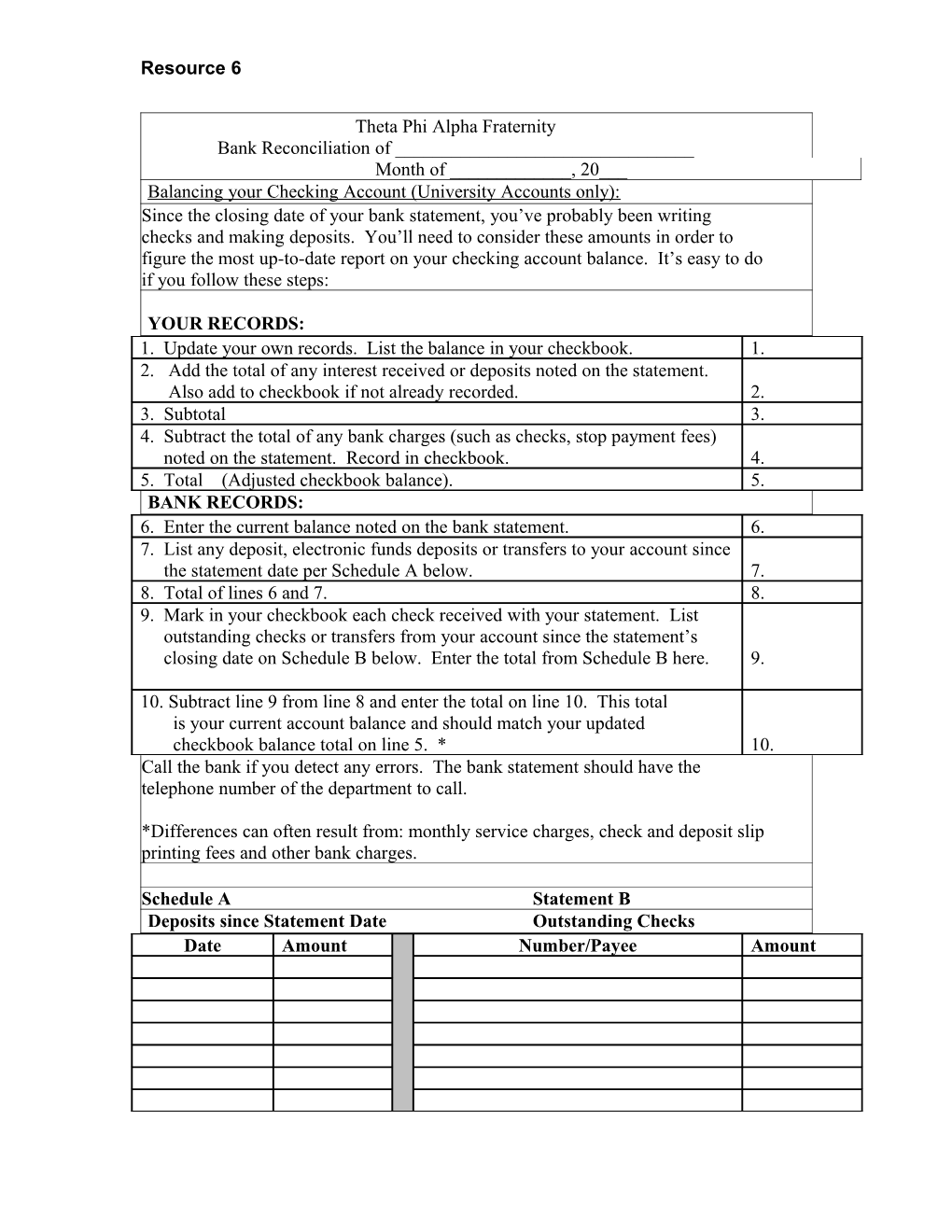

Resource 6

Theta Phi Alpha Fraternity Bank Reconciliation of ______Month of ______, 20___ Balancing your Checking Account (University Accounts only): Since the closing date of your bank statement, you’ve probably been writing checks and making deposits. You’ll need to consider these amounts in order to figure the most up-to-date report on your checking account balance. It’s easy to do if you follow these steps:

YOUR RECORDS: 1. Update your own records. List the balance in your checkbook. 1. 2. Add the total of any interest received or deposits noted on the statement. Also add to checkbook if not already recorded. 2. 3. Subtotal 3. 4. Subtract the total of any bank charges (such as checks, stop payment fees) noted on the statement. Record in checkbook. 4. 5. Total (Adjusted checkbook balance). 5. BANK RECORDS: 6. Enter the current balance noted on the bank statement. 6. 7. List any deposit, electronic funds deposits or transfers to your account since the statement date per Schedule A below. 7. 8. Total of lines 6 and 7. 8. 9. Mark in your checkbook each check received with your statement. List outstanding checks or transfers from your account since the statement’s closing date on Schedule B below. Enter the total from Schedule B here. 9.

10. Subtract line 9 from line 8 and enter the total on line 10. This total is your current account balance and should match your updated checkbook balance total on line 5. * 10. Call the bank if you detect any errors. The bank statement should have the telephone number of the department to call.

*Differences can often result from: monthly service charges, check and deposit slip printing fees and other bank charges.

Schedule A Statement B Deposits since Statement Date Outstanding Checks Date Amount Number/Payee Amount Resource 6

Total Total