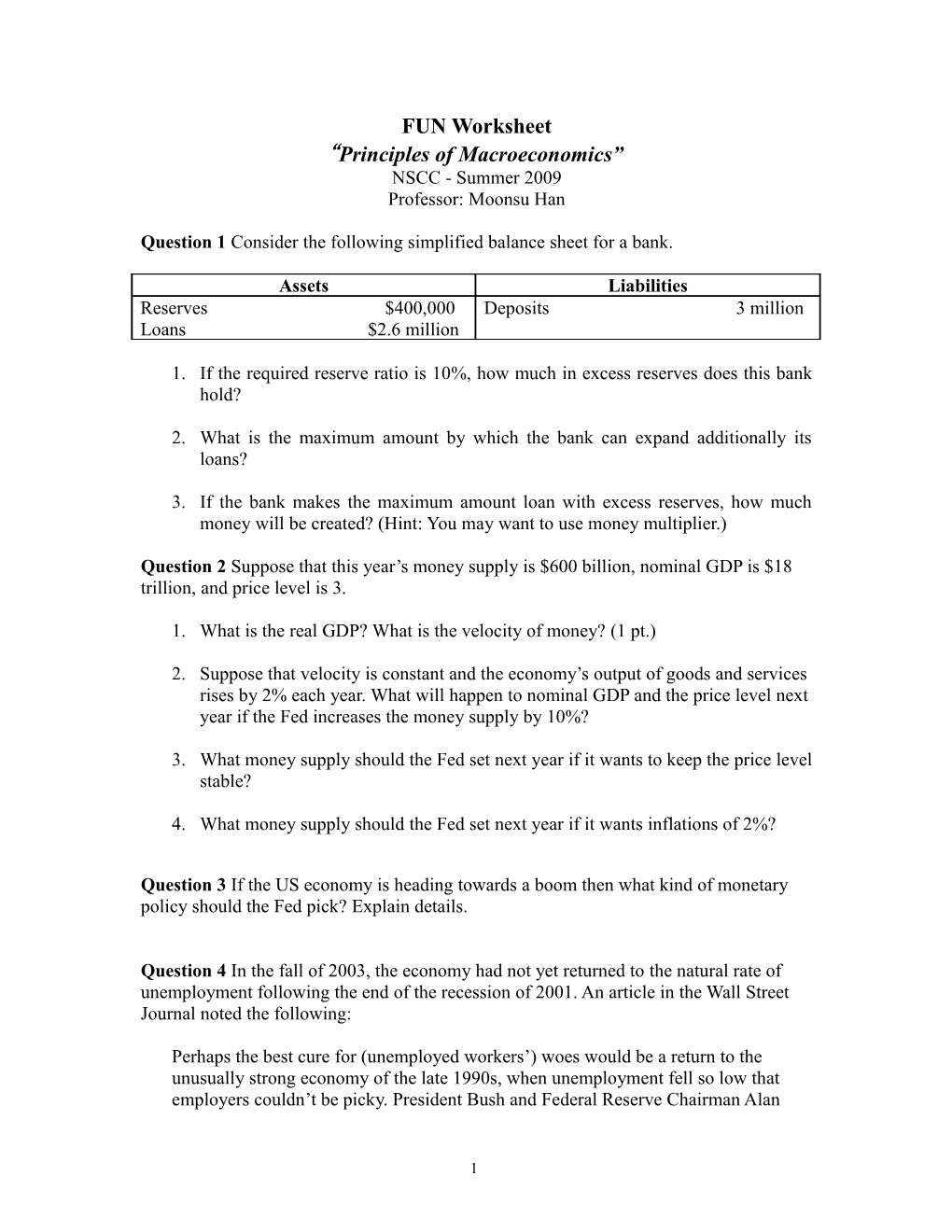

Question 1 Consider the following simplified balance sheet for a bank.

Assets Liabilities Reserves $400,000 Deposits 3 million Loans $2.6 million

1. If the required reserve ratio is 10%, how much in excess reserves does this bank hold?

2. What is the maximum amount by which the bank can expand additionally its loans?

3. If the bank makes the maximum amount loan with excess reserves, how much money will be created? (Hint: You may want to use money multiplier.)

Question 2 Suppose that this year’s money supply is $600 billion, nominal GDP is $18 trillion, and price level is 3.

1. What is the real GDP? What is the velocity of money? (1 pt.)

2. Suppose that velocity is constant and the economy’s output of goods and services rises by 2% each year. What will happen to nominal GDP and the price level next year if the Fed increases the money supply by 10%?

3. What money supply should the Fed set next year if it wants to keep the price level stable?

4. What money supply should the Fed set next year if it wants inflations of 2%?

Question 3 If the US economy is heading towards a boom then what kind of monetary policy should the Fed pick? Explain details.

Question 4 In the fall of 2003, the economy had not yet returned to the natural rate of unemployment following the end of the recession of 2001. An article in the Wall Street Journal noted the following:

Perhaps the best cure for (unemployed workers’) woes would be a return to the unusually strong economy of the late 1990s, when unemployment fell so low that employers couldn’t be picky. President Bush and Federal Reserve Chairman Alan

1 Greenspan are working on that, (using) tax cuts and interest-rate cuts.

1. Which of these two actions is fiscal policy and which is monetary policy?

2. Briefly explain how tax cuts and interest-rate cuts reduce unemployment.

3. Above article mentioned only one fiscal policy and one monetary policy. What else fiscal policy is possible and what else monetary policy is possible?

Question 5 Suppose that the T-account for First Boston Bank is as follows:

Assets Liabilities Reserves $200,000 Deposits $1,000,000 Loans $800,000

1. If the Fed requires banks to hold 10% of deposits as reserves, how much in excess reserves does First Boston Bank how hold?

2. Assume that all other banks hold only the required amt of reserves. If Fed reduces reserve requirement to 5% and if First Boston Bank decides to reduce its reserves to only the required amt, by how much would the economy’s money supply increase?

Question 6 (Might be Difficult)

Suppose the money supply is currently $400 billion and the Fed wishes to increase it by $100 billion.

1. Given a required reserve ratio of 20%, how much the Fed should increase money supply?

2. If the Fed decided to change the money supply by changing the required reserve ratio, what should the required reserve ratio be?

Question 7 (I will cover this part in next class)

Molson’s Beer is produced in Canada and sold in many countries. In the province of Ontario a six-pack of Molson’s beer sold for $8.00 Canadian. Across the border in Minnesota, a six-pack of the same beer was for sale for $5.00 US. At the time, the exchange rate was $1.00 Canadian = $0.67 US

1. How much would it cost in US currency to buy the beer in Ontario?

2. How much would it cost in Canadian currency to buy the beer in Minnesota? 3. Is there an arbitrage opportunity? If yes, explain why arbitrage opportunity exists, and where would you buy and where would you sell?

2 4. How much profit could you expect on a six-pack?

Question 8 If we know the exchange rate between Country A’s currency and Country B’s currency, and we know the exchange rate between Country B’s currency and Country C’s currency, then we can compute the exchange rate between Country A’s currency and Country C’s currency. (Assume PPP holds.) (Next Class)

(a) Suppose the exchange rate between the Korean Won and the US dollar is currently “1,000 Won = $1” and the exchange rate between the British pound and the US dollar is “0.70 Pound = $1”. What is the exchange rate between the Won and the Pound?

(b) Suppose that exchange rate between the Won and dollar changes to “800 Won = $1” and the exchange rate between the pound and dollar changes to “0.80 Pound = $1”. Has the dollar appreciated or depreciated against the won? Has the dollar appreciated or depreciated against the pound? Has the Won appreciated or depreciated against the pound? (2 pts.)

Question 9 Find one of following real data from BLS or BEA webpage and find recent data for following terms.

Unemployment rate

Real GDP

CPI

3