I think every business client has asked us at least once, “how long do we have do keep all these tax records? We have bank statements, cancelled checks, invoices, journals, ledgers, and payroll reports going back forever.” The IRS is, as usual, officially vague. Every taxpayer is required to maintain adequate records, make those records available upon a proper request and to keep those records so long as they may be material to the administration of the tax laws.

In reality, we normally look to the time frame that the IRS can audit a return and assess additional taxes or that you can file an amended return to claim a refund. For most taxpayers, this period is three years from the original due date of the return or the date the return is filed if later. However, if a return includes a substantial understatement of income (greater than 25%), the statute of limitations is extended to six years and if there is fraud involved, or a return is not filed, there is no limit.

A good general rule is to add a year to the IRS statute of limitations period. Using this approach you should keep your income tax records for a minimum of four years, but it may be more prudent to retain them for seven years, which is what the IRS informally recommends. State tax rules must also be considered, but holding records long enough for IRS purposes will normally work for state tax purposes, assuming the federal and state returns were filed at the same time.

Certain tax records, however, should be kept much longer and some, indefinitely. There are also non-tax reasons to keep certain records beyond the time needed for tax purposes. These include insurance policies, leases, employment records and other legal documents. There also can be requirements of regulatory agencies unique to a particular industry. Your CPA or attorney can provide additional guidance.

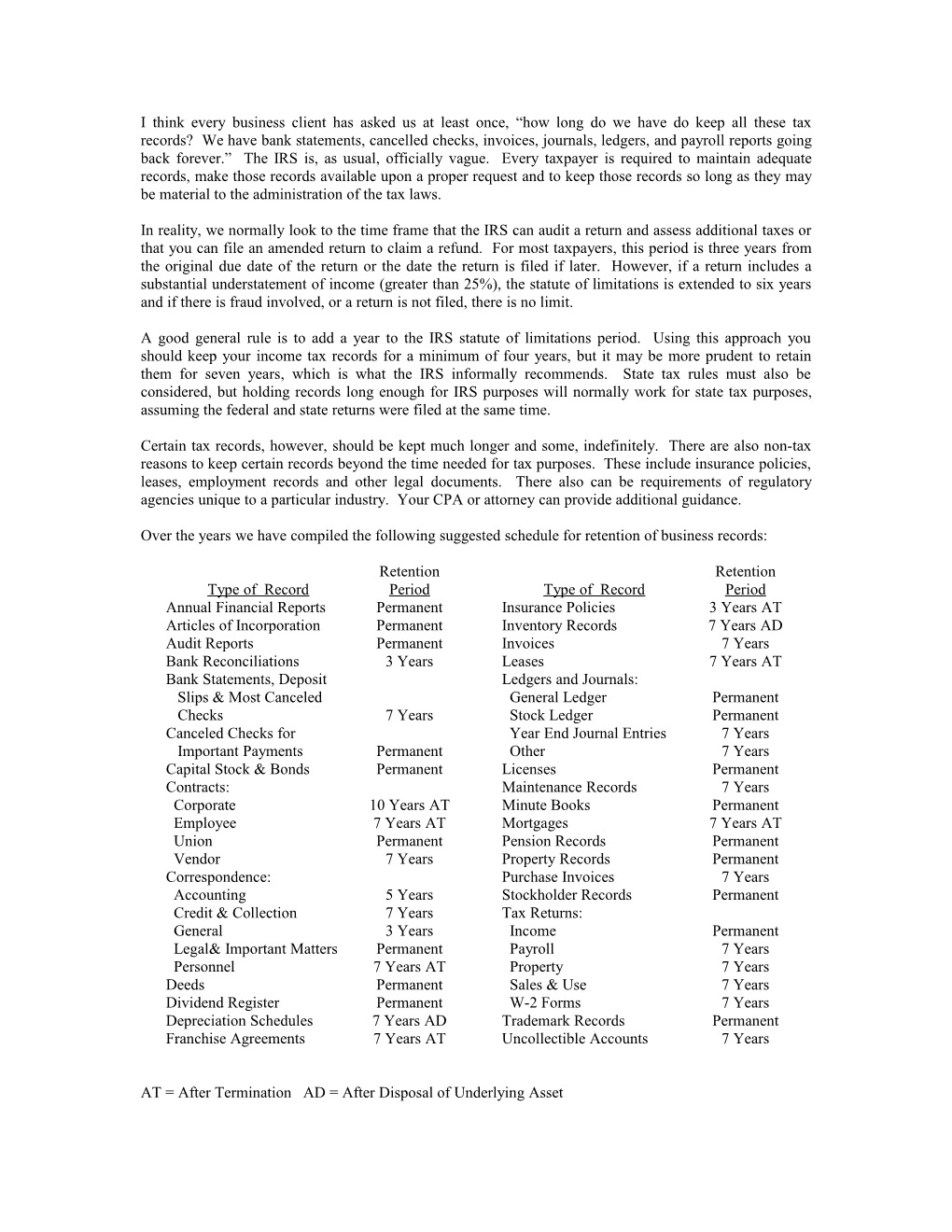

Over the years we have compiled the following suggested schedule for retention of business records:

Retention Retention Type of Record Period Type of Record Period Annual Financial Reports Permanent Insurance Policies 3 Years AT Articles of Incorporation Permanent Inventory Records 7 Years AD Audit Reports Permanent Invoices 7 Years Bank Reconciliations 3 Years Leases 7 Years AT Bank Statements, Deposit Ledgers and Journals: Slips & Most Canceled General Ledger Permanent Checks 7 Years Stock Ledger Permanent Canceled Checks for Year End Journal Entries 7 Years Important Payments Permanent Other 7 Years Capital Stock & Bonds Permanent Licenses Permanent Contracts: Maintenance Records 7 Years Corporate 10 Years AT Minute Books Permanent Employee 7 Years AT Mortgages 7 Years AT Union Permanent Pension Records Permanent Vendor 7 Years Property Records Permanent Correspondence: Purchase Invoices 7 Years Accounting 5 Years Stockholder Records Permanent Credit & Collection 7 Years Tax Returns: General 3 Years Income Permanent Legal& Important Matters Permanent Payroll 7 Years Personnel 7 Years AT Property 7 Years Deeds Permanent Sales & Use 7 Years Dividend Register Permanent W-2 Forms 7 Years Depreciation Schedules 7 Years AD Trademark Records Permanent Franchise Agreements 7 Years AT Uncollectible Accounts 7 Years

AT = After Termination AD = After Disposal of Underlying Asset