CHECKLIST FOR APPLICATION FOR AUTHORIZATION OF REAL ESTATE INVESTMENT TRUSTS (“REITs”)

I. Introduction

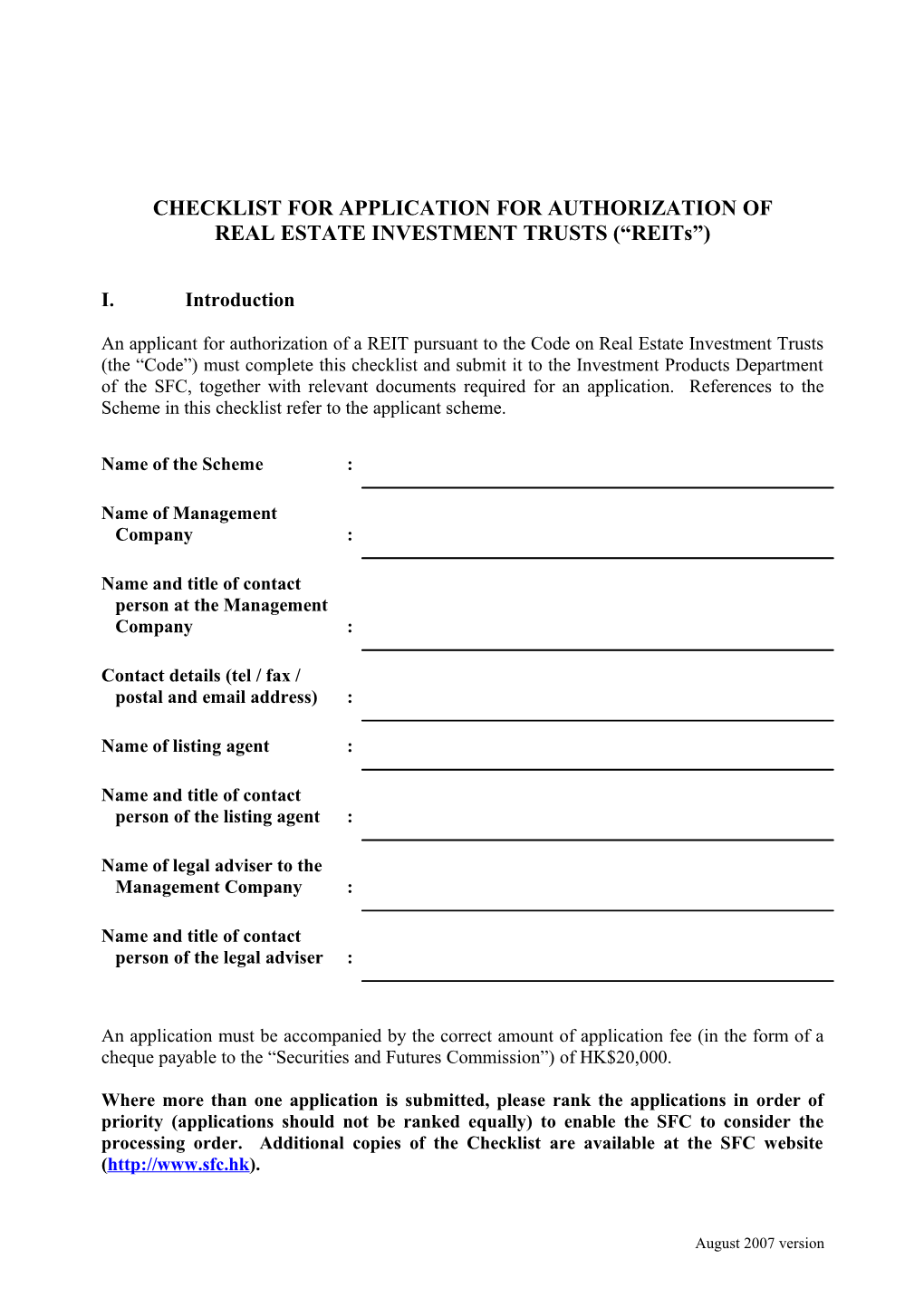

An applicant for authorization of a REIT pursuant to the Code on Real Estate Investment Trusts (the “Code”) must complete this checklist and submit it to the Investment Products Department of the SFC, together with relevant documents required for an application. References to the Scheme in this checklist refer to the applicant scheme.

Name of the Scheme :

Name of Management Company :

Name and title of contact person at the Management Company :

Contact details (tel / fax / postal and email address) :

Name of listing agent :

Name and title of contact person of the listing agent :

Name of legal adviser to the Management Company :

Name and title of contact person of the legal adviser :

An application must be accompanied by the correct amount of application fee (in the form of a cheque payable to the “Securities and Futures Commission”) of HK$20,000.

Where more than one application is submitted, please rank the applications in order of priority (applications should not be ranked equally) to enable the SFC to consider the processing order. Additional copies of the Checklist are available at the SFC website (http://www.sfc.hk).

August 2007 version II. Compliance checklists to be completed

Completed and Comments Submitted?

Yes No N/A

1. Documents to be supplied to the SFC (see also Annex A and Annex B)

2. Compliance checklist for Offering Document (see also Annex C)

3. Compliance checklist for Trust Deed

4. Compliance checklist for historical financial statements

Annex A: Key points for preparation of the Compliance Manual of the Management Company of REITs

Annex B: Independent director’s declaration

Annex C: Operating data of real estate

III. Instructions for completing the compliance checklists

Please find attached a set of standard compliance checklists that sets out the basic documentary requirements in support of an application for authorization of a REIT pursuant to the Code. The compliance checklists should not be considered as exhaustive and where appropriate, they should be tailored to meet the specific features and requirements of the Scheme. Additional material information that is relevant to the application should also be submitted.

Compliance checklists making reference to disclosure in the offering documents should be updated before bulk printing of the offering documents. The Management Company and the listing agent must sign and submit a final copy of each compliance checklist to the SFC before the authorization of a REIT. The compliance checklists submitted in connection with the Offering Document and the Constitutive Document of a REIT must contain proper cross- references to the relevant pages in the final set of documents submitted in connection with the application.

2 August 2007 version The final copy of the Offering Document submitted to the SFC should be certified by all directors of the Management Company or by their agents authorized in writing as having been approved by resolution of the Management Company. Where the Offering Document includes a statement purporting to be made by an expert, a written consent should be included in the Offering Document stating that the expert has given, and has not withdrawn before publication of the Offering Document, the expert’s consent to the issue of the Offering Document with the statement included in the form and context in which it is included.

When completing the compliance checklists, you must note the following:

1. each relevant requirement in the compliance checklists should be referenced to the page number in the document where the requirement is complied with;

2. to keep the compliance checklists as short as possible, only a small amount of space has been set aside for comments. If further space is required, please attach a separate sheet of paper to the checklist and cross-reference all comments to the appropriate requirement; and

3. where your answer to an item on the checklist is “No” or “Not Applicable”, the reason for such response should be clearly disclosed in the “Comment” section and if necessary, on a separate page cross-referenced to the checklist. We may reject an incomplete application to the extent the compliance forms are not properly or fully completed and/or where negative responses (i.e. “No” or “Not Applicable”) are not properly explained.

Please note that we will only accept documents for review if all relevant compliance checklists are submitted and they are substantially complete, accurate and properly annotated. We reserve the right to return forthwith, without processing, any application that is accompanied by documents that do not meet the requirements of the Code.

3 August 2007 version 1. Documents to be supplied to the SFC

Please note that documents submitted should be in an advanced form, in good order and suitable for clearance. The SFC reserves the right to reject draft documents that are not in an advanced form.

Please notify the SFC immediately if there are any changes to the information provided.

The list below is not exhaustive. The SFC may require additional information.

Submitted? Comments

Yes No N/A

(1) Completed Application Form

(2) Offering circular Trust deed Compliance manual*

(3) Confirmation by the Management Company and the listing agent(s) that . the offering circular contains sufficient particulars and information to enable a reasonable person to form as a result thereof a valid and justifiable opinion of the units and the financial position and profitability of the Scheme at the time of the issue of the offering circular . the material terms of the trust deed and all other material agreements have been fairly and accurately disclosed in the offering circular without any omission in any material respect

(4) A diagram showing the Scheme’s structure, indicating the relationships between the Scheme, each layer of SPVs (if any) and the underlying real estate

Approved person

(5) A letter from the Management Company nominating an individual to be approved by the SFC as an approved person (see Chapter 3.3 and 3.4 of the Code) containing the individual’s name, employer, position held and contact details

(6) A letter from the nominated approved person to the SFC confirming and undertaking compliance with relevant provisions in the

1 August 2007 version Submitted? Comments

Yes No N/A

Code and the SFO applicable to an approved person of a collective investment scheme authorized by the SFC under section 104 of the SFO

(7) Management Company’s undertaking to the SFC to appoint and ensure there is an approved person in respect of the Scheme at all times

(8) Trustee’s undertaking to the SFC that it shall procure an appointment of an approved person for the Scheme if the Management Company fails to comply with its undertaking to the SFC

Trustee (Please go to the next section “Management Company” if the proposed trustee of the Scheme is already currently acting as trustee of SFC-authorised REITs)

(9) Letter of consent to the appointment from the Trustee (for newly established Schemes)

(10) Evidence to demonstrate compliance with Chapter 4.3 of the Code. Examples: . certificate of incorporation of the Trustee . for a bank licensed under section 16 of the Banking Ordinance, licence issued by the relevant authority . for a subsidiary of licensed bank, documentation showing its relationship with the licensed bank such as group organizational chart . name of primary supervisory authority and appropriate certificate from such authority

(11) Evidence to demonstrate compliance with Chapter 4.4 or 4.5 of the Code such as the Trustee’s latest audited report (and if more recent, latest interim report)

(12) Evidence to demonstrate the Trustee’s ability to discharge its functions in accordance with Chapter 4.6 of the Code: (a) where the trustee possesses appropriate personnel (see Chapter 4.6(a)): . detailed profiles of the key personnel

. a description of the real estate

2 August 2007 version Submitted? Comments

Yes No N/A

investment schemes to which the experience of the Trustee relates . an organizational chart

(b) where the trustee does not possess appropriate personnel (see Chapter 4.6(b)) in addition to the information set out in (a) above: . documentation to show its relationship with a corporate group that has acted as trustees for overseas REITs or real estate investment schemes . details of overseas REITs or real estate investment schemes for which the corporate group (or any of its members) acts as trustee . an undertaking from the corporate group for adequate support to the Trustee

(13) Self-declaration by the Trustee in respect of any disciplinary or legal proceedings commenced or pending against the Trustee that may affect its eligibility as a trustee under Chapter 4 or where appropriate, a negative statement signed by the Trustee

(14) Self-declaration by the Trustee in respect of its independence in accordance with Chapter 4.8 of the Code

(15) Where the Trustee and the Management Company are both corporations having the same ultimate holding company, the following: . documentation such as group organizational chart to demonstrate that they are both subsidiaries of a substantial financial institution, and that neither the Trustee nor the Management Company is a subsidiary of the other . documentation to demonstrate that no person is a director of both the Trustee and the Management Company . an undertaking signed by both the Trustee and the Management Company to the effect that they will act independently of each other in their dealings with the Scheme . a declaration and an undertaking by the

3 August 2007 version Submitted? Comments

Yes No N/A

ultimate holding company to the effect that the Trustee and the Management Company are, and that the ultimate holding company shall ensure that they continue to be, independent of each other, except as regards their relationship with each other as member companies in the same group

Management Company

(16) Evidence to demonstrate fulfilment of the acceptability criteria: . documents to support that the Management Company is licensed by the SFC to carry out the business of regulated activities including but not limited to, asset management . documents to support that the Management Company meets the financial resources requirements in Chapter 5.5 of the Code such as its latest audited report (and if more recent, the latest unaudited report) . identities and detailed profiles of the responsible officers (including at least one responsible officer shall be available at all times to supervise the Management Company), including their experience in investment management and/or property portfolio management during the period which constitutes the required 5-year track record . where the Management Company itself performs the general obligations required of it under the Code (i.e. internal management), e.g. those relating to the management of the Scheme’s real estate, detailed profiles of the key personnel responsible for each of these functions such as their professional qualifications and details of their past experience relevant to the functions they perform and the jurisdictions where the properties are located (see Note (2) to Chapter 5.4 of the Code) . internal controls and written compliance procedures (see Annex A – Key points for preparation of compliance manual for the Management Company of REITs) . organizational chart within the

4 August 2007 version Submitted? Comments

Yes No N/A

Management Company . group organizational chart of the Management Company . total assets under management (global / Hong Kong) . types of assets under management by asset class (such as securities vs real estate) and client base (such as retail vs institutional)

(17) Submission from the board of directors / senior management of the Management Company in relation to the following: . Biographical details of each of the directors including name, age, qualifications, experience, positions held with the Management Company and other members of the Management Company’s group, length of service with the Management Company, current directorships in other listed public companies, positions in other entities which may conflict with his role as a director of the Management Company and such other information of which unitholders should be aware pertaining to the ability or integrity of such directors . declaration and undertaking (in the format as set out in Annex B) from each of the independent non-executive directors of the Management Company . names and resumes of the senior management and key personnel of the Management Company

(18) Additional Information required for an overseas Management Company: . certification from the securities regulator of an overseas regime acceptable to the SFC (see Appendix A of the Code) to demonstrate that it has been licensed to manage schemes that operate in a similar manner as Schemes authorized under the Code . evidence to demonstrate that it is experienced with the property market in the relevant jurisdiction(s) . an undertaking that the Management Company will, upon request, provide the SFC with all books and records relating to the Scheme (see Note to Chapter 5.3 of

5 August 2007 version Submitted? Comments

Yes No N/A

the Code) . a self-declaration from the Management Company with respect to the following: - confirmation of its registration status with its home regulator (including its date of registration and approved status to manage real estate investment schemes) - any disciplinary history of the company in the past five years or since the date of registration if it has been registered for less than five years - any disciplinary history of its directors - whether the directors are aware of any current or pending investigation of the Management Company

(19) Delegation of functions (if applicable): . a diagram showing the delegation arrangement of the Management Company . detailed description of the delegation arrangement including the functions to be delegated, names and locations of delegates, and their qualifications, financial resources and experience . criteria and procedures for the selection and ongoing monitoring and replacement of delegates (contained in the compliance manual of the Management Company) . Management Company’s confirmation and undertaking that the delegation arrangement complies with Chapter 5 of the Code, including the delegates are fit and proper, of good repute, possess the necessary experience and resources to carry out the delegated activities (see Notes to Chapter 5.7) . Management Company’s undertaking that ultimate responsibilities and obligations shall lie in the Management Company (see Chapter 5.8 of the Code).

(20) Management Company’s confirmation that there are no actual or threatened claims or litigation against the Management Company / the Scheme / any of its SPVs which could materially affect the financial position of the Scheme

(21) Declaration of the Management Company’s

6 August 2007 version Submitted? Comments

Yes No N/A

independence from each of the Trustee and the Property Valuer (see Chapter 4.8, 4.9 and 6.5 of the Code)

(22) Management Company’s confirmation that there are no major issues or other matters relating to the Scheme which ought to be bought to the attention of the Commission or to be disclosed in the offering circular

Listing arrangement

(23) Evidence to demonstrate that an application for listing to the Stock Exchange of Hong Kong Limited (the “Exchange”) has been made, such as advance booking form and relevant correspondence with the Exchange

(24) Evidence of appointment, and acceptance of such appointment, of the listing agent(s) for the purpose of (i) dealing with the Exchange on all matters in relation to listing matters and (ii) assuming the duties of a sponsor in an initial public offering pursuant to Chapter 5.11 of the Code

(25) Information of the listing agent(s) such as: . names of the officers responsible for listing matters . a description of their experience in arranging collective investment schemes or corporations for listing on the Exchange . evidence to demonstrate that it is licensed by the SFC to carry out the regulated activity of providing corporate finance services . where more than one listing agent is appointed, the name of the listing agent to be designated as the primary channel of communication with the SFC concerning matters involving the application

(26) Where the Management Company appoints an agent to perform the functions of a listing agent, a confirmation by the Management Company to the effect that: . the agent is fit and proper and is licensed by the SFC to carry out the regulated activity of providing corporate finance

7 August 2007 version Submitted? Comments

Yes No N/A

services . the agent possesses the relevant experience and resources to perform its activities . the Management Company shall remain responsible for all matters relating to the conduct of an initial public offering and the listing of the Scheme

(27) Confirmation from the listing agent (or each of the listing agents) as to whether there are any pending, threatened or commenced disciplinary proceedings against the listing agent or its responsible officers by any regulatory bodies including the Exchange and the SFC or an appropriate negative statement

(28) A submission from each listing agent on any matters that it considers would or might affect its independence in discharging its duties and responsibilities as a listing agent as required by the Code

(29) Information of listing / IPO arrangement including: . listing timetable (if the listing involves a spin-off under the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (the “Listing Rules”), please include details of the expected timing regarding application to the Exchange for the approval of the spin-off and the timing of convening any shareholders’ meeting (if required) to approve the spin-off or any related matters) . the Exchange’s approval of the spin-off (if applicable) . a description of the offering mechanism . a summary of any underwriting arrangements . proposed offer size . indicative price ranges . tentative initial market capitalization of the Scheme . a contact list for key parties involved in the IPO

(30) Confirmation from the listing agent(s) that they have reviewed the building survey report on the properties and that issues that

8 August 2007 version Submitted? Comments

Yes No N/A

are identified in such building survey report that are material to a reasonable investor’s decision to invest in the units have been fully and fairly disclosed in the offering circular.

Appointment of the auditor

(31) Information of the auditor: . name and qualifications of the auditor . a declaration from the auditor of its independence in compliance with Chapter 5.19 of the Code

(32) Management Company’s confirmation that the auditor appointed for the Scheme and the SPVs (if any) fulfils the requirement set out in Chapter 5.19 of the Code

Appointment of Principal Valuer

(33) A confirmation provided by the Trustee (being responsible for the appointment the Principal Valuer to the Scheme, see Chapter 4.2(c) of the Code) to the effect that: . the Principal Valuer fulfils the qualification requirements set out in Chapter 6.4 of the Code

. the Principal Valuer is independent of the trustee, the Management Company and each of the significant holders of the Scheme in accordance with Chapter 6.5 of the Code . the directors of the Principal Valuer shall be persons of good repute who possess the necessary experience for the performance of their duties

(34) Valuation report prepared and duly signed by the Principal Valuer in accordance with Chapter 6.8 and 6.9 of the Code

(35) Confirmation from each listing agent that (i) where any material factual information in the valuation report has not been verified by the valuer, such information is true in all material respects and there is no omission of any material information; (ii) all bases and assumptions on which the valuating report are founded are fair, reasonable and complete; (iii) the scope of work of the

9 August 2007 version Submitted? Comments

Yes No N/A

valuer is appropriate to the opinion given in the valuation report; and (iv) the offering circular fairly represents the view of the valuer and contains a fair copy of or extract from the valuation report

SPVs arrangement (if applicable)

(36) Financial statements of the SPVs: . audited by properly qualified accountants (see Note to Chapter 7.6(a) of the Code) . indicating how the profits and losses of the SPVs would have impacted on the Scheme, if the Scheme had at all material times held the SPVs . where an SPV has subsidiaries, dealing with the profits or losses and the assets and liabilities of the SPV and its subsidiaries, either as a whole or separately

(See Chapter 7.6 of the Code for details)

(37) Letter of appointment by the Trustee appointing the board of directors of each of the SPVs

Joint ownership arrangement (if applicable)

(38) Management Company to confirm and demonstrate in a written submission the rationale for such arrangement (including the decision of owning less than a 100% interest in the property) and that such arrangement is in the interest of the holders

(39) Confirmation from the Management Company that: . proper due diligence has been conducted in identifying restrictions and constraints that may limit the Scheme’s direct ownership of a 100% interest in a property . the liability of or assumed by the Scheme does not exceed the percentage of its interest in the joint ownership arrangement and there is no assumption of unlimited liability by the Scheme

Legal opinions*

10 August 2007 version Submitted? Comments

Yes No N/A

(40) Legal opinion issued by Hong Kong legal counsel to the Management Company confirming the following details of the Scheme: . date of establishment of the Scheme . governing laws . validity of the Scheme formed as a trust to hold real estate and SPVs (if applicable) under the laws of Hong Kong . legality, validity and enforceability of the Trust Deed under the laws of Hong Kong and the Trust Deed is binding on the parties thereto . the Scheme, including its SPVs, has not violated any applicable laws, regulations and policies in Hong Kong and/or in the relevant jurisdiction . the Scheme has legal and beneficial sole/ majority ownership and control of the SPVs and free from any encumbrances

. where there is one layer of SPVs, they are established for the sole purpose of directly holding real estate for the Scheme and/or arranging financing for the Scheme . where there are two layers of SPVs, the top-layer SPV is formed solely for the purpose of holding interests in one or more SPVs described above . where there are more than two layers of SPVs, the rationale for such establishment and the explanation of the structure, and confirming that the structure is for the sole purpose of holding the SPVs that only holds the real estate for the Scheme and/or arranges financing for the Scheme

(41) Legal opinion in accordance with Chapter 7.7 of the Code, certifying the Scheme holds good marketable legal and beneficial title in each of its real estate and other matters, where applicable, regarding the Scheme holding majority interest and control and having freedom to dispose of its interest

(42) Legal opinions issued by legal counsel from the relevant jurisdictions in accordance with Chapter 7.5 of the Code (if applicable), confirming that:

11 August 2007 version Submitted? Comments

Yes No N/A

. the SPVs are duly incorporated in accordance with the laws of the place of incorporation and there are no statutory or other requirements that would render the holding of real estate by the SPV to be in contravention of the Code . the SPVs are incorporated in jurisdictions which have established laws and corporate governance standards which are commensurate with those observed by companies incorporated in Hong Kong. Examples include jurisdictions with common law systems and well established legal framework for corporations

Note: If this cannot be opined on in the legal opinion, the Management Company written submission on the acceptability of the place of incorporation together with a confirmation from the Management Company and the Trustee that in its opinion this will not prejudice interests of holders of the Scheme.

. the memorandum and articles of association (M&A) (or equivalent constitutional documents) of the SPVs are in compliance with all applicable requirements of the Code and otherwise do not contain provisions that contravene any requirements of the Code . the M&A (or equivalent constitutional documents) of the SPVs are legal, valid, binding and enforceable under applicable law . a statement that all necessary licences and consents required in the location where the subject property is located have been obtained by the Scheme or its SPV

(43) Where there is joint ownership arrangement in relation to a property, a legal opinion in accordance with Chapter 7.7A(b) of the Code, certifying the Scheme holds good and marketable legal and beneficial interest in the property

12 August 2007 version Submitted? Comments

Yes No N/A

(44) Where there is joint ownership arrangement in relation to a property, a legal opinion in accordance with Chapter 7.7A(c) of the Code to include: . a description of the significant terms of the joint ownership arrangement . a description of the equity and profit sharing arrangements of the parties to the agreement . a legal opinion that the relevant contract and joint ownership arrangements are legal, valid, binding and enforceable under applicable law . a statement that all necessary licences and consents required in the location where the subject property is located have been obtained by the Scheme or its SPV . any restriction on the divestment by the Scheme of its interest, in whole or in part, in the property

Connected party transactions

(45) A detailed description of: . the connected party transactions entered into by the Scheme and the connected person in the past 12 months . any subsisting connected party transactions . proposed connected party transactions following the listing of the Scheme

Note: Details of each connected party transaction shall include: - names of the parties and their relationship to the Scheme - date and nature of the transaction and the consideration involved - duration of the transactions (e.g. one-off or continuous) - categories to which the transaction belongs under Chapter 8 - for leasing transactions, whether the terms of leases are, in the opinion of the valuer, are at market levels as of their respective tenancy agreement dates and on

13 August 2007 version Submitted? Comments

Yes No N/A

normal commercial terms - whether the transactions are, in the opinion of the Management Company and the listing agent(s), carried out in the ordinary course of business of the Scheme, at arm’s length, on normal commercial terms and on terms which are fair and reasonable, consistent with the investment objectives and strategy of the Scheme, and in the best interests of holders as a whole

Financial information

(46) Latest audited annual report of the Scheme (if more recent, the latest interim report)

(47) In relation to the working capital statement: . confirmation from the Management Company that the Scheme has sufficient working capital to meet its present requirements, that is, for at least the next twelve months after listing as demonstrated by its working capital forecast . confirmation from the listing agent(s) and the auditors that the working capital statement has been made by the Management Company after due and careful enquiry and that persons or institutions providing finance have stated in writing that the relevant financing facilities exist

Note: Working capital forecast memorandum to be submitted upon request only

(48) Where the offering document contains a profit / dividend forecasts: . the board of the Management Company’s forecast memorandum with principal assumptions, accounting policies and calculations for the forecast* . the following documents (also for disclosure in the offering document): - a letter from the Management Company confirming that it has exercised due care and consideration in compilation of the forecast and it

14 August 2007 version Submitted? Comments

Yes No N/A

has satisfied itself that the forecast has been stated after due and careful enquiry - a report from the auditor confirming that it has reviewed the accounting policies and calculations for the forecast - a report from the valuer confirming that it has examined the rental income used in the calculations of the forecast - a letter from the listing agent(s) confirming that the forecast has been made after due and careful enquiry

(49) A letter from the auditors confirming that the unaudited pro forma financial information of the Scheme has been properly compiled on the basis stated; such basis is consistent with the accounting policies of the Scheme; and the adjustments are appropriate for the purpose of the unaudited pro forma financial information as disclosed in the offering circular

(50) A letter from the auditor confirming that it has checked the arithmetic accuracy of the distribution per unit and found that it is arithmetically accurate and in agreement with the profit forecast as set out in the offering circular

Chinese translation

(51) A certificate issued by the translator certifying that the Chinese translation of the English version of the Offering Document is true and accurate accompanied with a certificate issued by the Hong Kong legal counsel to the Management Company / listing agent(s) certifying that the translator is competent to have given the Chinese translation certificate provided

Waiver applications

(52) Application for waiver from compliance with a provision in the Code shall be made at the earliest possible time when the application for authorization is submitted. A waiver

15 August 2007 version Submitted? Comments

Yes No N/A

application must be supported by a formal submission with detailed reasons and a proposal for any alternative measures to afford the sufficient safeguard to investors if the waiver were granted. The applicant should note that the SFC may exercise its discretion to grant or to refuse to grant any waivers requested. Any application which departs from the ten General Principles of the Code may not be accepted.

REITs with overseas investments

Qualifications of the Management Company

(53) Evidence to demonstrate that the Management Company and its key personnel have the experience, capability, resources and competence, track record and, where applicable, any support from group companies in dealing with the legal, regulatory and other requirements of overseas property investments in compliance with paragraph 10 of the Practice Note on Overseas Investments by SFC-authorized REITs (the “PN”)

(54) Business plan as to how the Management Company can implement its investment strategy, given its resources and circumstances

(55) Contingency plans of the Management Company to deal with exigencies that may arise in overseas jurisdiction(s) and to address any consequential impact that may affect the Scheme’s investments

(56) Where the Management Company delegates its functions in relation to the management of the Scheme’s overseas investments, due diligence procedures and structured plans as to how an overseas entity (appointed to perform management functions) shall be selected and monitored on a continuous basis, including: . criteria and procedures for selection of an overseas entity . mechanism for regular review of performance of the appointed overseas

16 August 2007 version Submitted? Comments

Yes No N/A

entity . means to assess shortfalls in standards / performance of the appointed overseas entity . measures to identify and address any potential conflicts of interests

Due diligence exercise

(57) Confirmation from the Management Company that it has conducted proper and adequate due diligence as regards the properties, SPVs or joint ownership arrangements held / to be acquired by the Scheme as required by the Code and the PN

Valuation

(58) Statement provided by the Principal Valuer with the name(s), registered address(es), place(s) of incorporation, qualifications and experience of the “overseas property valuer(s)” appointed by the Principal Valuer to assist in preparing the valuation of any overseas properties and the respective geographical responsibility of the valuers (if applicable)

(59) Principal Valuer’s certification of the valuation report(s) prepared by overseas valuer(s)

(60) Confirmation from the Principal Valuer that the overseas valuer fulfils the criteria and requirements as set out in Chapter 6.4 to 6.7 (except for 6.4(b) and (c)) of the Code

(61) Confirmation from the Principal Valuer that it has conducted proper and adequate due diligence on the appointment of overseas valuer(s) as required by the Code and the PN

Taxation

(62) Documentation confirming the tax rate which the Scheme is subject to and evidence to demonstrate that the Scheme and/or the SPVs have paid the relevant tax liabilities

(* To be submitted upon request only)

17 August 2007 version Signed by and on behalf of:

Management Listing Agent(s) : Company :

Name of authorized Name(s) of authorized : signatory : signatory

18 August 2007 version 2. Compliance checklist for Offering Document

Name of Scheme :

Name of Management Company :

Date submitted :

Proof number of Offering Document :

Applicants should note the following in preparing the Scheme’s Offering Document:

1. The offering document should be clear and succinct, and written in plain language so as to facilitate investors' understanding of the Scheme.

2. The following list is not intended to be exhaustive. The Management Company is obliged to disclose any information which may be necessary for investors to make an informed judgment.

3. The finalized Chinese version of the Offering Document together with the Chinese translation certificate may be submitted after the English version has been cleared.

Appendix B and relevant Page Complied with? Comments Chapters of the reference Code Yes No N/A

Constitution of the Scheme B1 Investment objectives and restrictions B2(a) 7.1 7.2 7.3 7.4 7.5 (if applicable) 7.6 (if applicable) 7.7

1 August 2007 version Appendix B and relevant Page Complied with? Comments Chapters of the reference Code Yes No N/A

Constitution of the Scheme B1 7.7A (including the notes if applicable) 7.8 B2(b) B2(c) B2(d) B2(e) B2(f) B2(g) B2(h) B2(i) (Note 1) B2(j) 7.9 (Note 2) B2(k) B2(l) 7.12 B2(m) B2(n) B2(o) B2(p) B2(q) B2(r) B3 Operators and principals B4(a)(i) B4(a)(ii) B4(b) B4(c) B4(d) B4(e) B4(f) Significant holders

2 August 2007 version Appendix B and relevant Page Complied with? Comments Chapters of the reference Code Yes No N/A

Constitution of the Scheme B1 B5 5.13 B6 Characteristics of units B7 B8 B9 B10 Application procedures B11 B12 Distribution policy B13 Fees and Charges B14(a) B14(b) B14(c) 9.10 9.12 (if applicable) Taxation B15 Reports and accounts B16 B17 B18 9.3 (if applicable) 9.4(a) (if applicable) 9.4(b) (if applicable) Warnings B19(a)

3 August 2007 version Appendix B and relevant Page Complied with? Comments Chapters of the reference Code Yes No N/A

Constitution of the Scheme B1 B19(b) B20(a) B20(b) B20(c) B21 Expert statements B22 B23 General information B24 B25 B26 B27 B28 10.10(u) Termination of scheme B29 Merger of schemes B30 Accompaniment to the Offering Document B31(a) B31(b) B31(c) Transactions with connected persons 8.2 8.3(a) 8.3(b) 8.3(c) 8.4(a) 8.4(b)

4 August 2007 version Appendix B and relevant Page Complied with? Comments Chapters of the reference Code Yes No N/A

Constitution of the Scheme B1 Practice Note on Overseas Investment by SFC-authorised REITs (if applicable) Valuation report PN17(a) PN17(b) PN17(c) PN17(d) In relation to overseas property market PN21 PN22(a) PN22(b) PN22(c) PN22(d) PN23(a) PN23(b) PN23(c) PN23(d) PN23(e) PN23(f) PN23(g) PN23(h) PN23(i) PN24 PN25(a) PN25(b) PN25(c) PN26

Additional information Other statements Working capital statement

5 August 2007 version Appendix B and relevant Page Complied with? Comments Chapters of the reference Code Yes No N/A

Constitution of the Scheme B1 Profits / dividends forecast (where applicable) Letter from Management Company Letter from listing agent(s) Report from the auditors on accounting policies and calculations Report from the valuer on rental income

Note 1: In preparing disclosure on the operating data of each of the real estate, applicant may wish to consider whether information set out in Annex C should be included in the offering document, where applicable.

Note 2: Please include a statement of capitalization and indebtedness of the Scheme upon completion of the intended offering (if applicable).

Signed by and on behalf of:

Management Listing Agent(s) : Company :

Name of authorized Name(s) of authorized : signatory : signatory

6 August 2007 version 3. Compliance Checklist for Trust Deed

Name of Scheme :

Name of Management Company :

Date submitted :

Proof number of Trust Deed :

Appendix D of Page Complied with? Comment the Code reference Yes No N/A

D1 D2 D3 D4(a) D4(b) D4(c) D5(a) D5(b) D5(c) D5(d) D6(a)(i) D6(a)(ii) D6(a)(iii) D6(a)(iv) D6(b) D7(a) D7(b) D7(c) D7(d) D7(e) D8(a) D8(b) D9(a) D9(b)(i) D9(b)(ii) D9(b)(iii) D9(b)(iv)

1 August 2007 version Appendix D of Page Complied with? Comment the Code reference Yes No N/A

D9(c) D9(d) D9(e) D10(a) D10(b) D11(a) D11(b) D11(c) D11(d) D11(e) D11(f) D12 D13(a) D13(b) D13(c)(i) D13(c)(ii) D13(c)(iii) D13(c)(iv) D13(d) D14 D15 D16 D17 D17 (a) D17 (b) D18

Signed by and on behalf of:

Management Company : Listing Agent(s) :

Name of authorized Name(s) of authorized signatory : signatory :

2 August 2007 version 4. Compliance checklist for historical financial statements

Name of Scheme :

Name of Management Company :

Date submitted :

Proof number of Offering Document :

Appendix C of Page Complied with? Comment the Code reference Yes No N/A

Balance Sheet 1 2 3 4 5 6 7 8 9 10 11 12 Income Statement 1 2 3 4 5 6(a) 6(b) 6(c) 6(d) 6(e) 6(f) 6(g) 6(h)

1 August 2007 version Appendix C of Page Complied with? Comment the Code reference Yes No N/A

6(i) 6(k) 7 8 9 Cash Flow Statement 1 2 3 Distribution Statement 1 2 3 Statement of Movements in Capital Account 1 2 3(a) 3(b) 3(c) 3(d) 4 5 Notes to the Accounts 1(a) 1(b) 1(c) 1(d) 1(e) 2(a) 2(b) 2(c) 2(d) 2(e) 3 4 5

2 August 2007 version Appendix C of Page Complied with? Comment the Code reference Yes No N/A

6 Comparative figures Auditor’s report

Signed by and on behalf of:

Management Company : Listing Agent(s) :

Name of authorized Name(s) of authorized signatory : signatory :

3 August 2007 version Annex A

Key points for preparation of compliance manual for the Management Company of REITs

1. Objectives

. Clearly identify which part of the Management Company is responsible for carrying out the compliance procedures;

. How compliance with those procedures will be monitored and the reporting system;

. Persons responsible for monitoring each of these compliance procedures.

2. Operational and compliance flowchart

. Use of an operational flowchart with a corresponding compliance flowchart would be useful to demonstrate how the respective compliance procedures are monitored;

. Use of a summary table to set out the functions, the responsible officers or persons within the organisation, the reporting frequency and cross references to detailed provisions in the manual would be useful to give a succinct description of the compliance procedures and persons responsible.

3. Special attention to compliance procedures relating to REITs

In view of the nature of underlying properties held by and the mode of operation of a REIT, special attention should be paid to the following areas in devising the compliance procedures for the Management Company:

. Collection of Income: Proper records for collection of rental proceeds and the disbursements of any expenses for and on behalf of the Scheme. Example: if income to the Scheme is collected by external delegates, measures should be in place to ensure prompt remittance be made to the Scheme and reconciliation of any income and expenses be accurately and timely made by the parties concerned;

. Safekeeping of assets: Measures to ensure safekeeping and segregation of Scheme properties including title and lease documents for the Scheme and maintenance of insurance as required by the REITs Code. Example: Scheme properties should be properly registered and described to the public and counter-parties of the Scheme as property held on trust by the trustee;

. Asset Investment: Procedures in place to implement appropriate policies for the acquisition and disposal of assets in accordance with investment objectives and limits and procedures for conducting due diligence on property investment and ensure all such procedures and processes followed, and decisions made in property

1 August 2007 version investment are fully, properly and clearly documented as part of the record- keeping;

. Delegation: Selection of delegates and due diligence procedures, on-going monitoring and control of risks arising out of delegations and their defaults or non- compliance with any delegation arrangements, criteria applicable to replacement of delegates and proper audit trail of delegates’ functions and responsibilities.

. External service providers: Measures to ensure that there is adequate due diligence when appointing external service providers and to monitor their compliance with the service contracts and proper records for payments to service providers;

. Asset verification and valuation: Procedures to verify ownership and conditions of the properties held by the Scheme and to ensure valuation of the properties of the Scheme is carried out in accordance with the requirements of the Code;

. Conflicts of interest: Measures to avoid and manage actual and potential conflicts of interest relating to the Scheme, such as provisions for voting prohibition for directors who have conflict of interest in matters to be considered by the board. Example: where the management company provides property investment and management services to other entities (including other REITs or property owners / investments), the management company shall have proper and adequate measures to avoid conflicts of interest that may arise therefrom;

. Connected party transactions: Procedures for carrying out different categories of connected party transactions and ensuring compliance with disclosure and reporting requirements for such transactions in accordance with the Code;

. Disclosure and unit dealing rules on directors and other senior management of the Management Company of the Scheme: Provisions for disclosing holdings and procedures for obtaining proper notifications and/or permissions for dealings in the Scheme’s units of the directors and other senior management of the Scheme;

. Disclosure of interests: Provisions governing disclosure of interests obligations by unitholders, the Management Company, its directors and chief executive and consequences of failure to notify;

. Best corporate governance practice: Clear and concise description of the function and composition of the board and various committees, terms of reference of the board and the committees, the interaction among the committees, and the role of independent non-executive directors, and other best corporate governance practices;

. Listing status: Procedures to ensure that listing rules and other applicable trading rules imposed by the exchange on which the Scheme is listed are complied with;

. On-going disclosure: Procedures to ensure compliance with on-going disclosure requirements under the listing regime and ensure proper contacts be maintained with the relevant regulators;

2 August 2007 version . Media handling policy: Policy and procedures with respect to enquiries from or interviews with the media and practitioners in the financial industry.

. Complaints handling: Procedures for proper handling of enquiries or complaints from investors about the Scheme;

. Breaches: Procedures to ensure breaches are reported to the relevant regulators and remedied in accordance with the applicable laws and regulations.

. Website: Procedures to ensure the Scheme has its own website on which it must publish any announcement, notice, circular, annual report, interim report, proxy form, listing document, notice of disclosure of interests or other corporate communication issued by the Scheme.

Note: Information set out above highlights areas that are specific to REITs management, and should not be considered as exhaustive or as a replacement of any applicable regulatory requirements under the law or any codes or guidelines issued by the SFC in relation to persons licensed to carry out investment management activities under the SFO.

For REITs investing in overseas properties, there should be appropriate measures and safeguards to mitigate foreign investment risks, such as legal, regulatory, fiscal and operational risks and to ensure proper checks and balances are in place to monitor and supervise the activities performed by overseas delegates in relation to the Scheme. There should be proper and adequate due diligence procedures and structured plans as to how an overseas entity shall be selected and monitored on a continuous basis. There should be mechanism in place to identify and address any potential conflicts of interest of such overseas entity.

The management company should also have a contingency plan that enables it to proactively respond to any exigencies that may arise in the course of its investment and management of overseas properties, its divestment of such properties and any matters arising in the course of a public offering of any units in the Scheme.

3 August 2007 version Annex B

Independent Director’s Declaration

To: Investment Products Department Securities and Futures Commission (the “SFC”)

[Date]

Dear Sirs

I, [name in English and Chinese of the independent director] being the independent non- executive director of [name of the Management Company] (the “Management Company”) hereby declare, confirm and undertake that:

4. I understand and will discharge the obligations and duties of an independent non- executive director.

5. Having regard to the factors in assessing independence as referred to in the internal policy / compliance manual of the Management Company (an extract of which is attached hereto), I am qualified to act as an independent non-executive director of the Management Company for the purposes of [name of the Scheme] (the “REIT”) and there are no other factors or circumstances, having made all reasonable enquiries, that may affect my independence.

6. I undertake to inform the SFC as soon as practicable if there is any subsequent change of circumstances which may affect my independence in acting as an independent non- executive director of the Management Company for the purpose of the REIT during the term of my directorship.

Yours faithfully

Signed:______

Name:______

August 2007 version Annex C

Operating Data of Real Estate

The applicant may wish to consider including these items in the Offering Document (where applicable) and in such format that is readily comprehensible e.g. tabular format.

1. Description of each of the underlying real estate and the overall property portfolio: (a) Name(s) (b) Location(s) (c) Brief description of the general characters, for example: . Scope and type of investments (e.g. retail / office / industrial / residential) . Competition conditions

2. Overview of any current, intended or proposed substantial business plans: (d) Leasing strategy (e) Loan arrangements (if any) (f) Renovation or improvement programs, include the estimated cost and the method of financing (g) Zoning, re-zoning or any other significant development programs in the surrounding area

3. Information on each of the underlying real estate and the overall property portfolio: (h) Year of construction completion (i) Year of last renovation (j) Acquisition price (k) Appraised valuation (include discussion of the valuation methodology and assumptions used, and justification of the assumptions) (l) Ownership holdings (include joint ownership arrangement) (m) Nature of interest in the property, e.g. freehold or leasehold (include the remainder of the term) (n) Total area, including breakdown by usage (o) Number of car park spaces (if any)

4. Details on the tenancy mix of each of the underlying real estate: (p) Occupancy rate (q) Average rental per measurement unit (r) Annual rental income (s) Guaranteed income (if any) (t) Number of tenants (u) Tenancy mix breakdown by occupation or business (v) % of rental income contributed and % of area occupied by the largest group of tenants (at a minimum by the five largest tenants) (w) % of rental income contributed and % of area occupied by the connected persons (x) Schedule of lease expiries for the forthcoming five years

August 2007 version