"SUBJECT: RESPONSIBILITIES FOR IMPORTER SECURITY FILINGS “10 + 2”

To our valued and esteemed import customers, shippers and business partners:

On January 26, 2009 US Customs published the final rule of new Importer Security Filing (ISF) regulations governing all imports coming to or travelling through the USA (containing amendments to Regulations: 19 CFR 149: go here: (http://www.cbp.gov/xp/cgov/trade/cargo_security/carriers/security_filing/) to see the regulation, the history and commentary. Effective today, January 26, 2010, US Customs and Border Protection (CBP) has begun active enforcement of the rules, entailing mandatory advanced and amendment filing of certain information that the US Department of Homeland Security will use to better review security of national cargo importation by sea, and to determine earlier and with more precision what cargo they wish to inspect or investigate further prior to its entry into US ports.

This ISF information must be filed by several different parties in the import supply chain, and all must be filed electronically by properly bonded and participating entities in each case.

Be assured that China Shipping Container Lines companies and agencies are in complete compliance with the vessel operating carrier (VOCC) requirements of the law, and you should notice little or no change to our procedures for booking, documenting and carrying your valuable cargo to and through USA ports and points.

If you have not already done so, as an importer or a shipper or ocean intermediary handling import goods or cargo which may transit the USA (e.g., of freight remaining on board a vessel that calls a US PORT prior to its Port of Discharge elsewhere), you need to take several actions to continue to ship cargo without interruption or penalty. The actions you should take vary by what you need the vessel operating common carrier (VOCC: e.g.: China Shipping Container Line) to do to handle your cargo. Please read the following brief descriptions through completely and act accordingly in your interests, or the interests of your customers. Be aware that you may have to follow different procedures at different times depending on the actual routing and billing of the cargo. Each circumstance is linked to a complete description.

China Shipping Container Lines provides this as a guideline reference only: it cannot be relied upon as an official representation of the pertinent regulations and CBP technical instructions for filing. China Shipping Container Lines and its agents and subsidiaries accept no responsibility nor liability for any action or omission made due to reliance on this interpretation.

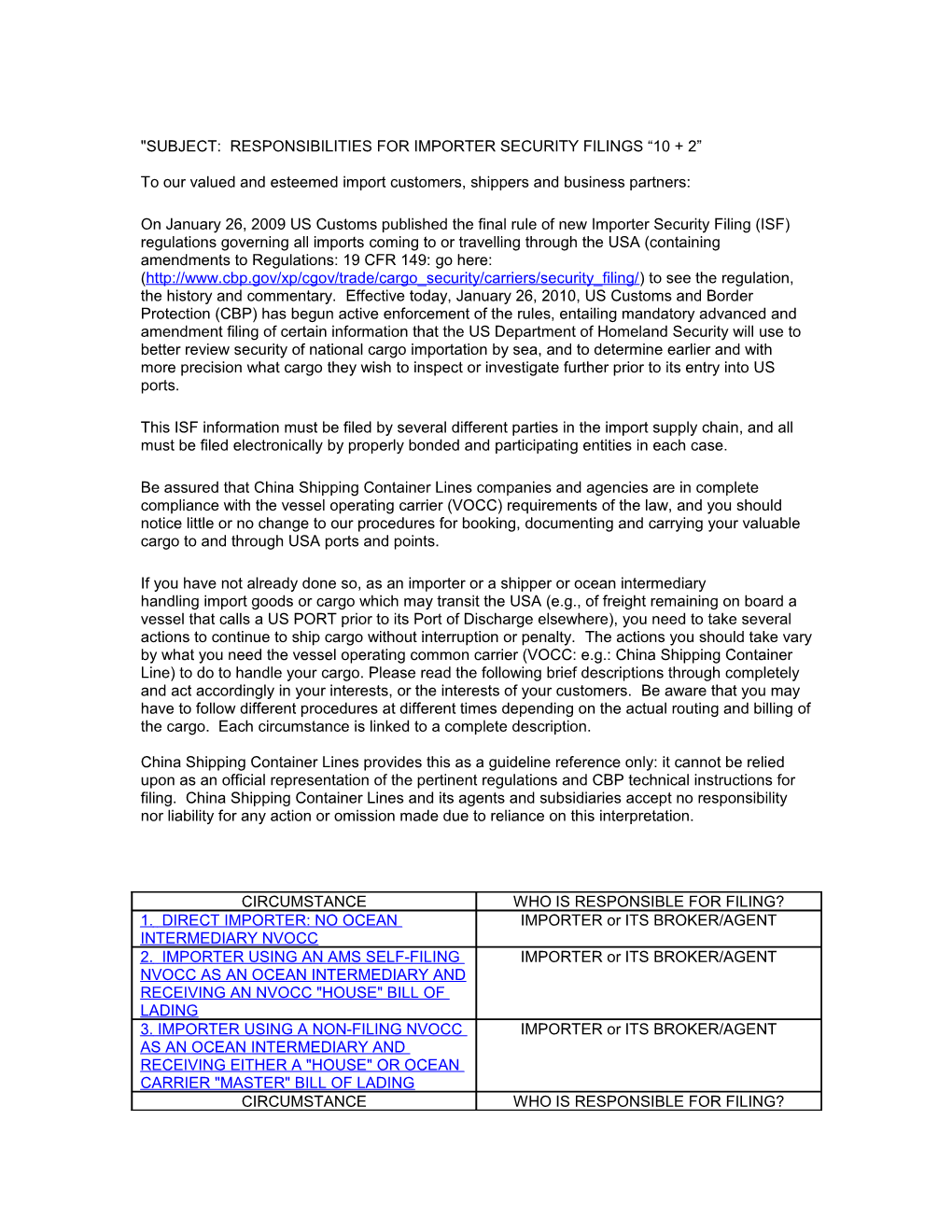

CIRCUMSTANCE WHO IS RESPONSIBLE FOR FILING? 1. DIRECT IMPORTER: NO OCEAN IMPORTER or ITS BROKER/AGENT INTERMEDIARY NVOCC 2. IMPORTER USING AN AMS SELF-FILING IMPORTER or ITS BROKER/AGENT NVOCC AS AN OCEAN INTERMEDIARY AND RECEIVING AN NVOCC "HOUSE" BILL OF LADING 3. IMPORTER USING A NON-FILING NVOCC IMPORTER or ITS BROKER/AGENT AS AN OCEAN INTERMEDIARY AND RECEIVING EITHER A "HOUSE" OR OCEAN CARRIER "MASTER" BILL OF LADING CIRCUMSTANCE WHO IS RESPONSIBLE FOR FILING? 4. NVOCC FILING AMS DIRECTLY FOR IMPORTER or ITS BROKER/AGENT "HOUSE" BILLS OF LADING WITH US CUSTOMS CBP/AMS FOR IMPORT TO USA 5. NON-AMS FILING NVOCC ENGAGING IMPORTER or ITS BROKER/AGENT VOCC TO FILE AMS "HOUSE" BILLS OF LADING WITH US CUSTOMS CBP/AMS FOR IMPORT TO USA ON YOUR BEHALF 6. DIRECT SHIPPER OF “FROB” OR “IE” VOCC CARGO: NO OCEAN INTERMEDIARY NVOCC BILL OF LADING FILED 7. NON-AMS FILING NVOCC MOVING VOCC “FROB” OR “IE” CARGO, ENGAGING VOCC TO FILE AMS "HOUSE" BILLS OF LADING WITH US CUSTOMS CBP/AMS THIRD COUNTRY MOVEMENTS TRANSITING USA TERRITORY 8. AMS SELF-FILING NVOCC ENGAGING NVOCC VOCC TO FILE “FROB” OR “IE” CARGO WITH US CBP/AMS FOR CARGO TRANSITTING USA PORTS. 9. VESSEL OPERATING COMMON CARRIER VOCC STOWFILE AND CONTAINER STATUS MESSAGES (CSM) 1. DIRECT IMPORTER: NO OCEAN INTERMEDIARY NVOCC BILL OF LADING FILED

If you or your company are an importer of goods to the USA and a party in interest to an Ocean Carrier Bill of Lading of any kind (Original, Seaway, Express Bill of Lading or beneficiary of automatic cargo release for stock transfer without presentation of Bill of Lading to the carrier). You are already accustomed to filing or have nominated a broker or bonded agent to file CUSTOMS CLEARANCE (whether or not paying duty therefore) with US CBP. Your vessel operating carrier (VOCC) already files a direct bill of lading in an ADVANCED MANIFEST filing to US Customs on your behalf no later than 24 hours prior to loading cargo on board at the overseas Port of Loading.

Now, you will have to arrange to file an additional advanced electronic filing at the same time as the carrier files your advanced manifest composed of 12 data elements, many of which are similar to your CLEARANCE documents. You or your company are responsible to file this data no later than 24 hours prior to sailing, though you may use a power of attorney to authorize a bonded broker or filing agent to do this on your behalf. This info is sometimes (erroneously) referred to as "ISF10", but includes twelve required and two optional items.

1. The exact vessel/voyage number of the conveyance/ship carrying the cargo that is filed with US Customs. 2. Your Importer of Record Number (Importer ID# per CBP Form 5106): one per filing. 3. Consignee Bond holder residing in USA (Importer ID# and Customs bond activity type) - multiple consignees OK on one filing. 4. Seller (Owner) DUNS number + 4 or name/address - multiple sellers OK on one filing. 5. Buyer (Owner) DUNS number + 4 or name/address – multiple sellers OK on one filing. 6. Ship to Party DUNS number + 4 or name/address and FIRMS CODE of warehouse for household goods – multiple ship to parties OK on one filing. 7. Manufacturer (Supplier) name/address FOR EACH COMMODITY linked by line item – multiple ship-to parties OK on one filing. 8 Country of Origin FOR EACH COMMODITY linked by line item – multiple ship to parties OK for one filing. 9. Commodity HTSUS-6 unless filing together with Customs clearance: HTSUS-10 FOR EACH COMMODITY linked by line item – multiple commodities OK for one filing. Package or piece count number or quantity not required. 10. Direct import Bill(s) of Lading under which cargo will clear Customs – multiple bills of lading OK on one ISF10 filing, but all must be on one vessel/voyage. 11. Container Stuffing Location “DUNS number + 4” or name/address – multiple locations OK on one filing. 12. Consolidator or container stuffing party “DUNS number + 4” or name/address – multiple locations OK on one filing. OPTIONAL 1: Container number(s) OPTIONAL 2: Carrier Master B/L number(s).

TIP: Your filing will be judged "late" or "in error" if it is filed later than 24 hours before the VESSEL DEPARTURE time/date reported by the carrier after the vessel departs from its Port of Loading. This may result in penalties to you: check with your carrier in the event such is reported to you by US Customs.

2. IMPORTER USING AN AMS (AUTOMATED MANIFEST SYSTEM) SELF-FILING NVOCC AS AN OCEAN INTERMEDIARY AND RECEIVING AN NVOCC "HOUSE" BILL OF LADING

If you or your company are an importer of goods to the USA and a party in interest to a direct- filing NVOCC (Non-Vessel Operating Common Carrier) Bill of Lading (sometimes referred to as an NVOCC "house" bill of lading. You are already accustomed to filing or have nominated a broker or bonded agent, or your NVOCC TO file CUSTOMS CLEARANCE (whether or not paying duty therefore) with US CBP. Your vessel operating carrier (VOCC) already files a Master Ocean bill of lading in an ADVANCED MANIFEST filing to US Customs no later than 24 hours prior to loading cargo on board at the overseas Port of Loading. In addition, your NVOCC is a direct self filer with Customs, and has filed its House B/L on your behalf at the same time.

Now, you or your NVOCC will have to arrange to file an additional advanced electronic filing at the same time as the carrier files your advanced manifest composed of 12 data elements, many of which are similar to your CLEARANCE documents. You or your company are responsible to file this data no later than 24 hours prior to sailing, though you may use a power of attorney to authorize a bonded broker or filing agent to do this on your behalf. This info is sometimes (erroneously) referred to as "ISF10", but includes twelve required and two optional items.

1. The exact vessel/voyage number of the conveyance/ship carrying the cargo that is filed with US Customs. 2. Your Importer of Record Number (Importer ID# per CBP Form 5106): one per filing. 3. Consignee Bond holder residing in USA (Importer ID# and Customs bond activity type) - multiple consignees OK on one filing. 4. Seller (Owner) DUNS number + 4 or name/address - multiple sellers OK on one filing. 5. Buyer (Owner) DUNS number + 4 or name/address – multiple sellers OK on one filing. 6. Ship to Party DUNS number + 4 or name/address and FIRMS CODE of warehouse for household goods – multiple ship to parties OK on one filing. 7. Manufacturer (Supplier) name/address FOR EACH COMMODITY linked by line item – multiple ship-to parties OK on one filing. 8 Country of Origin FOR EACH COMMODITY linked by line item – multiple ship to parties OK for one filing. 9. Commodity HTSUS-6 unless filing together with Customs clearance: HTSUS-10 FOR EACH COMMODITY linked by line item – multiple commodities OK for one filing. Package or piece count number or quantity not required. 10. NVOCC "House" import Bill(s) of Lading under which cargo will clear Customs – multiple bills of lading OK on one ISF10 filing, but all must be on one vessel/voyage. 11. Container Stuffing Location “DUNS number + 4” or name/address – multiple locations OK on one filing. 12. Consolidator or container stuffing party “DUNS number + 4” or name/address – multiple locations OK on one filing. OPTIONAL 1: Container number(s) OPTIONAL 2: Carrier Master B/L number(s).

TIP: Your filing will be judged "late" or "in error" if this ISF is filed later than 24 hours before the VESSEL DEPARTURE time/date reported by the carrier after the vessel departs from its Port of Loading. This may result in penalties to you: have your NVOCC or filing agent/broker check with the VOCC carrier in the event such is reported to you by US Customs. Note: please DO NOT call directly to the VOCC ocean carrier to ask this question directly, since the VOCC has no way to know whether you are entitled to any information with regard to the shipment tendered/filed

3. IMPORTER USING A NON-FILING NVOCC AS AN OCEAN INTERMEDIARY AND RECEIVING EITHER A "HOUSE" OR OCEAN CARRIER "MASTER" BILL OF LADING

If you or your company are an importer of goods to the USA and a party in interest to a non-filing NVOCC (Non-Vessel Operating Common Carrier) Bill of Lading (sometimes referred to as an NVOCC "house" bill of lading. You are already accustomed to filing or have nominated a broker or bonded agent to file CUSTOMS CLEARANCE (whether or not paying duty therefore) with US CBP. Your vessel operating carrier (VOCC) already files a Master Ocean bill of lading in an ADVANCED MANIFEST filing to US Customs, together with an NVOCC "House" Bill of lading on behalf of your non-filing NVOCC no later than 24 hours prior to loading cargo on board at the overseas Port of Loading.

Now, you or your NVOCC will have to arrange to file an additional advanced electronic filing at the same time as the carrier files your advanced manifest composed of 12 data elements, many of which are similar to your CLEARANCE documents. You or your company are responsible to file this data no later than 24 hours prior to sailing, though you may use a power of attorney to authorize a bonded broker or filing agent to do this on your behalf. This info is sometimes (erroneously) referred to as "ISF10", but includes twelve required and two optional items. Note: neither the non-filing NVOCC nor the Ocean Carrier (VOCC) can do this for you: a separate filing agent or bonded broker acting as filing agent must do it for you, and post or maintain an appropriate bond on your behalf.

1. The exact vessel/voyage number of the conveyance/ship carrying the cargo that is filed with US Customs. 2. Your Importer of Record Number (Importer ID# per CBP Form 5106): one per filing. 3. Consignee Bond holder residing in USA (Importer ID# and Customs bond activity type) - multiple consignees OK on one filing. 4. Seller (Owner) DUNS number + 4 or name/address - multiple sellers OK on one filing. 5. Buyer (Owner) DUNS number + 4 or name/address – multiple sellers OK on one filing. 6. Ship to Party DUNS number + 4 or name/address and FIRMS CODE of warehouse for household goods – multiple ship to parties OK on one filing. 7. Manufacturer (Supplier) name/address FOR EACH COMMODITY linked by line item – multiple ship-to parties OK on one filing. 8 Country of Origin FOR EACH COMMODITY linked by line item – multiple ship to parties OK for one filing. 9. Commodity HTSUS-6 unless filing together with Customs clearance: HTSUS-10 FOR EACH COMMODITY linked by line item – multiple commodities OK for one filing. Package or piece count number or quantity not required. 10. NVOCC "House" import Bill(s) of Lading under which cargo will clear Customs – multiple bills of lading OK on one ISF10 filing, but all must be on one vessel/voyage. 11. Container Stuffing Location “DUNS number + 4” or name/address – multiple locations OK on one filing. 12. Consolidator or container stuffing party “DUNS number + 4” or name/address – multiple locations OK on one filing. OPTIONAL 1: Container number(s) OPTIONAL 2: Carrier Master B/L number(s).

TIP: Your filing will be judged "late" or "in error" if this ISF is filed later than 24 hours before the VESSEL DEPARTURE time/date reported by the carrier after the vessel departs from its Port of Loading. This may result in penalties to you: have your NVOCC or filing agent/broker check with the VOCC carrier in the event such is reported to you by US Customs. Note: please DO NOT call directly to the VOCC ocean carrier to ask this question directly, since the VOCC has no way to know whether you are entitled to any information with regard to the shipment tendered/filed.

4. NVOCC FILING AMS DIRECTLY FOR "HOUSE" BILLS OF LADING WITH US CUSTOMS CBP/AMS FOR IMPORT TO USA

If you or your company are a direct-filing NVOCC (Non-Vessel Operating Common Carrier) filing an Advanced Manifest Bill of Lading (sometimes referred to as an NVOCC "house" bill of lading) on behalf of your Customer. You are already accustomed to filing or you or your importing customer have nominated a broker or bonded agent, to file CUSTOMS CLEARANCE (whether or not paying duty therefore) with US CBP. Your vessel operating carrier (VOCC) already files a Master Ocean bill of lading in an ADVANCED MANIFEST filing to US Customs no later than 24 hours prior to loading cargo on board at the overseas Port of Loading. In addition, you or your company are a direct self-filer with Customs, and have filed a House B/L on behalf of your Customer at the same time.

Now, you or your customer will have to arrange to file an additional advanced electronic filing at the same time as the carrier files an Ocean Master Bill of Lading in an advanced manifest with US CBP/AMS. This additional Importer Security Filing is composed of 12 data elements, many of which are similar to the Customer's CLEARANCE documents. Your customer or, if engaged as the importer's filing agent, you or your company are responsible to file this data no later than 24 hours prior to sailing, though you may use a power of attorney to authorize a bonded broker or filing agent to do this on your Customer's behalf. This info is sometimes (erroneously) referred to as "ISF10", but includes twelve required and two optional items. The Ocean Carrier is not responsible, and many are technically not able to do this for you.

1. The exact vessel/voyage number of the conveyance/ship carrying the cargo that is filed with US Customs. 2. Your Importer of Record Number (Importer ID# per CBP Form 5106): one per filing. 3. Consignee Bond holder residing in USA (Importer ID# and Customs bond activity type) - multiple consignees OK on one filing. 4. Seller (Owner) DUNS number + 4 or name/address - multiple sellers OK on one filing. 5. Buyer (Owner) DUNS number + 4 or name/address – multiple sellers OK on one filing. 6. Ship to Party DUNS number + 4 or name/address and FIRMS CODE of warehouse for household goods – multiple ship to parties OK on one filing. 7. Manufacturer (Supplier) name/address FOR EACH COMMODITY linked by line item – multiple ship-to parties OK on one filing. 8 Country of Origin FOR EACH COMMODITY linked by line item – multiple ship to parties OK for one filing. 9. Commodity HTSUS-6 unless filing together with Customs clearance: HTSUS-10 FOR EACH COMMODITY linked by line item – multiple commodities OK for one filing. Package or piece count number or quantity not required. 10. NVOCC "House" import Bill(s) of Lading under which cargo will clear Customs – multiple bills of lading OK on one ISF10 filing, but all must be on one vessel/voyage. 11. Container Stuffing Location “DUNS number + 4” or name/address – multiple locations OK on one filing. 12. Consolidator or container stuffing party “DUNS number + 4” or name/address – multiple locations OK on one filing. OPTIONAL 1: Container number(s) OPTIONAL 2: Carrier Master B/L number(s).

TIP: Your customer's ISF filing will be judged "late" or "in error" if this ISF is filed later than 24 hours before the VESSEL DEPARTURE time/date reported by the carrier after the vessel departs from its Port of Loading. This may result in penalties to your customer: check with the VOCC carrier in the event such is reported to you by US Customs. Note: DO NOT refer your customer directly to the VOCC ocean carrier to ask this question directly, since the VOCC has no way to know whether that party is entitled to any information with regard to the shipment tendered/filed.

5. NON-AMS FILING NVOCC ENGAGING VOCC TO FILE AMS "HOUSE" BILLS OF LADING WITH US CUSTOMS CBP/AMS FOR IMPORT TO USA ON YOUR BEHALF

If you or your company are a NON-AMS filing NVOCC (Non-Vessel Operating Common Carrier) engaging an Ocean Vessel Operating carrier (VOCC) to file an Advanced Manifest Bill of Lading (sometimes referred to as an NVOCC "house" bill of lading) on behalf of your Customer. You or your importing customer have nominated a broker or bonded agent, to file CUSTOMS CLEARANCE (whether or not paying duty therefore) with US CBP. Your vessel operating carrier (VOCC) already files both a Master Ocean bill of lading and your "House" bill of lading in an ADVANCED MANIFEST filing to US Customs no later than 24 hours prior to loading cargo on board at the overseas Port of Loading.

Now, your customer will have to arrange to file an additional advanced electronic filing at the same time as the carrier files an Ocean Master Bill of Lading in an advanced manifest with US CBP/AMS. This additional Importer Security Filing is composed of 12 data elements, many of which are similar to the Customer's CLEARANCE documents. Your customer or, if engaged as the importer's filing agent, you or your company are responsible to file this data no later than 24 hours prior to sailing, though you may use a power of attorney to authorize a bonded broker or filing agent to do this on your Customer's behalf. This info is sometimes (erroneously) referred to as "ISF10", but includes twelve required and two optional items. The Ocean Carrier is not responsible, and many are technically not able to do this for you.

1. The exact vessel/voyage number of the conveyance/ship carrying the cargo that is filed with US Customs. 2. Your Importer of Record Number (Importer ID# per CBP Form 5106): one per filing. 3. Consignee Bond holder residing in USA (Importer ID# and Customs bond activity type) - multiple consignees OK on one filing. 4. Seller (Owner) DUNS number + 4 or name/address - multiple sellers OK on one filing. 5. Buyer (Owner) DUNS number + 4 or name/address – multiple sellers OK on one filing. 6. Ship to Party DUNS number + 4 or name/address and FIRMS CODE of warehouse for household goods – multiple ship to parties OK on one filing. 7. Manufacturer (Supplier) name/address FOR EACH COMMODITY linked by line item – multiple ship-to parties OK on one filing. 8 Country of Origin FOR EACH COMMODITY linked by line item – multiple ship to parties OK for one filing. 9. Commodity HTSUS-6 unless filing together with Customs clearance: HTSUS-10 FOR EACH COMMODITY linked by line item – multiple commodities OK for one filing. Package or piece count number or quantity not required. 10. NVOCC "House" import Bill(s) of Lading under which cargo will clear Customs – multiple bills of lading OK on one ISF10 filing, but all must be on one vessel/voyage. 11. Container Stuffing Location “DUNS number + 4” or name/address – multiple locations OK on one filing. 12. Consolidator or container stuffing party “DUNS number + 4” or name/address – multiple locations OK on one filing. OPTIONAL 1: Container number(s) OPTIONAL 2: Carrier Master B/L number(s).

TIP: Your customer's ISF filing will be judged "late" or "in error" if this ISF is filed later than 24 hours before the VESSEL DEPARTURE time/date reported by the carrier after the vessel departs from its Port of Loading. This may result in penalties to your customer: check with the VOCC carrier in the event such is reported to you by US Customs. Note: DO NOT refer your customer directly to the VOCC ocean carrier to ask this question directly, since the VOCC has no way to know whether that party is entitled to any information with regard to the shipment tendered/filed. 6. DIRECT SHIPPER OF “FROB” OR “IE” CARGO: NO OCEAN INTERMEDIARY NVOCC BILL OF LADING FILED

If you or your company are a shipper/ beneficiary of goods being transported by the Ocean Carrier (VOCC) between two countries (e.g.: China and Canada), AND your cargo will TRANSIT USA ports (FREIGHT REMAINING ON ), OR FOR IMMEDIATE EXPORT: I.E., CARGO ARRIVING BY VESSEL TO A US PORT TO BE EXPORTED FROM THE SAME PORT. You or your nominated broker/forwarder are already accustomed to having a Vessel Operating Common Carrier (VOCC) file a “FROB” manifest copy of your bill of lading with US Customs 24 hours prior to loading cargo on board at its Port of Loading. Your vessel operating carrier (VOCC) already files a direct bill of lading in an ADVANCED MANIFEST filing to US Customs. No other (e.g., NVOCC) bill of lading is filed or received.

As an example: this would apply if your cargo was to load on China Shipping Container Line’s service: “ANW1” at any Asian port for carriage to Canada via the Port of Vancouver since the vessel rotation of this service has all ships calling either Seattle (USSEA) or Tacoma (USTCM) before arriving at Vancouver (CAVAN), with Canada import freight remaining on board.

Now, the Ocean carrier (VOCC) will have to arrange an additional advanced electronic filing at the same time as the FROB manifest, composed of 5 data elements. You or your company are responsible to provide this data no later than 30 hours prior to sailing to avoid refusal to lade cargo. This info is sometimes referred to as "ISF5", and includes data as follows:

1. Booking party name and address with postal code if postal codes are used in the Booking party’s country (may be the same as Direct B/L shipper of record) 2. Foreign port of unlading (from Direct B/L) 3. Place of delivery (from Direct B/L) 4. Ship-to party name and address with postal code (may be the same as Direct B/L First Notify party or consignee) 5. Commodity HTSUS number to 6 digits.

TIP: Normally the carrier filing will be judged "late" or "in error" if it is filed later than the VESSEL DEPARTURE time/date reported by the carrier after the vessel departs from its Port of Loading. If late or incorrect filing was due to late presentation of information by the shipper or booking party, all costs/penalties will be for the merchant’s account (i.e., account of the cargo). 7. NON-AMS FILING NVOCC MOVING “FROB” OR “IE” CARGO, ENGAGING VOCC TO FILE AMS "HOUSE" BILLS OF LADING WITH US CUSTOMS CBP/AMS THIRD COUNTRY MOVEMENTS TRANSITING USA TERRITORY

If you or your company are a non-AMS filing NVOCC/Ocean Transport Intermediary engaging the Ocean Carrier (VOCC) to file a FROB manifest for cargo you are moving on a “House” bill of lading between two countries (e.g.: China and Canada), AND the billed cargo will TRANSIT USA ports (FREIGHT REMAINING ON BOARD ), OR FOR IMMEDIATE EXPORT: I.E., CARGO ARRIVING BY VESSEL TO A US PORT TO BE EXPORTED FROM THE SAME PORT. You are already accustomed to having a Vessel Operating Common Carrier (VOCC) file a “FROB” manifest copy of your bill of lading with US Customs prior to loading cargo on board at its Port of Loading. Your vessel operating carrier (VOCC) already files a master bill of lading as FROB in an ADVANCED MANIFEST filing to US Customs.

As an example: this would apply if the House B/L cargo was to load on China Shipping Container Line’s service: “ANW1” at any Asian port for carriage to Canada via the Port of Vancouver since the vessel rotation of this service has all ships calling either Seattle (USSEA) or Tacoma (USTCM) before arriving at Vancouver (CAVAN), with Canada import freight remaining on board.

Now, the Ocean carrier (VOCC) will have to arrange an additional advanced electronic filing at the same time as the FROB manifest, composed of 5 data elements. You or your company are responsible to provide this data no later than 30 hours prior to loading at Port of Loading to avoid refusal to lade cargo or other penalties/costs. This info is sometimes referred to as "ISF5", and includes data as follows:

1. Booking party name and address with postal code if postal codes are used in the Booking party’s country (may be the same as the filed FROB House B/L shipper of record) 2. Foreign port of unlading (from FROB House B/L) 3. Place of delivery (from FROB House B/L) 4. Ship-to party name and address with postal code if postal codes are used in the ship-to party’s country (may be the same as the filed FROB House B/L consignee/notify party) 5. Commodity HTSUS number to 6 digits.

TIP: Normally the carrier filing will be judged "late" or "in error" if it is filed later than the VESSEL DEPARTURE time/date reported by the carrier after the vessel departs from the Port of Loading. If late or incorrect filing was due to late presentation of information by the NVOCC, all costs/penalties will be for the Master B/L merchant’s account (i.e., account of the cargo). 8. AMS SELF-FILING NVOCC ENGAGING VOCC TO FILE “FROB” OR “IE” CARGO WITH US CBP/AMS FOR CARGO TRANSITTING USA PORTS.

If you or your company are a direct AMS filing NVOCC/Ocean Transport Intermediary engaging a VOCC to file a FROB manifest for cargo you are moving on a “House” bill of lading between two countries (e.g.: China and Canada), AND the billed cargo will TRANSIT USA ports (FREIGHT REMAINING ON BOARD ), OR FOR IMMEDIATE EXPORT: I.E., CARGO ARRIVING BY VESSEL TO A US PORT TO BE EXPORTED FROM THE SAME PORT. You are already accustomed to having a Vessel Operating Common Carrier (VOCC) file a “FROB” manifest copy of your bill of lading with US Customs prior to loading cargo on board at its Port of Loading. Your vessel operating carrier (VOCC) already files a bill of lading as FROB in an ADVANCED MANIFEST filing to US Customs.

As an example: this would apply if the House B/L cargo was to load on China Shipping Container Line’s service: “ANW1” at any Asian port for carriage to Canada via the Port of Vancouver since the vessel rotation of this service has all ships calling either Seattle (USSEA) or Tacoma (USTCM) before arriving at Vancouver (CAVAN), with Canada import freight remaining on board.

Now, YOU OR YOUR COMPANY will have to arrange an additional advanced electronic filing at the same time as the FROB manifest is filed with Customs, composed of 5 data elements. You or your company are responsible to file this data before cargo is laden on board at Port of Loading to avoid penalties/costs. This info is sometimes referred to as "ISF5", and includes data as follows:

1. Booking party name and address with postal code if postal codes are used in the Booking party’s country (may be the same as the your House B/L shipper of record) 2. Foreign port of unlading (from House B/L) 3. Place of delivery (from House B/L) 4. Ship-to party name and address with postal code if postal codes are used in the ship-to party’s country (may be the same as your House B/L consignee/notify party) 5. Commodity HTSUS number to 6 digits.

TIP: Normally the NVOCC (the carrier in this situation) filing the ISF5, will be judged "late" or "in error" if it is filed later than the VESSEL DEPARTURE time/date reported by the carrier after the vessel departs from the Port of Loading. If late or incorrect filing was due to late presentation of information by the NVOCC, all costs/penalties will be for the Master B/L merchant’s account (i.e., account of the cargo). 9. VESSEL OPERATING COMMON CARRIER STOWFILE AND CONTAINER STATUS MESSAGES (CSM)

The Ocean carrier will file the following two additional information transmissions:

1. Baplie stowfile 48 hours after the last overseas Port of loading, or if earlier, prior to arrival at first USA port of call for all vessels actually operated by the carrier. So, for example, the VOCC will file the entire stowfile for all cargo laden on board by any other slot purchasing or slot swapping consortium partner according to technical specifications set by US CBP/AMS

2. Container Status Messages in specified formats within 24 hours of insertion of such messages in the container tracking system of the VOCC carrier for the following types of events concerning the cargo:

Booking confirmed/empty containers released Container stuffed at origin Container received at feeder/loaded or unloaded from feeder vessel Gate activity (in/out) at any point/time between booking and arrival of container at first USA port of call Unstuffing or transload requested prior to arrival at first USA port of call. Unstuffing or transload confirmed Intra-terminal movement of container within a terminal