Chapter 12

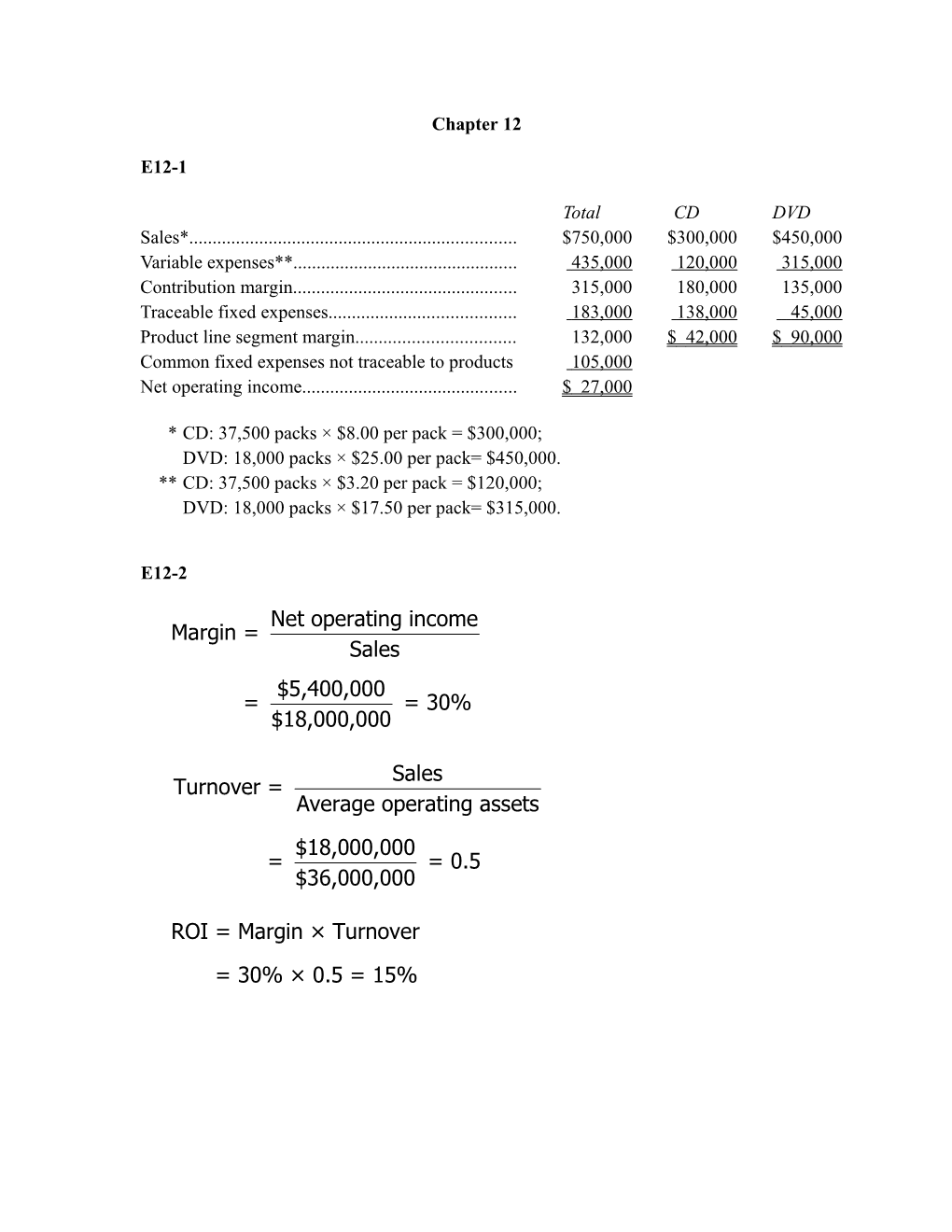

E12-1

Total CD DVD Sales*...... $750,000 $300,000 $450,000 Variable expenses**...... 435,000 120,000 315,000 Contribution margin...... 315,000 180,000 135,000 Traceable fixed expenses...... 183,000 138,000 45,000 Product line segment margin...... 132,000 $ 42,000 $ 90,000 Common fixed expenses not traceable to products 105,000 Net operating income...... $ 27,000

* CD: 37,500 packs × $8.00 per pack = $300,000; DVD: 18,000 packs × $25.00 per pack= $450,000. ** CD: 37,500 packs × $3.20 per pack = $120,000; DVD: 18,000 packs × $17.50 per pack= $315,000.

E12-2

Net operating income Margin = Sales $5,400,000 = = 30% $18,000,000

Sales Turnover = Average operating assets $18,000,000 = = 0.5 $36,000,000

ROI = Margin × Turnover = 30% × 0.5 = 15% E12-3

Average operating assets (a)...... £2,200,000 Net operating income...... £400,000 Minimum required return: 16% × (a)...... 352,000 Residual income...... £ 48,000

E12-6

1. Total Geographic Market Company South Central North Sales...... $1,500,000 $400,000 $600,000 $500,000 Variable expenses...... 588,000 208,000 180,000 200,000 Contribution margin...... 912,000 192,000 420,000 300,000 Traceable fixed expenses...... 770,000 240,000 330,000 200,000 Geographic market segment margin...... 142,000 $(48,000) $ 90,000 $100,000 Common fixed expenses not traceable to geographic markets* 175,000 Net operating income (loss)...... $ (33,000) *$945,000 – $770,000 = $175,000.

2. Incremental sales ($600,000 × 15%)...... $90,000 Contribution margin ratio ($420,000 ÷ $600,000)...... × 70% Incremental contribution margin...... 63,000 Less incremental advertising expense...... 25,000 Incremental net operating income...... $38,000 Yes, the advertising program should be initiated.

E12-8

1. Computation of ROI. $300,000 $6,000,000 Division A: ROI = × = 5% × 4 = 20% $6,000,000 $1,500,000 Division B: $900,000 $10,000,000 ROI = × = 9% × 2 = 18% $10,000,000 $5,000,000 Division C: $180,000 $8,000,000 ROI = × = 2.25% × 4 = 9% $8,000,000 $2,000,000

2. Division A Division B Division C Average operating assets...... $1,500,000 $5,000,000 $2,000,000 Required rate of return...... × 15% × 18% × 12% Required operating income...... $ 225,000 $ 900,000 $ 240,000 Actual operating income...... $ 300,000 $ 900,000 $ 180,000 Required operating income (above). 225,000 900,000 240,000 Residual income...... $ 75,000 $ 0 $ (60,000)

3. a. and b. Division A Division B Division C Return on investment (ROI)...... 20% 18% 9% Therefore, if the division is presented with an investment opportunity yielding 17%, it probably would...... Reject Reject Accept Minimum required return for computing residual income...... 15% 18% 12% Therefore, if the division is presented with an investment opportunity yielding 17%, it probably would...... Accept Reject Accept If performance is being measured by ROI, both Division A and Division B probably would reject the 17% investment opportunity. The reason is that these companies are presently earning a return greater than 17%; thus, the new investment would reduce the overall rate of return and place the divisional managers in a less favorable light. Division C probably would accept the 17% investment opportunity, since its acceptance would increase the Division’s overall rate of return. If performance is being measured by residual income, both Division A and Division C probably would accept the 17% investment opportunity. The 17% rate of return promised by the new investment is greater than their required rates of return of 15% and 12%, respectively, and would therefore add to the total amount of their residual income. Division B would reject the opportunity, since the 17% return on the new investment is less than B’s 18% required rate of return. E12-11

1. $75,000 × 40% CM ratio = $30,000 increased contribution margin in Dallas. Since the fixed costs in the office and in the company as a whole will not change, the entire $30,000 would result in increased net operating income for the company. It is incorrect to multiply the $75,000 increase in sales by Dallas’s 25% segment margin ratio. This approach assumes that the segment’s traceable fixed expenses increase in proportion to sales, but if they did, they would not be fixed.

2. a. The segmented income statement follows: Segments Total Company Houston Dallas Amount % Amount % Amount % Sales...... $800,000 100.0 $200,000 100 $600,000 100 Variable expenses...... 420,000 52.5 60,000 30 360,000 60 Contribution margin... 380,000 47.5 140,000 70 240,000 40 Traceable fixed expenses...... 168,000 21.0 78,000 39 90,000 15 Office segment margin...... 212,000 26.5 $ 62,000 31 $150,000 25 Common fixed expenses not traceable to segments...... 120,000 15.0 Net operating income...... $ 92,000 11.5

b. The segment margin ratio rises and falls as sales rise and fall due to the presence of fixed costs. The fixed expenses are spread over a larger base as sales increase. In contrast to the segment ratio, the contribution margin ratio is stable so long as there is no change in either variable expenses or the selling price of a unit of service.

Chapter 13 E13-2

1. No, the housekeeping program should not be discontinued. It is actually generating a positive program segment margin and is, of course, providing a valuable service to seniors. Computations to support this conclusion follow: Contribution margin lost if the housekeeping program is dropped...... $(80,000) Fixed costs that can be avoided: Liability insurance...... $15,000 Program administrator’s salary...... 37,000 52,000 Decrease in net operating income for the organization as a whole...... $(28,000) Depreciation on the van is a sunk cost and the van has no salvage value since it would be donated to another organization. The general administrative overhead is allocated and none of it would be avoided if the program were dropped; thus it is not relevant to the decision. The same result can be obtained with the alternative analysis below: Total If Difference: Net House- Operating Current keeping Is Income Increase Total Dropped or (Decrease) Revenues...... $900,000 $660,000 $(240,000) Variable expenses...... 490,000 330,000 160,000 Contribution margin...... 410,000 330,000 (80,000) Fixed expenses: Depreciation*...... 68,000 68,000 0 Liability insurance...... 42,000 27,000 15,000 Program administrators’ salaries...... 115,000 78,000 37,000 General administrative overhead...... 180,000 180,000 0 Total fixed expenses...... 405,000 353,000 52,000 Net operating income (loss)...... $ 5,000 $(23,000) $ (28,000) *Includes pro-rated loss on disposal of the van if it is donated to a charity.

2. To give the administrator of the entire organization a clearer picture of the financial viability of each of the organization’s programs, the general administrative overhead should not be allocated. It is a common cost that should be deducted from the total program segment margin. Following the format introduced in Chapter 12 for a segmented income statement, a better income statement would be: Total Home Meals on House- Nursing Wheels keeping Revenues...... $900,000 $260,000 $400,000 $240,000 Variable expenses...... 490,000 120,000 210,000 160,000 Contribution margin...... 410,000 140,000 190,000 80,000 Traceable fixed expenses: Depreciation...... 68,000 8,000 40,000 20,000 Liability insurance...... 42,000 20,000 7,000 15,000 Program administrators’ salaries.... 115,000 40,000 38,000 37,000 Total traceable fixed expenses...... 225,000 68,000 85,000 72,000 Program segment margins...... 185,000 $ 72,000 $105,000 $ 8,000 General administrative overhead...... 180,000 Net operating income (loss)...... $ 5,000

E13-3

1. Per Unit Differential Costs 15,000 units Make Buy Make Buy Cost of purchasing...... $20 $300,000 Direct materials...... $ 6 $ 90,000 Direct labor...... 8 120,000 Variable manufacturing overhead...... 1 15,000 Fixed manufacturing overhead, traceable1.. 2 30,000 Fixed manufacturing overhead, common.... 0 0 0 0 Total costs...... $17 $20 $255,000 $300,000 Difference in favor of continuing to make the parts...... $3 $45,000 1 Only the supervisory salaries can be avoided if the parts are purchased. The remaining book value of the special equipment is a sunk cost; hence, the $3 per unit depreciation expense is not relevant to this decision. Based on these data, the company should reject the offer and should continue to produce the parts internally.

2. Make Buy Cost of purchasing (part 1)...... $300,000 Cost of making (part 1)...... $255,000 Opportunity cost—segment margin forgone on a potential new product line...... 65,000 Total cost...... $320,000 $300,000 Difference in favor of purchasing from the outside supplier...... $20,000 Thus, the company should accept the offer and purchase the parts from the outside supplier.

E13-4

Only the incremental costs and benefits are relevant. In particular, only the variable manufacturing overhead and the cost of the special tool are relevant overhead costs in this situation. The other manufacturing overhead costs are fixed and are not affected by the decision.

Per Total Unit 10 bracelets Incremental revenue...... $349.95 $3,499.50 Incremental costs: Variable costs: Direct materials...... 143.00 1,430.00 Direct labor...... 86.00 860.00 Variable manufacturing overhead...... 7.00 70.00 Special filigree...... 6.00 60.00 Total variable cost...... $242.00 2,420.00 Fixed costs: Purchase of special tool...... 465.00 Total incremental cost...... 2,885.00 Incremental net operating income...... $ 614.50

Even though the price for the special order is below the company's regular price for such an item, the special order would add to the company's net operating income and should be accepted. This conclusion would not necessarily follow if the special order affected the regular selling price of bracelets or if it required the use of a constrained resource.

E13-5

1. A B C (1) Contribution margin per unit...... $18 $36 $20 (2) Direct labor cost per unit...... $12 $32 $16 (3) Direct labor rate per hour...... 8 8 8 (4) Direct labor-hours required per unit (2) ÷ (3)...... 1.5 4.0 2.0 Contribution margin per direct labor-hour (1) ÷ (4)...... $12 $ 9 $10 2. The company should concentrate its labor time on producing product A: A B C Contribution margin per direct labor-hour...... $12 $9 $10 Direct labor-hours available...... × 3,000 × 3,000 × 3,000 Total contribution margin...... $36,000 $27,000 $30,000 Although product A has the lowest contribution margin per unit and the second lowest contribution margin ratio, it has the highest contribution margin per direct labor-hour. Since labor time seems to be the company’s constraint, this measure should guide management in its production decisions.

3. The amount Banner Company should be willing to pay in overtime wages for additional direct labor time depends on how the time would be used. If there are unfilled orders for all of the products, Banner would presumably use the additional time to make more of product A. Each hour of direct labor time generates $12 of contribution margin over and above the usual direct labor cost. Therefore, Banner should be willing to pay up to $20 per hour (the $8 usual wage plus the contribution margin per hour of $12) for additional labor time, but would of course prefer to pay far less. The upper limit of $20 per direct labor hour signals to managers how valuable additional labor hours are to the company.

E13-6

Product X Product Y Product Z Sales value after further processing...... $80,000 $150,000 $75,000 Sales value at split-off point...... 50,000 90,000 60,000 Incremental revenue...... 30,000 60,000 15,000 Cost of further processing...... 35,000 40,000 12,000 Incremental profit (loss)...... $(5,000) 20,000 3,000

Products Y and Z should be processed further, but not Product X.

E13-8

Contribution margin lost if the Bath Department is dropped: Lost from the Bath Department...... $700,000 Lost from the Kitchen Department (10% × $2,400,000)...... 240,000 Total lost contribution margin...... 940,000 Less avoidable fixed costs ($900,000 – $370,000)...... 530,000 Decrease in overall net operating income...... $410,000

E13-9

Relevant Costs Item Make Buy Direct materials (60,000 @ $4.00)...... $240,000 Direct labor (60,000 @ $2.75)...... 165,000 Variable manufacturing overhead (60,000 @ $0.50)...... 30,000 Fixed manufacturing overhead, traceable (1/3 of $180,000)...... 60,000 Cost of purchasing from outside supplier (60,000 @ $10)...... $600,000 Total cost...... $495,000 $600,000 The two-thirds of the traceable fixed manufacturing overhead costs that cannot be eliminated, and all of the common fixed manufacturing overhead costs, are irrelevant. The company would save $105,000 per year by continuing to make the parts itself. In other words, profits would decline by $105,000 per year if the parts were purchased from the outside supplier.

E13-10

1. Monthly profits would be increased by $9,000: Total for 2,000 Per Unit Units Incremental revenue...... $12.00 $24,000 Incremental costs: Variable costs: Direct materials...... 2.50 5,000 Direct labor...... 3.00 6,000 Variable manufacturing overhead...... 0.50 1,000 Variable selling and administrative...... 1.50 3,000 Total variable cost...... $ 7.50 15,000 Fixed costs: None affected by the special order...... 0 Total incremental cost...... 15,000 Incremental net operating income...... $ 9,000

2. The relevant cost is $1.50 (the variable selling and administrative costs). All other variable costs are sunk, since the units have already been produced. The fixed costs would not be relevant, since they would not be affected by the sale of leftover units.

E13-12

Merifulon should be processed further: Sales value after further processing...... $60,000 Sales value at the split-off point...... 40,000 Incremental revenue from further processing...... 20,000 Cost of further processing...... 13,000 Profit from further processing...... $ 7,000 The $10,000 in allocated common costs (1/3 × $30,000) will be the same regardless of which alternative is selected, and hence is not relevant to the decision.

E13-14

No, the overnight cases should not be discontinued. The computations are: Contribution margin lost if the cases are discontinued...... $(260,000) Less fixed costs that can be avoided if the cases are discontinued: Salary of the product line manager...... $ 21,000 Advertising...... 110,000 Insurance on inventories...... 9,000 140,000 Net disadvantage of dropping the cases...... $(120,000)

The same solution can be obtained by preparing comparative income statements: Difference: Net Keep Drop Operating Income Overnight Overnight Increase or Cases Cases (Decrease) Sales...... $450,000 $ 0 $(450,000) Variable expenses: Variable manufacturing expenses...... 130,000 0 130,000 Sales commissions...... 48,000 0 48,000 Shipping...... 12,000 0 12,000 Total variable expenses...... 190,000 0 190,000 Contribution margin...... 260,000 0 (260,000) Fixed expenses: Salary of line manager...... 21,000 0 21,000 General factory overhead...... 104,000 104,000 0 Depreciation of equipment...... 36,000 36,000 0 Advertising—traceable...... 110,000 0 110,000 Insurance on inventories...... 9,000 0 9,000 Purchasing department...... 50,000 50,000 0 Total fixed expenses...... 330,000 190,000 140,000 Net operating loss...... $ (70,000) $(190,000) $(120,000)